Академический Документы

Профессиональный Документы

Культура Документы

Com

Загружено:

cachandhiran0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров2 страницыCOMMUNICATION INCOME TAX DEPARTMENT

Авторское право

© © All Rights Reserved

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документCOMMUNICATION INCOME TAX DEPARTMENT

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров2 страницыCom

Загружено:

cachandhiranCOMMUNICATION INCOME TAX DEPARTMENT

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

SRI eg

CENTRALIZED PROCESSING CENTER

ange stereo

Bengaluru-560500

Telephone: 18004252229, 18001034455 (Toll Free) or 080-22546500 err. 4.o0u24222g.acooror say (Camp) o¢e- 224¥E4oo

——

—

Name and Address mre,

SELLAPPAN GOVINDASAMY x

ALLAMPALAYAM POST OODAYAM MUTHUR me

Kangayam Fee Pere acs04

Tiupour TAMIL NADU 636105

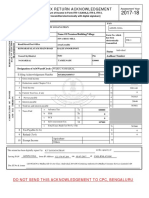

Communication Reference No. Date of Communication

aan (CPCI1718/622/1710383510| se ne 23072017

TTR Form Type ‘Assessment Year PAN

atten se 1 [Om et 201718 | pee wre woe AFSPCa3A6L.

Dear Sir/Madam,

‘Subject: Communication of proposed adjustment u/s 143(1)(a) of Income Tax Act, 1961,

The return for PAN AFSPG3346L, Assessment Year 2017-18 E-fling- Acknowledgement number 789614270020617 Dated 02-JUN-17

AY, Acknowiedgement Number and Date are obtained from the ITR) contains the errors/incorrect claims inconsistencies which

attract adjustment(s), as specified ws. 143(1)(a) of Income Tax Act, 1961, as annexed in Part [() to (vi), as applicable,

You are herewith affordes an opportunity to respond to the below mentioned adjustments) proposed us. 143(1)(a) within a period

‘of 30 days (thirty days) from the date of issue ofthis communication. Please provide the required information or file a revised retum,

2 applicable, through online mode. To submit response, kindly log on to wav incometaxincias‘ling.qov.n with your "user name and

password” and choose “e-Assessment/Proceeding" under the "e-proceeding” section,

Kindly note:

1. Revised return uploaded as above should have all the data to enable processing. It should contain complete information as

{furnished in the earlier retum along with information pertaining to the errors/incorrect claims! inconsistencies listed below.

2. You are advised to use the software utity available on the website www incometaxindlefling gov in

3. The online response to this communication will be presumed to be duly verified, correct and complete in accordance withthe

provisions of the Act

4. The response received shall be considered before making any adjustment. In case, no response is received

within 30 days (thirty days) of issue of this intimation, the return of income will be processed after making

necessary adjustment(s) u/s 143(1)(a) of Income Tax Act, 1961 without providing any further opportunities in this

Deeside

Deputy Commissioner of income Tax,

CPC, Bengaluru

‘This communication is computer generated and may not contain signature. Where sent by emai, this is signed with the digital signature

ofthe Income Tax Department - CPC, which fs obtained from a certifying authority under the Information Technology Act, 2000, For any

‘queries, please quote the PAN,Communication Reference Number and eall on the telephone number provided above

CONUS 04M 0 Page tof?

1708203006800,

Part A

Adjustments us 143(1)(a)

ry ‘Addition of income appearing in Form 26AS or Form 16A or Form 16 which has not been included in computing the total

Income in the return-143(1)(a)(vi)

SLNo | Formused or comparison | Income as per Return Income as per Form Proposed addition of income

® @ I oy i

Form 16‘Salay Income 58420 77020 212000

+ | Form 16-6rss Tota ncome nss20 01747 sersar

5 [Fern t6-Taxabie Tol ncome | aovazo 01747 se0027

Page 20f 2

Вам также может понравиться

- Murugu and Co: 5 Sakthi Complex Cutcherry Street, Erode, Tamil Nadu 638001 7010641977Документ1 страницаMurugu and Co: 5 Sakthi Complex Cutcherry Street, Erode, Tamil Nadu 638001 7010641977cachandhiranОценок пока нет

- Deed CompressPdfДокумент1 страницаDeed CompressPdfcachandhiranОценок пока нет

- Sample BillДокумент1 страницаSample BillcachandhiranОценок пока нет

- Challan 1Документ1 страницаChallan 1cachandhiranОценок пока нет

- E WAY BILL 11Документ1 страницаE WAY BILL 11cachandhiranОценок пока нет

- DeedДокумент1 страницаDeedcachandhiranОценок пока нет

- APPLICATIONДокумент3 страницыAPPLICATIONcachandhiranОценок пока нет

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageДокумент1 страницаIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillagecachandhiranОценок пока нет

- Nila Purchases GSTДокумент11 страницNila Purchases GSTcachandhiranОценок пока нет

- Form GST REG-06: Government of IndiaДокумент3 страницыForm GST REG-06: Government of IndiacachandhiranОценок пока нет

- 2EWBДокумент1 страница2EWBcachandhiranОценок пока нет

- Serial - No Name - of - Seller Seller - TIN Commodity - Invoice - No Invoice - DateДокумент11 страницSerial - No Name - of - Seller Seller - TIN Commodity - Invoice - No Invoice - DatecachandhiranОценок пока нет

- Balaji Traders Sales July PDFДокумент1 страницаBalaji Traders Sales July PDFcachandhiranОценок пока нет

- Authorisation Letter Ilovepdf CompressedДокумент2 страницыAuthorisation Letter Ilovepdf CompressedcachandhiranОценок пока нет

- Aadhar 1Документ1 страницаAadhar 1cachandhiranОценок пока нет

- Rental AgreementДокумент2 страницыRental AgreementcachandhiranОценок пока нет

- Nila TextilesДокумент1 страницаNila TextilescachandhiranОценок пока нет

- Bank StatementДокумент1 страницаBank StatementcachandhiranОценок пока нет

- Tamil Nadu VAT Registration Certificate for Sri Kumaravel TextilesДокумент2 страницыTamil Nadu VAT Registration Certificate for Sri Kumaravel TextilescachandhiranОценок пока нет

- Balaji Traders Sales JulyДокумент1 страницаBalaji Traders Sales JulycachandhiranОценок пока нет

- Letter From DepartmentДокумент1 страницаLetter From DepartmentcachandhiranОценок пока нет

- Tamil Nadu VAT registration receiptДокумент1 страницаTamil Nadu VAT registration receiptcachandhiranОценок пока нет

- Reck NorДокумент5 страницReck NorcachandhiranОценок пока нет

- Samayasangili Road, Avathipalayam, Pallipalayam Erode 638008. GSTIN: 33FAMPS4712L1Z9Документ1 страницаSamayasangili Road, Avathipalayam, Pallipalayam Erode 638008. GSTIN: 33FAMPS4712L1Z9cachandhiranОценок пока нет

- Star positions for boy and girl horoscopesДокумент9 страницStar positions for boy and girl horoscopescachandhiranОценок пока нет

- Itr VДокумент1 страницаItr VcachandhiranОценок пока нет

- Bank ChallanДокумент1 страницаBank ChallancachandhiranОценок пока нет

- A: !B 6m D6Of !b6ofirn 8) RR B: RR RR L I TДокумент1 страницаA: !B 6m D6Of !b6ofirn 8) RR B: RR RR L I Tcachandhiran100% (1)

- Registration AknowДокумент1 страницаRegistration AknowcachandhiranОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)