Академический Документы

Профессиональный Документы

Культура Документы

2017-01-06 - The Income-Tax (1st Amendment) Rules, 2017 - Amendment of Rules 114-B To 114-E

Загружено:

Raj A KapadiaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2017-01-06 - The Income-Tax (1st Amendment) Rules, 2017 - Amendment of Rules 114-B To 114-E

Загружено:

Raj A KapadiaАвторское право:

Доступные форматы

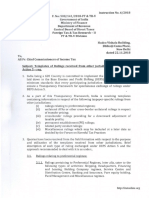

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II,

SECTION 3, SUB-SECTION (i)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF REVENUE

CENTRAL BOARD OF DIRECT TAXES

Notification

New Delhi, the 9th February, 2017

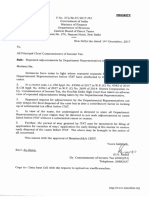

G.S.R.117(E)- In exercise of the powers conferred by section 139A and sub-section (1) of

section 203A, read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central

Board of Direct Taxes hereby makes the following rules further to amend the Income-tax

Rules, 1962, namely:-

1. (1) These rules may be called the Income tax (2nd Amendment) Rules, 2017.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. In the Income-tax Rules, 1962,

(i) in rule 114, in sub-rule (1) for the proviso the following proviso shall be substituted,

namely:-

Provided that an applicant may apply for allotment of permanent account number through

a common application form notified by the Central Government in the Official Gazette,

and the Principal Director General of Income-tax (Systems) or Director General of

Income-tax (Systems) shall specify the classes of persons, forms and formats along with

procedure for safe and secure transmission of such forms and formats in relation to

furnishing of permanent account number.;

(ii) in rule 114A, in sub-rule (1) for the proviso the following proviso shall be substituted,

namely:-

Provided that an applicant may apply for allotment of a tax deduction and collection

account number through a common application form notified by the Central Government

in the Official Gazette, and the Principal Director General of Income-tax (Systems) or

Director General of Income-tax(Systems) shall specify the classes of persons, applicable

forms and formats along with procedure for safe and secure transmission of such forms

and formats in relation to furnishing of tax deduction and collection account number..

[Notification No. 9/2017/F.No. 370142/40/2016-TPL]

Dr T. S. MAPWAL, Under Secy.

Note: The principal rules were published vide notification number S.O. 969 (E), dated the

26th March, 1962 and last amended by Income-tax (1st Amendment) Rules, 2017 vide

notification number G.S.R.No.14 (E), dated the 6th January, 2017.

Вам также может понравиться

- 2019-10-02 - Circular No 29-2019 - Clarifications in Respect of Option Exercised U-S 115-BBAДокумент2 страницы2019-10-02 - Circular No 29-2019 - Clarifications in Respect of Option Exercised U-S 115-BBARaj A KapadiaОценок пока нет

- PressRelease Supreme Court Judgement Aadhar PanДокумент2 страницыPressRelease Supreme Court Judgement Aadhar PanFilozófus ÖnjelöltОценок пока нет

- Interest On Refunds - Applicability of Section 244 or Section 244-A - Raj A Kapadia (2020) 120 Taxmann - Com 416 (Art)Документ4 страницыInterest On Refunds - Applicability of Section 244 or Section 244-A - Raj A Kapadia (2020) 120 Taxmann - Com 416 (Art)Raj A KapadiaОценок пока нет

- 2019-12-15 - H Res 755 - RESOLUTION of House of Representatives, Impeaching Donald J Trump, PresidentДокумент10 страниц2019-12-15 - H Res 755 - RESOLUTION of House of Representatives, Impeaching Donald J Trump, PresidentRaj A KapadiaОценок пока нет

- 2017-07-31 - Office Memorandum - Stay of Demand at 1st Appeal Stage - Partial Modification of Instruction No 1914 DT 21-Mar-1996Документ1 страница2017-07-31 - Office Memorandum - Stay of Demand at 1st Appeal Stage - Partial Modification of Instruction No 1914 DT 21-Mar-1996Raj A KapadiaОценок пока нет

- Pepsico Puerto Rico Inc V CIR (US Tax Court) (30-Sep-2012)Документ100 страницPepsico Puerto Rico Inc V CIR (US Tax Court) (30-Sep-2012)Raj A KapadiaОценок пока нет

- 2018-11-22 - Instruction No 06-2018 - Templates of Rulings Recd From Other Jurisdictions Under BEPS Action 5Документ4 страницы2018-11-22 - Instruction No 06-2018 - Templates of Rulings Recd From Other Jurisdictions Under BEPS Action 5Raj A KapadiaОценок пока нет

- MahaRERA General RegulationsДокумент27 страницMahaRERA General RegulationsKunal BaviskarОценок пока нет

- 2019-10-30 - H R 116-266 - REPORT On H R 660 (Directing Continuation of Impeachment Investigation)Документ25 страниц2019-10-30 - H R 116-266 - REPORT On H R 660 (Directing Continuation of Impeachment Investigation)Raj A KapadiaОценок пока нет

- 2018-03-27 - ORDER - Extension Until 30 June of Deadline For PAN-AADHAAR LinkingДокумент1 страница2018-03-27 - ORDER - Extension Until 30 June of Deadline For PAN-AADHAAR LinkingRaj A KapadiaОценок пока нет

- Income-Tax Appellate Tribunal - Mumbai Bench (Es) - Cause List For Period 31-12-2018 To 03-01-2019Документ37 страницIncome-Tax Appellate Tribunal - Mumbai Bench (Es) - Cause List For Period 31-12-2018 To 03-01-2019Raj A KapadiaОценок пока нет

- 2017-07-31 - OrDER - Extension of Date For Filing of Income Tax ReturnsДокумент1 страница2017-07-31 - OrDER - Extension of Date For Filing of Income Tax ReturnsRaj A KapadiaОценок пока нет

- Mumbai ITAT Erred in Applying Ejusdem Generis Rule (2019) 105 Taxmann - Com 240 (Art) (IE)Документ20 страницMumbai ITAT Erred in Applying Ejusdem Generis Rule (2019) 105 Taxmann - Com 240 (Art) (IE)Raj A KapadiaОценок пока нет

- The Statute of Westminster and Dominion Status (K C Wheare - OUP (1949 - 4th Ed) )Документ378 страницThe Statute of Westminster and Dominion Status (K C Wheare - OUP (1949 - 4th Ed) )Raj A KapadiaОценок пока нет

- 2017-12-14 - Repeated Adjournments by Dept Reps Before ITAT PDFДокумент3 страницы2017-12-14 - Repeated Adjournments by Dept Reps Before ITAT PDFRaj A KapadiaОценок пока нет

- 2017-10-06 - CBDT's Letter Inviting Comments - DRAFT Rules For CBC Report & Master FileДокумент15 страниц2017-10-06 - CBDT's Letter Inviting Comments - DRAFT Rules For CBC Report & Master FileRaj A KapadiaОценок пока нет

- 2017-12-14 - CBDT - Repeated Adjournments by Dept Reps Before ITATДокумент3 страницы2017-12-14 - CBDT - Repeated Adjournments by Dept Reps Before ITATRaj A KapadiaОценок пока нет

- 2017-05-25 - Office Memorandum - Constitution of Committee - Measures For Expeditious Recovery of Tax Arrears PDFДокумент2 страницы2017-05-25 - Office Memorandum - Constitution of Committee - Measures For Expeditious Recovery of Tax Arrears PDFRaj A KapadiaОценок пока нет

- 2017-11-15 - Instruction No 10-2017 - Processing of Returns U-S 143 (1) - Applicability of Sec 143 (1) (A) (Vi)Документ3 страницы2017-11-15 - Instruction No 10-2017 - Processing of Returns U-S 143 (1) - Applicability of Sec 143 (1) (A) (Vi)Raj A KapadiaОценок пока нет

- ITA No. 565/Ahd/17 questions Rs 1,588 crore TP adjustmentДокумент161 страницаITA No. 565/Ahd/17 questions Rs 1,588 crore TP adjustmentRaj A KapadiaОценок пока нет

- 2017-11-08 - Issue Re Representation Before Benches of NCLT PDFДокумент5 страниц2017-11-08 - Issue Re Representation Before Benches of NCLT PDFRaj A KapadiaОценок пока нет

- 2017-11-08 - Issue Re Representation Before Benches of NCLT PDFДокумент5 страниц2017-11-08 - Issue Re Representation Before Benches of NCLT PDFRaj A KapadiaОценок пока нет

- 2017-11-08 - CBDT - Lodging of Tax Arrear Claim in Respect of Corporate Cases Filed Under IBC-2016Документ35 страниц2017-11-08 - CBDT - Lodging of Tax Arrear Claim in Respect of Corporate Cases Filed Under IBC-2016Raj A KapadiaОценок пока нет

- 2017-07-04 - The Income-Tax (19th Amendment) Rules, 2017 - Amendment of Rule 29-B and Form No 15-CДокумент1 страница2017-07-04 - The Income-Tax (19th Amendment) Rules, 2017 - Amendment of Rule 29-B and Form No 15-CRaj A KapadiaОценок пока нет

- 2017-06-09 - The Income-Tax (14th Amendment) Rules, 2017 - Amendment of 2nd Proviso To Rule 114-BДокумент2 страницы2017-06-09 - The Income-Tax (14th Amendment) Rules, 2017 - Amendment of 2nd Proviso To Rule 114-BRaj A KapadiaОценок пока нет

- 2019-09-19 - No 9-2017 - Procedure - Online Filing of Form No 67 For Claiming Foreign Tax CreditДокумент2 страницы2019-09-19 - No 9-2017 - Procedure - Online Filing of Form No 67 For Claiming Foreign Tax CreditRaj A KapadiaОценок пока нет

- 2017-06-07 - The Income-Tax (12th Amendment) Rules, 2017 - Amendment of Safe Harbour Rules For Int'l TransactionsДокумент1 страница2017-06-07 - The Income-Tax (12th Amendment) Rules, 2017 - Amendment of Safe Harbour Rules For Int'l TransactionsRaj A KapadiaОценок пока нет

- 2017-06-09 - The Income-Tax (14th Amendment) Rules, 2017 - Amendment of 2nd Proviso To Rule 114-B PDFДокумент1 страница2017-06-09 - The Income-Tax (14th Amendment) Rules, 2017 - Amendment of 2nd Proviso To Rule 114-B PDFRaj A KapadiaОценок пока нет

- CBDT Instruction No 05-2017 - Guidelines For Selection of Cases For Scrutiny During F Y 2017-18Документ2 страницыCBDT Instruction No 05-2017 - Guidelines For Selection of Cases For Scrutiny During F Y 2017-18Raj A KapadiaОценок пока нет

- 2017-06-07 - The Income-Tax (12th Amendment) Rules, 2017 - Amendment of Safe Harbour Rules For Int'l Transactions PDFДокумент6 страниц2017-06-07 - The Income-Tax (12th Amendment) Rules, 2017 - Amendment of Safe Harbour Rules For Int'l Transactions PDFRaj A KapadiaОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- REMEDIAL LAW PRINCIPLESДокумент10 страницREMEDIAL LAW PRINCIPLESDaphne Dione BelderolОценок пока нет

- Orcino Vs GasparДокумент3 страницыOrcino Vs GasparMavic MoralesОценок пока нет

- Suspense EssayДокумент3 страницыSuspense Essayapi-358049726Оценок пока нет

- The Dogmatic Structure of Criminal Liability in The General Part of The Draft Israeli Penal Code - A Comparison With German Law - Claus RoxinДокумент23 страницыThe Dogmatic Structure of Criminal Liability in The General Part of The Draft Israeli Penal Code - A Comparison With German Law - Claus RoxinivanpfОценок пока нет

- Alliance in Motion Global Business Centers Across LuzonДокумент5 страницAlliance in Motion Global Business Centers Across LuzonDee Compiler100% (1)

- WHAP Chapter 9 Notes Part IIДокумент38 страницWHAP Chapter 9 Notes Part IIDuezAP100% (2)

- San Miguel Properties, Inc. vs. BF Homes, Inc.Документ52 страницыSan Miguel Properties, Inc. vs. BF Homes, Inc.Mariel ManingasОценок пока нет

- Active-And-Passive Exercise Shelby D1A023188Документ2 страницыActive-And-Passive Exercise Shelby D1A023188Shelby SabitaОценок пока нет

- Special Proceedings Case DigestДокумент14 страницSpecial Proceedings Case DigestDyan Corpuz-Suresca100% (1)

- Bagalihog vs. Judge Fernandez PDFДокумент8 страницBagalihog vs. Judge Fernandez PDFDeric MacalinaoОценок пока нет

- Pirate+Borg BeccaДокумент1 страницаPirate+Borg BeccaamamОценок пока нет

- Current Research On Technology and Trafficking - Technology and Human TraffickingДокумент4 страницыCurrent Research On Technology and Trafficking - Technology and Human Traffickingpratap81912Оценок пока нет

- Deed of Chattel MortgageДокумент2 страницыDeed of Chattel MortgageInnoKal100% (1)

- "Playing The Man": Feminism, Gender, and Race in Richard Marsh's The BeetleДокумент8 страниц"Playing The Man": Feminism, Gender, and Race in Richard Marsh's The BeetleSamantha BuoyeОценок пока нет

- Peaceful Settlement of DisputesДокумент12 страницPeaceful Settlement of DisputesKavita Krishna MoortiОценок пока нет

- Republic vs. Court of Appeals - Docx GR No. L-61647Документ10 страницRepublic vs. Court of Appeals - Docx GR No. L-61647Friendship GoalОценок пока нет

- Child Custody in OhioДокумент23 страницыChild Custody in Ohioscott100% (1)

- Oct. 18 2022 Duluth Public Schools SRO ContractДокумент12 страницOct. 18 2022 Duluth Public Schools SRO ContractJoe BowenОценок пока нет

- What Is The Solo ParentДокумент5 страницWhat Is The Solo ParentAdrian MiraflorОценок пока нет

- Email List of Producers, Engineers, Artists & A&RsДокумент7 страницEmail List of Producers, Engineers, Artists & A&RsИван Лазарев100% (1)

- Graduates Constituency Voters Enrollment Form 18Документ4 страницыGraduates Constituency Voters Enrollment Form 18DEEPAKОценок пока нет

- Kenfig Hill V CwmllynfechДокумент1 страницаKenfig Hill V CwmllynfechChris LeyshonОценок пока нет

- Ship Stability Notes BS222Документ74 страницыShip Stability Notes BS222Ahmed Aboelmagd100% (1)

- Reception and DinnerДокумент2 страницыReception and DinnerSunlight FoundationОценок пока нет

- Employer Contractor Claims ProcedureДокумент2 страницыEmployer Contractor Claims ProcedureNishant Singh100% (1)

- Member Statements-04302021Документ2 страницыMember Statements-04302021bОценок пока нет

- Suffer in Silence A Novel of Navy SEAL TrainingДокумент13 страницSuffer in Silence A Novel of Navy SEAL TrainingMacmillan Publishers100% (1)

- Dark Void (Official Prima Guide)Документ161 страницаDark Void (Official Prima Guide)mikel4carbajoОценок пока нет

- CSEC Tourism QuestionДокумент2 страницыCSEC Tourism QuestionJohn-Paul Mollineaux0% (1)

- Rumun 2015 CommitteesДокумент4 страницыRumun 2015 Committeesapi-263920848Оценок пока нет