Академический Документы

Профессиональный Документы

Культура Документы

PR201007

Загружено:

qtipx0 оценок0% нашли этот документ полезным (0 голосов)

208 просмотров1 страницаАвторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

208 просмотров1 страницаPR201007

Загружено:

qtipxАвторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

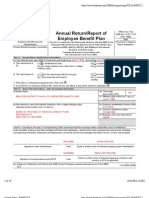

Monitoring trends for over 60 years

July 30, 2010

Consumer Confidence Tumbles

Index of Consumer Sentiment

Surveys of Consumers chief

Jul’10 Jun’10 Jul’09 M-M Chng Y-Y Chng economist, Richard Curtin

67.8 76.0 66.0 -10.8% +2.7%

“Scarce jobs and stagnating incomes

Index of Consumer Expectations have been the top concerns of con-

62.3 69.8 63.2 -10.7% -1.4% sumers for some time. What changed

in July was their recognition that the anticipated

Current Conditions Index slowdown in the economy will keep jobs scarce

76.5 85.6 70.5 -10.6% +8.5% for some time, while their uncertainties about fu-

ture prospects were increased by the policies of the

ANN ARBOR. Confidence tumbled in July due to height- Obama administration. Rather than itching to re-

ened concerns about personal financial prospects as well as sume old spending habits, consumers have begun

the overall economic outlook. Income and job prospects to actively embrace a more defensive outlook,

were extraordinarily weak and those bleak prospects have making them more likely to further pare their debt

made consumers more cautious spenders. Rather than the and increase saving and reserve funds. This new

economy gaining strength, consumers now anticipate a defensive posture could result in even slower eco-

slowing pace of growth, and rather than economic policies nomic growth and fewer jobs in the future.”

acting to improve prospects, the policies of the Obama ad-

ministration have increased economic uncertainty among consumers. Overall, the data suggest that the current

slowdown in spending is likely to persist well into 2011 as it reflects a widespread and general realignment of

job and wage expectations. While a double dip is still unlikely, it now has a non-ignorable 25% probability.

Grim Outlook for Personal Finances

Nearly a year after the economic recovery began, the financial situation of consumers has continued to weaken

mainly due to the loss of jobs and work hours as well as stagnating incomes. Half of all consumers reported that

their finances had worsened this July as well as in last July’s survey. The smallest proportion ever recorded in

the sixty year history of the surveys anticipated an increase in their household’s income during the year ahead.

Moreover, eight-in-ten consumers expected no improvement in the unemployment rate during the year ahead.

Consumers sensed a slowdown in economic growth. The backslide meant that six-in-ten consumers judged pros-

pects for the economy unfavorably, and just one-in-three consumers anticipated uninterrupted economic growth

during the next five years. Confidence in economic policies fell to the lowest level in the July survey since the

start of the Obama administration. While the effectiveness of Obama’s policies in creating jobs remained the top

concern, the rising level of federal debt and prospects for higher future taxes have gained a foothold as well.

Consumer Sentiment Index

The Sentiment Index was 67.8 in the July 2010 survey, down sharply from the 76.0 in June, erasing the entire

gain since 66.0 was recorded last July. The Expectations Index, a component of the Index of Leading Indicators,

THE INDEX OF CONSUMER SENTIMENT

declined by 10.7% in July, falling to the lowest level since

March of 2009. The Current Conditions Index also posted a

100

double digit decline, but it remained above last year’s 70.5.

90

80

About the survey

70 The Survey of Consumers is a rotating panel survey based on a nation-

ally representative sample that gives each household in the coterminous

60 U.S. an equal probability of being selected. Interviews are conducted

50 throughout the month by telephone. The 95% confidence interval indi-

Jul-07 Jul-08 Jul-09 Jul-10 vidual months for most percentages are plus or minus 4.7 percentage

MONTHLY DATA 3 MONTH MOVING AVERAGE points.

Richard T. Curtin • Director, Thomson Reuters/University of Michigan Surveys of Consumers • Phone 734.763.5224

Thomson Reuters PR Hotline: 646.223.7222 ext. 1 • http://press.sca.isr.umich.edu

Вам также может понравиться

- Preliminary Results For July 2019 Featured Chart (Or) : ExcelДокумент1 страницаPreliminary Results For July 2019 Featured Chart (Or) : ExcelValter SilveiraОценок пока нет

- Westpac Red Book July 2013Документ28 страницWestpac Red Book July 2013David SmithОценок пока нет

- Er 20130612 Bull Consumer SentimentДокумент4 страницыEr 20130612 Bull Consumer SentimentDavid SmithОценок пока нет

- Consumer Confidence Poll 06-12Документ4 страницыConsumer Confidence Poll 06-12cara12345Оценок пока нет

- 11-084 ICC-Aug10 WebДокумент2 страницы11-084 ICC-Aug10 Webderailedcapitalism.comОценок пока нет

- New York Consumer Confidence Inches Upwards Despite Gas & Food WorriesДокумент4 страницыNew York Consumer Confidence Inches Upwards Despite Gas & Food WorriesJon CampbellОценок пока нет

- Er 20120912 Bull Consumer SentimentДокумент2 страницыEr 20120912 Bull Consumer SentimentLuke Campbell-SmithОценок пока нет

- Siena Research Institute: Consumer Sentiment in NY Reaches Five Year HighДокумент4 страницыSiena Research Institute: Consumer Sentiment in NY Reaches Five Year Highcara12345Оценок пока нет

- Siena Research Institute: NY Consumer Confidence Up Highest Since Summer of 2007Документ4 страницыSiena Research Institute: NY Consumer Confidence Up Highest Since Summer of 2007embenjamin2001Оценок пока нет

- The Red Book: Westpac Economics With TheДокумент28 страницThe Red Book: Westpac Economics With TheLauren FrazierОценок пока нет

- Er 20120815 Bull Consumer SentimentДокумент2 страницыEr 20120815 Bull Consumer SentimentChrisBeckerОценок пока нет

- Siena Research Institute: Stock Market Roller Coaster Leaves Consumer Confidence Low and FlatДокумент4 страницыSiena Research Institute: Stock Market Roller Coaster Leaves Consumer Confidence Low and FlatNick ReismanОценок пока нет

- Siena Research Institute: NY Consumer Sentiment Flat, Trails Nation, Down 5% From A Year AgoДокумент4 страницыSiena Research Institute: NY Consumer Sentiment Flat, Trails Nation, Down 5% From A Year AgojspectorОценок пока нет

- HDFC Doc 2Документ11 страницHDFC Doc 2Chinmay MohapatraОценок пока нет

- What We Can Learn by Going Back To School: MarketДокумент5 страницWhat We Can Learn by Going Back To School: MarketdpbasicОценок пока нет

- Siena Research Institute: National Confidence Frighteningly Low NY S Better But Lowest Since Feb 09Документ4 страницыSiena Research Institute: National Confidence Frighteningly Low NY S Better But Lowest Since Feb 09Robert TranОценок пока нет

- JF - Consumer Confidence Index FinalДокумент10 страницJF - Consumer Confidence Index FinalJeffrey ForstnerОценок пока нет

- The Red Book: Westpac Economics With TheДокумент26 страницThe Red Book: Westpac Economics With TheBelinda WinkelmanОценок пока нет

- Reading. Inflation Boosts U.S. Household Spending by $433 A Month, On Average, Moody's FindsДокумент5 страницReading. Inflation Boosts U.S. Household Spending by $433 A Month, On Average, Moody's Findss.lopezОценок пока нет

- Cumulative Weight: Impact On CreditДокумент3 страницыCumulative Weight: Impact On CreditThe Partnership for a Secure Financial FutureОценок пока нет

- TD BANK-JUL-27-TD Economic-US Consumer Confidence CommentaryДокумент1 страницаTD BANK-JUL-27-TD Economic-US Consumer Confidence CommentaryMiir ViirОценок пока нет

- SFA OW Insurance Redefined VFДокумент30 страницSFA OW Insurance Redefined VFJonathan ChuahОценок пока нет

- Siena Research Institute: NY Confidence Up Slightly Led by Women, Upper Income & DemocratsДокумент4 страницыSiena Research Institute: NY Confidence Up Slightly Led by Women, Upper Income & Democratscara12345Оценок пока нет

- Consumer Confidence Survey by RbiДокумент3 страницыConsumer Confidence Survey by RbiGarimaОценок пока нет

- Siena Research Institute: NY Consumer Sentiment Slips Falls To 20 Month LowДокумент4 страницыSiena Research Institute: NY Consumer Sentiment Slips Falls To 20 Month LowjspectorОценок пока нет

- Final Results For June 2019 Featured Chart (Or) : ExcelДокумент1 страницаFinal Results For June 2019 Featured Chart (Or) : ExcelValter SilveiraОценок пока нет

- The Red Book: Westpac Economics With TheДокумент24 страницыThe Red Book: Westpac Economics With TheDavid4564654Оценок пока нет

- Volatile February Torpedoes ConfidenceДокумент3 страницыVolatile February Torpedoes ConfidenceCeleste KatzОценок пока нет

- Bulletin: Most Australians See Mortgage Rates Flat or Higher Over The Next 12mthsДокумент4 страницыBulletin: Most Australians See Mortgage Rates Flat or Higher Over The Next 12mthsLauren FrazierОценок пока нет

- Er 20121010 Bull Consumer SentimentДокумент2 страницыEr 20121010 Bull Consumer SentimentBelinda WinkelmanОценок пока нет

- Inflation Is Defined As The Rate of Increase in The Value of Goods and Services Over A Given Time PeriodДокумент5 страницInflation Is Defined As The Rate of Increase in The Value of Goods and Services Over A Given Time Periodjean gabitoОценок пока нет

- Weekly Economic & Financial Commentary 15julyДокумент13 страницWeekly Economic & Financial Commentary 15julyErick Abraham MarlissaОценок пока нет

- How Much Annual Income Can Your Retirement Portfolio Provide?Документ4 страницыHow Much Annual Income Can Your Retirement Portfolio Provide?gvandykeОценок пока нет

- CBRE North America CapRate 2014H1 MasterДокумент49 страницCBRE North America CapRate 2014H1 Mastercubsfan936Оценок пока нет

- Effect of Customer Satisfaction On Consumer Spending GrowthДокумент29 страницEffect of Customer Satisfaction On Consumer Spending Growthargue2muchОценок пока нет

- IndiaEconomicsOverheating090207 MFДокумент4 страницыIndiaEconomicsOverheating090207 MFsdОценок пока нет

- Westpac Red Book (September 2013)Документ28 страницWestpac Red Book (September 2013)leithvanonselenОценок пока нет

- America RecessionДокумент9 страницAmerica RecessionashulibraОценок пока нет

- Economic Mega Trends That Will Drive Our FutureДокумент12 страницEconomic Mega Trends That Will Drive Our FutureexpertllcОценок пока нет

- PWC Financial Institution Continuous Cost ManagementДокумент40 страницPWC Financial Institution Continuous Cost ManagementhellowodОценок пока нет

- How Much Annual Income Can Your Retirement Portfolio Provide?Документ4 страницыHow Much Annual Income Can Your Retirement Portfolio Provide?gvandykeОценок пока нет

- Fed Full SpeechДокумент22 страницыFed Full SpeechZerohedgeОценок пока нет

- MBA 502 - Final Project - Part 2 - SEMIRAT - KUKUДокумент8 страницMBA 502 - Final Project - Part 2 - SEMIRAT - KUKUEric WogbeОценок пока нет

- Inflation Environment and OutlookДокумент8 страницInflation Environment and OutlookStephen LinОценок пока нет

- The Conference Board Consumer Confidence IndexДокумент1 страницаThe Conference Board Consumer Confidence IndexBecket AdamsОценок пока нет

- Siena Research Institute: Confidence Down in NY Consumer Recovery StallsДокумент4 страницыSiena Research Institute: Confidence Down in NY Consumer Recovery StallsElizabeth BenjaminОценок пока нет

- MENGES GROUP Assessment of Illinois Cost Trends Dec 5 2017Документ8 страницMENGES GROUP Assessment of Illinois Cost Trends Dec 5 2017Natasha KoreckiОценок пока нет

- Global Weekly Economic Update - Deloitte InsightsДокумент8 страницGlobal Weekly Economic Update - Deloitte InsightsSaba SiddiquiОценок пока нет

- Emerging Consumer Survey Databook 2014Документ240 страницEmerging Consumer Survey Databook 2014Devina Yao100% (1)

- Media Release: Consumer Sentiment TumblesДокумент4 страницыMedia Release: Consumer Sentiment TumblesChrisBeckerОценок пока нет

- Greenpath's Weekly Mortgage Newsletter - 10/2/2011Документ1 страницаGreenpath's Weekly Mortgage Newsletter - 10/2/2011CENTURY 21 AwardОценок пока нет

- 'Tis Better To GiveДокумент2 страницы'Tis Better To GiveSamuel RinesОценок пока нет

- 1Q12 MSARelease FinalДокумент2 страницы1Q12 MSARelease FinaljspectorОценок пока нет

- Employment Tracker December 2011Документ2 страницыEmployment Tracker December 2011William HarrisОценок пока нет

- Macro Economic Impact Apr08Документ16 страницMacro Economic Impact Apr08shekhar somaОценок пока нет

- MSARelease 4Q12 FinalДокумент2 страницыMSARelease 4Q12 Finalcara12345Оценок пока нет

- Case StudyДокумент16 страницCase StudyDisha PuriОценок пока нет

- The Recession of 20082009: How Painful WillДокумент25 страницThe Recession of 20082009: How Painful WillkakasethОценок пока нет

- Speech 456Документ11 страницSpeech 456qtipxОценок пока нет

- Euro Area Annual Inflation Up To 1.9%Документ4 страницыEuro Area Annual Inflation Up To 1.9%qtipxОценок пока нет

- Speech 456Документ11 страницSpeech 456qtipxОценок пока нет

- 49229Документ16 страниц49229qtipxОценок пока нет

- PpiДокумент22 страницыPpiqtipxОценок пока нет

- Advance Monthly Sales For Retail and Food Services September 2010Документ4 страницыAdvance Monthly Sales For Retail and Food Services September 2010qtipxОценок пока нет

- Mtis CurrentДокумент3 страницыMtis CurrentqtipxОценок пока нет

- Final Cat Inc ReleaseДокумент34 страницыFinal Cat Inc ReleaseqtipxОценок пока нет

- U.S. Census Bureau News U.S. Census Bureau News U.S. Census Bureau News U.S. Census Bureau NewsДокумент4 страницыU.S. Census Bureau News U.S. Census Bureau News U.S. Census Bureau News U.S. Census Bureau NewsqtipxОценок пока нет

- Euro Area and EU27 GDP Up by 1.0%Документ6 страницEuro Area and EU27 GDP Up by 1.0%qtipxОценок пока нет

- Money and Asset Prices: Indicators of Market UncertaintyДокумент9 страницMoney and Asset Prices: Indicators of Market UncertaintyqtipxОценок пока нет

- BP Second Quarter 2010 ResultsДокумент43 страницыBP Second Quarter 2010 ResultsqtipxОценок пока нет

- Inflation Report: August 2010Документ58 страницInflation Report: August 2010qtipxОценок пока нет

- Tots AДокумент2 страницыTots AqtipxОценок пока нет

- HuДокумент9 страницHuqtipxОценок пока нет

- CpiДокумент19 страницCpiqtipxОценок пока нет

- NewresconstДокумент6 страницNewresconstqtipxОценок пока нет

- CHN Jun 10 RevДокумент3 страницыCHN Jun 10 RevqtipxОценок пока нет

- Advance Monthly Sales For Retail and Food Services JUNE 2010Документ4 страницыAdvance Monthly Sales For Retail and Food Services JUNE 2010qtipxОценок пока нет

- International Monetary Fund: How Did Emerging Markets Cope in The Crisis?Документ47 страницInternational Monetary Fund: How Did Emerging Markets Cope in The Crisis?qtipxОценок пока нет

- Vincent Fernando Durable Goods May 2010Документ4 страницыVincent Fernando Durable Goods May 2010qtipxОценок пока нет

- FINAL Report June 10Документ5 страницFINAL Report June 10qtipxОценок пока нет

- Obama Administration Introduces Monthly Housing ScorecardДокумент11 страницObama Administration Introduces Monthly Housing ScorecardqtipxОценок пока нет

- Advance Monthly Sales For Retail and Food Services APRIL 2010Документ4 страницыAdvance Monthly Sales For Retail and Food Services APRIL 2010qtipxОценок пока нет

- gdp1q10 2ndДокумент15 страницgdp1q10 2ndqtipxОценок пока нет

- Cpi MayДокумент19 страницCpi MayqtipxОценок пока нет

- Cpi MayДокумент19 страницCpi MayqtipxОценок пока нет

- PpiДокумент22 страницыPpiqtipxОценок пока нет

- WGC Q1Документ24 страницыWGC Q1ZerohedgeОценок пока нет

- Valuation of GoodwillДокумент15 страницValuation of Goodwillbtsa1262013Оценок пока нет

- Anti Money Laundering PolicyДокумент8 страницAnti Money Laundering PolicysonilaОценок пока нет

- The Beginnings of FDI in E-CommerceДокумент16 страницThe Beginnings of FDI in E-CommerceAbhinavОценок пока нет

- 32AEHPM9073L1Z3 Kottoor Mathew Jose MathewДокумент5 страниц32AEHPM9073L1Z3 Kottoor Mathew Jose MathewVVR &CoОценок пока нет

- WRD 27e SE PPT Ch16Документ24 страницыWRD 27e SE PPT Ch16Hằng Nga Nguyễn ThịОценок пока нет

- Group 2: Topic 1Документ29 страницGroup 2: Topic 1jsemlpzОценок пока нет

- Carpenters Annuity Fund 2007Документ19 страницCarpenters Annuity Fund 2007Latisha WalkerОценок пока нет

- Etf PDFДокумент14 страницEtf PDFYash MeelОценок пока нет

- Consultants DirectoryДокумент36 страницConsultants DirectoryPeter WahlburgОценок пока нет

- Functions of Bombay Stock ExchangeДокумент9 страницFunctions of Bombay Stock ExchangeOmkar Shingare50% (2)

- Schedule and FormulasДокумент55 страницSchedule and FormulasRodmae VersonОценок пока нет

- Environmental, Social and Governance KPIДокумент14 страницEnvironmental, Social and Governance KPISuta Vijaya100% (1)

- Fundamentals of Marketing ManagementДокумент65 страницFundamentals of Marketing ManagementPriaa100% (1)

- Investment Analysis 1Документ48 страницInvestment Analysis 1yonasteweldebrhan87Оценок пока нет

- A. QB Lesson 6Документ28 страницA. QB Lesson 6Shena Mari Trixia Gepana100% (1)

- 2014-VII-1&2 NilimaДокумент13 страниц2014-VII-1&2 NilimaAPOORVA GUPTAОценок пока нет

- WineCare Storage LLC: DECLARATION OF DEREK L. LIMBOCKERДокумент25 страницWineCare Storage LLC: DECLARATION OF DEREK L. LIMBOCKERBrad DempseyОценок пока нет

- NTPC ReportДокумент15 страницNTPC ReportKaushal Jaiswal100% (1)

- Ta/Da Bill of Non-Official Member Invited To Attend The MeetingДокумент3 страницыTa/Da Bill of Non-Official Member Invited To Attend The MeetingVasoya ManojОценок пока нет

- Introduction of Aditya Birla GroupДокумент4 страницыIntroduction of Aditya Birla GroupdeshmonsterОценок пока нет

- Yes Bank Annual Report 2011-12Документ204 страницыYes Bank Annual Report 2011-12shah1703Оценок пока нет

- Capital Budgeting Techniques: Multiple Choice QuestionsДокумент10 страницCapital Budgeting Techniques: Multiple Choice QuestionsRod100% (1)

- De Beers Insight Report 2014 PDFДокумент90 страницDe Beers Insight Report 2014 PDFAntonia Maria100% (1)

- Building Business Credit - CreditXДокумент14 страницBuilding Business Credit - CreditXsonwuu469100% (1)

- Nitta PDFДокумент146 страницNitta PDFSridhara DwarampudiОценок пока нет

- Exchange RateДокумент5 страницExchange Ratekim juhwiОценок пока нет

- Perbandingan Akuntansi Akrual Di Swedia Dan FinalndiaДокумент30 страницPerbandingan Akuntansi Akrual Di Swedia Dan FinalndiaAbdul RohmanОценок пока нет

- OD328480839739601100Документ3 страницыOD328480839739601100Rana HiralakkiОценок пока нет

- CBRE Releases Q4 2017 Quarterly Report Highlights Ho Chi Minh City MarketДокумент5 страницCBRE Releases Q4 2017 Quarterly Report Highlights Ho Chi Minh City Marketvl coderОценок пока нет

- ChemicalsДокумент92 страницыChemicalsBrian KawaskiОценок пока нет