Академический Документы

Профессиональный Документы

Культура Документы

Collector v. Goodrich International (Bad Debt)

Загружено:

Argel CosmeАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Collector v. Goodrich International (Bad Debt)

Загружено:

Argel CosmeАвторское право:

Доступные форматы

Collector v Goodrich International Rubber Co. (G.R. No.

L-22265)

Facts:

Goodrich claimed for deductions based upon receipts issued, not by entities in which the

alleged expenses had been incurred, but by the officers of Goodrichwho allegedly paid for them.

The Commissioner disallowed deductions in the amount of P50,455.41 (for the year 1951) for

bad debts and P30,188.88 (for year 1952) for representation expenses.

Goodrich appealed from the said assessment to the Court of Tax Appeals (CTA) which allowed

the deduction for bad debts but disallowing the alleged representation expenses. CTA amended

its decision allowing the deduction of representation expenses.

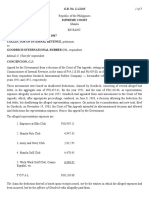

The Government appealed to the SC. The alleged bad debts are the following:

1. Portillo's Auto Seat Cover 630.31

2. Visayan Rapid Transit 17,810.26

3. Bataan Auto Seat Cover 373.13

4. Tres Amigos Auto Supply 1,370.31

5. P. C. Teodorolawphil 650.00

6. Ordnance Service, P.A. 386.42

7. Ordnance Service, P.C. 796.26

8. National land Settlement Administration 3,020.76

9. National Coconut Corporation 644.74

10. Interior Caltex Service Station 1,505.87

11. San Juan Auto Supply 4,530.64

12. P A C S A 45.36

13. Philippine Naval Patrol 14.18

14. Surplus Property Commission 277.68

15. Alverez Auto Supply 285.62

16. Lion Shoe Store 1,686.93

17. Ruiz Highway Transit 2,350.00

18. Esquire Auto Seat Cover 3,536.94

TOTAL P50,455.41*

Issue:

Whether or not these bad debts are properly deducted.

Held:

The claim for deduction for debt numbers 1-10 is REJECTED. Goodrich has not established

either that the debts are actually worthless or that it had reasonable grounds to believe them to

be so.

NIRC permits the deduction of debts actually ascertained to be worthless within the taxable

year obviously to prevent arbitrary action by the taxpayer, to unduly avoid tax liability.

The requirement of ascertainment of worthlessness require proof of 2 facts:

1. That the taxpayer did in fact ascertain the debt to be worthless

2. That he did so, in good faith.

Good faith on the part of the taxpayer is not enough. He must also how that he had reasonably

investigated the relevant facts and had drawn a reasonable inference from the information

obtained by him. In the case, Goodrich has not adequately made such showing.

The payments made, after being characterized as bad debts, merely stresses the undue haste

with which the same had been written off. Goodrich has not proven that said debts were

worthless. There was no evidence that the debtors can not pay them.

SC held that the claim for bad debts are allowed but only up to P22,627.35. (those from Debts

11-18)

Вам также может понравиться

- EO No. 226 - Omnibus Investments CodeДокумент26 страницEO No. 226 - Omnibus Investments CodeJen AnchetaОценок пока нет

- California v. Hodari D., 499 U.S. 621 (1991)Документ23 страницыCalifornia v. Hodari D., 499 U.S. 621 (1991)Scribd Government DocsОценок пока нет

- Sovereignty Over Natural ResourcesДокумент24 страницыSovereignty Over Natural ResourcesMohd. Atif KhanОценок пока нет

- People Vs Silvestre Liwanag Aka Linda BieДокумент3 страницыPeople Vs Silvestre Liwanag Aka Linda BieShiena Lou B. Amodia-RabacalОценок пока нет

- Velasco's Unauthorized Bank WithdrawalДокумент46 страницVelasco's Unauthorized Bank Withdrawaljhen agustinОценок пока нет

- 50 Babao v. PerezДокумент14 страниц50 Babao v. PerezDianne Karla CruzОценок пока нет

- Preliminary attachment requires valid service of summonsДокумент1 страницаPreliminary attachment requires valid service of summonsGia DimayugaОценок пока нет

- INVALID DEED OF DONATION DUE TO LACK OF PROPRIETARY RIGHTДокумент1 страницаINVALID DEED OF DONATION DUE TO LACK OF PROPRIETARY RIGHTMikka MonesОценок пока нет

- Woodchild Holdings, Inc. vs. Roxas Electric and Construction Company, Inc.Документ22 страницыWoodchild Holdings, Inc. vs. Roxas Electric and Construction Company, Inc.Xtine CampuPotОценок пока нет

- 07 Republic Vs BatugasДокумент8 страниц07 Republic Vs BatugasFlois SevillaОценок пока нет

- Liton Vs HillДокумент4 страницыLiton Vs HillXing Keet LuОценок пока нет

- Bus Company Fails to Prove AbandonmentДокумент2 страницыBus Company Fails to Prove Abandonmentjovani emaОценок пока нет

- Allado vs. DioknoДокумент1 страницаAllado vs. DioknoLloyd David P. VicedoОценок пока нет

- 6 The Diocese of Bacolod V COMELEC PDFДокумент3 страницы6 The Diocese of Bacolod V COMELEC PDFJpSocratesОценок пока нет

- People vs. TudtudДокумент12 страницPeople vs. TudtudHans Henly GomezОценок пока нет

- MANDATORY NEWSPAPER PUBLICATIONДокумент3 страницыMANDATORY NEWSPAPER PUBLICATIONfjl_302711Оценок пока нет

- Gonzales v. Court of Appeals (Will Execution RequirementsДокумент1 страницаGonzales v. Court of Appeals (Will Execution RequirementsAngelReaОценок пока нет

- Cases and Materials On International Law, Ninth Edition: Brierly, The Law of NationsДокумент11 страницCases and Materials On International Law, Ninth Edition: Brierly, The Law of NationsAraceli DabuetОценок пока нет

- Comprehensive Agrarian Reform Program: (CARP)Документ73 страницыComprehensive Agrarian Reform Program: (CARP)irene anibongОценок пока нет

- People vs. GalloДокумент2 страницыPeople vs. GalloMAry Jovan PanganОценок пока нет

- Miranda v. TuliaoДокумент2 страницыMiranda v. TuliaoAphrОценок пока нет

- Harris v. United States, 390 U.S. 234 (1968)Документ3 страницыHarris v. United States, 390 U.S. 234 (1968)Scribd Government DocsОценок пока нет

- Human Resource ManagementДокумент19 страницHuman Resource ManagementjinadiОценок пока нет

- Bersabal Vs SalvadorДокумент4 страницыBersabal Vs SalvadormingmingmeowchuОценок пока нет

- Rule 57 Cases (Originals)Документ76 страницRule 57 Cases (Originals)Anonymous Ig5kBjDmwQОценок пока нет

- Republic of The Philippines Manila Second Division: Supreme CourtДокумент3 страницыRepublic of The Philippines Manila Second Division: Supreme CourtChris InocencioОценок пока нет

- 95 Alimpoos Vs CaДокумент1 страница95 Alimpoos Vs CaYvon BaguioОценок пока нет

- Singson v. NLRC - FajutagДокумент2 страницыSingson v. NLRC - FajutagSand FajutagОценок пока нет

- Civil Procedure Midterm Coverage Full Cases and ReadablesДокумент107 страницCivil Procedure Midterm Coverage Full Cases and ReadablesEllen Glae DaquipilОценок пока нет

- UN Convention On Contracts For International Sale of Goods (CISG) 1980Документ22 страницыUN Convention On Contracts For International Sale of Goods (CISG) 1980曹家卫Оценок пока нет

- La Union, or Baguio City, For Reasons of Security and Personal Safety, As Shown in Their AffidavitsДокумент3 страницыLa Union, or Baguio City, For Reasons of Security and Personal Safety, As Shown in Their AffidavitsMoira SarmientoОценок пока нет

- Rescissible Contracts: ARTICLE 1380-1389Документ26 страницRescissible Contracts: ARTICLE 1380-1389Crizhae Ocon100% (1)

- Sy Vs GuitierrezДокумент2 страницыSy Vs GuitierrezJennilyn TugelidaОценок пока нет

- Department of Education Culture and Sports Now Department of Education Et Al V Heirs of Regino Banguilan Et AlДокумент4 страницыDepartment of Education Culture and Sports Now Department of Education Et Al V Heirs of Regino Banguilan Et AlSanjeev J. SangerОценок пока нет

- Taxation Case DoctrinesДокумент156 страницTaxation Case DoctrinesLibay Villamor IsmaelОценок пока нет

- PP V LucasДокумент5 страницPP V LucasBatmanrobin RobinbatmanОценок пока нет

- Corpo Cases CompiledДокумент20 страницCorpo Cases CompiledJacqueline Carlotta SydiongcoОценок пока нет

- Statement of Management Responsibility For Financial StatementsДокумент2 страницыStatement of Management Responsibility For Financial StatementsRizzvillEspinaОценок пока нет

- Sat Consti Fajardo V People To Harris V USДокумент3 страницыSat Consti Fajardo V People To Harris V USBrandon BanasanОценок пока нет

- Coscolluela V SBДокумент3 страницыCoscolluela V SBJenny A. BignayanОценок пока нет

- ADZUCL Incomesyllabus SY2014 15Документ72 страницыADZUCL Incomesyllabus SY2014 15Benn DegusmanОценок пока нет

- BMGT 491.03 - Special Topics - Human Resource Management PDFДокумент6 страницBMGT 491.03 - Special Topics - Human Resource Management PDFAmy BCОценок пока нет

- 118 Burgos v. Chief of Staff G.R. No. L-64261 December 26, 1984Документ2 страницы118 Burgos v. Chief of Staff G.R. No. L-64261 December 26, 1984Enid SevilleОценок пока нет

- CA denies naturalization petition due to lack of declarationДокумент15 страницCA denies naturalization petition due to lack of declarationenarguendoОценок пока нет

- ArrestДокумент47 страницArrestPaul Christopher PinedaОценок пока нет

- SY Et - Al. Vs CA (Feb 27, 2003)Документ1 страницаSY Et - Al. Vs CA (Feb 27, 2003)Novi Mari NobleОценок пока нет

- NHC employees allowed to unionize despite GOCC statusДокумент2 страницыNHC employees allowed to unionize despite GOCC statusCentSeringОценок пока нет

- Mantok Vs TecsonДокумент1 страницаMantok Vs TecsonVal SanchezОценок пока нет

- Nature of Agency RelationshipДокумент2 страницыNature of Agency RelationshipCarie LawyerrОценок пока нет

- 17 - Fronda-Baggao V PeopleДокумент1 страница17 - Fronda-Baggao V PeopleAndrea RioОценок пока нет

- Lino Luna V RodriguezДокумент2 страницыLino Luna V RodriguezNypho PareñoОценок пока нет

- Lita Ent&Teja MarketingДокумент4 страницыLita Ent&Teja MarketingMary AnneОценок пока нет

- Republic Vs Drugmake R'S LAB (GR NO. 190837 MARCH 5, 2014)Документ10 страницRepublic Vs Drugmake R'S LAB (GR NO. 190837 MARCH 5, 2014)Harrison sajorОценок пока нет

- Mendoza Vs COAДокумент1 страницаMendoza Vs COAHudson CeeОценок пока нет

- Lico v. Comelec, 771 Scra 596 (2015)Документ5 страницLico v. Comelec, 771 Scra 596 (2015)Ralph LorenzoОценок пока нет

- CASE NO. 025 Agustin v. Edu Ref./Date/ PN G.R. No. L-49112 / February 2, 1979 / Kaye Lim Law/ Subject PIL Case AidДокумент2 страницыCASE NO. 025 Agustin v. Edu Ref./Date/ PN G.R. No. L-49112 / February 2, 1979 / Kaye Lim Law/ Subject PIL Case AidMaria Jennifer Yumul BorbonОценок пока нет

- Facts:: REPUBLIC v. REV. CLAUDIO R. CORTEZ, GR No. 197472, 2015-09-07Документ4 страницыFacts:: REPUBLIC v. REV. CLAUDIO R. CORTEZ, GR No. 197472, 2015-09-07Sean Pamela BalaisОценок пока нет

- Case DigestДокумент3 страницыCase DigestChristine LarogaОценок пока нет

- Collector V. Goodrich International Rubber Co.: By: Ellaine M. QuimsonДокумент2 страницыCollector V. Goodrich International Rubber Co.: By: Ellaine M. QuimsonLudy Jane FelicianoОценок пока нет

- 74-CIR v. Goodrich, Int'l G.R. No. L-22265 December 22, 1967Документ5 страниц74-CIR v. Goodrich, Int'l G.R. No. L-22265 December 22, 1967Jopan SJОценок пока нет

- Orphans and DogsДокумент1 страницаOrphans and DogsArgel CosmeОценок пока нет

- Egotiable Nstruments AW: Executive Committee Subject Committee MembersДокумент45 страницEgotiable Nstruments AW: Executive Committee Subject Committee MembersArgel CosmeОценок пока нет

- League of Provinces Vs DENRДокумент29 страницLeague of Provinces Vs DENRArgel CosmeОценок пока нет

- Dual citizenship vs dual allegiance; requirements for administrative naturalizationДокумент2 страницыDual citizenship vs dual allegiance; requirements for administrative naturalizationArgel CosmeОценок пока нет

- Some Problems Concerning Expert WitnessesДокумент14 страницSome Problems Concerning Expert WitnessesArgel CosmeОценок пока нет

- Taxpayer RemediesДокумент39 страницTaxpayer RemediesArgel CosmeОценок пока нет

- Affidavit of Damaged VehicleДокумент1 страницаAffidavit of Damaged VehicleArgel Cosme100% (1)

- The LawyerДокумент1 страницаThe LawyerArgel CosmeОценок пока нет

- Affidavit of DiscrepancyДокумент2 страницыAffidavit of DiscrepancyArgel CosmeОценок пока нет

- TRANSPOДокумент36 страницTRANSPOArgel CosmeОценок пока нет

- Transfer Taxes and Estate PlanningДокумент22 страницыTransfer Taxes and Estate PlanningArgel CosmeОценок пока нет

- Safelift Inflatables Rental AgreementДокумент2 страницыSafelift Inflatables Rental AgreementArgel CosmeОценок пока нет

- Return of Misplaced Baggage AffidavitДокумент3 страницыReturn of Misplaced Baggage AffidavitArgel CosmeОценок пока нет

- VAT: A Transparent Tax on Value AddedДокумент29 страницVAT: A Transparent Tax on Value AddedArgel CosmeОценок пока нет

- Anking AWS: (GBL) R.A. N - 8791Документ41 страницаAnking AWS: (GBL) R.A. N - 8791Argel CosmeОценок пока нет

- Intellectual PropertyДокумент42 страницыIntellectual PropertyArgel CosmeОценок пока нет

- Effect of Failure To Allege Assessed Value of Property: Et Al.Документ6 страницEffect of Failure To Allege Assessed Value of Property: Et Al.Argel CosmeОценок пока нет

- Insurance LawДокумент40 страницInsurance LawArgel CosmeОценок пока нет

- Four bills aim to amend estate tax systemДокумент1 страницаFour bills aim to amend estate tax systemArgel CosmeОценок пока нет

- Lyceum of the Philippines vs Court of Appeals ruling on use of "LyceumДокумент2 страницыLyceum of the Philippines vs Court of Appeals ruling on use of "LyceumjohnsalongaОценок пока нет

- CTA Taxation Report ReviewДокумент7 страницCTA Taxation Report ReviewRia Kriselle Francia PabaleОценок пока нет

- Sinumpaang SalaysayДокумент9 страницSinumpaang SalaysayArgel CosmeОценок пока нет

- Effect of Failure To Allege Assessed Value of Property: Et Al.Документ6 страницEffect of Failure To Allege Assessed Value of Property: Et Al.Argel CosmeОценок пока нет

- El Banco Espanol V PalancaДокумент15 страницEl Banco Espanol V PalancaArgel CosmeОценок пока нет

- Tax RemediesДокумент34 страницыTax RemediesArgel Cosme100% (1)

- Real Property TaxДокумент13 страницReal Property TaxArgel Cosme100% (2)

- Eloisa Goitia de La Camara V. Jose Campos RuedaДокумент1 страницаEloisa Goitia de La Camara V. Jose Campos RuedaPaolo OlleroОценок пока нет

- Wiegel Vs Sempio DyДокумент1 страницаWiegel Vs Sempio DyArgel CosmeОценок пока нет

- Anaya V PalaroanДокумент1 страницаAnaya V PalaroanArgel CosmeОценок пока нет

- Perido Vs PeridoДокумент1 страницаPerido Vs PeridoArgel CosmeОценок пока нет

- IVALIFE - IVApension Policy BookletДокумент12 страницIVALIFE - IVApension Policy BookletJosef BaldacchinoОценок пока нет

- Income Tax FilingДокумент21 страницаIncome Tax FilingMark Emil BaritОценок пока нет

- Business Combi CH 6 de JesusДокумент9 страницBusiness Combi CH 6 de JesusMerel Rose FloresОценок пока нет

- Fee Details Fee Details Fee DetailsДокумент1 страницаFee Details Fee Details Fee DetailsTabish KhanОценок пока нет

- Adjusted Trial BalanceДокумент4 страницыAdjusted Trial BalanceMonir HossainОценок пока нет

- Chapter 6 Income Statement & Statement of Changes in EquityДокумент7 страницChapter 6 Income Statement & Statement of Changes in EquitykajsdkjqwelОценок пока нет

- SBI Focused Equity Fund (1) 09162022Документ4 страницыSBI Focused Equity Fund (1) 09162022chandana kumarОценок пока нет

- Bata & AB BankДокумент8 страницBata & AB BankSaqeef RayhanОценок пока нет

- Case Delta Beverage Group 7Документ8 страницCase Delta Beverage Group 7Wouter Hendriksen100% (1)

- Coa C2015-002Документ71 страницаCoa C2015-002Pearl AudeОценок пока нет

- Lesson 10 - Study MaterialДокумент15 страницLesson 10 - Study Materialnadineventer99Оценок пока нет

- Residual Valuations & Development AppraisalsДокумент16 страницResidual Valuations & Development Appraisalscky20252838100% (1)

- DR Stanisław Kubielas: International FinanceДокумент4 страницыDR Stanisław Kubielas: International FinanceGorana Goga RadisicОценок пока нет

- Advanced Accounting Chapter 5Документ21 страницаAdvanced Accounting Chapter 5leelee030275% (4)

- Service-Charges 01.01.2022 WEBДокумент58 страницService-Charges 01.01.2022 WEBRenesh RОценок пока нет

- 7 Things About Support and Resistance That Nobody Tells YouДокумент6 страниц7 Things About Support and Resistance That Nobody Tells YouAli Abdelfatah Mahmoud100% (1)

- New Income Tax Law 2018.1 NewДокумент87 страницNew Income Tax Law 2018.1 NewDamascene100% (1)

- 50 Cent - Schedules A-JДокумент38 страниц50 Cent - Schedules A-JMike Huseman100% (1)

- DepartmentalizationДокумент19 страницDepartmentalizationmbmsabithОценок пока нет

- Collection of HC and SC DecisionsДокумент63 страницыCollection of HC and SC DecisionsDayavantiОценок пока нет

- Non - Negotiable: Notification of DepositДокумент1 страницаNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့Оценок пока нет

- Engineering Economics HandoutДокумент6 страницEngineering Economics HandoutRomeoОценок пока нет

- Final Exam/2: Multiple ChoiceДокумент4 страницыFinal Exam/2: Multiple ChoiceJing SongОценок пока нет

- 822 Taxation XI PDFДокумент181 страница822 Taxation XI PDFPiyush GargОценок пока нет

- Chapter 16 - Management of Current AssetsДокумент7 страницChapter 16 - Management of Current Assetslou-924Оценок пока нет

- Risk Based Investment in Davanrik Drug CompoundДокумент19 страницRisk Based Investment in Davanrik Drug Compoundjk kumarОценок пока нет

- Analysis and Correction of Errors WorksheetДокумент3 страницыAnalysis and Correction of Errors WorksheetDaphneОценок пока нет

- Calm Finance Unit PlanДокумент7 страницCalm Finance Unit Planapi-331006019Оценок пока нет

- INV2001082Документ1 страницаINV2001082Bisi AgomoОценок пока нет

- SalesBill VI 139 DigitallySignedДокумент1 страницаSalesBill VI 139 DigitallySignedKundariya MayurОценок пока нет