Академический Документы

Профессиональный Документы

Культура Документы

Cpa Australia Tax and Social Security Guide: 2016-2017

Загружено:

Lupo AlbertoОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cpa Australia Tax and Social Security Guide: 2016-2017

Загружено:

Lupo AlbertoАвторское право:

Доступные форматы

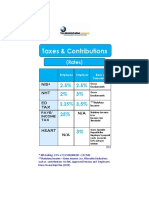

CPA AUSTRALIA

TAX AND SOCIAL SECURITY GUIDE: 20162017

This guide is the initiative of the CPA Australia Retirement Savings MEDICARE LEVY SURCHARGE

Centre of Excellence. Information is current based on legislation

TAXABLE INCOME TAXABLE INCOME SURCHARGE

and Social Security rates as at 1 January 2017.

($) SINGLE ($) FAMILIES*^

TAX RATES Tier 1 90,001105,000 180,001210,000 1.0%

Tier 2 105,001140,000 210,001280,000 1.25%

RESIDENT PERSONAL TAX RATES 1/7/1630/6/17

Tier 3 Over 140,000 Over 280,000 1.5%

TAXABLE INCOME $ MARGINAL RATE TAX PAYABLE $

* Threshold increased by $1,500 per child after the first.

Up to 18,200 Nil Nil

^ Single parents and couples (including de facto couples) subject to family

18,20137,000 19% 19c for each $1 tiers.

over 18,200

37,00187,000* 32.5% 3,572 plus 32.5c for OTHER TAX RATES

each $1 over 37,000

TAX RATE

87,001180,000* 37% 19,822 plus 37c for

each $1 over 87,000 Company 30%

Excess over 180,000 45% 54,232 plus 45c for Superannuation fund:

each $1 over 180,000 Complying 15%

Non-complying 45%

Insurance and Friendly Society 30%

TAX RATE FOR MINORS UNEARNED INCOME Bonds

INCOME MARGINAL RATE

$0$416 Nil TAX OFFSETS

$417$1,307 66% LOW INCOME TAX OFFSET (LITO)

Excess over $1,307 45% on all income MAX. REBATE SHADE-OUT CUT-OUT

Earned income taxed at (adult) marginal rates. LEVEL $* THRESHOLD $ THRESHOLD $

Low 445 37,000 66,667

NON-RESIDENT PERSONAL TAX RATES 1/7/1630/6/17 income

earner

TAXABLE INCOME $ MARGINAL RATE TAX PAYABLE $ * Reduced by 1.5c for each $1 of taxable income over $37,000. Tax free

Up to 87,000 32.5% 32.5c for each $1 over threshold effectively $20,542. Not available for minors on unearned

income.

87,001180,000 37% 28,275 plus 37c for

each $1 over 80,000

SENIOR AND PENSIONERS TAX OFFSET (SAPTO)

Excess over $180,000 45% 62,685 plus 45% for

each $1 over $180,000 MAX. REBATE SHADE-OUT CUT-OUT

LEVEL $* THRESHOLD $ THRESHOLD $

TEMPORARY BUDGET REPAIR LEVY Single 2,230 32,279 50,119

Applies to resident and non-resident individual taxpayers, with a Couple (each) 1,602 28,974 41,790

taxable income of more than $180,000 per year. Couple 2,040 31,279 47,599

Levy is 2% of each dollar over taxable income of $180,000. (separated due

to illness each)

Will cease to apply from 1 July 2017.

* Rebate reduces by 12.5c for each $1 of taxable income above the shade-

MEDICARE LEVY out threshold.

2.0% of taxable income not applicable to:

Non-residents.

Individual taxpayers where taxable income is under the threshold

amount $21,355 (2015/16).

Married taxpayers where family income is under the family

income threshold $45,001 + $4,132 for each dependent child/

student (201516).

Individual taxpayers eligible for SAPTO where taxable income is

under $33,738 (2015/16).

Married taxpayer eligible for SAPTO where family income is

under $58,707 + $4,132 for each dependent child/student

(201516).

Medicare levy shaded in where taxable income is above the

threshold limits.

2 | Tax and Social Security Guide: 20162017

SUPERANNUATION SPOUSE CONTRIBUTION EMPLOYMENT TERMINATION PAYMENTS

TAX OFFSET

THRESHOLDS MAXIMUM CAP TO

SPOUSE ASSESSABLE MAX. REBATABLE MAX. REBATE $ (18% TAX RATE* APPLY

INCOME (SAI) CONTRIBUTION OF THE LESSER OF)

Life benefit ETP 0%

(MRC) $

Tax free component

010,800 3,000 MRC or actual

contribution Life benefit ETP

Taxable component

10,80113,799 3,000 (SAI 10,800) MRC or actual

contribution Under preservation age $0$195,000^ 30% ETP cap

13,800+ Nil Nil Preservation age or over $0$195,000 15% ETP cap

* Includes reportable fringe benefits + reportable employer super All ages Balance over 45% ETP cap

contributions. Payment is because of: ETP cap

* The SAI threshold to claim the maximum rebate will increase to $37,000 early retirement scheme

from 1 July 2017. The upper threshold will increase to $40,000.

genuine redundancy

invalidity

FRINGE BENEFITS TAX compensation for

personal injury, unfair

FRINGE BENEFITS TAX RATE (FBT YEAR END 31 MARCH dismissal, harassment or

2017) discrimination.

FRINGE BENEFIT PROVIDED GROSS-UP RATE Life benefit ETP

After 30/6/00 which have been 2.1463 Taxable component

eligible to an input tax credit under Under preservation age $0$195,000^ 30% Lesser of

GST regime ETP cap

Preservation age or over $0$195,000 15%

Does not attract an input tax credit 1.9608 and whole-

All ages Balance over 45% of-income

FBT Rate is 49% and calculated on tax-inclusive value of fringe benefit ETP cap cap

Payment is because of:

provided in the year.

golden handshake

gratuities

STATUTORY FRACTIONS FOR CAR BENEFIT VALUATION

payment in lieu of notice

Flat statutory rate of 20% applies to all car fringe benefits

payment for unused sick

provided from 1 April 2014. leave

The statutory percentages for car fringe benefits below apply payment for unused

to pre-existing commitments prior to 7:30 pm AEST on 10 May rostered days off.

2011, or where there is a pre-existing commitment in place to * Plus Medicare Levy (2%).

provide the car after this time. ^ Indexed to AWOTE, increase in $5,000 increments.

Whole-of-income cap for 201213 and onwards is $180,000 (not indexed).

ANNUALISED NO. OF WHOLE EXISTING CONTRACTS

KMS

Less than 15,000 26%

DEATH BENEFIT EMPLOYMENT TERMINATION

PAYMENTS

15,000 to 24,999 20%

25,000 to 40,000 11% THRESHOLDS MAXIMUM TAX RATE*

More than 40,000 7% Dependent $0$195,000^ 0%

Tax free component Balance 0%

Taxable component 45%

TRANSITIONAL ARRANGEMENTS AND RATES

Non-dependent $0$195,000^ 0%

Apply to any new commitments entered into from 10 May 2011.

Tax free component Balance 30%

Where there is a change to pre-existing commitment these

Taxable component 45%

transitional arrangements will also apply.

* Plus Medicare Levy (2%).

STATUTORY % ^ Indexed to AWOTE, increase in $5,000 increments.

ANNUALISED FROM 10 FROM 1 FROM 1 FROM 1

NO. OF WHOLE MAY 2011 APRIL 2012 APRIL 2013 APRIL 2014

KMS

Less than 15,000 .20 .20 .20 .20

15,00025,000 .20 .20 .20 .20

25,00040,000 .14 .17 .20 .20

Over 40,000 .10 .13 .17 .20

3 | Tax and Social Security Guide: 20162017

OTHER TERMINATION PAYMENTS AGE PENSION

NON ETP LUMP SUM PAYMENTS QUALIFICATION

PERIOD OF ASSESSABLE MAX. TAX DATE OF BIRTH ELIGIBLE FOR AGE PENSION

ACCRUAL AMOUNT RATE* AT AGE

Unused Long Pre 16/8/78 5% Marginal rate WOMEN MEN

Service Leave

1 January 194630 June 1947 64.5 65

16/5/7817/8/93 100% 30%

1 July 194731 December 1948 64.5 65

Post 17/8/93 100% Marginal rate

1 January 194930 June 1952 65 65

Accrued Annual Pre 18/8/93 100% 30%

1 July 195231 December 1953 65.5 65.5

Leave

1 January 195430 June 1955 66 66

Post 17/8/93 100% Marginal rate

1 July 195531 December 1956 66.5 66.5

* Tax rates excludes Medicare Levy.

1 January 1957 or later 67 67

BONA FIDE REDUNDANCY AND APPROVED EARLY

RETIREMENT SCHEME PAYMENTS PENSION RATES

PERIOD OF ASSESSABLE MAX. TAX MAX. BENEFIT $ MAX. BENEFIT $

ACCRUAL AMOUNT RATE* (PER FORTNIGHT)* (PER ANNUM)*

Unused Long Pre 16/8/78 5% Marginal rate Single 797.90 20,745.40

Service Leave Couple (each) 601.50 15,639.00

Post 15/8/93 100% 30% Couple separated due 797.90 20,745.40

Accrued Annual Full Period 100% 30% to illness (each)

Leave * Excludes the Pension Supplement $65.10 (singles) and $49.10 (couples)

Bona fide redundancy Tax-Free Amount: $9,936 + $4,969 for each per fortnight can elect to receive as a quarterly payment.

completed year of service. Also excludes Clean Energy Supplement $14.10 (singles) and $10.60

* Excludes Medicare Levy. (couple, each).

TABLE OF LIFE EXPECTANCY INCOME TEST

AGE LIFE EXPECTANCY (YRS) AGE LIFE EXPECTANCY (YRS) INCOME INCOME CUT-OUT**

THRESHOLD* (PER FORTNIGHT)

MALE FEMALE MALE FEMALE (PER FORTNIGHT)

55 27.71 31.02 73 13.11 15.38 Single Up to $164 Less than $1,918.20

56 26.83 30.10 74 12.40 14.60 Couple (combined) Up to $292 Less than $2,936.80

57 25.95 29.19 75 11.72 13.83 Couple separated due Up to $292 Less than $3,800.40

58 25.09 28.28 76 11.05 13.08 to illness (combined)

59 24.22 27.37 77 10.41 12.33 Income includes reportable super contributions and net investment losses.

Exempt from income test if permanently blind and receive Age Pension or

60 23.37 26.47 78 9.78 11.61

Disability Support Pension (DSP).

61 22.52 25.57 79 9.18 10.90 * Fortnightly pension reduced by 50c (single) or 25c (couple, each) for each

62 21.68 24.68 80 8.60 10.21 dollar over the threshold.

63 20.85 23.80 81 8.04 9.55 ** Payment rates may be higher if also receive Rent Assistance with the

pension payment.

64 20.03 22.92 82 7.51 8.90 Work Bonus

65 19.22 22.05 83 7.00 8.29 First $250 of employment income earned each fortnight exempt from

66 18.41 21.18 84 6.52 7.70 the income test.

Any unused amount earned between $0 and $250 is added to the Work

67 17.62 20.33 85 6.06 7.14

Bonus balance, up to $6,500.

68 16.84 19.48 86 5.64 6.61 This can be used to offset any future employment income earned in a

69 16.07 18.64 87 5.24 6.11 single fortnight above $250.

70 15.31 17.80 88 4.87 5.65

71 14.56 16.98 89 4.52 5.22

72 13.83 16.18 90 4.21 4.82

* Payments commenced on or after 1/1/2015. Based on 2010-12 life tables.

4 | Tax and Social Security Guide: 20162017

ASSETS TEST PENSION BONUS SCHEME

HOMEOWNER LOWER LIMIT* UPPER LIMIT# YEARS IN THE SINGLE MAX. RATE PARTNERED (EACH)

SCHEME MAX. RATE

Single Up to $250,000 Less than $542,500

1 year $2,005.50 $1,515.80

Couple Up to $375,000 Less than $816,000

2 years $8,072.20 $6,063.10

Couple separated by Up to $375,000 Less than $960,000

illness (combined) 3 years $18,049.90 $13,641.90

One partner eligible Up to $375,000 Less than $816,000 4 years $32,088.70 $24,252.30

NON-HOMEOWNER LOWER LIMIT* UPPER LIMIT# 5 years $50,138.70 $37,894.20

Single Up to $450,000 Less than $742,500 Closed to new entrants 20 Sept 2009 (unless qualified for Age Pension

before this), subject to eligibility tests e.g. work test.

Couple Up to $575,000 Less than $1,016,000

Paid as a lump sum, dependent upon how much Age Pension entitled

Couple separated by Up to $575,000 Less than $1,160,000 to and time in scheme.

illness (combined)

One partner eligible Up to $575,000 Less than $1,016,000

* From 1 January 2017, rate of pension reduces by $3.00 per fortnight for

AGE PENSION TRANSITION RULES

every $1,000 above lower limit. PENSION RATES

# Limits may increase if you receive Rent Assistance with pension payment.

MAX. BENEFIT MAXIMUM BENEFIT

(PER FORTNIGHT)* $ (PER ANNUM)* $

EXTRA ALLOWABLE AMOUNT FOR RETIREMENT Single $724.50 $18,837.00

VILLAGE AND GRANNY FLAT RESIDENCE

Couple (each) $585.20 $15,215.20

EXTRA ALLOWABLE AMOUNT* $151,500

* Excludes Clean Energy Supplement $14.10 (singles) and $10.60

* Amount equal to different between the non-homeowner and homeowner (couples, each).

assets test limits.

If entry contribution is equal to or less than the extra allowable amount at INCOME TEST

the time of entry, then assessed as a non-homeowner. Entry contribution

will count as an asset. INCOME INCOME CUT-OUT**

May also quality for Rent Assistance. THRESHOLD* (PER FORTNIGHT)

(PER FORTNIGHT)

DEEMING RATES Single Up to $164 Less than $2,010.50

Couple (combined) Up to $292 Less than $3,271.00

FINANCIAL INVESTMENT DEEMING RATE

Couple separated due Up to $292 Less than $3,985.00

Single $0$49,200 1.75% to illness (combined)

(Pension or allowance) Balance 3.25%

Allowable income increased by up to $24.60/dependent child.

Couple combined $0$81,600 1.75% * Transitional/saved cases, pension reduced by 40c (single) and 20c

(Pensioner) Balance 3.25% (couple).

Couple for each $0$40,800 1.75% ** Payment rates may be higher if also receive Rent Assistance with the

allowee pension payment.

Balance 3.25%

(Neither is Pensioner)

ASSETS TEST

PENSION LOAN SCHEME

HOMEOWNER LOWER LIMIT* UPPER LIMIT#

Loan paid in regular fortnightly instalments.

Single Up to $250,000 Less than $496,250

Loan amount depends on property value offered as security,

Couple Up to $375,000 Less than $772,500

equity to retain and age at time loan is granted.

Couple separated by Up to $375,000 Less than $867,500

Compounding interest charged on the balance of the loan and illness (combined)

calculated on a fortnightly basis.

One partner eligible Up to $375,000 Less than $772,500

Can receive up to max. amount of Age Pension including

NON-HOMEOWNER LOWER LIMIT* UPPER LIMIT#

Pharmaceutical Allowance and Rent Assistance each fortnight.

Single Up to $450,000 Less than $696,250

Couple Up to $575,000 Less than $972,500

Couple separated by Up to $575,000 Less than $1,067,500

illness (combined)

One partner eligible Up to $575,000 Less than $972,500

* From 1 January 2017, rate of pension reduces by $3.00/fortnight for every

$1,000 above lower limit.

# Limits may increase if you receive Rent Assistance with pension payment.

5 | Tax and Social Security Guide: 20162017

SOCIAL SECURITY FRINGE BENEFITS

COMMONWEALTH SENIORS HEALTH CARD

To qualify must:

have reached pension age but not qualify for the Age Pension

(or other certain pensions);

be an Australian resident living in Australia;

have an annual adjusted taxable income below the income

test threshold, where adjusted taxable income = taxable income

+ foreign income (where no Australian income tax is paid) + net

investment losses + employer provided benefits (in excess of

$1000) + reportable super contributions.

INCOME TEST*

Single $52,796

Couples $84,472

Couples separated by illness $105,592

combined

* Limit increased by $639.60 for each dependent child the individual cares

for.

The Commonwealth Seniors Health Care Card also provides access

to the Seniors Supplement.

LIQUID ASSETS WAITING PERIOD

THRESHOLD (EQUAL OF

EXCEEDS)

Single (no children) $5,500

Single (with children) $11,000

Partnered $11,000

* Liquid Assets Waiting Period applicable if have a certain amount of

available assets on the date after left work or study, or on the day claim an

income support payment.

** Applicable to Newstart Allowance, Youth Allowance, Sickness Allowance

and Austudy.

CPAH1045_B_01/2017

Copyright CPA Australia Ltd 2017

DISCLAIMER

CPA Australia Ltd has used reasonable care and skill in compiling the content of this material. However, CPA Australia Ltd makes no warranty as to the accuracy or

completeness of any information in these materials. These materials are not intended to be advice, whether legal or professional. All names, figures, solutions and

scenarios are fictitious and have been established for training purposes only. You should not act solely on the basis of the information contained in these materials as parts

may be generalised and the application of exercises, examples and case studies may vary from organisation to organisation and may apply differently to different people

and circumstances. Further, as laws change frequently, all practitioners, readers, viewers and users are advised to undertake their own research or to seek professional

advice to keep abreast of any reforms and developments in the law.

Вам также может понравиться

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformОт EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformОценок пока нет

- Free Australia Personal Income Tax Calculator v1.0.2017Документ7 страницFree Australia Personal Income Tax Calculator v1.0.2017Minh Nguyen Vo NhatОценок пока нет

- Taxes by The NumbersДокумент2 страницыTaxes by The NumbersBrad StevensОценок пока нет

- Medicare Levi Surcharge AustraliaДокумент4 страницыMedicare Levi Surcharge AustraliaimranaliacaОценок пока нет

- Tabl2751 - Business Taxation Tax Rates and Example Calculation TAX RATES (2017-18)Документ3 страницыTabl2751 - Business Taxation Tax Rates and Example Calculation TAX RATES (2017-18)Benjamin PangОценок пока нет

- TABL2751 Tax Rates 2021 - UpdatedДокумент4 страницыTABL2751 Tax Rates 2021 - UpdatedPeper12345Оценок пока нет

- TABL 2751 Tax Rates 2022Документ4 страницыTABL 2751 Tax Rates 2022Crystal CheahОценок пока нет

- Tax Foundation FF6241Документ5 страницTax Foundation FF6241muhammad mudassarОценок пока нет

- 17vs18taxbracket FinalДокумент2 страницы17vs18taxbracket Finalapi-426611448Оценок пока нет

- Info Card 2016-17Документ12 страницInfo Card 2016-17Nick KОценок пока нет

- Formula Sheet: Income Tax Rates 2012/13Документ6 страницFormula Sheet: Income Tax Rates 2012/13scribbyscribОценок пока нет

- Payroll and Contribution Rates Employers PDFДокумент2 страницыPayroll and Contribution Rates Employers PDFNicquainCTОценок пока нет

- RG146 Pocket GuideДокумент30 страницRG146 Pocket GuideMentor RG146Оценок пока нет

- Surcharge: On Contributi Employee Use Business Proportion - 100% Cost X OperatingДокумент4 страницыSurcharge: On Contributi Employee Use Business Proportion - 100% Cost X Operatinglouis_parker_5553Оценок пока нет

- Chapter 08 Test BankДокумент158 страницChapter 08 Test BankBrandon LeeОценок пока нет

- Income Taxation MIDTERMSДокумент7 страницIncome Taxation MIDTERMSgamit gamitОценок пока нет

- Tax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesДокумент3 страницыTax Cuts and Jobs Act of 2017: Reduced Individual Tax RatesAlex SimonettiОценок пока нет

- 2019 Tax GuideДокумент20 страниц2019 Tax GuidetaulantzeОценок пока нет

- Joint Explanatory StatementДокумент570 страницJoint Explanatory Statementacohnthehill50% (4)

- Bank 2008: Financial Planning Tax Rates SheetДокумент4 страницыBank 2008: Financial Planning Tax Rates SheetmayangdjempolanОценок пока нет

- 2019-2020 Tax GuideДокумент2 страницы2019-2020 Tax Guidecherry LiОценок пока нет

- The Kiplingertox Letter: Circulated Biweekly To Business Clients Since 1925 DC Vol. 92, No. 26Документ4 страницыThe Kiplingertox Letter: Circulated Biweekly To Business Clients Since 1925 DC Vol. 92, No. 26brandonОценок пока нет

- Taxation RA 10963 - TRAIN LAW: Readings in Philippine History Kurt Zeus L. DizonДокумент16 страницTaxation RA 10963 - TRAIN LAW: Readings in Philippine History Kurt Zeus L. DizonLennon Jed AndayaОценок пока нет

- Unit - IДокумент43 страницыUnit - ISuseela PОценок пока нет

- 1 Tax RatesДокумент5 страниц1 Tax Ratesvinod nainiwalОценок пока нет

- ExtraTaxProblem-TY2020 Student - SUSANДокумент6 страницExtraTaxProblem-TY2020 Student - SUSANhhunter530Оценок пока нет

- International Tax ComparisonsДокумент23 страницыInternational Tax ComparisonsJahnavi BadlaniОценок пока нет

- MnDOR LetterДокумент3 страницыMnDOR LetterTim NelsonОценок пока нет

- US Master Tax Guide (PDFDrive)Документ1 258 страницUS Master Tax Guide (PDFDrive)sutan mОценок пока нет

- Self Employed Tax ContributionДокумент4 страницыSelf Employed Tax ContributionLe-Noi AndersonОценок пока нет

- Tax Rates and Formula Sheet 2023Документ7 страницTax Rates and Formula Sheet 2023MarvinОценок пока нет

- Chapter 4 - TaxesДокумент28 страницChapter 4 - TaxesabandcОценок пока нет

- 2007 Tax RatesДокумент3 страницы2007 Tax RatesmobiletaxboysОценок пока нет

- Income Tax Credits - ReviewerДокумент10 страницIncome Tax Credits - Reviewer버니 모지코Оценок пока нет

- Tax Rates Ontario 2019Документ2 страницыTax Rates Ontario 2019Pratik BajajОценок пока нет

- Train Law WordДокумент12 страницTrain Law WordIsaac CursoОценок пока нет

- 2015 Brackets & Planning Limits (Janney)Документ5 страниц2015 Brackets & Planning Limits (Janney)John CortapassoОценок пока нет

- FINA1109 Lecture 6 2019 HandoutДокумент48 страницFINA1109 Lecture 6 2019 HandoutDylan AdrianОценок пока нет

- Individual Income Tax RatesДокумент6 страницIndividual Income Tax RatesLydia Mohammad SarkawiОценок пока нет

- Tax PlanningДокумент6 страницTax PlanningsukkОценок пока нет

- Income Tax Proof Guidelines FY. 2022-23Документ11 страницIncome Tax Proof Guidelines FY. 2022-23Ghousia BegumОценок пока нет

- LECTURE - 9 - TAX - COMPUTATION Year 2024 RateДокумент14 страницLECTURE - 9 - TAX - COMPUTATION Year 2024 RateArnold BucudОценок пока нет

- Tax On Individuals Different Kinds of Taxpayers:: (Part 1 - Applicable From Year 2018 To 2022)Документ9 страницTax On Individuals Different Kinds of Taxpayers:: (Part 1 - Applicable From Year 2018 To 2022)Ellah MaeОценок пока нет

- Tabc - Train - Noel N. Cobangbang, CpaДокумент117 страницTabc - Train - Noel N. Cobangbang, CpaIsaac CursoОценок пока нет

- SGV Train LawДокумент149 страницSGV Train LawEm-em CantosОценок пока нет

- Income Tax Slabs & Rates As Announced in Budget: FY 2017-18 (AY 2018-19)Документ6 страницIncome Tax Slabs & Rates As Announced in Budget: FY 2017-18 (AY 2018-19)vashishthanuragОценок пока нет

- Provision of Train Law UpdatedДокумент91 страницаProvision of Train Law UpdatedAldrich De VeraОценок пока нет

- Jorg R. MenesesДокумент3 страницыJorg R. MenesesKevin JugaoОценок пока нет

- CalculationsДокумент5 страницCalculationsKhawaja HamzaОценок пока нет

- Richmond Tax Relief Analysis by Benjamin PaulДокумент4 страницыRichmond Tax Relief Analysis by Benjamin PaulRoberto RoldanОценок пока нет

- TestBank Chapter-1Документ62 страницыTestBank Chapter-1Mallory CooperОценок пока нет

- Payroll Taxes 2002-2019Документ19 страницPayroll Taxes 2002-2019Charles HopeОценок пока нет

- 2.03 Sharing With Uncle SamДокумент3 страницы2.03 Sharing With Uncle SamJakeFromStateFarmОценок пока нет

- Standard Pay CalculationДокумент16 страницStandard Pay Calculationnaresh86chОценок пока нет

- Excise Taxes On Alcohol ProductsДокумент18 страницExcise Taxes On Alcohol ProductsChristine ChuaОценок пока нет

- Algebra I m1 Topic D Lesson 28 StudentДокумент5 страницAlgebra I m1 Topic D Lesson 28 Studentkaren roderickОценок пока нет

- Iligan City - Seminar On TRAIn Law For Students - 05 03 18Документ195 страницIligan City - Seminar On TRAIn Law For Students - 05 03 18Lorainne AjocОценок пока нет

- 10K Financial Report: EmersonДокумент4 страницы10K Financial Report: EmersonjajaОценок пока нет

- TDS On SalaryДокумент5 страницTDS On SalaryAato AatoОценок пока нет

- Use of Five Whys in Preventing Construction Incident RecurrenceДокумент10 страницUse of Five Whys in Preventing Construction Incident RecurrenceDavid GreenfieldОценок пока нет

- Principal of ManagementДокумент9 страницPrincipal of ManagementGau Rav AsharaОценок пока нет

- UGC - Minimum Qualification and Career AdvancementДокумент59 страницUGC - Minimum Qualification and Career AdvancementJoseph AnbarasuОценок пока нет

- Business Ethics - Environmental EthicsДокумент6 страницBusiness Ethics - Environmental EthicsDivina AquinoОценок пока нет

- Nissan ReportДокумент9 страницNissan ReportAmornrat Ting-Ting SriprajittichaiОценок пока нет

- HSE CaseДокумент95 страницHSE CaseHafiz Akhtar100% (3)

- Toolbox Talk - Slips Trips & Falls - ENДокумент1 страницаToolbox Talk - Slips Trips & Falls - ENJomy JohnyОценок пока нет

- By Murray JohannsenДокумент2 страницыBy Murray JohannsenAli AhmedОценок пока нет

- 14 Fundamental Principles of Management With ExamplesДокумент21 страница14 Fundamental Principles of Management With ExamplesPattyОценок пока нет

- Human Resource Management: Research ProjectДокумент20 страницHuman Resource Management: Research ProjectSneha MayekarОценок пока нет

- Bbhi4103 FДокумент11 страницBbhi4103 Fsthiyagu0% (1)

- Digital Business Proposal Spellsgood Victoria DixonДокумент6 страницDigital Business Proposal Spellsgood Victoria Dixonapi-304800740Оценок пока нет

- Item 9780521789578 ExcerptДокумент10 страницItem 9780521789578 ExcerptPhạm Ngọc Hải LongОценок пока нет

- The Marikina Shoe IndustryДокумент4 страницыThe Marikina Shoe IndustryHowell FelicildaОценок пока нет

- Force Automotive Breach of Code of Conduct: Case Study by Group 9Документ7 страницForce Automotive Breach of Code of Conduct: Case Study by Group 9manik singhОценок пока нет

- Understanding Community Needs and IssuesДокумент13 страницUnderstanding Community Needs and IssuesralieghОценок пока нет

- Central Statistical Agency: Report On Small Scale Manufacturing Industries SurveyДокумент55 страницCentral Statistical Agency: Report On Small Scale Manufacturing Industries SurveySintayehu AshenafiОценок пока нет

- OM PPT Manager's Job Functions Roles and SkillsДокумент17 страницOM PPT Manager's Job Functions Roles and SkillsRosette UngabОценок пока нет

- (Day 1) - LESSON 10 - Salaries and WagesДокумент3 страницы(Day 1) - LESSON 10 - Salaries and WagesClover RayОценок пока нет

- PDP GuideДокумент45 страницPDP GuideedrialdeОценок пока нет

- Intermediate Accounting Exam SolutionsДокумент11 страницIntermediate Accounting Exam SolutionsDean Craig80% (5)

- Cover Letter For Surgical Technologist StudentДокумент7 страницCover Letter For Surgical Technologist Studentafjwftijfbwmen100% (2)

- Prime HRM Recruitment Selection and PlacementДокумент29 страницPrime HRM Recruitment Selection and PlacementlilaquitaineОценок пока нет

- Enhancing Promotion and Career Prospects For Female Employees Student's Name Institutional Affiliation Professor's Name DateДокумент5 страницEnhancing Promotion and Career Prospects For Female Employees Student's Name Institutional Affiliation Professor's Name Datekenneth kimathiОценок пока нет

- Diversity in RecruitmentДокумент19 страницDiversity in RecruitmentumangОценок пока нет

- "Chashma Sugar Mills (Expansion) Ramak, D.I.Khan".Документ3 страницы"Chashma Sugar Mills (Expansion) Ramak, D.I.Khan".siddiq ul HassanОценок пока нет

- What Non Readers 2Документ37 страницWhat Non Readers 2gent_ohnoОценок пока нет

- Human Resource Management Question BankДокумент6 страницHuman Resource Management Question BankNavin Kumar100% (2)

- Swati Patle Performance ApprisalДокумент64 страницыSwati Patle Performance ApprisalujwaljaiswalОценок пока нет

- Sales TrainingДокумент25 страницSales TrainingAmareshОценок пока нет