Академический Документы

Профессиональный Документы

Культура Документы

Establishing Domestic Banks in the Philippines

Загружено:

Karl LabagalaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Establishing Domestic Banks in the Philippines

Загружено:

Karl LabagalaАвторское право:

Доступные форматы

APP.

37

16.03.31

BASIC GUIDELINES IN ESTABLISHING DOMESTIC BANKS

(Appendix to Sec. X102)

A. THE APPLICATION PROCESS

PRE-APPROVAL

1. The application for authority to application are, as follows:

establish a bank shall be submitted to the a. Agreement to organize a bank.

Office of Supervisory Policy Development b. For each individual Filipino/non-

(OSPD) in two (2) copies. Filipino incorporators, subscribers,

2. The required papers/documents and proposed directors and principal officers:

other information in support of the

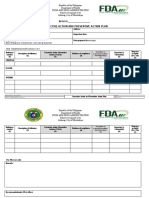

Requirements Incorporators Subscribers Directors Principal

Officers

1. Biographical data

2. Evidence of citizenship

3. Evidence of financial capacity

as of a date not earlier than

ninety (90) days prior to the filing

of application such as credit

reports, bank deposits,

investments, real estate owned,

etc., accompanied by waiver of

rights under R. A. No. 1405, as

amended, for covered items

4. Certified photocopies of

Income Tax Returns (ITRs) for

the last two (2) calendar years

5. Clearances from the National

Bureau of Investigation (NBI) and

Bureau of Internal Revenue (BIR)

as well as equivalent clearances

from home country for

non-Filipinos

Manual of Regulations for Banks Appendix 37 - Page 1

APP. 37

16.03.31

c. For corporate subscribers:

Requirements Domestic Foreign 1

Bank Non-bank Bank2 Non-bank

1. Board resolution authorizing the

corporation to invest in such bank; and

designating the person who will represent

the corporation in connection therewith

2. Latest articles of incorporation and

by-laws

3. Corporate background providing the

following:

a. date and place of incorporation;

b. list of domestic and foreign

branches, agencies, other offices,

subsidiaries and affiliates and their

location and line of business;

c. range of products/services offered to

their clients;

d. Conglomerate structure/map where

the corporate subscriber belongs; and

e. Financial and commercial

relationship with the Philippine

government, local banks, business

entities and residents, past and present

4. Latest General Information Sheet filed

with the Securities and Exchange

Commission (SEC)

5. List of all stockholders, including the

corporations ultimate beneficial owners,

indicating the citizenship and the number,

amount and percentage of the voting and

non-voting shares held by them

6. Annual report with audited financial

statements for the last two (2) years prior

to the filing of application

7. Certified photocopies of ITRs for the

last two (2) calendar/fiscal years

8. BIR clearance

9. Certification from the Board of Directors

that it is compliant with the applicable

conditions set forth in Section X376 and its

subsections for the equity investment to

the proposed bank

10. List of directors and principal officers

including their citizenships

1

For foreign corporate subscribers, items 1, 2 and 11 should be duly consularized by the Philippine Consulate

Officer or authorized officer of the Philippine Representative Office in the country of origin

2

For Foreign bank subscriber other than those entering via R.A. No. 7721, as amended by R.A. No. 10641

Appendix 37 - Page 2 Manual of Regulations for Banks

APP. 37

16.03.31

Requirements Domestic Foreign 1

Bank Non-bank Bank2 Non-bank

11. Certification from home country

supervisory authority that it has no

objection to the investment in a bank in

the Philippines, and it will provide the

Bangko Sentral with relevant supervisory

information on the foreign bank subscriber

to the extent allowed under existing laws

d. Corporate plan describing in meaningful percent (25%) of such subscription shall

details its business model, corporate be paid-up: Provided, That in no case shall

strategy and economic justification for the paid-up capital be less than the

establishing the bank. minimum required capital stated in Item

e. Feasibility study to show viable business 1 above.

together with projected monthly financial 3. The stockholdings in any bank shall be

statements for the first twelve (12) months subject to the limits on stockholdings in a

of operations, using realistic assumptions single bank and several banks as

consistent with the proposed business prescribed under Subsecs. X126.1 and

model and corporate strategy. 1127.1, respectively.

f. Notarized Certification executed by each

of the subscribers that the amount Incorporators, Subscribers, Directors and

committed to pay the proposed paid-up Officers

capitalization in the bank was not derived 1. The incorporators, subscribers and

from borrowings, unlawful activity or any proposed directors and officers must be

money laundering activity. persons of integrity and of good credit

3. The application shall be processed on a standing in the business community. The

first-come, first-served basis: Provided, That subscribers must have adequate financial

all the required documents are complete strength to pay their proposed

and properly accomplished. The subscriptions in the bank.

application fee shall be paid upon 2. The incorporators, subscribers and

acceptance of application. proposed directors and officers must not

4. Prescribed application form, together have been convicted of any crime

with other forms, is available at the Bangko involving moral turpitude, and unless

Sentral website3. otherwise allowed under the provisions

of existing laws are not officers or

EVALUATION employees of a government agency,

Capital Requirements/Stockholdings instrumentality, department or office

1. Banks to be established shall comply charged with the supervision of, or the

with the required minimum capital granting of loans to banks.

prescribed under Subsec. X111.1. 3. A bank may be organized with not less

2. At least twenty-five percent (25%) of the than five (5) nor more than fifteen (15)

total authorized capital stock shall be incorporators.

subscribed by the subscribers of the 4. The number and nationality of the

proposed bank, and at least twenty-five members of the board of directors of the

1

For foreign corporate subscribers, items 1, 2 and 11 should be duly consularized by the Philippine Consulate

Officer or authorized officer of the Philippine Representative Office in the country of origin

2

For Foreign bank subscriber other than those entering via R.A. No. 7721, as amended by R.A. No. 10641

3

http://www.bsp.gov.ph/downloads/Regulations/guidelines/guidelines%20for%20banks.pdf

Manual of Regulations for Banks Appendix 37 - Page 3

APP. 37

16.03.31

bank shall be subject to the limits prescribed a. Complete the establishment of the bank

under Subsec. X141.1. premises, with the minimum security

5. No appointive or elective public official, measures under Subsection X181.4 and the

whether full-time or part-time shall at the requirements under Batas Pambansa

same time serve as officer of a bank except Blg. 3441 and Republic Act No. 99942;

in cases where such service is incident to b. Effect and complete the recruitment and

financial assistance provided by the hiring of officers and employees of the bank;

government or a government-owned or c. Attend the briefing on Bangko Sentral

-controlled corporation (GOCC) to the bank reportorial requirements conducted by the

or in cases allowed under existing laws. appropriate department of the Bangko

6. The proposed directors and officers of the Sentral together with the relevant officers

bank shall be subject to qualifications and of the bank;

other requirements under Sections X141 and d. Submit the following documentary

X142. requirements at least thirty (30) days before

7. The disqualifications of directors and the scheduled start of operations:

officers prescribed under Section X143 shall (1) Proof of registration of articles of

also apply. incorporation and by-laws with the SEC;

(2) Notarized Certification signed by all the

POST APPROVAL directors stating that

1. Within thirty (30) days from receipt of i. All the conditions of the approval to

advice of approval by the Monetary Board establish the proposed bank have been

of their application for authority to establish complied with;

the bank, the organizers shall: ii. The manual of operations embodying the

a. Submit the proposed articles of policies and operating procedures of each

incorporation, by-laws and treasurers department/unit/office, covering all risk

sworn statement in four (4) copies; areas of the proposed bank have been

b. Deposit with any KB (for KBs and TBs) prepared;

and any bank (for RBs) the initial paid-up iii. The necessary bond policy on custodial

capital of the proposed bank; officers and insurance policy on bank

c. Pay the applicable license fee at the properties required to be insured have been

Bangko Sentral Cash Department, net of the obtained;

previously paid application fee; and iv. All pre-operating requirements under

d. Proof of inward remittance of capital, in existing laws and regulations, which include

the case of foreign subscribers. among others, (a) use of business name,

2. Within sixty (60) days after the articles (b) posting of schedule of banking days and

of incorporation and by-laws had been hours, notice to depositors on clearing cut-

passed upon by the Office of the General off time, and disclosure statement on loan/

Counsel and the corresponding certificates credit transaction, (c) Batas Pambansa Blg.

of authority to register had been issued, the 344 and Republic Act No. 9994;

organizers shall effect the filing of said (d) minimum security measures; and

documents with the SEC. (e) publication of consumer assistance

3. Within one year from receipt of advice management system have been complied

of approval by the Monetary Board of their with; and

application for authority to establish the v. No person who is the spouse or relative

bank, the organizers shall: within the second degree of consanguinity

1

An Act to Enhance the Mobility of Disabled Persons by Requiring Certain Buildings, Institutions, Establishments

and Public Utilities to Install Facilities and Other Devices

2

An Act Granting Additional Benefits and Privileges to Senior Citizens

Appendix 37 - Page 4 Manual of Regulations for Banks

APP. 37

16.03.31

or affinity will be appointed to any (10) Other documents/papers which may be

officership positions across the following required.

functional categories in the bank:

(a) decision making and senior management B. OPENING OF THE BANK FOR

function, (b) treasury function, BUSINESS AFTER THE CERTIFICATE OF

(c) recordkeeping and financial reporting AUTHORITY TO OPERATE HAS BEEN

function, (d) safekeeping of assets, (e) risk ISSUED

management function, (f) compliance

function, and (g) internal audit function. C. START OF OPERATIONS

(3) Proof of compliance with all the pre- Within five (5) banking days after the start

operating requirements under existing rules of operation, the bank shall-

and regulations; 1. Inform the Bangko Sentral of the first day

(4) List of principal and junior officers and of operation and the banking days and

their respective designations and salaries; hours; and

(5) Chart of organization; 2. Submit a statement of condition as of the

(6) Contract of lease on banks premises, if first day of operation.

the same are to be leased;

(7) List of stockholders stating the number D. REVOCATION OF AUTHORITY TO

and percentage of voting stocks owned by ESTABLISH A BANK

them as well as their citizenships; The authority to establish a bank shall be

(8) Certification from the Philippine Deposit automatically revoked if the bank is not

Insurance Corporation (PDIC) stating that organized and opened for business within

the organizers have undergone a briefing one year after receipt by the organizers of

on all of its requirements; the notice of approval by the Monetary Board

(9) Alien Employment Permit issued by the of their application.

Department of Labor and Employment for (As amended by Circular Nos. 902 dated 15 February 2016 and

foreign directors and officers; and 774 dated 16 November 2012)

Manual of Regulations for Banks Appendix 37 - Page 5

Вам также может понравиться

- Customers Switching Intentions Behavior in Retail Hypermarket Kingdom of Saudi Arabia: Customers Switching Intentions Behavior in Retail HypermarketОт EverandCustomers Switching Intentions Behavior in Retail Hypermarket Kingdom of Saudi Arabia: Customers Switching Intentions Behavior in Retail HypermarketОценок пока нет

- My Life Journey Through . . . with God: Reality and Facts of Life!От EverandMy Life Journey Through . . . with God: Reality and Facts of Life!Оценок пока нет

- Life and Works of Rizal Compromisers Vs Plebian ConstiuencyДокумент1 страницаLife and Works of Rizal Compromisers Vs Plebian ConstiuencySapag PatakОценок пока нет

- Bimmang2CShairaMaeL - Bsed 1Документ17 страницBimmang2CShairaMaeL - Bsed 1Renz ModalesОценок пока нет

- Polytechnic University Philippines Admission Registration FormДокумент1 страницаPolytechnic University Philippines Admission Registration Formchichi guzman100% (1)

- Philippine Banking SystemДокумент20 страницPhilippine Banking SystempatriciaОценок пока нет

- The Soil in Which We Root: Identifying Sources of Tradition for Filipino ArtistsДокумент3 страницыThe Soil in Which We Root: Identifying Sources of Tradition for Filipino ArtistsKisha Lacson IIОценок пока нет

- (Rizal) Module 2 AssignmentДокумент1 страница(Rizal) Module 2 AssignmentAeri SadadaОценок пока нет

- RE103 – 1 Catechesis on Church and SacramentsДокумент8 страницRE103 – 1 Catechesis on Church and SacramentsMJ UyОценок пока нет

- The Main Objective of This Paper Is To Investigate The Unemployment and GrowthДокумент18 страницThe Main Objective of This Paper Is To Investigate The Unemployment and GrowthTiffany Leong100% (1)

- Specialized Government BanksДокумент5 страницSpecialized Government BanksCarazelli AysonОценок пока нет

- Tan Kaye Angeli Q. - Case Problem 8.1 Maury MillsДокумент2 страницыTan Kaye Angeli Q. - Case Problem 8.1 Maury MillsAlvin LuisaОценок пока нет

- BMGT 26 Chapter 1 ReviewerДокумент11 страницBMGT 26 Chapter 1 ReviewerJohn Louie SierraОценок пока нет

- Microeconomics Chapter 3Документ14 страницMicroeconomics Chapter 3Ian Jowmariell GonzalesОценок пока нет

- Set A Colegio de Dagupan: Rizal'S Life and WritingsДокумент6 страницSet A Colegio de Dagupan: Rizal'S Life and WritingsJohn Carlo AquinoОценок пока нет

- Activity 4Документ4 страницыActivity 4Stephen VillanteОценок пока нет

- Rizal's Noli Me Tangere Reading ExperienceДокумент7 страницRizal's Noli Me Tangere Reading ExperienceRammele Opemia NonОценок пока нет

- Reflection Paper and AnswersДокумент8 страницReflection Paper and AnswersDonita BinayОценок пока нет

- Ateneo ACET Application ChecklistДокумент13 страницAteneo ACET Application ChecklistHannah SorreraОценок пока нет

- Code of Ethics For Advertising: Section 1Документ20 страницCode of Ethics For Advertising: Section 1Kym AlgarmeОценок пока нет

- Jose Rizal LIFE PDFДокумент20 страницJose Rizal LIFE PDFSon RoblesОценок пока нет

- Five National Scientist and Their SpecializationДокумент5 страницFive National Scientist and Their SpecializationElysa Jana LasapОценок пока нет

- PUP: Application For Dean's and President"s ListerДокумент1 страницаPUP: Application For Dean's and President"s ListerJohn PaulОценок пока нет

- Rationale of Delaying Payments Towards Home Credit Philippines 1Документ13 страницRationale of Delaying Payments Towards Home Credit Philippines 1Katrina De LeonОценок пока нет

- Chapter 8: Global CityДокумент18 страницChapter 8: Global CityClaire ManzanoОценок пока нет

- Presentation of FSДокумент9 страницPresentation of FSrose anneОценок пока нет

- Wages and Salary Administration TheoriesДокумент15 страницWages and Salary Administration TheoriesBelle MendozaОценок пока нет

- M2 Learning ActivityДокумент2 страницыM2 Learning ActivityArish Manalastas100% (1)

- Kartilya ng Katipunan teachings for freedomДокумент3 страницыKartilya ng Katipunan teachings for freedomeulaОценок пока нет

- Amanah BankДокумент3 страницыAmanah BankMaannavie MarcosОценок пока нет

- Basic Long - Term Financial ConceptДокумент11 страницBasic Long - Term Financial ConceptGezalyn GuevarraОценок пока нет

- FM 6 Module Lesson 1Документ14 страницFM 6 Module Lesson 1kaye nicolasОценок пока нет

- Swot Analysis: Event DescriptionДокумент2 страницыSwot Analysis: Event DescriptionErica Joi Flores BiscochoОценок пока нет

- Persons Who Tried To Block Its Aprroval: Sen. Decoroso Rosales Francisco Rodrigo Sen. Mariano Cuenco Jesus Paredes Fr. Jesus Cavana The FriarsДокумент2 страницыPersons Who Tried To Block Its Aprroval: Sen. Decoroso Rosales Francisco Rodrigo Sen. Mariano Cuenco Jesus Paredes Fr. Jesus Cavana The FriarsKevin LavinaОценок пока нет

- Rizal's La Liga Filipina Reform SocietyДокумент3 страницыRizal's La Liga Filipina Reform SocietyQuerolf PadecioОценок пока нет

- Last Filipino General Simeon Ola Surrendered in 1903Документ4 страницыLast Filipino General Simeon Ola Surrendered in 1903AngelJoy PerezОценок пока нет

- An Overview of the Philippine Financial SystemДокумент61 страницаAn Overview of the Philippine Financial SystemQuenie De la CruzОценок пока нет

- Rizal in Dapitan - Being A FarmerДокумент2 страницыRizal in Dapitan - Being A FarmerCHERYL TENCHAVEZ DEANOОценок пока нет

- Bukidnon Pharmaceutical Multi-Purpose Cooperative Sayre Highway, Valencia City, BukidnonДокумент27 страницBukidnon Pharmaceutical Multi-Purpose Cooperative Sayre Highway, Valencia City, BukidnonMewGulf JeonОценок пока нет

- RLW Module 1 Berania Kim HazelДокумент4 страницыRLW Module 1 Berania Kim HazelKim HazelОценок пока нет

- Case Description Illustrative - Plush and PlayДокумент3 страницыCase Description Illustrative - Plush and PlayIzza MarasiganОценок пока нет

- Brief History Philippine Money EvolutionДокумент4 страницыBrief History Philippine Money EvolutionDanneth TabunoОценок пока нет

- Understanding The Self Activity 1Документ2 страницыUnderstanding The Self Activity 1Asteria Gojo100% (1)

- Cabolis, John Alexis A. Assessment Chapter 1 and Homeworks 1, 2, 3Документ12 страницCabolis, John Alexis A. Assessment Chapter 1 and Homeworks 1, 2, 3John Alexis CabolisОценок пока нет

- NSTP 1: Citizenship Training: Unit 2 - The Philippine ConstitutionДокумент28 страницNSTP 1: Citizenship Training: Unit 2 - The Philippine ConstitutionPatrick BuyainОценок пока нет

- Character Analysis of Mercy in OndoyДокумент3 страницыCharacter Analysis of Mercy in OndoyBanadhi Kurnia DОценок пока нет

- Background History of The Development of Credit in The Philippines How Credit Instruments Are NegotiatedДокумент33 страницыBackground History of The Development of Credit in The Philippines How Credit Instruments Are Negotiatedelizabeth bernalesОценок пока нет

- TRial BalanceДокумент8 страницTRial BalanceBarcelona, Tricia Mae F.Оценок пока нет

- Exercises Lesson 3 0809Документ11 страницExercises Lesson 3 0809ChrisYapОценок пока нет

- Executive Summary: Gigi Dacoco's Noodles & Sizzling House, Established in 1992, Founded by Mr. ConradoДокумент15 страницExecutive Summary: Gigi Dacoco's Noodles & Sizzling House, Established in 1992, Founded by Mr. ConradoMa. Angelica Celina MoralesОценок пока нет

- Group 6 - Katipunan PamphletДокумент2 страницыGroup 6 - Katipunan PamphletKirstelle SarabilloОценок пока нет

- Atia The Figure of The Refugee in Hassan Blasim's "The Reality and The Record" 2017 AcceptedДокумент27 страницAtia The Figure of The Refugee in Hassan Blasim's "The Reality and The Record" 2017 AcceptedJanssen TarongoyОценок пока нет

- Gorumba Activity SophistsДокумент3 страницыGorumba Activity SophistsMelwel GorumbaОценок пока нет

- Reflection Instruction: in No More Than Seven (7) Sentences, Answer The Following Questions As Concise As Possible. (2 Items X 10 Points)Документ1 страницаReflection Instruction: in No More Than Seven (7) Sentences, Answer The Following Questions As Concise As Possible. (2 Items X 10 Points)J VIDSОценок пока нет

- History - 03 - Sucesos de Las Islas Filipinas-1 PDFДокумент22 страницыHistory - 03 - Sucesos de Las Islas Filipinas-1 PDFAlyson FortunaОценок пока нет

- Reflecting The IACD-MOOC ExperienceДокумент2 страницыReflecting The IACD-MOOC Experienceoz asier cyrusОценок пока нет

- La Liga Filipina and KatipunanДокумент22 страницыLa Liga Filipina and KatipunanStefennie Ann Benabente GelitoОценок пока нет

- Activity For NMT Chapter 3Документ2 страницыActivity For NMT Chapter 3Juliet Marie MiomioОценок пока нет

- Income Tax Credits - ReviewerДокумент10 страницIncome Tax Credits - Reviewer버니 모지코Оценок пока нет

- RA-4054 Philippine Rice Share Tenancy ActДокумент7 страницRA-4054 Philippine Rice Share Tenancy ActDenz MercadoОценок пока нет

- Template - Project EstimatingДокумент1 страницаTemplate - Project EstimatingKarl LabagalaОценок пока нет

- Template Tiered Growth of Employees v2Документ5 страницTemplate Tiered Growth of Employees v2Karl LabagalaОценок пока нет

- Japan Itinerary 2Документ1 страницаJapan Itinerary 2Karl LabagalaОценок пока нет

- Agile Kanban BoardДокумент10 страницAgile Kanban BoardKarl LabagalaОценок пока нет

- Distribution AgreementДокумент15 страницDistribution AgreementKarl LabagalaОценок пока нет

- Action Items TemplateДокумент3 страницыAction Items TemplatethissrОценок пока нет

- Variable IC Mock Exam - 02062020 PDFДокумент30 страницVariable IC Mock Exam - 02062020 PDFMikaella Sarmiento100% (1)

- Exclusive Distribution AgreementДокумент8 страницExclusive Distribution AgreementKarl Labagala100% (1)

- FOI Response To Ms. Kyla DantesДокумент2 страницыFOI Response To Ms. Kyla DantesKarl LabagalaОценок пока нет

- Traditional IC Mock ExamДокумент37 страницTraditional IC Mock ExamNald FigueroaОценок пока нет

- Investment CalculatorДокумент18 страницInvestment CalculatorKarl LabagalaОценок пока нет

- Japan ItineraryДокумент4 страницыJapan ItineraryKarl LabagalaОценок пока нет

- QWP-FROO-06 Annex 28 CAPA Plan Rev 01Документ3 страницыQWP-FROO-06 Annex 28 CAPA Plan Rev 01Karl LabagalaОценок пока нет

- Apply for an Auto Loan in 4 StepsДокумент2 страницыApply for an Auto Loan in 4 StepsKarl LabagalaОценок пока нет

- Rks Form 5 and Jdms GC Forms FinalДокумент2 страницыRks Form 5 and Jdms GC Forms FinalHazel SabadlabОценок пока нет

- Rks Form 5 and Jdms GC Forms FinalДокумент2 страницыRks Form 5 and Jdms GC Forms FinalHazel SabadlabОценок пока нет

- Employee HandbookДокумент32 страницыEmployee HandbookKarl LabagalaОценок пока нет

- Rks Form 5 and Jdms GC Forms FinalДокумент2 страницыRks Form 5 and Jdms GC Forms FinalHazel SabadlabОценок пока нет

- HR Policy ManualДокумент81 страницаHR Policy ManualKarl LabagalaОценок пока нет

- Disciplinary HearingsДокумент4 страницыDisciplinary HearingsKarl LabagalaОценок пока нет

- Consumer Compliance Handbook: Division of Consumer and Community AffairsДокумент867 страницConsumer Compliance Handbook: Division of Consumer and Community AffairsKarl LabagalaОценок пока нет

- ExpandedДокумент171 страницаExpandedKarl LabagalaОценок пока нет

- Final Chapter 7 CR & Debt HBK - Loan Billings and Collections 9-22-11Документ8 страницFinal Chapter 7 CR & Debt HBK - Loan Billings and Collections 9-22-11Karl LabagalaОценок пока нет

- Code of Conduct and Business EthicsДокумент8 страницCode of Conduct and Business EthicsKarl Labagala100% (1)

- BHCДокумент1 959 страницBHCKarl LabagalaОценок пока нет

- BDO 2013 Annual Report Highlights Financial and Operational StrengthДокумент56 страницBDO 2013 Annual Report Highlights Financial and Operational StrengthKarl LabagalaОценок пока нет

- CoreДокумент142 страницыCoreKarl LabagalaОценок пока нет

- Establishing Domestic Banks in the PhilippinesДокумент5 страницEstablishing Domestic Banks in the PhilippinesKarl LabagalaОценок пока нет

- Amended Manual OnCorporate Governance - June162014Документ27 страницAmended Manual OnCorporate Governance - June162014Karl LabagalaОценок пока нет

- Strategy, Business Models, and Competitive Advantage: Because Learning Changes EverythingДокумент19 страницStrategy, Business Models, and Competitive Advantage: Because Learning Changes EverythingSage MainОценок пока нет

- 2020 - The Disruptor PlaybookДокумент14 страниц2020 - The Disruptor Playbookjuan kazasОценок пока нет

- Switzerland Offers Three Training Institutes To Service The Milling SectorДокумент4 страницыSwitzerland Offers Three Training Institutes To Service The Milling SectorMilling and Grain magazine100% (1)

- 9 Keys To Subscription Success WhitepaperДокумент12 страниц9 Keys To Subscription Success WhitepaperGaneshaSpeaks.comОценок пока нет

- BP 68 ScruibdДокумент4 страницыBP 68 ScruibdJechaiiiiОценок пока нет

- Guide c07 740737Документ37 страницGuide c07 740737Sandheep HiriyanОценок пока нет

- 13 Insights From Y CombinatorДокумент19 страниц13 Insights From Y CombinatorRaghuram SheshadriОценок пока нет

- Listening Practice 3 (Fill in Blanks)Документ9 страницListening Practice 3 (Fill in Blanks)Phong LeОценок пока нет

- Quick Start GuideДокумент28 страницQuick Start GuideAhmed SalievОценок пока нет

- Wharton Consulting Club Casebook V1.1Документ82 страницыWharton Consulting Club Casebook V1.1malek100% (2)

- Houston Chronicle - Vol. 120 No. 073 (25 Dec 2020)Документ61 страницаHouston Chronicle - Vol. 120 No. 073 (25 Dec 2020)Ali TanveerОценок пока нет

- Non Financial Liabilities Provision and Contingencies.v2Документ44 страницыNon Financial Liabilities Provision and Contingencies.v2Angelica Mingaracal RosarioОценок пока нет

- ARINCDirect FOS Brochure-001Документ4 страницыARINCDirect FOS Brochure-001kallepalliОценок пока нет

- Thesis BedrijfseconomieДокумент8 страницThesis Bedrijfseconomiecrystaltorresworcester100% (2)

- ASC 606 Revenue Recognition - Membership DuesДокумент6 страницASC 606 Revenue Recognition - Membership DuesAdam SandersОценок пока нет

- Amway India Enterprises challenges applicability of Prize Chits ActДокумент22 страницыAmway India Enterprises challenges applicability of Prize Chits ActGurupreet AnandОценок пока нет

- Tally Integrator: Frequently Asked QuestionsДокумент7 страницTally Integrator: Frequently Asked QuestionsUday kumarОценок пока нет

- BQS FormДокумент5 страницBQS FormMrPepper MintОценок пока нет

- CMGT 553 Final Isabella JimenezДокумент21 страницаCMGT 553 Final Isabella Jimenezapi-524854335Оценок пока нет

- 100+ Real Estate Agent Tax DeductionsДокумент1 страница100+ Real Estate Agent Tax DeductionsJosephОценок пока нет

- The Limitations of Subscription Services - A Critical ExaminationДокумент2 страницыThe Limitations of Subscription Services - A Critical ExaminationRicardo GulapaОценок пока нет

- Sophos Pricelist Reseller Dec2021 LatamДокумент2 857 страницSophos Pricelist Reseller Dec2021 LatamDanny CarrascoОценок пока нет

- Red Giant Software LicenseДокумент6 страницRed Giant Software LicenseHarish BabuОценок пока нет

- Sap Hec FaqДокумент2 страницыSap Hec Faqmhassim123Оценок пока нет

- Revit Integration Using MWF: BackgroundДокумент1 страницаRevit Integration Using MWF: BackgroundPsiko QuattroОценок пока нет

- SecASC - M05 - CSPM API IntegrationДокумент26 страницSecASC - M05 - CSPM API IntegrationGustavo WehdekingОценок пока нет

- Koream MNPДокумент17 страницKoream MNPManoj KumarОценок пока нет

- The Lennon Group, Inc Corp DocumentsДокумент81 страницаThe Lennon Group, Inc Corp DocumentsMarktoTrotОценок пока нет

- Introducing Tivoli Personalized Services Manager 1.1 Sg246031Документ340 страницIntroducing Tivoli Personalized Services Manager 1.1 Sg246031bupbechanhОценок пока нет

- 01 - Activity - 12 MITДокумент3 страницы01 - Activity - 12 MITBenedict CastroОценок пока нет