Академический Документы

Профессиональный Документы

Культура Документы

Equity Report 19 June To 23 June

Загружено:

zoidresearchОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Equity Report 19 June To 23 June

Загружено:

zoidresearchАвторское право:

Доступные форматы

EQUITY TECHNICAL REPORT

WEEKLY

[19 JUN to 23 JUN 2017]

ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

19 JUN TO 23 JUN 17

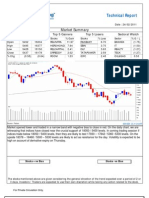

NIFTY 50 9588.05 (-65.45) (-0.68%)

The benchmark Index Nifty opened with a negative

note on Monday. as investors seemed unenthusiastic

by the revised rates on 66 items by the GST Council

in its 16th meeting on Sunday and await the

macroeconomic data to be released later. Next

meeting will held on 18th June 2017. On Tuesday,

The Nifty was traded in a narrow range and the Nifty

closed at 9606 down by 9 points. On Wednesday, The

Nifty managed to close in the green after making a

low of 9580. The Index recovered by 38 points from

its day low in the second half of trading session. Nifty

closed at the 9618 level, up by 11 points. In a more

recent development regarding the decision of non-

performing assets, the Reserve Bank of India (RBI)

has recognized 12 bad accounts for instant resolution

under the Insolvency and Bankruptcy Code (IBC). RBI

did not disclose the names of bad accounts. The

Internal Advisory Committee (IAC) noted that under

the recommended criterion, 12 accounts totaling

about 25% of the current gross NPAs of the banking

system would qualify for immediate reference under

the IBC. On Thursday, The Nifty opened at 9618 and

closed at 9578 after making a low of 9561.The Index

closed 40 points down from Wednesday close and the

Nifty finally closed below the 9600 mark, which is not

a good sign. On Friday, The last Trading day of the

week; The Nifty opened with a positive note. Nifty had

gained over 38 points, but has ended in the red. The

Nifty close below 9600 at 9588. The benchmark Index

Nifty50 (spot) opened the week at 9646.70 made a

high of 9654.15. low of 9560.8 and closed the week at

9588.05. Thus the Nifty closed the week with a losing

of -65.45 points or 0.68%.

Formations Future Outlook:

The 20 days EMA are placed at The Nifty daily chart is bearish

9573.74 trend. we advised to sell Nifty future

The 5 days EMA are placed at below 9575 then target will be

9602.57 9500-9400. Nifty upside weekly

Resistance is 9650-9700 level. On

the downside strong support at

9550-9500

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

19 JUN TO 23 JUN 17

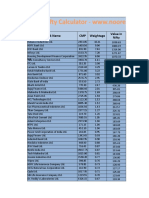

Weekly Pivot Levels for Nifty 50 Stocks

Script Symbol Resistance2 Resistance1 Pivot Support 1 Support 2

NIFTY 50 (SPOT) 9694 9641 9601 9548 9508

AUTOMOBILE

BAJAJ-AUTO 2891.80 2850.80 2825.40 2784.40 2759.00

BOSCHLTD 25102.43 24784.87 24192.43 23874.87 23282.43

EICHERMOT 30202.57 29474.73 28989.87 28262.03 27777.17

HEROMOTOCO 3859.68 3821.62 3781.93 3743.87 3704.18

M&M 1488.47 1437.88 1408.37 1357.78 1328.27

MARUTI 7527.97 7395.93 7322.97 7190.93 7117.97

TATAMTRDVR 299.25 290.75 281.50 273.00 263.75

TATAMOTORS 474.28 465.02 455.98 446.72 437.68

CEMENT & CEMENT PRODUCTS

ACC 1686.47 1662.53 1623.52 1599.58 1560.57

AMBUJACEM 243.78 240.52 235.28 232.02 226.78

GRASIM 1155.92 1137.03 1114.32 1095.43 1072.72

ULTRACEMCO 4205.87 4165.58 4096.32 4056.03 3986.77

CONSTRUCTION

LT 1806.97 1766.83 1737.87 1697.73 1668.77

CONSUMER GOODS

ASIANPAINT 1175.83 1160.62 1143.43 1128.22 1111.03

HINDUNILVR 1137.27 1114.53 1098.77 1076.03 1060.27

ITC 315.63 311.22 305.18 300.77 294.73

ENERGY

BPCL 727.13 700.47 681.98 655.32 636.83

GAIL 393.78 386.07 379.53 371.82 365.28

NTPC 164.67 162.63 159.22 157.18 153.77

ONGC 173.02 170.08 167.97 165.03 162.92

POWERGRID 217.52 213.73 209.37 205.58 201.22

RELIANCE 1450.00 1419.40 1365.20 1334.60 1280.40

TATAPOWER 80.87 79.38 78.02 76.53 75.17

FINANCIAL SERVICES

AXISBANK 521.52 515.98 508.77 503.23 496.02

BANKBARODA 177.87 172.78 169.92 164.83 161.97

HDFCBANK 1709.88 1689.57 1671.58 1651.27 1633.28

HDFC 1703.78 1672.32 1650.73 1619.27 1597.68

ICICIBANK 326.10 321.30 317.60 312.80 309.10

INDUSINDBK 1541.87 1520.38 1502.77 1481.28 1463.67

KOTAKBANK 1007.55 995.10 977.65 965.20 947.75

SBIN 290.42 288.18 284.77 282.53 279.12

YESBANK 1541.77 1492.63 1461.82 1412.68 1381.87

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

19 JUN TO 23 JUN 17

INDUSTRIAL MANUFACTURING

BHEL 143.27 140.78 138.72 136.23 134.17

IT

HCLTECH 877.20 858.10 849.55 830.45 821.90

INFY 980.02 960.13 948.07 928.18 916.12

TCS 2559.43 2479.57 2433.03 2353.17 2306.63

TECHM 410.10 400.20 390.10 380.20 370.10

WIPRO 272.15 263.70 258.25 249.80 244.35

MEDIA & ENTERTAINMENT

ZEEL 532.18 520.37 513.18 501.37 494.18

METALS

COALINDIA 266.57 261.13 257.07 251.63 247.57

HINDALCO 207.55 201.40 198.15 192.00 188.75

TATASTEEL 520.08 511.02 505.13 496.07 490.18

SERVICES

ADANIPORTS 373.88 368.52 361.03 355.67 348.18

PHARMA

AUROPHARMA 704.97 679.33 637.87 612.23 570.77

CIPLA 562.48 549.62 542.33 529.47 522.18

DRREDDY 2780.77 2731.68 2671.87 2622.78 2562.97

LUPIN 1232.65 1181.85 1143.20 1092.40 1053.75

SUNPHARMA 564.45 546.80 534.35 516.70 504.25

TELECOM

BHARTIARTL 376.95 370.90 365.75 359.70 354.55

INFRATEL 397.73 386.42 378.53 367.22 359.33

IDEA 81.38 79.57 77.93 76.12 74.48

Weekly Top gainers stocks

Script Symbol Previous Close Current Price % Change In Points

AUROPHARMA 608.60 653.70 7.41% 45.10

RELIANCE 1335.70 1388.80 3.98% 53.10

BOSCHLTD 23863.45 24467.30 2.53% 603.85

DRREDDY 2628.80 2682.60 2.05% 53.80

NTPC 157.80 160.60 1.77% 2.80

Weekly Top losers stocks

Script Symbol Previous Close Current Price % Change In Points

TCS 2507.00 2399.70 -4.28% 107.30

BPCL 703.75 673.80 -4.26% -29.95

IOC 420.05 404.60 -3.68% -15.45

BANKBARODA 173.75 167.70 -3.48% -6.05

EICHERMOT 29764.85 28746.90 -3.42% -1017.95

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

19 JUN TO 23 JUN 17

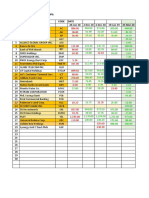

Weekly FIIS Statistics*

DATE Buy Value Sell Value Net Value

16/JUN/2017 7936.21 8700.69 -764.48

15/JUN/2017 4998.79 5644.14 -645.35

14/JUN/2017 6715.41 6876.54 -161.13

13/JUN/2017 3941.55 4253.95 -312.40

12/JUN/2017 3279.42 3448.67 -169.25

Weekly DIIS Statistics*

DATE Buy Value Sell Value Net Value

16/JUN/2017 3555.73 2664.82 890.91

15/JUN/2017 3015.31 2160.46 854.85

14/JUN/2017 2760.90 2689.25 71.65

13/JUN/2017 2480.57 2175.99 304.58

12/JUN/2017 2395.15 2458.26 -63.11

MOST ACTIVE NIFTY CALLS & PUTS

EXPIRY DATE TYPE STRIKE PRICE VOLUME OPEN INTEREST

29/JUN/2017 CE 9700 193503 7602825

29/JUN/2017 CE 9600 176879 5413500

29/JUN/2017 CE 9800 131399 4953600

29/JUN/2017 PE 9600 179801 5863275

29/JUN/2017 PE 9500 142588 7033125

29/JUN/2017 PE 9400 84563 5173800

MOST ACTIVE BANK NIFTY CALLS & PUTS

EXPIRY DATE TYPE STRIKE PRICE VOLUME OPEN INTEREST

22/JUN/2017 CE 23500 102171 322120

22/JUN/2017 CE 23600 80568 275920

22/JUN/2017 CE 23700 69193 286680

22/JUN/2017 PE 23400 86887 242840

22/JUN/2017 PE 23300 80465 302880

22/JUN/2017 PE 23000 58877 410400

www.zoidresearch.com ZOID RESEARCH TEAM

WEEKLY TECHNICAL REPORT

19 JUN TO 23 JUN 17

Weekly Recommendations:-

DATE SYMBOL STRATEGY ENTRY TARGET STATUS

17 JUN 17 TVSMOTORS BUY AROUND 550 572-600 OPEN

ALL TARGET

3 JUN 17 AUROPHARMA BUY AROUND 590 614-640

ACHIEVED

20 MAY 17 BHARTIARTL BUY AROUND 372 388-402 OPEN

13 MAY 17 AXISBANK SELL BELOW 500 480-450 OPEN

1ST TARGET

6 MAY 17 VOLTAS BUY ON DEEP 422 439-456

ACHIEVED

1ST TARGET

29 APR 17 IDFC BUY ON DEEP 62 65-68

ACHIEVED

1ST TARGET

22 APR 17 RELIANCE BUY ON DEEP 1400 1455-1525

ACHIEVED

BOOK AT

14 APR 17 TATAELXSI BUY ABOVE 1550 1612-1675

1603

1ST TARGET

8 APR 17 AXISBANK BUY ON DEEP 505-503 525-560

ACHIEVED

1ST TARGET

1 APR 17 ACC BUY ON DEEP 1440 1498-1558

ACHIEVED

25 MAR 17 COALINDIA BUY ON DEEP 295-290 307-320 EXIT AT 282.7

18 MAR 17 AUROPHARMA BUY ON DEEP 698 727-760 EXIT AT 670

11 MAR 17 SUNTV BUY ABOVE 745 775-805 BOOK AT 770

ALLTARGET

4 MAR 17 APOLLOTYRE BUY ON DEEP 182-183 190-198

ACHIEVED

* FII & DII trading activity on NSE, BSE, and MCXSX in Capital Market Segment (in Rs. Crores)

DISCLAIMER

Stock trading involves high risk and one can lose Substantial amount of money. The recommendations made herein do

not constitute an offer to sell or solicitation to buy any of the Securities mentioned. No representations can be made

that recommendations contained herein will be profitable or they will not result in losses. Readers using the

information contained herein are solely responsible for their actions. The information is obtained from sources deemed

to be reliable but is not guaranteed as to accuracy and completeness. The above recommendations are based on

technical analysis only. NOTE WE HAVE NO HOLDINGS IN ANY OF STOCKS RECOMMENDED ABOVE

Zoid Research

Office 101, Shagun Tower

A.B. Commercial Road, Indore

452001

Mobile: +91 9039073611

Email: info@zoidresearch.com

Website: www.zoidresearch.com

www.zoidresearch.com ZOID RESEARCH TEAM

Вам также может понравиться

- Equity Report 26 June To 30 JuneДокумент6 страницEquity Report 26 June To 30 JunezoidresearchОценок пока нет

- Equity Report 10 July To 14 JulyДокумент6 страницEquity Report 10 July To 14 JulyzoidresearchОценок пока нет

- Equity Weekly ReportДокумент6 страницEquity Weekly ReportzoidresearchОценок пока нет

- Equity Report 16 - 20 OctДокумент6 страницEquity Report 16 - 20 OctzoidresearchОценок пока нет

- Equity Report 21 Aug To 25 AugДокумент6 страницEquity Report 21 Aug To 25 AugzoidresearchОценок пока нет

- Equity Report 22 May To 26 MayДокумент6 страницEquity Report 22 May To 26 MayzoidresearchОценок пока нет

- Equity Report 15 May To 19 MayДокумент6 страницEquity Report 15 May To 19 MayzoidresearchОценок пока нет

- Equity Weekly Report 8 May To 12 MayДокумент6 страницEquity Weekly Report 8 May To 12 MayzoidresearchОценок пока нет

- Equity Outlook 13 Feb To 17 FebДокумент6 страницEquity Outlook 13 Feb To 17 FebzoidresearchОценок пока нет

- Equity Report 6 To 10 NovДокумент6 страницEquity Report 6 To 10 NovzoidresearchОценок пока нет

- Equity Technical Weekly ReportДокумент6 страницEquity Technical Weekly ReportzoidresearchОценок пока нет

- Index Movement:: National Stock Exchange of India LimitedДокумент36 страницIndex Movement:: National Stock Exchange of India LimitedTrinadh Kumar GuthulaОценок пока нет

- Index Movement:: National Stock Exchange of India LimitedДокумент37 страницIndex Movement:: National Stock Exchange of India LimitedJayant SharmaОценок пока нет

- Index Movement:: National Stock Exchange of India LimitedДокумент36 страницIndex Movement:: National Stock Exchange of India Limitedanilkhubchandani9744Оценок пока нет

- NIFTYCALCULATOROctober2018www - Nooreshtech.co .InДокумент13 страницNIFTYCALCULATOROctober2018www - Nooreshtech.co .InbrijsingОценок пока нет

- Technical Morning - Call - 120922 PDFДокумент5 страницTechnical Morning - Call - 120922 PDFSomeone 4780Оценок пока нет

- Index Movement:: National Stock Exchange of India LimitedДокумент27 страницIndex Movement:: National Stock Exchange of India LimitedjanuianОценок пока нет

- Skrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityДокумент12 страницSkrip Name Tran Quantity: Client Id: N147669 Client Name: Shourya Mohan Asset Class: EquityDeepanjaliОценок пока нет

- Term PaperДокумент9 страницTerm Paperkavya surapureddy100% (1)

- Symbol Open Dayhigh Daylow Lastprice Previousclose ChangeДокумент4 страницыSymbol Open Dayhigh Daylow Lastprice Previousclose ChangeVijayОценок пока нет

- Incurred - Claims - RatioДокумент20 страницIncurred - Claims - RatioPravin YeluriОценок пока нет

- Weekly 12082017Документ5 страницWeekly 12082017Thiyaga RajanОценок пока нет

- Technical Morning - Call - 200921Документ5 страницTechnical Morning - Call - 200921Equity NestОценок пока нет

- Orb Plus Excel Call Generator1Документ8 страницOrb Plus Excel Call Generator1dewanibipin0% (2)

- Tech Report 05.01Документ3 страницыTech Report 05.01Swayam MangwaniОценок пока нет

- Open High Low LTP CHNG TradeДокумент33 страницыOpen High Low LTP CHNG TradeAnand ChineyОценок пока нет

- Category Date Buy Value Sell Value Net ValueДокумент7 страницCategory Date Buy Value Sell Value Net ValueMohd FarazОценок пока нет

- Daily Market Update OF 25 APRIL 2023-202304251728143358428Документ4 страницыDaily Market Update OF 25 APRIL 2023-202304251728143358428Pratik ShingareОценок пока нет

- Portfolio-1 With February 2022 CE Writting OpportunityДокумент5 страницPortfolio-1 With February 2022 CE Writting OpportunityPravin SinghОценок пока нет

- Tech Report 24 (1) .02.2011Документ3 страницыTech Report 24 (1) .02.2011Arijit TagoreОценок пока нет

- Gain 24 MayДокумент5 страницGain 24 MayPallavi M SОценок пока нет

- Tech Report 08.12Документ3 страницыTech Report 08.12bnr534Оценок пока нет

- Nifty Calculator Jan 2023Документ19 страницNifty Calculator Jan 2023Shovan GhoshОценок пока нет

- Daily-Equity 17 Sep 2010Документ3 страницыDaily-Equity 17 Sep 2010Vikram JunejaОценок пока нет

- New Microsoft Excel WorksheetДокумент9 страницNew Microsoft Excel WorksheetSneha JadhavОценок пока нет

- Project FRA Milestone1 JPY Nikita Chaturvedi 05.05.2022 Jupyter Notebook PDFДокумент102 страницыProject FRA Milestone1 JPY Nikita Chaturvedi 05.05.2022 Jupyter Notebook PDFRekha Rajaram74% (19)

- Weekly Newsletter Equity 30-SEPT-2017Документ7 страницWeekly Newsletter Equity 30-SEPT-2017Market Magnify Investment Adviser & ResearchОценок пока нет

- 05 03 2019anДокумент120 страниц05 03 2019anNarnolia'sОценок пока нет

- BSE PSU Energy StocksДокумент3 страницыBSE PSU Energy StocksYatrikОценок пока нет

- Watch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Документ11 страницWatch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Damini CapitalОценок пока нет

- Bel Lalpathlab Cub L&TFH Maruti: Symbol Open Dayhigh Daylow Lastprice Previousclose Change PchangeДокумент8 страницBel Lalpathlab Cub L&TFH Maruti: Symbol Open Dayhigh Daylow Lastprice Previousclose Change PchangeVijayОценок пока нет

- John Neff 22 Sep 2020 1116Документ5 страницJohn Neff 22 Sep 2020 1116Debashish Priyanka SinhaОценок пока нет

- 300zx 1991 FSM SearchableДокумент1 248 страниц300zx 1991 FSM SearchableMilka Tesla100% (2)

- Shareable Sheet-Protected-UnlockedДокумент2 страницыShareable Sheet-Protected-UnlockedTrading TrainingОценок пока нет

- Equity StockДокумент4 страницыEquity StockChaitanya EnterprisesОценок пока нет

- Halal StocksДокумент8 страницHalal Stocksmustang100% (1)

- February 16-17, 2011 - UpdateДокумент2 страницыFebruary 16-17, 2011 - UpdateJC CalaycayОценок пока нет

- Kingston Educational Institute: Ratio AnalysisДокумент1 страницаKingston Educational Institute: Ratio Analysisdhimanbasu1975Оценок пока нет

- Private LTD CompaniesДокумент16 страницPrivate LTD CompaniesanjankatamОценок пока нет

- Narration Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27Документ11 страницNarration Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27Manan ToganiОценок пока нет

- Zamboanga Peninsula Regional Development Investment Program 2017-2022Документ544 страницыZamboanga Peninsula Regional Development Investment Program 2017-2022DONNAVEL ROSALESОценок пока нет

- Stocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Документ3 страницыStocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Marcus AmabaОценок пока нет

- Investment Self RealisationДокумент18 страницInvestment Self Realisationankur_haldarОценок пока нет

- Report Closing Area 29.09.2022Документ1 страницаReport Closing Area 29.09.2022MardiansahОценок пока нет

- Vertex Trading Bell 04 Feb 2022Документ4 страницыVertex Trading Bell 04 Feb 2022dinilaОценок пока нет

- Historic Data Nifty50 9THJULYДокумент3 страницыHistoric Data Nifty50 9THJULYsriniaithaОценок пока нет

- B2Документ14 страницB2marathi techОценок пока нет

- Nifty 100 - Expected Returns (Holding Period of 6-8weeks)Документ2 страницыNifty 100 - Expected Returns (Holding Period of 6-8weeks)Sathv100% (1)

- Equity Report 6 To 10 NovДокумент6 страницEquity Report 6 To 10 NovzoidresearchОценок пока нет

- Equity Weekly Report 19-23 NovДокумент10 страницEquity Weekly Report 19-23 NovzoidresearchОценок пока нет

- Equity Weekly Report - Zoid ResearchДокумент9 страницEquity Weekly Report - Zoid ResearchzoidresearchОценок пока нет

- Nifty Technical Report (31july - 4aug)Документ6 страницNifty Technical Report (31july - 4aug)zoidresearchОценок пока нет

- Outlook On Equity Report 1 MAY To 5 MAYДокумент6 страницOutlook On Equity Report 1 MAY To 5 MAYzoidresearchОценок пока нет

- Equity Weekly Report 20 Feb To 24 FebДокумент6 страницEquity Weekly Report 20 Feb To 24 FebzoidresearchОценок пока нет

- Equity Report 3 July To 7 JulyДокумент6 страницEquity Report 3 July To 7 JulyzoidresearchОценок пока нет

- Equity Report 22 May To 26 MayДокумент6 страницEquity Report 22 May To 26 MayzoidresearchОценок пока нет

- Equity Report 15 May To 19 MayДокумент6 страницEquity Report 15 May To 19 MayzoidresearchОценок пока нет

- Equity Report 5 Jun To 9 JunДокумент6 страницEquity Report 5 Jun To 9 JunzoidresearchОценок пока нет

- Equity Weekly Report 8 May To 12 MayДокумент6 страницEquity Weekly Report 8 May To 12 MayzoidresearchОценок пока нет

- Nifty Weekly Report 17 Apr To 21 AprДокумент6 страницNifty Weekly Report 17 Apr To 21 AprzoidresearchОценок пока нет

- Equity Report 24 Apr To 28 AprДокумент6 страницEquity Report 24 Apr To 28 AprzoidresearchОценок пока нет

- Equity Technical Report 10 Apr To 14 AprДокумент6 страницEquity Technical Report 10 Apr To 14 AprzoidresearchОценок пока нет

- Equity Report Outlook 6 Feb To 10 FebДокумент6 страницEquity Report Outlook 6 Feb To 10 FebzoidresearchОценок пока нет

- Equity Technical Weekly ReportДокумент6 страницEquity Technical Weekly ReportzoidresearchОценок пока нет

- Equity Market Outlook (3-7 April)Документ6 страницEquity Market Outlook (3-7 April)zoidresearchОценок пока нет

- Equity Outlook 13 Feb To 17 FebДокумент6 страницEquity Outlook 13 Feb To 17 FebzoidresearchОценок пока нет

- Equity Report 12 Dec To 16 DecДокумент6 страницEquity Report 12 Dec To 16 DeczoidresearchОценок пока нет

- Equity Technical Report 28 Nov To 2 DecДокумент6 страницEquity Technical Report 28 Nov To 2 DeczoidresearchОценок пока нет

- Equity Technical Report 30 Jan To 3 FebДокумент6 страницEquity Technical Report 30 Jan To 3 FebzoidresearchОценок пока нет

- Equity Technical Report 23 Jan To 27 JanДокумент6 страницEquity Technical Report 23 Jan To 27 JanzoidresearchОценок пока нет

- Equity Technical Report 2 Jan To 6 JanДокумент6 страницEquity Technical Report 2 Jan To 6 JanzoidresearchОценок пока нет

- Equity Technical Report 5 Dec To 9 DecДокумент6 страницEquity Technical Report 5 Dec To 9 DeczoidresearchОценок пока нет

- Shareholder's Equity - Practice SetsДокумент6 страницShareholder's Equity - Practice SetsGian GarciaОценок пока нет

- Chapter 1 ProblemsДокумент3 страницыChapter 1 Problemsahmedknight100% (2)

- SRC Rule 17-1 Notification of Inability To Timely File All or Any Required Portion of An SEC FORM 17-A or 17-QДокумент4 страницыSRC Rule 17-1 Notification of Inability To Timely File All or Any Required Portion of An SEC FORM 17-A or 17-QNic NalpenОценок пока нет

- Eco 389 Corporate Finance / Tutorialoutlet Dot ComДокумент13 страницEco 389 Corporate Finance / Tutorialoutlet Dot Comalbert0077Оценок пока нет

- (Mas) 07 - Capital BudgetingДокумент7 страниц(Mas) 07 - Capital BudgetingCykee Hanna Quizo Lumongsod100% (1)

- E.K. Buck Retail Stores V HarkertДокумент2 страницыE.K. Buck Retail Stores V HarkertTrxc MagsinoОценок пока нет

- Organizational IssuesДокумент27 страницOrganizational IssuesKanako LeongОценок пока нет

- Sample Case FAFVPL and FAFVOCI FOR PRINT Ans Key Part 1Документ2 страницыSample Case FAFVPL and FAFVOCI FOR PRINT Ans Key Part 1PATRICIA ALVAREZОценок пока нет

- Subject: Fm-07 Assignment: S B Decker, Inc.: Tanley Lack ANDДокумент3 страницыSubject: Fm-07 Assignment: S B Decker, Inc.: Tanley Lack ANDSuryakant BurmanОценок пока нет

- Cemco Holdings Vs National Life InsuranceДокумент3 страницыCemco Holdings Vs National Life InsuranceRowena Gallego100% (2)

- Jefferies-High Yield Best Picks 2004-Greg ImbruceДокумент3 страницыJefferies-High Yield Best Picks 2004-Greg ImbrucerpupolaОценок пока нет

- 702 - Black BookДокумент73 страницы702 - Black BookSonam PandeyОценок пока нет

- BADVAC1X - MOD 2 Conso FS Date of AcqДокумент6 страницBADVAC1X - MOD 2 Conso FS Date of AcqJopnerth Carl CortezОценок пока нет

- Security Analysis Syllabus IBSДокумент2 страницыSecurity Analysis Syllabus IBSnitin2khОценок пока нет

- Shareholder RightsДокумент4 страницыShareholder RightsJayveerose BorjaОценок пока нет

- BP Annual Report and Form 20f 2018 PDFДокумент328 страницBP Annual Report and Form 20f 2018 PDFscottОценок пока нет

- Capital BudgetingДокумент24 страницыCapital BudgetingInocencio Tiburcio100% (2)

- Presentation On WACCДокумент12 страницPresentation On WACCIF387Оценок пока нет

- ITM MaricoДокумент8 страницITM MaricoAdarsh ChaudharyОценок пока нет

- TLV - 20191216165648 - Raport Curent Extindere Program de Rascumparare Actiuni ENДокумент1 страницаTLV - 20191216165648 - Raport Curent Extindere Program de Rascumparare Actiuni ENAndrei NitaОценок пока нет

- ReportДокумент22 страницыReportTrinh LyОценок пока нет

- Ar2018 FinancialДокумент321 страницаAr2018 FinancialJam UsmanОценок пока нет

- Final Doc of Management AssignmentДокумент10 страницFinal Doc of Management AssignmentrasithapradeepОценок пока нет

- Financial Management PROBLEMS FROM UNIT - 3Документ8 страницFinancial Management PROBLEMS FROM UNIT - 3jeganrajrajОценок пока нет

- Adobe Scan Jan 30, 2023Документ6 страницAdobe Scan Jan 30, 2023Karan RajakОценок пока нет

- Value Investing With Legends (Santos, Greenwald, Eveillard) SP2015Документ6 страницValue Investing With Legends (Santos, Greenwald, Eveillard) SP2015ascentcommerce100% (1)

- 30 Something DirectorДокумент6 страниц30 Something DirectorazharaqОценок пока нет

- Mutual Fund PPT 123Документ53 страницыMutual Fund PPT 123Sneha SinghОценок пока нет

- Depository System: This System Came in To Force With Effect FromДокумент38 страницDepository System: This System Came in To Force With Effect Fromanilkanwar111Оценок пока нет

- hw2 2015 Bpes SolutionsДокумент7 страницhw2 2015 Bpes SolutionsDaryl Khoo Tiong Jinn100% (1)