Академический Документы

Профессиональный Документы

Культура Документы

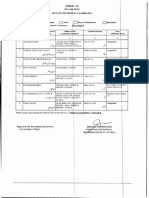

Inflow & Outflow Chart - Hill Metal & Gifts

Загружено:

سچ ٹی ویАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Inflow & Outflow Chart - Hill Metal & Gifts

Загружено:

سچ ٹی ویАвторское право:

Доступные форматы

INFLOW & OUTFLOW OF HILL METAL ESTABLISHMENT

1 3

AL-Azizia Steel Mill HILL METAL ESTABLISHMENT

Sale proceeds of Al-Azizia (6/6/05)

HME in Red till 2009

Al-Azizia sold for SAR 42 mn and not

First profit 2010 onwards

Not in position to extend PROCEEDS

Loans not incorporated at the time

of establishment of HME gifts owing to strict

restrictions by the Banks

Bank Loans

Al-Rajhi: SAR 35 mn (2008) Al-Azizia sold in 6 Jun 05;

HME was established in Returns

SIDF Loans: SAR 149.4 mn (2010/12)

Muscat: SAR 40 mn (2013) 18 Jun 05

NCB: SAR 102 mn (2014)

2 2a 4a

Hussain Paid up Capital SAR 120 mn (2011) Multiple transactions to Hassan

MNS (Sources not known) SAR 1,912,500

SAR 1,876,750

Hassan Net Equity SAR 204 mn (2011)

SAR 3.7 mn (2009-10) Refundable Family Borrowing Multiple transactions to HDS

SAR 40 mn (30/7/11) SAR 1,875,000

Sheikh Saeed Convertable Borrowing

SAR 60 mn (2009) SAR 560,000

SAR 60 mn (30/7/11)

Al-Jannat Transactions: Hassan Company's

4

SAR 1.4 mn (2009-10)

Capital FZE Dubai

SAR 3,752,300

HDS

SAR 2.4 mn (2009-10) Flagship Investments

Remittances from HME (KSA) as Gift

(RS. 1,165,655,303) SAR 36,271

Bank Record

FTT: Rs. 172.517 mn (2013-14)

FTT: Rs. 218.811 mn (2014-15)

FTT: Rs. 236.893 mn (2015-16)

FTT: Rs. 106.623 mn (2016-17)

IT Return Record

Remittance: Rs. 192.050 mn (Gift) Remittances from HME (KSA) as Gift

Remittance: Rs. 215.620 mn (Gift) (RS. 69.228mn)

Remittance: Rs. 234.600 mn (Gift)

5

5a 5b

Remittances from MNS

(RS. 1,004.042 mn) Declared land Holdings Property

1431 Kanal

Bank Record Rs. 32.059 mn (2010-11) Agriculture Land

Rs. 189.170 mn (2013-14) Rs. 74.055 mn (2011-12) (Rs. 804 mn)

Rs. 310.535 mn (2014-15)

MS

Rs. 104.111 mn (2012-13)

Rs. 172.522 mn (2015-16) Rs. 261.065 mn (2013-14)

Rs. 39.306 mn (2016-17) Declared Assets

Rs. 540.215 mn (2014-15) Investment/ Share

IT Return Record (Rs. 26 mn)

Remittance: Rs. 192.058 mn

Remittance: Rs. 310.535 mn

Remittance: Rs. 172.522 mn

CHRONOLOGY OF EVENTS

Stance of HN

As per CMA No. 432/2017, In 2005 Hussain Nawaz

set up a new steel manufacturing business in

Jeddah, Saudi Arabia by utilizing the sale proceeds of The annual cash flow and retained earnings from

the Azizia Steel Company Limited. It has been revealed that MNS transferred SAR Al-Azizia was sold in 06 Jun 2005, whereas HME HME enabled HN to send remittances to his father It has been in the knowledge of HN that his father

Total amount of sale proceeds were SR 63.1 million 750,000 to HN in Sep 2010 which was further was established in 18 Jun 2005; difficult to invest (MNS) in Pakistan cash amounting (RS. has used the gift remittances sent by him to

equivalent to USD 16.827 mn (2005) remitted to Hill Metal Establishment - case in point money in such short notice 1,165,655,303), brother SR 3.7 mn, HDS SAR 2.4 equitably strengthen the financial position of his

Funds from foreign banks sanctioned as Project Loan Whereas Hassan, Sheikh Saeed, Al-Jannat & HDS After establishment, HME remained in Red till mn, FZE SR 3.7 mn and Flagship Investment SAR sister (Mariam)

1 2 3 4

for HME includes SIDF - SR 149.4 million (USD 39 invested cash amounting SAR 3.7 mn, SAR 60 mn, 2009; first profit of HME was generated in 2010 36,271 Mariam purchased property (1431 Kanal

5

mn) in 2010-12, Al-Rajhi (SR 35m in 2008), NCB (SR SAR 1.4 mn and SAR 2.4 mn respectively to HME onwards From the year 2010 till May 2017, MNS received Agricultural land) amounting Rs. 804 mn and

102 mn in 2014), Muscat Bank (SR 40 mn in 2013) As per the accounts statement received from third Keeping in view the track record, it brings out that gifts of Euro 1.267 mn and US$ 10.148 mn from declared assets (Investment/ Shares) amountong

The baseline analysis of the agreement reveals that party, paid up capital of HME as at 2011 was SAR HME was not in position to extend gifts to MNS, HNS & HME. The Rupee equivalent of these foreign Rs. 26 mn

the Assets of the Company were sold for SR 63 mn, 120 mn and Net Equity was 204 mn (after adding owing to the strict restrictions by the Banks during currency amounts come to around Rs.1,165 mn. A total amount of Rs.1,165.655 million was sent by

however, after adjustment of SR 20 mn on account up Refundable Family Borrowing SAR 40 mn and that time Remittances of around Rs.69.228 mn were also HN to MNS as gifts and remittances from 2010 till

of outstanding loan liability, net worth came to Convertable Borrowing SAR 60 mn on 30 Jul 11 Around 89% of total net profit earned by M/s HME received by . Mariam Safdar (MS) from HME May 2017. Out of this amount, Rs.822.725 mn were

amount of SR 43 mn during 2010 to 2015 was sent to MNS through gifts More than 70% of these gifts were further gifted by MNS to MS during the same period.

Follies and remittances indicating his close association or transferred by MNS to the accounts of MS as gifts Consequently the declared land holding of MS

Retrieved document claimed that HN established beneficial interest in the company while a substantial amount of Rs.100 million was increased from zero in 2010 to Rs.804.424 mn in

the company in Jeddah having paid up capital of 120 Till the year 2012-13, the received by MNS from given as donation to PML(N) right before GE 2013 2016

mn, purchased land, bought machinery and HN & HME were declare as gifts whereas, the Around 25% of these gifts were withdrawn in cash Declared gifts were used to repay the amounts to

constructed grey structure; not possible in SR 43 mn same amounts were termed as remittances after while the substantial amount of gifts given to MS the person who gifted those amounts i.e. from MS

(justification required) the year 2013-14 in his tax returns (70%) was reportedly utilized for purchase of (Rs.24.851 mn) to MNS and from MNS (Rs.19.460

First loan alocated in respect of HME was in 2008, properties in the name of MS. This indicates that mn) to HN

however, the company was established in 2005; gifts and remittances received by MNS were

contrary to the claims of HN substantially used for acquiring assets

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Faisalabad Matric Result 2019 AnnouncedДокумент3 317 страницFaisalabad Matric Result 2019 Announcedسچ ٹی ویОценок пока нет

- Multan Board Announced Result of SSC 2019Документ897 страницMultan Board Announced Result of SSC 2019سچ ٹی وی100% (1)

- Full Text of Special Court's Verdict in Musharraf Treason CaseДокумент169 страницFull Text of Special Court's Verdict in Musharraf Treason Caseسچ ٹی ویОценок пока нет

- Dera Ghazi Khan Matric Result Announced 2019Документ1 963 страницыDera Ghazi Khan Matric Result Announced 2019سچ ٹی ویОценок пока нет

- BISE GRW Matric Annual Result Announced 2019Документ2 894 страницыBISE GRW Matric Annual Result Announced 2019سچ ٹی ویОценок пока нет

- Sahiwal Board Announced SSC Annual 2019Документ2 061 страницаSahiwal Board Announced SSC Annual 2019سچ ٹی ویОценок пока нет

- Sargodha Borad Announced Matric Annual 2019Документ685 страницSargodha Borad Announced Matric Annual 2019سچ ٹی ویОценок пока нет

- Muhammad Buksh Textile Mills LTD - (Assets Beyond Means - MNS)Документ1 страницаMuhammad Buksh Textile Mills LTD - (Assets Beyond Means - MNS)سچ ٹی ویОценок пока нет

- 172 ECL Fake Account CaseДокумент5 страниц172 ECL Fake Account Caseسچ ٹی وی100% (1)

- Avenfield Verdict 07-06-2018Документ173 страницыAvenfield Verdict 07-06-2018سچ ٹی ویОценок пока нет

- Punjab AssemblyДокумент363 страницыPunjab AssemblyKashif AwanОценок пока нет

- PunjabДокумент156 страницPunjabazharОценок пока нет

- Panama JIT Final Report Vol-IX (B) (Assets Beyond Means - MNS)Документ417 страницPanama JIT Final Report Vol-IX (B) (Assets Beyond Means - MNS)سچ ٹی ویОценок пока нет

- Hamza Spinning Mills LTD - (Assets Beyond Means - MNS)Документ1 страницаHamza Spinning Mills LTD - (Assets Beyond Means - MNS)سچ ٹی ویОценок пока нет

- Hudabiya Paper Mills LTD - (Assets Beyond Means - MNS)Документ1 страницаHudabiya Paper Mills LTD - (Assets Beyond Means - MNS)سچ ٹی ویОценок пока нет

- Panama JIT Final Report Vol-IX (A) (Assets Beyond Means - Other Respondents)Документ95 страницPanama JIT Final Report Vol-IX (A) (Assets Beyond Means - Other Respondents)سچ ٹی ویОценок пока нет

- Maryam Nawaz Annex B - (Assets Beyond Means - Other Respondents)Документ1 страницаMaryam Nawaz Annex B - (Assets Beyond Means - Other Respondents)سچ ٹی ویОценок пока нет

- Muhammad Buksh Textile Mills LTD - (Assets Beyond Means - Other Respondents)Документ1 страницаMuhammad Buksh Textile Mills LTD - (Assets Beyond Means - Other Respondents)سچ ٹی ویОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Prisoners RightДокумент14 страницPrisoners RightMaha LakshmiОценок пока нет

- Fundamentals of Corporate Finance 7th Edition Ross Solutions ManualДокумент10 страницFundamentals of Corporate Finance 7th Edition Ross Solutions Manualomicronelegiac8k6st100% (18)

- Twitter Thread By: History of RajputanaДокумент12 страницTwitter Thread By: History of Rajputanafreetrial dontbanОценок пока нет

- ProjectДокумент70 страницProjectAshish mathew chackoОценок пока нет

- PLMДокумент3 страницыPLMMyrna Coyoca AranzansoОценок пока нет

- St. Peter The Apostle Bulletin For The Week of 4-2-17Документ8 страницSt. Peter The Apostle Bulletin For The Week of 4-2-17ElizabethAlejoSchoeterОценок пока нет

- SDS Salisbury Rub Out TowellettesДокумент8 страницSDS Salisbury Rub Out TowellettesMarco Bonilla MartínezОценок пока нет

- Latah CountyДокумент1 страницаLatah Countyapi-129344665Оценок пока нет

- Allowable DeductionsДокумент5 страницAllowable DeductionsAimeeОценок пока нет

- Corruption and Indonesian CultureДокумент6 страницCorruption and Indonesian CultureRopi KomalaОценок пока нет

- Company PolicyДокумент58 страницCompany PolicyChitresh BishtОценок пока нет

- IDirect Brokerage SectorUpdate Mar23Документ10 страницIDirect Brokerage SectorUpdate Mar23akshaybendal6343Оценок пока нет

- In Re John H. Gledhill and Gloria K. Gledhill, Debtors, State Bank of Southern Utah v. John H. Gledhill and Gloria K. Gledhill, 76 F.3d 1070, 10th Cir. (1996)Документ26 страницIn Re John H. Gledhill and Gloria K. Gledhill, Debtors, State Bank of Southern Utah v. John H. Gledhill and Gloria K. Gledhill, 76 F.3d 1070, 10th Cir. (1996)Scribd Government DocsОценок пока нет

- 016 Magtajas v. Pryce Properties - 234 SCRA 255Документ13 страниц016 Magtajas v. Pryce Properties - 234 SCRA 255JОценок пока нет

- Grant Support AgreementДокумент15 страницGrant Support AgreementManoj MaharjanОценок пока нет

- INSTALL FFFFДокумент3 страницыINSTALL FFFFcomercializadora JySОценок пока нет

- Sample Answer For California Credit Card LitigationДокумент3 страницыSample Answer For California Credit Card LitigationStan Burman100% (1)

- The Carnatic WarsДокумент7 страницThe Carnatic WarsMohAmmAd sAmiОценок пока нет

- International Fuel Prices 2010 2011 GIZДокумент7 страницInternational Fuel Prices 2010 2011 GIZCarlos Cadena GaitánОценок пока нет

- 2021-06-07 Yoe Suárez Case UpdateДокумент1 страница2021-06-07 Yoe Suárez Case UpdateGlobal Liberty AllianceОценок пока нет

- Medical Certificate TemplateДокумент1 страницаMedical Certificate TemplateAnjo Alba100% (1)

- Assignment On Business PlanДокумент28 страницAssignment On Business PlanFauzia AfrozaОценок пока нет

- Civrev1 CasesДокумент264 страницыCivrev1 Casessamjuan1234Оценок пока нет

- Professional Ethics and EtiquetteДокумент14 страницProfessional Ethics and EtiquetteArunshenbaga ManiОценок пока нет

- Study Note 3, Page 114-142Документ29 страницStudy Note 3, Page 114-142s4sahithОценок пока нет

- Invoice Form 9606099Документ4 страницыInvoice Form 9606099Xx-DΞΛDSH0T-xXОценок пока нет

- Historical Sketch of The Rise, Progress, and Decline of The Reformation in Poland PDFДокумент460 страницHistorical Sketch of The Rise, Progress, and Decline of The Reformation in Poland PDFਸਾਦੇ ਪਾਗਲОценок пока нет

- Ancheta v. DalaygonДокумент2 страницыAncheta v. DalaygonRobert MantoОценок пока нет

- Lesson 08. Franchising - Sample ProblemsДокумент7 страницLesson 08. Franchising - Sample ProblemsHayes HareОценок пока нет

- Identifying Text Structure 1 PDFДокумент3 страницыIdentifying Text Structure 1 PDFUsaid BukhariОценок пока нет