Академический Документы

Профессиональный Документы

Культура Документы

Form No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961

Загружено:

Anonymous 2evaoXKKdОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Form No. 3ae: Audit Report Under Section 35D (4) /35E (6) of The Income-Tax Act, 1961

Загружено:

Anonymous 2evaoXKKdАвторское право:

Доступные форматы

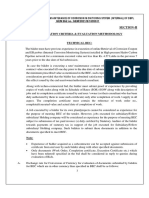

FORM NO.

3AE

[See rule 6AB]

Audit Report under section * 35D(4)/35E(6) of the Income-tax Act, 1961

* I/We have examined the Balance Sheet(s) of M/s as at and the Profit

and Loss Account(s) for the year(s) ended on * that/those date(s) which are in agreement with the books of

account maintained at the head office at * and branches at

* I/We have obtained all the information and explanations which to the best of * my/our knowledge and belief

were necessary for the purposes of the audit. In * my/our opinion, proper books of account have been kept by

the head office and the branches of the abovenamed assessee visited by * me/us so far as appears from *

my/our examination of the books, and proper returns adequate for the purposes of audit have been received from

branches not visited by * me/us, subject to the comments given below :-

In * my/our opinion and to the best of * my/our information and according to explanations given to * me/us,

the said accounts give a true and fair view :-

(i) in the case of the Balance Sheet(s) of the state of the abovenamed assessee's affairs as at ; and

(ii) in the case of the Profit and Loss Account(s), of the profit or loss of his accounting year(s) ending on

The statement of particulars required for the purposes of the deduction under section * 35D/35E is annexed

and in

* my/our opinion and to the best of * my/our information and according to explanations given to * me/us,

these are true and correct.

Place

Date Signed

Accountant

Notes :

1. *Delete whichever is not applicable.

2. This report is to be given by-

(i) a chartered accountant within the meaning of the Chartered Accountants Act, 1949 (38 of 1949); or

(ii) any person who, in relation to any State, is, by virtue of the provisions of sub-section (2) of section

226 of the Companies Act, 1956 (1 of 1956), entitled to be appointed to act as an auditor of

companies registered in that State.

3. Where any of the matters stated in this Report is answered in the negative or with a qualification, the

Report shall state the reasons for the same.

ANNEXURE TO FORM NO. 3B

SECTION A

STATEMENT OF PARTICULARS REQUIRED FOR THE PURPOSES OF DEDUCTION UNDER

SECTION 35D

1. Date of commencement of business

2. Where the deduction is claimed with reference to the

expenditure incurred in connection with the

extension of the industrial undertaking or the setting

up of a new industrial unit, the date on which the

extension was completed or new industrial unit

commenced production or operation

* 3. Qualifying amount of expenditure :

(a) Expenditure in connection with-

(i) preparation of feasibility report Rs.

(ii) preparation of project report Rs.

(iii) conducting market survey or any other Rs.

survey necessary for the business of the

assessee

(iv) engineering services relating to the Rs.

business of the assessee

(b) Legal charges for drafting any agreement Rs.

between the assessee and any other person for

Printed from www.incometaxindia.gov.in Page 1 of 2

any purpose relating to the setting up or

conduct of the business of the assessee

TOTAL

4. Cost of the project, i.e., actual cost of :

(i) land and buildings (including expenditure on Rs.

development)

(ii) leaseholds Rs.

(iii) plant and machinery Rs.

(iv) furniture and fittings Rs.

(v) railway sidings Rs.

TOTAL

5. Deduction claimed under section 35D Rs.

Place

Date Signed

Accountant

SECTION B

STATEMENT OF PARTICULARS REQUIRED FOR PURPOSES OF DEDUCTION UNDER SECTION

35E

1. Name(s) of mineral(s) or group(s) of associated

minerals in respect of which operation relating to

prospecting or development were undertaken

2. Year of commercial production

3. Qualifying amount of expenditure :

Year in which expenditure was incurred Amount of expenditure (Give details)

Rs.

Place

Date Signed

Accountant

*Where the qualifying expenditure was incurred during more than one year, year-wise details of the expenditure

should be given.

Expenditure under this head should be claimed only where the work in connection with the preparation of the

feasibility report or project report or conducting market survey or any other survey or engineering services has

been carried out by the assessee himself or by a concern which has been approved in this behalf by the Board.

In a case where the claim relates to preliminary expenses incurred before the commencement of business, the

actual cost of the specified assets which are shown in the books of the assessee as on the last day of the previous

year in which the business was commenced should be given. In a case where the expenses were incurred in

connection with the extension of the industrial undertaking or the setting up of a new industrial unit, the actual

cost of the specified assets which are shown in the books of account as on the last day of the previous year in

which the extension of the industrial undertaking was completed or the new industrial unit commenced

production or operation (in so far as such assets have been acquired or developed in connection with the

extension of the industrial undertaking or the setting up of the new industrial unit) should be given.

Printed from www.incometaxindia.gov.in Page 2 of 2

Вам также может понравиться

- Amendment in Schedule III at Icsi Indore On 28052022Документ29 страницAmendment in Schedule III at Icsi Indore On 28052022kandmoreОценок пока нет

- Amendment To Schedule III of Companies Act 2013 Wef 01042021Документ41 страницаAmendment To Schedule III of Companies Act 2013 Wef 01042021Chaithanya RajuОценок пока нет

- Statement of Single Largest Completed ContractДокумент4 страницыStatement of Single Largest Completed ContractMelvanne Nuesca TamboboyОценок пока нет

- Form 3ad: Audit Report Under Section 33ABAДокумент3 страницыForm 3ad: Audit Report Under Section 33ABAAnonymous 2evaoXKKdОценок пока нет

- Form 3ad: Audit Report Under Section 33ABAДокумент3 страницыForm 3ad: Audit Report Under Section 33ABARajshree GuptaОценок пока нет

- Form CHG-1-16032017 Signe Cfil CДокумент6 страницForm CHG-1-16032017 Signe Cfil CsunjuОценок пока нет

- Printed From WWW - Incometaxindia.gov - in Page 1 of 2Документ2 страницыPrinted From WWW - Incometaxindia.gov - in Page 1 of 2Rajshree GuptaОценок пока нет

- Form No. 3aaa (Now Redundant) Audit Report Under Section 32ABДокумент4 страницыForm No. 3aaa (Now Redundant) Audit Report Under Section 32ABAnonymous 2evaoXKKdОценок пока нет

- Form No. 3ac: Audit Report Under Section 33ABДокумент3 страницыForm No. 3ac: Audit Report Under Section 33ABAnonymous 2evaoXKKdОценок пока нет

- Form 23ACДокумент6 страницForm 23ACNikkhil GuptaaОценок пока нет

- Pioneer Legislation-2Документ8 страницPioneer Legislation-2Abioye PeterОценок пока нет

- Application For Standard Investment Subsidy (Sis)Документ7 страницApplication For Standard Investment Subsidy (Sis)shenoy84Оценок пока нет

- 1 Tax Audit ConsolДокумент199 страниц1 Tax Audit Consolrishi Kr.Оценок пока нет

- Bidding FormsДокумент26 страницBidding FormsAndrew BenitezОценок пока нет

- FRB 7 Sme Rental Relief Framework FinalДокумент17 страницFRB 7 Sme Rental Relief Framework Finalcheezhen5047Оценок пока нет

- Bidding Documents 19K00330Документ126 страницBidding Documents 19K00330Vinzsoy Daypal MalagarОценок пока нет

- Form GFR 12AДокумент2 страницыForm GFR 12AMandalpu Rajasekhar Reddy100% (1)

- Form No. 3C-O: Printed From WWW - Incometaxindia.gov - in Page 1 of 2Документ2 страницыForm No. 3C-O: Printed From WWW - Incometaxindia.gov - in Page 1 of 2Rajshree GuptaОценок пока нет

- 3468 Instructions ITCДокумент18 страниц3468 Instructions ITCMichael ZambitoОценок пока нет

- CA Audit Report Format-1Документ88 страницCA Audit Report Format-1nuudmОценок пока нет

- FORM O-12 Certificate of The Auditor On Valuation of Unquoted Equity Share of An Investment CompanyДокумент1 страницаFORM O-12 Certificate of The Auditor On Valuation of Unquoted Equity Share of An Investment Companysudhir.kochhar3530Оценок пока нет

- Department of Public Works & Highways: Regional Office XДокумент120 страницDepartment of Public Works & Highways: Regional Office XMANNY CARAJAYОценок пока нет

- Form 0-12Документ1 страницаForm 0-12Amit BhatiОценок пока нет

- CARO 2020 Book NotesДокумент11 страницCARO 2020 Book NotesCreanativeОценок пока нет

- US Internal Revenue Service: I3468 - 1996Документ3 страницыUS Internal Revenue Service: I3468 - 1996IRSОценок пока нет

- Test Paper - 3 CA FinalДокумент3 страницыTest Paper - 3 CA FinalyeidaindschemeОценок пока нет

- b2-c1 Grande Finale Solving 2023 May (Set 2)Документ17 страницb2-c1 Grande Finale Solving 2023 May (Set 2)charlesmicky82Оценок пока нет

- GFR 2005Документ279 страницGFR 2005chunayОценок пока нет

- Nidhi-Amendment 2019-20Документ12 страницNidhi-Amendment 2019-20Manoj KumarОценок пока нет

- Applicability of Companies (Auditor'S Report) Order, 2020Документ7 страницApplicability of Companies (Auditor'S Report) Order, 2020GopiОценок пока нет

- 7.guideline For Application For Provisional Eligibility CertificateДокумент14 страниц7.guideline For Application For Provisional Eligibility CertificateKumar SrinivasanОценок пока нет

- L-20, 21 and 22: Profits and Gains From Business and ProfessionДокумент27 страницL-20, 21 and 22: Profits and Gains From Business and ProfessionShreyas SrivastavaОценок пока нет

- 18K00293-Lumbatan-Binidayan Section PDFДокумент125 страниц18K00293-Lumbatan-Binidayan Section PDFVincent PorrazzoОценок пока нет

- Corporate Financial Reporting: © The Institute of Chartered Accountants of IndiaДокумент7 страницCorporate Financial Reporting: © The Institute of Chartered Accountants of IndiaNmОценок пока нет

- Revised Form 3CD by Pankaj GargДокумент17 страницRevised Form 3CD by Pankaj GargAditya HalderОценок пока нет

- SCH IiiДокумент4 страницыSCH IiiSheet RavalОценок пока нет

- 17BD0054-MPB (Completion) Bayabat, AmulungДокумент106 страниц17BD0054-MPB (Completion) Bayabat, AmulungChristian HindangОценок пока нет

- NonДокумент6 страницNonb jayaОценок пока нет

- US Internal Revenue Service: I3468 - 1992Документ3 страницыUS Internal Revenue Service: I3468 - 1992IRSОценок пока нет

- Key Changes in Schedule III and Reporting RequirementsДокумент6 страницKey Changes in Schedule III and Reporting RequirementsKB AssociatesОценок пока нет

- Right To Information Act 2005 Particulars of TheДокумент14 страницRight To Information Act 2005 Particulars of TheAman DubeyОценок пока нет

- Annexure - XII Format For Claiming Final Subsidy: Ith ID Includin Teh Il DistrictДокумент4 страницыAnnexure - XII Format For Claiming Final Subsidy: Ith ID Includin Teh Il DistrictHarsh ShrivastavaОценок пока нет

- Application Form I Psi 2007 Non MegaДокумент7 страницApplication Form I Psi 2007 Non MegaRohan KulkarniОценок пока нет

- Newgen Iedc: ( (See Rule 238 (1) )Документ4 страницыNewgen Iedc: ( (See Rule 238 (1) )E-Cell MPCОценок пока нет

- Consolidated BTL 02 03Документ36 страницConsolidated BTL 02 03santoshsadanОценок пока нет

- Module 2.1 (Property, Plant, and Equipment)Документ15 страницModule 2.1 (Property, Plant, and Equipment)Hazel Jane EsclamadaОценок пока нет

- Contract ID No. 17-FA-0038: Department of Public Works and HighwaysДокумент165 страницContract ID No. 17-FA-0038: Department of Public Works and HighwaysrrpenolioОценок пока нет

- Tax Theory PDFДокумент44 страницыTax Theory PDFReazul IslamОценок пока нет

- 1 Belgaum Tendernotice - 1Документ2 страницы1 Belgaum Tendernotice - 1phalgunrvr1987Оценок пока нет

- Caro 2020Документ11 страницCaro 2020Gaurav Chauhan CAОценок пока нет

- Tendernotice - 1 - 2023-12-16T134219.316Документ3 страницыTendernotice - 1 - 2023-12-16T134219.316MJ GROUPОценок пока нет

- Application Form For CSR Funding From Igl NewДокумент5 страницApplication Form For CSR Funding From Igl NewPrafull ShahaОценок пока нет

- Bidding Documents RX ClusterBДокумент135 страницBidding Documents RX ClusterBfhdОценок пока нет

- Instructions For Filling Out FORM ITR-2Документ7 страницInstructions For Filling Out FORM ITR-2haryy1234567Оценок пока нет

- Bid Evaluation Criteria & Evaluation MethodologyДокумент5 страницBid Evaluation Criteria & Evaluation MethodologyVipul MishraОценок пока нет

- Tax Audit ReportДокумент18 страницTax Audit ReportNeha DenglaОценок пока нет

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОт EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisОценок пока нет

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703От EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703Оценок пока нет

- Sem 3 Malacca Itinerary - W Tutorial HoursДокумент1 страницаSem 3 Malacca Itinerary - W Tutorial HoursAnonymous 2evaoXKKdОценок пока нет

- Volume 2 - Supply Chain Management PDFДокумент18 страницVolume 2 - Supply Chain Management PDFAnonymous 2evaoXKKdОценок пока нет

- May05 121 Musick Air AsiaДокумент6 страницMay05 121 Musick Air AsiaAnonymous 2evaoXKKdОценок пока нет

- Form No. 10Cc: (Now Redundant) Audit Report Under Section 80HHA of The Income-Tax Act, 1961Документ1 страницаForm No. 10Cc: (Now Redundant) Audit Report Under Section 80HHA of The Income-Tax Act, 1961Anonymous 2evaoXKKdОценок пока нет

- The Big Brown Fox Jumps Over The Lazy DogДокумент1 страницаThe Big Brown Fox Jumps Over The Lazy DogAnonymous 2evaoXKKdОценок пока нет

- Form 60Документ5 страницForm 60Harit KumarОценок пока нет

- Form No. 10C: (Now Redundant) Audit Report Under Section 80HH of The Income-Tax Act, 1961Документ1 страницаForm No. 10C: (Now Redundant) Audit Report Under Section 80HH of The Income-Tax Act, 1961Anonymous 2evaoXKKdОценок пока нет

- 2016 APAC Fit-Out Cost Guide - Occupier ProjectsДокумент26 страниц2016 APAC Fit-Out Cost Guide - Occupier ProjectsSkywardFire100% (1)

- Itr62form 64cДокумент1 страницаItr62form 64cAnonymous 2evaoXKKdОценок пока нет

- Itr62form 64cДокумент1 страницаItr62form 64cAnonymous 2evaoXKKdОценок пока нет

- Itr62form 64c PDFДокумент1 страницаItr62form 64c PDFAnonymous 2evaoXKKdОценок пока нет

- Itr62form 64dДокумент2 страницыItr62form 64dAnonymous 2evaoXKKdОценок пока нет

- "Formno.64A Statementofincomedistributed by A Business Trust Tobefurnishedundersection115Uaoftheincome-Taxact, 1961 1. 2. 3. 4. 5. 6Документ3 страницы"Formno.64A Statementofincomedistributed by A Business Trust Tobefurnishedundersection115Uaoftheincome-Taxact, 1961 1. 2. 3. 4. 5. 6Anonymous 2evaoXKKdОценок пока нет

- Itr 62 Form 64 BДокумент2 страницыItr 62 Form 64 BAnonymous 2evaoXKKdОценок пока нет

- Form No. 3ced Application For An Advance Pricing AgreementДокумент8 страницForm No. 3ced Application For An Advance Pricing AgreementAnonymous 2evaoXKKdОценок пока нет

- Place - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationДокумент2 страницыPlace - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationAnonymous 2evaoXKKdОценок пока нет

- Printed From WWW - Incometaxindia.gov - in Page 1 of 2Документ2 страницыPrinted From WWW - Incometaxindia.gov - in Page 1 of 2gupta_gk4uОценок пока нет

- Income-Tax Rules, 1962Документ2 страницыIncome-Tax Rules, 1962Anonymous 2evaoXKKdОценок пока нет

- Income-Tax Rules, 1962: "FORM No.68 Form of Application Under Section 270AA (2) of The Income-Tax Act, 1961Документ1 страницаIncome-Tax Rules, 1962: "FORM No.68 Form of Application Under Section 270AA (2) of The Income-Tax Act, 1961Anonymous 2evaoXKKdОценок пока нет

- Place - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationДокумент2 страницыPlace - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationAnonymous 2evaoXKKdОценок пока нет

- Place - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationДокумент2 страницыPlace - Signature of The Principal Officer of The Recognised Association - Date - Name and DesignationAnonymous 2evaoXKKdОценок пока нет

- Form No. 3ba: Report Under Section 36 (1) (Xi) of The Income-Tax Act, 1961Документ2 страницыForm No. 3ba: Report Under Section 36 (1) (Xi) of The Income-Tax Act, 1961rajdeeppawarОценок пока нет

- Form No. 3aaa (Now Redundant) Audit Report Under Section 32ABДокумент4 страницыForm No. 3aaa (Now Redundant) Audit Report Under Section 32ABAnonymous 2evaoXKKdОценок пока нет

- For Persons: (See Rule 12 (1) (D) of Income-Tax Rules, 1962)Документ4 страницыFor Persons: (See Rule 12 (1) (D) of Income-Tax Rules, 1962)Anonymous 2evaoXKKdОценок пока нет

- Form No. 3ac: Audit Report Under Section 33ABДокумент3 страницыForm No. 3ac: Audit Report Under Section 33ABAnonymous 2evaoXKKdОценок пока нет

- Form No. 3aa (Now Redundant) Report Under Section 32 (1) (Iia) of The Income-Tax Act, 1961Документ2 страницыForm No. 3aa (Now Redundant) Report Under Section 32 (1) (Iia) of The Income-Tax Act, 1961Anonymous 2evaoXKKdОценок пока нет

- (See Rule 12 (1A) of Income-Tax Rules, 1962) : Form No. 2B Return of Income For Block Assessment ITS-2BДокумент14 страниц(See Rule 12 (1A) of Income-Tax Rules, 1962) : Form No. 2B Return of Income For Block Assessment ITS-2BDaniel C MohanОценок пока нет

- Antosha Haimovich - Chromatic Scale (Exercise For Saxophone)Документ3 страницыAntosha Haimovich - Chromatic Scale (Exercise For Saxophone)João Israel FerreiraОценок пока нет

- Pile cp7Документ38 страницPile cp7casarokarОценок пока нет

- Customer Relationship Management CRMДокумент30 страницCustomer Relationship Management CRMAshri Nur Istiqomah100% (1)

- Chapter 5 - 7 Eleven Case Studies - QuesДокумент3 страницыChapter 5 - 7 Eleven Case Studies - QuesMary KarmacharyaОценок пока нет

- Instabiz: Mobile Banking App For Self Employed Segment CustomersДокумент146 страницInstabiz: Mobile Banking App For Self Employed Segment Customerssiva krishna60% (5)

- Ihracat1000 2013 Eng WebДокумент168 страницIhracat1000 2013 Eng WebAnupriya Roy ChoudharyОценок пока нет

- GeraДокумент2 страницыGeraAnonymousОценок пока нет

- Annual Report 2010 11Документ192 страницыAnnual Report 2010 11Deepak KumarОценок пока нет

- CABA CBOK Ver 9-1Документ390 страницCABA CBOK Ver 9-1Afonso SouzaОценок пока нет

- Advance AccДокумент8 страницAdvance AccjayaОценок пока нет

- Legal AspectДокумент12 страницLegal AspectVhin BaldonОценок пока нет

- Business in A Borderless World: Business Policy Instructor: Sumera KaziДокумент19 страницBusiness in A Borderless World: Business Policy Instructor: Sumera KaziSumera KaziОценок пока нет

- Boldflash-Cross Functional Challenges in The Mobile DivisionДокумент1 страницаBoldflash-Cross Functional Challenges in The Mobile DivisionVerona Felton100% (1)

- Leadership Managing Change Globalization Innovation Cost Reduction New Economy and KnowledgeДокумент8 страницLeadership Managing Change Globalization Innovation Cost Reduction New Economy and KnowledgeAllison Nadine MarchandОценок пока нет

- ADBL Report PCДокумент43 страницыADBL Report PCBabita ChhetriОценок пока нет

- Petitioner vs. vs. Respondents Josue H. Gustilo & Associates Solicitor GeneralДокумент16 страницPetitioner vs. vs. Respondents Josue H. Gustilo & Associates Solicitor GeneralRosegailОценок пока нет

- WFDSA Annual Report 112718Документ17 страницWFDSA Annual Report 112718Oscar Rojas GuerreroОценок пока нет

- RPA Questions 1Документ11 страницRPA Questions 1Furkan ŞahinОценок пока нет

- Solavei MarketingДокумент254 страницыSolavei MarketingKelvin WilsonОценок пока нет

- Fact Orders Tec Stored A To S 2022Документ2 364 страницыFact Orders Tec Stored A To S 2022Mikel SUAREZ BARREIROОценок пока нет

- Analytics Fortified Talent Management The New Role For HR in Oil and Gas FinalДокумент4 страницыAnalytics Fortified Talent Management The New Role For HR in Oil and Gas FinalArnab DebОценок пока нет

- EDI Manual PDFДокумент119 страницEDI Manual PDFLuis SousaОценок пока нет

- ACCT 423 Cheat Sheet 1.0Документ2 страницыACCT 423 Cheat Sheet 1.0HelloWorldNowОценок пока нет

- Complete List of Published Papers Papers and PresentationsДокумент15 страницComplete List of Published Papers Papers and PresentationsWayne H WagnerОценок пока нет

- Company Sales Plan TemplateДокумент3 страницыCompany Sales Plan TemplateAbdelfatah Zyan50% (2)

- Sap C TSCM62 64 PDFДокумент24 страницыSap C TSCM62 64 PDFjpcupcupin23100% (2)

- P&GДокумент18 страницP&GPayal GargОценок пока нет

- Intelectual Property Law RA 8293 1Документ5 страницIntelectual Property Law RA 8293 1Alfred Joseph ZuluetaОценок пока нет

- Ariba Cig PocДокумент7 страницAriba Cig PocParesh GanganiОценок пока нет

- AfarДокумент3 страницыAfarLeizzamar BayadogОценок пока нет

- Derivatives in India Blackbook Project TYBFM 2015-2016: Download NowДокумент20 страницDerivatives in India Blackbook Project TYBFM 2015-2016: Download NowSanjay KadamОценок пока нет