Академический Документы

Профессиональный Документы

Культура Документы

Sample Problems On Cost Accounting

Загружено:

milleranИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sample Problems On Cost Accounting

Загружено:

milleranАвторское право:

Доступные форматы

Use the following to answer questions 63-64:

Edco Company produced and sold 45,000 units of a single product last year, with the following

results:

Sales revenue $1,350,000

Manufacturing costs:

Variable 585,000

Fixed 270,000

Selling costs:

Variable 40,500

Fixed 54,000

Administrative costs:

Variable 184,500

Fixed 108,000

63. Edco's operating leverage factor was:

A. 4.

B. 5.

C. 6.

D. 7.

E. 8.

Answer: B LO: 8 Type: A

64. If Edco's sales revenues increase 15%, what will be the percentage increase in income before

income taxes?

A. 15%.

B. 45%.

C. 60%.

D. 75%.

E. An amount other than those above.

Answer: D LO: 8 Type: A

65. When advanced manufacturing systems are installed, what effect does such installation

usually have on fixed costs and the break-even point?

Fixed Costs Break-even Point

A. Increase Increase

B. Increase Decrease

C. Decrease Increase

D. Decrease Decrease

E. Do not change Does not change

Answer: A LO: 8 Type: RC

66. Which of the following statements is (are) true regarding a company that has implemented

flexible manufacturing systems and activity-based costing?

I. The company has erred, as these two practices used in conjunction with one another

will severely limit the firm's ability to analyze costs over the relevant range.

II. Costs formerly viewed as fixed under traditional-costing systems may now be

considered variable with respect to changes in cost drivers such as number of setups,

number of material moves, and so forth.

III. As compared with the results obtained under a traditional-costing system, the concept

of break-even analysis loses meaning.

A. I only.

B. II only.

C. III only.

D. I and II.

E. II and III.

Answer: B LO: 10 Type: N

67. A company, subject to a 40% tax rate, desires to earn $500,000 of after-tax income. How

much should the firm add to fixed costs when figuring the sales revenues necessary to

produce this income level?

A. $200,000.

B. $300,000.

C. $500,000.

D. $833,333.

E. $1,250,000.

Answer: D LO: 11 Type: A

68. Barney, Inc., is subject to a 40% income tax rate. The following data pertain to the period

just ended when the company produced and sold 45,000 units:

Sales revenue $1,350,000

Variable costs 810,000

Fixed costs 432,000

How many units must Barney sell to earn an after-tax profit of $180,000?

A. 42,000.

B. 45,000.

C. 51,000.

D. 61,000.

E. An amount other than those above.

Answer: D LO: 11 Type: A

Вам также может понравиться

- Midterm - Set BДокумент7 страницMidterm - Set BCamille Garcia100% (1)

- Chapter 11: Allocation of Joint Costs and Accounting For By-ProductsДокумент100 страницChapter 11: Allocation of Joint Costs and Accounting For By-Productsmoncarla lagonОценок пока нет

- P1 Day1 RMДокумент4 страницыP1 Day1 RMabcdefg100% (2)

- EOQ QuestionsДокумент2 страницыEOQ QuestionsHalsey Shih TzuОценок пока нет

- Cost Accounting RefresherДокумент16 страницCost Accounting RefresherDemi PardilloОценок пока нет

- Homework Number 4Документ8 страницHomework Number 4ARISОценок пока нет

- 25 Profit-Performance Measurements & Intracompany Transfer PricingДокумент13 страниц25 Profit-Performance Measurements & Intracompany Transfer PricingLaurenz Simon ManaliliОценок пока нет

- 2009-09-06 125024 MmmmekaДокумент24 страницы2009-09-06 125024 MmmmekathenikkitrОценок пока нет

- FAR - RQ - Investment in AssociatesДокумент2 страницыFAR - RQ - Investment in AssociatesKriane Kei50% (2)

- Activity 1 Cost Concepts and Cost BehaviorДокумент2 страницыActivity 1 Cost Concepts and Cost BehaviorLacie Hohenheim (Doraemon)Оценок пока нет

- Relevant Costing by A BobadillaДокумент80 страницRelevant Costing by A BobadillaJoshОценок пока нет

- Midterms 201 NotesДокумент6 страницMidterms 201 NotesLyn AbudaОценок пока нет

- Bsa 2202 SCM PrelimДокумент17 страницBsa 2202 SCM PrelimKezia SantosidadОценок пока нет

- 2Документ17 страниц2shaniaОценок пока нет

- Additional Problems DepnRevaluation and ImpairmentДокумент2 страницыAdditional Problems DepnRevaluation and Impairmentfinn heartОценок пока нет

- Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Документ106 страницSelf-Instructional Manual (SIM) For Self-Directed Learning (SDL)Maria AnnaОценок пока нет

- X04 Cost Volume Profit RelationshipsДокумент39 страницX04 Cost Volume Profit Relationshipschiji chzzzmeowОценок пока нет

- Examination 2Документ64 страницыExamination 2Leonie JeanОценок пока нет

- DocxДокумент6 страницDocxMico Duñas CruzОценок пока нет

- Far 6660Документ2 страницыFar 6660Glessy Anne Marie FernandezОценок пока нет

- Just-in-Time and Backflushing 1Документ6 страницJust-in-Time and Backflushing 1Claudette ClementeОценок пока нет

- Cost Accounting 1 SW No. 4 With AnswersДокумент1 страницаCost Accounting 1 SW No. 4 With AnswersApril NudoОценок пока нет

- Quantitative TechniquesДокумент4 страницыQuantitative Techniquesshamel marohom100% (2)

- Assignment 4 - CVPДокумент12 страницAssignment 4 - CVPAlyssa BasilioОценок пока нет

- Cost Quizzer6Документ6 страницCost Quizzer6LumingОценок пока нет

- Saint Joseph College of Sindangan Incorporated College of AccountancyДокумент18 страницSaint Joseph College of Sindangan Incorporated College of AccountancyRendall Craig Refugio0% (1)

- B BДокумент6 страницB BNile Alric AlladoОценок пока нет

- Advanced Financial Accounting and Reporting (CPALE Review)Документ3 страницыAdvanced Financial Accounting and Reporting (CPALE Review)Micko LagundinoОценок пока нет

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Документ3 страницы(Use The Below Problem To Answers The Succeeding Four (4) Questions.)Janine LerumОценок пока нет

- Management Advisory Services - Final RoundДокумент14 страницManagement Advisory Services - Final RoundRyan Christian M. CoralОценок пока нет

- D2Документ12 страницD2neo14Оценок пока нет

- Business Law SurecpaДокумент35 страницBusiness Law SurecpaChessaAlenelLigutom100% (1)

- Acctg 120 CVP Bud Resp 2018 KeyДокумент11 страницAcctg 120 CVP Bud Resp 2018 KeyChristopher BioreОценок пока нет

- MAS 3 - Standard Costing For UploadДокумент9 страницMAS 3 - Standard Costing For UploadJD SolañaОценок пока нет

- MA2E Relevant Cost ExercisesДокумент6 страницMA2E Relevant Cost ExercisesRolan PalquiranОценок пока нет

- Quiz m2.5g HomeworkДокумент10 страницQuiz m2.5g HomeworkMarie MagallanesОценок пока нет

- QUIZ REVIEW Homework Tutorial Chapter 5Документ5 страницQUIZ REVIEW Homework Tutorial Chapter 5Cody TarantinoОценок пока нет

- Joint CostДокумент35 страницJoint CostthenikkitrОценок пока нет

- Reviewer Mas5Документ26 страницReviewer Mas5Joyce Anne MananquilОценок пока нет

- 1Документ3 страницы1Sunshine Vee0% (1)

- 1Документ2 страницы1Your MaterialsОценок пока нет

- ABC ProblemsДокумент2 страницыABC Problemsxenon cloudОценок пока нет

- Review 105 - Day 15 P1Документ12 страницReview 105 - Day 15 P1John De Guzman100% (1)

- MAS 1 1st Long QuizДокумент6 страницMAS 1 1st Long QuizHanna Lyn BaliscoОценок пока нет

- RFBT AssessmentДокумент9 страницRFBT AssessmentJirah Bernal100% (1)

- 12Документ2 страницы12Carlo ParasОценок пока нет

- Exam 7Документ15 страницExam 7mohit verrmaОценок пока нет

- Reviewer in CVP AnalysisДокумент5 страницReviewer in CVP AnalysisIts meh SushiОценок пока нет

- Mas MidtermДокумент10 страницMas MidtermChristopher Nogot100% (2)

- Costing Accounting Practice SetДокумент2 страницыCosting Accounting Practice SetKristel SumabatОценок пока нет

- Answer Value 800000Документ1 страницаAnswer Value 800000Kath LeynesОценок пока нет

- The Operating Results in Summarized Form For A Retail ComputerДокумент1 страницаThe Operating Results in Summarized Form For A Retail ComputerAmit PandeyОценок пока нет

- NakakaxДокумент3 страницыNakakaxPaula Villarubia100% (1)

- Chapter 04 Process Costing and Hybrid Product-Costing SystemsДокумент21 страницаChapter 04 Process Costing and Hybrid Product-Costing SystemsJc AdanОценок пока нет

- Sarmiento, Shayne Angela - Exercises-Inventories P-1Документ4 страницыSarmiento, Shayne Angela - Exercises-Inventories P-1SHAYNE ANGELA SARMIENTOОценок пока нет

- Finacc 3Документ12 страницFinacc 3jano_art21Оценок пока нет

- Ma1 Mock Test 1Документ5 страницMa1 Mock Test 1Vinh Ngo Nhu83% (12)

- CVP Multiple Choice Questions With AnswerДокумент7 страницCVP Multiple Choice Questions With AnswerCarla Garcia100% (4)

- ACCY 2002 Fall 2013 Quiz # 5 - Chapter 7 DUE October 20thДокумент4 страницыACCY 2002 Fall 2013 Quiz # 5 - Chapter 7 DUE October 20thRad WimpsОценок пока нет

- Instructions: Cpa Review School of The PhilippinesДокумент17 страницInstructions: Cpa Review School of The PhilippinesCyn ThiaОценок пока нет

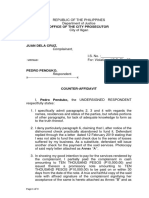

- @WPC vs. JMCДокумент7 страниц@WPC vs. JMCMarife Tubilag ManejaОценок пока нет

- Assignment 12Документ2 страницыAssignment 12milleranОценок пока нет

- PreambleДокумент1 страницаPreamblechelci14Оценок пока нет

- 9-11 Case DoctrinesДокумент15 страниц9-11 Case DoctrinesmilleranОценок пока нет

- Complaint - EjectmentДокумент3 страницыComplaint - EjectmentmilleranОценок пока нет

- Assignment 11Документ3 страницыAssignment 11milleranОценок пока нет

- Bayot Vs Court of AppealsДокумент17 страницBayot Vs Court of AppealsAyries AntonioОценок пока нет

- General ProvisionsДокумент1 страницаGeneral ProvisionsmilleranОценок пока нет

- FC5. Imbong V. Ochoa, JR., 721 Scra 146 (2014)Документ56 страницFC5. Imbong V. Ochoa, JR., 721 Scra 146 (2014)milleranОценок пока нет

- Wage Distortion Case DigestДокумент2 страницыWage Distortion Case Digestmilleran100% (1)

- Legitimate Contractor DoctrineДокумент3 страницыLegitimate Contractor DoctrinemilleranОценок пока нет

- MFLO - Memorandum For The ProsecutionДокумент1 страницаMFLO - Memorandum For The ProsecutionmilleranОценок пока нет

- Pacio V DOHLE Case DigestДокумент3 страницыPacio V DOHLE Case DigestmilleranОценок пока нет

- Pacio V DOHLE Case DigestДокумент3 страницыPacio V DOHLE Case DigestmilleranОценок пока нет

- Bar 2019 PreparationДокумент1 страницаBar 2019 PreparationmilleranОценок пока нет

- Comments To PFRДокумент1 страницаComments To PFRmilleranОценок пока нет

- G.R. No. 171914Документ13 страницG.R. No. 171914louis jansenОценок пока нет

- Rule 1020 New Establishment RegistrationДокумент1 страницаRule 1020 New Establishment Registrationmilleran0% (2)

- Chapter IДокумент8 страницChapter ImilleranОценок пока нет

- Chapter IIДокумент3 страницыChapter IImilleranОценок пока нет

- Legal Forms FinalsДокумент4 страницыLegal Forms FinalsmilleranОценок пока нет

- 2014 - Local TaxationДокумент1 страница2014 - Local TaxationmilleranОценок пока нет

- Position Paper For The PlaintiffДокумент6 страницPosition Paper For The PlaintiffmilleranОценок пока нет

- Petition For Review: Other PetitionsДокумент47 страницPetition For Review: Other PetitionsmilleranОценок пока нет

- Nalysis ND Nterpretation F Inancial TatementsДокумент76 страницNalysis ND Nterpretation F Inancial Tatementsafridi3089Оценок пока нет

- Position Paper For The DefendantДокумент6 страницPosition Paper For The DefendantmilleranОценок пока нет

- Position Paper For The DefendantДокумент4 страницыPosition Paper For The DefendantmilleranОценок пока нет

- 4 13 2019Документ13 страниц4 13 2019milleranОценок пока нет

- Message To Group 2Документ1 страницаMessage To Group 2milleranОценок пока нет

- Factoran Vs CAДокумент3 страницыFactoran Vs CAmilleranОценок пока нет

- DavisIM PDFДокумент36 страницDavisIM PDFRizwanОценок пока нет

- Finance Management Notes MbaДокумент12 страницFinance Management Notes MbaSandeep Kumar SahaОценок пока нет

- Corporate Finance 10th Edition Ross Test Bank 1Документ70 страницCorporate Finance 10th Edition Ross Test Bank 1james100% (39)

- Leverage AnalysisДокумент6 страницLeverage AnalysisJoshua CabinasОценок пока нет

- Module B CVP Analysis For MAS 5 Sep 2022 5Документ10 страницModule B CVP Analysis For MAS 5 Sep 2022 5Angela Miles DizonОценок пока нет

- Carlyn Cpa EncodeДокумент215 страницCarlyn Cpa Encodelana del reyОценок пока нет

- 03 Cost Volume Profit AnalysisДокумент6 страниц03 Cost Volume Profit AnalysisPhoebe WalastikОценок пока нет

- AДокумент42 страницыAmoniquettnОценок пока нет

- Chapter5 HW AnswersДокумент54 страницыChapter5 HW Answerscourtdubs100% (11)

- Manacc - CC - UTSДокумент125 страницManacc - CC - UTSfaniОценок пока нет

- Chapter 3 CVPДокумент21 страницаChapter 3 CVPSinh TrầnОценок пока нет

- Ms 03 - CVP AnalysisДокумент10 страницMs 03 - CVP AnalysisDin Rose GonzalesОценок пока нет

- CVP Analysis and Break Even Point AnalysisДокумент16 страницCVP Analysis and Break Even Point AnalysisKirito Uzumaki100% (1)

- Capital Structure and LeverageДокумент47 страницCapital Structure and LeverageLokamОценок пока нет

- The Leverage FactorДокумент613 страницThe Leverage FactorYuriwaОценок пока нет

- Managerial Accounting The Cornerstone of Business Decision Making 7Th Edition Mowen Solutions Manual Full Chapter PDFДокумент63 страницыManagerial Accounting The Cornerstone of Business Decision Making 7Th Edition Mowen Solutions Manual Full Chapter PDFKennethRiosmqoz100% (14)

- 5 6255862442081910859Документ29 страниц5 6255862442081910859Christine PedronanОценок пока нет

- MS05 - Cost-Volume-Profit (CVP) AnalysisДокумент5 страницMS05 - Cost-Volume-Profit (CVP) AnalysisElsie GenovaОценок пока нет

- Tutor 2 (Cost, Volume, Profit Analysis)Документ2 страницыTutor 2 (Cost, Volume, Profit Analysis)aulia100% (1)

- Capital Structure Analysis of TriveniДокумент73 страницыCapital Structure Analysis of Trivenisurender_singh0092100% (5)

- Capital Structure - Chapter 16, Eugene Brigham-GeneralДокумент9 страницCapital Structure - Chapter 16, Eugene Brigham-GeneralMahmud PalashОценок пока нет

- 2010 CMA Part 2 Section B: Corporate FinanceДокумент326 страниц2010 CMA Part 2 Section B: Corporate FinanceAhmed Magdi0% (1)

- 04 Review Problem - CVP AnalysisДокумент3 страницы04 Review Problem - CVP AnalysisIzzahIkramIllahi100% (1)

- BIAYA MODAL CompressedДокумент89 страницBIAYA MODAL CompressedMuh IdhamsyahОценок пока нет

- MBA Question PapersДокумент36 страницMBA Question PapersVaidehi JoshiОценок пока нет

- Fin Man Reviewer CH 14Документ2 страницыFin Man Reviewer CH 14Kriz Genesis BurgosОценок пока нет

- Final Assessment: NAME: Sumama Syed Reg No.: 1811339 Class: BBA Open Course: Cost AccountingДокумент7 страницFinal Assessment: NAME: Sumama Syed Reg No.: 1811339 Class: BBA Open Course: Cost AccountingSyed SumamaОценок пока нет

- FM-II-CH-1 Capital Structure and LeverageДокумент14 страницFM-II-CH-1 Capital Structure and LeverageAschalew Ye Giwen LijiОценок пока нет

- Chapter 20: Break Even and Cost Volume Profit Analysis: Group MemebersДокумент34 страницыChapter 20: Break Even and Cost Volume Profit Analysis: Group MemebersMuhammad HasanОценок пока нет

- Master of Business Administration 2020-2022: Financial Analysis of Infosys Ltd. For THE YEAR 2016-20Документ36 страницMaster of Business Administration 2020-2022: Financial Analysis of Infosys Ltd. For THE YEAR 2016-20Prachi RaiОценок пока нет

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyОт EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyРейтинг: 5 из 5 звезд5/5 (22)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeОт EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeРейтинг: 4.5 из 5 звезд4.5/5 (88)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveОт EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveОценок пока нет

- Summary of Zero to One: Notes on Startups, or How to Build the FutureОт EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureРейтинг: 4.5 из 5 звезд4.5/5 (100)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurОт Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurРейтинг: 4 из 5 звезд4/5 (2)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizОт EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizРейтинг: 4.5 из 5 звезд4.5/5 (112)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldОт Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldРейтинг: 5 из 5 звезд5/5 (20)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryОт EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryРейтинг: 4 из 5 звезд4/5 (26)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthОт EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthРейтинг: 4.5 из 5 звезд4.5/5 (1026)

- Anything You Want: 40 lessons for a new kind of entrepreneurОт EverandAnything You Want: 40 lessons for a new kind of entrepreneurРейтинг: 5 из 5 звезд5/5 (46)

- The Master Key System: 28 Parts, Questions and AnswersОт EverandThe Master Key System: 28 Parts, Questions and AnswersРейтинг: 5 из 5 звезд5/5 (62)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeОт EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeРейтинг: 4.5 из 5 звезд4.5/5 (58)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedОт EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedРейтинг: 4.5 из 5 звезд4.5/5 (38)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleОт EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleРейтинг: 4.5 из 5 звезд4.5/5 (48)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessОт EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessРейтинг: 4.5 из 5 звезд4.5/5 (407)

- Cryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyОт EverandCryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyРейтинг: 4.5 из 5 звезд4.5/5 (300)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeОт EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeРейтинг: 5 из 5 звезд5/5 (22)

- Your Next Five Moves: Master the Art of Business StrategyОт EverandYour Next Five Moves: Master the Art of Business StrategyРейтинг: 5 из 5 звезд5/5 (799)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursОт EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursРейтинг: 5 из 5 звезд5/5 (24)

- Startup: How To Create A Successful, Scalable, High-Growth Business From ScratchОт EverandStartup: How To Create A Successful, Scalable, High-Growth Business From ScratchРейтинг: 4 из 5 звезд4/5 (114)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsОт EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsРейтинг: 5 из 5 звезд5/5 (48)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsОт EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsРейтинг: 5 из 5 звезд5/5 (2)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelОт EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelРейтинг: 5 из 5 звезд5/5 (51)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОт EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyОценок пока нет

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessОт EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessРейтинг: 4.5 из 5 звезд4.5/5 (24)

- WEALTH EXPO$ED: This Short Argument Made Me a Fortune... Can It Do The Same For YouОт EverandWEALTH EXPO$ED: This Short Argument Made Me a Fortune... Can It Do The Same For YouРейтинг: 4.5 из 5 звезд4.5/5 (87)