Академический Документы

Профессиональный Документы

Культура Документы

Math Relating To Real Estate Financing

Загружено:

Ronald KahoraОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Math Relating To Real Estate Financing

Загружено:

Ronald KahoraАвторское право:

Доступные форматы

Math Relating to Real Estate Financing

1. Determining Equity and Percent of Equity Increase

A. Parts of the problem: (1) Market Value (or price), (2) Amount of increase, (3) Percent of equity

increase

B. Equity is the value or sales price of the property less the debt(s) owed on the property.

C. Example: A couple bought a home for $90,000 and had a $70,000 mortgage loan. Equity is

determined as follows:

$90,000.00 - $70,000 = $20,000 Original Equity

Ten years later the value of the above property has increased to $110,000 and the loan debt

has been reduced to $60,000. The equity is now:

$110,000 - $60,000 = $50,000 New Equity

Determine the percent of equity increase. NOTE: In order to find the percent of equity

increase, you MUST first determine the amount of increase.

$50,000 New Equity - $20,000 Original Equity = $30,000 Equity Increase

Divide the Equity Increase by the Original Equity

$30,000 $20,000 = 1.5 = 150% of Equity Increase

2. Principal and Interest Math

A. Parts of the Problem: (1) Principal (2) Loan Amount/Loan Balance (3) Interest (4) Interest Rate

(%)

B. Formulas:

1. I =PR (Interest = Principal x Rate)

2. P = I R

3. R = I P

C. Example: The loan amount is $85,000 and the interest rate is 6.5%. What is annual interest?

$85,000 x .065 = $5,525 annual interest

What is monthly interest?

$5,525 12 months = $460.42 monthly interest

Math Relating to Brokerage Commissions and Splits

Mingle School of Real Estate 2016 1

D. Example: The loan amount is $66,000 and the annual interest is $5,200. What is the rate of

interest?

$5,200 $66,000 = .078 = 7.8%

E. Example: The annual interest is $7,200 at a rate of 7.5%. What is the principal loan balance?

$7,200 .075 = $96,000

3. Determining Monthly Principal and Interest Payments and Monthly PITI

A. Parts of the Problem: (1) "Loan Factor" from a rate card, (2) Loan Amount Borrowed, (3)

Annual Taxes, (4) Annual Insurance Premium

B. Example: You bought a house with a loan of $21,500 at 8% interest. The monthly principal and

interest (PI) will be $7.70 per $1,000 of the loan amount. The annual property taxes are

$496.20, and the homeowner's insurance premium is $240 per year. What is the total monthly

PITI?

Step 1: Determine number of $1,000's in loan amount

$21,500 $1,000 = 21.5

Step 2: Determine monthly PI

$7.70 x 21.5 = $165.55 PI

Step 3: Determine monthly taxes

$496.20 by 12 months = $41.35

Step 4: Determine monthly insurance Premium

$240 12 months = $20

Step 5: Determine monthly PITI

$165.55 + $41.35 + $20 = $226.90 PITI

4. Determining Total Amount of Interest Paid Over the Life of a Loan

A. Parts of the problem: (1) Loan Term, (2) Number of payments, (3) PI monthly payment

(4) Original Loan Amount

B. Example: Monthly payments are $580 PI on an amount borrowed of $60,000 for 25 years.

What is the amount of interest paid over the entire term of the loan?

Step 1: Determine total PI paid over life of the loan

$580 PI x 12 months = $6,960 x 25 years = $174,000 Total PI

Step 2: Determine Interest Paid over life of loan

$174,000 PI - $60,000 P = $114,000 Interest

Math Relating to Brokerage Commissions and Splits

Mingle School of Real Estate 2016 2

5. Determining Loan Balance After One Month's Payment Bas Been Made (Loan Reduction)

A. Parts of the problem: (1) Loan Amount, (2) Monthly P/I payments, (3) Interest Rate

B. Example: Loan balance is $75,525 at 13% interest with the monthly payment being $855 PI.

What is loan balance remaining after one month's payment has been made?

Step 1: Determine Annual Interest

$75,525 x .13 = $9,818.25

Step 2: Determine Monthly Interest

$9,818.25 12 months = $818.19 I

Step 3: Determine Monthly Principal

$855 PI- $818.19 I = $36.81 P

Step 4: Determine Loan Balance Remaining

$75,525 - $36.81 = $75,488.19

6. Qualifying a Buyer on an FHA Loan

A. In qualifying for an FHA loan, lenders will use the following ratios:

I. Monthly housing expenses should not exceed 29% of the monthly gross income.

II. Monthly recurring obligations should not exceed 41% of the monthly gross income.

B. Gross income is gross income of borrower and co-borrower expected to continue for the first

five years of the mortgage loan.

C. Housing expenses include:

I. Monthly Loan principal and interest (PI) payment

II. 1/12 of annual real property taxes

III. 1/12 of annual homeowner's insurance premium

IV. The monthly FHA Mortgage Insurance Premium (MIP), if being financed along with the loan

amount

V. Monthly Home Owner's Association Dues, if applicable

D. Recurring obligations include all of the Housing Expenses (paragraph C above) plus all other

fixed recurring payments (Debts) that have more than 6 payments left, such as automobile,

personal loans, alimony and child support, credit cards and revolving charge accounts.

Math Relating to Brokerage Commissions and Splits

Mingle School of Real Estate 2016 3

E. Example: Bill and Betty have applied for a 30 year FHA loan in the amount of $72,500 at 11%

interest. Their combined monthly gross income is $3,600. The estimated monthly loan

payment including taxes and insurance and MIP is $820.00. They have other recurring debts

of $600.00 per month.

Under which of the qualifying ratios will the lender find them to qualify?

I. Housing expenses to income

II. Recurring obligations to income

(a) I Only (b) II Only (c) Both (d) Neither

Solution

Housing expenses:

$820 PITI/MIP = $820.00 divided by $3,600 effective income = .227 =22.7%. This does

not exceed 29%. They will qualify under this ratio.

Recurring obligations:

$820 monthly housing expenses plus $600 other debts = $1,420 total monthly recurring

obligations $3,600 effective income = .394 = 39.4%, which does not exceed 41%. They will

qualify under this ratio.

Answer to this problem is (c) Both.

7. Qualifying a Buyer on a Conventional Loan

A. In qualifying for a conventional loan, lenders will use ratios based on the amount of down

payments given by the buyer:

The making of a down payment of more than 10%, the monthly housing expenses cannot

exceed 28% of monthly gross income, and recurring obligations cannot exceed 36% of

monthly gross income.

NOTE: These qualifying ratios will be given in the problem to work.

B. Qualifying for a conventional loan, lenders use gross monthly income

C. Housing Expenses Include:

Monthly loan P I Payment

1/12 of annual real property taxes

1/12 of annual insurance premium

Monthly private mortgage insurance (PMI) if being financed with the loan amount

Monthly Homeowner's Association Dues, if applicable

Math Relating to Brokerage Commissions and Splits

Mingle School of Real Estate 2016 4

D. Recurring obligations include:

Housing expenses (All of paragraph C above)

Automobile payments

Personal loan payments

Other mortgage loan payments

Credit cards/revolving charge accounts

Alimony/child support payments

Any other recurring debts (NOTE: It does not matter that these debts may be paid off in

the near future. Any recurring debts at time of loan application will be considered as

a long-term recurring obligation.)

E. Parts of the problem: (l) Loan amount (2) Housing expenses (3) Recurring Obligations

(4) Qualifying ratios

F. Example: A husband and wife apply for a $90,000 conventional mortgage loan with a sales

price of $110,000. The ''housing expenses" are $825 per month. The couple's "total monthly

recurring obligations" are $1,600, and their combined monthly gross income is $3,600. Under

which of the following ratios will the lender find them to be qualified? Use qualifying ratios of

28/36.

I. Housing expenses to gross income

II. Recurring obligations to gross income

(a) I Only (b) II Only (c) Both (4) Neither

Solution:

Housing expenses = $825 $3,600 = .23 = 23%. Does not exceed 28%: Okay Recurring

obligations = $1,600 $3,600 = .444 = 44.4%. Exceeds 36%: Do not qualify.

Answer is (a) I Only.

G. Example: A husband and wife apply for a conventional loan of $85,000. The lender estimates

housing expenses to be $995 per month. Their recurring obligations (excluding housing

expenses) are $525. Their combined annual gross income is $43,200. Using ratios of 28/36,

under which of the following will the lender find them to qualify?

I. Housing Expenses to Gross Income

II. Recurring Obligations to Gross Income

(a) I Only (b) II Only (c) Both (d) Neither

Solution:

$43,200 12 months = $3,600 monthly income

Housing expenses = $995 divided by $3,600 = .276 = 27.6%.

Does not exceed 28%, will qualify under this ratio.

Math Relating to Brokerage Commissions and Splits

Mingle School of Real Estate 2016 5

Recurring Obligations = $995 + $525 = $1,520 $3,600 = .422 = 42.2%

exceeds 36%, will not qualify.

Answer is (a) I Only.

8. Property Analysis

The appraised value must be high enough to justify the loan in accordance with the lender 's

established policies on loan-to-value ratios. The lender would prefer the appraised va1ue to

equal or be above the sales price.

A. Parts of the problem: (1) Requested loan amount, (2) Loan to Value Ratio, (3) Appraised

Value

B. Example: If the requested loan amount is $76,500, and the maximum permissible loan to

value ratio is 90%, what must be the appraised value?

Solution: Determine the appraised value by dividing the requested loan amount by the loan to

value ratio.

$76,500 .90 = $85,000 Appraised Value

9. Loan Analysis

The lender will insure the loan is a sound investment by evaluating the characteristics of the loan

itself. The yield must be adequate, discount points will be charged if the rate is below market

rates, and if the down payment is less than 20%, the lender will require private mortgage

insurance (PMI).

Example: A buyer wants an $80,000 loan to purchase a $100,000 house. Current market

rates are 10% but the buyer wants a 9.5% loan. Lender will charge a 1% origination fee, plus

appropriate discount points. How much cash money will the buyer need to close the loan?

Solution:

Down payment: $20,000

Origination Fee: + $800 (80,000 x .01)

Discount Points: + $3,200 (10.00% - 9.50% = .50 x 8 = 4 = .04 x 80,000 = $3,200)

Cash Required: $24,000 (20,000 + 800 + 3,200)

Math Relating to Brokerage Commissions and Splits

Mingle School of Real Estate 2016 6

10. Discount Points and Yield

If a lender charges an interest rate lower than market rates, they will charge discount points to

increase their yield.

A. To determine the number of discount points that will be charged to increase the yield, lenders

apply the following:

One (1) discount point adjusts the effective interest rate by one-eighth of one percent. (Or

put another way, "there is one discount point charged for each 1/8% difference in the two

interest rates.)

B. Convert the fractions in the rates to an equivalent decimal percentage, subtract the loan rate

from the market rate and multiply the difference by 8: the result being the number of discount

points to be charged.

Example: Market rate of 10 % and loan rate at 9 %

10 % = 10.75%

9 % = 9.50 %

10.75 9.50 = 1.25 x 8 = 10 Discount Points

C. To determine the amount of money required to pay the discount points, simply convert the

amount of discount points to a decimal and multiply by the loan amount:

Example: Loan amount is $60,000 at 2 discount points.

$60,000 x .02 = $1,200

11. Practice Problems: Finance Math

A. A couple purchased a home for $90,000 with a $20,000 down payment. Ten years later the

house sold for $150,000 with the loan being reduced to $65,000. What was the percent of

equity increase?

(a) 200% (b) 425% (c) 325% (d) 166%

B. Original equity in a property was $7,500 and in two years the equity increased by $3,750. What

is the percent of equity increase?

(a) 200% (b) 50% (c) 25% (d) 33%

C. You have a mortgage loan at 7.5% interest. The annual interest is $6,520. What is the principal

balance?

(a) $86,733.33 (b) $85,310.28 (c) $93,142.85 (d) $86,933.33

D. You are paying a 10.5% rate of interest on a loan of $72,250. What is the monthly interest?

(a) $7,586.25 (b) $632.19 (c) $602.08 (d) $7,225

Math Relating to Brokerage Commissions and Splits

Mingle School of Real Estate 2016 7

E. Smith bought a home with a mortgage loan of $92,500. The monthly payment will be $9.15 per

$1,000 of the loan amount. The annual property taxes are $1,496 and the homeowner's

insurance policy is $340 per year. What is the monthly PITI?

(a) $846.38 (b) $847.71 (c) $999.38 (d) $971.05

F. Loan balance is $55,500 at 10% interest. The monthly payment is $8.78 per $1,000. What is

the loan balance after one month's payment?

(a) $55,421.13 (b) $55,475.21 (c) $56,475.21 (d) $55,381.14

G. You borrowed $73.000 at 12% interest. Monthly payments are $745 PI for a term of 30 years.

What is the total amount of interest paid over the life of the loan?

(a) $268,200 (b) $195,200 (c) $262,000 (d) $189,800

H. A couple wants to buy a home with an $80,000 first mortgage loan at 10.5%. Their combined

gross annual income is $40,800. Estimated monthly housing expenses are $875. Their total

monthly recurring obligations are $1,670, which includes housing expenses. Using ratios of

28/36, under which of the following ratios will the lender find them to qualify?

I. Housing expenses to gross income

II. Recurring obligations to gross income

a) I Only (b) II Only (c) Both (d) Neither

I. A conventional loan interest rate is 10% and VA loan rates are 9%. How many discount

points would be charged by the lender in order to set the VA rate?

(a) 6 (b) 7 (c) 5 (d) 8

J. Current market rates are 11%. Loan is to be given at 10%. How many discount points would

be charged?

(a) 9 (b) 10 (c) 8 (d) 7

K. Lender is giving a buyer a loan at 9% and needs to increase the yield up to 10%. The loan

amount is $50,000. How much money would the buyer have to pay in discount points?

(a) $5,100 (b) $5,250 (c) $4,000 (d) $5,000

Math Relating to Brokerage Commissions and Splits

Mingle School of Real Estate 2016 8

L. Bill and Betty received $19,000 from the sale of their house to apply toward the purchase of a

new home costing $90,000. They assumed an existing mortgage of $49,500 and borrowed

$24,000 at 12% to be secured by a second mortgage. The lender charged them a 0.5%

assumption fee; a 2% origination fee on the second, at 5 points on the new loan. How much

was the lender paid in fees?

(a) $2,226 (b) $3,092 (c) $2,047.50 (d) $2,470

M. Bob and Mary got a VA Loan for $80,000. The lender charged them a 1% origination fee and 4

discount points. Other closing costs included $500 for attorney fees, $35 survey fees, and $15

recording fee. How much cash did Bob and Mary have to bring to the closing?

(a) $4,550 (b) $3,750 c) $1,350 (d) None, VA's require no down payment.

N. What is the interest due from May 1 through May 15th (day of closing) on a $80,000 loan at

9% interest?

(a) $316.65 (b) $337.76 (c) $295.54 (d) $300

Solutions to finance math practice problems:

A. $20,000 is original equity

$150,000 - $65,000 = $85,000 New Equity

$85,000 New Equity - $20,000 Original Equity = $65,000 Equity Increase

$65,000 $20,000 = 3.25 = 325% (c)

B. $3,750 is equity increase $7,500 original equity = .50 = 50% (b)

C. $6,520 .075 = $86,933.33 (d)

D. $72,250 loan balance x .105 = $7,586.25 annual interest 12 months = $632.19 (b)

E. $92,500 loan amount 1000 = 92.5 x $9.15 = $846.38 PI

$1,496 annual taxes 12 months = $124.67 Taxes

$340 annual insurance premium 12 months = $28.33 Insurance

$846.38 + $124.67 + $28.33 = $999.38 PITI (c)

F. $55,500 by 1000 = 55.5 x 8.78 = $487.29 PI

$55,500 x .10 = $5,550 divided by 12 months = 462.50 I

$487.29 PI - $462.50 I = $24.79 P

$55,500 - $24.79 = $55,475.21 (b)

G. 30 years x 12 months = 360 monthly payments x $745 PI = $268,200 PI - $73,000 P =

$195,200 (b)

Math Relating to Brokerage Commissions and Splits

Mingle School of Real Estate 2016 9

H. $40,800 annual gross income 12 months = $3,400 monthly gross income

Housing Expenses = $875 $3,400 = .257 = 25.7%, yes will qualify under this ratio.

Recurring Obligations = $1,670 $3,400 = .49 = 49%, no will not qualify under this ratio. (a)

I. 10% = 10.00

9% = 9.25

10.00 9.25 = .75 x 8 = 6 discount points (a)

J. 11% = 11.50

10% = 10.25

11.50 10.25 = 1.25 x 8 =10 discount points (b)

K. 10% = 10.75

9% = 9.50

10.75 9.50 = 1.25 x 8 = 10 discount points = .10 x $50,000 = $5,000 (d)

L. $49,500 loan assumption x .005 = $247.50 Assumption Fee

$24,000 second at 2% = $24,000 x .02 = $480 Origination Fee

$24,000 at 5 points = $24,000 x .055 = $1,320 Discount Points

$247.50 + $480 + $1,320 = $2,047.50 Total Fees paid to the lender (c)

M. $80,000 x .01 origination fee = $800

$800 + $3,200 points + $500 attorney fee + $35 survey fee +$15 recording fee = $4,550 cash

needed to close (a)

Caution: You may have a similar question, but it may ask, "How much will the lender receive

in fees?"

$800.00 origination fees + $3,200 discount points = $4,000 lender will receive

N. $80,000 x .095 = $7,600 12 months = $633.33 30 days = $21.11 daily interest

15 days x $21.11 = $316.65 (a)

Math Relating to Brokerage Commissions and Splits

Mingle School of Real Estate 2016 10

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Input Output: Int. Rate Rate Monthly Int. Rate Years # Pmts Pmts/yr Loan Amt PMT AmtДокумент1 страницаInput Output: Int. Rate Rate Monthly Int. Rate Years # Pmts Pmts/yr Loan Amt PMT AmtRonald KahoraОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Input Output: Int. Rate Rate Years # Pmts Pmts/yr Loan Amt PMT AmtДокумент1 страницаInput Output: Int. Rate Rate Years # Pmts Pmts/yr Loan Amt PMT AmtRonald KahoraОценок пока нет

- Mortgage Calculation and Amortization GeltnerMillerДокумент18 страницMortgage Calculation and Amortization GeltnerMillerRonald KahoraОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- FOOD - The Definitive Shoppers Guide PDFДокумент27 страницFOOD - The Definitive Shoppers Guide PDFRonald KahoraОценок пока нет

- Bookkeeping Forms and Templates Book PDFДокумент33 страницыBookkeeping Forms and Templates Book PDFRonald KahoraОценок пока нет

- Energysaver - Gov: Tips On Saving Money & Energy at HomeДокумент44 страницыEnergysaver - Gov: Tips On Saving Money & Energy at HomeRonald KahoraОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Manual First AidДокумент176 страницManual First AidRonald Kahora100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- 2012 NC Building Level 1 Student WorksheetsДокумент95 страниц2012 NC Building Level 1 Student WorksheetsRonald KahoraОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Architectural Standards Graphic Student EditionДокумент510 страницArchitectural Standards Graphic Student EditionRonald Kahora100% (8)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Plumbing 101Документ234 страницыPlumbing 101Ronald Kahora100% (2)

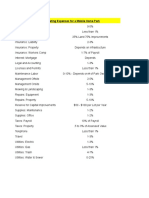

- Typical Operating Expenses For A Mobile Home ParkДокумент1 страницаTypical Operating Expenses For A Mobile Home ParkRonald KahoraОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Chapter6 MasonryEstimating 0134405501Документ8 страницChapter6 MasonryEstimating 0134405501Ronald KahoraОценок пока нет

- Italiano Essenziale2 AK-AMSCOДокумент34 страницыItaliano Essenziale2 AK-AMSCORonald KahoraОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- HMMA 861: Guide Specifications For Commerical Hollow Metal Doors and FramesДокумент30 страницHMMA 861: Guide Specifications For Commerical Hollow Metal Doors and FramesRonald KahoraОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Lesson 1Документ27 страницLesson 1Ronald KahoraОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Nrrform PDFДокумент1 страницаNrrform PDFRonald KahoraОценок пока нет

- 41403A - Guide - Rev - 12-20-17 - With Edits - 2-16-18Документ167 страниц41403A - Guide - Rev - 12-20-17 - With Edits - 2-16-18Ronald KahoraОценок пока нет

- 2018 NBC Book PreviewДокумент70 страниц2018 NBC Book PreviewRonald KahoraОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

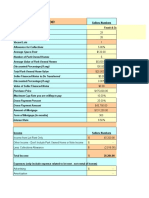

- MH Park Evaluation: Sellers NumbersДокумент9 страницMH Park Evaluation: Sellers NumbersRonald KahoraОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Cap Rate CalculationДокумент2 страницыCap Rate CalculationRonald KahoraОценок пока нет

- Clarity Inquiry #4y8tjzb6g4Документ56 страницClarity Inquiry #4y8tjzb6g4Patricia CarvajalОценок пока нет

- Simple MortgageДокумент10 страницSimple MortgagesubramonianОценок пока нет

- 15 Engineering Economy SolutionsДокумент4 страницы15 Engineering Economy SolutionsKristian Erick Ofiana Rimas0% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- NMLSbookДокумент386 страницNMLSbookejsimonsenОценок пока нет

- ALW Bank Loan With Real Estate Mortgage TemplateДокумент3 страницыALW Bank Loan With Real Estate Mortgage TemplateKikoy IlaganОценок пока нет

- Understanding Home Loan Interest Rates: A Comprehensive GuideДокумент2 страницыUnderstanding Home Loan Interest Rates: A Comprehensive GuideNeeraj ChopraОценок пока нет

- 2001 Irs Remic ReportДокумент74 страницы2001 Irs Remic Reportprunfeldt5399Оценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- JPM Mortgage ResearchДокумент30 страницJPM Mortgage ResearchflhaliliОценок пока нет

- Exercises in Pledgee and Mortgages Includong Past Cpa Examination Question 2Документ10 страницExercises in Pledgee and Mortgages Includong Past Cpa Examination Question 2Nicole MoralesОценок пока нет

- Almario Bsa2d At4 Fin2Документ4 страницыAlmario Bsa2d At4 Fin2Tracy CamilleОценок пока нет

- FHA Loans GuideДокумент5 страницFHA Loans GuideHollanderFinancialОценок пока нет

- BFS Property Listing For Posting As of 05.01.2019 Public Final v1 PDFДокумент12 страницBFS Property Listing For Posting As of 05.01.2019 Public Final v1 PDFLuis S Alvarez JrОценок пока нет

- 3 Bunga Sederhana Dan MajemukДокумент47 страниц3 Bunga Sederhana Dan MajemukJoel JahjaОценок пока нет

- Money Doesn't Grow On Trees: A Farmer's Point of View Amanda OuДокумент16 страницMoney Doesn't Grow On Trees: A Farmer's Point of View Amanda OuAmanda OuОценок пока нет

- Loan Amortization Schedule ABC LoanДокумент8 страницLoan Amortization Schedule ABC LoanThalia SandersОценок пока нет

- 21 XXX XXX TP Cibil - ReportДокумент6 страниц21 XXX XXX TP Cibil - ReportVishnu GaikwadОценок пока нет

- 2017-07-01 10.02PM Email Trent To Schneider Re. PMT.Документ3 страницы2017-07-01 10.02PM Email Trent To Schneider Re. PMT.larry-612445Оценок пока нет

- An Nu Ale Mortgage AdoptionДокумент32 страницыAn Nu Ale Mortgage AdoptionNye LavalleОценок пока нет

- Sample Qualified Written Request LetterДокумент4 страницыSample Qualified Written Request LetterStan Burman100% (2)

- Traders Royal Bank v. Sps. Castanares DigestДокумент2 страницыTraders Royal Bank v. Sps. Castanares DigestBenedict EstrellaОценок пока нет

- Persona 4 Translation Job Answers - Apply Online Within Minutes. 100% Approval in 1 Hour. Act NowДокумент2 страницыPersona 4 Translation Job Answers - Apply Online Within Minutes. 100% Approval in 1 Hour. Act NowAndika WidriantamaОценок пока нет

- What Is A MortgageДокумент6 страницWhat Is A MortgagekrishnaОценок пока нет

- The Government-Created Subprime Mortgage Meltdown by Thomas DiLorenzoДокумент3 страницыThe Government-Created Subprime Mortgage Meltdown by Thomas DiLorenzodavid rockОценок пока нет

- Request For NOC To Avail LoanДокумент3 страницыRequest For NOC To Avail LoanShirish63% (8)

- Right of Usufructuary Mortgagor To Recover PossessionДокумент8 страницRight of Usufructuary Mortgagor To Recover PossessionSaumy SinghОценок пока нет

- EXHIBIT A....... TP Inc V Bank of America NA/PRLAP/Jonathan JoynerДокумент9 страницEXHIBIT A....... TP Inc V Bank of America NA/PRLAP/Jonathan JoynerJames RimesОценок пока нет

- Deed of Real Estate MortgageДокумент2 страницыDeed of Real Estate MortgageKristian Paolo De CastroОценок пока нет

- Solving Problems On Business and Consumer Loans (Amortization and Mortgage)Документ17 страницSolving Problems On Business and Consumer Loans (Amortization and Mortgage)Nuevo VanОценок пока нет

- Mortgage-Backed Trusts Using Mortgage Assignments From DocX, LLC - The Housing Justice FoundationДокумент10 страницMortgage-Backed Trusts Using Mortgage Assignments From DocX, LLC - The Housing Justice FoundationGlenn AugensteinОценок пока нет

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОценок пока нет

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNОт Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNРейтинг: 4.5 из 5 звезд4.5/5 (3)