Академический Документы

Профессиональный Документы

Культура Документы

Silos V PNB

Загружено:

ZariCharisamorV.ZapatosОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Silos V PNB

Загружено:

ZariCharisamorV.ZapatosАвторское право:

Доступные форматы

Silos v. PNB, G.R. No.

181045, July 2, 2015

FACTS:

In loan agreements, it cannot be denied that the rate of interest is a principal condition, if not

the most important component. Thus, any modification thereof must be mutually agreed upon;

otherwise, it has no binding effect.

Spouses Eduardo and Lydia Silos secured a revolving credit line with Philippine National Bank

(PNB)through a real estate mortgage as a security. After two years, their credit line increased.

Spouses Silos then signed a Credit Agreement, which was also amended two years later, and

several Promissory Notes (PN) as regards their Credit Agreements with PNB. The said loan was

initially subjected to a 19.5% interest rate per annum. In the Credit Agreements, Spouses Silos

bound themselves to the power of PNB to modify the interest rate depending on whatever

policy that PNB may adopt in the future, without the need of notice upon them. Thus, the said

interest rates played from 16% to as high as 32% per annum. Spouses Silos acceded to the

policy by pre-signing a total of twenty-six (26) PNs leaving the individual applicable interest

rates at hand blank since it would be subject to

modification by PNB.

Spouses Silos regularly renewed and made good on their PNs, religiously paid the interests

without objection or fail. However, during the 1997 Asian Financial Crisis, Spouses Silos faltered

when the interest rates soared. Spouses Silos 26thPN became past due, and despite repeated

demands by PNB, they failed to make good on the note. Thus, PNB foreclosed and auctioned

the involved security for the mortgage. Spouses Silos instituted an action to annul the

foreclosure sale on the ground that the succeeding interest rates used in their loan agreements

was left to the sole will of PNB, the same fixed by the latter without their prior consent and

thus, void. The Regional Trial Court (RTC) ruled that such stipulation authorizing both the

increase and decrease of interest rates as may be applicable is valid. The Court of Appeals (CA)

affirmed the RTC decision.

ISSUE:

May the bank, on its own, modify the interest rate in a loan agreement without violating the

mutuality of contracts?

RULING:

No. Any modification in the contract, such as the interest rates, must be made with the consent

of the contracting parties. The minds of all the parties must meet as to the proposed

modification, especially when it affects an important aspect of the agreement. In the case of

loan agreements, the rate of interest is a principal condition, if not the most important

component.

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Memorandum Complainant Case 4Документ8 страницMemorandum Complainant Case 4ZariCharisamorV.Zapatos100% (2)

- Memorandum Complainant Case 3Документ4 страницыMemorandum Complainant Case 3ZariCharisamorV.ZapatosОценок пока нет

- JA Petitioner's Witness Santiago S. SantiagoДокумент4 страницыJA Petitioner's Witness Santiago S. SantiagoZariCharisamorV.ZapatosОценок пока нет

- PATCaseDigests31 40Документ7 страницPATCaseDigests31 40ZariCharisamorV.ZapatosОценок пока нет

- Atty. Delson PATCaseDigest1-10Документ17 страницAtty. Delson PATCaseDigest1-10ZariCharisamorV.ZapatosОценок пока нет

- Sales Case Doctrines FinalsДокумент9 страницSales Case Doctrines FinalsZariCharisamorV.Zapatos100% (1)

- Nego Cases 1Документ13 страницNego Cases 1ZariCharisamorV.ZapatosОценок пока нет

- Bedan HymnДокумент1 страницаBedan HymnZariCharisamorV.ZapatosОценок пока нет

- Sales Case Doctrines MidtermsДокумент9 страницSales Case Doctrines MidtermsZariCharisamorV.Zapatos50% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Exercise 23 - Sulfur OintmentДокумент4 страницыExercise 23 - Sulfur OintmentmaimaiОценок пока нет

- Lecture 1Документ11 страницLecture 1Taniah Mahmuda Tinni100% (1)

- tdr100 - DeviceДокумент4 страницыtdr100 - DeviceSrđan PavićОценок пока нет

- Beam Deflection by Double Integration MethodДокумент21 страницаBeam Deflection by Double Integration MethodDanielle Ruthie GalitОценок пока нет

- Agoura Hills DIVISION - 6. - NOISE - REGULATIONSДокумент4 страницыAgoura Hills DIVISION - 6. - NOISE - REGULATIONSKyle KimОценок пока нет

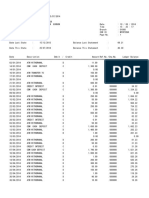

- Bank Statement SampleДокумент6 страницBank Statement SampleRovern Keith Oro CuencaОценок пока нет

- La Salle Lipa Integrated School Senior High School Community 1 Quarter Summative Assessment Earth Science AY 2021-2022 Household Conservation PlanДокумент4 страницыLa Salle Lipa Integrated School Senior High School Community 1 Quarter Summative Assessment Earth Science AY 2021-2022 Household Conservation PlanKarlle ObviarОценок пока нет

- Kayako Support Suite User Manual PDFДокумент517 страницKayako Support Suite User Manual PDFallQoo SEO BaiduОценок пока нет

- White Button Mushroom Cultivation ManualДокумент8 страницWhite Button Mushroom Cultivation ManualKhurram Ismail100% (4)

- Salem Telephone CompanyДокумент4 страницыSalem Telephone Company202211021 imtnagОценок пока нет

- Data Mining - Exercise 2Документ30 страницData Mining - Exercise 2Kiều Trần Nguyễn DiễmОценок пока нет

- Caso Kola RealДокумент17 страницCaso Kola RealEvelyn Dayhanna Escobar PalomequeОценок пока нет

- ABB Price Book 524Документ1 страницаABB Price Book 524EliasОценок пока нет

- Automatic Stair Climbing Wheelchair: Professional Trends in Industrial and Systems Engineering (PTISE)Документ7 страницAutomatic Stair Climbing Wheelchair: Professional Trends in Industrial and Systems Engineering (PTISE)Abdelrahman MahmoudОценок пока нет

- Mpi Model QuestionsДокумент4 страницыMpi Model QuestionshemanthnagОценок пока нет

- Business Testimony 3Документ14 страницBusiness Testimony 3Sapan BanerjeeОценок пока нет

- Hardware Architecture For Nanorobot Application in Cancer TherapyДокумент7 страницHardware Architecture For Nanorobot Application in Cancer TherapyCynthia CarolineОценок пока нет

- Tracker Pro Otm600 1.5Документ19 страницTracker Pro Otm600 1.5Camilo Restrepo CroОценок пока нет

- Kompetensi Sumber Daya Manusia SDM Dalam Meningkatkan Kinerja Tenaga Kependidika PDFДокумент13 страницKompetensi Sumber Daya Manusia SDM Dalam Meningkatkan Kinerja Tenaga Kependidika PDFEka IdrisОценок пока нет

- Active Directory FactsДокумент171 страницаActive Directory FactsVincent HiltonОценок пока нет

- Brochure 2017Документ44 страницыBrochure 2017bibiana8593Оценок пока нет

- A CMOS Current-Mode Operational Amplifier: Thomas KaulbergДокумент4 страницыA CMOS Current-Mode Operational Amplifier: Thomas KaulbergAbesamis RanmaОценок пока нет

- Validation of AnalyticalДокумент307 страницValidation of AnalyticalJagdish ChanderОценок пока нет

- MEMORANDUMДокумент8 страницMEMORANDUMAdee JocsonОценок пока нет

- CPE Cisco LTE Datasheet - c78-732744Документ17 страницCPE Cisco LTE Datasheet - c78-732744abds7Оценок пока нет

- Milestone 9 For WebsiteДокумент17 страницMilestone 9 For Websiteapi-238992918Оценок пока нет

- Service Manual Lumenis Pulse 30HДокумент99 страницService Manual Lumenis Pulse 30HNodir AkhundjanovОценок пока нет

- Hierarchy of The Inchoate Crimes: Conspiracy Substantive CrimeДокумент18 страницHierarchy of The Inchoate Crimes: Conspiracy Substantive CrimeEmely AlmonteОценок пока нет

- SH210 5 SERVCE CD PDF Pages 1 33Документ33 страницыSH210 5 SERVCE CD PDF Pages 1 33Em sulistio87% (23)

- 1980WB58Документ167 страниц1980WB58AKSОценок пока нет