Академический Документы

Профессиональный Документы

Культура Документы

Portfolio Diversification

Загружено:

kumar0302900 оценок0% нашли этот документ полезным (0 голосов)

74 просмотров3 страницыb

Авторское право

© © All Rights Reserved

Доступные форматы

XLSX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документb

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

74 просмотров3 страницыPortfolio Diversification

Загружено:

kumar030290b

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

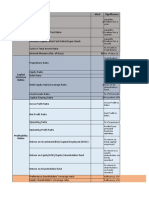

AXP HD BNS SBUX

-0.13894 -0.13354 0.01052 -0.04914

0.03368 0.06297 -0.05790 -0.02671 An investor has $100,000 to invest in the

0.10255 0.02983 0.05391 -0.07279 Developing a stock portfolio made up of s

-0.03482 -0.04988 0.04885 0.12098 (NYSE), the Toronto Stock Exchange (TSX)

-0.18728 -0.13717 -0.07364 -0.13490 American Express (AXP) and Home Depot

-0.01022 0.01766 0.06344 -0.06636 (BNS) (TSX) and Starbucks (SBUX) (NASDA

0.06875 0.13790 -0.05594 0.05899 much to invest in each one. She wants to

-0.10712 -0.03729 0.00079 -0.04430 to minimize the risk. She has computed th

-0.21985 -0.08891 -0.26382 -0.11728 a 60-month period (January 2008 to Dece

-0.15220 -0.02029 -0.17189 -0.31981 choices down to the following three. Wha

-0.20430 0.00690 -0.02063 0.05965 1. $25,000 in each stock

-0.09048 -0.06464 -0.10487 -0.00221 2. American Express: $10,000, Home Dep

-0.27907 -0.02984 -0.06176 -0.03097 Starbucks: $40,000

0.12993 0.14193 0.08882 0.21461 3. American Express: $10,000, Home Dep

0.87550 0.11720 0.17850 0.30169 Starbucks: $20,000

-0.01438 -0.12014 0.23249 -0.00505

-0.05792 0.02981 0.06905 -0.03483

0.21903 0.09757 0.15173 0.27444

0.19387 0.05232 -0.01798 0.07316

0.00751 -0.01576 0.08689 0.08741

0.02795 -0.05832 -0.07391 -0.08089

0.20060 0.09071 0.10423 0.15347

-0.03145 0.06597 0.02335 0.05293

-0.06651 -0.03188 -0.09945 -0.05480

0.01419 0.11391 0.07922 0.05127

0.08507 0.04452 0.10109 0.05925

0.11786 0.08924 0.02761 0.07487

-0.13552 -0.03883 -0.10310 -0.00320

0.00000 -0.16539 0.00779 -0.06145

0.12457 0.01563 0.10053 0.02268

-0.10682 -0.01576 -0.03887 -0.07071

0.05419 0.13877 0.10624 0.11211

-0.00890 -0.02477 0.01301 0.11781

0.04239 -0.01476 -0.02915 0.07606

-0.00694 0.16063 0.11046 0.04981

0.01494 0.04893 -0.01021 -0.01860

0.00427 0.01889 0.09247 0.05031

0.03734 -0.00421 -0.00735 0.12006

0.09023 0.00254 0.00300 -0.02027

0.05141 -0.02335 0.00474 0.02012

0.00557 0.00576 -0.01014 0.07335

-0.03202 -0.03552 -0.05669 0.01501

-0.00674 -0.03742 -0.01666 -0.03315

-0.09663 -0.01512 -0.09254 -0.03429

0.13200 0.08897 0.04910 0.13576

-0.05107 0.10414 -0.04260 0.03054

-0.01801 0.07191 -0.00084 0.05811

0.06688 0.05591 0.03032 0.04146

0.05480 0.07159 0.05073 0.01694

0.09394 0.06423 0.04944 0.15098

0.04434 0.02927 -0.01031 0.02660

-0.07283 -0.04158 -0.07940 -0.04036

0.04271 0.07387 0.02505 -0.02865

-0.00521 -0.01524 0.00768 -0.15069

0.01012 0.09327 0.01623 0.09973

-0.02470 0.06372 0.04464 0.02227

-0.01204 0.01664 -0.00810 -0.09485

-0.00125 0.06498 0.02507 0.13476

0.02818 -0.04949 0.04855 0.03393

0.05098 0.02215 0.01037 0.03711

or has $100,000 to invest in the stock market. She is interested in

g a stock portfolio made up of stocks on the New York Stock Exchange

e Toronto Stock Exchange (TSX), and the NASDAQ. The stocks are

Express (AXP) and Home Depot (HD) (NYSE), Bank of Nova Scotia

X) and Starbucks (SBUX) (NASDAQ). However, she doesnt know how

nvest in each one. She wants to maximize her return, but she would also like

ze the risk. She has computed the monthly returns for all four stocks during

th period (January 2008 to December 2012) Xm07-00. She narrowed her

own to the following three. What should she do?

0 in each stock

an Express: $10,000, Home Depot: $20,000, Bank of Nova Scotia: $30,000,

an Express: $10,000, Home Depot: $50,000, Bank of Nova Scotia: $20,000,

Вам также может понравиться

- Analysis Report On Macquarie GroupДокумент55 страницAnalysis Report On Macquarie GroupBruce BartonОценок пока нет

- Analysis of Sumsung Annual ReportДокумент11 страницAnalysis of Sumsung Annual ReportEr YogendraОценок пока нет

- 17 Stock Portfolio Bse NseДокумент81 страница17 Stock Portfolio Bse Nsechintandesai20083112Оценок пока нет

- Corporate Finance: Risk Analysis ReportДокумент3 страницыCorporate Finance: Risk Analysis ReportJasdeep Singh KalraОценок пока нет

- HDFC Bank - BaseДокумент613 страницHDFC Bank - BasebysqqqdxОценок пока нет

- At Time Company Is Formed: Capitalization TableДокумент2 страницыAt Time Company Is Formed: Capitalization TableArushi BhandariОценок пока нет

- Project Assignment Final - Finance With Excel.Документ34 страницыProject Assignment Final - Finance With Excel.Kaleemullah BhattiОценок пока нет

- 72 11 NAV Part 4 Share Prices AfterДокумент75 страниц72 11 NAV Part 4 Share Prices Aftercfang_2005Оценок пока нет

- Financial Modeling of TCS LockДокумент43 страницыFinancial Modeling of TCS LockSiddhesh GurjarОценок пока нет

- Test 3 Project Finance Case Question Yogesh GandhiДокумент14 страницTest 3 Project Finance Case Question Yogesh GandhiYogi GandhiОценок пока нет

- FCFE CalculationДокумент23 страницыFCFE CalculationIqbal YusufОценок пока нет

- Total Amount To Invest:: Moderate Risk ToleranceДокумент3 страницыTotal Amount To Invest:: Moderate Risk ToleranceElaineОценок пока нет

- Case 1 SwanDavisДокумент4 страницыCase 1 SwanDavissilly_rabbit0% (1)

- Sector GuideДокумент194 страницыSector Guidebookworm1234123412341234Оценок пока нет

- 1) Template Detailed ModelДокумент20 страниц1) Template Detailed Modelabdul5721Оценок пока нет

- Lbo Model Long FormДокумент6 страницLbo Model Long FormadsadasMОценок пока нет

- Valuation-Dividend Discount ModelДокумент23 страницыValuation-Dividend Discount Modelswaroop shettyОценок пока нет

- TRIAL Palm Oil Financial Model v.1.0Документ82 страницыTRIAL Palm Oil Financial Model v.1.0Maksa CuanОценок пока нет

- Asian Paints Equity ValuationДокумент24 страницыAsian Paints Equity ValuationYash DangraОценок пока нет

- Valuation Cash Flow A Teaching NoteДокумент5 страницValuation Cash Flow A Teaching NotesarahmohanОценок пока нет

- ProjectДокумент24 страницыProjectAayat R. AL KhlafОценок пока нет

- Course Project AДокумент9 страницCourse Project AJay PatelОценок пока нет

- Leverage Buyout - LBO Analysis: Investment Banking TutorialsДокумент26 страницLeverage Buyout - LBO Analysis: Investment Banking Tutorialskarthik sОценок пока нет

- ITC Financial ModelДокумент24 страницыITC Financial ModelKaushik JainОценок пока нет

- Amazon Financial Report MemoДокумент5 страницAmazon Financial Report MemoJoy SupanikaОценок пока нет

- Investment Project Financial AnalysisДокумент31 страницаInvestment Project Financial AnalysisBinus JoseОценок пока нет

- Axis Bank ValuvationДокумент26 страницAxis Bank ValuvationGermiya K JoseОценок пока нет

- PWC Corporate Finance at HSG Investment ClubДокумент20 страницPWC Corporate Finance at HSG Investment ClubJohn SmithОценок пока нет

- BAV Model v4.7Документ26 страницBAV Model v4.7jess236Оценок пока нет

- 1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678Документ18 страниц1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678X.r. GeОценок пока нет

- Mercury Athletic Historical Income StatementsДокумент18 страницMercury Athletic Historical Income StatementskarthikawarrierОценок пока нет

- (GR1) TCDN - Case 4Документ19 страниц(GR1) TCDN - Case 4Thắng Vũ Nguyễn Đức100% (1)

- MezzanineДокумент14 страницMezzaninevirtualatallОценок пока нет

- TCS ValuationДокумент264 страницыTCS ValuationSomil Gupta100% (1)

- Revenue (Sales) XXX (-) Variable Costs XXXДокумент10 страницRevenue (Sales) XXX (-) Variable Costs XXXNageshwar SinghОценок пока нет

- Hampton PortfolioДокумент1 страницаHampton Portfolioapi-314234873Оценок пока нет

- Project FinanceДокумент12 страницProject FinancePiyush HirparaОценок пока нет

- Nestle Report AnalysisДокумент3 страницыNestle Report AnalysisAkshatAgarwalОценок пока нет

- Analysis of Financial StatementsДокумент33 страницыAnalysis of Financial StatementsKushal Lapasia100% (1)

- Private Equity and Private Debt Investments in IndiaДокумент71 страницаPrivate Equity and Private Debt Investments in IndiaShashwat JainОценок пока нет

- Ratio AnalysisДокумент26 страницRatio AnalysisDeep KrishnaОценок пока нет

- Ross CH 13Документ23 страницыRoss CH 13miftahulamalahОценок пока нет

- Investment Analysis Square PharmaДокумент62 страницыInvestment Analysis Square PharmaFaraz SjОценок пока нет

- Alice PortafolioДокумент17 страницAlice PortafoliofannnyОценок пока нет

- Financial Modelling Cement CompanyДокумент17 страницFinancial Modelling Cement CompanyAdarsh KumarОценок пока нет

- Map - by Counrty PercentДокумент11 страницMap - by Counrty PercentRupee Rudolf Lucy HaОценок пока нет

- Equity Research ReportДокумент7 страницEquity Research Reportjyoti_prakash_11Оценок пока нет

- Stock Portfolio TemplateДокумент1 страницаStock Portfolio Templateapi-314985362Оценок пока нет

- A91 Partners JDДокумент2 страницыA91 Partners JDJohn DoeОценок пока нет

- RCL Stock PitchДокумент1 страницаRCL Stock Pitchapi-545367999Оценок пока нет

- DCF Calculation of Dabur India Ltd.Документ6 страницDCF Calculation of Dabur India Ltd.Radhika ChaudhryОценок пока нет

- Cold Storage Finance RohitДокумент11 страницCold Storage Finance RohitRohitGuleriaОценок пока нет

- Case1 - LEK Vs PWCДокумент26 страницCase1 - LEK Vs PWCmayolgalloОценок пока нет

- Valuation Bermuda Triangle A I MRДокумент59 страницValuation Bermuda Triangle A I MRCarlos Jesús Ponce AranedaОценок пока нет

- Assignment Due September 8Документ9 страницAssignment Due September 8Alexander UrvinaОценок пока нет

- Cash Flow Estimation: Given DataДокумент4 страницыCash Flow Estimation: Given DataMd. Din Islam Asif100% (2)

- Swati Anand - FRMcaseДокумент5 страницSwati Anand - FRMcaseBhavin MohiteОценок пока нет

- Portfolio Sharpe RatioДокумент7 страницPortfolio Sharpe RatioPooja SivayoganОценок пока нет

- Xm07 000Документ3 страницыXm07 000priyamОценок пока нет

- S30 2Документ1 страницаS30 2kumar030290Оценок пока нет

- Normal DistributionДокумент39 страницNormal Distributionkumar030290Оценок пока нет

- Assignment 2 BC-20Документ2 страницыAssignment 2 BC-20Sushmita GahlotОценок пока нет

- Testing of HypothesisДокумент90 страницTesting of Hypothesiskumar030290Оценок пока нет

- Production Plan L2 StartДокумент5 страницProduction Plan L2 Startkumar030290Оценок пока нет

- Consult Club IIMA Casebook - 2018Документ113 страницConsult Club IIMA Casebook - 2018kumar030290100% (1)

- Provisions, Contingent Liabilities and Contingent Assets: Accounting Standard (AS) 29Документ30 страницProvisions, Contingent Liabilities and Contingent Assets: Accounting Standard (AS) 29kumar030290Оценок пока нет

- Assignment1 BC20Документ3 страницыAssignment1 BC20Sushmita GahlotОценок пока нет

- Caste and Entrepreneurship in IndiaДокумент9 страницCaste and Entrepreneurship in IndiaSalmanОценок пока нет

- 1 The - Peculiar - Tenacity - of - Caste PDFДокумент8 страниц1 The - Peculiar - Tenacity - of - Caste PDFkumar030290Оценок пока нет

- Excel Formula ErrorsДокумент3 страницыExcel Formula Errorskumar030290Оценок пока нет

- STI Outline 2017Документ5 страницSTI Outline 2017kumar030290Оценок пока нет

- Popeyes Wendys Mcdonalds Hardees Jack in BoxДокумент4 страницыPopeyes Wendys Mcdonalds Hardees Jack in Boxkumar030290Оценок пока нет

- 4 Tribes As Indegenous People - XaxaДокумент7 страниц4 Tribes As Indegenous People - Xaxakumar030290Оценок пока нет

- Nick Foles PHI 13 119.2Документ2 страницыNick Foles PHI 13 119.2kumar030290Оценок пока нет

- 3 Crisis of Secularism by Rajeev BhargavaДокумент12 страниц3 Crisis of Secularism by Rajeev Bhargavakumar030290Оценок пока нет

- SSG TaskДокумент6 страницSSG Taskkumar030290Оценок пока нет

- Machine Operator Sum - Defect 1 133 A 133 2 72 A 72 3 75 B 75 4 71 B 71Документ5 страницMachine Operator Sum - Defect 1 133 A 133 2 72 A 72 3 75 B 75 4 71 B 71kumar030290Оценок пока нет

- Statistics For Management and Economics, Tenth Edition FormulasДокумент11 страницStatistics For Management and Economics, Tenth Edition Formulaskumar030290Оценок пока нет

- Group9 MM AtlanticComputersДокумент6 страницGroup9 MM AtlanticComputerskumar030290Оценок пока нет

- Fine ArtsДокумент6 страницFine Artskumar030290Оценок пока нет

- Product Look UpДокумент2 страницыProduct Look Upkumar030290Оценок пока нет

- MakeupdbДокумент43 страницыMakeupdbkumar030290Оценок пока нет

- Hyper OnlineДокумент64 страницыHyper Onlinekumar030290Оценок пока нет

- Wat Pi GuideДокумент13 страницWat Pi Guidekumar030290Оценок пока нет

- 1.Q. Case Study of Accenture Human Performance Practice UKДокумент10 страниц1.Q. Case Study of Accenture Human Performance Practice UK92Sgope0% (1)

- WAT PI Experiences 2016Документ25 страницWAT PI Experiences 2016kumar030290Оценок пока нет

- Ignicion FAQsДокумент1 страницаIgnicion FAQskumar030290Оценок пока нет

- Vanraj Mini-Tractors - Is Small BeautifulДокумент20 страницVanraj Mini-Tractors - Is Small Beautifulkumar030290Оценок пока нет

- Sourabh ResumeДокумент2 страницыSourabh ResumeVijay RajОценок пока нет

- Leaving Europe For Hong Kong and Manila and Exile in DapitanДокумент17 страницLeaving Europe For Hong Kong and Manila and Exile in DapitanPan CorreoОценок пока нет

- Seafood Serving Tools Make The Task of Cleaning Seafood and Removing The Shell Much Easier. ForДокумент32 страницыSeafood Serving Tools Make The Task of Cleaning Seafood and Removing The Shell Much Easier. Forivy l.sta.mariaОценок пока нет

- Bocconi PE and VC CourseraДокумент15 страницBocconi PE and VC CourseraMuskanDodejaОценок пока нет

- Rguhs Dissertation Titles 2015Документ5 страницRguhs Dissertation Titles 2015PaySomeoneToWriteAPaperForMeSingapore100% (1)

- Sony Ht-ct390 Startup ManualДокумент1 страницаSony Ht-ct390 Startup Manualalfred kosasihОценок пока нет

- English8 q1 Mod5 Emotive Words v1Документ21 страницаEnglish8 q1 Mod5 Emotive Words v1Jimson GastaОценок пока нет

- Moonage Daydream From Ziggy StardustДокумент18 страницMoonage Daydream From Ziggy StardustTin SmajlagićОценок пока нет

- MANILA HOTEL CORP. vs. NLRCДокумент5 страницMANILA HOTEL CORP. vs. NLRCHilary MostajoОценок пока нет

- Schneider - Ch16 - Inv To CS 8eДокумент33 страницыSchneider - Ch16 - Inv To CS 8ePaulo SantosОценок пока нет

- I. Lesson Plan Overview and DescriptionДокумент5 страницI. Lesson Plan Overview and Descriptionapi-283247632Оценок пока нет

- 1 Reviewing Number Concepts: Coursebook Pages 1-21Документ2 страницы1 Reviewing Number Concepts: Coursebook Pages 1-21effa86Оценок пока нет

- Extinction Summary Handout PDFДокумент1 страницаExtinction Summary Handout PDFJohn DОценок пока нет

- Lynker Technologies LLC U.S. Caribbean Watershed Restoration and Monitoring Coordinator - SE US Job in Remote - GlassdoorДокумент4 страницыLynker Technologies LLC U.S. Caribbean Watershed Restoration and Monitoring Coordinator - SE US Job in Remote - GlassdoorCORALationsОценок пока нет

- Labor Law Review Midterm Exercise 2ndsem 2017-2018Документ17 страницLabor Law Review Midterm Exercise 2ndsem 2017-2018MaeJoyLoyolaBorlagdatanОценок пока нет

- VW Aircraft Engine Building - Bob HooverДокумент133 страницыVW Aircraft Engine Building - Bob Hooverjwzumwalt100% (4)

- Unit 1 Revision PDFДокумент2 страницыUnit 1 Revision PDFИлья ЕвстюнинОценок пока нет

- Napoleons Letter To The Jews 1799Документ2 страницыNapoleons Letter To The Jews 1799larsОценок пока нет

- NASA: 45607main NNBE Interim Report1 12-20-02Документ91 страницаNASA: 45607main NNBE Interim Report1 12-20-02NASAdocumentsОценок пока нет

- Silo - Tips - Datex Ohmeda S 5 Collect Users Reference ManualДокумент103 страницыSilo - Tips - Datex Ohmeda S 5 Collect Users Reference Manualxiu buОценок пока нет

- Two Dimensional Flow of Water Through SoilДокумент28 страницTwo Dimensional Flow of Water Through SoilMinilik Tikur SewОценок пока нет

- BBS of Lintel Beam - Bar Bending Schedule of Lintel BeamДокумент5 страницBBS of Lintel Beam - Bar Bending Schedule of Lintel BeamfelixОценок пока нет

- V and D ReportДокумент3 страницыV and D ReportkeekumaranОценок пока нет

- câu điều kiện loại 1Документ5 страницcâu điều kiện loại 1ThuHoàiОценок пока нет

- PLM V6R2011x System RequirementsДокумент46 страницPLM V6R2011x System RequirementsAnthonio MJОценок пока нет

- 0015020KAI LimДокумент22 страницы0015020KAI LimJoshua CurtisОценок пока нет

- Menken & Sanchez (2020) - Translanguaging in English-Only SchoolsДокумент27 страницMenken & Sanchez (2020) - Translanguaging in English-Only SchoolsSumirah XiaomiОценок пока нет

- People Vs SantayaДокумент3 страницыPeople Vs SantayaAbigail DeeОценок пока нет

- Coursebook Answers Chapter 28 Asal ChemistryДокумент3 страницыCoursebook Answers Chapter 28 Asal ChemistryAditiОценок пока нет

- Chicago Citation and DocumentДокумент8 страницChicago Citation and DocumentkdemarchiaОценок пока нет