Академический Документы

Профессиональный Документы

Культура Документы

Identifying Suitable Strategic Options Answer To End of Chapter Exercises Siegmund LTD

Загружено:

Jay BrockОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Identifying Suitable Strategic Options Answer To End of Chapter Exercises Siegmund LTD

Загружено:

Jay BrockАвторское право:

Доступные форматы

1

Chapter 17

Identifying Suitable Strategic Options

Answer to End of Chapter Exercises

SIEGMUND LTD

Q 17.1 SWOT analysis

Strengths

S1 Brand name - Loyalty of customers

S2 A number of products are market leaders

S3 Highly skilled workforce

Weaknesses

W1 - Competitor products more reliable

W2 - Major investment programme required to update manufacturing facilities

W3 - Poor on-time delivery record.

W4 - Research and development resources are declining

W5 - Product development falling behind competitors

W6 - Skill shortages in the factory following staff leaving to join other organisations.

W7 lack of finance available.

Threats

T1 Removal of trade barriers allowing many new competitors into the market

T2 Consumer demand expected to fall over the next two years as inflation is

increasing and interest rates are expected to rise.

T3 better process technologies used by competitors.

T4 - A number of traditionally based Ruritanian competitors, but now a large number

of overseas competitors who have achieved scale economies.

T5 -Low switching costs for the buyer

T6 - Increasingly buying power is being concentrated in the hands of overseas

wholesales and super and hype markets.

Opportunity

O1 The economy has been growing at a substantial rate and with increased

affluence consumers are able to afford new types of products (e.g. ice cream makers).

O2 Increasing 3rd world prosperity.

O3 Population (particularly older customers) still have brand loyalty

O4 Growing home demand for modern and more complex equipment.

increasingly expect higher quality.

O5 Increased sales through use of internet

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

2

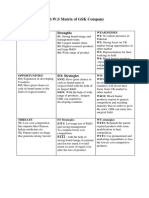

TOWS matrix

Strengths Weaknesses

S1 W1

S2 W2

S3 W3

W4

W5

W6

W7

Opportunities

O1 S1 + S3 + O3+O4 W3+O4

O2 Build on brand loyalty Invest in research and

O3 and develop new products development to again

O4 for growing home develop new product

O5 demand ranges

S1 + T4 + T6 W5 + W6 + T5

Threats

T1 Consider selling direct to Consider some form of

T2 customers, increased use agreement with overseas

T3 of internet selling. company that will enable

T4 Promotion as a Ruritanian Siegmund to focus on key

T5 company products and sell other

T6 products under licence?

Q 17.2

Existing products New products

Existing markets Upgrade existing products Consider new product

and aim for market development new

penetration within the models within existing

existing market product groups or new

product groups

New markets Broaden the portfolio to

Consider exports include other kitchen

equipment, fitted kitchens?

Q 17.3

Siegmund Ltd has a number of strenghs, in particular a strong brand name.

It could undertake a number of these options through internal development.

However it has not invested in recent years, has limited funds for reinvestment and at

present seems to be in danger of declining.

It may wish to form some sort of alliance with another company with funds and

complementary strengths. A merger is likely to occur with an overseas company with

funds acquiring Siegmund Ltd.

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

3

In order to retain some form of independence it might be best to consider some form

of alliance or joint development. If Siegmund does not have the resources to develop

all products in a desired product range it might consider manufacturing some products

under licence. Technical knowledge on improving its production processes might also

mean benefit for its other products.

ASSEMBLY DIVISION OF McLOED Ltd

Q 17.1 SWOT analysis and options

Strengths

S1 A number of talented engineers

S2 Some well engineered new products folding bicycles, electric bicycles

Weaknesses

W1 Old machinery and increasing maintenance costs

W2 Declining sales of main products mountain bicycles and racing bicycles.

Opportunities

O1 National cycling strategy expansion of national cycle network

O2 - Congestion charging for cars in London and potentially other cities.

O3 Increasing proportion using bicycles 10% in last 4 years compared to 2% in

1980.

O4 - Ageing population which is becoming increasingly health conscious and taking

up cycling. Also wanting greater comfort

O5 - Development of electric bicycles awaiting further development of battery

technology.

Threats

T1 Removal of trade barriers e.g. anti-dumping duty.

T2 Oversupply of bicycles on the world market

T3 Prices of supplies are being affected by shortages of raw materials.

T4 low barriers to entry although in the low cost high volume market a number of

companies have invested in automation to reduce costs.

T5 Increasingly buying power is being concentrated in the hands of a few multiples

e.g. Hafords, supermarkets etc.

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

4

TOWS matrix

For futher explanation of the strengths,weaknesses, opportunities and threats see

above

Strengths Weaknesses

S1 W1

S2 W2

S3

Opportunities Cell A- S1 talented engineers) +S2 W1 (old plant and

O1 (well engineered products) + O2 equipment in factory) +

O2 (congestion charging for cars) O5 (fall in interest

O3 Strategy suggested develop the rates).

O4 new product line and expand Strategy suggested - to

O5 production line of folding bicycle borrow funds to

for commuters. purchase new machinery

for chosen product lines.

W2 (declining sales of

Threats S 1 + S 3 + T5 ( increasing buying racing bicycles) + T2 +

T1 power of multiples) T4)

T2 Focus on niche markets selling Withdraw from

T3 through specialist bicycle retailers assembly of low cost

T4 and through internet. racing bicycles.

T5

Evaluating the suitability of different options

Consideration of product life cycle:

Before progressing with this option, it would be worthwhile considering the life cycle

stage of the road bicycles produced by the company. Although it is often difficult to

identify the exact stage of the life cycle, if this bicycle range was at the mature stage,

with many competing products, then an expensive promotional exercise may not

provide the returns that might be hoped for if the bicycle range was at the growth

stage of the life cycle.

A second option was to develop a new product range, such as a city bicycle for

commuters. Market information provided in the notes The bicycle industry,

indicates that sales of city bicycles are on the increase. Although development,

production and marketing of an appropriate bicycle might be expensive, it seems

likely that this type of bicycle is at the early stage of the life cycle and therefore may

have a relatively long term future.

BCG matrix

Depending on how they might measure market share, the mountain bicycle range

appears to be a cash cow, but with possible declining sales, appears to be on a

downward trend. Unless a significant change occurs in the market, from the

perspective of portfolio theory, it would seem that the option to launch a new product,

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

5

such as comfort bicycles or expand the hybrid or folding bicycle ranges would be

worthy of further consideration. Although the company is likely to have a small

market share initially, the market is growing rapidly and could become the star of the

future for the company.

Q 17.2

Existing products New products

Existing markets Consolidation Expansion of production

facilities for new folding

bicycles and electric

bicycles

New markets Consider exporting Related products e.g. roller

speciality bikes e.g. blades

folding bicycle.

Q 17.3) Discuss the relative merits for the company to achieve growth through

1) Internal development.

2) Merger or Acquisition,

3) Some form of joint development e.g. joint venture or licensing.

If sufficient funds are available and it has the skill base to manufacture the new

product lines such as folding bicycles then internal development may be the best

route. If it lacks the production capabilities then some form of licencing arrangement

might be appropriate

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

6

COOPER LEISURE RESORTS

Q 17.1 SWOT analysis

Strengths

S1 - Location

Weaknesses

W1 Ageing facilities needing reinvestment.

W2 Limited facilities for families.

W3 Marketing of the site has been limited

Opportunity

O1 Increasing number of holidays taken by families

O2 See threat 2!

Threats

T1 - Cost of other holidays other hotels offering off-peak breaks.

T 2 Unemployment is rising and interest rates are expected to rise. This may mean

that families have less money to spend on holidays. However, note that this might also

be considered an opportunity! Families are likely to still wish to take a holiday, but

may need to trade down to a cheaper holiday centre.

T3 New facilties offered by other resorts

T4 Rising expectations of families.

T5 Sunshine Sites is based in the Green belt and this may limit the opportunity for

expansion/new buildings.

Opportunities

O1 S1 + O1 W2+O2

O2 Promote Sunshine sites Invest in additional

to families wishing to facilities for families e.g.

take advantage of the childrens paddling pool,

Dorset location play park, additional

sports facilities for

children.

Threats

T1 S2 + T1 W1+ T3 + T4

T2 Invest in new facilities in

T3 Offer discounts for off- order to compete with

T4 peak breaks competition.

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

7

Q 17.2

Existing products New products

Existing markets Upgrade existing facilities Consider new product

and aim for market development new

penetration within the entertainment offerings

existing market e.g. sports facilities for

families (e.g. archery,

horse riding, football)

New markets Promotion of existing Consider offering special

products to attract new events to attract youth

groups e.g. caravan week- market e.g. pop festival

end. over one week.

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

Вам также может понравиться

- NOKIAДокумент16 страницNOKIACARTONEROS, MARC LUIS M.Оценок пока нет

- Tows GSKДокумент2 страницыTows GSKQanita Shah100% (2)

- Reasons For Restructuring - Improve ProfitabilityДокумент7 страницReasons For Restructuring - Improve Profitabilitydeepa cОценок пока нет

- Khao Yai Winery - Upload PDFДокумент12 страницKhao Yai Winery - Upload PDFwahyonoОценок пока нет

- TOWS AnalysisДокумент2 страницыTOWS Analysiskeith niduelanОценок пока нет

- Swot Tows Analysis of Ayala Land IncДокумент3 страницыSwot Tows Analysis of Ayala Land IncIsabel Sta Ines100% (3)

- Strategy Presentation Group 8Документ62 страницыStrategy Presentation Group 8Shivani BhatiaОценок пока нет

- As Limited (: BSE 500575 Air Conditioning Refrigeration Mumbai India Air Conditioning RefrigerationДокумент10 страницAs Limited (: BSE 500575 Air Conditioning Refrigeration Mumbai India Air Conditioning RefrigerationZain ParkarОценок пока нет

- Swot Matrix - AMANДокумент1 страницаSwot Matrix - AMANmedai lehОценок пока нет

- Political: Strategic Analysis - The External Environment Answer To End of Chapter ExercisesДокумент6 страницPolitical: Strategic Analysis - The External Environment Answer To End of Chapter ExercisesJay BrockОценок пока нет

- Research: Sachin GargДокумент7 страницResearch: Sachin GargAlfaaz -the wordsОценок пока нет

- SwotДокумент9 страницSwotYousab KaldasОценок пока нет

- TOWS MatrixДокумент6 страницTOWS MatrixRichard Adam SisonОценок пока нет

- Master of Business Administration 2020-22: Group Assignment 2 XiameterДокумент3 страницыMaster of Business Administration 2020-22: Group Assignment 2 Xiameterkusumit1011Оценок пока нет

- Tata Motors: Presentation On Swot Analysis ofДокумент6 страницTata Motors: Presentation On Swot Analysis ofshaanu123Оценок пока нет

- Swot Analysis Media PrimaДокумент9 страницSwot Analysis Media PrimaFikruddin AimanОценок пока нет

- Group 1 British MotorcycleДокумент11 страницGroup 1 British MotorcycleDebanjali Pal PGP 2017-19Оценок пока нет

- TOWSДокумент3 страницыTOWSKoko LaineОценок пока нет

- STRENGTHS OdtДокумент1 страницаSTRENGTHS OdtCristine JoyceОценок пока нет

- Project Final 1Документ60 страницProject Final 1m_gupta1981Оценок пока нет

- Strategic Management ProjectДокумент7 страницStrategic Management ProjectTirtham MukherjeeОценок пока нет

- TOWSДокумент2 страницыTOWSCristine JoyceОценок пока нет

- PBM Category AnalysisДокумент26 страницPBM Category AnalysisAbhi KumarОценок пока нет

- SM AssignmentДокумент16 страницSM AssignmentShahriat Sakib DhruboОценок пока нет

- Voltas-Mktg Project ReportДокумент37 страницVoltas-Mktg Project ReportUrooj Ansari69% (16)

- Towa MatrixДокумент8 страницTowa MatrixNancy ValdezОценок пока нет

- Industry Evolutionclass19Документ20 страницIndustry Evolutionclass19shaurya pratapОценок пока нет

- Ebook Context of Business Understanding The Canadian Business Environment Canadian 1St Edition Karakowsky Solutions Manual Full Chapter PDFДокумент38 страницEbook Context of Business Understanding The Canadian Business Environment Canadian 1St Edition Karakowsky Solutions Manual Full Chapter PDFkayleelopezotwgncixjb100% (10)

- Group Name: BBA Riders Program: BBA Section: Group MemberДокумент25 страницGroup Name: BBA Riders Program: BBA Section: Group Membernabila haroonОценок пока нет

- Strategies: Deliver With SmileДокумент16 страницStrategies: Deliver With SmileAun NarongritОценок пока нет

- GilletteДокумент15 страницGilletteVarun TyagiОценок пока нет

- Professor Anzenberger MGT 490 May 8 2018: Meriam MehayaДокумент14 страницProfessor Anzenberger MGT 490 May 8 2018: Meriam MehayaEmmanuel MakauОценок пока нет

- Strategic Management - CH 8 - Corporate Strategy & DiversificationДокумент65 страницStrategic Management - CH 8 - Corporate Strategy & DiversificationMursel50% (4)

- Voltas Case StudyДокумент27 страницVoltas Case Studyvasistakiran100% (3)

- Volkswagen PPT (Erp)Документ19 страницVolkswagen PPT (Erp)henna0% (1)

- Swot Analysis of BajajДокумент10 страницSwot Analysis of Bajajneo0787Оценок пока нет

- SWOT Analysis StarbucksДокумент11 страницSWOT Analysis StarbucksAina Criselle Marco89% (9)

- Winnebago CaseДокумент10 страницWinnebago CaseYee Sook YingОценок пока нет

- All Template Chapter 6 As of September 10 2019Документ32 страницыAll Template Chapter 6 As of September 10 2019Aira Dizon50% (2)

- Marketing Management - IsurindiДокумент16 страницMarketing Management - Isurindisam rosОценок пока нет

- Case Study1Документ4 страницыCase Study1Hasnaa SkiredjОценок пока нет

- Industry Life CycleДокумент26 страницIndustry Life CycleMd. Rashed Kamal 221-45-042Оценок пока нет

- Swot Matrix of AdidasДокумент1 страницаSwot Matrix of Adidasclaire anne CaranguianОценок пока нет

- Analysis of VoltasДокумент26 страницAnalysis of VoltasAviralОценок пока нет

- Ica SK IIДокумент14 страницIca SK IItunggaltriОценок пока нет

- SWOTДокумент4 страницыSWOTWaffi Bin Faruque 1812505030Оценок пока нет

- Nokia SwotДокумент5 страницNokia Swotrameesmohammed85Оценок пока нет

- 9D Research GroupДокумент8 страниц9D Research Groupapi-291828723Оценок пока нет

- Hindalco NovelisДокумент22 страницыHindalco NovelisprachiОценок пока нет

- NIKEДокумент12 страницNIKEnegisushils100% (1)

- Nokia SWOT Analysis FKДокумент186 страницNokia SWOT Analysis FKRony KaranwalОценок пока нет

- VoltasДокумент3 страницыVoltasAnant VishwakarmaОценок пока нет

- SP-434 World Class Production Management (E) (P-V) Sem - Iv May-2018Документ4 страницыSP-434 World Class Production Management (E) (P-V) Sem - Iv May-2018Krishnanand AnvekarОценок пока нет

- Marketing PlanДокумент27 страницMarketing PlanMohamed FathyОценок пока нет

- FTM Business Template - Strategic FrameworkДокумент12 страницFTM Business Template - Strategic FrameworkSofTools Limited100% (1)

- Report On DawlanceДокумент17 страницReport On DawlanceSara Ehsan33% (3)

- IB BusMan 35 Resources EPQ35Документ2 страницыIB BusMan 35 Resources EPQ35Gabriel FungОценок пока нет

- HavellsДокумент2 страницыHavellssamy7541Оценок пока нет

- Discount Business Strategy: How the New Market Leaders are Redefining Business StrategyОт EverandDiscount Business Strategy: How the New Market Leaders are Redefining Business StrategyОценок пока нет

- Introduction To The Consolidation Process: Learning Objectives - Coverage by QuestionДокумент21 страницаIntroduction To The Consolidation Process: Learning Objectives - Coverage by QuestionJay BrockОценок пока нет

- Chapter 12 Project Management: Quantitative Analysis For Management, 11e (Render)Документ36 страницChapter 12 Project Management: Quantitative Analysis For Management, 11e (Render)Jay BrockОценок пока нет

- Aa2e Hal SM Ch09Документ19 страницAa2e Hal SM Ch09Jay BrockОценок пока нет

- Solution Manual: (Updated Through November 11, 2013)Документ55 страницSolution Manual: (Updated Through November 11, 2013)Jay BrockОценок пока нет

- Solution Manual Chapter 9 - Government Accounting: Fund-Based Financial StatementsДокумент25 страницSolution Manual Chapter 9 - Government Accounting: Fund-Based Financial StatementsJay BrockОценок пока нет

- Chapter 4 Regression Models: Quantitative Analysis For Management, 11e (Render)Документ27 страницChapter 4 Regression Models: Quantitative Analysis For Management, 11e (Render)Jay BrockОценок пока нет

- Chapter 16 Statistical Quality Control: Quantitative Analysis For Management, 11e (Render)Документ20 страницChapter 16 Statistical Quality Control: Quantitative Analysis For Management, 11e (Render)Jay BrockОценок пока нет

- Chapter 15 Markov Analysis: Quantitative Analysis For Management, 11e (Render)Документ18 страницChapter 15 Markov Analysis: Quantitative Analysis For Management, 11e (Render)Jay BrockОценок пока нет

- Chapter 14 Simulation Modeling: Quantitative Analysis For Management, 11e (Render)Документ20 страницChapter 14 Simulation Modeling: Quantitative Analysis For Management, 11e (Render)Jay BrockОценок пока нет

- Solution Manual: (Updated Through November 11, 2013)Документ23 страницыSolution Manual: (Updated Through November 11, 2013)Jay BrockОценок пока нет

- Political: Strategic Analysis - The External Environment Answer To End of Chapter ExercisesДокумент6 страницPolitical: Strategic Analysis - The External Environment Answer To End of Chapter ExercisesJay BrockОценок пока нет

- Budgetary Control, Performance Management and Alternative Approaches To Control Answer To End of Chapter ExercisesДокумент2 страницыBudgetary Control, Performance Management and Alternative Approaches To Control Answer To End of Chapter ExercisesJay BrockОценок пока нет

- Chapter 11 Network Models: Quantitative Analysis For Management, 11e (Render)Документ32 страницыChapter 11 Network Models: Quantitative Analysis For Management, 11e (Render)Jay BrockОценок пока нет

- Chapter 5 Forecasting: Quantitative Analysis For Management, 11e (Render)Документ27 страницChapter 5 Forecasting: Quantitative Analysis For Management, 11e (Render)Jay BrockОценок пока нет

- Strategy and Control System Design Answer To End of Chapter ExercisesДокумент5 страницStrategy and Control System Design Answer To End of Chapter ExercisesJay BrockОценок пока нет

- CH23 PDFДокумент5 страницCH23 PDFJay BrockОценок пока нет

- Measuring and Improving Internal Business Processes Answer To End of Chapter ExercisesДокумент7 страницMeasuring and Improving Internal Business Processes Answer To End of Chapter ExercisesJay BrockОценок пока нет

- Chapter 6 Inventory Control Models: Quantitative Analysis For Management, 11e (Render)Документ27 страницChapter 6 Inventory Control Models: Quantitative Analysis For Management, 11e (Render)Jay BrockОценок пока нет

- Funding The Business Answer To End of Chapter ExercisesДокумент2 страницыFunding The Business Answer To End of Chapter ExercisesJay BrockОценок пока нет

- Accounting and Strategic Analysis Answer To End of Chapter ExercisesДокумент6 страницAccounting and Strategic Analysis Answer To End of Chapter ExercisesJay BrockОценок пока нет

- Internal Appraisal of The Organization Answer To End of Chapter ExercisesДокумент5 страницInternal Appraisal of The Organization Answer To End of Chapter ExercisesJay BrockОценок пока нет

- Standard Costing and Control Using Accounting Rules Answer To End of Chapter ExercisesДокумент4 страницыStandard Costing and Control Using Accounting Rules Answer To End of Chapter ExercisesJay BrockОценок пока нет

- Activity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing ApproachДокумент4 страницыActivity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing ApproachJay BrockОценок пока нет

- Control in Divisionalized Organizations Answer To End of Chapter ExercisesДокумент6 страницControl in Divisionalized Organizations Answer To End of Chapter ExercisesJay BrockОценок пока нет

- Capital Investment Decisions Answers To End of Chapter ExercisesДокумент3 страницыCapital Investment Decisions Answers To End of Chapter ExercisesJay BrockОценок пока нет

- Budgetary Control Systems Answer To End of Chapter ExercisesДокумент3 страницыBudgetary Control Systems Answer To End of Chapter ExercisesJay BrockОценок пока нет

- Pricing and Costing in A Competitive Environment Answers To End of Chapter ExercisesДокумент2 страницыPricing and Costing in A Competitive Environment Answers To End of Chapter ExercisesJay BrockОценок пока нет

- Standard Costing and Manufacturing Methods Answer To End of Chapter ExercisesДокумент5 страницStandard Costing and Manufacturing Methods Answer To End of Chapter ExercisesJay BrockОценок пока нет

- Traditional Approaches To Full Costing Answers To End of Chapter ExercisesДокумент4 страницыTraditional Approaches To Full Costing Answers To End of Chapter ExercisesJay BrockОценок пока нет

- Further Decision-Making Problems Answers To End of Chapter ExercisesДокумент6 страницFurther Decision-Making Problems Answers To End of Chapter ExercisesJay BrockОценок пока нет

- Questionnaire On EthnocentrismДокумент14 страницQuestionnaire On Ethnocentrismkalpa vrikshaОценок пока нет

- Scala and Spark For Big Data AnalyticsДокумент874 страницыScala and Spark For Big Data AnalyticsSneha SteevanОценок пока нет

- Project On Brand Awareness of ICICI Prudential by SajadДокумент99 страницProject On Brand Awareness of ICICI Prudential by SajadSajadul Ashraf71% (7)

- A Study On Impact of Acne Vulgaris On Quality of LifeДокумент7 страницA Study On Impact of Acne Vulgaris On Quality of LifeIJAR JOURNALОценок пока нет

- EAU 2022 - Prostate CancerДокумент229 страницEAU 2022 - Prostate Cancerpablo penguinОценок пока нет

- Woman Magazine Who Was Changing Jobs To Be The Editor Of: Family Circle AdweekДокумент11 страницWoman Magazine Who Was Changing Jobs To Be The Editor Of: Family Circle AdweekManish RanaОценок пока нет

- Assignment On Industrial Relation of BDДокумент12 страницAssignment On Industrial Relation of BDKh Fahad Koushik50% (6)

- HSTE User GuideДокумент26 страницHSTE User GuideAnca ToleaОценок пока нет

- L11 Single Phase Half Controlled Bridge ConverterДокумент19 страницL11 Single Phase Half Controlled Bridge Converterapi-19951707Оценок пока нет

- AttitudeДокумент24 страницыAttitudeisratazimОценок пока нет

- Eco SPARДокумент3 страницыEco SPARMohammad LabinОценок пока нет

- 02 - STD - Bimetal Overload Relay - (2.07 - 2.08)Документ2 страницы02 - STD - Bimetal Overload Relay - (2.07 - 2.08)ThilinaОценок пока нет

- Flexi Multiradio Introduction - Sharing SessionДокумент96 страницFlexi Multiradio Introduction - Sharing SessionRobby MiloОценок пока нет

- Read Me - CADWorx Plant 2019 SP2 HF1Документ4 страницыRead Me - CADWorx Plant 2019 SP2 HF1Himanshu Patel (Himan)Оценок пока нет

- Cash Management Bank of IndiaДокумент52 страницыCash Management Bank of Indiaakalque shaikhОценок пока нет

- EECI-Modules-2010Документ1 страницаEECI-Modules-2010maialenzitaОценок пока нет

- Flex Comp Gas Cryo Catalog 2013 AДокумент40 страницFlex Comp Gas Cryo Catalog 2013 ABenh ThanKinhОценок пока нет

- Presentation - 02 Reliability in Computer SystemsДокумент24 страницыPresentation - 02 Reliability in Computer Systemsvictorwu.ukОценок пока нет

- SCADA Generic Risk Management FrameworkДокумент49 страницSCADA Generic Risk Management FrameworkAnak PohonОценок пока нет

- PF2579EN00EMДокумент2 страницыPF2579EN00EMVinoth KumarОценок пока нет

- SRB 301 Ma Operating Instructions Safety-Monitoring ModulesДокумент6 страницSRB 301 Ma Operating Instructions Safety-Monitoring ModulesMustafa EranpurwalaОценок пока нет

- Ebook Principles of Corporate Finance PDF Full Chapter PDFДокумент67 страницEbook Principles of Corporate Finance PDF Full Chapter PDFmichelle.haas303100% (28)

- PepsiCo Strategic Plan Design PDFДокумент71 страницаPepsiCo Strategic Plan Design PDFdemereОценок пока нет

- Tween 80 CoAДокумент1 страницаTween 80 CoATấn Huy HồОценок пока нет

- Manaloto V Veloso IIIДокумент4 страницыManaloto V Veloso IIIJan AquinoОценок пока нет

- Media DRIVEON Vol25 No2Документ21 страницаMedia DRIVEON Vol25 No2Nagenthara PoobathyОценок пока нет

- Auto Setting DataДокумент6 страницAuto Setting Datahalo91Оценок пока нет

- Om - 3M CaseДокумент18 страницOm - 3M CaseBianda Puspita Sari100% (1)

- Argumentative E-WPS OfficeДокумент6 страницArgumentative E-WPS OfficeoneОценок пока нет

- Diesel Oil Matters 70 YrsДокумент1 страницаDiesel Oil Matters 70 YrsingsespinosaОценок пока нет