Академический Документы

Профессиональный Документы

Культура Документы

What customers want most from insurers: Value, trust and service

Загружено:

Jeremy KurnОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

What customers want most from insurers: Value, trust and service

Загружено:

Jeremy KurnАвторское право:

Доступные форматы

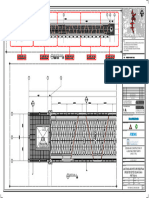

WHAT CUSTOMERS WANT FROM

AN INSURANCE PROVIDER

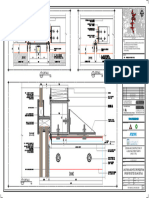

MOST IMPORTANT ATTRIBUTES OF CUSTOMER EXPERIENCE COMPARED WITH PERFORMANCE Global all-industry Global all-industry

performance median importance median

GLOBAL CONSUMER SURVEY OF GENERAL INSURANCE PROVIDERS

TYPE OF ATTRIBUTE Staff engagement Brand value and reputation Value for money Executional excellence Ease of doing business Personalised offering Accessibility

60

LOW HIGH

IMPORTANCE IMPORTANCE

PERFORMS 03 PERFORMS

WELL WELL

06

13 02

05

50

11 08

16 12 01

14 10

18

04 07

23 17

20 19 15

PERFORMANCE (%)

22 09

40

24

26

28 21

29 25

27

30

30

LOW HIGH

IMPORTANCE IMPORTANCE

PERFORMS PERFORMS

POORLY POORLY

20 30 40 50 60 70 80

IMPORTANCE (%)

ATTRIBUTES

Value for money A company I know Ease of getting Consistency of service Rewards my choice

01 06 will deliver 11 issues/queries/ 16 continuity in communications 21 Rewards my loyalty 26 to do business with

complaints resolved or interactions the company

Staff who are honest Getting things right Speed of making an Ability to get in contact Availability of services

02 and tell the truth

07 the first time

12 inquiry/transaction

17 with the company with

22 around the clock

27 A brand that inspires me

short wait times

Staff who consistently Speed when resolving Staff who are Trust in the brand to do Choices/options available Physical proximity/ease

03 follow through on

08 a complaint/resolving

13 knowledgeable

18 the right thing

23 for communications

28 of access of a company

their promises a query

A company that puts Trust that the brand Staff with a Trust that the brand A company that is well Appearance and operations

04 the customer first 09 delivers on its promises 14 positive attitude 19 understands my needs 24 regarded in the media 29 of a website

Quality of advice and Speed of service Having services and Offers products and services Availability of rewards Ambience of decor of

05 service offers

10 15 products that are easy

20 that can be tailored to my

25 and promotions

30 a branch/store

to understand specific needs

Source: 2015 Customer Experience Barometer, KPMG

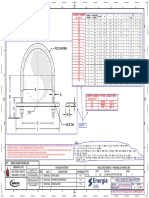

PREFERRED CHANNELS FOR COMMUNICATION WITH INSURER (%) FACTORS THAT WOULD HELP INSURERS IMPROVE

GLOBAL SURVEY OF INSURANCE CUSTOMERS CUSTOMER EXPERIENCE (%)

Digital E-mail Telephone GLOBAL SURVEY OF INSURANCE CUSTOMERS

RESEARCH ACCESSIBILITY

TAILOR TO

QUOTE CUSTOMER NEEDS

PURCHASE CONTENT EXPLANATION

VARIETY OF INSURANCE

RENEW SERVICES/PRODUCTS

AMEND MORE ONLINE ACCESS

LOYALTY POINTS FOR

CLAIM CONSUMER STORES

0 10 20 30 40 50 60 70 80 90 100 0 10 20 30 40 50

Source: PwC 2014 Source: PwC 2014

INSURANCE CUSTOMERS WHO HAD A POSITIVE EXPERIENCE, BY COUNTRY TOP REASONS FOR CLOSING/REPLACING A POLICY

SURVEY OF INSURANCE CUSTOMERS IN 30 COUNTRIES GLOBAL SURVEY OF INSURANCE CUSTOMERS

BY INSURANCE TYPE: LIFE AUTO HOME

TOP 5

01 AUSTRIA 64.9% Cost/terms 50% 57% 59%

02 US 58.5% Policy benefits/

coverage 47% 42% 48%

03 BELGIUM 57.7%

Recommended

by broker/friends 38% 29% 39%

04 AUSTRALIA 57.1%

Frequency/

relevance of 28% 16% 34%

communication

05 FRANCE 56.8%

Level of service 28%

received 26% 31%

BOTTOM 5 Policy did not

align to my life 26% 14% 26%

circumstances

26 SPAIN 39.2%

Research

I conducted 25% 20% 30%

27 TAIWAN 37.7%

Experienced personal/

family milestones 24% 11% 25%

28 HONG KONG 37.6%

29 CHINA 37.3%

Brand reputation 24% 17% 29%

Did not like the

30 SOUTH KOREA 33.6% way it was handled 22% 18% 26%

Source: Capgemini 2016 Source: EY 2015

Вам также может понравиться

- Don T Stop Til You Get Enough Michael JacksonДокумент8 страницDon T Stop Til You Get Enough Michael JacksonJose San MartinОценок пока нет

- A4 - Content Marketing Proposal PDFДокумент14 страницA4 - Content Marketing Proposal PDFAnonymous y3ZRCxK100% (7)

- Ott Business Model For The Sports BoadcastingДокумент63 страницыOtt Business Model For The Sports BoadcastingChristianОценок пока нет

- Sales Individual Report Assignment 2Документ20 страницSales Individual Report Assignment 2Linh Chi NguyenОценок пока нет

- 4 - Projeto Rede de Agua - Etapa 1Документ1 страница4 - Projeto Rede de Agua - Etapa 1yuriОценок пока нет

- SQDCM SDTДокумент1 страницаSQDCM SDTPatel AshokОценок пока нет

- Lajur Pipa Air Bekas Lt. 2: CC CCДокумент1 страницаLajur Pipa Air Bekas Lt. 2: CC CCKukuh HidayatОценок пока нет

- P007 Abn CCC Ar SHD 2554 S01Документ1 страницаP007 Abn CCC Ar SHD 2554 S01Abdul basithОценок пока нет

- Denah Dormitory Baru 1Документ1 страницаDenah Dormitory Baru 1yobiОценок пока нет

- GU 20 XX Yy - U Bolt Guía Con TPIДокумент1 страницаGU 20 XX Yy - U Bolt Guía Con TPIJesús JiménezОценок пока нет

- Critical Areas 10.11.2018Документ2 страницыCritical Areas 10.11.2018Vincent AlmoiteОценок пока нет

- Area: 4.90 SQM: FFL: +3.60 MTSДокумент1 страницаArea: 4.90 SQM: FFL: +3.60 MTSgalano.cybeleОценок пока нет

- Lajur Pipa Air Kotor Lt. 2: CC CCДокумент1 страницаLajur Pipa Air Kotor Lt. 2: CC CCKukuh HidayatОценок пока нет

- Des-J-1360-001-01-0 (Mto - Sketch - Form)Документ1 страницаDes-J-1360-001-01-0 (Mto - Sketch - Form)Yawar AliОценок пока нет

- Architectural floor plan layoutДокумент1 страницаArchitectural floor plan layoutnaufalОценок пока нет

- R1 - Block-A - Staircase Detail - Ground To First Floor - A3 - 12-07-2021Документ1 страницаR1 - Block-A - Staircase Detail - Ground To First Floor - A3 - 12-07-2021Mojilo GujjuОценок пока нет

- 52-Week Habit Tracker MEDIUMДокумент2 страницы52-Week Habit Tracker MEDIUMSoukaina NouaОценок пока нет

- A1 Manifesto Atmosphere LATESTДокумент1 страницаA1 Manifesto Atmosphere LATESTJoe Ji DongОценок пока нет

- 06 PDFДокумент1 страница06 PDFVirak PisethОценок пока нет

- LAMINASДокумент3 страницыLAMINASJonnathan Taipe OlsonОценок пока нет

- P007 Abn CCC Ar SHD 2553 S01Документ1 страницаP007 Abn CCC Ar SHD 2553 S01Abdul basithОценок пока нет

- P007 Abn CCC Ar SHD 2548 S01Документ1 страницаP007 Abn CCC Ar SHD 2548 S01Abdul basithОценок пока нет

- Jeffhadennet The Motivation Myth ExcerptДокумент20 страницJeffhadennet The Motivation Myth ExcerptAlex Fernando Trujillo BriosoОценок пока нет

- Adam Grant - Given and TakeДокумент62 страницыAdam Grant - Given and TakeDavi GomesОценок пока нет

- RX King Kelas Sport 2T 140 CC Rangka Standar ChamberДокумент1 страницаRX King Kelas Sport 2T 140 CC Rangka Standar ChamberWhyspeedkingОценок пока нет

- Improving Workplace Safety Behavioral Based Safety: ThroughДокумент32 страницыImproving Workplace Safety Behavioral Based Safety: ThroughYursОценок пока нет

- Avenida Principal: ComercioДокумент1 страницаAvenida Principal: ComercioAlvaro Maravi PalominoОценок пока нет

- Edc Structure PDFДокумент2 страницыEdc Structure PDFThai chheanghourtОценок пока нет

- Resite Plan - Blok PlanДокумент1 страницаResite Plan - Blok PlanWil EksploreОценок пока нет

- Calendario-Turnos (Version 1)Документ1 страницаCalendario-Turnos (Version 1)Maximo RomeroОценок пока нет

- Lessons From FCC HistoryДокумент10 страницLessons From FCC HistoryasdasdasdasdasdasdasdОценок пока нет

- Conventional SymbolДокумент1 страницаConventional SymbolSachin UniyalОценок пока нет

- ARQ A2Документ1 страницаARQ A2WILBUR JAVIER RAMOS LLANOSОценок пока нет

- Roboguide Training Manual FRDE Z KAE TRN Roboguide 1 01 enДокумент1 страницаRoboguide Training Manual FRDE Z KAE TRN Roboguide 1 01 enpitОценок пока нет

- 2018 SAP Security Notes Infographic PDFДокумент1 страница2018 SAP Security Notes Infographic PDFhusseinsadek7097Оценок пока нет

- Piscina AdministДокумент1 страницаPiscina Administsally alegreОценок пока нет

- Courage Is CallingДокумент26 страницCourage Is CallingAverage consumer50% (2)

- MCC 3Документ16 страницMCC 3vinod kumarОценок пока нет

- P007 Abn CCC Ar SHD 2559 S01Документ1 страницаP007 Abn CCC Ar SHD 2559 S01Abdul basithОценок пока нет

- Carvin F-Series AmpДокумент14 страницCarvin F-Series AmpDavid DertingОценок пока нет

- M-346 InstuctionsДокумент2 страницыM-346 InstuctionsBruce ROBERTSONОценок пока нет

- Ground Floor 0Документ1 страницаGround Floor 0Solaf ZeinОценок пока нет

- GR FloorДокумент1 страницаGR Floorahmedswalmeh84Оценок пока нет

- BP2 BoxlabelДокумент1 страницаBP2 BoxlabelAugusto SoaresОценок пока нет

- Issn 1314-7242, Volume 17, 2023: Economy & BusinessДокумент20 страницIssn 1314-7242, Volume 17, 2023: Economy & BusinesstassadarОценок пока нет

- GR00004100 00Документ26 страницGR00004100 00JBОценок пока нет

- Screenshot 2024-03-18 at 18.46.02Документ33 страницыScreenshot 2024-03-18 at 18.46.02leylat700Оценок пока нет

- Document layout with labeled sections A through FДокумент1 страницаDocument layout with labeled sections A through FAden Rivera MirandaОценок пока нет

- Metal Works ScopeДокумент1 страницаMetal Works ScopeMahmoud SamyОценок пока нет

- Manpower HistogramДокумент1 страницаManpower HistogramMDhana SekarОценок пока нет

- Less Policing More Murders: US HOMICIDES (1996-2020)Документ2 страницыLess Policing More Murders: US HOMICIDES (1996-2020)Paul BedardОценок пока нет

- Centro de Control de Motores Center LineДокумент4 страницыCentro de Control de Motores Center LineJorge Johnny Chipana MachacaОценок пока нет

- 16mm Alternate Bars and 10mm Temp and Nosing Bars SpacingДокумент1 страница16mm Alternate Bars and 10mm Temp and Nosing Bars SpacingJan DaveОценок пока нет

- Stair Plan and DetailДокумент1 страницаStair Plan and DetailQuinzell BisnanОценок пока нет

- SOBHA_KLL_MASTER PLAN_CROPPEDДокумент1 страницаSOBHA_KLL_MASTER PLAN_CROPPEDAshwini SinghОценок пока нет

- Passion Planner 52-Week Habit Tracker LARGEДокумент2 страницыPassion Planner 52-Week Habit Tracker LARGEGraciela PonchioОценок пока нет

- Esquema de Montagem: Guarda-Roupa ModenaДокумент4 страницыEsquema de Montagem: Guarda-Roupa ModenaCesar Carlos Quea PintoОценок пока нет

- Millermatic 200 User ManualДокумент72 страницыMillermatic 200 User ManualGhost GameplaysОценок пока нет

- Ose 53cyl Etoile Ose 3 Sisters OkДокумент2 страницыOse 53cyl Etoile Ose 3 Sisters OkJulio Almanza100% (1)

- SET Your Voice Free: Roger LoveДокумент24 страницыSET Your Voice Free: Roger LovewhahtОценок пока нет

- Daily ReportДокумент14 страницDaily Reportricki 2909Оценок пока нет

- Party in The USA - Miley CyrusДокумент2 страницыParty in The USA - Miley CyrusJeremy Kurn100% (1)

- Crazy Love - Van MorrisonДокумент1 страницаCrazy Love - Van MorrisonJeremy KurnОценок пока нет

- Water Pressure: Joint FirstДокумент1 страницаWater Pressure: Joint FirstJeremy KurnОценок пока нет

- Airbnb'S Impact On Hotels: Cheaper PriceДокумент1 страницаAirbnb'S Impact On Hotels: Cheaper PriceJeremy KurnОценок пока нет

- River - Leon BridgesДокумент2 страницыRiver - Leon BridgesJeremy KurnОценок пока нет

- Cardiovascular Health 2016Документ1 страницаCardiovascular Health 2016Jeremy KurnОценок пока нет

- Respect - Aretha FranklinДокумент2 страницыRespect - Aretha FranklinJeremy Kurn100% (1)

- Angel From Montgomery - Bonnie RaittДокумент1 страницаAngel From Montgomery - Bonnie RaittJeremy KurnОценок пока нет

- Modern office trends that didn't lastДокумент1 страницаModern office trends that didn't lastJeremy KurnОценок пока нет

- Cfo Outlook: Source: IBM 2016 Source: IBM 2016Документ1 страницаCfo Outlook: Source: IBM 2016 Source: IBM 2016Jeremy KurnОценок пока нет

- Taxing Times: Marginal Corporate Income Tax Rates by Region/GroupДокумент1 страницаTaxing Times: Marginal Corporate Income Tax Rates by Region/GroupJeremy KurnОценок пока нет

- Future of Packaging 2016Документ1 страницаFuture of Packaging 2016Jeremy KurnОценок пока нет

- Future of Work 2016Документ1 страницаFuture of Work 2016Jeremy KurnОценок пока нет

- The Rising Cost of University: 1,728 904 926k 966k 971k 1.01m 7,450Документ1 страницаThe Rising Cost of University: 1,728 904 926k 966k 971k 1.01m 7,450Jeremy KurnОценок пока нет

- Mobile Moments That Changed The WorldДокумент1 страницаMobile Moments That Changed The WorldJeremy KurnОценок пока нет

- Top Strategic Priorities and Challenges for CEOsДокумент1 страницаTop Strategic Priorities and Challenges for CEOsJeremy KurnОценок пока нет

- UK manufacturing productivity levels by industryДокумент1 страницаUK manufacturing productivity levels by industryJeremy KurnОценок пока нет

- The Beauty Economy 2016 PDFДокумент1 страницаThe Beauty Economy 2016 PDFJeremy KurnОценок пока нет

- Diversity and Inclusion 2016Документ1 страницаDiversity and Inclusion 2016Jeremy KurnОценок пока нет

- Corporate Treasury 2016Документ1 страницаCorporate Treasury 2016Jeremy KurnОценок пока нет

- Mobile Business 2017Документ1 страницаMobile Business 2017Jeremy KurnОценок пока нет

- Virtual Augmented Reality 2016Документ1 страницаVirtual Augmented Reality 2016Jeremy KurnОценок пока нет

- Global Wearable Shipments & Market Share ForecastДокумент1 страницаGlobal Wearable Shipments & Market Share ForecastJeremy KurnОценок пока нет

- Data Economy 2016Документ1 страницаData Economy 2016Jeremy KurnОценок пока нет

- Favourite Fictional Characters TimeДокумент1 страницаFavourite Fictional Characters TimeJeremy KurnОценок пока нет

- The Consequences of Rising Carbon EmissionsДокумент1 страницаThe Consequences of Rising Carbon EmissionsJeremy KurnОценок пока нет

- Modern office trends that didn't lastДокумент1 страницаModern office trends that didn't lastJeremy KurnОценок пока нет

- Supply Chain 2017 PDFДокумент1 страницаSupply Chain 2017 PDFJeremy KurnОценок пока нет

- Cost Estimating GuideДокумент109 страницCost Estimating GuideØwięs MØhãmmed100% (1)

- This Study Resource Was: Tourism and Hospitality MidtermДокумент9 страницThis Study Resource Was: Tourism and Hospitality MidtermMark John Paul CablingОценок пока нет

- Roles in Signode IndiaДокумент2 страницыRoles in Signode Indiaravi rajputОценок пока нет

- On GoodwillДокумент23 страницыOn GoodwillNabanita GhoshОценок пока нет

- Employee STSFCTNДокумент3 страницыEmployee STSFCTNMitali KalitaОценок пока нет

- Idea Generation and Business DevelopmentДокумент13 страницIdea Generation and Business DevelopmentbitetОценок пока нет

- THE PROPERTY MANAGEMENT PROCESSДокумент1 страницаTHE PROPERTY MANAGEMENT PROCESSFirst Capital AdvisoryОценок пока нет

- Implement Business PlanДокумент16 страницImplement Business PlanGhilany Carillo CacdacОценок пока нет

- A literature review of maintenance performance measurementДокумент32 страницыA literature review of maintenance performance measurementm sai ravi tejaОценок пока нет

- National Agricultural (Co-Operative Marketing) Federation of India Ltd.Документ18 страницNational Agricultural (Co-Operative Marketing) Federation of India Ltd.Sonam Gupta100% (3)

- BCG Presentation FinalДокумент24 страницыBCG Presentation FinalNitesh SinghОценок пока нет

- ExamДокумент58 страницExamRameen Alvi0% (1)

- Risks and Rewards of EntrepreneurshipДокумент5 страницRisks and Rewards of EntrepreneurshipJohn OpeñaОценок пока нет

- TempДокумент46 страницTemp17viruОценок пока нет

- Role of IT Report 123Документ6 страницRole of IT Report 123Soni SubediОценок пока нет

- Metorex Ar Dec10Документ148 страницMetorex Ar Dec10Take OneОценок пока нет

- Measuring Resources For Supporting Resource-Based CompetitionДокумент6 страницMeasuring Resources For Supporting Resource-Based CompetitionI Putu Eka Arya Wedhana TemajaОценок пока нет

- Fast Track To PRPC v5 5-09-21-09 FinalДокумент2 страницыFast Track To PRPC v5 5-09-21-09 FinalfuckreshukreОценок пока нет

- 180DC KMC CaseStudyResponse RiyaManchandaДокумент5 страниц180DC KMC CaseStudyResponse RiyaManchandaRiya ManchandaОценок пока нет

- CFNetworkDownload IEGF5s.tmp - ListДокумент4 страницыCFNetworkDownload IEGF5s.tmp - ListCHRISTINE REYESОценок пока нет

- Leading Global Online Food Delivery PlayerДокумент12 страницLeading Global Online Food Delivery PlayerClaudiuОценок пока нет

- Cost Accounting BasicsДокумент19 страницCost Accounting BasicstusarОценок пока нет

- SAP BW/HANA Consultant Jyoti Swanjary ResumeДокумент4 страницыSAP BW/HANA Consultant Jyoti Swanjary ResumeraamanОценок пока нет

- b5 Special Solving Set 5Документ6 страницb5 Special Solving Set 5MSHANA ALLYОценок пока нет

- Taxation Part 2Документ101 страницаTaxation Part 2Akeefah BrockОценок пока нет

- Manual On CAS For PACSДокумент96 страницManual On CAS For PACSShishir ShuklaОценок пока нет

- Marketing Research ReviewerДокумент3 страницыMarketing Research ReviewerJayson MeperaqueОценок пока нет

- CSR Project MMS 2018 - 2020Документ60 страницCSR Project MMS 2018 - 2020shahin shekh100% (2)