Академический Документы

Профессиональный Документы

Культура Документы

Leases: F:/course/ACCT3322/200720/module2/c15/tnotes/c15b.doc 12/11/2006 1

Загружено:

SteeeeeeeephИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Leases: F:/course/ACCT3322/200720/module2/c15/tnotes/c15b.doc 12/11/2006 1

Загружено:

SteeeeeeeephАвторское право:

Доступные форматы

Leases

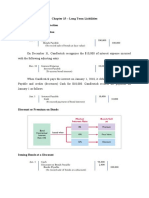

RESIDUAL VALUE AND BARGAIN PURCHASE OPTIONS

Residual Value

The estimated fair value (salvage value) at the end of the term of the lease is the residual value.

If title to the leased property transfers to the lessee the residual value is not considered in

computing the lease payments. If the title remains with the lessor the fair market value (amount

to be recovered) is reduced by the present value of the future residual value.

Guaranteed Residual Value: The residual value is treated as an additional lease payment that

will be paid at the end of the lease term. This amount is included in the payment stream.

Unguaranteed Residual Value: From the lessees perspective unguaranteed residual value is

the same as no residual value. It does not have any effect on the lesees computation of the

minimum lease payments or the capitalization of the leased asset and obligation. From the

lessors perspective the unguaranteed residual increases the Lease Receivable for the gross

amount of the estimated residual value and decreases cost of goods sold and sales revenue by the

present value of the unguaranteed residual.

Bargain Purchase Option

In a bargain purchase option the lessee has the option to purchase the property at the end of the

lease term at below expected fair value. The present value of the minimum lease payments is

increased by the present value of the bargain purchase option price. It is treated as an additional

payment at the end of the lease term. In computing annual depreciation, the lessee uses the

economic life of the asset as the service life by both the lessee and the lessor.

F:\course\ACCT3322\200720\module2\c15\tnotes\c15b.doc 12/11/2006 1

Вам также может понравиться

- Real Estate Terminology: Property Management, Financing, Construction, Agents and Brokers TermsОт EverandReal Estate Terminology: Property Management, Financing, Construction, Agents and Brokers TermsОценок пока нет

- Intermediate Accounting2 Finals TheoriesДокумент10 страницIntermediate Accounting2 Finals TheoriesColeen BiocalesОценок пока нет

- Group ActivityДокумент3 страницыGroup ActivityPark MinyoungОценок пока нет

- Winning the Office Leasing Game: Essential Strategies for Negotiating Your Office Lease Like an ExpertОт EverandWinning the Office Leasing Game: Essential Strategies for Negotiating Your Office Lease Like an ExpertОценок пока нет

- As 19Документ6 страницAs 19Prasad IngoleОценок пока нет

- Financial Leasing: Leasing Is A Significant Industry. in The Year 2004, It Accounted For OverДокумент41 страницаFinancial Leasing: Leasing Is A Significant Industry. in The Year 2004, It Accounted For OverSouliman MuhammadОценок пока нет

- The Inception of The Lease and Does Not Include Interest. The Second Payment Will Be Applied ToДокумент3 страницыThe Inception of The Lease and Does Not Include Interest. The Second Payment Will Be Applied ToV.A. NguyenОценок пока нет

- Hire PurchaseДокумент16 страницHire PurchasebrekhaaОценок пока нет

- Ind - As 17Документ22 страницыInd - As 17ambarishОценок пока нет

- Quizz Chapter 21Документ9 страницQuizz Chapter 21Rachel EnokouОценок пока нет

- Lease Accounting: Presented To: Sir, Zir U RehmanДокумент43 страницыLease Accounting: Presented To: Sir, Zir U Rehmanumarsaleem92Оценок пока нет

- Chapter14 - Leases Lessors2008 - Gripping IFRS 2008 by ICAPДокумент27 страницChapter14 - Leases Lessors2008 - Gripping IFRS 2008 by ICAPFalah Ud Din SheryarОценок пока нет

- 21 Accounting For LeasesДокумент28 страниц21 Accounting For LeasesWisnuadi Sony PradanaОценок пока нет

- Lease Test BankДокумент16 страницLease Test Bank4295.montesОценок пока нет

- Finance Lease-Lessee Intro+sale+and Lease BackДокумент16 страницFinance Lease-Lessee Intro+sale+and Lease Backmamasita25100% (2)

- 26 As19Документ14 страниц26 As19Selvi balanОценок пока нет

- Hire Purchase PPT 1Документ17 страницHire Purchase PPT 1Sourabh ChatterjeeОценок пока нет

- Actg 4 Lease AccountingДокумент9 страницActg 4 Lease AccountingScrunchies AvenueОценок пока нет

- LeasingДокумент14 страницLeasingFelix SwarnaОценок пока нет

- Unit 2Документ4 страницыUnit 2iDeo StudiosОценок пока нет

- Relative Resource Manager 2Документ61 страницаRelative Resource Manager 2hannah8985Оценок пока нет

- NAS 17 LeasesДокумент16 страницNAS 17 LeasesbinuОценок пока нет

- LEASESДокумент12 страницLEASESIrvin OngyacoОценок пока нет

- Leases in The Financial Statements of LessorsДокумент1 страницаLeases in The Financial Statements of LessorsdskrishnaОценок пока нет

- Hire Purchase Finance and Consumer CreditДокумент18 страницHire Purchase Finance and Consumer Creditchaudhary9240% (5)

- Hire Purchase PPT 1Документ17 страницHire Purchase PPT 1Virender Singh SahuОценок пока нет

- Lecture Notes Definition of TermsДокумент14 страницLecture Notes Definition of Termsrachel banana hammockОценок пока нет

- Chapter 20 Accounting For Leases: Advantages of Leasing From The Lessee's ViewpointДокумент4 страницыChapter 20 Accounting For Leases: Advantages of Leasing From The Lessee's ViewpointTruyenLeОценок пока нет

- A Note On Comdisco - S Lease AccountingДокумент25 страницA Note On Comdisco - S Lease AccountingHussain HaidryОценок пока нет

- Audit of LeaseДокумент17 страницAudit of LeaseTrisha Mae RodillasОценок пока нет

- Accounting 202 Final ReviewДокумент16 страницAccounting 202 Final ReviewAvi GoodsteinОценок пока нет

- Lease Accounting - Lessee CompДокумент5 страницLease Accounting - Lessee CompAngel DomingoОценок пока нет

- Leasing and Hire PurchaseДокумент38 страницLeasing and Hire PurchaseNeha SharmaОценок пока нет

- RMK Akm 2-CH 21Документ14 страницRMK Akm 2-CH 21Rio Capitano0% (1)

- Module 5.2Документ15 страницModule 5.2ankitaОценок пока нет

- Lease Accounting: Dr.T.P.Ghosh Professor, MDI, GurgaonДокумент20 страницLease Accounting: Dr.T.P.Ghosh Professor, MDI, Gurgaonkmillat100% (1)

- Module 1 LeasesДокумент12 страницModule 1 LeasesMon RamОценок пока нет

- Hire and PurcaseДокумент40 страницHire and PurcaseNeha SharmaОценок пока нет

- Chapter 13 LeaseДокумент4 страницыChapter 13 Leasemaria isabella100% (2)

- Leases: International Accounting Standards (IAS 17)Документ13 страницLeases: International Accounting Standards (IAS 17)ashfakkadriОценок пока нет

- Intacc 2 - Lease Accounting Part OneДокумент31 страницаIntacc 2 - Lease Accounting Part One11 LamenОценок пока нет

- AS19 LeaseДокумент3 страницыAS19 LeasehariomnarayanОценок пока нет

- Accounting Standard 19 LeaseДокумент5 страницAccounting Standard 19 Leaseanirudh6907Оценок пока нет

- Hire Purchase PPT 1Документ12 страницHire Purchase PPT 1sangeethamadan100% (2)

- Our Guide To Valuation TerminologyДокумент8 страницOur Guide To Valuation Terminologysonia87Оценок пока нет

- Accounting Standard 19Документ12 страницAccounting Standard 19Kamal HassanОценок пока нет

- Leasing of A WarehouseДокумент8 страницLeasing of A Warehouserollingsam7213Оценок пока нет

- Lease Accounting: Professor, I.M TiwariДокумент20 страницLease Accounting: Professor, I.M TiwariEr Swati NagalОценок пока нет

- Accounting For Leases Lecture Outline: Teaching TipДокумент7 страницAccounting For Leases Lecture Outline: Teaching TipKaya NedaОценок пока нет

- By: Deepti ChadhaДокумент19 страницBy: Deepti ChadhaDeepti ChadhaОценок пока нет

- Glossary-Chapter 21Документ2 страницыGlossary-Chapter 21Saul Ruiz IrizarryОценок пока нет

- Lessor Operating LeaseДокумент2 страницыLessor Operating LeaseChristine AltamarinoОценок пока нет

- LeasingДокумент17 страницLeasingvineet ranjanОценок пока нет

- IFRS Chapter 16 LeasingДокумент24 страницыIFRS Chapter 16 LeasingEbru Y.yiğitОценок пока нет

- ADVANCED ACCOUNTING NewДокумент72 страницыADVANCED ACCOUNTING NewShubham BawkarОценок пока нет

- Chapter 15 - Long Term Liabilities Journalizing Bond Transaction Issuing Bonds at Face ValueДокумент11 страницChapter 15 - Long Term Liabilities Journalizing Bond Transaction Issuing Bonds at Face Valueowais khanОценок пока нет

- FS Lease Accounting AA 19Документ55 страницFS Lease Accounting AA 19AnshuОценок пока нет

- Unit2 - EfsДокумент58 страницUnit2 - EfsAyush GargОценок пока нет

- C17E Pension & Postretirement BenefitsДокумент4 страницыC17E Pension & Postretirement BenefitsSteeeeeeeephОценок пока нет

- C17B Pension & Postretirement BenefitsДокумент2 страницыC17B Pension & Postretirement BenefitsSteeeeeeeephОценок пока нет

- Chapter 18 Shareholders' Equity: Paid-In Capital Fundamental Share RightsДокумент9 страницChapter 18 Shareholders' Equity: Paid-In Capital Fundamental Share RightsSteeeeeeeephОценок пока нет

- C14C Long Term NotesДокумент4 страницыC14C Long Term NotesSteeeeeeeephОценок пока нет

- Leases: Other Lease Accounting Issues Executory CostsДокумент1 страницаLeases: Other Lease Accounting Issues Executory CostsSteeeeeeeephОценок пока нет

- C12 Intangible Assets PDFДокумент32 страницыC12 Intangible Assets PDFSteeeeeeeephОценок пока нет

- C7A Cash & Cash EquivalentsДокумент6 страницC7A Cash & Cash EquivalentsSteeeeeeeephОценок пока нет

- C3C Balance SheetДокумент2 страницыC3C Balance SheetSteeeeeeeephОценок пока нет

- C7 Accounting For ReceivablesДокумент36 страницC7 Accounting For ReceivablesSteeeeeeeephОценок пока нет

- Inventories: Measurement: Methods of Simplifying Lifo LIFO ReserveДокумент3 страницыInventories: Measurement: Methods of Simplifying Lifo LIFO ReserveSteeeeeeeephОценок пока нет

- C5B Profitability AnalysisДокумент6 страницC5B Profitability AnalysisSteeeeeeeephОценок пока нет

- C4A Income StatementДокумент6 страницC4A Income StatementSteeeeeeeephОценок пока нет

- C3A Balance SheetДокумент3 страницыC3A Balance SheetSteeeeeeeephОценок пока нет

- Getting to Yes: How to Negotiate Agreement Without Giving InОт EverandGetting to Yes: How to Negotiate Agreement Without Giving InРейтинг: 4 из 5 звезд4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (15)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)От EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОт EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОценок пока нет

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!От EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Рейтинг: 4.5 из 5 звезд4.5/5 (14)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОт EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОценок пока нет

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeОт EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeРейтинг: 4 из 5 звезд4/5 (21)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsОт EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsРейтинг: 5 из 5 звезд5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)От EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Рейтинг: 4 из 5 звезд4/5 (33)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookОт EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookРейтинг: 5 из 5 звезд5/5 (4)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetОт EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageОт EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageРейтинг: 4.5 из 5 звезд4.5/5 (109)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCОт EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCРейтинг: 5 из 5 звезд5/5 (1)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsОт EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsРейтинг: 4 из 5 звезд4/5 (7)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyОт EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyОценок пока нет

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookОт EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookОценок пока нет

- Attention Pays: How to Drive Profitability, Productivity, and AccountabilityОт EverandAttention Pays: How to Drive Profitability, Productivity, and AccountabilityОценок пока нет

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsОт EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsРейтинг: 4.5 из 5 звезд4.5/5 (2)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItОт EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItРейтинг: 4.5 из 5 звезд4.5/5 (14)