Академический Документы

Профессиональный Документы

Культура Документы

Panama JIT Final Report Vol-IX (B) (Assets Beyond Means - MNS)

Загружено:

سچ ٹی وی0 оценок0% нашли этот документ полезным (0 голосов)

4K просмотров417 страницPanama JIT Final Report Vol-IX (B) (Assets Beyond Means - MNS)

Авторское право

© Public Domain

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документPanama JIT Final Report Vol-IX (B) (Assets Beyond Means - MNS)

Авторское право:

Public Domain

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

4K просмотров417 страницPanama JIT Final Report Vol-IX (B) (Assets Beyond Means - MNS)

Загружено:

سچ ٹی ویPanama JIT Final Report Vol-IX (B) (Assets Beyond Means - MNS)

Авторское право:

Public Domain

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 417

Investigation Report of the

Joint Investigation Team, Panama Case

Volume IX

(Assets beyond Means ~ Mian Muhammad Nawaz. Sharif)

Joint Investigotion Team Constiuted by the

Iimplementotion Bench ofthe Supreme Court ef Pokstan

vide Order doted Moy®,

——————————

IR (Q/PCHOT2017

ISLAMABAD.

INTRODUCTION

1. tts Onder die Anil 20,2017, the Honorable the Supreme Court of Pakistan, in

“alton tothe thinaea questions posed othe JIT fo investigation, task investigate the

case and colt evideree, iy, showing thst Respendent No. 1, orany of is dependents or

Tnamidars, owns, possess or bas wogited any assets or any interest therein,

“isproprtonate to his known mess of iam. The thitezn questions posed in the Onder

cect are inked with is nivel query

2. The nite twomonth long investigation proceeings have een focused on

tscetasing means of income of especially Respondents No. 1, 6,7, a 8, namely; Mian

‘awa Sharif Prine Minister of Pakistan, Ms. Maryam Saf, Mr, Hsin Nowa: Shit

and Mr, Hascan Nav, Shaif, respectively Extorsive bearings have been eld to reco

isements of the Respondents aa! accord them —opporiitics 9 provide

doeunentnfaton that may prove a plasile explanations fr amassing the wealth and

income. Al Respondents, as wel asthe persons connected with the afin of the Shari

family, who were suzmoned by the 1, dd tor could ot fuss relevant and eqs

information. ‘The record that was made available to the JIT by the Responds was 3

plication of ha aboady available, with very ew new documents made aval, in he

Honorable Cour thwugh their responses 19 the Constitution Petitions Np. 29 of 2016 et.

Not even emote content of plausibility was prove,

3. The new evidence collected by JIT (dscused inthe relevant documents ofthe JIT

Report Panana Papas Pakistan) is as une:

1. Conflemation ofthe beneficial ownership of Maryam Nava of BVI

‘eompanies namely: Nien Enterprises Limited and Nescol Limited by

the Federal Investigation Agency, British Virgin Islands - (Volume Vi

1 Confrmation of Chalrmanship of Mian Nawaz Shasit in offshore

company namely; FAE Capital UA. by Jabel Al Free Zone Authority

GAFZA)- (Volumes Vand D

ii, Confirmation of fet

1 salefparchase agreements submited

wa

yD) and

3

|. Confirmation of forgedtampered documents submitted as Destaratons of

“Tras bythe Respondent, by the forensic expert, UK. (Volume 1V)

4. The crvidenoe, epecilly pertaining to the Aven propeties at ()sbowe,

ndermines the saga of the Sharif family and questions the verity of the ene

ocuneaation submited by thm inthe Honorable Supreme Court of Pakistan in thei

oteace 1 justify the proportion of the income and the assets Ii etblised that the

ldo of Respondert No, 1 and wer his dependents they were minora with m0

independant soaces of income of thsi own and daring 1985-99 when Respondent No 1

catered into potcs. The goup of compunies owe by the respondent no 1 witness an

‘xcepional growth spur in ers of weath and income, The assets grew geometrically but

the doolod wean and known sources of Respondest’s No, 1 income vies the

retuns, company infomation, al bank account statements of Respondents collected from

«he FBR, SECP and SBP, respectively, tte otherwise

5, Te would bein the is af thing atin a spropotonate ass case sacha his,

tne Respondents shoud see recourse odcharging the burden fo prove th the ase ae

proportionate to known sures of income, I is up to the Respondents to establish beyond

reasonable dou, the valu ofthe asst poses by them and sources of neon fom

which hese were pcre. JIT does not live that ts necessary for the Respondent

provide an absolut estimation of thi income and assets but rather an explanation hts at

the lea, wasonable and worthy of secptance, It would hve sified o prove, relevant

income tax and welt saemests,seerate snd uptodate audited financial statements

showing the profits and income generated by compates incorporated Ioslly sl abrond

docuneted cash-ews; documentation of fcities underaken from fnanca nstations

nd thet repayment proof of collateraliecutyiguaranees provided for sscuring lets of

roi and other; documented cross-border ad ntercorporat transfer of fonds through

‘banking cannes, angst othe things, More apeifilly, proper docimesation showing

the exablishment an sale ot Gl Ste als, ALAM Stel Mil, nd AL-Aisia Sts Mie,

sources of equity sed for essblishnent of Hill Metals Fstblishnent Jeddah, KSA, ani

Flagship lavesmens Ine, and oer companies inthe UK, thir profitability and remitances

to Pakistan (detiledanalyyes of those isos re discussed in det nthe relevant volumes of

the Final Report of he JET). Yet atoter sea of obscury te dhe "SPVS" Special Pupone

‘Vehickesiotibore companies ied by the JIT Capital FZE, Chacon

4

\

Inc, Coomiber Ine, Nilson Enterprises Limited and Nescoll Limited and otter shelf

companies pooured i the UK, British Virgin nln, Ile of Mann, Jersey, ete. hich

played the role of combs fr tasting money wo destinations around the wok! or back

into Pakistan,

6 Neverticles, sn analysis ofthe tx and wealth etums, nancial statements of he

companies in Pakisan, bank secount statements and record of the Respondents was,

uadesahen to temp establish the money tll and account forthe build-up of assets in

Pakistan and abroad since the esablskment of Mafag Foundries by Mian Sharif and oer

assets which wereaesubrequendy managed bythe chien of Respandet No, 1. The

subsequent paragraphs present an expose of Respondents No.1, 6 7 8 nd 10 and any

person who had any ens with he asset scumaton with respect to hiss tax, company

aa aking cod

lent no 1 (Mian Maar

7. The avaiable ond shows that Respondent No, sted filing etums fom yer

1983.84. Complete rex of ax rma! wealth tateents wore not fished by FBR as for

aesoment years 199298 - 201/02 & from 200405 - 200708, wealth statements were not

“fled by Respondent Ne 1, wore so, TT ten forthe yet 2007 was no provided (dts ao

‘at Aauex A i his statement mde before the JIT on 5 June 2017, Respondent Not

category stated ts inal, he Bad ben a shareholder anor director in a few of he

companies estlishd by it Tne father in Pakistan, However, he bad not boss actively

involved in the busines of ay of tose comes sins th year 1985, He also tated that he

fad boca actively involved in politics since 1981 and has devoted it ene fife 0 his

‘cccuption sa poiticn. The se stance has ben ken by hin i various publi Pech.

His stance has also been sinforeod by Respondents 6, 7, and 8 in thee eonese statements

fled before the Honorable Supreme Cou, Gt ter filer (Respondent No, 1) bas no

concert role in thee busines and propertis. The JIT, ding the couse of investigation,

alysis of avaiable tx returns and walble financial details of his companies with SEC

State Bank of Pakistan (SBP) has come ars the following fs

Opening of accounts a5 CHO of Chaudhary Sugar Mills, During evaluation

ctor nee! em tv sy eT, nl

eremena sett nd Poin Gv

Srey eel on 1239 en

‘pei om i a ened tn

cra mea cup i Cty See

src (ht be met ping to fe en

poets Cure ut ast) Line wd aa

Cro tte ct Sap ts nin Ge 3 ie a a oe

peel Ora wei tipi loin

titan of et ot ne pening em fi

putes me ao z

Fae tay Rennes fs Rand a

wrseos a ae ee se st la

‘Sugar Mills Limited and adivess of taxpayer as ‘olo Chad suai Ma

“Limited, 146, Abu Bakar Block, Garden Town, Lahore’, It may’

sees Ren Ie 00 drs

if ao sect he

6

increas to 2,012,538 shares on 31-1-13 and 12 allo om 31-1-16 (Annex

Dp

Deawing of Salary from Chawdary Sugar Mili, While analyzing an

sccount tment of Respondent No.t (Annex), it was noted that during

2010 102013, he has esa ecivng regular slry from CSML on «monthly

basis (R624.372 milion in sgpregate) It was observed that ding 2010-1

snort of Rs, 560,00 per month was received by Respondent No. rom

‘CSML for nine months wile the amount was increased to Rs.800,000 pr

month cing 2011-12 Silay, Rx 20,47 per month was received ding

the fat 11 months of 2012-3. Contrary tobi pebly held stance that head

1 fle or involvement with the faiy business; be was drawing monthly

«lary fom CSMIL The rewing of salary from CSM i aso dselosed inthe

Income Tax ets le by hi

“Teanaton showing nvlvement wh CSML afae tn ition, couple

of nail tansetonsof spot No. with CSM were sto obs

600 28:6-2010, CSM ttre RsS.670 milion nhs account, Sina,

en 2350-2015, Rs 18019 wilion was transfered by responds No.1 (©

comL(ames

Capit FZE-Dubai: The Honorable Joie Yu-u-Absan in his separate

jndget specifically raed the iene of Capital FZE-Dubsi; The relevant

paras) are reproduce below

Quote:

2.1% an or eid postion tt Reson No 3m @ company

ter he name end slo lip esis ned which raced

‘hoi sa of money nthe ear 200 nh sl ape had

oe of cone. Ove he cnr ofthe ne fear amber of

her copra were er ple ver by Responder Na lege for

the pups hs eal ese bases, The owes fom wih he i

companies wert fone rs ded ty. hr

Jet amie company nr te mane and se of Capt FZE, Db

[esunably registered der the as of UAE. Funds also appge 0 HRA

brood og hed copy n't den hal

1

‘of Respandert No.7. The real ownership and business of the said company

isetear from the record whic neds to be explained. No effort hasbeen

made onthe part ofthe Respondent to amarer the questions onthe afore

ote mater

89, Rarer the source(s) of fing for Aisa Stel Mil and Hill Metals

atdlihoent in Sauih Arabia, Flagship Investments Lined and a

‘unber of ther companies set wlan over by Respondent No’ also

reed 1 be established. In adton to the as of Capital FZE, Dab

which als appears to be ned by Respondent No? mel an ingiry.

90. idence sll bso be collected bythe JIT regarding sorces) offing

of Capital P2E, Db; s business activites and ole in rans of ands

tw ferent entities ned ar controled by Respondents No.7 & 8

Unquot

‘As alse pointed ot by Honore Jastce aza-Ahsan the real ownership

and business ofthe sid company is unclear fom the reeatd which needs tobe

‘explins, No effrt has bean sade on the pat ofthe Respondents. The

noche use alan desir hat evidence to be ellested by JT eping

FE, Dubai its business activites and vole in aster of finds to diferent

nities owned or conolad by Respondents No. 7 and 8 These questions

vere psd tothe aforesid Respondents inter appesrances Before the JT:

weve, demi repeated request no saisfactory evidence was produced by

thew.

Hwee JT inthe couse oft investigations was sucessful in colcting

viens div fiom the conte Regalory Authority). Jebel Ali Free

‘one Autosty (AFZA), in Dubai, The evidence provided reveled that

Capital FZE was grated a Trading Licease, beating Registration No, 861, on

COcober 1, 2001. The license shows Respondent No, 8 as Manage. The

authorised activites included Metal Ores Tading, Bad Steel Prodoes

“Traig, Basic Non Ferous Metal Produt Trang, Fencing and Barbed Wire

“Traicg, Metal Ces and Continers Trading, Metal Alloys Trading ad Meta

‘nan Bartels Trang Fuhr, evidence ths procure reveals dat i

[Nave Sharif. Respondent No, 1, was the Charman ofthe Board for Capa

®

-F2E fron August 7, 2006 wil Apri 20, 2014 ata salary of AED 10,000

Furth, evidence reveled ta his slary was revisod on February 02,2007

vie Fnployment Contact Ansndnent ~ Form 9, daly signed by Respondent

No. I led with JAFZA. On the Basi f this employment Respondent No. 2

vas able to procure “igama dated 57-2009 and valid upto 4-6-2015 10

work anrl eside in Dub (Anne ©)

As dscessed in dtl dor the Sections covering Hill Metals Establishment

aac git between the Respondents, «payment of USD 100,00 fom he

secouns of Hil Metals Establishment 10 Capital PZE was noted in the

ocumeatsprocred depeing an evidence of rotation of money betwee

fanaly businesses

-Anothe: example of ration of funds bawoen the aeeauns of Respondents

acused in detail une the Secon on HEll Metals Establishment that

Responent No. | insted the Bane Manager AL Raed to transfer

‘SAR 750,00 fom his account No, 462 60801 34552 to Respondent No, 7

“Acooutt No. 46260801 0006782, Three, Respondent No, 7, othe same

Ay, trough an Advice dated Sept 20,2010 instated Al Raji Bank to

teaafr SAR 750,000 fr bis acount 462 60801 0067K2 fo Hill Metals

stablaiment (Annex H)

low of transactions es 6

Sighfiant infringes bave boon observed ducing detail seta of bank

accounts of Respondents No, 1 ad 6 Between the period of 2009 to May

2017, approximately Rs. L4 Bilin landed in Respondent No, 1's ben

sccout mal fom Respondent No, 7. Of these inflows, Respondent No. 1

trasfared Rs. 822.726 milion to the ascouat of Respondent No. 6. For

els reference t0 the Section covering he issue of git! remittances is

sade

isla at ‘tax Year 2003

soncesiment of Rs 45 milion by Main Nawaz Sharif: As per Ws

‘of Rs 100 million was shown as donation given to PML (N). Thi Et war

cooboratd by the J from he statement of Wealth of the seve”

2

‘(Aone During analysis of account tment was also observe that an

mount of R45 milion was tansfered back bythe PML (N) on 10-6201

to Respdent No4 (Annex J) This inflow of RAS milion, although

‘reflec inthe eount statment, was ot dislosed inthe Wealth Statement

enc, appear tht he Respondent No. J not nly eanceaed his set 1 the

tue of 845 milion bu also mreparted in the Wealth Statement forthe as

‘year 2013 submit under Seton 116 ofthe Income Tax Onnance, 2001

1k Respondent No, 1 in his adress tthe nation and speech on the for ofthe

Nationa Asetbiy laine ha hi father owned ution rypoes eset in

the 1970's before the indsey was naonalized; a clip that cannot be

sceraned throgh his personal Tax retusa wells ofthe parents. Refer

t» Annes Af Volume XA).

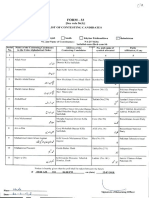

‘Years Teta West o Man Muhanad Shot

Bog

III IIE

“The recon me availble othe JT by the SECP (Geils and misstatements made

by SECP with regede to provision of document information is attached as Annex K)

revealed det saretolding of Respondent No, Lasunde=

‘Nam of Companies ‘Years of Starch

‘Cnalay Supt Mile Limited | 2090-2008, 2010-2013

‘ommnod Buks Texte ils |BOU2015

[hci cP Lod |

i

19921994 1

TE, 1986-198, 1990/1984

| i Ta

eS

ir)

TictagSoudies Pivaie Limited] 1980-1995,

azan Sugar Ms Lied Toon 9s

Tiig Sagar sini DRDO

Fwd Paper Mis ima ‘20107018

THodabiya Engineering eve Lined | 2070-2016

Tyas Fates Private Lied | 1986-1995

Teta Tele Mis inte T9719 IOTG, TTS I980, 186,

1s-19s9,1902-1994. 1998

‘Migfngoundeies (Private) Limited. Te comrany (incorporation on 6 Now

1962) was the firs company incorporated by Mian Mukamunal Sharif shares

were equily dstribted emongs seven brothers (Annex L). 12 1966, 100,

shares f tis company were alloted to Respondent No, thus he became the

ag

Direte of the sid company. Trend of loans ebixned against

ound from 1972-1992 isrefecte prapically below.

“ronof ens gant tela Foundries PARin Me)

Pa» satioaiaton ofthe ergy io 1972, he ak oa was RS 47

ilo towevs fer eatnlation fh company in 1979, oe of

omoiy wat Rs 70 iio, Mosover, he mil conpay bind thes

Tous and repr i foun Uiy f Re. 752 lion in the yea 199

Shaul, than ably was et Ni in ya 1992 allows

ys in 1 CC 9

209; CO 2395) and ssvey ais 9098; 38054 35904, AE

vot he Conan in 16 ts einen oetion ee Resp 1

i ot provide any Saal statements ofthe sid company 0 ren

Coy

n

Responcet’s No, {sk ote potiteaferetfont of Pakistan, especialy fir

1985, his company obtained subtatillons. Thera, the sid company

‘eas usb to py off its Hibilties, thus, wining up patton and recovery

suits wer filed sins the sid company in 1996, From te aforemeatione,

appears that Respondent No, {wed he

‘Morea, msjrshreioling was kept inthe names of eter faily members

‘oF Resoent No.1 it would se, 1 avoid any dec conection wih he

ins asin thereof Tn foundation for uch veatres was aid by tng

Found (Private) Limited.

ing scheme to accumulate weal

Wc Tene Mil Limi, tng Teste Mis Limited as ncorport

an 30-api-966 (Annex), As pr te aval nfrmation provided by

SCP, the saeoldng ofthe Respondent No was 096% shares end he

remind distor of the Company in he yar 1972 on 1986 t 1988

{Chief Minster Pu. The fou review of the avaible resort /

infnation sbowed tain the yer 198, the Company basa negative equity

of a 4 millon and ttl ast of RS, 1,132 millon, The Company bas

ites ward reed pts amoung 0 RS. 286 milion a seals

fre ete pti wos Rs, 448 ion, Te sabe eo evel ne

men of dividends by tis company ding the prod of Respondent No

Tel ses; and (Di we me, if ot then pean Teves euThe

copays profits dd mt canbe tovals the weath acumulision of

Respondent No, 1. The inate of his company ing tepid

‘win Respondent No, deere as eling pola fig of akan,

thas find eon compay tha is rina fai, mainly wed ove

Suns yet bloom he company sigue telow

‘defn Brothers (Private) Limited. lef Brothers (Private) Limited was

Incomperated on 23 May 1972 (Amex N)- The aviable record ofthe sid

company showed Respondent No.1 to be the sharholdr (ranging between

5% 035% since 1973 othe ast nul return receded in 1998 and estor

cf the Company fom 1973 to 1986, In 1981, Itefig Brothers (Pvt)

miedo ability OF RS. 15 million (an inert fom Rs, 2 milion)

vty a paid-up capital of Rs. 115 millon, A sini ptr of Taming ws

seve after 1986 (hes he prominely had riven on dhe pote! freon

‘of Pokisan) the lonns due bythe company were reported obs Rs, 210 milion

in 1987 and Rs. 236 milion the following yar. Hower, in 199 ll 1996,

the Jan ibis were epried at NIL, The company epertedly had nealve

cuily and no dividend was paid 1 the shareholders, The ssid company

salsequenly fled a Windingsp Petition CO 69S and Banking Taibanal

Suit 1095 followed therentr (Did we ask The available revo reveled 90

syne of dividend by ths company during the period of Respondent No. 1

‘eld shares ofthe eospany. Aer, Respondent's No.1 ite the pottica

focefint of Pakistn especially after 1985, his company bined sulstta

Ions. Threat, the sd company was unable to pay off iit ts,

windog op petition and resoveey suits were fled against the company

Respendent No. Idd ot provide ny poi eco! ofthe sid company

to jus the jcome ear om it.

‘Mefag Sugar Mile Limied, Inefag Sar Mis Limit was incorporsed

cy 04-May-1982 (Annex O), Respondent No, 1 was holding nominal shares in

‘he company as hs maar sarbolding was 188,000 shares in 1989 which

eolne! to only 1000 shares in 2007 whores Infiq Founis Private

Lied and nef Brothers Lined remained major shreolders in he sid

Company. As per te silable information, te company hada pup capital

of Rs. 56 milion from the years 1982-1995, In the initial year, the sid

‘company borowed finds ffom Sinncalisittions, which increased fom

NL toRs. 248 millon in the year 1983, and ot

lion in 1982 to Rs 360 millon in 1983, Ii pertinent to mention tat its

‘one ofthe very few eompies ofthe Shai group tat made pros however,

the sid eompeny dd ot pay any dividend il the year 1988 and thereafter 0

cts ierased fom Rs, 27

substi income cou! have been eared by Rexpondent No, 1 fem his

compary due to his nominally changed shrcoldng. The avaible record

revealed no payment of dividend by during te period of Respondent No.1

‘wus blding shares, I ean be concluded tha his compan}'s profits did not

contribute towatds the wealth accumulation of Respondent No,

Ramzan Sugar Milly The Company was inorporsed on 4Aug-990

(Annex PAs pr the avaiable information, the sarebolding of Respondent

No 1 aang-with his wife ad eile was 10% ors 1993 to 1996 and about

8% rm 1996 o 2014, Dating te afore-mentioned period Respondents No.7

& 8 rerined asthe directors ofthe Company forth year 1999 0 2001 and

2004 4 200. In 2015 onwards, the faily members of Mr, Shaaz Shait

became the majority shrcholes of the Company and th shareholding of

Reson No filed o NIL The Bia vet avlele

coat infomation reveal hat the Company was ini in losses and the

quit emained neptive for he yes 1992 to 1995, However, the Company

boctne profitable and as por the 2015 financial statements te Company's

xt improved to Rs. 875 milion. The aval ecord reves no payaent

of dvilends by this company during the period of Respondent No.1 Holding

significant shes. The company's profits did ot contibut towards the

wath accumulation of Respondent No.l Ithas been observe that his isthe

only Pokisan-Snsed company in which the Respondent No.1 alongwith his

Fanily members were shareholders end is equity relatively improved over he

yews

iia

1, Chaudhary Sugar Mis Limited Chaudhary Sugar Mills Lite is reported

tobe insorportd on 05-Aug-1991 (Annex Q). As per te lermaton made

availibiy Respondent No, 1 bel approxinsely 78% sates oF Chauthary

‘Sagar Mills Liited since 2000.

o

eo

11992, the said company morgage is roperies located at pant site

1 Toba Tek Singh to seoue ¢ long-temm monbaba finance fom

Faysal Al simi of Bahrin B.C amounting to Rs. 309313 milion

However, Company's operating fied sets were RS, 15.587 millon

only and Re. 652.064 milion were disclosed as “workin progres.

Moreover, a amount of Rs, 28.241 milion fongerm loan was

secured ftom Fit Hajvery Modarba, In vow of the fat that he

Company's operating xed assets (oer han work in progres),

bomowing unde morababasppeas tobe a sispicious eringement a5

caret aee were paced a ees forthe long-term mob Ln.

wove athe Snaealyear 1993 a long-emfoan see fom

Faysl Al lif Bann as tied and on was swapped with

bianng lan anounng Rs, 401.257 milion (USD 1520 ition)

fro Chadron Joey Limited 8. Helles, Jersey Island, a company

incomontet in Chtgel Ind, Foreign pvt loan se fom

Chao Kersey Limited won sce titres ato 10% per nh

eysble 10 fxs comnening fom Ose: ACCRA

However, 36 pet fit splomenl eter of Bypotecktoh ded

Janaary 30, 1995, payment schedule revealed five {ines

‘commencing fom 1985 and ending on 1998 \

6

(2) The avllble financial record ofthe said compar revealed that oly

Aividends of Rs. 1368 milion were declared! pid dividends during

9951989 Howeve, no evidence of Responat No 1 bolting sats

faring this poriod fave boon reported. urhermore, nani

statment ofthe ai company donot provide any specific iscosure

that Respondent No. 1 was drawing any emluments! oer benefits

‘om he Compe.

i (Alter, Respondat's No, 1 ise tothe pola fretioat of Paisan

1 specially ter 1985, ths company obtained substan lars

(6) From the aforementioned tappems that Respondent No. 1 and his

family members used this company a

|: wealth, Moreover, jr shareholding was kept inthe names of ote

fanly members of Respondent No. | to aveid any diet onnection

Touning scheme to secu

Muhammad Boks Textile Mis Limite The Company wos incorported

I ‘on $Sep-1991 Annex R)- Aspe Hanna statements 0 2015, the company

id oot commence operations of the business sine incorporation, Moreover, i

| ns been observed tha the company submited he accounts for the years 1992

i 1 200) in your 2002, Respondent No, 1 slong with is len an wife held

22.30% shes from 1994 to 2015. The majory of shares were el in the

i ame of Ms, Shani Athise (water of Respondent No. 1) holding 26%

shes Invi shareholding ofthe Respondents ae lows

(0) Respondent No: 6% fom 20 10 2015,

(2) Respondent No.7 6 frm 19540 2015

| (©) Respondent No. 6% fom 199-96 an 1% Fou 1997 fo 2015,

4) Repent No.6 64 om 1998162015.

“The Company has bes dormant sine incorporation as never

v vntl nd has mie ei The fl po

Coney ds ve yen wah

neste Gc pte op eso

Mdabiva Paper Ms Limited. tHobiya Paper Mills Limited was

incompoted on 29-an-1992 (Annex 5) (tailed analysis in Volumes).

o

®

‘As 0n Octobe 31,1992 the comany’s fixed sets amounting to Rs

38708 milion and its Fng-erm secured loans were Rs, 184247

rillion, which coukt have bees possible by pledging any other aset

‘tat ha ot been dislose in the nani statements. Moreover, 1993

was considerably variant fina! yeu for the company as ding the

same yea, the sid company had longterm secured eens of Rs

2357729 milion, shot tem finaoes of RS, 126619 milion snd

fenemted Re, 126024 milion fom associated undertakings

Furtiermore, the company secwed «Youn amouating to USD 10

nilion fom AbTowieck Company for Invesinent Funds, Bahmin

‘heough AL-Bania Islan Investment Bank Lahore on November 23,

192,

tis prinent omtion ere hat the said eompany didnot reveal any

lace on the legil proceedings of Queen's Bench, London

wechy the Avetild apron wove tached the Finns one

2000, the Company disclosed hat laites (lating to AL-Towfbek

Company for Investnens Funds Bahrain) were seed for USD 8

of financial statements fr the year ened 2000, ong

494.960 milion was disclose.

oe

o

©

©

8

‘The stance of Respondent No. 1 and his family members while

reponding t petitions CP 292016 & CP 30/2016 have been that

(tars Prince Hamad Bin Js bin abor AL-Thanj sted Toa ofthe

ssid company with AL-Towicek Company. This stance hs nt been

subsanisted though any documentary evidence of treptction or

seangement by the Respondent No. Land his fanily members

1s noted that share deposit money of Rs. 642 milion in 1998 was

rece inthe acounts of the sid company. This is contry to

adverse Sana postion ofthe ssid eommpany as at tha ine the id

emnpany ha negative equity oF Rs. 772 million and operations ofthe

ssi company hid already been shutdown. The sid company went

to negative eqiy in 1994 and closed its operations in 2000

ceumulted loses were Rs. £7,810 million as of fone 3, 2005 Last

ilablefnancil sttmeats were filed for the Finacial year 2005,

The Company did not file is accounts forthe year 2006 and for

ebsequent yeas.

‘the Respondent No, 1 and hit family members filed to substantiate

hei tance through evidence that Qatar's Prince Hamad Bin asim.

‘in Faber ALT’ st lun of AL-Towféek Company agains the

ssid company and twas disclosed in Noe 3 t Hansa staements for

‘th year 2000 that Jong tem loan was converted at Rs. 53.80 pee USD

for USD 8,000.00 substitatel loan. The atl bility teenie was

fe Rs, 494960 milion but nity oF Rs. 430 millon a he given

USD conversion sate was reported oe sted

From the aforementioned, it appears tat Respondent No, and is

family members use hs wou 29 medion to evo fade a

sccumuate wealth, Mowover, major surebolding was kept in the

ames of oer family members of Respondest No, 1 0 avoid any

let comnecton with the pi tind threo

nginetng Company (Privat) Mills Linited was icorpoted on 12-May-

1992 (ames D,

(1) As yer the cet te copes of the annual retums provided by

SCP, Respondent No, 1 long with is citren owned 22% shares

from year 2000 t0 2009 and 33% fiom year 2010 10 2016

‘Sharsholding pattor oft Respondent i follows

(Respondent No. I: 11% bolng fom year 2010 il 2016,

(©) Respondent No, 6 6% olding fom year 200 2016.

(© Respondent No.7 12% holding fom your 200 il 2016,

(2) From the analysis of avilable dita, the equity of the Company is

ete by Rs AD niin in 1998 and in 2014 was negative Rs, 151

rilion. Additionally, shire deposit money of RS, 69 milion was

otc inne 2014 accounts ofthe company. In 2014, related pat

tiabilty o Rs 159 lion was payable by the sald ebmpany.

6) However, om the werd eopes provide by SECP fom

the yer 199 997, th cai om ete pry companies

and sponsors wer Re. 242 lian 1s ao sone that Be ot

‘ots in ese years was Ra. 112 millon and he company advances

snout Rs 2€2 milion Ine yet 207, the Company hailey

anion sn mere al Det ith no prise ep Toe)

true ard vel no payee viet by hs compan)

20

Similaiy negative Equity was repoted in the finacils of the

‘exmpany, hence, it eppeat tht Financial perirmance ofthe Company

could not ont to the intese of weath of Respondent No.

ating Pas

‘Brothrs Stes! Mls Limited, Brothers Ste] Mills Limited was incomporated

‘on 28-1983 (Amex U). The only Financial latements avaiable with UT

wer 1985, 1986, 1987 and 1988, The company with a eumulative poston

of pofvloss during this period had loses of Rs, 125 million Iefaa

Found Private Limited was a major super of te Company. Brothers

Stes Mills Limited had oustanding redeemsbl capital of Rs. 42.227 milion

in 198, The Company proposed couvetible preference shares of Rs 11.797

tli, Redeemable Capital was tsved in the names; LCP Rs. 11032

rilioa, NIBP Rs. 6.154 milion, HBL Rs 6.154 milion, UBL Rs. 6.154

nilon, MCB Rs. 3.692 million, ABL Rs 2461 aillon and NIT Rs

6580 million, Fata, has bon ted tha sponsors foars amounting 1 RS.

11.290 milion (1985; Rs, 1.533 millon). It is noteworthy, that despite

signfeant sales, Brothers Stee! Mills Limited resorded loses and did no

ect dividends, The availble record reveled non-poyment of dividend by

‘his company doring the period of Respondent No.1 holding significant,

sharsholding

tn 19 tence of Regn No.1 ws R274 ass el wath

sere R546 million only.

using 1991-92, tansctions worth milions of US doliars were routed

through Benar’ accounts in the business of Shari family an amounts were

‘aves ino business at easily to increase the personal wel As these

transactions were roued though Hanami accoun, bene, there was m0

foot in the Tax Returns, Dea statements of Benn acount lead

sult ia Second Ler Report of IT

From 1992 10 1993, his wealth gow Som Rs 8.33 milion to Rs 6.027

milion witout any éelared plausible source of income. Mores, neame

decid by Respondent No, 1 in his tx rts was not commensurate with

is and his fly profi

‘earls Growthin Ase of

Respondent.

2

Inthe sane yar (199293), Respondent No | dectared talasts worth RS

(027 in his Reta of Weah Tax, wheres Wea Statement reed

asscts woth Rs 5.328 mili His income dst at complement is acy

to pay be tox on atts wort RS 68,427 milion while ketping in view Bis

expenses a well, Reta of west tx and wealth iaeent fo en 99293

isat Arex V

Since anessment year 1991, Respondent No. 1 was Hnking assets inthe

umes of minors (Hassan Nas and Asma Nawas). Ducing esesment you

199091 the value of these assets was declared as Re SOROS which

apprised to Rs 63.97 milion assesment year 19923 without any visible

inflow. Retum of wealth ox fr assesment years 1980/1 al Annex W, era

cof wealth x for assessmen: year 1992093 is at Amex V.

1 the year 1994-95, be pi Rs, 3.0 milion as wealth tx, however, visible

income was Rs. 5000! According 4 the statement of personal expenses

(aamesed with wlth statement) oven bis pesona’ fly expenses were

tome by his sine inlaw, Ms, Sabiba Abbes. IT rtm and statement of

person expenses for year 19985 is at Annex X.

nthe yeas 199295, tot wealth mx payable was Rs. 4561802, whores

‘ota wealth tox pais per wealth tx retums forthe same period was RS.

2,352,682 A sum of Rs, 780,977 was elamed a refundable tax 2 feted

in weath tox return of year 199-95, Thus, gap of Rs 2,208,820 in wealth

{ax payable fs noted during the period, Wealth Tax Retwas for assesment

‘yest 199293 at Arex Vand Wealth Tax Returns frasessment years 1993 ~

D5 area Annex Y,

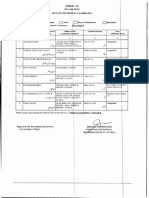

“Aewcoracat Year [Payable Tax [Tax Pad] Refund aimed

i929 16739 [0 0

Taam Tsim |e

nos Taussos [eae [780OTF

a

‘Aspe final dis of Itefag Sugar Mil Limite, Respondent No. | was

ong 8,00 shares in the years 2003 and 2004 and 1000 shares rom 2008 -

2013, hmever, he did nt dvlre ownerhip of hese shares in his wealth

stems for sid ox years, Wealth statement for years 200203, 2030,

tex yeas 2008/09 2011/2012 and Form A/29 of Iefag Sugar Mills Lined

forthe same years and Wealth statement for asessment years 2012/13 at

Annes 2

In ysts 2004-05 o 2007-08, Respondent No. 1d not iis wea rtm,

‘Since yar 2008, weal started to pour inthe form of Reavy remitances rom

‘soir Nawaz nd HL Mas Establishment (KSA) Funds worth Rs 1.083

Bh woe rete into peonal account of Respondent No. 1. Thave are

noma in these transactions which do not recone with the amounts

lara nx rtuns

Yer [Inflow iinow—‘Dilference” | Remarks

@ank fovea,

Statements). | Statements)

oe.i0 [Tara [128917 [1319] Fron Hasan

sailion | millon fii | Nawaz (KSA)

iacaao Pas 556

rill anion | milion

oii?

pons [aRzaT fons Tea

milion | milion | milion

2018 aia Vara

reilion | milion

mae jigs [i908 Pea] Wea

rilion | milion milion | Estabishments

norris panes pee — fae

rill nition | milion

BaIs6 | oats | 23eaI0 PAST

riton | ulfion | milion

Taio [TiaTasT —[sr93

nition — million | miton

2%

‘As pee financial reonds of MBTML with SECP, Respondent No. 1 owned

467,950 shares in 2011 but were aa doctared in wealth sateen fo tx Yer

2011/12, Westh sateen for 2011/2 a Annex A and MBTME, Foon Ay

29 ae Armex BB

Lom vorth Rs 110 milion wae taken from Ranwan Sugar Mills by

Responeat No, | between 2001-03; ot of theft, Rs 50 million was pid

‘yy Ronan Sugar Mist» NAB on account of Respondent No, 1, These

‘abs of RSM were st inthe year 2011/12 witout any visible sourwe

of income, Wealth statement of Respondent No.1 fr the yer 2011/12 a

|Annok AA, scout statement of RSMIL and document of NAB is at Antex

ce.

In year 201213, property worth Rs 63.75 million in Change Gali was

echusd by Respondent No. 1 t0 be i the ame of spouse in his wealth

statement, however, se didnot reflect in wealh statements of Kalsoom

‘Naw fra yeas 2013/14 ~ 2015/16, Wealth statement of Respondent No, 1

forthe year 201213 is at Ansex Z, West statement of Kalsoom Nawaz and

Respondent No.1 orth year 2013/M 2018/16 are at Annex DD.

‘As prtax etm of year 2012-13, Respondent No, 1 gave Rs 100 milion a8

Ahopntin to PML (N) on 30 Ape 2013. Reporting ofthis ety in Reta of

Peon Asses (ROPA) in ECP neo tobe countershesked

‘By yar 2013/14, eses of Respondent No.1 grew 6.59 times ence compared

‘vith his assets of year 2008 (Rs 55 milion in year 2008 to Rs 399 milion in

‘year 201213), Majo sure of ncease was it amounts seat by Hussain &

[ME Hil Metals Establishment from KSA fs 47.3 milion hi 2009-1.

roth of Respondent No.1

moi won wa waAL wee mE

ae

etensesefwetattenen) ctintows!!7/

2s

Inge o it woth milion of apes observed fom Mr, Hussuin & ME

to Respuadent No, 1 aed Maryam Nawaz and Respondent No, 1 0 Hassan

‘Nowaz Itt an sbnorml pation of exchanging gis 8 why a company would

it sot heavy amounts to individ, idence or profitability of IME. wax

rot fried; hence source of income of Husain could nat be asprin,

Heavy afte inthe form of cash ries eyebrows ikelyalempt of money

laundering nl of gis thelr stsbson/wtliztion iat Annex E.

4. Canetusion. The fats provided by Shari family show that Respondent No, 1,

twtensily fas conn his sole to tat of sn equity Roce only inthe fmily owned

Iusoeses, who does ot bald any forma psi oole in runing the busineses and is wot

iter om ny Hoan, Apparel the objective of such tance is to dstane binsel fom =

Foxmal roe in rnin ofthe businesses jn strictest elton and fel venue. However, on

the cater and it is ao evideot hat hei exjying pocunary benefits, ter than dividends

fom these businesses in the shape of unexpained inflows ia his personal bank accounts, on

futly regular basis, fiom the business profits of his son and businesses ran by hits

purportedly gifts

4. The evidenoe collected evens hat he, in fact, was the Chairman of the Bosrd,

zawing salmy from Capital FZE; a company owned by his son Respondent No, 8, is at

‘atiace withthe sane tken inthe CMAs Sed, by Regpondents No.1 6,7 and 8. This act

‘vas nt cose in ny latory retursdecaations before the authorities in Pakistan; be it

te Income Tax ears othe Filings before he Election Commision of akin.

5. Respondent No, [in his tox returns ied before the authors for he year 2013,

‘aimed to have made a donation of Re, 100 milion to Muslin League (N) an conceaing

the fact that he esi back Rs 4S milion from the sme party scout, before the close of

the relevent Fine year nd sous to mis-deokation of wealth

16. The above fits depict that Respondent No. was enjoying monetary benefits fom

‘ne fly busiest, ther shat dividends im bis declared oepacty of equity holder

Moreover, he was msntining. a stve operational ik with is family owned businesses,

contrary to his publ bei position that be snot actively involved in the ai

sv is devoting hist life to hi ceupation a8 politi. y

cee

7. As per clans of Mian Nawaz Sharif his business empire! assets i bse oi

inherit money fro his father who omnedillins of Rupees inthe 0s, The fiancia

2%

snatysisof Mian Mutanmad Sharif doesnot substan his clam. An exorbitant hike in

Inldup of his assess observed daring his Fst tenure of pms, however, inflows

mentioned in his tax returns i aot commensurate with his growth wich leads the

resumption tht this empze was not hesed on legal monetary soues. An atomly of

opoing Benoni accounts inthe names of Qui family, Saeed Ahmed ete, and source of

inflow in these scout was not lied by the Respondents, These Bena recounts were

‘sc as collateral for testo of loans and also for moving funds broad to build Sharif

faily's assets in Paki a well sn UK.

4. From the secox made available on Respondent No, 1 0 the JT, i 8 observed that

Respondent No. I hed minor diet sharcholdng in closely held family comparies. These

companies were not poitbering However, these companies were continuously revolving

funds amongst thonseives, sarcholderd diectos! sponsors and ofiore compan

Moreover, it ean be sen fom the avlalercord tat Respondent No.1 kept shares inthe

ane of his wit, son and daughters who were not sna independent a that ime; &

move to delink hi from the closely held fily businesses yt he bad conto over the

bases de to his song poiticland fy iauene, Another nortan actor noted bre

isthat despite the adverse Finacial postion of al closl held fanly businesses, Respondent

[No.1 hd phenomenal growth in accumulation of went by his dest family end ther

shareholder ofthe company, which were also his fay members

9. A deste arlysis of avilable Snancal details of Shatiffaily’s eompanis with

‘SEC and thee tax! well returns reflect serious dichotomies in desaring thee assets (is!

on declarations of ss), Respondent No.1 blasts and declared them on he mans of

hice, howevey, there ws no plausible source of income with Respondent No, Lo his

ction

10. As per Lahoe High Cout case no W.P 3114 HPML vs NAB, Mian Nawaz Shit

psi 10 million NAB as seterent in HIPML case, Anyi of account details of SM

voted tht the company oid Re SO ilion to NAB as payment on beh of Mian Nawaz

‘Shifts arto il 110 milion, This use of RSML finds sin wolaton of eompany ew ax

is peso libliies were paid through he funds of RSML.

11. Another hike is sen in asets after Shor fuiy’s polit rejuvenation moos,

Funds were shied fom tr UK/ UAB ene fo Pakistan inh form of gis nse of.

on nut fins wr tse inte sc of Rein No.1 in,

n

te form of gis from Hussain Nawaz and Hil Metals Esubishment accounts, king

advantage ofthe tx exemption on foreign remitaneey ifs, Massive sets were uit while

showing the costo il being ised on gi, Moreover, the Respondents ave led to

‘atta thirsouces of income behing hese git abroad if compared with he secoust

kel oftheir compass ebro it is observed tha thee companies were i lose under

‘inbles ad were nt ins position to peer ny dividend

12. Having gone through financial duis of his companies’ bank accounts and is

ection in FBR recon it rime facieesabishes hat Respondent No is in possession

ofASSETS BEYOND KNOWN SOURCES OF INCOME

oO fonds

(WAND ZA) PSP,

oes oe

auch ae camcanien CL

oR

woe

28

Spe

Annex -A

| emanee

meme ox | ,

Borers B

re rote aninateenteet

ee ecacateenmmieaaasen

. ee

ae ‘atid Cheque Book Form %

TM | Cheqye Socntmes

win

enn i

32 HER

eed

. ‘sop went COMA =LABEITR

| su vir pc ato oe ney pes Wa

i reso wt in aches th i he SONY

Were inmate

| Tat wpa om

| nine eter cca nn ~

4 sa erat or enn rn

Sea gectanm ome a

mann nese a tran menos ee me

nan tna

mona cs on ink we ae of et

‘Sat eg on ean se

st tnecneogs wn weg a mt ant mut 80 Sea OS

| Te, eg yen brates hos i OE

ae ee

= JT

2 ec rh wi asi, TO

ge. ca ee vt ts Sed a

z

s

2

g

4

<

i

3

: satire cane giant sig gna

| ‘enum wee etalon tanec

| verano a int oo a ad rs Se Set

ROOST Sees Sc aie

\ 43 {enituanamn. Ashe GARE

pee

} i lotenoityaesti

Percomna pn zt wy ne fatten on CET A

i farewe eaneeom,

it |

—

joe

|

Agcount Opening Form

me 19u74.agel -PKR

34

a ead

a aR

ag Bante

rosient Ore [rx Cluso Clase

pen

eeu ane nae rir

On een oeymamnaneed Co, Cay eon

a Efceartnie tne :

Beers octane

[Clr spn ot ene

Crewnranre LETT LL 1 ener aint

2 a0.

Divrencanes

Clow cotine wk Pat Phe

Trecetep t

‘Auto Dobit

Ses aims anne EER a

Poe dt ovo orton eye at et

“Fesertns CCELEEEEEEL &

Ye,

ceeree tt ——

rs eee aero

deste eo Sai

titra Goo)

ear Cif Coron

swssrsine

aecsion cave]

tenon tnt

isi CEEOL

ELC

ooo Tce PECEEEM eo

gece or

es semtosreks epmacotr!

i

TEE}

Dee antemnantnt

FEE

ro Censor

vec Dhaene Loney

(Cece

ooo

Coo,

rey

ee TT-LLEL

ee

lorie Clatctnto

i otters)

Coie Clow: Clon

samen CELL LLL

unmet ———— Ye fh

eeareceren “

Tutaece ers aie

ont smi

“ered

‘uivet Ts Crete

errr CCL

: a a Clef

Dleasm-stam Ditan-ttom

Tlospm-osom Casper rm

tity oir

on EET

oF coe

Emcee

Chrent

We

Does

ie

1

Qin

Tena sect

et

ee]?

“Rem eid Account

fn fee Fs tsin ses

senor etn PoECeee eee

pion zor

‘Siena

pei roel Or sh AF yer ch

ac pt enbor 218

Rain ba beta

‘simie] -

-eavaechon

Pe pacar sence

c lpmeer

“oat mcteaton

© co oh

Aes are

j A | 120499

Cw

cee

coor

fol 2AfAR 2A FAROE

Reese R000

ESE rnay

ooo

Oooo

ooo

agyl

durptarnegalac

eensoarasaal §S

eect peed by he Hak haundt, te Bank sale rte eae:

no “AGE ftene Prote wien eve eocuat ang be relat Pt

att lo ste yonsganat conpensalon ta Manapes Fro Shae

oon Ps eer daca te anager ra Sar (9 Prot noun

The Feraroa Mara Fo) omc ai eno enc lt Mecbon Paid eon ©

“tl aneoee Pett hare andthe Pot Walitsnes epato to cach Cala sal Oe

Toe ate sae conmanoamant of ry Prof Aaeton Pefod. The ose sd

ye te a chr ao Whos sop we Clery wo alte

Fa a gh ty benny eo oe anes Une

Sp Banks weiste So i Be Gmmalhty eer node, weber ose ee

ret Sewanee bo Oak vag pretes.

cre an th eda Fund aig «Prof Aan Pati alts ban a

nr on te a ae riod a cra ae Mra Aas a

{estes ew ye te Came ah ha Bark pete aceénce wi

Se eaby tn cusanar end e Sok he Mose ses nie ve

th osc aun ik Aoslon Pes, bo Ganka ot Yo eld toe

“pd enone scp ul remo is on wn te Acc) deni eo

Fe fet ena sc hl wa tn ae cad foggy

a i ely far caer nts to tre of wir 2

fie aa be sto pnPtr oss son oes th i 0

Ce eee tap omen na ert tre eran) a SE,

ite ora of fnde xa othe Ants deco

ca et pt ot nc rere, ean ae, newt,

Ce ey ed ce lhe Solar egies cl Oo

eon reste ro teria of wnce ts gel a ale gre th pave

nt oe te agg tm puro mt oe

rest Se aandanorg se Hak atbe estos.

custoverundtnds et be seat of accourn epet ol he Account)

Te cater scr gta orm uch ean spo by SBP, Chas ty

<1 lt ots a ine oy SOP. The conta of DP AE

fr ne, fe oe ane en at aap ot cons Fy alle

ee ios mwning oe Gk wn 4 days om cai of Sap

tne Bank nis ft content al mtr sng ou cant,

Baa hr nent te on ana of yon)

1 sceag lu, yor baserseors=s, Ou

aot wt soe ng mot wheie ach Acc) ee fo ne ia

a aan by eso of epoca eens

‘eae orton Socom arr wna fe ant bars nota fa al om |

Ian a ater seh at te Bank eal led

"dope ced

sme wcels htt he evs of dey af Cures, ee anes wt be ran

ae ace of trae ar pra. ca of death fa

Ha ad ser acpi mae aes x operation of Accs) NG

anol ot soar suzston ce, it ot

Sin oprtng ri ie open, 0 Os

invelpect of Aen) epoed tm arta ns, Oak alte 1 9 2

net of Accurate se saul openiog er, werpcr of we

Iga etn fo eo aio occ ie Dank rele wile sere

Sar zen piste gars) 2 nte 1 he an fom sepia

‘net

“yp Lancroseres ths deel anor al ole Cums esmnt) roseyer mene

Tre ek Gen tte any anor aftmy Doxa) witn Rnd ot ded

a am one ean och ae, coeds 8 nae one

mmer ovens hs Dank oe at evasion of any tesa open

re tet cy rested fixe yatta, on act of AP

a ee acne Castanos nly annie caryeg a

yr eect sd Se Or

ure.

1 eeount wil conser dorm thar as baba octamer easton

eae atone yon Aceves acsunt willbe conscered dom™at Hf here

2 a an int aceout or peo of at wo Yes

sain of te Demant account custome sal prove a writen rogues fo remava:

fate wie tgs my Ce mr) eran

ravingroxm Account Incas te eecount cman inoparaie

HT onent poco he ead acount ba conser x inclined

recs whe. agi So

tenis roi aden 1 onset etn fo he tame ad cod

Fhe che Bank aprerng be scons we

Fas aces save eto Gara HON Ee OO

tr tom's pot all ar undated ond revocaly aged foi:

ty ya on

ey to se ma eons gaa i

aru ct cote Me

seed Saar an isa) tod (220FU

mi oaaensn eg epg my EO

ese at my eqs a stb cola y mse

mh chy an anne rope, hls Hut

nancy cred by et ttre oxecing te

ub la Ch Eek and Suse VISA DMR Ca) wt

Io A et it ot bl spore roy wautrz$ uss oF INP

do awit ts caro a wl be cotati as anlene inte Santa

at es lun by Sandan Cte Sx Pato Lit Hom tne Bh

sq VGA Osi Card must tbe tans over any ntl (london cha

so cre cen ase nna onaz te magne

mi eos and Sanaa Docc Svar Aco are ated on aml

Soa Smo oa ts Sash pnts cua urea Aas A #

isa tera any share te Nut

‘Museu tat Sand Chad Oak Pak)

Eaves Bart le to wars ana cdr beat poe mec ay fa

fn hs a by cs Sct Craven Ganka pagar

Pol ass fe Ue caveoure more These ay eas

Sa a reas at ao oy Payoh zur 8 VISA Dab Ca

Sra rere a a a Sead suns wo mate den On

mopening Fam.

peer

sys to art ou Ploy Banking serees? GZ Yoo CO) No

a fp atv b eed spar he pretsling Sahoo Care

out mt ie ry cnr tary prin me, 3

tn) he

od

|

| pecans] Bama ea

| Muuarsara nwa cere pe cet at aaa

cme Dw Be eR or aeseeaa ol

~ DREAMPACK | |

| Bundled Financial Solutions

t

46

Standard

chartered

47

&

Standard

Chartered

~ 48

Standard

Chartered

v ‘A. ACCOUNT DETAILS exAfwritins

So a

ay Ecce i

CT sera + i

a ie

nee es,

cee xy :

oe

Bank a oa:

ied Ban ope ae

{GARDENCTOMECLAHORE = - sob eet

\ ‘il een —— a

pa

ACCOUNT OPENING FORM «31d 2

(eortndbicuat/Sole Proprietor) = Cnnispey

Se aT

rn wad

nis Ce

OTHER INSTRUCTIONS a

nn Fron fet i

" CehitctreeriocNengas

ee ae

pasa — Ee

[eno] RB

rae a!

evra ce SES ne)

ie

cia «ian

c. RERNOWLERGEHENT y

ae pc ot ping Fay aed olen tka sa ay

i ht a nb ri red "ead Ga

a hy ea Snipa ao ann lent odo a

hala sacs oda pet at

it ea

li iciasia iin

spate

ae

aaa

oo

“het! SSPECIVEN SIGNATURE CARD!

et auosesias

ane Ha

{it mm 5

ISTOMER PROFILE -...

jalg/Sole Proprictor/Partnors)

(einstein nate, a eosin

ake / apa Spear.

Nivea Shai -beating CHIC: #°35201-5369836-9,

Milly Ltd Kindy pe his peésenal iret sec

anion Ta, Lbs $4600, Patan

Sse eat

repo oq.

eta rata i eu o

Snes an ete aiden isu ina

of vinaoover ato eld eos cstfegenan

2b a bo pat xo

eve oa

eng wit ros)

> eignatare

plcable for Aezous.

lH

ose: las,

nur. owe i 29.25 bon” oy te el

camping Trt ub WO nn Hew

mie

6 a

|

sae

iva ear . |

inte 5

AN'SIAGENT’S DETAILS Veet yo

jinor/Blind Customer). (swale ‘ow

cm]

“NEXT OF KIN Zit F)

Yeas

Est Jl

D. DECLARATION tiie)

ies Rafe

= hy thy

Ronee

F 87

}Bank ie ‘I

ie ee eS

_ GusTouen DUE DILIGENCE (eDDy

|OW YOUR CUSTOMER (KYC) FORM

zi a

a om Cape

gaara Oy

For nk i

baccnre, IAG BRusmiste ne Geen Tas

fe an) LAME ni St coe

“el couc uciumggirrin Hewnmad Aun ate

ne alate

tan am ge? SFaad C0 lw meaty £0

OE BBs ae

Sina

Jee Sih Ceti our 9H

nin oer it i

rb 4 ki Onl EB,

“einen fire sechedai Ar——— —E

a aeertasien nbc gh a

sone canis al aan Mate Sa Overt ven He

“esc y

The oa

Femina

- ogi

‘een 2d

© pba dc

rete

wena os Tana Gisoer Cp e

Se emake oo meee

seis :

wovtarackecne

lie

"| coupon image

[scic erennah “Clinponesors oftoar Clete fix: Comer ch

sa :

| Bintan ne aR teen

Srna E av

. eoniict rome fo

ot Scot

Jaciastsop

‘oui roi et ox

tent comer

ce nantes eh

ie raimea anead

[ectenmunasieeleats

2 ,vad te re LNCt SER ts

2a

Aetite

tear

6

cot ei

seni Tt ae id mena

sito nondlibPrh eseSeiV da heate

et

“nbc Amen te yy or tig HE a mit

eects cele one Wee

‘sit ste dageciie CE Bi Ls 8,

as a |

* 82

cen

oN eine’

i oa :

| setae revecrstee

| "ous Aeliinaas age ge mccne foo:

| Cangtcecerpaimten meres, SS Ci aS PCB Ne

ae igen cranes

SN niseaatnnieiet | tected ein aAt

emer”

Pinecone rnb nce I RER "

a Bh

< Belen belie (ita gion

Ocal Sine

airplane tr

ga” ieatieetiaa tae 9

“oo eee |

snes + i

“scsonel ion eset. OO

rina AGieshonl CVE

“eu nme eta ire

Pincus anael

‘Remaster °.

nln Spo aaninanicaieiee

ae 3

cede

ee

crime gE ROIBEON at

econ “O

83

1 Recidenforelonet

+ caren ofcouiryceonenbah |

en’

“4 nae relent

3 lan rea tin

alist es

‘Gaaara ‘ipelcal areca eden] U

arose ‘lc padant os ascarid oF

F “to deren MVE

4 Prednt Aeros th CHIC uo

foot present adross provided

{nto fom .

‘inal dere whi Piston ath

estfeancrin whore te wont

‘iviy nous to ta ebeorved ih

: ; ‘Sport lay suena

ray, i

gujed wih gh ak

Eisnasoeems,

“Bisons ian ny of ie

Besangryad dedned ihe FAQ

‘Shoot Pee

f ae saat

oh ececlstcecar(F panan Sera

Ta eee ame

oon

heater aR tr

a tee eter

= [eee Rena atten

Haier :

a manta

nee a

Rae aera

4

as Tiara han Ra, 40.00

ae

i crgauss:

Mpc anc nn ne hh cle ial w

uti nee ese ee

ta ingen ct? OO he ame es

of ey i ae ean

agama aces me

a

(en Etre we,

‘en tag

‘tnt non

ina weal

| mnie

‘endintee

eso, |

iors ook :

GRRL fone Tea eave I

"Tas ree rao SED oF = aSasaMENT, u

‘acne

es

fe

NSW YOUR CUSTOMER (YC) FORM rman

Sa Te josie PG OUT

= Rio re

icmscominmt Houma Naw BARIE. iL

eOUNTPE A ceamtieced CY bimini) CN

Sepeetieed] limoneiceeat [} _ chit i

SANTO

‘it a

ee nem

Ya Mt

“cay EY ited Feets T Ba

seagumotarae) C-_eantet (Cher 6

oteal at. ao,

‘iat

“pan

‘That fy yaaa veo

Taimeomeoena ee eD

- 4

&

81... a

ca sca ae) mp.

RE SAG ts

Block, Garon tree

‘Ennai: ssigousnignorinl co

Trcnop sions Fox +8269 SARE

“Vosiggaisos

in sash] 10.10.10, Liverisys/verisvs jsp taion3520153698367-

> Lin Age

© opening

ey Sandan

Yo, Chartered

as fo

pocaremrine hares

72

Annex -B

Annex -C

ern.

net Act

fairs |

faproroiatns

nee

ug

ke

“TAREE R REGISTRATION CERTIFICATE

ontattaL,

erro

resouir

soi S007 ityelad ssa

0 cunt oun tl st-seiiv onc mciaccanagy Tom *

Goons on nO

auurterineorsvaNn

“ ciuweuee syiind

‘Honea oma

bea WEALTH STATEMENT UNDER SECTION 116 OF

‘THE INCOME TAX ORDINANCE, 2001

Feri aOR pa

PaolrDaeion of ants a Tabnoe

trl Property Gidea ovtlon Sava aeitin)

STEERED

ik at carat

[teitenn-e inn er

(ata your ci ot

testi tilt

dich apse

a PGR ana ent ou ae

7] Pains |CGRE roaoe tard a Mau

[adem ir

lesa ana tae

ita on

PNAC otc tame

utara es om Ate

ral towel rope

ROTM oSentr OT. RETEST

ager h b

oes tEnSa i My

18 pai

;

a2)

eam Spay ot suns nen anos orc Sete and tne one

Savi Safarsernotapon Tans eancay oe)

jaa ee RTA 726i

fasion Figg See alin Eo COUT Tia

fae 5 Sars aa Papi HrinTT

4 FED Shas Mara Ba Tena Ma | TEESTOT

‘noted on Fae

‘fioyeatand - Jroause | rat

steer

1

(tse Ges "a= soar

las

Biases 1D cose 5 Ta

esr ar | ae vata

Ta

[sete 70

Il

ESTE

ferent,

[ies _ ER!

stat — warren TT

Freon as

ere se

| FRO]

(oe nem (ae

ac a

as TT Roe TT FT| — AT

pate [enn sae

"eof

(mf et ec in ra

(rampant me etc crn a eT

ai a

ed :

SE a Gree teen ree ee

ae

roach a rT] eo

1 ante no mgs mnt Sra, t

a ee a a

ql

1a Fo bis

47. Net Wea of th cunt yar [minus 1),

“1, Aru peo ponane (Tob Racocld wsAnnex NT -

18. amber {tay mambo and copendnts

20, wns ay anata ny preon

‘oem

DB

EDs

ee

ererett f

acoA x

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Faisalabad Matric Result 2019 AnnouncedДокумент3 317 страницFaisalabad Matric Result 2019 Announcedسچ ٹی ویОценок пока нет

- Verdict Judge Arshad MalikДокумент25 страницVerdict Judge Arshad MalikAnonymous qjccOiLn0% (1)

- Dera Ghazi Khan Matric Result Announced 2019Документ1 963 страницыDera Ghazi Khan Matric Result Announced 2019سچ ٹی ویОценок пока нет

- Full Text of Special Court's Verdict in Musharraf Treason CaseДокумент169 страницFull Text of Special Court's Verdict in Musharraf Treason Caseسچ ٹی ویОценок пока нет

- BISE GRW Matric Annual Result Announced 2019Документ2 894 страницыBISE GRW Matric Annual Result Announced 2019سچ ٹی ویОценок пока нет

- Sargodha Borad Announced Matric Annual 2019Документ685 страницSargodha Borad Announced Matric Annual 2019سچ ٹی ویОценок пока нет

- BISE GRW Matric Annual Result Announced 2019Документ2 894 страницыBISE GRW Matric Annual Result Announced 2019سچ ٹی ویОценок пока нет

- 172 ECL Fake Account CaseДокумент5 страниц172 ECL Fake Account Caseسچ ٹی وی100% (1)

- Multan Board Announced Result of SSC 2019Документ897 страницMultan Board Announced Result of SSC 2019سچ ٹی وی100% (1)

- Sahiwal Board Announced SSC Annual 2019Документ2 061 страницаSahiwal Board Announced SSC Annual 2019سچ ٹی ویОценок пока нет

- Avenfield Verdict 07-06-2018Документ173 страницыAvenfield Verdict 07-06-2018سچ ٹی ویОценок пока нет

- Balochistan NA ListДокумент30 страницBalochistan NA ListKashif AwanОценок пока нет

- Provincial Assembly KPKДокумент134 страницыProvincial Assembly KPKKashif AwanОценок пока нет

- National Assembly Candidates List of SindhДокумент96 страницNational Assembly Candidates List of Sindhسچ ٹی ویОценок пока нет

- Muhammad Buksh Textile Mills LTD - (Assets Beyond Means - MNS)Документ1 страницаMuhammad Buksh Textile Mills LTD - (Assets Beyond Means - MNS)سچ ٹی ویОценок пока нет

- Punjab AssemblyДокумент363 страницыPunjab AssemblyKashif AwanОценок пока нет

- Ramzan Buksh Textile Mills LTD - (Assets Beyond Means - MNS)Документ1 страницаRamzan Buksh Textile Mills LTD - (Assets Beyond Means - MNS)سچ ٹی ویОценок пока нет

- Pakistan General Election 2018 Code of Conduct For MediaДокумент4 страницыPakistan General Election 2018 Code of Conduct For Mediaسچ ٹی ویОценок пока нет

- PunjabДокумент156 страницPunjabazharОценок пока нет

- Ittefaq Brothers PVT LTD - (Assets Beyond Means - MNS)Документ1 страницаIttefaq Brothers PVT LTD - (Assets Beyond Means - MNS)سچ ٹی ویОценок пока нет

- Ittefaq Textile Mills LTD - (Assets Beyond Means - MNS)Документ1 страницаIttefaq Textile Mills LTD - (Assets Beyond Means - MNS)سچ ٹی ویОценок пока нет

- Anx G Jafza & Mns Iqamah - (Assets Beyond Means - MNS)Документ9 страницAnx G Jafza & Mns Iqamah - (Assets Beyond Means - MNS)سچ ٹی ویОценок пока нет

- Ramzan Sugar Mills LTD - (Assets Beyond Means - MNS)Документ1 страницаRamzan Sugar Mills LTD - (Assets Beyond Means - MNS)سچ ٹی ویОценок пока нет

- Mehran Ramzan Textile Mills LTD - (Assets Beyond Means - MNS)Документ1 страницаMehran Ramzan Textile Mills LTD - (Assets Beyond Means - MNS)سچ ٹی ویОценок пока нет

- MNS - Annex A. Vol IX - (Assets Beyond Means - MNS)Документ1 страницаMNS - Annex A. Vol IX - (Assets Beyond Means - MNS)سچ ٹی ویОценок пока нет

- Ittefaq Sugar Mills LTD - (Assets Beyond Means - MNS)Документ1 страницаIttefaq Sugar Mills LTD - (Assets Beyond Means - MNS)سچ ٹی ویОценок пока нет

- Hamza Spinning Mills LTD - (Assets Beyond Means - MNS)Документ1 страницаHamza Spinning Mills LTD - (Assets Beyond Means - MNS)سچ ٹی ویОценок пока нет