Академический Документы

Профессиональный Документы

Культура Документы

15 Republic Vs Ablaza

Загружено:

Yaz Carloman0 оценок0% нашли этот документ полезным (0 голосов)

51 просмотров5 страницTax cases

Оригинальное название

15 Republic vs Ablaza

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документTax cases

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

51 просмотров5 страниц15 Republic Vs Ablaza

Загружено:

Yaz CarlomanTax cases

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

VOL.

108, JULY 26, 1960 1105

Republic of the Phils. vs. Ablaza

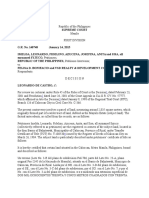

[No. L14519. July 26, 1960]

REPUBLIC OF THE PHILIPPINES, plaintiff and

appellant, vs. LUIS G. ABLAZA, defendant and appellee

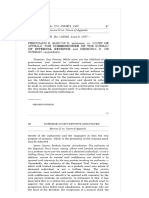

1. INCOME TAX, COLLECTION, LIMITATION OF

ACTIONS, PURPOSE BENEFICIAL BOTH TO

GOVERNMENT AND CITIZENS.The law prescribing a

limitation of actions for the collection of the income tax is

beneficial both to the Government and to its citizens, to

the government because tax officers would be obliged to

act properly in the making' of assessments and to citizens

because after the lapse of the period of prescription

citizens would have a feeling of security against

unscrupulous tax agents who will always find an excuse to

inspect the books of taxpayers, not to determine the

latter's real liability but to take advantage of every

opportunity to molest peaceful law abiding citizens.

Without such a legal defense taxpayers would furthermore

be under obligation to always keep their books and keep

them open for inspection subject to harrassment by

unscrupulous tax agents.

2. ID. ID. ID. REMEDIAL MEASURE

INTERPRETATION.The law of prescription being a

remedial measure should be interpreted in a way

conducive to bringing about the beneficient purpose of

affording protection to the taxpayer within the

contemplation of the Commission which recommend the

approval of the law.

APPEAL from a judgment of the Court of First Instance of

Manila. Alvendia, J.

The facts are stated in the opinion of the Court.

1106

1106 PHILIPPINE REPORTS ANNOTATED

Republic of the Phils. vs. Ablaza

Assistant Solicitor General Jose P. Alejandro and Special

Attorneys Cirilio R. Francisco and Santiago M. Kapunan

for appellant.

Martin B. Istaro for appellee.

LABRADOR, J.:

Appeal from a judgment of the Court of First Instance of

Manila, Hon. Carmelino G. Alvendia, presiding, dismissing

an action instituted by the Government to recover income

taxes from the defendantappellee corresponding to the

years 1945, 1946, 1947 and 1948.

The record discloses that on October 3, 1951, the

Collector of Internal Revenue assessed income taxes for the

years 1945, 1946, 1947 and 1948 on the income tax returns

of defendantappellee Luis G. Ablaza. The assessments

total P5,254.70 (Exhibit "I"). On October 16, 1951, the

accountants for Ablaza requested a reinvestigation of

Ablaza's tax liability, on the ground that (1) the assessment

is erroneous and incomplete (2) the assessment is based on

thirdparty information and (3) neither the taxpayer nor

his accountants were permitted to appear in person (Exh.

"J"). The petition for reinvestigation was granted in a letter

of the Collector of Internal Revenue, dated October 17,

1951. On October 30, 1951, the accountants for Ablaza

again sent another letter to the Collector of Internal

Revenue submitting a copy of their own computation (Exh.

"L"). On October 23, 1952, said accountants again

submitted a supplemental memorandum (Exh. "M"). On

March 10, 1954, the accountants for Ablaza sent a letter to

the examiner of accounts and collections of the Bureau of

Internal Revenue, stating:

"In this connection, we wish to state that this case is presently

under reinvestigation as per our request dated October 16, 1951,

and your letter to us dated October 17, 1951, and that said tax

liability being only a tentative assessment, we are not as yet

advised of the results of the requested reinvestigation.

"In view thereof, we wish to request, in fairness to the taxpayer

concerned, that we be furnished a copy of the detailed

computation

1107

VOL. 108, JULY 26, 1960 1107

Republic of the Phils. vs. Ablaza

of the alleged tax liability as soon as the reinvestigation is

terminated to enable us to prove the veracity of the taxpayer's

side of the case, and if it is found out that said assessment is

proper and in order, we assure you of our assistance in the speedy

disposition of this case." (Exh. "P")

On February 11, 1957, after the reinvestigation, the

Collector of Internal Revenue made a final assessment of

the income taxes of Ablaza, fixing said income taxes for the

years already mentioned at P2,066.56 (Exh. "Q"). Notice of

the said assessment was sent (Exhs. "V", "W" and "X") and

upon receipt thereof the accountants of Ablaza sent a letter

to the Collector of Internal Revenue, dated May 8, 1957,

protesting the assessments, on the ground that the income

taxes are no longer collectible for the reason that they have

already prescribed. As the Collector did not agree to the

alleged claim of prescription, action was instituted by him

in the Court of First Instance to recover the amount

assessed. The Court of First Instance upheld the contention

of Ablaza that the action to collect the said income taxes

had prescribed. Against this decision the case was brought

here on appeal, where it is claimed by the Government that

the prescriptive period has not f ully run at the time of the

assessment, in view especially of the letter of the

accountants of Ablaza, dated March 10, 1954, pertinent

provisions of which are quoted above.

It is of course true that when on October 14, 1951,

Ablaza's accountants requested a reinvestigation of the

assessment of the income taxes against him, the period of

prescription of action to collect the taxes was suspended.

(Sec. 333, C. A. No. 466.) The provision of law on

prescription was adopted in our statute books upon

recommendation of the tax commissioner of the Philippines

which declares:

"Under the former law, the right of the Government to collect the

tax does not prescribe. However, in fairness to the taxpayer, the

Government should be estopped from collecting the tax where

1108

1108 PHILIPPINE REPORTS ANNOTATED

Republic of the Phils. vs. Ablaza

it failed to make the necessary investigation and assessment

within 5 years after the filing of the return and where it failed to

collect the tax within 5 years from the date of assessment thereof.

Just as the government is interested in the stability of its

collections, so also are the taxpayers entitled to an assurance that

they will not be subjected to further investigation for tax purposes

after the expiration of a reasonable period of time." (Vol. Il, Report

of the Tax Commission of the Philippines, pp. 321322)

The law prescribing a limitation of actions for the collection

of the income tax is beneficial both to the Government and

to its citizens to the Government because tax officers

would be obliged to act promptly in the making of

assessment, and to citizens because after the lapse of the

period of prescription citizens would have a feeling of

security against unscrupulous tax agents who will always

find an excuse to inspect the books of taxpayers, not to

determine the latter's real liability, but to take advantage

of every opportunity to molest peaceful, lawabiding

citizens. Without such a legal defense taxpayers would

furthermore be under obligation to always keep their books

and keep them open for inspection subject to harassment

by unscrupulous tax agents. The law on prescription being

a remedial measure should be interpreted in a way

conducive to bringing about the beneficent purpose of

affording protection to the taxpayer within the

contemplation of the Commission which recommend the

approval of the law.

The question in the case at bar boils down to the

interpretation of Exhibit "P", dated March 10, 1954, quoted

above. If said letter be interpreted as a request for further

investigation or a new investigation, different and distinct

from the investigation demanded or prayed for in Ablaza's

first letter, Exhibit "L", then the period of prescription

would continue to be suspended thereby. But if the letter in

question does not ask for another investigation, the result

would be just the opposite. In our opinion the letter in

question, Exhibit "P", does not ask

1109

VOL. 108, JULY 26, 1960 1109

Ong Kue vs. Republic of the Phils.

for another investigation. Its first paragraph quoted above

shows that the reinvestigation then being conducted was

by virtue of its request of October 16, 1951. All that the

letter asks is that the taxpayer be furnished a copy of the

computation. The request may be explained in this

manner: As the reinvestigation was allowed on October 1,

1951 and on October 16, 1951, the taxpayer supposed or

expected that at that time, March, 1954 the reinvestigation

was about to be finished and he wanted a copy of the

reassessment in order to be prepared to admit or contest it.

Nowhere does the letter imply a demand or request for a

different or new and distinct reinvestigation from that

already requested and, therefore, the said letter may not be

interpreted to authorize or justify the continuance of the

suspension of the period of limitations.

We find the appeal without merit and we hereby affirm

the judgment of the lower court dismissing the action.

Without costs.

Pars, C. J., Bengzon, Montemayor, Bautista Angelo,

Concepcin, Reyes, J. B. L., Endencia, Barrera, and

Gutirrez David, JJ., concur.

Judgment affirmed.

________________

Copyright2017CentralBookSupply,Inc.Allrightsreserved.

Вам также может понравиться

- 14 Aznar vs. Cta (58 Scra 519)Документ29 страниц14 Aznar vs. Cta (58 Scra 519)Alfred GarciaОценок пока нет

- Manila Electric Company vs. Quisumbing, 326 SCRA 172 (2000)Документ17 страницManila Electric Company vs. Quisumbing, 326 SCRA 172 (2000)Kaye Miranda LaurenteОценок пока нет

- CIR Vs ReyesДокумент16 страницCIR Vs Reyes123456789Оценок пока нет

- Commissioner of Internal Revenue, Petitioner, vs. Enron Subic Power Corporation, Respondent.Документ9 страницCommissioner of Internal Revenue, Petitioner, vs. Enron Subic Power Corporation, Respondent.Mariel ManingasОценок пока нет

- 2 CIR vs. Sony Phils, Inc. G.R. No. 178697, November 17, 2010Документ17 страниц2 CIR vs. Sony Phils, Inc. G.R. No. 178697, November 17, 2010Alfred GarciaОценок пока нет

- 1 CIR vs. Fitness by Design, Inc., GR No. 215957 Dated November 9, 2016Документ32 страницы1 CIR vs. Fitness by Design, Inc., GR No. 215957 Dated November 9, 2016Alfred GarciaОценок пока нет

- Velasco vs. PoizatДокумент2 страницыVelasco vs. Poizatdura lex sed lexОценок пока нет

- Tax AmnestyДокумент25 страницTax AmnestyCali Shandy H.Оценок пока нет

- Coral Bay Vs CIR Cross Border DoctrineДокумент7 страницCoral Bay Vs CIR Cross Border DoctrineAira Mae P. LayloОценок пока нет

- Antam Consolidated v. CAДокумент2 страницыAntam Consolidated v. CASarah RosalesОценок пока нет

- On The Recognition and Enforcement of Foreign JudgmentДокумент5 страницOn The Recognition and Enforcement of Foreign JudgmentAlfred IlaganОценок пока нет

- CTA Requires Donors to Prove Donee Compliance for Deduction of DonationsДокумент1 страницаCTA Requires Donors to Prove Donee Compliance for Deduction of DonationsArdy Falejo FajutagОценок пока нет

- 94 Veraguth V Isabela Sugar CoДокумент2 страницы94 Veraguth V Isabela Sugar CoFrancesca Isabel MontenegroОценок пока нет

- Philippine Amusement and Gaming Corporation vs. Bureau of Internal Revenue, 782 SCRA 402, January 27, 2016Документ16 страницPhilippine Amusement and Gaming Corporation vs. Bureau of Internal Revenue, 782 SCRA 402, January 27, 2016j0d3Оценок пока нет

- CIR v. Sony PhilippinesДокумент1 страницаCIR v. Sony PhilippinesMarcella Maria KaraanОценок пока нет

- Jose B. Aznar v. Court of Tax Appeals, G.R No. L - 20569Документ2 страницыJose B. Aznar v. Court of Tax Appeals, G.R No. L - 20569Iris Mikaela P. RamosОценок пока нет

- Enbanc: Court Appeals CityДокумент13 страницEnbanc: Court Appeals CityjoannelegaspiОценок пока нет

- Abs-Cbn v. Cta and NPC v. CbaaДокумент2 страницыAbs-Cbn v. Cta and NPC v. CbaaRyan BagagnanОценок пока нет

- Sy Po v. CTAДокумент11 страницSy Po v. CTANester MendozaОценок пока нет

- RMC No 17-2018Документ6 страницRMC No 17-2018fatmaaleahОценок пока нет

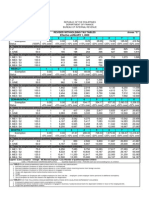

- Revised Withholding Tax TablesДокумент1 страницаRevised Withholding Tax TablesJonasAblangОценок пока нет

- THE CITY OF DAVAO, REPRESENTED BY THE CITY TREASURER OF DAVAO CITY, Petitioner, v.THE INTESTATE ESTATE OF AMADO S. DALISAY, REPRESENTED BY SPECIAL ADMINISTRATOR ATTY. NICASIO B. PADERNA, Respondent.Документ8 страницTHE CITY OF DAVAO, REPRESENTED BY THE CITY TREASURER OF DAVAO CITY, Petitioner, v.THE INTESTATE ESTATE OF AMADO S. DALISAY, REPRESENTED BY SPECIAL ADMINISTRATOR ATTY. NICASIO B. PADERNA, Respondent.Pame PameОценок пока нет

- Lascona Vs CIR DigestДокумент2 страницыLascona Vs CIR Digestminri721Оценок пока нет

- Prescription - PenaltiesДокумент13 страницPrescription - PenaltiesFrancisCarloL.FlameñoОценок пока нет

- Natonton V MagawayДокумент1 страницаNatonton V MagawayFidelis Victorino QuinagoranОценок пока нет

- Pals Tax Law Addu 2017 Final PDFДокумент53 страницыPals Tax Law Addu 2017 Final PDFArvin Clemm NarcaОценок пока нет

- Civil Service Law OverviewДокумент43 страницыCivil Service Law OverviewMark William S. MidelОценок пока нет

- CIR vs. BenipayoДокумент5 страницCIR vs. BenipayoHannah BarrantesОценок пока нет

- Expropriation in EuropeДокумент31 страницаExpropriation in EuropeCentar za ustavne i upravne studije100% (1)

- Tax Deductions Upheld for Professional Services Despite Accrual of Expenses in Prior YearsДокумент2 страницыTax Deductions Upheld for Professional Services Despite Accrual of Expenses in Prior YearsDee ObriqueОценок пока нет

- Prac 2 - Midterms ReviewerДокумент5 страницPrac 2 - Midterms ReviewerAndiel KyxzОценок пока нет

- Fuentes v. CAДокумент2 страницыFuentes v. CAKristine CentinoОценок пока нет

- CIR Rules Pawnshop Transactions Subject to DSTДокумент8 страницCIR Rules Pawnshop Transactions Subject to DSTReah CrezzОценок пока нет

- Summary of Significant SC Decisions (April May June 2011)Документ2 страницыSummary of Significant SC Decisions (April May June 2011)elmersgluethebombОценок пока нет

- Supreme Court Decision on Land Ownership DisputeДокумент27 страницSupreme Court Decision on Land Ownership DisputeMai AlterОценок пока нет

- Cir V BoacДокумент15 страницCir V BoaccandiceОценок пока нет

- Cir v. Nidec Copal Phil CorpДокумент24 страницыCir v. Nidec Copal Phil CorpKris CalabiaОценок пока нет

- How To Create A CorporationДокумент2 страницыHow To Create A Corporationicecyst888Оценок пока нет

- Banco Atlantico VДокумент5 страницBanco Atlantico Vfrank japosОценок пока нет

- Cir V ManningДокумент12 страницCir V Manningnia_artemis3414Оценок пока нет

- 82 Supreme Court Reports Annotated: Philippine Petroleum Corp. vs. Municipality of Pililla, RizalДокумент10 страниц82 Supreme Court Reports Annotated: Philippine Petroleum Corp. vs. Municipality of Pililla, RizalAaron ReyesОценок пока нет

- Lagrosas vs. Bristol MyersДокумент9 страницLagrosas vs. Bristol MyersPeo IcallaОценок пока нет

- CANONS 17-19 CASES ON DELAYED EXECUTIONДокумент33 страницыCANONS 17-19 CASES ON DELAYED EXECUTIONEzra Denise Lubong RamelОценок пока нет

- Supreme Court Rules on Taxation of Airlines Under FranchiseДокумент18 страницSupreme Court Rules on Taxation of Airlines Under Franchisemceline19Оценок пока нет

- CIR v. Fisher AДокумент30 страницCIR v. Fisher ACE SherОценок пока нет

- 12 - Ericsson Telecommunications, Inc. v. City of Pasig GR No 176667 PDFДокумент8 страниц12 - Ericsson Telecommunications, Inc. v. City of Pasig GR No 176667 PDFEmelie Marie DiezОценок пока нет

- Marcos II v. C.A. Et. Al. 273 SCRA 47Документ19 страницMarcos II v. C.A. Et. Al. 273 SCRA 47rgomez_940509Оценок пока нет

- Part 1 Remedies Under NIRC CompiledДокумент27 страницPart 1 Remedies Under NIRC Compiledjetisyan100% (2)

- CIR v. Metro Star Superama, Inc. (2010) (PAN requirementДокумент18 страницCIR v. Metro Star Superama, Inc. (2010) (PAN requirementNievesAlarconОценок пока нет

- Cta 2D CV 08551 M 2016mar02 AssДокумент10 страницCta 2D CV 08551 M 2016mar02 AssKathrine Chin LuОценок пока нет

- Quezon City Government's assessment, levy and sale of PHC properties assailedДокумент15 страницQuezon City Government's assessment, levy and sale of PHC properties assailedCzarianne GollaОценок пока нет

- SILICON PHILIPPINES, INC., (Formerly INTEL PHILIPPINES MANUFACTURING, INC.) vs. COMMISSIONER OF INTERNAL REVENUEДокумент4 страницыSILICON PHILIPPINES, INC., (Formerly INTEL PHILIPPINES MANUFACTURING, INC.) vs. COMMISSIONER OF INTERNAL REVENUETrishaОценок пока нет

- IBP's Mandatory Pro Bono Legal Services for Filipino CitizensДокумент16 страницIBP's Mandatory Pro Bono Legal Services for Filipino CitizensAlfred Bryan AspirasОценок пока нет

- 20 BPI vs. CIR (GR No. 139736, October 17, 2005)Документ41 страница20 BPI vs. CIR (GR No. 139736, October 17, 2005)Alfred Garcia100% (1)

- (People v. Macasling, GM, No. 90342, May 27,1993Документ7 страниц(People v. Macasling, GM, No. 90342, May 27,1993TrexPutiОценок пока нет

- DocumentДокумент2 страницыDocumentFaisa PactiwОценок пока нет

- A. Jurisdiction of The Court of Tax Appeals: 1. Civil CasesДокумент7 страницA. Jurisdiction of The Court of Tax Appeals: 1. Civil CasesRovi Anne IgoyОценок пока нет

- Compagnie Financiere Sucres Et Denrees vs. Commissioner of Internal RevenueДокумент5 страницCompagnie Financiere Sucres Et Denrees vs. Commissioner of Internal RevenuejafernandОценок пока нет

- Republic v. Ablaza, 108 Phil. 1105 (1906)Документ4 страницыRepublic v. Ablaza, 108 Phil. 1105 (1906)Czar Ian AgbayaniОценок пока нет

- Senate Bill Desecration of DeadДокумент3 страницыSenate Bill Desecration of DeadYaz CarlomanОценок пока нет

- Property in Dead BodiesДокумент9 страницProperty in Dead BodiesYaz CarlomanОценок пока нет

- SB 1297 DesecrationДокумент2 страницыSB 1297 DesecrationYaz CarlomanОценок пока нет

- AW DudleyДокумент7 страницAW DudleyYaz CarlomanОценок пока нет

- A Defense of Cannibalism PDFДокумент8 страницA Defense of Cannibalism PDFsylove76Оценок пока нет

- Mathew Lu Explaining - The - Wrongness - of - Cannibalism (Recovered) (Recovered) (Recovered) (Recovered)Документ26 страницMathew Lu Explaining - The - Wrongness - of - Cannibalism (Recovered) (Recovered) (Recovered) (Recovered)Yaz CarlomanОценок пока нет

- Mathew Lu Explaining - The - Wrongness - of - Cannibalism (Recovered) (Recovered) (Recovered) (Recovered)Документ26 страницMathew Lu Explaining - The - Wrongness - of - Cannibalism (Recovered) (Recovered) (Recovered) (Recovered)Yaz CarlomanОценок пока нет

- AW DudleyДокумент7 страницAW DudleyYaz CarlomanОценок пока нет

- Mathew Lu Explaining - The - Wrongness - of - Cannibalism (Recovered) (Recovered) (Recovered) (Recovered)Документ26 страницMathew Lu Explaining - The - Wrongness - of - Cannibalism (Recovered) (Recovered) (Recovered) (Recovered)Yaz CarlomanОценок пока нет

- Mathew Lu Explaining - The - Wrongness - of - Cannibalism (Recovered) (Recovered) (Recovered) (Recovered)Документ26 страницMathew Lu Explaining - The - Wrongness - of - Cannibalism (Recovered) (Recovered) (Recovered) (Recovered)Yaz CarlomanОценок пока нет

- Defiling The Dead - Necrophilia and The LawДокумент41 страницаDefiling The Dead - Necrophilia and The LawYaz CarlomanОценок пока нет

- Abhorrence and Justification John ShandДокумент15 страницAbhorrence and Justification John ShandYaz CarlomanОценок пока нет

- Defiling The Dead - Necrophilia and The LawДокумент41 страницаDefiling The Dead - Necrophilia and The LawYaz CarlomanОценок пока нет

- REGINA VДокумент4 страницыREGINA VYaz CarlomanОценок пока нет

- A Defense of CannibalismДокумент8 страницA Defense of CannibalismYaz CarlomanОценок пока нет

- 64 Paper Industries Vs CAДокумент54 страницы64 Paper Industries Vs CAYaz CarlomanОценок пока нет

- 1 Regina v. Dudley Stephens 2aioyfbДокумент9 страниц1 Regina v. Dudley Stephens 2aioyfb刘王钟Оценок пока нет

- 1 Regina v. Dudley Stephens 2aioyfbДокумент9 страниц1 Regina v. Dudley Stephens 2aioyfb刘王钟Оценок пока нет

- 05 CIR V FilinvestДокумент40 страниц05 CIR V FilinvestYaz CarlomanОценок пока нет

- AW DudleyДокумент7 страницAW DudleyYaz CarlomanОценок пока нет

- AW DudleyДокумент7 страницAW DudleyYaz CarlomanОценок пока нет

- Property in Dead BodiesДокумент9 страницProperty in Dead BodiesYaz CarlomanОценок пока нет

- A Defense of Cannibalism PDFДокумент8 страницA Defense of Cannibalism PDFsylove76Оценок пока нет

- Tax Avoidance Scheme Not a ReorganizationДокумент3 страницыTax Avoidance Scheme Not a ReorganizationYaz CarlomanОценок пока нет

- Abhorrence and Justification John ShandДокумент15 страницAbhorrence and Justification John ShandYaz CarlomanОценок пока нет

- 69 Fernandez Hermanos Vs CIRДокумент22 страницы69 Fernandez Hermanos Vs CIRYaz CarlomanОценок пока нет

- 1 Regina v. Dudley Stephens 2aioyfbДокумент9 страниц1 Regina v. Dudley Stephens 2aioyfb刘王钟Оценок пока нет

- 68 Philippine Refining Company Vs CAДокумент13 страниц68 Philippine Refining Company Vs CAYaz CarlomanОценок пока нет

- 70 Basilan Estates Vs CIRДокумент14 страниц70 Basilan Estates Vs CIRYaz CarlomanОценок пока нет

- 67 Philex Mining Vs CIRДокумент13 страниц67 Philex Mining Vs CIRYaz CarlomanОценок пока нет

- U.S. v. Taylor, G.R. No. 9726Документ4 страницыU.S. v. Taylor, G.R. No. 9726meerah100% (1)

- People v. GomezДокумент5 страницPeople v. GomezCelina Marie PanaliganОценок пока нет

- Employee RepresentationДокумент18 страницEmployee RepresentationRosalinda Melia SumbadОценок пока нет

- Theories in Crim LawДокумент1 страницаTheories in Crim LawYsmaelОценок пока нет

- CIR V Fortune Tobacco EscraДокумент69 страницCIR V Fortune Tobacco Escrasmtm06Оценок пока нет

- United States Court of Appeals Third CircuitДокумент13 страницUnited States Court of Appeals Third CircuitScribd Government DocsОценок пока нет

- BAR Questions and AnswersДокумент4 страницыBAR Questions and Answersejusdem generis100% (1)

- Five J Taxi vs. National Labor Relations CommissionДокумент1 страницаFive J Taxi vs. National Labor Relations CommissionXandee Teh KuizonОценок пока нет

- Government Contracts: Umakanth VarottilДокумент16 страницGovernment Contracts: Umakanth VarottilAadhitya NarayananОценок пока нет

- Torts Series FinalДокумент151 страницаTorts Series FinalsumitОценок пока нет

- Advise Fury As To Whether He Is Contractually Bound To LovelyДокумент5 страницAdvise Fury As To Whether He Is Contractually Bound To LovelyAshika LataОценок пока нет

- Module 3. Session 2. Activity 1. Child Protection and The Need For ItДокумент64 страницыModule 3. Session 2. Activity 1. Child Protection and The Need For ItSamKris Guerrero MalasagaОценок пока нет

- Procedure, Form #09.049Документ112 страницProcedure, Form #09.049Sovereignty Education and Defense Ministry (SEDM)Оценок пока нет

- Appeal to Remove Administrator in Estate CaseДокумент2 страницыAppeal to Remove Administrator in Estate CaseAndrew PigmentОценок пока нет

- Cyberi-Crime Law CaseДокумент11 страницCyberi-Crime Law CaseVince AbucejoОценок пока нет

- GCTA LawДокумент3 страницыGCTA LawPATRICIA MAE CABANAОценок пока нет

- REPORT Halliburton IranДокумент10 страницREPORT Halliburton Iranjons20Оценок пока нет

- Iglesia Ni Cristo v. Court of Appeals, G.R. No. 119673, July 26, 1996Документ10 страницIglesia Ni Cristo v. Court of Appeals, G.R. No. 119673, July 26, 1996Paul Romualdez TanОценок пока нет

- M01e1-Introduction of Optometrists & Opticians Act 2007 PresentationДокумент45 страницM01e1-Introduction of Optometrists & Opticians Act 2007 Presentationsytwins100% (1)

- 1b. People v. GuillenДокумент2 страницы1b. People v. GuillenMinerva LopezОценок пока нет

- Registered Land Transfers and Adverse ClaimsДокумент5 страницRegistered Land Transfers and Adverse ClaimsClarisse Ann MirandaОценок пока нет

- Circular No. 07/2017 - Customs F.No. 394/68/2013-Cus (AS)Документ4 страницыCircular No. 07/2017 - Customs F.No. 394/68/2013-Cus (AS)T Ankamma RaoОценок пока нет

- 35) Radio Communications of The Philippines, Inc. v. National Telecommunications CommissionДокумент2 страницы35) Radio Communications of The Philippines, Inc. v. National Telecommunications CommissionRuby SantillanaОценок пока нет

- Superior Court Orders NC to Comply with Federal Regulations on Driver's LicensesДокумент4 страницыSuperior Court Orders NC to Comply with Federal Regulations on Driver's Licenses3515dhallus88% (8)

- Vancil Vs BelmesДокумент1 страницаVancil Vs BelmesKM100% (1)

- Ethics Midterm ReviewerДокумент15 страницEthics Midterm Reviewerandreajade.cawaya10Оценок пока нет

- G.R. No. 202867 People vs. LabiagaДокумент6 страницG.R. No. 202867 People vs. LabiagaMichelle Montenegro - AraujoОценок пока нет

- Essentials of a valid contract and classificationДокумент13 страницEssentials of a valid contract and classificationAnkit BajajОценок пока нет

- 1582 1599Документ4 страницы1582 1599Neil Owen DeonaОценок пока нет

- CVC IRVM - 2006 - CH - 2 PDFДокумент38 страницCVC IRVM - 2006 - CH - 2 PDFAbhijit TripathiОценок пока нет