Академический Документы

Профессиональный Документы

Культура Документы

Class Activty 9 10

Загружено:

Zola ShikweniАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Class Activty 9 10

Загружено:

Zola ShikweniАвторское право:

Доступные форматы

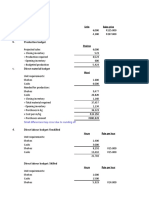

Activity 9

Nkosi Equipment uses a flexible budget for its indirect manufacturing costs. For

2013, the company anticipated that it would produce 18 000 units with 3 500

machine-hours and 7 200 employee days. The costs and cost drivers were to be

as follows:

FIXED VARIABLE COST DRIVER

Product handling R30 000 R0.40 per unit

Inspection R8 000 R8.00 per 100 unit batch

Utilities R400 R4.00 per 100 unit batch

Maintenance R1 000 R0.20 per machine-hour

Supplies - R5.00 per employee day

During the year, the company processed 20 000 units, worked 7 500 employee

days, and had 4 000 machine-hours. The actual costs for 2013 were:

Product handling R36 000

Inspection R9 000

Utilities R1 600

Maintenance R1 200

Supplies R37 500

Required

1. Prepare the static budget using the overhead items above and then compute

the static-budget variances. (5)

2. Prepare the flexible budget using the overhead items above and then

compute the flexible-budget variances. (5)

Activity 10

Shongwe Limited produces and sell product A. Product A consists of 2

materials: F and G. The following standard information is available:

Units produced and sold 5 000

Total cost: material F R75 000

Cost per kilogram: material F R5

Total cost: material G R100 000

Material G: liters to be used 50 000 L

Labour hours needed per product A 2

Labour rate per hour R15

Selling price per unit R125

Total fixed cost R85 000

During the period, the following occurred:

Units produced and sold 6 000

Material F cost of purchases (15 000 kg) R78 000

Material G: liters used 61 200

Cost per liter: material G R1.95

Direct labour cost (15 000 hours) R240 000

Selling price per unit R123

Total fixed cost R80 000

Required

1 Calculate the price and efficiency variances for materials and labour using an

arrow diagram. Show all calculations clearly. (18)

2 Give one possible reason for the material variances calculated in 2.1 (4)

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- K 1Документ1 страницаK 1Zola ShikweniОценок пока нет

- K 1Документ1 страницаK 1Zola ShikweniОценок пока нет

- Hca15 PPT ch07Документ26 страницHca15 PPT ch07حسينالربابعهОценок пока нет

- MEMO Activity 7 8Документ5 страницMEMO Activity 7 8Zola ShikweniОценок пока нет

- A010116SДокумент2 страницыA010116SZola ShikweniОценок пока нет

- 365 Sex Positions PDFДокумент387 страниц365 Sex Positions PDFsysrerun50% (90)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Objectives For Chapter 9: Business Cycle, Inflation and UnemploymentДокумент19 страницObjectives For Chapter 9: Business Cycle, Inflation and UnemploymentAnonymous BBs1xxk96VОценок пока нет

- Strategy Implementation - ClassДокумент56 страницStrategy Implementation - ClassM ManjunathОценок пока нет

- Kabushi Kaisha Isetan Vs IacДокумент2 страницыKabushi Kaisha Isetan Vs IacJudee Anne100% (2)

- Eco-Bend: CNC Hydraulic Press BrakeДокумент9 страницEco-Bend: CNC Hydraulic Press Brakehussein hajОценок пока нет

- Afp Vs NLRCДокумент2 страницыAfp Vs NLRCRyan AnatanОценок пока нет

- w9 - L2 - Review For Lecture Midterm 2Документ14 страницw9 - L2 - Review For Lecture Midterm 2Rashid AyubiОценок пока нет

- Students Satisfaction On The Services Provided by The School Canteens in Catanduanes State UniversityДокумент31 страницаStudents Satisfaction On The Services Provided by The School Canteens in Catanduanes State UniversityAnthony HeartОценок пока нет

- Leadership & Innovation BrochureДокумент10 страницLeadership & Innovation BrochureFiona LiemОценок пока нет

- FX4Cash CorporatesДокумент4 страницыFX4Cash CorporatesAmeerHamsa0% (1)

- Permission To MortgageДокумент14 страницPermission To MortgageAabad BrandОценок пока нет

- Analysis On Apollo Tyres LTDДокумент43 страницыAnalysis On Apollo Tyres LTDCHAITANYA ANNEОценок пока нет

- Front Office ManagementДокумент3 страницыFront Office ManagementLu XiyunОценок пока нет

- Iso 37001 Anti Bribery Mss PDFДокумент5 страницIso 37001 Anti Bribery Mss PDFDana NedeaОценок пока нет

- Preface and AcknowlegementДокумент5 страницPreface and Acknowlegementpraisy christianОценок пока нет

- Fuzzy AHPДокумент17 страницFuzzy AHPmsdpardisОценок пока нет

- Wordpress - The StoryДокумент3 страницыWordpress - The Storydinucami62Оценок пока нет

- The Hungarian Investment and Trade Development AgencyДокумент5 страницThe Hungarian Investment and Trade Development AgencydmaproiectОценок пока нет

- Web Based Crime Management SystemДокумент22 страницыWeb Based Crime Management SystemZain Ul Abedin SaleemОценок пока нет

- Tally MCQ 1Документ11 страницTally MCQ 1rs0100100% (4)

- IP-A1 SiddharthAgrawal 19A2HP405Документ2 страницыIP-A1 SiddharthAgrawal 19A2HP405Debanjan MukherjeeОценок пока нет

- ValentusДокумент13 страницValentusKaren AndreaОценок пока нет

- Research Project ReportДокумент21 страницаResearch Project ReportinternationalbankОценок пока нет

- KRN BIR ReqДокумент2 страницыKRN BIR ReqNitz GallevoОценок пока нет

- Merchandise Assortment PlanningДокумент9 страницMerchandise Assortment PlanningJyotika ThakurОценок пока нет

- Medical Devices and Ehealth SolutionsДокумент76 страницMedical Devices and Ehealth SolutionsEliana Caceres TorricoОценок пока нет

- Organizational StructureДокумент7 страницOrganizational StructureSiva Prasad KantipudiОценок пока нет

- Start A New Challenge - FXIFYДокумент1 страницаStart A New Challenge - FXIFYSähïl GäjëräОценок пока нет

- Lazaro Vs SSSДокумент2 страницыLazaro Vs SSSFatima Briones100% (1)

- XII Acc CH 4 and 5 Study Material 2024Документ28 страницXII Acc CH 4 and 5 Study Material 2024bhawanar674Оценок пока нет

- Roles & Responsibilities of A Maintenance Engineer - LinkedInДокумент4 страницыRoles & Responsibilities of A Maintenance Engineer - LinkedInEslam MansourОценок пока нет