Академический Документы

Профессиональный Документы

Культура Документы

2259 Chapter 23 PDF

Загружено:

melody shayanwakoОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2259 Chapter 23 PDF

Загружено:

melody shayanwakoАвторское право:

Доступные форматы

Chapter 23 An introduction to the accounts of limited companies

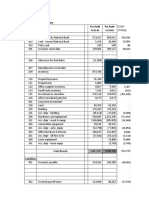

Q1 Bracket and Racket Ltd.

(a)

Trading and Profit and Loss Account

for six months ended 30 September 2002

$000 $000

Turnover (30841 53 820 + 420) 2631

Cost of sales

Stock at 1 April 2002 1540

Purchases (1996 1210 + 510) 1296

2836

Stock at 30 September 2002 704 2132

Gross profit 499

Wages 205

Expenses (823 192 + 103) 734

Interest on overdraft 20

Loss on disposal of building (70 53) 17

Provision for doubtful debts 21

Depreciation: Buildings 45

Fixtures and fittings 25 1067

Net loss 568

1

Cash takings: Cash expenditure: $(205 000 + 2 784 000 + 45 000 + 45 000) = $3 079 000

Add increase in cash balance 5 000

Total cash received $3 084 000

(b) Balance Sheet at 30 September 2002

$000 $000 $000

Fixed assets at net book value

Buildings (250 70 45) 135

Fixtures and fittings (100 25) 75

210

Current assets

Stock 704

Debtors (420 21) 399

Cash 8 1111

Current liabilities

Creditors for supplies 510

Accruals 103

Bank 258 871 240

450

Share capital: Ordinary shares 25

Retained profits (910 568) 342

367

Loan account: Bracket 59

Racket 24 83

450

Q2 Pecnut Ltd

(a) Profit and Loss Account for the year ended 31 March 2004

$000 $000 $000

Turnover 2 683

Cost of sales

Stock at 1 April 2003 85

Purchases 1 152

1 237

Stock at 31 March 2004 105 1 132

Gross profit 1 551

Selling and distribution 540

Administration 648

Depreciation of motor vehicles 21 669 1 209

Operating profit 342

Debenture interest 36

306

Transfer to General Reserve 10

Proposed dividend on ordinary shares 150 160

Retained profit for the year 146

(b) Balance Sheet at 31 March 2004

Cost or Depn NBV

valuation

$000 $000 $000

Tangible fixed assets

Freehold buildings 2 000 - 2 000

Motor vehicles 246 183 63

2 246 183 2 063

Current assets

Stock 105

Trade debtors 96

201

Creditors: amounts falling due within one year

Bank 51

Trade creditors 60

Debenture interest 18

Ordinary dividend 150 279

Net current liabilities (78)

Total assets less current liabilities 1985

Creditors: amounts falling due after more than one year

10% debentures 2007/2010 360

1625

Share capital and reserves

Ordinary shares of $1 600

Capital Redemption Reserve 680

General Reserve 130

Retained profit (69 + 146) 215

1 625

(c) A companys Profit and Loss Account must give a true and fair view of the profit or loss earned in the

period covered by the account, and its Balance Sheet must give a true and fair view of the position of the

company at the end of the period.

A company is a going concern if there is no intention to wind it up it in the foreseeable future. If a company is

insolvent (unable to pay its creditors as they fall due) it is not a going concern and will be wound up. The assets

should be valued in the Balance Sheet at the amounts they could be expected to fetch in an enforced sale, which

could be much less than their book values. If the assets have to be written down in value, the loss must be

provided for in the Profit and Loss Account with the consequent affect on profit.

The application of the going concern concept is necessary if the Profit and Loss Account and Balance Sheet are

to give true and fair views.

Вам также может понравиться

- Equity Valuation: Models from Leading Investment BanksОт EverandEquity Valuation: Models from Leading Investment BanksJan ViebigОценок пока нет

- AC201 Cash Flow - LLOYDДокумент17 страницAC201 Cash Flow - LLOYDJustice DhliwayoОценок пока нет

- Accounting IAS (Malaysia) Model Answers Series 2 2005 Old SyllabusДокумент20 страницAccounting IAS (Malaysia) Model Answers Series 2 2005 Old SyllabusAung Zaw HtweОценок пока нет

- LSH Financial ReportДокумент12 страницLSH Financial ReportJohnny TehОценок пока нет

- FM Assignment SolutionДокумент18 страницFM Assignment SolutionumeshОценок пока нет

- Q1 Pie LTD: $000 $000 $000 Cost Depn NBVДокумент3 страницыQ1 Pie LTD: $000 $000 $000 Cost Depn NBVmelody shayanwakoОценок пока нет

- Live Exam and Suggested SolutionsДокумент10 страницLive Exam and Suggested SolutionsAna-Maria GhОценок пока нет

- Dell Financial Data Mid Course Quiz 1668627324062Документ10 страницDell Financial Data Mid Course Quiz 1668627324062rohit goyalОценок пока нет

- Cashflow Statements IAS 7 - P4Документ10 страницCashflow Statements IAS 7 - P4Vardhan Chulani100% (1)

- Company AccountsДокумент4 страницыCompany AccountsShlokОценок пока нет

- Advanced Accounting 2aДокумент4 страницыAdvanced Accounting 2aHarusiОценок пока нет

- 2021 Seminar Paper Marking SchemeДокумент12 страниц2021 Seminar Paper Marking Schemesayuru423geenethОценок пока нет

- Valuation: © The Institute of Chartered Accountants of IndiaДокумент72 страницыValuation: © The Institute of Chartered Accountants of IndiaNmОценок пока нет

- H1 Consolidated FS 2023 FinalДокумент21 страницаH1 Consolidated FS 2023 FinalHussein BoffuОценок пока нет

- Workings Rs.000Документ1 страницаWorkings Rs.000.Оценок пока нет

- Workings Rs.000Документ1 страницаWorkings Rs.000.Оценок пока нет

- IAS 7 MathДокумент2 страницыIAS 7 Mathrumelrashid_seuОценок пока нет

- Hong Fok Corporation Limited: Revenue (Note 1)Документ8 страницHong Fok Corporation Limited: Revenue (Note 1)Theng RogerОценок пока нет

- Information and Communications University: TH THДокумент5 страницInformation and Communications University: TH THKj NayeeОценок пока нет

- BUA4002 - Assignment - Part - 3Документ23 страницыBUA4002 - Assignment - Part - 3julenjoe2Оценок пока нет

- 11 - Excelfiles - Student Text - Assignments - 2010Документ6 страниц11 - Excelfiles - Student Text - Assignments - 2010leuleuОценок пока нет

- 11 Excelfiles Student Text Assignments 2010Документ6 страниц11 Excelfiles Student Text Assignments 2010leuleuОценок пока нет

- 20X5 20X6 $ $ $ $ Non-Current Assets Tangible Assets: Socf Ii HMWK Q Q1Документ3 страницы20X5 20X6 $ $ $ $ Non-Current Assets Tangible Assets: Socf Ii HMWK Q Q1Takudzwa LanceОценок пока нет

- Financial Accounting and Reporting: IFRS - 2021 December AKДокумент15 страницFinancial Accounting and Reporting: IFRS - 2021 December AKMarchella LukitoОценок пока нет

- Stanley Gibbons Group PLCДокумент2 страницыStanley Gibbons Group PLCImran WarsiОценок пока нет

- Income Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsДокумент1 страницаIncome Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsAik Luen LimОценок пока нет

- Aifs I SMNR QДокумент4 страницыAifs I SMNR QChapo madzivaОценок пока нет

- 4019 XLS EngДокумент13 страниц4019 XLS EngAnonymous 1997Оценок пока нет

- AFE 5008-B Model Answers For The Final Examinations: SolutionsДокумент10 страницAFE 5008-B Model Answers For The Final Examinations: SolutionsDiana TuckerОценок пока нет

- Randall AnswersДокумент83 страницыRandall Answersmunashe shawnОценок пока нет

- Accounting Level 3/series 2 2008 (Code 3001)Документ16 страницAccounting Level 3/series 2 2008 (Code 3001)Hein Linn Kyaw67% (3)

- 664998Документ2 страницы664998Muhammad Saad UmarОценок пока нет

- Financial Report 2017Документ106 страницFinancial Report 2017Le Phong100% (1)

- Change Analysis: Balance Sheet AccountsДокумент10 страницChange Analysis: Balance Sheet AccountsIndra HadiОценок пока нет

- Acc AssignmentДокумент4 страницыAcc AssignmentBianca BenОценок пока нет

- FAR270 JULY 2022 SolutionДокумент8 страницFAR270 JULY 2022 SolutionNur Fatin AmirahОценок пока нет

- Zimbabwe School Examinations Council: Accounting 9197/3Документ8 страницZimbabwe School Examinations Council: Accounting 9197/3nyashamagutsa93Оценок пока нет

- Ratio Analysis SumsДокумент8 страницRatio Analysis Sumshabibi 101Оценок пока нет

- REVISION Qs FAДокумент12 страницREVISION Qs FAhannah ispandiОценок пока нет

- CommercialMetals SolutionДокумент5 страницCommercialMetals SolutionFalguni ShomeОценок пока нет

- Account Must Do List For May 2021Документ129 страницAccount Must Do List For May 2021Akshay PatilОценок пока нет

- Cash Flow Explanatory SheetДокумент4 страницыCash Flow Explanatory SheetTony DarwishОценок пока нет

- The Boeing Company and Subsidiaries Consolidated Statements of Cash FlowsДокумент1 страницаThe Boeing Company and Subsidiaries Consolidated Statements of Cash Flowsdivineyang05Оценок пока нет

- Financial MStatements Ceres MGardening MCompanyДокумент11 страницFinancial MStatements Ceres MGardening MCompanyRodnix MablungОценок пока нет

- HKICPA QP Exam (Module A) Sep2008 Question PaperДокумент9 страницHKICPA QP Exam (Module A) Sep2008 Question Papercynthia tsui67% (3)

- Tutorial 1 and 2 and 3 - 1Документ16 страницTutorial 1 and 2 and 3 - 1stevenОценок пока нет

- Lloyds Banking Group PLC Q1 2018 Interim Management StatementДокумент3 страницыLloyds Banking Group PLC Q1 2018 Interim Management StatementsaxobobОценок пока нет

- 2023 Half Year Balance SheetДокумент2 страницы2023 Half Year Balance SheetsrishtiladdhaОценок пока нет

- MAN ACC ProjectДокумент7 страницMAN ACC ProjectNurassylОценок пока нет

- 20 Additional Practice IAS 7Документ20 страниц20 Additional Practice IAS 7Nur FazlinОценок пока нет

- Paragon SPL & SFP With AnswerДокумент3 страницыParagon SPL & SFP With Answerramyaa baluОценок пока нет

- Week 4 Final Quiz Solutions 1 12Документ4 страницыWeek 4 Final Quiz Solutions 1 12Learning PointОценок пока нет

- AAFR R.Test 2 Solution FinalДокумент8 страницAAFR R.Test 2 Solution FinalShahzaib VirkОценок пока нет

- 07 JUNE QuestionДокумент11 страниц07 JUNE Questionkhengmai67% (3)

- 4ac1 02 Rms 20220825Документ10 страниц4ac1 02 Rms 20220825attackdfg2002Оценок пока нет

- 2246 Chapter 10Документ3 страницы2246 Chapter 10fp4jcjnsr4Оценок пока нет

- Fimd Training Unit 1 - Financial Analysis-ActivitiesДокумент8 страницFimd Training Unit 1 - Financial Analysis-ActivitiesErrol ThompsonОценок пока нет

- GR10 Accounting Practice Exam Memorandum November Paper 1Документ7 страницGR10 Accounting Practice Exam Memorandum November Paper 1morukakgothatso5Оценок пока нет

- Chapter 23 An Introduction To The Accounts of Limited Companies Q1 Bracket and Racket Ltd. (A)Документ3 страницыChapter 23 An Introduction To The Accounts of Limited Companies Q1 Bracket and Racket Ltd. (A)melody shayanwakoОценок пока нет

- Chapter 22 Partnership Changes Q1 Wilson, Keppel and BettyДокумент2 страницыChapter 22 Partnership Changes Q1 Wilson, Keppel and Bettymelody shayanwakoОценок пока нет

- Chapter 20 Valuation of Stock Q1 The Concept of Prudence Requires Profit To Be Stated On A Realistic Basis. in Particular, Profit Should Not BeДокумент2 страницыChapter 20 Valuation of Stock Q1 The Concept of Prudence Requires Profit To Be Stated On A Realistic Basis. in Particular, Profit Should Not Bemelody shayanwakoОценок пока нет

- 2257 Chapter 21Документ3 страницы2257 Chapter 21melody shayanwakoОценок пока нет

- Chapter 17 Non-Profit-Making Organisations (Clubs and Societies)Документ5 страницChapter 17 Non-Profit-Making Organisations (Clubs and Societies)melody shayanwakoОценок пока нет

- Chapter 18 Departmental Accounts Q1 MasonДокумент1 страницаChapter 18 Departmental Accounts Q1 Masonmelody shayanwakoОценок пока нет

- Chapter 19 Manufacturing Accounts Q1 Spinners & CoДокумент2 страницыChapter 19 Manufacturing Accounts Q1 Spinners & Comelody shayanwakoОценок пока нет

- Chapter 2 - Control AccountsДокумент9 страницChapter 2 - Control Accountsmelody shayanwakoОценок пока нет

- Chapter 16 Incomplete Records Q1 SengДокумент6 страницChapter 16 Incomplete Records Q1 Sengmelody shayanwakoОценок пока нет

- As Maths (Instant Revision)Документ128 страницAs Maths (Instant Revision)melody shayanwakoОценок пока нет

- Chapter 15 Suspense Accounts Q1 BastienДокумент4 страницыChapter 15 Suspense Accounts Q1 Bastienmelody shayanwakoОценок пока нет

- Cluster FinancingДокумент7 страницCluster Financingnhsureka100% (1)

- Chapter4 IA Midterm BuenaventuraДокумент10 страницChapter4 IA Midterm BuenaventuraAnonnОценок пока нет

- Canara BankДокумент421 страницаCanara BankReTHINK INDIAОценок пока нет

- Rmi Personal Budget Worksheet v05 Xls - Monthly BudgetДокумент6 страницRmi Personal Budget Worksheet v05 Xls - Monthly Budgetapi-344074071Оценок пока нет

- Gross Domestic Product and GrowthДокумент26 страницGross Domestic Product and Growthbea mendeaОценок пока нет

- 2010 CMA Part 2 Section B: Corporate FinanceДокумент326 страниц2010 CMA Part 2 Section B: Corporate FinanceAhmed Magdi0% (1)

- 03 04 Analysis Financial StatementДокумент216 страниц03 04 Analysis Financial StatementShanique Y. Harnett100% (1)

- Depreciation - WikipediaДокумент10 страницDepreciation - Wikipediapuput075Оценок пока нет

- Respondents Memorial - RДокумент37 страницRespondents Memorial - RNiteshMaheshwariОценок пока нет

- Chapter 9 Saving, Investment and The Financial SystemДокумент24 страницыChapter 9 Saving, Investment and The Financial SystemPhan Minh Hiền NguyễnОценок пока нет

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearДокумент1 страницаChallan No. / Itns 280: Tax Applicable (Tick One) Assessment YearKaran AsodariyaОценок пока нет

- Strategic Financial Performance Analysis Using Altman's Z Score Model: A Study of Listed Unicorn Startups in India From 2019 To 2023Документ12 страницStrategic Financial Performance Analysis Using Altman's Z Score Model: A Study of Listed Unicorn Startups in India From 2019 To 2023index PubОценок пока нет

- Bank Statement TareeqДокумент2 страницыBank Statement TareeqIzza NabbilaОценок пока нет

- Form 57AДокумент4 страницыForm 57AMiguel TancangcoОценок пока нет

- Marine InsuranceДокумент7 страницMarine InsuranceAngel VirayОценок пока нет

- TBChap 005Документ61 страницаTBChap 005trevorОценок пока нет

- DuhaДокумент26 страницDuhaKhánh LyОценок пока нет

- Euro MarketДокумент34 страницыEuro MarketKushal PandyaОценок пока нет

- Conceptual Framework in AccountingДокумент4 страницыConceptual Framework in AccountingKrizchan Deyb De LeonОценок пока нет

- Financial Management For Engineers Fall 2021 Calculating Yield (Bond) Using BA II Plus CalculatorДокумент5 страницFinancial Management For Engineers Fall 2021 Calculating Yield (Bond) Using BA II Plus CalculatorRussul Al-RawiОценок пока нет

- An Assignment On TFO UCBLДокумент15 страницAn Assignment On TFO UCBLFahim Dad KhanОценок пока нет

- Nanna'S House: Case AnalysisДокумент10 страницNanna'S House: Case AnalysisMigo SalvadorОценок пока нет

- 2 Nit04Документ139 страниц2 Nit04executive engineerОценок пока нет

- Calendar of The Ancient Records of Dublin Volume XI 1761 - 1768Документ608 страницCalendar of The Ancient Records of Dublin Volume XI 1761 - 1768Geordie WinkleОценок пока нет

- Export Advance Payment - Branch ProposalДокумент2 страницыExport Advance Payment - Branch ProposalKumar SwamyОценок пока нет

- Question Paper With Answers - Treasury Management-Final ExamДокумент7 страницQuestion Paper With Answers - Treasury Management-Final ExamHarsh MaheshwariОценок пока нет

- Tvs CreditДокумент1 страницаTvs CreditorugalluОценок пока нет

- Sales Tax Return 16353854Документ1 страницаSales Tax Return 163538547799349Оценок пока нет

- Financial Transcations Analysis: Under The Guidance of Dr. Nisha ShankarДокумент4 страницыFinancial Transcations Analysis: Under The Guidance of Dr. Nisha ShankarRUTVIKA DHANESHKUMARKUNDAGOLОценок пока нет

- Legal RiskДокумент7 страницLegal RiskOmprakash MaheshwariОценок пока нет

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (13)

- Waiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterОт EverandWaiter Rant: Thanks for the Tip—Confessions of a Cynical WaiterРейтинг: 3.5 из 5 звезд3.5/5 (487)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesОт EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeОт EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeРейтинг: 4 из 5 звезд4/5 (88)

- Summary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedОт EverandSummary: Unreasonable Hospitality: The Remarkable Power of Giving People More than They Expect by Will Guidara: Key Takeaways, Summary & Analysis IncludedРейтинг: 2.5 из 5 звезд2.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyОт EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyРейтинг: 4.5 из 5 звезд4.5/5 (37)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumОт EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumРейтинг: 3 из 5 звезд3/5 (12)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomОт EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomОценок пока нет

- AI Superpowers: China, Silicon Valley, and the New World OrderОт EverandAI Superpowers: China, Silicon Valley, and the New World OrderРейтинг: 4.5 из 5 звезд4.5/5 (398)

- The United States of Beer: A Freewheeling History of the All-American DrinkОт EverandThe United States of Beer: A Freewheeling History of the All-American DrinkРейтинг: 4 из 5 звезд4/5 (7)

- Pit Bull: Lessons from Wall Street's Champion TraderОт EverandPit Bull: Lessons from Wall Street's Champion TraderРейтинг: 4 из 5 звезд4/5 (17)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)От EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- Data-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseОт EverandData-ism: The Revolution Transforming Decision Making, Consumer Behavior, and Almost Everything ElseРейтинг: 3.5 из 5 звезд3.5/5 (12)

- The Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewОт EverandThe Kingdom of Prep: The Inside Story of the Rise and (Near) Fall of J.CrewРейтинг: 4.5 из 5 звезд4.5/5 (26)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyОт EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyОценок пока нет

- An Ugly Truth: Inside Facebook's Battle for DominationОт EverandAn Ugly Truth: Inside Facebook's Battle for DominationРейтинг: 4 из 5 звезд4/5 (33)

- Getting to Yes: How to Negotiate Agreement Without Giving InОт EverandGetting to Yes: How to Negotiate Agreement Without Giving InРейтинг: 4 из 5 звезд4/5 (652)

- Catching Hell: The Insider Story of Seafood from Ocean to PlateОт EverandCatching Hell: The Insider Story of Seafood from Ocean to PlateРейтинг: 5 из 5 звезд5/5 (13)