Академический Документы

Профессиональный Документы

Культура Документы

MF Ready Reckoner Schemes Oct 2016

Загружено:

Murali Krishna DАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

MF Ready Reckoner Schemes Oct 2016

Загружено:

Murali Krishna DАвторское право:

Доступные форматы

- -

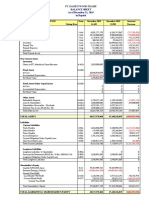

RETAIL RESEARCH MUTUAL FUNDS 17th May 2017

SIP Ready Reckoner

Equity and Hybrid Funds:

NAV value as on 28th April, 2017. Source: ACEMF

Period 3 Years 5 Years 7 Years

No of instalments 36 60 84

Amount invested per month (Rs) 10,000 10,000 10,000

Total Amount Invested (Rs) 360,000 600,000 840,000

Value Of Inv Value Of Inv Value Of Inv

Scheme Name Category XIRR (%) XIRR (%) XIRR (%)

(Rs) (Rs) (Rs)

Equity Oriented

Templeton India Growth Fund(G) Large Cap 466,638 17.79 966,552 19.30 - -

DSPBR Equity Fund-Reg(G) Large Cap 462,155 16.28 971,370 19.06 - -

HDFC Equity Fund(G)* Large Cap 451,255 14.56 949,440 18.12 1,381,197 13.60

HDFC Top 200 Fund(G) Large Cap 448,555 14.51 917,476 16.90 1,650,433 19.21

HDFC Capital Builder Fund(G) Large Cap 460,639 17.09 990,992 20.51 - -

Benchmark:

Nifty 50 418,317 8.97 811,134 11.48 1,236,002 10.46

S&P BSE 200 436,268 12.04 864,928 14.17 1,316,761 12.28

Canara Rob Emerg Equities Fund-Reg(G) Mid-Cap 529,603 26.70 1,344,965 33.12 1,247,800 10.58

L&T Midcap Fund-Reg(G) Mid-Cap 534,588 27.05 1,299,620 31.41 - -

HDFC Mid-Cap Opportunities Fund(G)* Mid-Cap 507,489 23.96 1,211,475 28.87 1,115,773 8.08

Reliance Small Cap Fund(G)* Small Cap 540,290 28.91 1,429,820 36.19 - -

DSPBR Micro-Cap Fund-Reg(G) Small Cap 554,566 30.05 1,473,455 37.00 1,509,310 16.40

Benchmark:

Nifty 50

Nifty Free Float Midcap 100 506,400 23.07 1,091,552 23.97 1,663,261 18.94

S&P BSE Small-Cap 497,978 21.85 1,095,254 24.15 1,577,087 17.44

Birla SL Pure Value Fund(G) Multi-Cap 505,351 24.01 1,260,931 30.83 1,111,252 7.83

L&T India Value Fund-Reg(G)* Multi-Cap 512,691 24.65 1,218,495 29.07 1,130,076 8.44

Benchmark:

Nifty 50 418,317 8.97 811,134 11.48 1,236,002 10.46

Nifty 500 443,445 13.18 887,357 15.22 1,352,919 13.04

HDFC Prudence Fund(G)* Balanced 455,665 15.56 959,812 18.74 1,174,756 9.51

HDFC Balanced Fund(G)* Balanced 453,590 15.63 973,393 19.57 1,372,532 13.66

DSPBR Balanced Fund-Reg(G)* Balanced 461,783 16.49 950,738 18.31 1,195,054 9.10

ICICI Pru Balanced Fund(G) Balanced 454,145 15.67 961,033 19.00 1,509,921 16.46

Birla SL Balanced '95 Fund(G) Balanced 450,415 15.25 947,150 18.49 1,731,508 20.55

Benchmark:

Nifty 50 418,317 8.97 811,134 11.48 1,236,002 10.46

CRISIL Balanced Fund - Aggressive Index 419,134 9.48 800,011 11.12 1,224,394 10.33

L&T Infrastructure Fund-Reg(G) Infra 513,155 24.34 1,137,434 25.89 1,731,662 20.43

Franklin Build India Fund(G)* Infra 484,878 20.54 1,186,511 28.00 1,162,528 9.20

Birla SL India GenNext Fund(G)* Consumption 483,147 20.28 1,045,913 22.59 1,130,654 8.45

Reliance Media & Entertainment Fund(G)* Media 450,339 17.42 916,325 18.34 1,300,461 11.85

UTI Transportation & Logistics Fund(G)* Auto 471,691 17.79 1,282,543 30.98 1,190,852 9.91

ICICI Pru Banking & Fin Serv Fund(G)* Banking 537,997 28.18 1,196,548 28.17 - -

Reliance Banking Fund(G) Banking 501,510 22.32 1,067,620 23.02 1,354,108 13.31

Benchmark:

S&P BSE BANKEX 465,123 16.22 957,401 18.15 1,488,607 15.59

RETAIL RESEARCH Page |1

RETAIL RESEARCH

L&T Tax Advt Fund-Reg(G) ELSS 479,622 19.33 1,003,391 20.60 1,131,772 8.48

Reliance Tax Saver (ELSS) Fund(G) ELSS 455,825 15.55 1,059,428 22.91 - -

DSPBR Tax Saver Fund-Reg(G)* ELSS 479,000 19.57 1,048,360 22.65 - -

Birla SL Tax Relief '96(ELSS U/S 80C of IT ACT)(G) ELSS 464,950 17.37 1,034,632 22.11 1,107,321 7.87

Benchmark:

Nifty 50 418,317 8.97 811,134 11.48 1,236,002 10.46

Nifty 500 443,445 13.18 887,357 15.22 1,352,919 13.04

DSPBR Natural Res & New Energy Fund-Reg(G) Energy 565,306 33.73 1,178,220 28.40 1,150,643 8.74

Birla SL Intl. Equity Fund-B(G) Global Funds 433,865 12.12 843,629 13.41 1,121,607 8.22

Franklin India Feeder - Franklin U.S. Opportunities Fund(G)* Global Funds 402,896 6.99 801,074 11.36 - -

Debt Oriented

UTI Gilt Adv-LTP(G) Gilt LT 431,140 12.02 802,246 11.53 1,467,635 15.49

SBI Magnum Gilt-LTP-Reg(G)* Gilt LT 429,532 11.73 808,894 11.86 - -

L&T Gilt Fund-Reg(G)* Gilt LT 421,155 10.66 792,208 11.19 1,376,321 13.72

Benchmark:

I-Sec Li-BEX 284,030 (8.99) 554,151 (0.46) 873,555 2.67

SBI Magnum Gilt-STP(G)* Gilt ST 421,573 10.77 781,681 10.66 1,145,268 8.71

IDFC G Sec-STP-Reg(G)* Gilt ST 412,010 9.05 766,950 9.83 - -

ICICI Pru Gilt-Treasury-PF(G) Gilt ST 419,100 10.28 733,543 7.99 - -

Benchmark:

I-Sec Si-BEX 294,710 (6.25) 562,780 0.22 876,318 2.76

*included in our lumpsum MF Ready Reckoner May 2017

What is an SIP? Systematic investment plan (SIP) is a disciplined way of investing in mutual fund schemes where an investor can

make regular and equal payments at regular intervals for periods to accumulate wealth over long run. It inculcates the habit of

saving and building wealth for the future.

What is the structure of an SIP? SIP can be termed as a regular investment scheme where a stipulated amount of money (can be

Rs. 50, Rs.100, Rs. 250, Rs. 500, etc) is invested daily, weekly, monthly, quarterly or yearly, instead of investing money in bulk

Investing in a mutual fund through SIP allows participation in the equity markets systematically.

What is the rationale and importance of Systematic investing? Lump sum investing will be suitable only when there is a high

degree of certainty that the market is going to go through a rising trend. However, timing the market is a very difficult task,

especially at individual investor level. Also for most investors, one-time investment may not be feasible due to a lack of resources.

In the case of SIP, it is not necessary for the investor to accumulate a huge amount at one go before making an investment. He

can accumulate small amounts and invest regularly. An SIP also enables investors to start investing in equity early.

The philosophy behind starting a SIP with an equity scheme is to go on investing regardless of the market conditions. Investors

should not stop it in downturns and keep SIP running for a longer period. Else, he/she will lose out a chance to make money in

the long term. Heres why:

1. Rupee Cost Averaging: Rupee cost averaging is an approach or a benefit wherein the investor can buy more units when prices

are low and less when prices are high. Ideally speaking, most investors want to buy stocks when the prices are low and sell them

when prices are high. But timing the market is time consuming and risky. Rupee-cost averaging can help reduce the average cost

per share over time (provided the investor does not stop SIPs in bear markets) and increase your profit when the cycle turns and

markets start rising.

However, Rupee-cost averaging doesn't guarantee a profit or eliminate risk, and it won't protect you from a loss if you sell shares

at a market low. Before adopting this strategy, you should consider your ability to continue investing through periods of low price

levels.

2. Power of compounding: Compounding is the fact that the money you make off an investment can be reinvested to make even

more money than your initial investment. The money you make goes back to work to make you even more money than before.

RETAIL RESEARCH Page |2

RETAIL RESEARCH

Say you've invested Rs.10, 000 and it makes 10% interest per year. In the first year, you make Rs.1, 000 in interest. But in the

second year, you'll make Rs.1, 100 (not only does your initial investment of Rs.10,000 accrue interest but so does the additional

Rs.1,000 you made in the first year). In the tenth year, you'll make Rs. 2,358. And in the 30th year you'll make Rs.15, 864. That's

all without making another investment beyond your initial Rs.10, 000. Hence the longer you stay invested, higher will be the

benefit of compounding.

What are the salient features of SIP? It is needless to say that for long-term wealth creation through equity market you need

discipline and long term time horizon which are inherent features of SIP. The following features of SIP makes it fit for equity

market.

Simple and disciplined approach towards investment.

Investment possible with small sum of money invested regularly to accumulate wealth.

Based on concept of Rupee Cost Averaging.

Flexibility in terms of amount or quantity based SIP.

Flexible intervals like Daily/ Weekly/ Fortnightly/ Monthly/ Yearly basis.

What are the benefits of SIP? As common investor doesnt have enough time and resources, SIP proves to be a viable option for

them. Listed below are the important benefits of this instrument.

Reduces Risk because of Rupee Cost Averaging.

SIP can be started with very small amount of money.

Timing the market is not necessary.

Long term financial goal can be aligned with SIP.

Disciplined approach towards Investment helps in controlling the emotions.

How does SIP help to reach Your Financial Goal? SIP is a perfect tool for people who have a specific, future financial

requirement. By investing an amount of your choice every month, you can plan for and meet financial goals, like funds for a

childs education, a marriage in the family or a comfortable post retirement life.

What are the benefits of starting early? The earlier you start, the lesser the investment required to achieve your goals. This is

because of compounding, as explained earlier. Since the return generated also starts earning further returns, the initial

investment required comes down. Usually, people at young age undermine the importance of saving small sums of money and

keep procrastinating, pushing the start to a later date. Besides, they often perceive investing as a cumbersome process. This is

where SIP comes in handy, a good way to save through MFs is to set aside a certain amount of ones income for them. This,

besides helping one make forced savings, also gives one a financial headstart.

Why one should not stop SIP?

Many investors make the mistake of discontinuing their SIP investments when market falls. As discussed above, this exit could

impact the portfolio returns significantly as it fails to get the benefit of lower average costs.

Investments through an SIP can ensure steady returns. Ideally speaking, it is difficult to time the market. Whereas, with an SIP,

investors can ride safely during market downturns and manage better returns if they stay invested through an entire market

cycle. SIP investors need not to worry about the fluctuations or ups and down that are seen in the equity market. You could grab

better returns in the next 6 to 12 months period if you stay invested during market falls.

Taxation in SIP:

The tax implication applicable to the SIP investment is as same as that of the lumpsum investment in MF. The main point is that

the taxation of SIPs depends on the dates of investments. In equity oriented mutual fund schemes, under Growth option, the long

term capital gain tax is exempt if the units are sold after a year of the date of purchase (as per the current law structure). In this

case, to benefit out the long term capital gain tax, every instalment should be held at least one year.

RETAIL RESEARCH Page |3

RETAIL RESEARCH

Likewise, in non-equity oriented schemes, to attain the Long Term Capital Gain Tax benefit (that is 20% with indexation), the units

should be sold after 3 years from the date of allotment.

In ELSS, all the SIP instalments are locked in for three years.

There is an ideology behind selling the MF units that had invested through SIP as using the first-in-first-out (FIFO) method. That

means sell the earliest units first.

Conclusion:

Investing in Equity Oriented mutual fund schemes through SIP - longer the period the better the returns.

Investing in Debt Oriented mutual fund schemes through SIP - no major advantage of extending SIP beyond 3 years, however on

tax considerations, one may extend SIP beyond three years.

RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office.

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone:

(022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com.

Disclaimer: This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or

arrived at, based upon information obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty,

express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. This document is for information purposes only.

Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as an offer or solicitation of an

offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any locality, state,

country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HSL or its affiliates to any registration or

licensing requirement within such jurisdiction.

If this report is inadvertently sent or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not be

reproduced, distributed or published for any purposes without prior written approval of HSL.

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived from them.

In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HSL may from time to time solicit from, or perform broking, or other services for, any company mentioned in

this mail and/or its attachments.

HSL and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b)

be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act

as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.

HSL, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this

report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc.

HSL and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or may make sell or purchase

or other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

Dhuraivel Gunasekaran (Dhuraivel.Gunasekaran@hdfcsec.com)

HSL or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past

twelve months.

HSL or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from to date of this report for services in respect of

managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal

course of business.

HSL or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly,

neither HSL nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking,

investment banking or brokerage service transactions. HSL may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not

received any compensation/benefits from the subject company or third party in connection with the Research Report.

This report is intended for non-Institutional Clients only. The views and opinions expressed in this report may at times be contrary to or not in consonance with those of Institutional Research or PCG

Research teams of HDFC Securities Ltd. and/or may have different time horizons. Mutual Funds Investments are subject to market risk. Please read the offer and scheme related documents carefully

before investing.

RETAIL RESEARCH Page |4

Вам также может понравиться

- CalPERS Sep2022Документ7 страницCalPERS Sep2022Manish SinghОценок пока нет

- Mayes 8e CH05 SolutionsДокумент36 страницMayes 8e CH05 SolutionsRamez AhmedОценок пока нет

- Cara Urutan Minyak LintahДокумент4 страницыCara Urutan Minyak Lintahaerohel100% (1)

- Assessment - Manage Quality Customer Service - BSBCUS501 PDFДокумент29 страницAssessment - Manage Quality Customer Service - BSBCUS501 PDFEricKang26% (19)

- MF DoneДокумент10 страницMF DoneVIREN GOHILОценок пока нет

- 61b0a0056fbe6.1638965253.SIP Report 27092021Документ3 страницы61b0a0056fbe6.1638965253.SIP Report 27092021delightadvertisementОценок пока нет

- HDFC Sec - Weekly Mutual Fund & ETF Ready Reckoner - Oct 13, 2023Документ16 страницHDFC Sec - Weekly Mutual Fund & ETF Ready Reckoner - Oct 13, 2023ashoksoftОценок пока нет

- April 19Документ52 страницыApril 19sahithi reddyОценок пока нет

- HDFCsec MFReckonerFeb2022Документ11 страницHDFCsec MFReckonerFeb2022Sanjib DekaОценок пока нет

- 01 Adm 05695 RumaDas 20220328 Portfolio DetailedДокумент26 страниц01 Adm 05695 RumaDas 20220328 Portfolio DetailedAnirОценок пока нет

- Top Mutual FundsДокумент6 страницTop Mutual FundsPubg UpdateОценок пока нет

- Dipali-Mf StatementДокумент1 страницаDipali-Mf Statementdipalifulzele21Оценок пока нет

- Star Oct Dec 23 1Документ6 страницStar Oct Dec 23 1aeikhanpurОценок пока нет

- NJ Star Funds Jan-Mar 2022Документ4 страницыNJ Star Funds Jan-Mar 2022Suresh TrivediОценок пока нет

- Prime Series 4Документ3 страницыPrime Series 4peeyushbcihmctОценок пока нет

- MF CurrДокумент2 страницыMF Curraparna tiwariОценок пока нет

- KBC Knowledge Series - Top Ten SchemesДокумент2 страницыKBC Knowledge Series - Top Ten SchemesktiindiaОценок пока нет

- Suresh Rathi Securities PVT LTD.: Ronak JajooДокумент17 страницSuresh Rathi Securities PVT LTD.: Ronak JajooRonak JajooОценок пока нет

- Absolute ReturnsДокумент3 страницыAbsolute Returnsshubha6Оценок пока нет

- HDFC MF Equity SIP Report July 2022Документ4 страницыHDFC MF Equity SIP Report July 2022Indrajeet BhattacharyaОценок пока нет

- Chapter-5 Analysis of Financial Statement: Statement of Profit & Loss Account For The Year Ended 31 MarchДокумент5 страницChapter-5 Analysis of Financial Statement: Statement of Profit & Loss Account For The Year Ended 31 MarchAcchu RОценок пока нет

- HTTPSWWW Idx Co Idmedia4865idx-Annual-Statistics-2018 PDFДокумент210 страницHTTPSWWW Idx Co Idmedia4865idx-Annual-Statistics-2018 PDFKarinakarennОценок пока нет

- Jamna Auto 2017-18Документ184 страницыJamna Auto 2017-18Karun DevОценок пока нет

- HDFCsec WeeklyMutualFundReadyReckoner Jan13,2023Документ12 страницHDFCsec WeeklyMutualFundReadyReckoner Jan13,2023Sanjeeva KarnaОценок пока нет

- Exchange Trade of FundДокумент4 страницыExchange Trade of Fundnidhi thakurОценок пока нет

- Kotak Mahindra Bank Limited Consolidated Financials FY18Документ60 страницKotak Mahindra Bank Limited Consolidated Financials FY18Kunal ObhraiОценок пока нет

- Icici Bank LTDДокумент3 страницыIcici Bank LTDSrinjoy SealОценок пока нет

- Allocation Analysis-13-11-2023-08-08-56Документ49 страницAllocation Analysis-13-11-2023-08-08-56fortune144370Оценок пока нет

- HDFC MF 10 Year Challenge - Leaflet (As of January 31, 2019) - Low ResДокумент4 страницыHDFC MF 10 Year Challenge - Leaflet (As of January 31, 2019) - Low ResYogesh RathodОценок пока нет

- Money Control Balanced Mutual Fund Rating 2016Документ4 страницыMoney Control Balanced Mutual Fund Rating 2016Anonymous q0irDXlWAmОценок пока нет

- Suresh S B 2019 - 20 PDFДокумент1 страницаSuresh S B 2019 - 20 PDFNACHIKETH89Оценок пока нет

- Market Mantra: Indian Market % Change Last Close 1 Day YTDДокумент7 страницMarket Mantra: Indian Market % Change Last Close 1 Day YTDDishanto DasguptaОценок пока нет

- Sensitivity Analysis in Excel TemplateДокумент8 страницSensitivity Analysis in Excel Templateuyenbp.a2.1720Оценок пока нет

- Market Cues: April 27, 2018Документ10 страницMarket Cues: April 27, 2018Rakesh HОценок пока нет

- SIP Performance For Select Schemes Leaflet (As On 29th April 2022)Документ4 страницыSIP Performance For Select Schemes Leaflet (As On 29th April 2022)Akash BОценок пока нет

- Market Outlook 24-10-2017Документ16 страницMarket Outlook 24-10-2017mohak2506Оценок пока нет

- Materi Mekanisme Perdagangan LMKA Nov 2020 - BPK IrvanДокумент29 страницMateri Mekanisme Perdagangan LMKA Nov 2020 - BPK IrvannurlisaОценок пока нет

- Gita AgricultureДокумент20 страницGita AgriculturemrigendrarimalОценок пока нет

- Anushka Chauhan 80012100054Документ6 страницAnushka Chauhan 80012100054TANYA AGGARWALОценок пока нет

- Organization Structure of Hul: Presented By:-Lavesh SethiaДокумент11 страницOrganization Structure of Hul: Presented By:-Lavesh SethiaLavesh SethiaОценок пока нет

- Report PDFДокумент10 страницReport PDFDinesh ChoudharyОценок пока нет

- Company DataДокумент10 страницCompany DataAvengers HeroesОценок пока нет

- StatementДокумент12 страницStatementsupertraderОценок пока нет

- SREI Infrastructure Finance LTD: Retail ResearchДокумент13 страницSREI Infrastructure Finance LTD: Retail ResearchAbhijit TripathiОценок пока нет

- Starwood Hotels & Resorts Worldwide Inc. (HOT)Документ14 страницStarwood Hotels & Resorts Worldwide Inc. (HOT)assenav001Оценок пока нет

- Balance Sheet As of December 31, 2019 in Rupiah: Pt. Daisen Wood FrameДокумент6 страницBalance Sheet As of December 31, 2019 in Rupiah: Pt. Daisen Wood FrameDwiputra SetiabudhiОценок пока нет

- Aditya Birla Sun Life Amc Limited: All You Need To Know AboutДокумент7 страницAditya Birla Sun Life Amc Limited: All You Need To Know AboutSarfarazОценок пока нет

- Best Stocks To Buy in India For Long Term in 2017 - GetMoneyRichДокумент4 страницыBest Stocks To Buy in India For Long Term in 2017 - GetMoneyRichPalanisamy BalasubramaniОценок пока нет

- FundManager PerformanceДокумент38 страницFundManager Performanceshashank_khatri3728Оценок пока нет

- JETIR2002031Документ5 страницJETIR2002031adilsk1019Оценок пока нет

- Q1FY18 Investor PresentationДокумент40 страницQ1FY18 Investor Presentationdivya mОценок пока нет

- Afs LTCFДокумент7 страницAfs LTCFJiah Mae GamoloОценок пока нет

- RISHI21 - Alpha Bluechip - LUMPSUMДокумент4 страницыRISHI21 - Alpha Bluechip - LUMPSUMPower of Stock MarketОценок пока нет

- Financial Management ProjectДокумент59 страницFinancial Management ProjectFaizan MoazzamОценок пока нет

- Balance SheetДокумент2 страницыBalance SheetUDAYTRSОценок пока нет

- HDFC Bank: Analysing The Ability of The Organizations To Pay DividendsДокумент6 страницHDFC Bank: Analysing The Ability of The Organizations To Pay Dividendssumit rajОценок пока нет

- Sip One Pager Tata Ethical Fun4Документ2 страницыSip One Pager Tata Ethical Fun4MohammedОценок пока нет

- SIP Performance of Select Equity Schemes Leaflet - November 2023Документ4 страницыSIP Performance of Select Equity Schemes Leaflet - November 2023Tanuj BhattОценок пока нет

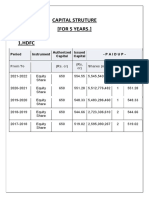

- Capital StructureДокумент3 страницыCapital StructureJanvi BadlaniОценок пока нет

- Company Name Ticker Free Float Volume Traded Share Outstandin G Average Closing PriceДокумент23 страницыCompany Name Ticker Free Float Volume Traded Share Outstandin G Average Closing PricenkmpatnaОценок пока нет

- 2020 Batch: 74953 MD - Forensic MedicineДокумент8 страниц2020 Batch: 74953 MD - Forensic MedicineMurali Krishna DОценок пока нет

- Optical Coherence Tomography in Branch Retinal Vein Occlusion at Tertiary Care Center-A Cross Sectional StudyДокумент7 страницOptical Coherence Tomography in Branch Retinal Vein Occlusion at Tertiary Care Center-A Cross Sectional StudyMurali Krishna DОценок пока нет

- DoD COVID19 Practice Management GuideДокумент51 страницаDoD COVID19 Practice Management GuideAhraxazel Galicia ReynaОценок пока нет

- RopДокумент172 страницыRopMurali Krishna DОценок пока нет

- RopДокумент172 страницыRopMurali Krishna DОценок пока нет

- DSL Broadband Modem Configuration - Dlink 2730U - 2750U With WiFi Setup - Netvuze Tips and Tricks To Simply Web LifeДокумент9 страницDSL Broadband Modem Configuration - Dlink 2730U - 2750U With WiFi Setup - Netvuze Tips and Tricks To Simply Web LifeMurali Krishna DОценок пока нет

- Catalog Encoder MILEДокумент1 страницаCatalog Encoder MILELucas SuplinoОценок пока нет

- Frankenstein Final EssayДокумент3 страницыFrankenstein Final Essayapi-605318216Оценок пока нет

- RizalДокумент6 страницRizalKin BarklyОценок пока нет

- HM3 ChaosHallsДокумент36 страницHM3 ChaosHallsBrady Mcghee100% (2)

- Kerala University PHD Course Work Exam SyllabusДокумент4 страницыKerala University PHD Course Work Exam Syllabuslozuzimobow3100% (2)

- Account StatementДокумент12 страницAccount StatementGladson JsОценок пока нет

- Upholding Malay Language Strengthening Command English LanguageДокумент12 страницUpholding Malay Language Strengthening Command English LanguagemucheliaОценок пока нет

- Quantitative Option Strategies: Marco Avellaneda G63.2936.001 Spring Semester 2009Документ29 страницQuantitative Option Strategies: Marco Avellaneda G63.2936.001 Spring Semester 2009Adi MОценок пока нет

- SanamahismДокумент7 страницSanamahismReachingScholarsОценок пока нет

- Examples in C++Документ39 страницExamples in C++ZhvannОценок пока нет

- John Zink - Flare - Upstream - ProductionДокумент20 страницJohn Zink - Flare - Upstream - ProductionJose Bijoy100% (2)

- Buad 306 HW 2Документ4 страницыBuad 306 HW 2AustinОценок пока нет

- Culture Shock Refers To The Feelings of Confusion and Uncertainty That You Experience When You Come Into Contact With A New CultureДокумент13 страницCulture Shock Refers To The Feelings of Confusion and Uncertainty That You Experience When You Come Into Contact With A New CultureRetno WulanОценок пока нет

- Table of Contents COPY 1 2Документ15 страницTable of Contents COPY 1 2Keann Nicole SearesОценок пока нет

- PhysicsssssДокумент1 страницаPhysicsssssSali IqraОценок пока нет

- Abnormal or Exceptional Mental Health Literacy For Child and Youth Care Canadian 1St Edition Gural Test Bank Full Chapter PDFДокумент20 страницAbnormal or Exceptional Mental Health Literacy For Child and Youth Care Canadian 1St Edition Gural Test Bank Full Chapter PDFdustin.washington425100% (22)

- Project SelectingДокумент29 страницProject SelectingayyazmОценок пока нет

- 3 C FamilyIImoot2015Документ3 страницы3 C FamilyIImoot2015ApoorvaChandraОценок пока нет

- EDEL453 Spring2013 MelanieHADJES Unit 4 Economic Day1Документ6 страницEDEL453 Spring2013 MelanieHADJES Unit 4 Economic Day1Melanie HadjesОценок пока нет

- Why Worldview - OutlineДокумент3 страницыWhy Worldview - OutlineDaveОценок пока нет

- A Written Report in Pure Monopoly: Submitted ToДокумент12 страницA Written Report in Pure Monopoly: Submitted ToEd Leen ÜОценок пока нет

- CBR Bahasa Inggris Fisika Kelompok 1Документ9 страницCBR Bahasa Inggris Fisika Kelompok 1Ryan SianiparОценок пока нет

- Survey of Dealers and Subdealers of Kajaria Vitrified Tiles To Know The Market Trend and Potential in Ghaziabad and NoidaДокумент13 страницSurvey of Dealers and Subdealers of Kajaria Vitrified Tiles To Know The Market Trend and Potential in Ghaziabad and Noidajdjeet4100% (1)

- B.sc. Hons. ZoologyДокумент110 страницB.sc. Hons. ZoologyHarsh Dalal0% (1)

- Critical Thinking and The Nursing ProcessДокумент22 страницыCritical Thinking and The Nursing ProcessAnnapurna DangetiОценок пока нет

- EndomytosisДокумент8 страницEndomytosisBlackbeetleОценок пока нет

- Celex 02003L0109-20110520 en TXTДокумент22 страницыCelex 02003L0109-20110520 en TXTertanОценок пока нет

- 2008-12-16Документ32 страницы2008-12-16CoolerAdsОценок пока нет