Академический Документы

Профессиональный Документы

Культура Документы

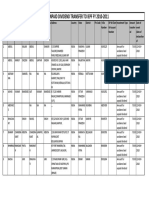

ITDF

Загружено:

Vadivel Muthu0 оценок0% нашли этот документ полезным (0 голосов)

24 просмотров2 страницыThe document provides details of an investment declaration for employee Vadivel M for the month of April 2017, including information on housing rental amounts paid to landlord Geetha H from April 2017 to March 2018. It also lists tax deductions claimed under sections such as 80C for investments in NSC, insurance, and post office savings, totaling Rs. 150,000. The employee declares that the information provided is true and correct to the best of their knowledge.

Исходное описание:

ITDF

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe document provides details of an investment declaration for employee Vadivel M for the month of April 2017, including information on housing rental amounts paid to landlord Geetha H from April 2017 to March 2018. It also lists tax deductions claimed under sections such as 80C for investments in NSC, insurance, and post office savings, totaling Rs. 150,000. The employee declares that the information provided is true and correct to the best of their knowledge.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

24 просмотров2 страницыITDF

Загружено:

Vadivel MuthuThe document provides details of an investment declaration for employee Vadivel M for the month of April 2017, including information on housing rental amounts paid to landlord Geetha H from April 2017 to March 2018. It also lists tax deductions claimed under sections such as 80C for investments in NSC, insurance, and post office savings, totaling Rs. 150,000. The employee declares that the information provided is true and correct to the best of their knowledge.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

Details of Investment Declaration for the Month of April 2017

Employee Details

Employee Code BLR2117 Name VADIVEL M

PAN No AJAPV5405F Date of Joining 28/11/2013

Information for HRA Exemption

Month Landlord Name Landlord PAN Address City Amount Declared

Apr-17 GEETHA H N0:42,10th Main,14th Others 8000.00

Cross,Maruthi

Nagar,Malleshpalaya

May-17 GEETHA H N0:42,10th Main,14th Others 8000.00

Cross,Maruthi

Nagar,Malleshpalaya

Jun-17 GEETHA H N0:42,10th Main,14th Others 8000.00

Cross,Maruthi

Nagar,Malleshpalaya

Jul-17 GEETHA H N0:42,10th Main,14th Others 8000.00

Cross,Maruthi

Nagar,Malleshpalaya

Aug-17 GEETHA H N0:42,10th Main,14th Others 8000.00

Cross,Maruthi

Nagar,Malleshpalaya

Sep-17 GEETHA H N0:42,10th Main,14th Others 8000.00

Cross,Maruthi

Nagar,Malleshpalaya

Oct-17 GEETHA H N0:42,10th Main,14th Others 8000.00

Cross,Maruthi

Nagar,Malleshpalaya

Nov-17 GEETHA H N0:42,10th Main,14th Others 8000.00

Cross,Maruthi

Nagar,Malleshpalaya

Dec-17 GEETHA H N0:42,10th Main,14th Others 8000.00

Cross,Maruthi

Nagar,Malleshpalaya

Jan-18 GEETHA H N0:42,10th Main,14th Others 8000.00

Cross,Maruthi

Nagar,Malleshpalaya

Feb-18 GEETHA H N0:42,10th Main,14th Others 8000.00

Cross,Maruthi

Nagar,Malleshpalaya

Mar-18 GEETHA H N0:42,10th Main,14th Others 8000.00

Cross,Maruthi

Nagar,Malleshpalaya

Housing Loan/House Property/Other Income Amount Declared

House Property Income/(Loss) - Let Out Property (Sec 24(b)) 0.00

Interest on Housing Loan-Self Occupied Property (Sec 24(b)) 0.00

Other Income (Bank Interest, etc.) 0.00

Previous Employment Income Amount Declared

Income received from previous employer salary 0.00

Professional Tax recovered by previous employer 0.00

Provident Fund contributed with Previous employer 0.00

Tax paid outside salary / Tax recovered by previous employer 0.00

Other Permitted Exemptions (Section 80D to 80U) Amount Declared

Medical Insurance Premium (Sec 80D) 0.00

Medical Insurance Premium for parents (sec 80D) 0.00

Medical Insurance Premium paid for senior Citizen (Parents) 0.00

Medical for Handicapped Dependents (Sec 80DD) 0.00

Medical for Handicapped Dependents (severe disability) (Sec 80 DD) 0.00

Medical for Specified Diseases (Sec 80DDB) 0.00

Medical for Specified Diseases for Senior Citizen (Sec 80DDB) 0.00

Interest Paid on Higher Education Loan (Sec 80E) 0.00

Deduction for Permanent Disability (Sec 80U) 0.00

Interest on House Property - Additional Exemption 0.00

Total Deductibles 0.00

Tax Saving Investments Under Section 80C Amount Declared

Employees Provident Fund (Auto populated through payroll) 0.00

Voluntary Provident Fund (Auto populated through payroll) 0.00

Deduction under Life Insurance Pension Scheme (Sec 80CCC) 0.00

Public Provident Fund 0.00

Children Education Expenses 0.00

National Savings Certificate (NSC) 50000.00

Insurance Premium 50000.00

Housing Loan Principal Repayment 0.00

Others - Post Office Savings Schemes , Tax Saver Term Deposit - 5 years 50000.00

Sukanya Samriddhi Scheme 0.00

Accrued NSC Interest 0.00

Mutual Funds / ULIP 0.00

Central Govt equity savings scheme(80CCG) 0.00

Employee's contribution towards NPS 0.00

Total Investments U/s 80C & 80CCC limited up to Rs.1.5 Lakhs + Rs.50000 for additional NPS + Rs.25000

150000.00

for 80CCG

Verification

I do hereby declare that the information provided above is true and correct to the best of my knowledge and belief and also undertake

to indemnify the company for any loss / liability that may arise in the event of the above information being incorrect..

Date :

Place : Employee Signature(Mandatory)

Вам также может понравиться

- Payslip: Satender Sharma:: Tool Room:: Incharge::: Payslip For May - 2008Документ10 страницPayslip: Satender Sharma:: Tool Room:: Incharge::: Payslip For May - 2008vntkhatri50% (6)

- Pay Pay Slip For The Month of AUGUST-2018: Deep Industries LimitedДокумент1 страницаPay Pay Slip For The Month of AUGUST-2018: Deep Industries LimitedAnkush SehgalОценок пока нет

- RDO No. 72 - Roxas City All MunicipalitiesДокумент225 страницRDO No. 72 - Roxas City All MunicipalitiesPaul Pabilico PorrasОценок пока нет

- 315 - 4 - 2017 - P5585 - Kuldeep Manibhai Kothiya PDFДокумент1 страница315 - 4 - 2017 - P5585 - Kuldeep Manibhai Kothiya PDFKuldeep KothiyaОценок пока нет

- Details of Investment Declaration For The Month of April 2022 Old Tax RegimeДокумент2 страницыDetails of Investment Declaration For The Month of April 2022 Old Tax RegimePraveenОценок пока нет

- Astute C001 As7223 2023027791527116615907703Документ1 страницаAstute C001 As7223 2023027791527116615907703Gautam Sharma (Hattrick)Оценок пока нет

- Shambhuvi Pay SlipДокумент1 страницаShambhuvi Pay SlipShivani TiwariОценок пока нет

- Astute C001 As7223 2023027791527116615907703Документ1 страницаAstute C001 As7223 2023027791527116615907703Gautam Sharma (Hattrick)Оценок пока нет

- Shankesh NARAYAN MANDAVAKAR 5071 Payslip DecemberДокумент1 страницаShankesh NARAYAN MANDAVAKAR 5071 Payslip DecemberZeenatОценок пока нет

- Himanshu Sharma PDFДокумент1 страницаHimanshu Sharma PDFHimanshu SharmaОценок пока нет

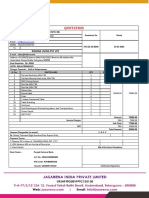

- Invoice Vedalax8226Документ1 страницаInvoice Vedalax8226Suresh VedalaОценок пока нет

- CashReceipt 2Документ1 страницаCashReceipt 2mОценок пока нет

- Nataraj Polyplast Pvt. LTD.: Cash ReceiptДокумент1 страницаNataraj Polyplast Pvt. LTD.: Cash ReceiptmОценок пока нет

- E-In-C'S Branch Co-Op T&C Society LTD: ReceiptДокумент1 страницаE-In-C'S Branch Co-Op T&C Society LTD: ReceiptarnaОценок пока нет

- Sal Dec 23Документ1 страницаSal Dec 23dharmendraОценок пока нет

- EmployeeSalarySlip PDFДокумент1 страницаEmployeeSalarySlip PDFShivika DograОценок пока нет

- Payslip:: Petrofac International LTDДокумент1 страницаPayslip:: Petrofac International LTDRakesh PatelОценок пока нет

- Ashapuri, Naira, Khodiyar & Yashoda Revdi BazarДокумент7 страницAshapuri, Naira, Khodiyar & Yashoda Revdi Bazarvishal.nithamОценок пока нет

- Adobe Scan 14 Jan 2022Документ1 страницаAdobe Scan 14 Jan 2022Raju Kumar SoniОценок пока нет

- Adobe Scan 14 Jan 2022Документ1 страницаAdobe Scan 14 Jan 2022Raju Kumar SoniОценок пока нет

- Sumit Salary SlipДокумент3 страницыSumit Salary SlipPankajSharmaОценок пока нет

- E-In-C'S Branch Co-Op T&C Society LTD: ReceiptДокумент1 страницаE-In-C'S Branch Co-Op T&C Society LTD: ReceiptarnaОценок пока нет

- January 5, 2018: Accord Advertising Pvt. LTDДокумент2 страницыJanuary 5, 2018: Accord Advertising Pvt. LTDDibyojyoti SahaОценок пока нет

- Payslip For The Month of July 2018 - EktaДокумент1 страницаPayslip For The Month of July 2018 - Ektaniml1Оценок пока нет

- Wage SlipДокумент1 страницаWage SlipOxen PartsОценок пока нет

- Content ServerДокумент1 страницаContent ServerMahendra RawatОценок пока нет

- Socialight: H-No:8-2-703/4/1, 1st Floor, Sai Enclave, Bhola Nagar, Road No:12, Banjarahills, Hyderabad-500034Документ4 страницыSocialight: H-No:8-2-703/4/1, 1st Floor, Sai Enclave, Bhola Nagar, Road No:12, Banjarahills, Hyderabad-500034subba reddyОценок пока нет

- Insta Cool-SWH Order JulyДокумент2 страницыInsta Cool-SWH Order JulyINSTA SERVICEОценок пока нет

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)अभिषेक मिश्राОценок пока нет

- Taklikar Fa1281Документ1 страницаTaklikar Fa1281NAGESH SARODEОценок пока нет

- Udipta Energy & Equipment Pvt. LTDДокумент3 страницыUdipta Energy & Equipment Pvt. LTDParesh NayakОценок пока нет

- Tax Invoice: Legalite Corporate Solutions Private LimitedДокумент1 страницаTax Invoice: Legalite Corporate Solutions Private LimitedCS. ROSHAN SINGH CHANDELОценок пока нет

- Good Samaritan School: FEE RECEIPT (2021-2022)Документ1 страницаGood Samaritan School: FEE RECEIPT (2021-2022)AHMED NAEEM 2Оценок пока нет

- List of Unpaid Interim Dividend FY 2010-11 Transfer To IEPFДокумент416 страницList of Unpaid Interim Dividend FY 2010-11 Transfer To IEPFHarishОценок пока нет

- Gaji HusniДокумент1 страницаGaji HusniBarry YsrnrОценок пока нет

- PDK 03Документ1 страницаPDK 03anuragv.paawanОценок пока нет

- Glow Fixtures Lighting SolutionДокумент1 страницаGlow Fixtures Lighting Solutionanimjain90Оценок пока нет

- 1281 Taklikar-FaДокумент1 страница1281 Taklikar-FaNAGESH SARODEОценок пока нет

- Po 478Документ1 страницаPo 478felix manuelОценок пока нет

- Patbil Detail Dikonversi DikonversiДокумент1 страницаPatbil Detail Dikonversi DikonversiFarmasi Bandung Heart ClinicОценок пока нет

- Itdf 2Документ3 страницыItdf 2Rajan KMRОценок пока нет

- ESS MarkfedДокумент2 страницыESS MarkfedSandeep MohapatraОценок пока нет

- PayslipДокумент1 страницаPayslipKiran Kumar100% (2)

- Aster Pharmacy: Earnings DeductionsДокумент1 страницаAster Pharmacy: Earnings DeductionsRyalapeta Venu YadavОценок пока нет

- Wa0013Документ1 страницаWa0013THE PLATFORMSОценок пока нет

- KJM - 0021Документ1 страницаKJM - 0021murniyawati171Оценок пока нет

- Servlet ControllerДокумент1 страницаServlet Controllermukesh sahuОценок пока нет

- Servlet ControllerДокумент1 страницаServlet Controllermukesh sahuОценок пока нет

- Doctore Bill 2Документ1 страницаDoctore Bill 2Raju Kumar SoniОценок пока нет

- Doctore Bill 2Документ1 страницаDoctore Bill 2Raju Kumar SoniОценок пока нет

- Quotation 208 Ridhira StallДокумент1 страницаQuotation 208 Ridhira StallDeba SinhaОценок пока нет

- Nov 23Документ1 страницаNov 23hetalahir149Оценок пока нет

- April 2019Документ1 страницаApril 2019mahesh ilagОценок пока нет

- No 21/17-18 Puliakulam Road - 641045Документ1 страницаNo 21/17-18 Puliakulam Road - 641045Dr Sivaram HariharanОценок пока нет

- Attachmentu0sview Att&th 167f781838e31980&attid 0 1&disp Attd&safe 1&zw&saddb PDFДокумент2 страницыAttachmentu0sview Att&th 167f781838e31980&attid 0 1&disp Attd&safe 1&zw&saddb PDFSoumya Shrisha IyengarОценок пока нет

- E-In-C'S Branch Co-Op T&C Society LTD: ReceiptДокумент1 страницаE-In-C'S Branch Co-Op T&C Society LTD: ReceiptarnaОценок пока нет

- MW Gamer: Payslip - Monthly PayrollДокумент2 страницыMW Gamer: Payslip - Monthly PayrollEren Dela CruzОценок пока нет

- Assets Base of ComapnyДокумент2 страницыAssets Base of ComapnyPavan SAMEER KUMARОценок пока нет

- Training ExcercisesДокумент16 страницTraining ExcercisesVadivel MuthuОценок пока нет

- Exadata Services 069268Документ3 страницыExadata Services 069268Vadivel MuthuОценок пока нет

- Twenty Years of Performance Tuning by Chris Lawson: TIP #1 Don't Begin With ParallelismДокумент1 страницаTwenty Years of Performance Tuning by Chris Lawson: TIP #1 Don't Begin With ParallelismVadivel MuthuОценок пока нет

- SodexoДокумент1 страницаSodexoVadivel MuthuОценок пока нет

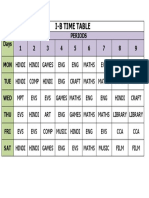

- Time TableДокумент1 страницаTime TableVadivel MuthuОценок пока нет

- CeCOC Low ModifiedДокумент10 страницCeCOC Low ModifiedkripanshОценок пока нет

- Cost SheetДокумент4 страницыCost SheetQuestionscastle FriendОценок пока нет

- CVP Analysis No AnswerДокумент9 страницCVP Analysis No AnswerAybern BawtistaОценок пока нет

- PPI Provisional BST 2018-19Документ6 страницPPI Provisional BST 2018-19accounts ppintОценок пока нет

- MNCs Are They DevilsДокумент26 страницMNCs Are They DevilsMekhla MittalОценок пока нет

- FMCG P&G Dabur Group 5Документ10 страницFMCG P&G Dabur Group 5Kautilya ParmarОценок пока нет

- Retirement Calculator & Planner DemoДокумент39 страницRetirement Calculator & Planner DemoSumit TodiОценок пока нет

- Capital Adequacy Asset Quality Management Soundness Earnings & Profitability Liquidity Sensitivity To Market RiskДокумент23 страницыCapital Adequacy Asset Quality Management Soundness Earnings & Profitability Liquidity Sensitivity To Market RiskCharming AshishОценок пока нет

- E-Filing Home Page, Income Tax Department, Government of IndiaДокумент2 страницыE-Filing Home Page, Income Tax Department, Government of IndiassОценок пока нет

- CommissionДокумент2 страницыCommissionvincevillamora2k11Оценок пока нет

- DeltaBeverageCase PDFДокумент8 страницDeltaBeverageCase PDFAsri ZefanyaОценок пока нет

- Memoire Finance Julien BOUSQUET Synergie Valuation in M AДокумент77 страницMemoire Finance Julien BOUSQUET Synergie Valuation in M AManal DassallemОценок пока нет

- WWW - Fbr.gov - PK: Prepared by Azmat Shah (Dy. Director Finance)Документ23 страницыWWW - Fbr.gov - PK: Prepared by Azmat Shah (Dy. Director Finance)arsalanssgОценок пока нет

- Double Taxation IДокумент16 страницDouble Taxation IReese Peralta100% (1)

- PFRS 3 - Business Combination, PAS 27 - Consolidated and Separate Financial StatementsДокумент5 страницPFRS 3 - Business Combination, PAS 27 - Consolidated and Separate Financial Statementsd.pagkatoytoyОценок пока нет

- Internship ReportДокумент36 страницInternship ReportJuhi Marmat100% (1)

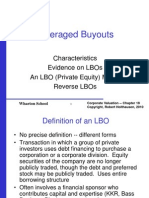

- LBO PowerpointДокумент36 страницLBO Powerpointfalarkys100% (1)

- Financial PlanДокумент68 страницFinancial PlanYASHA BAIDОценок пока нет

- Mgac AnsДокумент23 страницыMgac AnsMark Ivan JagodillaОценок пока нет

- Financial Analysis Assignment No. 1Документ9 страницFinancial Analysis Assignment No. 1Shaista BanoОценок пока нет

- NFL Econ 398Документ5 страницNFL Econ 398Amena91Оценок пока нет

- AC4303 Final Exam 2021 - 22 Sem BДокумент7 страницAC4303 Final Exam 2021 - 22 Sem BDaisy LeungОценок пока нет

- Class 12 Syllabus 2019-2020 IscДокумент4 страницыClass 12 Syllabus 2019-2020 IscPIYA CHAKRABORTY100% (1)

- Resume Stephen SouthernДокумент2 страницыResume Stephen SouthernstevesouthernОценок пока нет

- Form 15g NewДокумент4 страницыForm 15g NewnazirsayyedОценок пока нет

- Cost of Environmental Degradation Training ManualДокумент483 страницыCost of Environmental Degradation Training ManualNath RoussetОценок пока нет

- Lesson-18 CAPITAL BUDGETINGДокумент23 страницыLesson-18 CAPITAL BUDGETINGTrupti BorikarОценок пока нет

- Keown Chapter 8Документ33 страницыKeown Chapter 8be_aeonОценок пока нет

- Solution Manual For Fundamentals of Taxation 2019 Edition 12th by CruzДокумент31 страницаSolution Manual For Fundamentals of Taxation 2019 Edition 12th by CruzSherryBakerdawz100% (35)

- Final Project: Ittefaq Iron Industries Ltd. Submitted ToДокумент16 страницFinal Project: Ittefaq Iron Industries Ltd. Submitted ToAman BaloooshiiОценок пока нет