Академический Документы

Профессиональный Документы

Культура Документы

1b Final Accounts of Companies - Stdts

Загружено:

GodsonАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

1b Final Accounts of Companies - Stdts

Загружено:

GodsonАвторское право:

Доступные форматы

FINAL ACCOUNT OF COMPANIES

ILLUSTRATION

(MAY 2014 Q3)

Asetrapa Ltd is a listed company reporting under IFRS. During the year ended 31 st December, 2012, the

company changed its accounting policy with respect to property valuation. There are also a number of other

issues that need to be finalized before the financial statement can be published.

Asetrapa Ltds trial balance from the general ledger at 31st December, 2012 showed the following balances:

GH'm GH'm

Revenue 2,648.00

Loan note interest paid 3.00

Purchases 1,669.00

Distribution cost 514.00

Administrative expenses 345.00

Interim dividend paid 6.00

Inventories at 1st January, 2012 444.00

Trade receivable 545.00

Trade payable 434.00

Cash and cash equivalent 28.00

Stated capital (ordinary shares issued at 50p) 100.00

Capital surplus 314.00

Retained earnings at 1st January, 2012 849.00

4% loan note repayable 2018 (issued 2010) 150.00

Land and buildings: cost (including GHC120m land) 380.00

Accumulated depreciation at 1st January, 2012 64.00

Plant and equipment: cost 258.00

Accumulated depreciation at 1st January, 2012 126.00

Investment property at 1st January, 2012 548.00

Rental income 48.00

Proceeds from sale of equipment 7.00

4,740.00 4,740.00

Further information to be taken into account:

(a) Closing inventories were counted and amounted to GHC388m at cost. However, shortly after the year end

out-of-date inventories with a cost of GHC15m were sold for GHC8m.

(b) The company decided to change its accounting policy with respect to its 10 year old land and buildings

from the cost model to the revaluation model. The revaluation amounts at 1st January, 2012 were

GHC800m (including GHC100m for the land). No further revaluation was necessary at 31st December,

2012. The company wishes to treat the revaluation surplus as being realized over the life of the assets.

(c) Due to a change in the companys product portfolio plans, an item of plant with a carrying value GHC22m

at 31st December, 2011 (after adjusting for depreciation for the year) may be impaired due to change in

use. An impairment test conducted at 31st December, 2012, revealed its fair value less costs to sell to be

GHC16m. The asset is now expected to generate an annual net income stream of GHC3.8m for the next 5

years at which point the asset would be disposed for GHC4.2m. An appropriate discount rate is 8%. 5 year

discount factors at 8% are:

Simple Cumulative

0.677 3.993

(d) The income tax liability for the year is estimated at GHC27m. Ignore deferred tax.

Final Account of Companies paulampadu@gmail.com pg. 1

(e) An interim dividend of 3p per share was paid on 30th June, 2012. A final dividend of 1.5p per share was

declared by the directors on 28th January, 2013.

(f) During the year, Asetrapa Co. disposed of some malfunctioning equipment for GHC7m. The equipment

had cost GHC15m and had accumulated depreciation brought forward at 1st January 2012 of GHC3m.

There were no other additions or disposal to property, plant and equipment in the year.

(g) The company treats depreciation on plant and equipment as a cost of sale and on land and buildings as an

administration cost. Depreciation rates as per the companys accounting policy notes are as follows:

Buildings Straight line over 50 years

Plant and equipment 20% reducing balance

Asetrapa Ltds accounting policy is to charge a full years depreciation in the year of an assets purchase

and none in the year of disposal.

(h) On 1st July 2012, Asetrapa Ltd made a bonus issue of 1 share for every 4 held capitalizing its retained

earnings. This transaction has not yet been accounted for. The fair value of the companys shares on the

date of the bonus issue was GHC7.50 each.

(i) Asetrapa Ltd uses the fair value model of IAS 40. The fair value of the investment property at 31st

December, 2012 was GHC586m.

Required:

(a) Prepare Statement of profit or loss and other comprehensive income for the year ended 31st December

2012;

(b) Prepare Statement of changes in equity for the year ended 31st December 2012

(c) Prepare Statement of financial position as at 31st December 2012

(Work to nearest 1 million Ghana Cedis) (20 marks)

ICA NOV 2012 Q4

The Faith Rural Bank Ltd has presented the following trial balance for the 2011 financial year:

DR CR

GH'000 GH'000

Operating Expenses 987.00

Donations 24.00

Staff Cost 2,213.00

Directors remuneration 39.00

Capital work-in-progress 168.00

Motor Vehicles/Accum. Depreciation 327.00 182.00

Equipment & Furniture /Accum. Depreciation 588.00 163.00

Computers/Accum. Depreciation 390.00 133.00

Land and Building/Accum. Depreciation 776.00 83.00

Corporate tax 180.00

Sundry Payables 763.00

Interest from short term funds 243.00

Interest from Government securities 7,137.00

Interest on loans and advances 373.00

Other accounts 789.00

Staff advances 449.00

Loans and Overdrafts granted 8,233.00

Income Surplus 01/01/2011 1,146.00

Final Account of Companies paulampadu@gmail.com pg. 2

Allowance for doubtful debts 01/01/2011 614.00

Statutory reserves 01/01/2011 648.00

Share Deals 34.00

Capital Surplus 410.00

Trade investment 1,343.00

19,593.0

Government Treasury Bills 0

Interest on customers' deposits 3,515.00

Amounts due to other banks 3,871.00

12,794.0

Deposits with other banks 0

Cash in hand 1,629.00

Balance with other banks 4,666.00

State Capital 4,823.00

Current Accounts 22,767.00

Fixed/Time deposits 3,582.00

Savings accounts 7,819.00

Profit on foreign exchange transaction 141.00

Dividend from investments 55.00

Miscellaneous income 2,328.00

Commission and fee income 1,388.00

58,703.0

Total 0 58,703.00

Additional Information

i. Increase allowance for doubtful debts to GH851,700.00

ii. Provide for depreciation at the following rates:

Land and buildings 5% on cost

Equipment and furniture 20% on cost

Computers 33% on cost

Motor vehicles 33% on cost

iii. Provide for Audit fees of GH60,000.00

iv. Transfer 12 of net profit after tax to Statutory Reserve Fund.

v. The corporate tax provision made in the 2010 financial statements was GH200,000.00. This was agreed

with Ghana Revenue Authority at GH220,000.00 and fully settled in March 2011. Interim tax for 2011

based on self-assessment was settled at GH160,000.00 Corporate tax applicable to the bank is 25%.

vi. Directors have agreed to pay end-of-year bonus to staff estimated at GH72,000.00. This is yet to be paid.

vii. The authorised capital is 10,000 equity shares of no par value out of which 6,000 shares have been issued

and fully paid.

Required.

a) Statement of Comprehensive Income for the year ended 31st December, 2011.

b) Statement of changes in equity for the year ended 31st December, 2011.

c) Statement of financial position as at 31st December, 2011

Notes are not required but show all workings. (20 marks)

Final Account of Companies paulampadu@gmail.com pg. 3

Final Account of Companies paulampadu@gmail.com pg. 4

Вам также может понравиться

- Common Passwords of 2016Документ1 страницаCommon Passwords of 2016WXYZ-TV Channel 7 DetroitОценок пока нет

- Password CrackedДокумент1 страницаPassword CrackedShashank SKОценок пока нет

- x13 XBOX Premium Accounts: Downloaded FromДокумент1 страницаx13 XBOX Premium Accounts: Downloaded FromSánchez AlexisОценок пока нет

- Acc BekasДокумент2 страницыAcc BekasAditiyaОценок пока нет

- Nokia n9 Import Google Contacts - Syncing Gmail With Nokia n9 - How To Synchronise n9 With PC - How To Sync Contacts To Nokia N9 - BlackBerry and Cell PhonesДокумент3 страницыNokia n9 Import Google Contacts - Syncing Gmail With Nokia n9 - How To Synchronise n9 With PC - How To Sync Contacts To Nokia N9 - BlackBerry and Cell PhonesRolands KapočusОценок пока нет

- Hik StudioДокумент5 страницHik StudioWisnu HidayatОценок пока нет

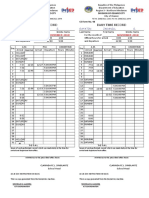

- Daily Time Record Daily Time Record: Gayatin Jaranill S. Gayatin Jaranill SДокумент1 страницаDaily Time Record Daily Time Record: Gayatin Jaranill S. Gayatin Jaranill SSaligan DolfОценок пока нет

- 5 6093759166466228408Документ2 страницы5 6093759166466228408sandeep saini100% (1)

- Express VPN ACCOUNTSДокумент2 страницыExpress VPN ACCOUNTSHayyagoОценок пока нет

- 223x OriginДокумент9 страниц223x OriginBASTIÁN ALFREDO DELGADOОценок пока нет

- Last ShelterДокумент2 страницыLast Shelterkorean buffОценок пока нет

- Netflix 253Документ7 страницNetflix 253mynickОценок пока нет

- PasswordДокумент1 страницаPasswordSwastika ChandraОценок пока нет

- Gpnc1600029or2485988 20230603Документ2 страницыGpnc1600029or2485988 20230603Richmond Delos SantosОценок пока нет

- IFTTT Setup For MoiMoiДокумент9 страницIFTTT Setup For MoiMoiXymund Swart PaulinesОценок пока нет

- MessageДокумент3 страницыMessageJIMNHIT23 JIMNHIT23Оценок пока нет

- 192.168.0.1 Dlink - 3 Facebook - 3Документ4 страницы192.168.0.1 Dlink - 3 Facebook - 3SIVA KRISHNA PRASAD ARJAОценок пока нет

- Netflix BumberДокумент6 страницNetflix BumberAdel BejОценок пока нет

- Configure SMTP Settings GmailДокумент1 страницаConfigure SMTP Settings GmailHands OffОценок пока нет

- Accounts MinecraftДокумент1 страницаAccounts Minecraftabiel nazimОценок пока нет

- CS 404 Introduction To Compiler Design: Lecture 12 + 13 Ahmed EzzatДокумент25 страницCS 404 Introduction To Compiler Design: Lecture 12 + 13 Ahmed Ezzatmaverick_33100% (1)

- Spotify Premium AccountДокумент4 страницыSpotify Premium AccountdutzXОценок пока нет

- 200 RawДокумент7 страниц200 Rawjaddy majaddyОценок пока нет

- Gmail HTMLДокумент43 страницыGmail HTMLSooraj RaveendranОценок пока нет

- Raboplus Account Opening ChecklistДокумент3 страницыRaboplus Account Opening Checklistkbot@Оценок пока нет

- Minecraft Accounts PremiumДокумент1 страницаMinecraft Accounts PremiumHammer AlexОценок пока нет

- CpanelДокумент1 страницаCpanelCikoОценок пока нет

- SMTP SssДокумент1 страницаSMTP SsstraceОценок пока нет

- New Text DocumentДокумент1 страницаNew Text DocumentjitendraОценок пока нет

- GmailДокумент13 страницGmailKhameer L ShahОценок пока нет

- AsxДокумент5 страницAsxrupali kokateОценок пока нет

- EEE TestДокумент272 страницыEEE TestxanderОценок пока нет

- Bang Dwi Bagi Akun DongДокумент531 страницаBang Dwi Bagi Akun DongMinda AduanaОценок пока нет

- DirectoryДокумент8 страницDirectoryRodillo Jr GarridoОценок пока нет

- 2 Netflix by Brian1a1Документ140 страниц2 Netflix by Brian1a1essagydat-7691Оценок пока нет

- What Would Happen If I SurrenderДокумент211 страницWhat Would Happen If I SurrenderJessicaTheLazy PlayerОценок пока нет

- Gemius Design Studio Mail - FWD - Invoice - SLA010RS2186391, Purchased On - 2021!09!01Документ3 страницыGemius Design Studio Mail - FWD - Invoice - SLA010RS2186391, Purchased On - 2021!09!01Gemius AccountsОценок пока нет

- Spot 60Документ9 страницSpot 60karanmalhotra31Оценок пока нет

- Clave FirefoxДокумент2 страницыClave FirefoxLuis PerezОценок пока нет

- Binance LoginPassДокумент5 страницBinance LoginPassGui VieraОценок пока нет

- Word CountДокумент129 страницWord Countcharlie531Оценок пока нет

- Web PVДокумент9 страницWeb PVsamlascar61Оценок пока нет

- 100Документ2 страницы100laksmipandu5Оценок пока нет

- x150 Disney+ Premium AccountsДокумент12 страницx150 Disney+ Premium Accountsdavideinha23Оценок пока нет

- OfficeДокумент2 страницыOfficeelandor marukiОценок пока нет

- Yahoo Mail - Sea Chefs Academy - Account ConfirmationДокумент1 страницаYahoo Mail - Sea Chefs Academy - Account ConfirmationDayrit BertОценок пока нет

- Lista de CheatersДокумент11 страницLista de CheatersvictorcdamataОценок пока нет

- 5 6129656782299070595Документ35 страниц5 6129656782299070595Danny SanjayaОценок пока нет

- CookiesДокумент117 страницCookiesRaghu ThapaОценок пока нет

- x52 Cuentas Peacock TV (Kepahoo) (31!12!22)Документ2 страницыx52 Cuentas Peacock TV (Kepahoo) (31!12!22)Willian KrostyОценок пока нет

- Username: 89302715790 Password: 85016093499066 Username: 89302715789 Password: 35277184619199 Username: 89302715788 Password: 75644363574557Документ2 страницыUsername: 89302715790 Password: 85016093499066 Username: 89302715789 Password: 35277184619199 Username: 89302715788 Password: 75644363574557Imtihan KomahateeОценок пока нет

- Advance Cracking CourseДокумент1 страницаAdvance Cracking CourseSaeZ offi0% (1)

- WordPress ProcessДокумент30 страницWordPress Processrobertplant22Оценок пока нет

- TwilioElasticSIPTrunking AsteriskPBX Configuration Guide Version2 1 FINAL 09012018Документ13 страницTwilioElasticSIPTrunking AsteriskPBX Configuration Guide Version2 1 FINAL 09012018mohitsinghcseОценок пока нет

- NordvpnДокумент2 страницыNordvpnAbdul KarimОценок пока нет

- My - Shraidar Victimes 15-06-2022Документ29 страницMy - Shraidar Victimes 15-06-2022lordricchiОценок пока нет

- Drop Rapha EyДокумент34 страницыDrop Rapha Eylolnnlol77Оценок пока нет

- TOP 500 Most Common Passwords Used OnlineДокумент33 страницыTOP 500 Most Common Passwords Used OnlineAdrian LennonОценок пока нет

- Midsem Exams Fin Accting WeekendДокумент4 страницыMidsem Exams Fin Accting WeekendMichael LastОценок пока нет

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОт EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОценок пока нет

- Financial Report and Analysis On Total Petroleum GhanaДокумент16 страницFinancial Report and Analysis On Total Petroleum GhanaGodsonОценок пока нет

- AML Risk ManagementДокумент7 страницAML Risk ManagementGodsonОценок пока нет

- Importance of Liquidity and Capital AdequacyДокумент21 страницаImportance of Liquidity and Capital AdequacyGodsonОценок пока нет

- Nurses Access Resit: 2 & 3 July, 2016Документ2 страницыNurses Access Resit: 2 & 3 July, 2016GodsonОценок пока нет

- Why You Should Strategically Invest in Regulatory Reporting Documentation Platform Whitepaper 20160614 k7729Документ11 страницWhy You Should Strategically Invest in Regulatory Reporting Documentation Platform Whitepaper 20160614 k7729GodsonОценок пока нет

- Questions About The Certification and The Exams 1Документ7 страницQuestions About The Certification and The Exams 1Godson0% (1)

- Godwin Francis Asamoah PDFДокумент4 страницыGodwin Francis Asamoah PDFGodsonОценок пока нет

- Chapter 22 - Corporate Failure Definitions-Methods and Failure Prediction ModelsДокумент14 страницChapter 22 - Corporate Failure Definitions-Methods and Failure Prediction ModelsGodsonОценок пока нет

- 7a StandardsДокумент51 страница7a StandardsGodson100% (3)

- Mifi Year 1.Tema.2017.18.Sem 1.Ftf - TTДокумент4 страницыMifi Year 1.Tema.2017.18.Sem 1.Ftf - TTGodsonОценок пока нет

- Ghana Livestock Development Policy and Strategy FinalДокумент107 страницGhana Livestock Development Policy and Strategy FinalGodsonОценок пока нет

- ACCPA Conference 2017 - IFC PresentationДокумент23 страницыACCPA Conference 2017 - IFC PresentationGodsonОценок пока нет

- (B1) Accounting For MaterialsДокумент9 страниц(B1) Accounting For MaterialsGodsonОценок пока нет

- Future of Bank Risk Management PDFДокумент32 страницыFuture of Bank Risk Management PDFAshwin LeonardОценок пока нет

- Esoko Market Watchweek Ending March 22nd1Документ1 страницаEsoko Market Watchweek Ending March 22nd1GodsonОценок пока нет

- PFJ Fertilizer Subsidy Programme Information For Stakeholders AgricinghanaДокумент5 страницPFJ Fertilizer Subsidy Programme Information For Stakeholders AgricinghanaGodsonОценок пока нет

- PFJ Fertilizer Subsidy Programme Information For Stakeholders AgricinghanaДокумент5 страницPFJ Fertilizer Subsidy Programme Information For Stakeholders AgricinghanaGodsonОценок пока нет

- Private Company Limited by Shares Regulations FormДокумент17 страницPrivate Company Limited by Shares Regulations FormGerard 'Rockefeller' YitamkeyОценок пока нет

- Job Card - EnquiryДокумент13 страницJob Card - EnquiryGodsonОценок пока нет

- Contacts DetailsДокумент33 страницыContacts DetailsviswaОценок пока нет

- MEC 1st Year 2018-19 English-Final PDFДокумент9 страницMEC 1st Year 2018-19 English-Final PDFUmesh Kumar MahatoОценок пока нет

- totallyMAd - 18 January 2008Документ2 страницыtotallyMAd - 18 January 2008NewsclipОценок пока нет

- Tax - Cases 1-15 - Full TextДокумент120 страницTax - Cases 1-15 - Full TextNoel RemolacioОценок пока нет

- Workplace Parking LevyДокумент10 страницWorkplace Parking LevyparkingeconomicsОценок пока нет

- Small Medium Enterprise (SME) PositioningДокумент31 страницаSmall Medium Enterprise (SME) Positioningnitish110009Оценок пока нет

- Some Moderating Effects On The Service Quality-Customer Retention LinkДокумент19 страницSome Moderating Effects On The Service Quality-Customer Retention Linksajid bhattiОценок пока нет

- Fco - 63 - 61 - Alim-AiiДокумент2 страницыFco - 63 - 61 - Alim-AiiAmiОценок пока нет

- Prog Announcment 201112Документ140 страницProg Announcment 201112Wahab VohraОценок пока нет

- VAT Transfer PostingДокумент1 страницаVAT Transfer PostingabbasxОценок пока нет

- Veritext Legal Solutions Midwest 888-391-3376Документ2 страницыVeritext Legal Solutions Midwest 888-391-3376Anonymous dtsjTbОценок пока нет

- Derivative Securities Markets: Boliche, Marianne Chan, James Chua, Tomas Papa, JadeДокумент85 страницDerivative Securities Markets: Boliche, Marianne Chan, James Chua, Tomas Papa, JadeJimmyChaoОценок пока нет

- Data Mexico EdcДокумент12 страницData Mexico EdcDaniel Eduardo Arriaga JiménezОценок пока нет

- Media General - Balance ScorecardДокумент16 страницMedia General - Balance ScorecardSailesh Kumar Patel86% (7)

- Create Storage LocationДокумент6 страницCreate Storage LocationganeshОценок пока нет

- Excel Exam 01Документ4 страницыExcel Exam 01redouane50% (2)

- GE Honeywell.Документ20 страницGE Honeywell.Sripal ShahОценок пока нет

- PCT CountriesДокумент1 страницаPCT CountriesshamimОценок пока нет

- Module 6 - Operating SegmentsДокумент3 страницыModule 6 - Operating SegmentsChristine Joyce BascoОценок пока нет

- Business Tour, DubaiДокумент12 страницBusiness Tour, DubaiVIVEKОценок пока нет

- Hunt V Spotlight Transcript 2Документ585 страницHunt V Spotlight Transcript 2Alan Jules WebermanОценок пока нет

- 3 Creating Customer Value & Customer RelationshipsДокумент35 страниц3 Creating Customer Value & Customer RelationshipsFaryal MasoodОценок пока нет

- Chapter5 Project PlanningДокумент38 страницChapter5 Project PlanningSanchit BatraОценок пока нет

- BCM Development SDN BHD V The Titular Roman Catholic Bishop of Malacca JohorДокумент18 страницBCM Development SDN BHD V The Titular Roman Catholic Bishop of Malacca JohorfatinsaraОценок пока нет

- Primer On Market ProfileДокумент4 страницыPrimer On Market Profilechalasanica100% (2)

- UPS Case StudyДокумент2 страницыUPS Case StudyCharysa Januarizka50% (2)

- CFC HOO - Refund FormДокумент1 страницаCFC HOO - Refund FormAiza GarnicaОценок пока нет

- Maidcorp Employment Pte LTD: Sheila (Ref: Mce-T033)Документ3 страницыMaidcorp Employment Pte LTD: Sheila (Ref: Mce-T033)diandОценок пока нет

- VSM TrainingДокумент90 страницVSM Trainingjoaoalcada100% (1)

- DocumentДокумент2 страницыDocumentJhazreel BiasuraОценок пока нет