Академический Документы

Профессиональный Документы

Культура Документы

Bba 504

Загружено:

armaanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bba 504

Загружено:

armaanАвторское право:

Доступные форматы

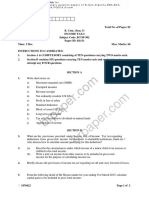

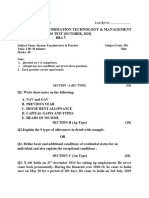

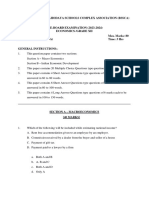

ASSIGNMENT

DRIVE SPRING 2017

PROGRAM BBA

SEMESTER V

SUBJECT CODE & BBA 504 &

NAME TAXATION MANAGEMENT

BK ID B1852

CREDITS 2

MARKS 30

Note: Answer all questions. Kindly note that answers for 10 marks questions should be

approximately of 400 words. Each question is followed by evaluation scheme.

Q.No Questions

1 Write notes on :

a) Tax Treatment of Income.

b) Capital Expenses vs. Revenue Expenses.

c) Fringe Benefit Tax.

A a) Tax Treatment of Income. 3 10

b) Capital Expenses vs. Revenue Expenses. 3

c) Fringe Benefit Tax. 4

2 A) Raj was born in Karachi on January 2,1947. He has been staying in USA since 1986.He comes to

India on a visit of 200 days on October 10,2014. Determine the residential status of Mr Raj for the

assessment year 2015-16.

B) Discuss the advantages of VAT over Sales tax.

A A)Determine the residential status of Mr Raj. 5 10

B)Discuss the advantages of VAT over Sales tax. 5

3 Section 48 of the Income-tax Act, 1961 discusses the methods of computation of short term

and long term capital gains. Enumerate with examples.

A Discuss the methods of computation of Short term and Long term 10 10

Capital Gains under Section 48 of the Income-tax Act, 1961 with

examples

Вам также может понравиться

- Brazilian Derivatives and Securities: Pricing and Risk Management of FX and Interest-Rate Portfolios for Local and Global MarketsОт EverandBrazilian Derivatives and Securities: Pricing and Risk Management of FX and Interest-Rate Portfolios for Local and Global MarketsОценок пока нет

- Fin 303 PDFДокумент4 страницыFin 303 PDFSimanta KalitaОценок пока нет

- TaxationДокумент4 страницыTaxationshreya chhajerОценок пока нет

- Code No: MB164G/R16: MBA IV Semester Regular Examinations, April-2018Документ1 страницаCode No: MB164G/R16: MBA IV Semester Regular Examinations, April-2018LakshmirajuОценок пока нет

- Lat PGDM 2020-22 Sem 2Документ2 страницыLat PGDM 2020-22 Sem 2Uddhav FarakteОценок пока нет

- Sa 3 DT NovДокумент9 страницSa 3 DT NovRishabh GargОценок пока нет

- CorporateS18 PDFДокумент30 страницCorporateS18 PDFMohammad FaisalОценок пока нет

- BEFA Model Qestion PapersДокумент6 страницBEFA Model Qestion PapersdesignandeditorsОценок пока нет

- Direct Tax QB 30-9-2016-1Документ46 страницDirect Tax QB 30-9-2016-1Sriji VijayОценок пока нет

- Pakistan Institute of Public Finance Accountants: Summer Exam-2016Документ27 страницPakistan Institute of Public Finance Accountants: Summer Exam-2016RALFОценок пока нет

- IT1 (5th) Dec2017 PDFДокумент2 страницыIT1 (5th) Dec2017 PDFjaspreet kaurОценок пока нет

- Assignment: 400 Words. Each Question Is Followed by Evaluation SchemeДокумент1 страницаAssignment: 400 Words. Each Question Is Followed by Evaluation SchemeSujal SОценок пока нет

- Prelim Que. Paper - EEFM 23-24Документ4 страницыPrelim Que. Paper - EEFM 23-24ffqueen179Оценок пока нет

- III Semester CSE & CSTДокумент11 страницIII Semester CSE & CSTSuthari AmbikaОценок пока нет

- 06-Spring 2014 - BTДокумент4 страницы06-Spring 2014 - BTpabloescobar11yОценок пока нет

- August 2016Документ3 страницыAugust 2016nwanguiОценок пока нет

- F1 FIOO - L-December-2020Документ8 страницF1 FIOO - L-December-2020Laskar REAZОценок пока нет

- FAR ND-2023 QuestionДокумент4 страницыFAR ND-2023 QuestionMd HasanОценок пока нет

- PFM S-22Документ2 страницыPFM S-22Rana Sunny KhokharОценок пока нет

- Pe III Taxation II Nov Dec 2010Документ2 страницыPe III Taxation II Nov Dec 2010swarna dasОценок пока нет

- Taxation I-P1 - (NOV-08), ICABДокумент2 страницыTaxation I-P1 - (NOV-08), ICABgundapolaОценок пока нет

- Taxtion II Nov Dec 2014Документ5 страницTaxtion II Nov Dec 2014Md HasanОценок пока нет

- Paper - Iii: Co 243F - Accounting Standards Time - 3hrs Max Marks-75 Section - A Answer All Questions. Each Question Carries 2 Marks)Документ2 страницыPaper - Iii: Co 243F - Accounting Standards Time - 3hrs Max Marks-75 Section - A Answer All Questions. Each Question Carries 2 Marks)Titus ClementОценок пока нет

- FMДокумент18 страницFMPriyanka DashОценок пока нет

- Taxation I: Time Allowed 3 Hours Maximum Marks 100Документ2 страницыTaxation I: Time Allowed 3 Hours Maximum Marks 100Sariful Islam SujonОценок пока нет

- Paper-2 International Tax Practice-NOV 20Документ22 страницыPaper-2 International Tax Practice-NOV 20dhawaljaniОценок пока нет

- Mba 3 Sem Tax Planning and Management Kmbfm02 2020Документ2 страницыMba 3 Sem Tax Planning and Management Kmbfm02 2020Vinod GuptaОценок пока нет

- Reg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)Документ10 страницReg. No.: Q.P. Code: (17 BBA 31/ 17 BBACA 31/17 BBARM 44/ 17 BBAIB 49/17 BBABPM 15)AK GAMINGОценок пока нет

- Tutor Marked Assignment Course Code: BCOC-131 Course Title: Assignment Code: BCOC-131/TMA/2020-2021 Coverage: All Blocks Maximum Marks: 100Документ32 страницыTutor Marked Assignment Course Code: BCOC-131 Course Title: Assignment Code: BCOC-131/TMA/2020-2021 Coverage: All Blocks Maximum Marks: 100Rajni KumariОценок пока нет

- Finance of International Trade Related Treasury OperationsДокумент2 страницыFinance of International Trade Related Treasury OperationsmuhammadОценок пока нет

- FAR MA-2023 QuestionДокумент4 страницыFAR MA-2023 QuestionMd HasanОценок пока нет

- Gujarat Technological UniversityДокумент3 страницыGujarat Technological UniversityChirag SabhayaОценок пока нет

- Gujarat Technological UniversityДокумент4 страницыGujarat Technological UniversityAmul PatelОценок пока нет

- Test Series: October, 2019 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionДокумент12 страницTest Series: October, 2019 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionANIL JARWALОценок пока нет

- FM Assignment 6Документ2 страницыFM Assignment 6Vundi RohitОценок пока нет

- Instructions:: Question Paper Booklet CodeДокумент24 страницыInstructions:: Question Paper Booklet CodeVikram DasОценок пока нет

- International Tax and Technology - IiДокумент2 страницыInternational Tax and Technology - IiShravan Subramanian BОценок пока нет

- Pakistan Institute of Public Finance Accountants: Winter Exam-2016Документ28 страницPakistan Institute of Public Finance Accountants: Winter Exam-2016Muhammad QamarОценок пока нет

- BCOC-131 Assignment 2020-21 (English)Документ4 страницыBCOC-131 Assignment 2020-21 (English)Ankit KumarОценок пока нет

- Itlp Question BankДокумент4 страницыItlp Question BankHimanshu SethiОценок пока нет

- Income Tax and Auditing Code: B-104: AssignmentДокумент2 страницыIncome Tax and Auditing Code: B-104: AssignmentHritik singhОценок пока нет

- Financial Accounting For Managers KMB103Документ3 страницыFinancial Accounting For Managers KMB103ujjawalr9027Оценок пока нет

- IT Assignment 2Документ1 страницаIT Assignment 2rohitkumarc4ppОценок пока нет

- R2.TAXM - .L Question CMA June 2021 Exam.Документ7 страницR2.TAXM - .L Question CMA June 2021 Exam.Pavel DhakaОценок пока нет

- ITA (4th) May2015Документ3 страницыITA (4th) May2015yukkiyukki171Оценок пока нет

- 2nd TAX LAWS MOCK Test TWO JUNE 2018 Students With SolutionДокумент15 страниц2nd TAX LAWS MOCK Test TWO JUNE 2018 Students With SolutionJasmeet KaurОценок пока нет

- Engineering Economics and Accountancy 18MBC01 - 23-6-21Документ2 страницыEngineering Economics and Accountancy 18MBC01 - 23-6-21AjayОценок пока нет

- National Officers Academy: Mock Exams CSS-2022 April 2022 (Final Mock) Accountancy and Auditing, Paper-IiДокумент2 страницыNational Officers Academy: Mock Exams CSS-2022 April 2022 (Final Mock) Accountancy and Auditing, Paper-IiAli KaziОценок пока нет

- SUNAKSHI Income Taxation Laws & PracticeS - BBA-301Документ3 страницыSUNAKSHI Income Taxation Laws & PracticeS - BBA-301Adesh YadavОценок пока нет

- Afm 2810001 May 2018Документ4 страницыAfm 2810001 May 2018PILLO PATELОценок пока нет

- Taxation - MAR 2021Документ2 страницыTaxation - MAR 2021hemanОценок пока нет

- Bangladesh Open University: BBA Program Semester: 211 (5 Level)Документ13 страницBangladesh Open University: BBA Program Semester: 211 (5 Level)SABBIR AHMEDОценок пока нет

- Bba 402 PDFДокумент2 страницыBba 402 PDFarmaanОценок пока нет

- Class 12 Sahodaya Pre Board QP Economics Set AДокумент23 страницыClass 12 Sahodaya Pre Board QP Economics Set AAnshika GangwarОценок пока нет

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsДокумент2 страницыInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsSyed Mohammad Ali Zaidi KarbalaiОценок пока нет

- 2231 Accounts Full CourseДокумент6 страниц2231 Accounts Full Coursebkbalaji110Оценок пока нет

- MBAG-204 - April 2019Документ3 страницыMBAG-204 - April 2019Abhishake ChhetriОценок пока нет

- PTP PP OS v0.2Документ27 страницPTP PP OS v0.2sanketpavi21Оценок пока нет

- Taxation MTP 1 QuestionsДокумент9 страницTaxation MTP 1 QuestionsVishal Kumar 5504Оценок пока нет

- Of Questions-6: LimitedprovidesДокумент16 страницOf Questions-6: Limitedprovidesanila rathodaОценок пока нет

- Mit 206Документ1 страницаMit 206armaanОценок пока нет

- Assignment Drive SPRING 2017 Program Bajm Semester 5 Subject Code & Name Bj0057 - Media, Society and Development BK Id B1524 Credit 4 Marks 60Документ1 страницаAssignment Drive SPRING 2017 Program Bajm Semester 5 Subject Code & Name Bj0057 - Media, Society and Development BK Id B1524 Credit 4 Marks 60armaanОценок пока нет

- Bba 106Документ2 страницыBba 106armaanОценок пока нет

- Bca 114Документ1 страницаBca 114armaanОценок пока нет

- BIT101Документ5 страницBIT101armaanОценок пока нет

- Bca 113Документ1 страницаBca 113armaan100% (1)

- Bit 103Документ1 страницаBit 103armaanОценок пока нет

- BBR602 - Retail Project Property Management and Case StudiesДокумент1 страницаBBR602 - Retail Project Property Management and Case StudiesarmaanОценок пока нет

- BCA5020 Visual Programming deДокумент1 страницаBCA5020 Visual Programming dearmaan0% (1)

- Bca 112Документ1 страницаBca 112armaanОценок пока нет

- BCA5010 Web Design deДокумент1 страницаBCA5010 Web Design dearmaanОценок пока нет

- Bba 503Документ2 страницыBba 503armaanОценок пока нет

- Bba 207Документ1 страницаBba 207armaanОценок пока нет

- Bba 501Документ2 страницыBba 501armaanОценок пока нет

- Bba 404Документ1 страницаBba 404armaanОценок пока нет

- Bba 505Документ1 страницаBba 505armaanОценок пока нет

- Bba 402 PDFДокумент2 страницыBba 402 PDFarmaanОценок пока нет

- Bba 405Документ1 страницаBba 405armaanОценок пока нет

- Bba 208Документ3 страницыBba 208armaanОценок пока нет

- MBA101 - Management Process and Organisational BehaviourДокумент61 страницаMBA101 - Management Process and Organisational BehaviourarmaanОценок пока нет