Академический Документы

Профессиональный Документы

Культура Документы

Group Critical Illness Insurance Coverage

Загружено:

AndrewОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Group Critical Illness Insurance Coverage

Загружено:

AndrewАвторское право:

Доступные форматы

Group Critical Illness Insurance Coverage

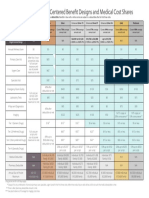

SUMMARY OF BENEFITS

Sponsored by: Hargrove Engineers Constructors

Critical Illness insurance coverage provides a cash benefit to the policyholder when an insured person has

a covered illness or event.

Eligibility All employees in an eligible class. Issue Ages 17-70

Critical Illness Base Coverage

Benefit Description Benefit Amount

Maximum Principal Sum Choice of $5,000 - $10,000 -

Employee $15,000 - $20,000 - $25,000 -

$30,000 - $35,000 - $40,000 -

$45,000 - $50,000

Spouse Choice of $5,000 - $10,000 -

$15,000 - $20,000 - $25,000 -

Spouse Principal Sum cannot exceed the Employee Principal Sum

$30,000 - $35,000 - $40,000 -

$45,000 - $50,000

Child 25% of Principal Sum

Child Principal Sum cannot exceed the Employee Principal Sum

Guarantee Issue*

Employee $20,000

Spouse $10,000

Child All Guarantee Issue

*Conditional GI subject to 15% participation

SM

Lincoln CareCompass Category

Critical Illness Assessment Benefit $75

Family Care Benefit (per insured dependent) $25

Heart Category Percent of Principal Sum

Heart Attack, Heart Transplant, Stroke 100%

Arteriosclerosis, Aneurysm 10%

Cancer Category Percent of Principal Sum

Invasive Cancer 100%

Cancer In Situ, Benign Brain Tumor, Bone Marrow Transplant 25%

Organ Category Percent of Principal Sum

End Stage Renal Failure, Major Organ Transplant 100%

Acute Respiratory Distress Syndrome

Quality of Life Category Percent of Principal Sum

ALS/Lou Gehrigs Disease, Advanced Alzheimers Disease, Advanced 100%

Parkinsons Disease, Advanced MS, Loss of Sight, Hearing, or Speech 25%

Accident 100% of Principal Sum

Lifetime Category Maximum (Category Recurrence) 100%

Additional Category Occurrence 100% payable benefit

Benefit Waiting Period None

Pre-existing Period None

Benefit Reduction 50% at Age 70

www.LincolnFinancial.com GLM-07012 Rev. 7/13 CI

Cost Summary - Critical Illness Base Coverage Cost

Employee premiums are based on employee actual age.

Spouse premiums are based on Spouse actual age.

Non-Tobacco Semi-Monthly Premium per benefit amount for Employee and Spouse

Issue $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 $50,000

Age

17-30 $1.66 $3.28 $4.94 $6.56 $8.22 $9.84 $11.50 $13.12 $14.78 $16.40

31-40 $2.42 $4.82 $7.24 $9.64 $12.06 $14.46 $16.88 $19.28 $21.70 $24.10

41-50 $4.59 $9.15 $13.74 $18.30 $22.89 $27.45 $32.04 $36.60 $41.19 $45.75

51-60 $7.54 $15.03 $22.57 $30.06 $37.60 $45.09 $52.63 $60.12 $67.66 $75.15

61-70 $11.19 $22.36 $33.55 $44.72 $55.91 $67.08 $78.27 $89.44 $100.63 $111.80

*Child Dependent coverage offered at no additional cost

Tobacco Semi-Monthly Premium per benefit amount for Employee and Spouse

Issue $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 $50,000

Age

17-30 $2.27 $4.51 $6.78 $9.02 $11.29 $13.53 $15.80 $18.04 $20.31 $22.55

31-40 $4.27 $8.51 $12.78 $17.02 $21.29 $25.53 $29.80 $34.04 $38.31 $42.55

41-50 $8.52 $17.01 $25.53 $34.02 $42.54 $51.03 $59.55 $68.04 $76.56 $85.05

51-60 $15.47 $30.90 $46.37 $61.80 $77.27 $92.70 $108.17 $123.60 $139.07 $154.50

61-70 $23.66 $47.30 $70.96 $94.60 $118.26 $141.90 $165.56 $189.20 $212.86 $236.50

*Child Dependent coverage offered at no additional cost

* The policy is guaranteed renewable. The insurer has the right to increase premium rates on any policy anniversary after the

Policys first anniversary, for all policies of like class.

** This is an estimate of premium cost. Actual deductions may vary slightly due to rounding and payroll frequency

Exclusions

A benefit will not be paid under this policy when:

A category maximum has been reached (for that Category, coverage will automatically terminate). If Lincoln CareCompass SM is the

only remaining Category, coverage will be terminated.

A new Category Occurrence happens within 90 days of another payable event in a different category.

A Category Recurrence happens within 180 days of another payable event in the same category.

Diagnosis occurs after policy termination.

The diagnosis of any Child Category event and or any Quality of Life Category event prior to the effective date of coverage.

An event was caused by self-inflicted injury, self destructive, suicide or attempting any of these, whether sane or insane.

An event occurs during the attempt or commission of a felony, whether charged or not.

An event occurs during an act of war (which is not terrorism), participation in a riot, insurrection or rebellion of any kind.

An event occurs while serving as a member of any armed forces or auxiliary unit.

An event occurs after the insured had resided outside of the US, Mexico, or Canada for 12 or more months.

An event occurs while the insured was incarcerated in any type of penal facility.

Accident Exclusions:

Additionally, a benefit will not be paid under this policy amendment when injury occurs due to:

Bungee jumping, parachuting, base jumping, or mountaineering.

Cosmetic or elective surgery.

Being intoxicated.

Having any sickness, illness (physical or mental), or infection independent of accident.

Deliberate use of drugs, poison, gas or fumes, by ingestion, injection, inhalation, or absorption.

Injury at work or in the course of employment.

Participating in, practicing for, or officiating a semiprofessional or professional sport.

Riding in or driving any motor-driven vehicle for race, stunt show, or speed test.

For assistance or additional information Contact Lincoln Financial Group at

(800) 423-2765; reference ID: HARGROVEEN www.LincolnFinancial.com

NOTE: This is not intended as a complete description of the insurance coverage offered. While benefit amounts stated in this summary are specific to your

coverage, other items may summarize our standard product features and not the specific features of your coverage. Controlling provisions are provided in the

policy, and this summary does not modify those provisions or the insurance in any way. This is not a binding contract. A policy will be made available to you that

describes the benefits in greater details. Should there be a difference between this summary and the policy, the policy will govern.

2014 Lincoln National Corporation

Insurance products GL51 are issued by The Lincoln National Life Insurance Company (Fort Wayne, IN), which does not solicit business in New York, nor is it

licensed to do so. In New York, insurance products are issued by Lincoln Life & Annuity Company of New York (Syracuse, NY). Both are Lincoln Financial

Group companies. Product availability and/or features may vary by state. Limitations and exclusions may apply.

Lincoln Financial Group is the marketing name for Lincoln National Corporation and its affiliates.

Affiliates are separately responsible for their own financial and contractual obligations.

Insurance products policy series WIND are issued by Lincoln Life & Annuity Company of New York, a Lincoln Financial Group company.

Lincoln Financial Group is the marketing name for Lincoln National Corporation and its affiliates. Affiliates are separately responsible for their own financial and

contractual obligations. Limitations and exclusions apply. For use in New York only.

www.LincolnFinancial.com GLM-07012 Rev. 7/13 CI

Вам также может понравиться

- 2022 Benefits Summary For FA EE'sДокумент6 страниц2022 Benefits Summary For FA EE'sFrancisca VigilОценок пока нет

- Pensionize Your Nest Egg: How to Use Product Allocation to Create a Guaranteed Income for LifeОт EverandPensionize Your Nest Egg: How to Use Product Allocation to Create a Guaranteed Income for LifeРейтинг: 3.5 из 5 звезд3.5/5 (2)

- Investment Linked ProductsДокумент15 страницInvestment Linked ProductsMay BucagОценок пока нет

- Swift Gpi Overview January 2019Документ20 страницSwift Gpi Overview January 2019Anuj AnandОценок пока нет

- PreviewДокумент6 страницPreviewHafza AbdiОценок пока нет

- Life Insurance Offerings Globe Life - Liberty National Colonial AflacДокумент3 страницыLife Insurance Offerings Globe Life - Liberty National Colonial AflacTina Hughes0% (1)

- FWDДокумент57 страницFWDLawrence SagabaenОценок пока нет

- Manulife ESP PDFДокумент31 страницаManulife ESP PDFTim YapОценок пока нет

- Fannie Mae Requirements For Document CustodiansДокумент48 страницFannie Mae Requirements For Document CustodiansDinSFLAОценок пока нет

- A Comparative Study of Loans and Advances of Federal BankДокумент95 страницA Comparative Study of Loans and Advances of Federal Bankpranoy100% (2)

- Project Report On E-BankingДокумент60 страницProject Report On E-BankingAshis karmakar100% (3)

- Axis Bank Mutual FUndДокумент76 страницAxis Bank Mutual FUndSuman KumariОценок пока нет

- OLDSTU PresentationДокумент18 страницOLDSTU Presentationkomla kofiОценок пока нет

- 2023 Talent BAAGДокумент3 страницы2023 Talent BAAGThi HanОценок пока нет

- 2010 UnitedHealthcare Benefits SummaryДокумент1 страница2010 UnitedHealthcare Benefits Summaryapi-27017317Оценок пока нет

- Prubuddy Brochure 2022Документ11 страницPrubuddy Brochure 2022Agbodeka PatriciaОценок пока нет

- Your Customized Benefits Plan at HCL America IncДокумент2 страницыYour Customized Benefits Plan at HCL America IncShiv RanjanОценок пока нет

- 2022 Steven Charles BAG - COДокумент4 страницы2022 Steven Charles BAG - COAlejuanchis Kamacho GarciaОценок пока нет

- Enterprise Holdings Benefits 2022Документ2 страницыEnterprise Holdings Benefits 2022meganОценок пока нет

- UserДокумент5 страницUserAldieno PribadiОценок пока нет

- EmblemHealth Benefits 2019Документ7 страницEmblemHealth Benefits 2019Jorge Luis Rivera AgostoОценок пока нет

- Life Insurance Offerings Globe Life - Liberty National Colonial AflacДокумент3 страницыLife Insurance Offerings Globe Life - Liberty National Colonial AflacTina HughesОценок пока нет

- Photon Benefits 2022 (August)Документ7 страницPhoton Benefits 2022 (August)sojithesouljaОценок пока нет

- SLI Frontline Heroes Brochure - TT 140820Документ6 страницSLI Frontline Heroes Brochure - TT 140820Kerwin CaesarОценок пока нет

- Isoa Hea OMPASS - 2016 - 2017 PDFДокумент13 страницIsoa Hea OMPASS - 2016 - 2017 PDFSharif M Mizanur RahmanОценок пока нет

- Housekeeping Matters: Please Silence Your Cell PhonesДокумент61 страницаHousekeeping Matters: Please Silence Your Cell PhonesSaurabh RajОценок пока нет

- Pet Insurance ComparisonsДокумент2 страницыPet Insurance ComparisonsHSVC50% (2)

- Income Disclosure Statement: JULY 2018 - JUNE 2019Документ1 страницаIncome Disclosure Statement: JULY 2018 - JUNE 2019tinotenda ganaganaОценок пока нет

- HPA00001134392 Mansfield PAC 3557 HP 1625 Coverage Selection FormДокумент7 страницHPA00001134392 Mansfield PAC 3557 HP 1625 Coverage Selection FormLinda MansfieldОценок пока нет

- Generic Open Enrollment KitДокумент22 страницыGeneric Open Enrollment KitSteve BarrowsОценок пока нет

- Snap Guardian Dental Plan Summary 2022Документ4 страницыSnap Guardian Dental Plan Summary 2022Samson FungОценок пока нет

- Manu 3Документ4 страницыManu 3Temp RoryОценок пока нет

- Compass: Gold / SilverДокумент16 страницCompass: Gold / SilverStan SmithОценок пока нет

- Great Eastern Travel SmartДокумент6 страницGreat Eastern Travel SmartHihiОценок пока нет

- Benefits Highlights 2018Документ5 страницBenefits Highlights 2018Marcus CosmeОценок пока нет

- Benefits Overview 2018Документ5 страницBenefits Overview 2018Joby JoОценок пока нет

- Index Rate Sheet 4-29-09Документ2 страницыIndex Rate Sheet 4-29-09PFIОценок пока нет

- Endowment Plus: A Unit Linked Endowment Plan Which Offers Investment Cum Insurance CoverДокумент11 страницEndowment Plus: A Unit Linked Endowment Plan Which Offers Investment Cum Insurance CoverSumit AnandОценок пока нет

- Schedule of Benefits 2023 (Including Covid-19)Документ1 страницаSchedule of Benefits 2023 (Including Covid-19)Sykesh BhivahОценок пока нет

- Harmonic ScalpelДокумент2 страницыHarmonic ScalpelHerman HalimОценок пока нет

- Federal Poverty Levels - CA 2023Документ2 страницыFederal Poverty Levels - CA 2023tata8125aaОценок пока нет

- Personal FinanceДокумент10 страницPersonal FinanceJovilyn WatinОценок пока нет

- Barbados NemCare Individuals Health InsuranceДокумент3 страницыBarbados NemCare Individuals Health InsuranceKammieОценок пока нет

- Cardea Schedule of Benefits Effective Jan 1st 2021Документ4 страницыCardea Schedule of Benefits Effective Jan 1st 2021Wayne GajadharОценок пока нет

- Afyaimara BrochureДокумент16 страницAfyaimara BrochureJoenathan EbenezerОценок пока нет

- Benefit at A GlanceДокумент2 страницыBenefit at A GlanceShiv ChauhanОценок пока нет

- Kaiser Permanente Compare Plans CA 2011 KPIFДокумент1 страницаKaiser Permanente Compare Plans CA 2011 KPIFDennis AlexanderОценок пока нет

- Summary of 2022 Benefit Changes: MedicalДокумент5 страницSummary of 2022 Benefit Changes: MedicalChinnu SalimathОценок пока нет

- SeKON Employee Benefits Summary 2016Документ3 страницыSeKON Employee Benefits Summary 2016Ali HajassdolahОценок пока нет

- Data About The College: College Return On InvestmentДокумент5 страницData About The College: College Return On Investmentsri krishnasОценок пока нет

- 2020 Health Benefits Table PDFДокумент1 страница2020 Health Benefits Table PDFTitoОценок пока нет

- KidAssure GIO Rider BrochureДокумент4 страницыKidAssure GIO Rider BrochureCC KosОценок пока нет

- PRUretirement GrowthДокумент32 страницыPRUretirement GrowthlongcyОценок пока нет

- Brochure PDF MANHATTHAN LIFEДокумент2 страницыBrochure PDF MANHATTHAN LIFEEmanuel ChirinosОценок пока нет

- PA One Pager EnglishДокумент1 страницаPA One Pager EnglishSMART INSURANCE SERVICES MSОценок пока нет

- Koti Personal Accident Leaflet - Round3 - Final - Highraise - 221214 - 153052Документ4 страницыKoti Personal Accident Leaflet - Round3 - Final - Highraise - 221214 - 153052nirav56Оценок пока нет

- Kaiser Permanente California Plans and Benefits Brochure KPIF 2011Документ6 страницKaiser Permanente California Plans and Benefits Brochure KPIF 2011DennisОценок пока нет

- Protect What You Treasure Most: HealthДокумент12 страницProtect What You Treasure Most: HealthNelly HОценок пока нет

- Participant DocumentsДокумент8 страницParticipant DocumentsSergiu EniОценок пока нет

- Bronze HSA 5000Документ4 страницыBronze HSA 5000Vasikaran PrabaharanОценок пока нет

- VRC-2301 (V10 Rate Card)Документ2 страницыVRC-2301 (V10 Rate Card)lead sulphideОценок пока нет

- Description: Tags: Table10Документ5 страницDescription: Tags: Table10anon-787868Оценок пока нет

- 2021 THNM Individual Health PlansДокумент1 страница2021 THNM Individual Health PlansSara SnowОценок пока нет

- Medical Comparison Chart 2020Документ3 страницыMedical Comparison Chart 2020hollingermikeОценок пока нет

- Family YMCA Financial Assistance 2023 - Annual IncomeДокумент1 страницаFamily YMCA Financial Assistance 2023 - Annual IncomeCynthiaОценок пока нет

- CARD MBA Presentation - External 8.04.18.pptx (Autosaved) PDFДокумент56 страницCARD MBA Presentation - External 8.04.18.pptx (Autosaved) PDFTherese Marie B. RicoОценок пока нет

- Health BillsДокумент28 страницHealth BillsBrian AhierОценок пока нет

- HNX Fact Book 2012Документ152 страницыHNX Fact Book 2012Thuy VuОценок пока нет

- LIC ExamДокумент11 страницLIC ExamumeshОценок пока нет

- Habib Bank LimitedДокумент16 страницHabib Bank Limitedhasanqureshi3949100% (2)

- East West Bank: H1/Q2 ResultsДокумент47 страницEast West Bank: H1/Q2 ResultsBusinessWorldОценок пока нет

- Invoice: PT Cemerlang MultimediaДокумент1 страницаInvoice: PT Cemerlang MultimediaDwiman Nugraha SutantoОценок пока нет

- Candidate Selected To Join Access Course-Rwegalurila.Документ5 страницCandidate Selected To Join Access Course-Rwegalurila.Rashid BumarwaОценок пока нет

- Banks On Second-Endorsed Checks Accept or Not?Документ3 страницыBanks On Second-Endorsed Checks Accept or Not?Vanessa May GaОценок пока нет

- Bank of Maharashtra ProjectДокумент43 страницыBank of Maharashtra ProjectNikhil BavaskarОценок пока нет

- Investment Operations Analyst in Chicago IL Resume Michael FreasДокумент1 страницаInvestment Operations Analyst in Chicago IL Resume Michael FreasMichaelFreasОценок пока нет

- Prevention of Money Laundering ACT, 2002Документ22 страницыPrevention of Money Laundering ACT, 2002Anrick AhmedОценок пока нет

- Research Report On Electronic Banking E-Banking ManagementДокумент5 страницResearch Report On Electronic Banking E-Banking ManagementshivkmrchauhanОценок пока нет

- 6th Oct 2nd LotДокумент12 страниц6th Oct 2nd Lotapi-3705615Оценок пока нет

- Multi-Purpose Loan (MPL) Application Form: MARCH 4,1988 Numancia, AklanДокумент2 страницыMulti-Purpose Loan (MPL) Application Form: MARCH 4,1988 Numancia, AklanVinz CustodioОценок пока нет

- Faisal Bank HRM SystemsДокумент31 страницаFaisal Bank HRM SystemsShoaib HasanОценок пока нет

- Opinion Reg Reconstitution OfpartnershipДокумент3 страницыOpinion Reg Reconstitution OfpartnershipNarayan ChanyalОценок пока нет

- Financially Yours: Assignment IДокумент3 страницыFinancially Yours: Assignment IDevesh Prasad MishraОценок пока нет

- Cbi 2010-11 Interim PDFДокумент426 страницCbi 2010-11 Interim PDFRahul KumarОценок пока нет

- Navpen-Navv@nic - in 180022056 - 0: of ToДокумент25 страницNavpen-Navv@nic - in 180022056 - 0: of ToPankaj TiwariОценок пока нет

- FinalДокумент80 страницFinalFardous ChowdhuryОценок пока нет

- Core Banking Solutions FinalДокумент7 страницCore Banking Solutions FinalShashank VarmaОценок пока нет

- Revisiting The Rules On Offsetting ArrangementsДокумент4 страницыRevisiting The Rules On Offsetting ArrangementsRufino Gerard Moreno IIIОценок пока нет

- Askari Bank Internship ReportДокумент101 страницаAskari Bank Internship ReportsolacuanОценок пока нет

- EastwestДокумент22 страницыEastwestgerrymalgapoОценок пока нет