Академический Документы

Профессиональный Документы

Культура Документы

Marcus Lemonis Video QUESTION

Загружено:

jycm20010 оценок0% нашли этот документ полезным (0 голосов)

28 просмотров2 страницыMarcus Lemonis Video

Оригинальное название

Marcus Lemonis Video QUESTION (1)

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документMarcus Lemonis Video

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

28 просмотров2 страницыMarcus Lemonis Video QUESTION

Загружено:

jycm2001Marcus Lemonis Video

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

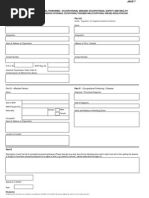

MBSA 1453 Financial Management and

Corporate Governance

Answer the following questions based on a video entitled Marcus Lemonis: Why an IPO

may not be the answer.

1. Who is the interviewer?

a. Marcus Lemonis,

2. What is the name of the show?

The Profit and CEO of Camping World,

3. Who is the interviewee?

Abe Issa's thriving green-energy startup, Global Efficient Energy

4. What is the subject matter?

The best method to get financing .

5. What is the main business of Global Efficient Energy?

Solar panel , energy consulting service.

6. How much sales has been recorded by Global Efficient Energy?

a. $60 million in sales this year, with a 15 percent profit

margin

7. In the video, Lemonis said about capital intensive. What is a definition of capital

intensive?

a business process or an industry that requires large amounts of money and

other financial resources to produce a good or service.

8. What is Issas main concern?

Accelerate the growth of company.

9. Why Global Efficient Energy eye on going public?

To raise capital.

10. From the conservation, there are three other that Issa will consider rather than

going public. Explain in brief of all the options.

Traditional financiang, strategic equity partner.

Prepared by: Dr Maizaitulaidawati Md Husin

MBSA 1453 Financial Management and

Corporate Governance

11. In the video, Lemonis said about Capex and EBITDA. What is a capex? What is

EBITDA?

Capex capital expenditure.

Earnings Before Interest,

Taxes, Depreciation and

Amortization

12. From your opinion, why Lemonis advises to go for traditional bank cash flow

financing rather than IPO?

IPO - pay dividend. Lost company control.

Bank cash flow financing pay interest.

13. Do you think licensing deal and revenue share model will help Global Efficient

Energy to achieve fast growth?

Earn from Copyright licensing, franchising.

Prepared by: Dr Maizaitulaidawati Md Husin

Вам также может понравиться

- Northpass Best Practices To Successfully Implement A Learning Management SystemДокумент12 страницNorthpass Best Practices To Successfully Implement A Learning Management SystemJStoneОценок пока нет

- Case 3 - TransmileДокумент16 страницCase 3 - TransmileSumirah Maktar100% (1)

- Applicationof Accounting SoftwareДокумент15 страницApplicationof Accounting SoftwareWilfred MartinezОценок пока нет

- Swift Transportation Company Porter Five Forces AnalysisДокумент5 страницSwift Transportation Company Porter Five Forces AnalysisAshrafulОценок пока нет

- IndividualAssignmentUber YapChoonMing MITДокумент6 страницIndividualAssignmentUber YapChoonMing MITjycm2001100% (1)

- IndividualAssignmentUber YapChoonMing MITДокумент6 страницIndividualAssignmentUber YapChoonMing MITjycm2001100% (1)

- IHTДокумент5 страницIHTAbdul HafidzОценок пока нет

- Instructor Competency KSAДокумент32 страницыInstructor Competency KSAGabriel ChungОценок пока нет

- SampleДокумент16 страницSampleEtty NasaruddInОценок пока нет

- Talent Man1Документ180 страницTalent Man1R K DIVYA SRIОценок пока нет

- MGT 490 RepotДокумент21 страницаMGT 490 RepotmithunОценок пока нет

- Capability Development For Growth: Leverage Strength or Build Competencies atДокумент11 страницCapability Development For Growth: Leverage Strength or Build Competencies atAbhay KumarОценок пока нет

- Case Analysis: Recruitment of A StarДокумент26 страницCase Analysis: Recruitment of A StarWidi HartonoОценок пока нет

- Farm Land Dangerous Radiation Material Detection Robot - 2Документ7 страницFarm Land Dangerous Radiation Material Detection Robot - 2aminuОценок пока нет

- Business Strategic ManagementДокумент21 страницаBusiness Strategic Managementhaidil abd hamidОценок пока нет

- FEEP Edit 1Документ52 страницыFEEP Edit 1Ehsan DarwishmoqaddamОценок пока нет

- Oral Presentations RubricДокумент1 страницаOral Presentations RubricMohd Idris Shah IsmailОценок пока нет

- An Opinion Essay About Fast Food - EssayДокумент4 страницыAn Opinion Essay About Fast Food - EssayIrene SanduОценок пока нет

- Sample Ghantt Chat For ResearchДокумент2 страницыSample Ghantt Chat For Researchkhor758Оценок пока нет

- Price DiscriminationДокумент58 страницPrice DiscriminationBalamani Kandeswaran M100% (1)

- WPM 01 IntroДокумент123 страницыWPM 01 IntroZahra JabaraniОценок пока нет

- Mind Mapping PDFДокумент8 страницMind Mapping PDFNazwa ShhrinОценок пока нет

- Islamic Corporate GovernanceДокумент25 страницIslamic Corporate Governanceilyan_izani100% (2)

- BNMДокумент39 страницBNMKhairy Al-Habshee67% (3)

- LMS Project ThesisДокумент46 страницLMS Project Thesisraymar2kОценок пока нет

- Case Study PCL ConstructionДокумент7 страницCase Study PCL ConstructionNikhilesh Daby100% (1)

- Satay HouseДокумент43 страницыSatay Househannanadddeen0% (1)

- 4 Chemical Exposure MeasurementДокумент58 страниц4 Chemical Exposure MeasurementHani Liana100% (1)

- KHDA - The Kindergarten Starters 2016-2017Документ24 страницыKHDA - The Kindergarten Starters 2016-2017Edarabia.comОценок пока нет

- Report MKTДокумент18 страницReport MKTHANISОценок пока нет

- Corporate Governance in MalaysiaДокумент19 страницCorporate Governance in Malaysiakhorteik100% (1)

- TN2 Bill Miller and Value TrustДокумент7 страницTN2 Bill Miller and Value Trustfrans leonardОценок пока нет

- Faculty of Business and Management Transport Diploma in Business Studies Transport Ba117Документ15 страницFaculty of Business and Management Transport Diploma in Business Studies Transport Ba117Mizan SezwanОценок пока нет

- Design An Orientation Training Programme For A Group of Employees in An OrganisationДокумент11 страницDesign An Orientation Training Programme For A Group of Employees in An OrganisationNa'ilah Apandi100% (1)

- Assignment/ Tugasan - Marketing Management IiДокумент6 страницAssignment/ Tugasan - Marketing Management IiYogeswari SubramaniamОценок пока нет

- ResumeДокумент7 страницResumeAniezmahabbah AzlanОценок пока нет

- Coca ColaДокумент13 страницCoca ColaEvaCHIENОценок пока нет

- JKKP 8 - Register of Occupational Accidents, Dangerous Occurrence, Occupational Poisoning and Occupational DiseaseДокумент5 страницJKKP 8 - Register of Occupational Accidents, Dangerous Occurrence, Occupational Poisoning and Occupational Diseasepalanii5Оценок пока нет

- 2021.04 - 17009 - Talent - Trends - 2021 - Report - VN.v4 - 0Документ49 страниц2021.04 - 17009 - Talent - Trends - 2021 - Report - VN.v4 - 0Toan NgoОценок пока нет

- Recruiting & RetainingДокумент20 страницRecruiting & RetainingDrAmit DuttaОценок пока нет

- Gamuda AnalysisДокумент9 страницGamuda AnalysisAnonymous fE2l3DzlОценок пока нет

- Introduction of AirlinesДокумент27 страницIntroduction of AirlinesRaman Sharma100% (1)

- Tutorial Chapter 1,2 & 3Документ31 страницаTutorial Chapter 1,2 & 3Nur Nabilah Kamaruddin0% (1)

- JKKP 7 - Notification of Occupational Poisoningoccupational DiseaseДокумент1 страницаJKKP 7 - Notification of Occupational Poisoningoccupational Diseasepalanii5Оценок пока нет

- Action ResearchДокумент57 страницAction ResearchAhmad NaqiuddinОценок пока нет

- Essay On Junk FoodДокумент24 страницыEssay On Junk FoodShyam Bahadur Sunari MagarОценок пока нет

- Action Research - A Pathway To Action, Knowledge and LearningДокумент157 страницAction Research - A Pathway To Action, Knowledge and LearningFebri Susmintarti100% (1)

- FYP1 Student & Supervisor Guide (02092015) UitmДокумент32 страницыFYP1 Student & Supervisor Guide (02092015) UitmHaziq JamaludinОценок пока нет

- Acs4093 - Seminar in Entrepreneurship: Se14: Marketing Kit WorkshopДокумент13 страницAcs4093 - Seminar in Entrepreneurship: Se14: Marketing Kit WorkshopNashran Harith NazreeОценок пока нет

- Management AssignmentДокумент19 страницManagement Assignmentmohd_adib_18Оценок пока нет

- Advanced Strategic Management Yr 3 - Assignment - Strategic Options For Malaysia Airlines To Enhance Its Growth - SДокумент51 страницаAdvanced Strategic Management Yr 3 - Assignment - Strategic Options For Malaysia Airlines To Enhance Its Growth - Sjohn33% (3)

- 2016 Students ch04 - Lovelock - Developing Service Products - 6e - STUDENTДокумент36 страниц2016 Students ch04 - Lovelock - Developing Service Products - 6e - STUDENTbold onyxОценок пока нет

- AirAsia An EvaluationДокумент17 страницAirAsia An Evaluationwak_dotОценок пока нет

- Air Asia Strategic AnalysisДокумент4 страницыAir Asia Strategic AnalysisSiddhant RishiОценок пока нет

- Name: Suria Binti Zaki STUDENT ID: 2019229534 Assignment 2: Evaluation of Telegram Prepared For Prof. Dr. Fariza Hanis Abdul RazakДокумент30 страницName: Suria Binti Zaki STUDENT ID: 2019229534 Assignment 2: Evaluation of Telegram Prepared For Prof. Dr. Fariza Hanis Abdul RazakBUNGALAWANGОценок пока нет

- Marketing Ethic AssigmentДокумент5 страницMarketing Ethic AssigmentFaizal FazilОценок пока нет

- Product Life CycleДокумент5 страницProduct Life CycleEkkala Naruttey0% (1)

- Answer Case Study A Window On LifeДокумент2 страницыAnswer Case Study A Window On LifeTrần ChâuОценок пока нет

- Tutorial PerakaunanДокумент5 страницTutorial PerakaunanNureenKamalОценок пока нет

- MasДокумент29 страницMasSyaz AmriОценок пока нет

- Analysis of DigiДокумент25 страницAnalysis of DigiSabrina ShawОценок пока нет

- Introduction To Corporate Finance What Companies Do 3rd Edition Graham Solutions ManualДокумент25 страницIntroduction To Corporate Finance What Companies Do 3rd Edition Graham Solutions ManualKathrynBurkexziq100% (57)

- Humitrac XR ManualДокумент2 страницыHumitrac XR Manualjycm2001Оценок пока нет

- IT Group Project Cindy (QD) Yap (QB) Rev24Apr16Документ5 страницIT Group Project Cindy (QD) Yap (QB) Rev24Apr16jycm2001Оценок пока нет

- Documents - Tips - Group 1 LenovoДокумент18 страницDocuments - Tips - Group 1 Lenovojycm2001Оценок пока нет

- Foot Tang Gold Smith Sim Whoan YapДокумент6 страницFoot Tang Gold Smith Sim Whoan Yapjycm2001Оценок пока нет

- Presentation Slides For Question F (Sim) - QB (Yap)Документ14 страницPresentation Slides For Question F (Sim) - QB (Yap)jycm2001Оценок пока нет

- IT Group Project Cindy (QD) Yap (QB) Rev2 02may2016Документ6 страницIT Group Project Cindy (QD) Yap (QB) Rev2 02may2016jycm2001Оценок пока нет

- KTM 10apr2017 6AM TakenEllaChewДокумент1 страницаKTM 10apr2017 6AM TakenEllaChewjycm2001Оценок пока нет

- Chapter One - IntroductionДокумент14 страницChapter One - Introductionjycm2001Оценок пока нет

- ThreeДокумент9 страницThreejycm2001Оценок пока нет

- Introduction To Research: © 2009 John Wiley & Sons LTDДокумент11 страницIntroduction To Research: © 2009 John Wiley & Sons LTDjycm2001Оценок пока нет

- Case Study 2 - AppirioДокумент11 страницCase Study 2 - Appiriojycm2001Оценок пока нет

- Group 2 - UBER Case Example (Information Systems)Документ5 страницGroup 2 - UBER Case Example (Information Systems)jycm2001Оценок пока нет

- Leading Talent in Organization: Case Study 3Документ5 страницLeading Talent in Organization: Case Study 3jycm2001Оценок пока нет

- Eltek Annual Report 2014 PDFДокумент72 страницыEltek Annual Report 2014 PDFjycm2001Оценок пока нет

- Leading Talent in Organization: Case Study 2Документ6 страницLeading Talent in Organization: Case Study 2jycm2001Оценок пока нет

- Leading Talent in Organization: Case Study 1Документ4 страницыLeading Talent in Organization: Case Study 1jycm2001Оценок пока нет

- Leading Talent in Organization: Case Study 2Документ6 страницLeading Talent in Organization: Case Study 2jycm2001Оценок пока нет

- Whon Chin Wei (MBS151034) Yap Choon Ming (MBS151030) Pavanesvaraan A/L Subramaniam (MBS151007) Revathy A/P Ganesan (MBS151006)Документ21 страницаWhon Chin Wei (MBS151034) Yap Choon Ming (MBS151030) Pavanesvaraan A/L Subramaniam (MBS151007) Revathy A/P Ganesan (MBS151006)jycm200133% (3)

- Bers Case Study 3 LatestДокумент10 страницBers Case Study 3 Latestjycm2001Оценок пока нет

- Case Study 5Документ10 страницCase Study 5jycm2001Оценок пока нет

- Group Project CI YapДокумент3 страницыGroup Project CI Yapjycm2001Оценок пока нет

- ABC Class ExerciseДокумент3 страницыABC Class Exercisejycm2001Оценок пока нет

- ResponsibilitiesДокумент2 страницыResponsibilitiesjycm2001Оценок пока нет