Академический Документы

Профессиональный Документы

Культура Документы

43 Shweta Singh

Загружено:

rohit sharma0 оценок0% нашли этот документ полезным (0 голосов)

58 просмотров5 страницBanking

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документBanking

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

58 просмотров5 страниц43 Shweta Singh

Загружено:

rohit sharmaBanking

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

International Journal of Theoretical & Applied Sciences, Special Issue-NCRTAST 8(1): 180-184(2016)

ISSN No. (Print): 0975-1718

ISSN No. (Online): 2249-3247

The Role & Regulations of NBFCs (Non Banking Finance

Companies) in India: The Structure and status profile

Shweta Singh*, Anuj Pratap Singh** and Sharad Tiwari**

*

Department of Mathematics, School of Engineering and Technology,

Jagran Lakecity University, Bhopal, (Madhya Pradesh), India

ISSN No. (Print) : 0975-1718 **Department of Economics,

Government Hamidiya Arts & Commerce College Bhopal, (Madhya Pradesh), India

ISSN No. (Online) :

2249-3247 (Corresponding author: Shweta Singh)

(Received 11 April, 2016 Accepted 20 May, 2016)

(Published by Research Trend, Website: www.researchtrend.net)

ABSTRACT: Non-banking financial companies, or NBFCs, are financial institutions that provide banking

services, but do not hold a banking license. This paper mainly focus on the role & regulations of NBFCs in

India, its significance, the funding sources of NBFCs & its future prospects. Financial System in its

composition, status, evolution, regulatory frame work, functional arena besides the nexus between the

financial system and economical development. Many of the studies were already made and published to

explore the functions and working of NBFCs and evaluation of NBFCs in India.. The operational profile, the

growth focus, the dimensions of business volume over the years and also the financial performance of the

NBFCs in India are also given a comprehensive focus to provide vital background peripheral to the study. An

insight has also been given on recent structure financial sector reforms and its implications on the non

banking financial institutions.

medium industrial concerns direct finance assistance

I. INTRODUCTION

and small and medium industrial concerns through the

The term Finance is often understood as being State Financial Institutions. These corporations issue

equivalent to money. However, finance exactly is not bonds and debentures and also accept deposits from the

money; it is the source of providing funds for a public. But the private sector had to rely mostly on the

particular activity. Providing or securing finance by commercial banks which were also not grown to such a

itself is a distinct activity or function, which results in scale as to provide corporate funds required by the

Financial Management, Financial Services and promoters. Traditional banks have been financing

Financial Institutions. Finance therefore represents the manufacturing activity by providing working capital.

resources by way funds are needed for a particular With the shortage of financial resources against

activity. We thus speak of 'finance' only in relation to a Expanding activities the companies were mostly

proposed activity. Finance goes with commerce, depending on credit deals. Capital goods Such as

business, banking etc. Finance is also referred to as machinery, equipment etc., were imported on deferred

"Funds" or "Capital", when referring to the financial payment terms

needs of a corporate body It is well acknowledged in the academic literature

Evolution of Non-Banking Financial Companies. that an efficient and well-developed financial system is

India soon after independence launched on a important for influencing economic growth. The

programmer of rapid industrialization which needed positive effects of financial development on growth are

long term investment in capital assets. Industries which basically credited to the functions1 it plays particularly

were essential and required huge investments were in the mobilization and allocation of resources needed

setup by the Government of India in the public sector. to undertake productive investment activities by various

The government also extended guarantees whenever economic agents. Theoretical literature argued that the

loan was obtained by the public sector industries from increased availability of financial instruments and

the foreign agencies. Public financial institutions were institutions greatly reduces transaction and information

established for instance, the Industrial Development costs in economy which in turn influences savings rate,

Bank of India and the statutory Finance Corporations. investment decisions and undertaking of technological

The development banks have been providing large and innovations.

Singh, Singh and Tiwari 181

A large number of empirical works have also tested the Or dividend.

finance-growth relationship employing different (i) Banking: Reserve Bank of India (RBI),

methodological techniques using different indicators of Commercial Banks, Co-operative Credit Societies, Co-

financial development in cross-country or time series operative Banks, Post-office Saving Banks.

studies. The empirical findings are generally in (ii) Non-Banking : Provident and Pension Funds,

consensus that a well-functioning and efficient financial Small Savings Organizations, Life Insurance

system has beneficial impacts on economic growth. Corporation (LIC), General Insurance Corporation

The activities of non-banking financial companies (GIC), Unit Trust of India(UTI), Mutual Funds,

(NBFCs) in India have undergone qualitative changes Investment Trusts, Investment Companies, Finance

over the years through functional specialization. The Corporations, Nidhis, Chit Funds, Hire-Purchase

role of NBFCs as effective financial intermediaries has Finance Companies, Lease Finance Companies,

been well recognized as they have inherent ability to National Housing Bank (NHB ), Housing and Urban

take quicker decisions, assume greater risks, and Development Corporation (HUDCO), Housing

customize their services and charges more according to Development Finance Corporation (HDFC), and other

the needs of the clients. While these features, as housing finance companies, Manufacturing companies

compared to the banks, have contributed to the accepting public deposits, Venture Capital Funds and

proliferation of NBFCs, their flexible structures allow National Cooperative Bank of India(NCBI).

them to unbundle services provided by banks and And NBFCs can be further classified into different

market the components on a competitive basis. The types depending on their nature of business.

distinction between banks and non-banks has been Further, total Finance sector in India may be classified

gradually getting blurred since both the segments of the into Formal and Informal Finance.

financial system engage themselves in many similar The informal sector of finance may be said to refer to

types of activities. At present, NBFCs in India have all economic activities that fall outside the formal sector

become prominent in a wide range of activities like that is regulated by economic and legal institutions e.g

hire-purchase finance, equipment lease finance, loans, money lenders, some channels of micro finance and the

investments, etc. By employing innovative marketing other not necessarily regulated sectors. Landlords, local

strategies and devising tailor-made products, NBFCs shopkeepers, traders, suppliers and professional money

have also been able to build up a clientele base among lenders, and relatives are the informal sources of micro-

the depositors, mop up public savings and command finance for the poor, both in rural and urban areas. The

large resources as reflected in the growth of their Formal sector can be said to comprise of the Formal

deposits from public, shareholders, directors and other and necessarily regulated channels of financing like,

companies, and borrowings by issue of non-convertible finance provided by Banks, Financial Institutions, Non-

debentures, etc Banking Financial Institutions, and Micro finance

Framework Financial System in India institutions.

The Financial Intermediaries in the Financial System What is a Non Banking Financial Institution

can broadly be said to comprise of: (NBFI)?

-Banks A Non Banking Financial Institution/ Non Banking

-NBFCs Financial Intermediary have different definitions in

More often financial markets are classified as different countries:

money markets and capital markets. While the -Any institution which is not a bank but is involved in

money market deals in the short-term claims finance.

(with a period of maturity of one year or less), -Financial institutions not taking demand deposits

the capital market does so in the long-term -Financial institutions not taking any deposit

(maturity period above 1 year) claim NBFIs are different types of financial institutions

Commercial banks, for example, belong to that provide the following Types of services:

both. While Treasury Bills Market, Call - Payments

Money Market, and Commercial Bills Market -Liquidity / credit

are examples of the money market, Stock -Divisibility: break up large denomination and

Market and Government Bonds Market are aggregate small denomination

examples of the capital market. Financial asset -Store of value

represent a claim to the payment of a sum of -Information: processing and assessing risks

money sometime in future (repayment -Risk pooling: lower the risks of investors

Of principal) and /or a periodic (regular or not

so regular) payment in the form of interest

Singh, Singh and Tiwari 182

Types of NBFI through proper regulation. Risk will vary depending

NBFIs can be classified by the main services they upon the economic functions performed by NBFIs. The

provide: challenge for regulation is striking the right balance

-Deposit taking institutions (e.g Thrifts, credit unions, between the risks and benefits. On the one hand, too

savings& loans.) little or no regulation can lead to crisis and severely

- Risk-pooling institutions (e.g insurance co.) impact the vulnerable and the economy. This has been a

- Contractual savings institutions (e.g Mutual funds, major attribute to the Asian crisis in the late 90s

pension funds, other investment institutions) finance companies in Thailand and merchant banks in

-Market makers (e.g Investment banks, stockbrokers.) Korea. On the other hand, too strict or inappropriate

- Specialized sectoral financiers (e.g leasing companies, regulation can hinder innovation and development. The

real state finance co.micro-finance institutions.) call for deregulation in developed economies reflects

- Financial service providers (e.g Brokers, investment this. Getting the right balance is a perpetual challenge

advisers). for financial regulators and supervisors, not only in the

Risks Associated with NBFIs and why they need to developing countries, but also in developed and

be regulated: advanced economies.

While NBFIs can contribute to the economy, they also

bring risks and the only way to contol these risks is

Singh, Singh and Tiwari 183

can play a useful role in the economy of the country. To

the extent that they help in monetizing the economy and

transferring unproductive financial assets into

productive assets, they contribute to the countrys

economic development. In fact, the nature and diversity

of financial institutions themselves have become

measures of economic development of a country. The

Reserve Bank of India expert committees identified the

need of non banking financial companies in the

following areas:

-Development of sectors like transport and

infrastructure

-Substantial employment generation

-Help and increase wealth creation

- Broad base economic development

-Irreplaceable supplement to bank credit in rural

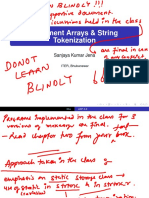

Chart 2 : The main reasons behind low penetration of segments

banking have been as shown above. -Major thrust on semi-urban, rural Areas and first time

buyers/users

Role of NBFCs

-To finance economically weaker sections.

NBFCs like banks and other financial institutions act as

-Huge contribution to the state exchequer.

intermediaries between the ultimate savers and the

Regulation of NBFCs

ultimate borrowers. The rationale of their existence

While NBFCs have been rendering many useful

derives from the fact that in an economy there are

services, several advances, unhealthy features of their

surplus units which save and deficit units which are in

working also have been observed. At present all NBFCs

need of such savings and a mechanism is needed to

except HFCs are regulated by the RBI. With enactment

bring the two together. Surplus units (savers) can lend

of RBI (Amendment) act 1997, all of them with net

to the deficit units (borrowers) directly. This, however,

owned funds of .25Lakhs and above have to register

is normally inconvenient to both the savers and

with the RBI now. The BFS with the help of

borrowers and is certainly not the most efficient means

department of supervision of the RBI began supervising

of flow of funds between the units. With the mediation

NBFCs from July 1995. HFCs are regulated by NHB.

of financial institutions, there is a reduction in the

The major regulatory provisions are:-

degree of risks involved and there is also a more

(i) The minimum net worth funds of 25 Lakh and the

efficient utilization of the resources in the economy.

NBFC should achieve the minimum net worth norm in

Financial intermediaries can provide a more economical

3 years or extended 3years more at the discretion of

service because of the economies of scale, their

RBI.

professional expertise and their ability to spread the risk

(ii) NBFCs have to maintain 10%and15% of their

over a large number of units. Thus, their operations

deposits in liquid assets.

give to the saver the combined benefits of higher return,

(iii) They have to create reserve fund and transfer not

lower risk and liquidity. The borrowers on the other

less than 20% of their net deposits to it every year.

hand also get a wider choice on account of

(iv) The RBI directs them on issues of disclosures,

intermediation of financial institutions. It may be of

prudential norms, credit, investments etc.

relevance to note that while the loans granted by

(v) Nomination facility is available to depositors of

commercial banks are, by and large, for industrial,

these companies. 90

commercial and agricultural purposes, those granted by

(vi) Unincorporated bodies engaged in financial activity

NBFCs are generally for transport, trading, acquisition

cannot accept deposits from the public from April,

of durable consumer goods, purchase and repair of

1997.

houses or just for plain consumption. Since their

(vii) They have to achieve a minimum capital adequacy

activities are not controlled by monetary authorities to

norm of 8% by March, 1996.

the same extent as those of commercial banks, the

(viii) They have to obtain a minimum credit rating

credit extended by NBFCs may not necessarily be in

from any one of 3 credit rating agencies.

consonance with national objectives and priorities. The

(ix) A ceiling of 15% interest on deposits has been

major function of financial intermediaries is to transfer

prescribed for MBFCs or Nidhis.

the savings of surplus units to deficit units; hence, they

Singh, Singh and Tiwari 184

(x) The interest rate ceiling on deposits as also the is not so progressive as many of the published research

ceiling on quantum of deposits for NBFCs (other than papers shows only basics of the NBFCs and still it is

Nidhis) have removed. essential to study the evaluate the performance of

NBFCs in India.

CONCLUSION

REFERENCES

To conclude, the NBFCs are playing significant role in

meeting financial requirements of the medium sized [1]. Amit Kumar and Anshika Agarwal, Latest Trends in

and small sized industries and development of Indian Non-banking Financial Institutions, Academicia: An

economy indirectly. This paper mainly focus on the role International Multidisciplinary Research Journal, Vol. 4, No.

& regulations of NBFCs in India, its significance, the 1, January 2014, pp. 225-235.

[2]. Dash Saroj K, et al, Housing Loan Disbursement in India:

funding sources of NBFCs & its future prospects. Suggestive Metrics to Prevent Bad Debts, International

Financial System in its composition, status, evolution, Journal of Managment, IT and Engineering, Vol. 4, No. 3,

regulatory frame work, functional arena besides the 2014, pp. 254-261.

nexus between the financial system and economical [3]. Jafor Ali Akhan, Non-Banking Financial Companies in

development .On the other hand, policies of NBFCs are India: Functioning and Reforms, New Delhi, New Century

also providing investment security for the investors. It Publications, 2010.

is highlighted that due to the regulations of the Reserve [4]. Naresh Makhijani, Non-Banking Finance Companies:

Bank of India, still the NBFCs are not extending more Time to Introspect, Analytique, Vol. 9 & 10, No. 2, April-

credit. It is suggested to the NBFC credit policy to June 2014, pp. 34-36.

[5]. Ravi Puliani and Mahesh Puliani, Manual of Non-

reduce rate of interests, which helps to small enterprises Banking Financial Companies, New Delhi, Bharat Law

to get loans for their different capital requirements. The House, 2014.

review made above shows that the research in NBFCs

Вам также может понравиться

- Indian Financial System & Indian Banking Sector: A Descriptive Research StudyДокумент8 страницIndian Financial System & Indian Banking Sector: A Descriptive Research StudyHemanth Kumar RajendakumarОценок пока нет

- A Review of Role and Challenges of Non-Banking Financial Companies in Economic Development of IndiaДокумент9 страницA Review of Role and Challenges of Non-Banking Financial Companies in Economic Development of IndiaSushm GiriОценок пока нет

- NBFC ProjectДокумент97 страницNBFC Projectsanjaydesai173_8631850% (2)

- Unit 9 Monetary Policy: 9.0 ObjectivesДокумент21 страницаUnit 9 Monetary Policy: 9.0 ObjectivesShashank Cooled RanaОценок пока нет

- NBFC Final ProjectДокумент56 страницNBFC Final ProjectYogesh PatilОценок пока нет

- Financial SystemДокумент13 страницFinancial SystemIsha AggarwalОценок пока нет

- Introduction To FinanceДокумент68 страницIntroduction To FinancejohnnybondОценок пока нет

- Accelerating research accessДокумент9 страницAccelerating research accessNaveed ShahzadaОценок пока нет

- Changes in The Indian Financial System Since 1991Документ8 страницChanges in The Indian Financial System Since 1991Samyra RathoreОценок пока нет

- Analysis of Growth Prospects of Non BankДокумент7 страницAnalysis of Growth Prospects of Non Bankmahesh toshniwalОценок пока нет

- Dessertation Report On NBFCДокумент65 страницDessertation Report On NBFCHarsh ChaudharyОценок пока нет

- UntitledДокумент16 страницUntitledಲೋಕೇಶ್ ಎಂ ಗೌಡОценок пока нет

- FinancialДокумент99 страницFinancialMohan Krishna SimhadriОценок пока нет

- Sources of institutional finance in India and their role in economic developmentДокумент22 страницыSources of institutional finance in India and their role in economic developmentLakshya DheerОценок пока нет

- Introduction:-: Financial Service Refer To Services Provided by The Finance Industry. The Finance IndustryДокумент63 страницыIntroduction:-: Financial Service Refer To Services Provided by The Finance Industry. The Finance Industrypriyasen2433Оценок пока нет

- Introduction To FinanceДокумент69 страницIntroduction To FinancejohnnybondОценок пока нет

- Nisha SipДокумент35 страницNisha Sippooja vermaОценок пока нет

- DFIs Role in India's Capital MarketДокумент41 страницаDFIs Role in India's Capital MarketKaustubh JageОценок пока нет

- Adarsh SrivastavДокумент35 страницAdarsh Srivastavpooja vermaОценок пока нет

- Mediating Effect of Service Quality on Non-Banking Financial InstitutionsДокумент8 страницMediating Effect of Service Quality on Non-Banking Financial InstitutionsGAYATHRIОценок пока нет

- Synopsis of Mutual FundДокумент9 страницSynopsis of Mutual Fundmanpreet kaurОценок пока нет

- Shriram Finace Sip ReportДокумент64 страницыShriram Finace Sip Reportshiv khillari75% (4)

- Synopsis Corporate Finiance: Corporate Debt Market in IndiaДокумент4 страницыSynopsis Corporate Finiance: Corporate Debt Market in Indiasiddharth pandeyОценок пока нет

- OS at Hedge EquitiesДокумент46 страницOS at Hedge EquitiesEby JoseОценок пока нет

- Financial institutions typesДокумент6 страницFinancial institutions typesAshok InsaОценок пока нет

- Non-Banking Financial InstitutionsДокумент4 страницыNon-Banking Financial Institutionscool_vardahОценок пока нет

- Accounts AssigmentДокумент6 страницAccounts Assigmenturvigarg079Оценок пока нет

- Factors Building Stable Financial SystemsДокумент11 страницFactors Building Stable Financial SystemsShailly GargОценок пока нет

- A Study On Financial Performance Analysis of Sundaram Finance LimitedДокумент56 страницA Study On Financial Performance Analysis of Sundaram Finance LimitedAnonymous lOz8e6tl0Оценок пока нет

- Credit Risk Management in BanksДокумент53 страницыCredit Risk Management in Banksrahulhaldankar100% (1)

- Corporate Financing With Special Reference To Bank of India, Thane (Main) BranchДокумент73 страницыCorporate Financing With Special Reference To Bank of India, Thane (Main) BranchMohit SharmaОценок пока нет

- NBFC Full NotesДокумент69 страницNBFC Full NotesJumana haseena SОценок пока нет

- CASE: Financial Services in IndiaДокумент8 страницCASE: Financial Services in IndiaANCHAL SINGHОценок пока нет

- Non-Banking Financial CompaniesДокумент36 страницNon-Banking Financial CompaniessarvaianОценок пока нет

- Role of Financial System in Economic Development of A CountryДокумент8 страницRole of Financial System in Economic Development of A CountryTaraОценок пока нет

- Growth of NBFC Sector in IndiaДокумент40 страницGrowth of NBFC Sector in IndiaNirmal Kumar Kushwah67% (3)

- Overview of the Indian Financial SystemДокумент84 страницыOverview of the Indian Financial Systemriya das100% (1)

- Financial Institutions: by S.K TannanДокумент10 страницFinancial Institutions: by S.K TannanSuresh TannanОценок пока нет

- Indian Financial System Regulatory Bodie PDFДокумент13 страницIndian Financial System Regulatory Bodie PDFRaushan MehrotraОценок пока нет

- Blackbook FinalДокумент86 страницBlackbook Finalgunesh somayaОценок пока нет

- Ma 0027Документ17 страницMa 0027sathishОценок пока нет

- Universal BankingДокумент13 страницUniversal BankingShrutikaKadamОценок пока нет

- Financial Institutions and Markets A ST MoumdzДокумент10 страницFinancial Institutions and Markets A ST MoumdzNageshwar SinghОценок пока нет

- Financial Services: An IntroductionДокумент12 страницFinancial Services: An IntroductionVINIT RATANОценок пока нет

- A Business Reading ON: Role of Financial Institution On Indian Economy"Документ15 страницA Business Reading ON: Role of Financial Institution On Indian Economy"adil khanОценок пока нет

- Banking and NBFC - Module 4 - NBFC Products Deposit BasedДокумент43 страницыBanking and NBFC - Module 4 - NBFC Products Deposit Basednandhakumark152Оценок пока нет

- Unit V FMДокумент35 страницUnit V FMHR HMA TECHОценок пока нет

- Financial Services M.com NotesДокумент31 страницаFinancial Services M.com NotesFarhan Damudi75% (8)

- A Study On Financial Performance Analysis of The Sundaram Finance LTDДокумент56 страницA Study On Financial Performance Analysis of The Sundaram Finance LTDSindhuja Venkatapathy88% (8)

- Chapter 1: Introduction To Financial System: S.T Gonsalo Garcia CollegeДокумент40 страницChapter 1: Introduction To Financial System: S.T Gonsalo Garcia CollegeSalman ShaikhОценок пока нет

- Financial SystemДокумент17 страницFinancial Systemদেবব্রত নাথОценок пока нет

- Financial Services MbaДокумент251 страницаFinancial Services MbaMohammed Imran50% (2)

- Indian Financial SystemДокумент12 страницIndian Financial SystemRaghuОценок пока нет

- NBFC Edelweise Retail FinanceДокумент14 страницNBFC Edelweise Retail FinancesunitaОценок пока нет

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)От EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Оценок пока нет

- Marketing of Consumer Financial Products: Insights From Service MarketingОт EverandMarketing of Consumer Financial Products: Insights From Service MarketingОценок пока нет

- Banking India: Accepting Deposits for the Purpose of LendingОт EverandBanking India: Accepting Deposits for the Purpose of LendingОценок пока нет

- Financial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingОт EverandFinancial Markets Fundamentals: Why, how and what Products are traded on Financial Markets. Understand the Emotions that drive TradingОценок пока нет

- Gnlu Short AssignmentДокумент3 страницыGnlu Short Assignmentrohit sharmaОценок пока нет

- Legal Issues and Risks of Net Banking in IndiaДокумент4 страницыLegal Issues and Risks of Net Banking in Indiarohit sharmaОценок пока нет

- Module 1Документ22 страницыModule 1rohit sharmaОценок пока нет

- Aressian States Challenge Linking of Rivers ProjectДокумент44 страницыAressian States Challenge Linking of Rivers ProjectSDОценок пока нет

- Muktajee Vandasjiswami S.J.M.S. Trust v. V.R. Rudani, Reported in AIR 1989 SC 1607, TheДокумент3 страницыMuktajee Vandasjiswami S.J.M.S. Trust v. V.R. Rudani, Reported in AIR 1989 SC 1607, Therohit sharmaОценок пока нет

- Module 2Документ41 страницаModule 2rohit sharmaОценок пока нет

- Module 3Документ24 страницыModule 3rohit sharmaОценок пока нет

- Petition Under Article 32 of ConstitutionДокумент26 страницPetition Under Article 32 of ConstitutionKashishKhattarОценок пока нет

- Indira GandhiДокумент5 страницIndira GandhiSoumyadeep Banerjee0% (1)

- Muktajee Vandasjiswami S.J.M.S. Trust v. V.R. Rudani, Reported in AIR 1989 SC 1607, TheДокумент3 страницыMuktajee Vandasjiswami S.J.M.S. Trust v. V.R. Rudani, Reported in AIR 1989 SC 1607, Therohit sharmaОценок пока нет

- Gambia Non-Bank Financial InstitutionsДокумент37 страницGambia Non-Bank Financial Institutionsrohit sharmaОценок пока нет

- Module 1Документ22 страницыModule 1rohit sharmaОценок пока нет

- 8 NBFCДокумент110 страниц8 NBFCrohit sharmaОценок пока нет

- NBFCДокумент3 страницыNBFCGaurav SinОценок пока нет

- Indias Leading BFSI Companies 2017Документ244 страницыIndias Leading BFSI Companies 2017rohit sharma100% (1)

- ProjectДокумент17 страницProjectrohit sharmaОценок пока нет

- Chapter - III Financial System and Non-Banking Financial Companies - The Structure and Status ProfileДокумент55 страницChapter - III Financial System and Non-Banking Financial Companies - The Structure and Status Profilechirag10pnОценок пока нет

- Right to Suit and Appeal AnalyzedДокумент33 страницыRight to Suit and Appeal AnalyzedAbhijitDholeОценок пока нет

- ProjectДокумент17 страницProjectrohit sharmaОценок пока нет

- PresentationДокумент4 страницыPresentationrohit sharmaОценок пока нет

- Your Money Personality Unlock The Secret To A Rich and Happy LifeДокумент30 страницYour Money Personality Unlock The Secret To A Rich and Happy LifeLiz Koh100% (1)

- Legal Maxim V02Документ29 страницLegal Maxim V02singam harikanthОценок пока нет

- Treatment of Pituitary Adenoma by Traditional Medicine TherapiesДокумент3 страницыTreatment of Pituitary Adenoma by Traditional Medicine TherapiesPirasan Traditional Medicine CenterОценок пока нет

- Annexure 2 Form 72 (Scope) Annexure IДокумент4 страницыAnnexure 2 Form 72 (Scope) Annexure IVaghasiyaBipinОценок пока нет

- Strategic Planning and Program Budgeting in Romania RecentДокумент6 страницStrategic Planning and Program Budgeting in Romania RecentCarmina Ioana TomariuОценок пока нет

- Exp Mun Feb-15 (Excel)Документ7 510 страницExp Mun Feb-15 (Excel)Vivek DomadiaОценок пока нет

- USP 11 ArgumentArraysДокумент52 страницыUSP 11 ArgumentArraysKanha NayakОценок пока нет

- Best Safety Practices in The Philippine Construction PDFДокумент16 страницBest Safety Practices in The Philippine Construction PDFDione Klarisse GuevaraОценок пока нет

- Political Science Assignment PDFДокумент6 страницPolitical Science Assignment PDFkalari chandanaОценок пока нет

- Cycling Coaching Guide. Cycling Rules & Etiquette Author Special OlympicsДокумент20 страницCycling Coaching Guide. Cycling Rules & Etiquette Author Special Olympicskrishna sundarОценок пока нет

- Piramal Annual ReportДокумент390 страницPiramal Annual ReportTotmolОценок пока нет

- Corporate Office Design GuideДокумент23 страницыCorporate Office Design GuideAshfaque SalzОценок пока нет

- Web Design Course PPTX Diana OpreaДокумент17 страницWeb Design Course PPTX Diana Opreaapi-275378856Оценок пока нет

- Training of Local Government Personnel PHДокумент5 страницTraining of Local Government Personnel PHThea ConsОценок пока нет

- Principle of Utmost Good FaithДокумент7 страницPrinciple of Utmost Good FaithshreyaОценок пока нет

- AOM NO. 01-Stale ChecksДокумент3 страницыAOM NO. 01-Stale ChecksRagnar Lothbrok100% (2)

- AC & Crew Lists 881st 5-18-11Документ43 страницыAC & Crew Lists 881st 5-18-11ywbh100% (2)

- ICE Learned Event DubaiДокумент32 страницыICE Learned Event DubaiengkjОценок пока нет

- Sample Detailed EvaluationДокумент5 страницSample Detailed Evaluationits4krishna3776Оценок пока нет

- Iso 1964 1987Документ11 страницIso 1964 1987Dina ANDRIAMAHEFAHERYОценок пока нет

- 001 Joseph Vs - BautistacxДокумент2 страницы001 Joseph Vs - BautistacxTelle MarieОценок пока нет

- Monitoring and Evaluation of Sediment Control Structure (Sabo Dam)Документ8 страницMonitoring and Evaluation of Sediment Control Structure (Sabo Dam)Ricky PriyatmokoОценок пока нет

- Infinitive Clauses PDFДокумент3 страницыInfinitive Clauses PDFKatia LeliakhОценок пока нет

- Once in his Orient: Le Corbusier and the intoxication of colourДокумент4 страницыOnce in his Orient: Le Corbusier and the intoxication of coloursurajОценок пока нет

- Shilajit The Panacea For CancerДокумент48 страницShilajit The Panacea For Cancerliving63100% (1)

- Problem Areas in The Inpatient DepartmentДокумент2 страницыProblem Areas in The Inpatient DepartmentVineet AgarwalОценок пока нет

- Mitanoor Sultana: Career ObjectiveДокумент2 страницыMitanoor Sultana: Career ObjectiveDebasish DasОценок пока нет

- Commissioning GuideДокумент78 страницCommissioning GuideNabilBouabanaОценок пока нет

- A Brief History of The White Nationalist MovementДокумент73 страницыA Brief History of The White Nationalist MovementHugenОценок пока нет

- Alluring 60 Dome MosqueДокумент6 страницAlluring 60 Dome Mosqueself sayidОценок пока нет