Академический Документы

Профессиональный Документы

Культура Документы

BIR RMC 28-2017 Annex A

Загружено:

Anonymous yKUdPvwjИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

BIR RMC 28-2017 Annex A

Загружено:

Anonymous yKUdPvwjАвторское право:

Доступные форматы

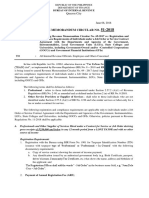

ANNEX A

REMINDER TO ALL TAXPAYERS MANDATED TO

FILE AND PAY ELECTRONICALLY

RR 5-2015 imposes the following penalties on taxpayers mandated to e-file but fail to do so:

Php 1,000 per return, pursuant to Section 250 of the NIRC of 1997, as amended;

25% of the tax due to be paid, pursuant to Section 248 (A) (2) of the NIRC of 1997, as

amended;

In addition, non-compliant taxpayers will be included in the priority audit program.

Mandated Taxpayers Mandated Taxpayers

Taxpayer Account Management Program Accredited tax agents/practitioners and all

(TAMP) taxpayers its client-taxpayers

Those required to secure the BIR-ICC and Accredited Printers of Principal and

BIR-BCC Supplementary Receipts/Invoices

National Government Agencies One-Time Transaction (ONETT) taxpayers

who are classified as real estate

Licensed Local Contractors dealers/developers; those who are

considered habitually engaged in the sale of

Enterprises enjoying fiscal incentives (PEZA, real property and regular taxpayers already

BOI, etc.) covered by eBIRForms. Taxpayers who are

filing BIR Form Nos. 1706, 1707, 1800, 1801

Top 5,000 Individual Taxpayers and 2000-OT (for BIR Form No. 1706 only)

are excluded

Corporations with paid-up capital stock of

P10 million and above Those filing a No Payment return

Corporations with complete Computerized Government-Owned or -Controlled

Accounting System Corporations

Procuring Government Agencies withholding Local Government Units, except barangays

VAT and Percentage taxes

Cooperatives registered with National

Government Bidders Electrification Administration and Local

Water Utilities Administrations

Large Taxpayers

Top 20,000 Private Corporations

Insurance companies and stockbrokers

Those enrolling in behalf of their company for either eFPS or eBIRForms must submit an official certificate

designating them as authorized representatives as per Sec 52 (A) of the Tax Code.

Individuals are exempt from this requirement.

Вам также может понравиться

- Filepay Ver2Документ1 страницаFilepay Ver2Aries ParazoОценок пока нет

- RMO No 19-2015 PDFДокумент10 страницRMO No 19-2015 PDFEcarg EtrofnomОценок пока нет

- Mid-Term-Day 1-Other Percentage Taxes (Opt)Документ52 страницыMid-Term-Day 1-Other Percentage Taxes (Opt)Christine Joyce MagoteОценок пока нет

- Percentage TaxДокумент5 страницPercentage TaxGIGI BODOОценок пока нет

- Accounting Technician Level 3 - Module 3 Part 2Документ4 страницыAccounting Technician Level 3 - Module 3 Part 2Rona Amor MundaОценок пока нет

- Percentage Tax: o o o o o oДокумент11 страницPercentage Tax: o o o o o oMark Joseph BajaОценок пока нет

- Percentage TaxДокумент7 страницPercentage TaxArielle CabritoОценок пока нет

- 1702 RTsasaДокумент4 страницы1702 RTsasaEysOc11Оценок пока нет

- 29133rmo 10-2006Документ15 страниц29133rmo 10-2006Denzel Edward CariagaОценок пока нет

- Percentage Tax ReviewerДокумент5 страницPercentage Tax ReviewerJerico ManaloОценок пока нет

- RR 14-08 DigestДокумент2 страницыRR 14-08 DigestPat PatОценок пока нет

- Tax Filing Reminders: OutlineДокумент30 страницTax Filing Reminders: OutlineMarc Nathaniel RanayОценок пока нет

- Business TaxationДокумент33 страницыBusiness Taxationrose querubinОценок пока нет

- What Is Percentage Tax?Документ3 страницыWhat Is Percentage Tax?Lucas JuanchoОценок пока нет

- BIR Form 2551Q: Under Sections 116 To 126 of The Tax Code, As AmendedДокумент9 страницBIR Form 2551Q: Under Sections 116 To 126 of The Tax Code, As AmendedJAYAR MENDZОценок пока нет

- Revenue Memorandum Circular No. 62-05: SubjectДокумент12 страницRevenue Memorandum Circular No. 62-05: Subject김비앙카Оценок пока нет

- Remedies: TaxAdmin-PowerRemedyДокумент101 страницаRemedies: TaxAdmin-PowerRemedyJm CruzОценок пока нет

- References: Philippine Tax Code CREATE Law TRAIN Law Income Taxation, Banggawan RR8-2018 RR14-2001 RR12-2007 RA 9520Документ16 страницReferences: Philippine Tax Code CREATE Law TRAIN Law Income Taxation, Banggawan RR8-2018 RR14-2001 RR12-2007 RA 9520Mark Lawrence YusiОценок пока нет

- RMC 42-99 17533-1999-Amending - Revenue - Memorandum - Circular - No.Документ3 страницыRMC 42-99 17533-1999-Amending - Revenue - Memorandum - Circular - No.KC AtinonОценок пока нет

- Pa Tax Brief - March 2018Документ11 страницPa Tax Brief - March 2018Teresita TibayanОценок пока нет

- Module VIДокумент13 страницModule VIRenz Joshua Quizon MunozОценок пока нет

- 2 Tips & Tricks For MSMEs Tax Compliance Handouts PDFДокумент79 страниц2 Tips & Tricks For MSMEs Tax Compliance Handouts PDFGetty Reagan DyОценок пока нет

- 244877-2019-Clarifications On The Inclusion of Taxpayers20220328-11-5qiv23Документ2 страницы244877-2019-Clarifications On The Inclusion of Taxpayers20220328-11-5qiv23Vence EugalcaОценок пока нет

- Description: (Return To Index)Документ8 страницDescription: (Return To Index)Dura LexОценок пока нет

- Top 20000 Private Corp. and Top 5000 Individual TaxpayersДокумент7 страницTop 20000 Private Corp. and Top 5000 Individual TaxpayersJolina HenoguinОценок пока нет

- Income, Tax Treatment and Mode of Filing 2020Документ2 страницыIncome, Tax Treatment and Mode of Filing 2020francis dungcaОценок пока нет

- RMC 42-99 VAT On OECFДокумент4 страницыRMC 42-99 VAT On OECFLeizlyn Ann De OcampoОценок пока нет

- 2019101151017301SRO1160Документ27 страниц2019101151017301SRO1160NaziaОценок пока нет

- Revenue Regulation 1-2013Документ7 страницRevenue Regulation 1-2013Jerwin DaveОценок пока нет

- Guidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnДокумент1 страницаGuidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnJenel ChuОценок пока нет

- Taxation Report Vina MarieДокумент12 страницTaxation Report Vina MarieAnonymous gmDxRbnwOОценок пока нет

- Manual Return Ty 2017Документ56 страницManual Return Ty 2017Muhammad RizwanОценок пока нет

- Ease of Paying TaxesДокумент2 страницыEase of Paying TaxesLET ReviewerОценок пока нет

- CPAR Lecture Filing and Penalties (Batch 90) HandoutДокумент25 страницCPAR Lecture Filing and Penalties (Batch 90) HandoutAljur SalamedaОценок пока нет

- Frequency of ReportingДокумент5 страницFrequency of ReportingNeriza maningasОценок пока нет

- Guidelines 1702-EX June 2013 PDFДокумент4 страницыGuidelines 1702-EX June 2013 PDFRica Rianni GisonОценок пока нет

- January 14, 2011: DescriptionДокумент11 страницJanuary 14, 2011: DescriptionRosselle GuevarraОценок пока нет

- Activity4 MPortarcosДокумент14 страницActivity4 MPortarcosMichaela T PortarcosОценок пока нет

- OptДокумент19 страницOptDanica SarmientoОценок пока нет

- 10.-BIR TRAIN Briefing Administrative-ProvisionsДокумент9 страниц10.-BIR TRAIN Briefing Administrative-ProvisionsMaria Luisa RafaelОценок пока нет

- RMC No 51-2008Документ7 страницRMC No 51-2008Yasser MangadangОценок пока нет

- Chapter 8 - TaxationДокумент20 страницChapter 8 - TaxationKaila Mae Tan DuОценок пока нет

- CPAR Filing, Penalties, and Remedies (Batch 89) HandoutДокумент25 страницCPAR Filing, Penalties, and Remedies (Batch 89) HandoutlllllОценок пока нет

- Other Percentage TaxesДокумент11 страницOther Percentage TaxesmavslastimozaОценок пока нет

- XYZ Water Inc. FAN ProtestДокумент16 страницXYZ Water Inc. FAN ProtestRalf Arthur SilverioОценок пока нет

- RMC 42-99Документ4 страницыRMC 42-99fatmaaleahОценок пока нет

- 23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Документ55 страниц23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Aristeia NotesОценок пока нет

- Guidelines and Instruction For BIR Form No. 2551Q: Quarterly Percentage Tax ReturnДокумент1 страницаGuidelines and Instruction For BIR Form No. 2551Q: Quarterly Percentage Tax ReturnRieland CuevasОценок пока нет

- RMO No. 6-2023Документ11 страницRMO No. 6-2023Anostasia NemusОценок пока нет

- Entries On Construction in ProgressДокумент8 страницEntries On Construction in ProgressRomyleen WennaОценок пока нет

- BMBE SeminarДокумент60 страницBMBE SeminarBabyGiant LucasОценок пока нет

- BIR Clarification On 8%Документ10 страницBIR Clarification On 8%FABURRITO FOOD GROUP INCОценок пока нет

- RMO No. 25-98Документ2 страницыRMO No. 25-98d-fbuser-49417072Оценок пока нет

- Taxation Laws - Ms. de CastroДокумент54 страницыTaxation Laws - Ms. de CastroCC100% (1)

- Lecture 12 Tax Law - UpdatedДокумент39 страницLecture 12 Tax Law - UpdatedAatir ImranОценок пока нет

- Guidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesДокумент2 страницыGuidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesKarlОценок пока нет

- CIR vs. CA - G.R. No. 125355 (Digest)Документ7 страницCIR vs. CA - G.R. No. 125355 (Digest)Karen Gina DupraОценок пока нет

- 55153rr10 17Документ2 страницы55153rr10 17fatmaaleahОценок пока нет

- Registration, Taxation & Accounting Compliance of Construction IndustryДокумент52 страницыRegistration, Taxation & Accounting Compliance of Construction IndustryJohn Erick FernandezОценок пока нет

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesОт EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesОценок пока нет

- Tourt: L/epublic of TbeДокумент12 страницTourt: L/epublic of TbeAnonymous yKUdPvwjОценок пока нет

- 217617Документ17 страниц217617Anonymous yKUdPvwjОценок пока нет

- August 2, 2017 - G.R.No.185597Документ12 страницAugust 2, 2017 - G.R.No.185597Anonymous yKUdPvwjОценок пока нет

- RMC No. 50-2007 PDFДокумент6 страницRMC No. 50-2007 PDFAnonymous yKUdPvwjОценок пока нет

- BOC Customs Memorandum Order No. 11-2014 PDFДокумент21 страницаBOC Customs Memorandum Order No. 11-2014 PDFAnonymous yKUdPvwjОценок пока нет

- Pilipinas Makro, Inc. vs. Coco Charcoal Philippines, Inc. and Lim Kim San G.R. No. 196419.Документ13 страницPilipinas Makro, Inc. vs. Coco Charcoal Philippines, Inc. and Lim Kim San G.R. No. 196419.Anonymous yKUdPvwjОценок пока нет

- RMC 04-2003 - Gross Income On Services For MCIT PurposesДокумент7 страницRMC 04-2003 - Gross Income On Services For MCIT PurposesjtilloОценок пока нет

- Bir RR No 2-2015 Annex CДокумент1 страницаBir RR No 2-2015 Annex CAnonymous yKUdPvwj67% (6)

- BOI - Monitoring and Compliance With BOI Terms and ConditionsДокумент14 страницBOI - Monitoring and Compliance With BOI Terms and ConditionsAnonymous yKUdPvwjОценок пока нет

- BOI - Promoting Investments Through ServicingДокумент15 страницBOI - Promoting Investments Through ServicingAnonymous yKUdPvwjОценок пока нет

- Traffic Violations PDFДокумент5 страницTraffic Violations PDFAnonymous yKUdPvwjОценок пока нет

- F (Certificate of Foundling)Документ2 страницыF (Certificate of Foundling)Anonymous yKUdPvwjОценок пока нет

- Heirs of Malabanan Separate Opinion by BrionДокумент21 страницаHeirs of Malabanan Separate Opinion by BrionAnonymous yKUdPvwjОценок пока нет

- 03 Mercado vs. CAДокумент4 страницы03 Mercado vs. CAAnonymous yKUdPvwjОценок пока нет

- 04 PAL vs. CA, GR 49188, Jan. 30, 1990Документ22 страницы04 PAL vs. CA, GR 49188, Jan. 30, 1990Anonymous yKUdPvwjОценок пока нет

- KPMG Flash News Draft Guidelines For Core Investment CompaniesДокумент5 страницKPMG Flash News Draft Guidelines For Core Investment CompaniesmurthyeОценок пока нет

- Winter Project Report (Mba) "Risk Management in Debt Funds of State Bank of India"Документ79 страницWinter Project Report (Mba) "Risk Management in Debt Funds of State Bank of India"ShubhampratapsОценок пока нет

- Transaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)Документ3 страницыTransaction Details: Product Type Loan Amount/Premium (RS.) Downpayment (RS.) EMI Amount (RS.)Saradhi JastiОценок пока нет

- Syndicated Loan MarketДокумент56 страницSyndicated Loan MarketYolanda Glover100% (1)

- Declaration of Trust With Power of AttorneyДокумент1 страницаDeclaration of Trust With Power of AttorneyCora EleazarОценок пока нет

- Statement - Jul 2016 PDFДокумент2 страницыStatement - Jul 2016 PDFAnonymous 52yAaJidzОценок пока нет

- BV DDRДокумент276 страницBV DDRManish RawatОценок пока нет

- Case 35 Deluxe CorporationДокумент6 страницCase 35 Deluxe CorporationCarmelita EsclandaОценок пока нет

- MAXIS-Cover To Page 192 (2.3MB)Документ219 страницMAXIS-Cover To Page 192 (2.3MB)Eddie LewОценок пока нет

- Lehman Inc Financial Fraud Case StudyДокумент78 страницLehman Inc Financial Fraud Case StudyericОценок пока нет

- Session 3 Financial Management - Kurnadi GularsoДокумент43 страницыSession 3 Financial Management - Kurnadi GularsoDjong Surya AtmandraОценок пока нет

- Financial Close Process Questionnaire - Generate Financial Statements and DisclosuresДокумент2 страницыFinancial Close Process Questionnaire - Generate Financial Statements and DisclosuresCROCS Acctg & Audit Dep'tОценок пока нет

- Final Sip - SuyashДокумент37 страницFinal Sip - Suyashshrikrushna javanjalОценок пока нет

- FM Theory NotesДокумент31 страницаFM Theory NotesHosea KanyangaОценок пока нет

- RPS Manajemen Keuangan IIДокумент2 страницыRPS Manajemen Keuangan IIaulia endiniОценок пока нет

- 10000003293Документ33 страницы10000003293Chapter 11 DocketsОценок пока нет

- MGT 201 Financial Management Grand QuizДокумент5 страницMGT 201 Financial Management Grand Quizعباس ناناОценок пока нет

- FIN 3331 Managerial Finance: Time Value of MoneyДокумент23 страницыFIN 3331 Managerial Finance: Time Value of MoneyHa NguyenОценок пока нет

- Seven Useful and Effective Steps For ForexДокумент144 страницыSeven Useful and Effective Steps For Forexkasra goliradОценок пока нет

- Bard NoteДокумент20 страницBard NoteAmulya Kumar SahuОценок пока нет

- Surya Citra Media TBK - Billingual - 31 Des 2018 - ReleasedДокумент129 страницSurya Citra Media TBK - Billingual - 31 Des 2018 - ReleasedIntan Putri MОценок пока нет

- The Kelly Criterion in Blackjack, Sports Betting, and The Stock MarketДокумент2 страницыThe Kelly Criterion in Blackjack, Sports Betting, and The Stock MarketAbgreenОценок пока нет

- Exxon Mobil CorpДокумент1 страницаExxon Mobil Corpgarikai masawiОценок пока нет

- Lamont, ThalerДокумент19 страницLamont, ThalerYelyzaveta VerkhovodovaОценок пока нет

- Corporate Overview - Oxane PartnersДокумент11 страницCorporate Overview - Oxane PartnersSaubhagya SuriОценок пока нет

- Basel Committee On Banking Supervision: MAR Calculation of RWA For Market RiskДокумент187 страницBasel Committee On Banking Supervision: MAR Calculation of RWA For Market RiskSaad RahoutiОценок пока нет

- SAP New GL #10 Document Splitting in Cross Company Code Vendor PaymentДокумент9 страницSAP New GL #10 Document Splitting in Cross Company Code Vendor Paymentspani92100% (1)

- White Collar Crime - MonishДокумент11 страницWhite Collar Crime - MonishBharat JoshiОценок пока нет

- Ex - Scenario and Sensitifity AnalysisДокумент3 страницыEx - Scenario and Sensitifity AnalysisSakura Rosella100% (1)