Академический Документы

Профессиональный Документы

Культура Документы

Amalgamation Revision Notes

Загружено:

ghsjgjАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Amalgamation Revision Notes

Загружено:

ghsjgjАвторское право:

Доступные форматы

CA ANAND V KAKU

+91-9762717777

AMALGAMATION

Amalgamation in the nature of merger is an amalgamation which satisfies all the following

conditions:

(i) All the assets and liabilities of the transferor company become, after amalgamation, the

assets and liabilities of the transferee company.

(ii) Shareholders holding not less than 90% of the face value of the equity shares of the

transferor company (other than the equity shares already held therein, immediately before the

amalgamation, by the transferee company or its subsidiaries or their nominees) become equity

shareholders of the transferee company by virtue of the amalgamation.

(iii) The consideration for the amalgamation receivable by those equity shareholders of the

transferor company who agree to become equity shareholders of the transferee company is

discharged by the transferee company wholly by the issue of equity shares in the transferee

company, except that cash may be paid in respect of any fractional shares.

(iv) The business of the transferor company is intended to be carried on, after the

amalgamation, by the transferee company.

(v) No adjustment is intended to be made to the book values of the assets and liabilities of the

transferor company when they are incorporated in the financial statements of the transferee

company except to ensure uniformity of accounting policies.

If any one or more of the above conditions are not satisfied in an amalgamation, such

amalgamation is called amalgamation in the nature of purchase

Purchase Consideration

AS 14 defines the term purchase consideration as the aggregate of the shares and other

securities issued and the payment made in the form of cash or other assets by the transferee

company to the shareholders of the transferor company. In simple words, it is the price

payable by the transferee company to the transferor company for taking over the business of

the transferor company.

It is notable that purchase consideration does not include the sum which the transferee

company will directly pay to the creditors of the transferor company.

COMPUTATION OF PURCHASE CONSIDERATION

i) Lump Sum Method: The amount to be paid by the transferee company as consideration

may be stated in the problem as a lump sum. In such a case, no calculation is required.

(ii) Net Assets Method: The amount of consideration or the amount of net assets is

ascertained under this method in the following manner:

Assets taken over (at their revalued figures, if any, otherwise at their book figures).

Less: Liabilities taken over (at their agreed values, if any, otherwise at their book figures).

While determining the amount of consideration under this method care should be taken of the

following:

1. The term Assets will always include cash in hand and cash at bank, unless

otherwise stated but shall not include any fictitious asset like preliminary

expenses, underwriting commission, discount on issue of shares or debentures,

profit and loss account (debit balance), etc.

2. If any particular asset is not taken over by the transferee company, the same

should not be included while computing purchase consideration.

CA IPC- 1 DAY REVISIONARY MAY 2016 1

CA ANAND V KAKU

+91-9762717777

3. If there is any goodwill or pre-paid expenses, the same should be included in the

assets taken over unless otherwise stated.

4. The term Liabilities will mean all liabilities to third parties (the company being

the first party and shareholders being the second party).

5. The term Trade Liabilities will mean trade creditors and bills payable and shall

not include other liabilities to third parties, such as, bank overdraft, debentures,

outstanding expenses, taxation liability, etc.

6. The term Liabilities shall not include any past accumulated profits or reserves,

such as general reserve, reserve fund, sinking fund, dividend equalisation fund,

capital reserve, securities premium account, capital redemption reserve account,

profit and loss account etc. These are payable to the shareholders and not to the

third parties.

7. If any fund or portion of any fund denotes liability to third parties, the same

must be included in liabilities, such as, staff provident fund, workmens savings

bank account, workmens profit sharing fund, workmens compensation fund

(up to the amount of claim, if any), etc.

8. If any liability is not taken over by the transferee company, the same should not

be included.

9. The term business will always mean both the assets and the liabilities of the

company.

(iii) Net Payment Method: The amount of consideration under this method is ascertained by

adding up the total value of shares and other securities issued and the payments made in the

form of cash and other assets by the transferee company to the transferor company in

discharge of consideration. So the consideration constitutes the total payment in whatever

form either in shares, debentures, or in cash to the liquidator of the transferor company for

payment to the shareholders of the transferor company.

Significantly, the total payments made by the transferee company to discharge the claims of

preference shareholders and/or equity shareholders of the transferor company may be

construed as consideration.

In fact they can be satisfied by issuing preference shares/equity shares or debentures, at par,

premium or discount and partly by cash. Now the question arises, suppose the transferee

company has agreed to discharge the debentures of the transferor company by issuing its own

debentures whether it is possible to include the debentures issued to the debenture holders

as part of consideration.

In this case, according to AS-14, any payments made by the transferee company to other than

the shareholders of the transferor company cannot be treated as part of consideration.

Moreover, consideration implies the value agreed upon for the net assets taken over by the

transferee company, hence payments made to discharge the liabilities of the transferor

company may be excluded from consideration. Therefore payments made to the

debentureholders should not be considered as part of consideration and they should treated

separately and discharged as per the terms of agreement. The same principles may apply to

the cost of amalgamation paid by the transferee company since such payment will not form

part of purchase consideration and hence ignored. A separate entry will be made by the

transferee company in this regard.

It may be noted that in this study material, by consideration, under net payment method we

shall mean the total payments made by the transferee company to the shareholders of the

transferor company for the value of net assets taken over which would have been available to

the shareholders of the transferor company had there been no merger. Therefore, any

payments made to debentureholders or to discharge the liabilities of the transferor company

CA IPC- 1 DAY REVISIONARY MAY 2016 2

CA ANAND V KAKU

+91-9762717777

by the transferee company are excluded from the calculation of consideration. The practical

problems in this study material are also worked out accordingly.

While determining the amount of consideration under this method, care should be taken of

the following:

1. The value of assets and liabilities taken over by the transferee company are not to be

considered in calculating the consideration.

2. The payments made by the transferee company for shareholders, whether in cash or in

shares or in debentures must to be taken into account.

3. Where the liabilities are taken over by the transferee company and subsequently

discharged such amount should not be added to consideration.

4. When liabilities are taken over by the transferee company they are neither deducted

nor added to the amount arrived at as consideration.

5. Any payments made by the transferee company to some other party on behalf of the

transferor company are to be ignored.

6. If the liquidation expenses of the transferor company are paid by the transferee

company, the same should not be taken as a part of the consideration.

(iv) Shares Exchange Method: In this method, the consideration is ascertained on the basis

of the ratio in which the shares of the transferee company are to be exchanged for the shares

of the transferor company.

This exchange ratio is generally determined on the basis of the value of each companys

shares.

Methods of Accounting for Amalgamations

Pooling of Interest Method

Under pooling of interests method, the assets, liabilities and reserves of the Transferor

Company will be taken over by Transferee Company at existing carrying amounts unless any

adjustment is required due to different accounting policies followed by these companies. As a

result the difference between the amount recorded as share capital issued (plus any

additional consideration in the form of cash or other assets) and the amount of share capital

of Transferor Company should be adjusted in reserves.

Purchase Method

Assets and Liabilities: the assets and liabilities of the transferor company should be

incorporated at their existing carrying amounts or the purchase consideration should be

allocated to individual identifiable assets and liabilities on the basis of their fair values at the

date of amalgamation.

Reserves: No reserves, other than statutory reserves, of the transferor company should be

incorporated in the financial statements of transferee company. Statutory reserves of the

transferor company should be incorporated in the balance sheet of transferee company by

way of the following journal entry.

Amalgamation Adjustment A/c Dr.

To Statutory Reserves

When the above statutory reserves will no longer be required to be maintained by transferee

company, such reserves will be eliminated by reversing the above entry

Inter Company-owing - Should the purchasing company owe an amount to the vendor

company or vice versa, the amount will be included in the book debts of one company and

trade payables of the other. This should be adjusted by the entry:

CA IPC- 1 DAY REVISIONARY MAY 2016 3

CA ANAND V KAKU

+91-9762717777

Trade payables Dr.

To Trade receivables

The entry should be made after the usual acquisition entries have been passed. At the time of

preparing the Realisation Account and passing the business purchase entries, no attention

need be paid to the fact that the two companies involved owed money mutually.

Adjustment of the value of stock - Inter-company owings arise usually from purchase and

sale of goods; it is likely, therefore, that at the time, of the sale of business, the debtor

company also has goods in stock which it purchased from the creditor company - the cost of

the debtor company will include the profit made by the creditor company. After the takeover of

the business it is essential that such a profit is eliminated. The entry for this will be made by

the purchasing company. If it is the vendor company which has such goods in stock, at the

time of passing the acquisition entries, the value of the stock should be reduced to its cost to

the company which is acquiring the business; automatically goodwill or capital reserve, as the

case may be, will be adjusted. But if the original sale was made by the vendor company and

the stock is with the company acquiring the business, the latter company will have to debit

Goodwill (or Capital Reserve) and credit stock with the amount of the profit included in the

stock.

ACCOUNTING ENTRIES IN THE BOOKS OF TRANSFEREE COMPANY

A. In case the Amalgamation is in the nature of Merger: (Pooling of Interest Method)

On amalgamation Business Purchase Account Dr (with the amount of

of the business To Liquidator of Transferor Company consideration)

When assets, Sundry Assets (Individually) Dr (with the book value)

liabilities and To Sundry Liabilities (Individually) (with the book value)

reserves are taken To Profit and Loss A/c (with the book balance)

over from the To Reserves (with the book balance)

transferor company To Business Purchase A/c (with the consideration)

and incorporated in

the books See (Note 1 & 2)

When Liquidator of Transferor Company Dr. (with the purchase

consideration is To Equity Share Capital consideration)

satisfied To Preference Share Capital (with the paid-up value of

To Bank shares allotted)

See (Note 3) (with cash paid)

On discharge of Debentures in Transferor Company Dr.

liability (with the paid-up value of

To Debentures debentures allotted)

If the liquidation General Reserve A/c Dr. (with the amount

expenses of the of expenses)

transferor company To Bank

are borne by the

transferee company

For the formation Preliminary Expenses Account Dr. (with

expenses of the the amount of expenditure)

transferee company To Bank

Note:

CA IPC- 1 DAY REVISIONARY MAY 2016 4

CA ANAND V KAKU

+91-9762717777

1) Amalgamation in the nature of merger, all the assets, written off expenses, debit

balance of Profit and Loss Account, outside liabilities and reserves of the transferor

company have to be recorded in the books of the transferee company in the form and at

the book values as they were appearing in the books of the transferor company on the

date of amalgamation. However, if there is a conflict in the accounting policies of the

transferee and transferor companies, changes in the book values may be made to

ensure uniformity.

2) While passing the above journal entry, the difference between the amount of

consideration payable by the transferee company to the transferor company and the

amount of the share capital of the transferor company is adjusted in the general

reserve or other reserves.

3) The shares may be allotted at premium or at discount, in which case share premium

account and discount on issue of shares account should be stated. In the case of

mergers the consideration receivable by those equity shareholders of the transferor

company who agree to become equity shareholders of the transferee company is

discharged by the transferee company wholly by issue of equity shares in the transferee

company, except that cash may be paid in respect of any fractional shares. However,

the transferee company may issue preference shares to the preference shareholders of

the transferor company. Moreover, the transferee company may allot securities other

than equity shares and give cash and other assets to satisfy the dissenting

shareholders of the transferor company.

B. In case the Amalgamation is in the nature of Purchase:

On acquisition of the Business Purchase A/c Dr. (with the amount of consideration)

business from the To Liquidator of Transferor

transferor company Company

When the assets and Sundry Assets A/c Dr. (Individually excluding goodwill,

liabilities are taken with their revalued figures, if any,

over from transferor otherwise at their book figures)

company To Sundry Liabilities A/c (with the figures at which

(Individually) they are taken over)

To Business Purchase A/c (with the amount of consideration)

When the Liquidator of Transferor (with the amount of consideration)

consideration is Company Dr.

satisfied To Preference Share Capital (with the face value of shares

A/c allotted)

To Equity Share Capital A/c

To Debentures A/c (with the face value of debentures

allotted)

To Bank (with the amount paid)

To record the Amalgamation Adjustment A/c (with the amount of statutory

statutory reserves of Dr reserve)

the transferor To Statutory Reserve A/c

company in the books

of the transferee

company

If the liquidation Goodwill Account Dr. (with the amount of expenditure)

expenses of the To Bank

transferor company

are borne by the

CA IPC- 1 DAY REVISIONARY MAY 2016 5

CA ANAND V KAKU

+91-9762717777

transferee company

With the formation Preliminary Expenses A/c Dr. (with the amount of expenditure)

expenses of the To Bank

transferee company

If there are both Capital Reserve A/c Dr. (with the amount written off)

goodwill and capital To Goodwill A/c

reserve, Goodwill may

be written off against

Capital Reserve

If any liability is Respective Liability A/c Dr. (with the amount payable)

discharged by the To Share Capital A/c (as the case may be)

transferee company To Debentures A/c

To Bank

ACCOUNTING ENTRIES IN THE BOOKS OF TRANSFEROR COMPANY

It involves the closing of accounts in the books of the transferor company. The following

procedures are followed:

Open a Realisation Realisation A/c Dr. (with the total)

Account and transfer all To Sundry Assets A/c (with their books value)

the assets except any (Individually)

fictitious assets like

preliminary expenses,

underwriting

commission, discount

on issue of shares or

debentures, profit and

loss account (Dr.)

balance, etc., to it at

their book value:

Transfer the liabilities Sundry Liabilities A/c Dr (with their book figure)

taken over by the (individually)

transferee company To Realisation A/c (with the total)

consideration becoming Transferee Company Dr (with the amount of

due To Realisation A/c consideration)

If any assets (other than Bank Dr (with the realised value)

fictitious assets) is not To Realisation A/c

taken over by the

transferee company, the

same has to be realised

by the transferor

company itself:

On receiving the Shares in Transferee Company (as the case may be

consideration from the Dr Debentures in according to

transferee company: Transferee Company Dr the terms of discharge of the

Bank Dr consideration)

CA IPC- 1 DAY REVISIONARY MAY 2016 6

CA ANAND V KAKU

+91-9762717777

To Transferee Company

If the liquidation Realisation A/c Dr (with the amount of

expenses or realisation To Bank expenditure)

expenses are borne by

the transferor company

itself

If the liquidation In such a case, it is better not to

expenses or realisation pass any entry in the books of

expenses are borne by the transferor company.

the transferee company: Alternatively, the

following two entries may be

passed, the effect of which will be

practically nil:

(i) Transferee Company Dr (with

the amount of

To Bank expenditure)

(ii) Bank Dr (with the amount of

To Transferee Company

expenditure)

Entry (i) is passed when the

expenditure is incurred, and

entry (ii) when it is reimbursed

If any liability is not (a) In case of Profit: (with the profit, i.e difference

taken over by the Respective Liability A/c Dr between the

transferee company, the To Realisation A/c amount due and the amount

same need not be payable)

transferred to the

Realisation

Account. On payment, (b) In case of Loss: (with the loss, i.e,difference

the liability account Realisation A/c Dr between the amount payable

should be debited and To Respective Liability A/c and

Bank Account is the amount due)

credited with the actual

amount paid. But, if

there is any profit or

loss on redemption of

the liability, the same

must be shown in the

Realisation Account.

Now pay off the outside Respective Liability A/c Dr (with the amount paid)

liabilities, if any, not To Bank

taken over by the

transferee company:

When the debentures (a) Debentures A/c Dr (with the book value)

are discharged: (not To Debentureholders A/c

assumed or discharged (b) Debentureholders A/c Dr (with the amount paid)

by transferee company) To Bank

Now, pay off the (a) Preference Share Capital A/c (with the book figures)

CA IPC- 1 DAY REVISIONARY MAY 2016 7

CA ANAND V KAKU

+91-9762717777

preference Dr

shareholders, if any To Preference Shareholders (with the amount payable)

A/c

(b) Preference Shareholders A/c

Dr

To Preference Shares in

Transferee Company

To Equity Shares in Transferee

Company (as the case may be)

To Debentures in Transferee

Company

To Bank

Now, close the (a) In case of profit: (with the amount of profit)

Realisation Account and Realisation A/c Dr

transfer the profit or To Equity Shareholders A/c

loss on realisation to (b) In case of loss: (with the amount of loss)

Equity Shareholders Equity Shareholders A/c Dr

Account: To Realisation A/c

Before the equity Equity Share Capital A/c Dr (with the paid up value)

shareholders are paid General Reserve A/c Dr (with their figures as the

off, transfer equity Reserve Fund A/c Dr case may be)

share capital and the Capital Reserve A/c Dr

past accumulated Profit and Loss A/c Dr

profits and reserves to To Equity Shareholders A/c (with the total)

Equity Shareholders

Account:

Similarly, transfer the Equity Shareholders A/c Dr (with the total)

past accumulated To Profit and Loss A/c

losses and fictitious To Preliminary Expenses A/c

assets, if any, to Equity To Underwriting Commission A/c

Shareholders Account: To Discount on Issue of Shares (as the case may be)

A/c

To Discount on Issue of

Debentures A/c

Now, pay off the equity Equity Shareholders A/c Dr (with the amount payable)

shareholders: To Equity Shares in Transferee (as the case may be)

Co A/c

To Preference Shares in

Transferee Co A/c

To Debentures in Transferee

Co A/c

To Bank

Notes:

(i) If cash in hand and cash at bank are not taken over by the transferee company, do not

transfer them to Realisation Account. But, if it is taken over, then it must be transferred to

the Realisation Account.

CA IPC- 1 DAY REVISIONARY MAY 2016 8

CA ANAND V KAKU

+91-9762717777

(ii) The asset not taken over by the transferee company has also to be transferred to the

Realisation Account.

(iii) Goodwill and other intangible assets like trade marks, patent rights, etc. are also

transferred to Realisation Account provided they have realisable value or they are taken over

by the transferee company.

Notes:

1. If preference shareholders or debentureholders are paid more or less than the amount due

to them as per balance sheet, the difference be transferred Equity Shareholders Account

through Realisation Account.

2. After the equity shareholders are paid off, all the accounts in the book of the transferor

company will be closed and not a single account will show any balance.

3. The net amount payable to the equity shareholders, after adjustment of accumulated

profits and reserves, fictitious assets and profit or loss on realisation, must be equal to the

amount of shares and debentures in transferee company and cash received from the

transferee company left after discharge of all liabilities and preference share capital.

---****---

Nothing can stop the man with the right mental attitude from

achieving his goal; nothing on earth can help the man with the

wrong mental attitude.

-Thomas Jefferson

CA IPC- 1 DAY REVISIONARY MAY 2016 9

Вам также может понравиться

- Paper XV Corporate Accounting: Kannur University School of Distance EducationДокумент110 страницPaper XV Corporate Accounting: Kannur University School of Distance EducationUnni AmpadiОценок пока нет

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingОт EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingОценок пока нет

- Accounting Standard (AS) 14 (Issued 1994)Документ18 страницAccounting Standard (AS) 14 (Issued 1994)Jayanti JainОценок пока нет

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeОт Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeРейтинг: 1 из 5 звезд1/5 (1)

- Aca Mergers and Acquitions of CompaniesДокумент9 страницAca Mergers and Acquitions of CompaniesRavichandraОценок пока нет

- Accounting Aspects For Mergers and AcquisitionsДокумент19 страницAccounting Aspects For Mergers and AcquisitionsHiral PatelОценок пока нет

- Ac Standard - AS14Документ10 страницAc Standard - AS14api-3705877Оценок пока нет

- 4 Sem Bcom - Advanced Corporate AccountingДокумент56 страниц4 Sem Bcom - Advanced Corporate AccountingDipak Mahalik57% (7)

- AS 14 Amalgamation and Absorption ChapterДокумент20 страницAS 14 Amalgamation and Absorption ChapternshklwrОценок пока нет

- Amalgmation, Absorbtion, External ReconstructionДокумент9 страницAmalgmation, Absorbtion, External Reconstructionpijiyo78Оценок пока нет

- Lesson 5 Tax Planning With Reference To Capital StructureДокумент37 страницLesson 5 Tax Planning With Reference To Capital StructurekelvinОценок пока нет

- Notes To Fs - SeДокумент8 страницNotes To Fs - SeMilds LadaoОценок пока нет

- AmalgamationДокумент35 страницAmalgamationKaran VyasОценок пока нет

- Amalgamation VS AbsorptionДокумент7 страницAmalgamation VS AbsorptionAbhinav RandevОценок пока нет

- Financial Instruments FINALДокумент40 страницFinancial Instruments FINALShaina DwightОценок пока нет

- Probiotec Annual Report 2022 6Документ8 страницProbiotec Annual Report 2022 6楊敬宇Оценок пока нет

- Day 13 - Insurance - SAДокумент3 страницыDay 13 - Insurance - SAVarun JoshiОценок пока нет

- Amalgamation of Companies (AS 14)Документ22 страницыAmalgamation of Companies (AS 14)Sanaullah M SultanpurОценок пока нет

- Chapter - 2 Amalgamation of CompaniesДокумент10 страницChapter - 2 Amalgamation of CompanieshanumanthaiahgowdaОценок пока нет

- Amalgamation of Companies 2Документ19 страницAmalgamation of Companies 2Dipen Adhikari0% (1)

- IND AS NotesДокумент3 страницыIND AS NotesKhushi SoniОценок пока нет

- Accounting Standard (As) 14 (Issued 1994) Accounting ForamalgamationsДокумент9 страницAccounting Standard (As) 14 (Issued 1994) Accounting ForamalgamationsasifanisОценок пока нет

- Amalgamation of CompaniesДокумент3 страницыAmalgamation of CompaniessandeepОценок пока нет

- 69242asb55316 As14Документ15 страниц69242asb55316 As14harinivadivel2000Оценок пока нет

- AFAR 201808 1 Business Combination Statutory MergersДокумент6 страницAFAR 201808 1 Business Combination Statutory MergersAlarich Catayoc0% (1)

- Cash Flow Statement Summary PDFДокумент3 страницыCash Flow Statement Summary PDFAnantha NarayanОценок пока нет

- BOSCOMДокумент18 страницBOSCOMArah Opalec100% (1)

- Acquirer Obtains Control of One or More Businesses.: ConceptДокумент6 страницAcquirer Obtains Control of One or More Businesses.: ConceptJohn Lexter MacalberОценок пока нет

- WWW Yourarticlelibrary Com Accounting Amalgamation Amalgamation of Companie PDFДокумент20 страницWWW Yourarticlelibrary Com Accounting Amalgamation Amalgamation of Companie PDFMayur100% (1)

- ACC208 CH 7 AmalgamationДокумент23 страницыACC208 CH 7 AmalgamationSaja AlbarjesОценок пока нет

- 76322bos61648 cp5Документ70 страниц76322bos61648 cp5pikachupiki181Оценок пока нет

- Redemption of Debentures.Документ11 страницRedemption of Debentures.Basil shibuОценок пока нет

- Amalgamation TheoryДокумент21 страницаAmalgamation TheorySubashVenkataram100% (1)

- Chapter - 1: Meaning and DefinitionДокумент12 страницChapter - 1: Meaning and DefinitionShilpa S RaoОценок пока нет

- Fischer11e SMChap14 FinalДокумент38 страницFischer11e SMChap14 Finalgilli1trОценок пока нет

- Mergers and AcquisitionsДокумент16 страницMergers and Acquisitionsnaman somaniОценок пока нет

- Chapter03 PDFДокумент27 страницChapter03 PDFBabuM ACC FIN ECOОценок пока нет

- Chapter 1Документ9 страницChapter 1Trazy Jam BagsicОценок пока нет

- Chapter One: Current Liabilities, Provisions, and Contingencies The Nature, Type and Valuation of Current LiabilitiesДокумент12 страницChapter One: Current Liabilities, Provisions, and Contingencies The Nature, Type and Valuation of Current LiabilitiesJuan KermaОценок пока нет

- Lesson 5 - Statement of Financial Position (Part 1)Документ10 страницLesson 5 - Statement of Financial Position (Part 1)yana jungОценок пока нет

- Final SummaryДокумент6 страницFinal SummaryAkanksha singhОценок пока нет

- Sureme 75 FinalxcbcvbvcbДокумент61 страницаSureme 75 FinalxcbcvbvcbBhavin Shah100% (1)

- Amalgamantion and External ReconstructionДокумент67 страницAmalgamantion and External Reconstructionkhuranaamanpreet7gmailcomОценок пока нет

- Acc470 Ias 36Документ33 страницыAcc470 Ias 36Naji EssaОценок пока нет

- Module 2 - ReceivablesДокумент15 страницModule 2 - ReceivablesJehPoyОценок пока нет

- Chapter 12 Audit of General Insurance Companies PMДокумент11 страницChapter 12 Audit of General Insurance Companies PMforevapure_bar88162Оценок пока нет

- Provisions, Contingent Liabilities and Contingent AssetsДокумент36 страницProvisions, Contingent Liabilities and Contingent Assetspks009Оценок пока нет

- 14 Purchase of Business And, Profits Prior To Incorporation: O EctivesДокумент20 страниц14 Purchase of Business And, Profits Prior To Incorporation: O EctivesSandhiyaОценок пока нет

- Amalgamation of CompaniesДокумент46 страницAmalgamation of CompaniesRoyal funОценок пока нет

- ACCOUNTING-IMPLICATION Merger and AcquisitionДокумент32 страницыACCOUNTING-IMPLICATION Merger and AcquisitionPrison PubgОценок пока нет

- Aud Prob Part 1Документ106 страницAud Prob Part 1Ma. Hazel Donita DiazОценок пока нет

- Chapter 1 - Introduction To CFSДокумент27 страницChapter 1 - Introduction To CFSKISHAALINI BALANОценок пока нет

- Int. Acc 3 AssignДокумент3 страницыInt. Acc 3 AssignElea MorataОценок пока нет

- Financial Accounting Theory (Sem V) PDFДокумент4 страницыFinancial Accounting Theory (Sem V) PDFHarshal JainОценок пока нет

- 3sm Finalnew Accpro-Part3Документ167 страниц3sm Finalnew Accpro-Part3B GANAPATHYОценок пока нет

- Probiotec Annual Report 2021 6Документ8 страницProbiotec Annual Report 2021 6楊敬宇Оценок пока нет

- IFRS 3 Business CombinationДокумент52 страницыIFRS 3 Business CombinationRusselle Therese DaitolОценок пока нет

- Cfas Chapter 23-26 NotesДокумент12 страницCfas Chapter 23-26 Noteskhyzhirell028Оценок пока нет

- August 2013: PR No. 9/2013 - Special Deduction For Expenditure On Treasury SharesДокумент18 страницAugust 2013: PR No. 9/2013 - Special Deduction For Expenditure On Treasury SharesKen ChiaОценок пока нет

- Course Business LawДокумент8 страницCourse Business LawghsjgjОценок пока нет

- Childhood Gender Nonconformity and Children's Past-Life MemoriesДокумент10 страницChildhood Gender Nonconformity and Children's Past-Life MemoriesghsjgjОценок пока нет

- Course Structure - NMIMS Navi Mumbai Campus BBA (2017 - 2020)Документ2 страницыCourse Structure - NMIMS Navi Mumbai Campus BBA (2017 - 2020)ghsjgjОценок пока нет

- Oyster Mushrooms Humidity Control Based On Fuzzy Logic by Using Arduino Atmega238 MicrocontrollerДокумент13 страницOyster Mushrooms Humidity Control Based On Fuzzy Logic by Using Arduino Atmega238 MicrocontrollerghsjgjОценок пока нет

- Chapter 4 Retirement or Death of A PartnerДокумент2 страницыChapter 4 Retirement or Death of A PartnerghsjgjОценок пока нет

- Chapter 1663Документ26 страницChapter 1663ghsjgjОценок пока нет

- Sybba FДокумент1 страницаSybba FghsjgjОценок пока нет

- Case Study Journey Into Self AwarenessДокумент1 страницаCase Study Journey Into Self Awarenessghsjgj100% (1)

- Lunacy and Idiocy - The Old Law and Its IncubusДокумент8 страницLunacy and Idiocy - The Old Law and Its IncubusghsjgjОценок пока нет

- (I) Purpose (Ii) Scope: Maharashtra Debate Open 2020 Equity PolicyДокумент11 страниц(I) Purpose (Ii) Scope: Maharashtra Debate Open 2020 Equity PolicyghsjgjОценок пока нет

- BBA Course Structure 2020 - 23Документ1 страницаBBA Course Structure 2020 - 23ghsjgjОценок пока нет

- Scanned With CamscannerДокумент5 страницScanned With CamscannerghsjgjОценок пока нет

- Welcome - Freebie (Absurd - Design)Документ6 страницWelcome - Freebie (Absurd - Design)ghsjgjОценок пока нет

- Principles of Management ProjectДокумент23 страницыPrinciples of Management ProjectghsjgjОценок пока нет

- Fffi:-Ffid Ffirffi F T T: FfitqtДокумент4 страницыFffi:-Ffid Ffirffi F T T: FfitqtghsjgjОценок пока нет

- Barriers To Effective ListeningДокумент2 страницыBarriers To Effective ListeningghsjgjОценок пока нет

- FlipMoran - Origami Flowers - Book One (2004) - Michael LafosseДокумент18 страницFlipMoran - Origami Flowers - Book One (2004) - Michael LafosseghsjgjОценок пока нет

- Align Yourself With The CompanyДокумент2 страницыAlign Yourself With The CompanyghsjgjОценок пока нет

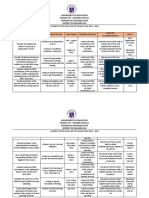

- Egistration: Learning OutcomesДокумент56 страницEgistration: Learning OutcomesghsjgjОценок пока нет

- Spirale PDFДокумент1 страницаSpirale PDFghsjgjОценок пока нет

- CIR Vs PAL - ConstructionДокумент8 страницCIR Vs PAL - ConstructionEvan NervezaОценок пока нет

- Amerisolar AS 7M144 HC Module Specification - CompressedДокумент2 страницыAmerisolar AS 7M144 HC Module Specification - CompressedMarcus AlbaniОценок пока нет

- Dialog Suntel MergerДокумент8 страницDialog Suntel MergerPrasad DilrukshanaОценок пока нет

- ADS 460 Management Principles and Practices: Topic 1: Introduction To ManagementДокумент33 страницыADS 460 Management Principles and Practices: Topic 1: Introduction To ManagementNURATIKAH BINTI ZAINOL100% (1)

- PLT Lecture NotesДокумент5 страницPLT Lecture NotesRamzi AbdochОценок пока нет

- Delta AFC1212D-SP19Документ9 страницDelta AFC1212D-SP19Brent SmithОценок пока нет

- Marine Lifting and Lashing HandbookДокумент96 страницMarine Lifting and Lashing HandbookAmrit Raja100% (1)

- Unit 2Документ97 страницUnit 2MOHAN RuttalaОценок пока нет

- 09 WA500-3 Shop ManualДокумент1 335 страниц09 WA500-3 Shop ManualCristhian Gutierrez Tamayo93% (14)

- Lactobacillus Acidophilus - Wikipedia, The Free EncyclopediaДокумент5 страницLactobacillus Acidophilus - Wikipedia, The Free Encyclopediahlkjhlkjhlhkj100% (1)

- Presentation Report On Customer Relationship Management On SubwayДокумент16 страницPresentation Report On Customer Relationship Management On SubwayVikrant KumarОценок пока нет

- BASUG School Fees For Indigene1Документ3 страницыBASUG School Fees For Indigene1Ibrahim Aliyu GumelОценок пока нет

- GL 186400 Case DigestДокумент2 страницыGL 186400 Case DigestRuss TuazonОценок пока нет

- Cancellation of Deed of Conditional SalДокумент5 страницCancellation of Deed of Conditional SalJohn RositoОценок пока нет

- Microsoft Word - Claimants Referral (Correct Dates)Документ15 страницMicrosoft Word - Claimants Referral (Correct Dates)Michael FourieОценок пока нет

- Heavy LiftДокумент4 страницыHeavy Liftmaersk01Оценок пока нет

- LMU-2100™ Gprs/Cdmahspa Series: Insurance Tracking Unit With Leading TechnologiesДокумент2 страницыLMU-2100™ Gprs/Cdmahspa Series: Insurance Tracking Unit With Leading TechnologiesRobert MateoОценок пока нет

- Section 8 Illustrations and Parts List: Sullair CorporationДокумент1 страницаSection 8 Illustrations and Parts List: Sullair CorporationBisma MasoodОценок пока нет

- Oem Functional Specifications For DVAS-2810 (810MB) 2.5-Inch Hard Disk Drive With SCSI Interface Rev. (1.0)Документ43 страницыOem Functional Specifications For DVAS-2810 (810MB) 2.5-Inch Hard Disk Drive With SCSI Interface Rev. (1.0)Farhad FarajyanОценок пока нет

- Algorithmique Et Programmation en C: Cours Avec 200 Exercices CorrigésДокумент298 страницAlgorithmique Et Programmation en C: Cours Avec 200 Exercices CorrigésSerges KeouОценок пока нет

- State Immunity Cases With Case DigestsДокумент37 страницState Immunity Cases With Case DigestsStephanie Dawn Sibi Gok-ong100% (4)

- 23 Things You Should Know About Excel Pivot Tables - Exceljet PDFДокумент21 страница23 Things You Should Know About Excel Pivot Tables - Exceljet PDFRishavKrishna0% (1)

- QA/QC Checklist - Installation of MDB Panel BoardsДокумент6 страницQA/QC Checklist - Installation of MDB Panel Boardsehtesham100% (1)

- Online Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Документ16 страницOnline Learning Interactions During The Level I Covid-19 Pandemic Community Activity Restriction: What Are The Important Determinants and Complaints?Maulana Adhi Setyo NugrohoОценок пока нет

- Income Statement, Its Elements, Usefulness and LimitationsДокумент5 страницIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamОценок пока нет

- Action Plan Lis 2021-2022Документ3 страницыAction Plan Lis 2021-2022Vervie BingalogОценок пока нет

- Republic of The Philippines National Capital Judicial Region Regional Trial Court Manila, Branch 1Документ4 страницыRepublic of The Philippines National Capital Judicial Region Regional Trial Court Manila, Branch 1brendamanganaanОценок пока нет

- Sky ChemicalsДокумент1 страницаSky ChemicalsfishОценок пока нет

- Course Specifications: Fire Investigation and Failure Analysis (E901313)Документ2 страницыCourse Specifications: Fire Investigation and Failure Analysis (E901313)danateoОценок пока нет

- Sophia Program For Sustainable FuturesДокумент128 страницSophia Program For Sustainable FuturesfraspaОценок пока нет

- Getting to Yes: How to Negotiate Agreement Without Giving InОт EverandGetting to Yes: How to Negotiate Agreement Without Giving InРейтинг: 4 из 5 звезд4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (14)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsОт EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsРейтинг: 5 из 5 звезд5/5 (1)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!От EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Рейтинг: 4.5 из 5 звезд4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessОт EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessРейтинг: 4.5 из 5 звезд4.5/5 (28)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)От EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Рейтинг: 4 из 5 звезд4/5 (33)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsОт EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsРейтинг: 4 из 5 звезд4/5 (7)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОт EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОценок пока нет

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItОт EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetОт EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCОт EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCРейтинг: 5 из 5 звезд5/5 (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)От EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeОт EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeРейтинг: 4 из 5 звезд4/5 (21)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingОт EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingРейтинг: 4.5 из 5 звезд4.5/5 (760)

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookОт EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookРейтинг: 5 из 5 звезд5/5 (4)

- Attention Pays: How to Drive Profitability, Productivity, and AccountabilityОт EverandAttention Pays: How to Drive Profitability, Productivity, and AccountabilityОценок пока нет

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookОт EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookОценок пока нет

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)От EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditОт EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditРейтинг: 5 из 5 звезд5/5 (1)