Академический Документы

Профессиональный Документы

Культура Документы

Vat Output Set A Tax 2 Class Discussion

Загружено:

Philip CastroОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Vat Output Set A Tax 2 Class Discussion

Загружено:

Philip CastroАвторское право:

Доступные форматы

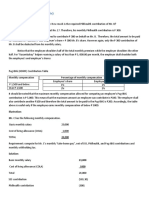

TAX 2 : VALUE ADDED TAX

BIR FORMS 2550M AND 2550Q

CEDTONJOY DISTRIBUTOR, INC. (TIN 234-789-143-000), located at C. Padilla St., Cebu City, which is

under the jurisdiction of RDO 082, Cebu City South. The companys telephone number is 260-7900.

The Company had the following transactions, net of any VAT for the taxable year 2016:

FIRST QUARTER ENDING MARCH 31, 2016

Transaction January February March

Regular Sales 9,000,000.00 8,500,000.00 10,000,000.00

Government Sales 600,000.00 500,000.00 800,000.00

Export Sales 1,000,000.00 900,000.00 1,300,000.00

Exempt Sales 400,000.00 350,000.00 390,000.00

Input tax from previous

period 50,000.00 - -

Purchase of Goods

(attributable to 12%

Vatable Sales only) 7,300,000.00 7,700,000.00 8,300,000.00

Purchase of Goods

(attributable to Zero-

Rated Sales) 700,000.00 660,000.00 590,000.00

Purchase of Goods

(attributable to Exempt

Sales) 310,000.00 190,000.00 300,000.00

Purchase of Services

(attributable to 12%

Vatable sales and zero-

rated sales) 150,000.00 300,000.00 200,000.00

Purchase of Goods

(attributable to

government sales)

340,000.00 300,000.00 340,000.00

Purchases from NON-

VAT Suppliers 400,000.00 380,000.00 300,000.00

SECOND QUARTER ENDING JUNE 30, 2016

Transaction April May June

Regular Sales 11,000,000.00 9,000,000.00 12,000,000.00

Government Sales 500,000.00 900,000.00 700,000.00

Export Sales 500,000.00 900,000.00 800,000.00

Exempt Sales 500,000.00 450,000.00 400,000.00

Input tax from previous

period - - -

Purchase of Goods

(attributable to 12%

Vatable Sales only) 8,900,000.00 11,500,000.00 12,600,000.00

Purchase of Goods

(attributable to Zero-

Rated Sales) 1,000,000.00 600,000.00 500,000.00

Purchase of Goods

(attributable to Exempt

Sales) 450,000.00 380,000.00 350,000.00

Purchase of Services

(attributable to 12%

Vatable sales and zero-

rated sales) 300,000.00 400,000.00 200,000.00

Purchase of Goods

(attributable to

government sales)

280,000.00 220,000.00 360,000.00

Purchases from NON-

VAT Suppliers 600,000.00 500,000.00 900,000.00

THIRD QUARTER ENDING SEPTEMBER 30, 2016

Transaction July August September

Regular Sales 8,000,000.00 7,000,000.00 10,000,000.00

Government Sales 800,000.00 600,000.00 500,000.00

Export Sales 1,000,000.00 800,000.00 800,000.00

Exempt Sales 550,000.00 450,000.00 500,000.00

Input tax from previous

period - - -

Purchase of Goods

(attributable to 12%

Vatable Sales only) 9,400,000.00 8,600,000.00 7,400,000.00

Purchase of Goods

(attributable to Zero-

Rated Sales) 2,000,000.00 500,000.00 440,000.00

Purchase of Goods

(attributable to Exempt

Sales) 500,000.00 500,000.00 590,000.00

Purchase of Services

(attributable to 12%

Vatable sales and zero-

rated sales) 300,000.00 200,000.00 350,000.00

Purchase of Goods

(attributable to

government sales)

800,000.00 570,000.00 420,000.00

Purchases from NON-

VAT Suppliers 400,000.00 300,000.00 400,000.00

FOURTH QUARTER ENDING DECEMBER 31, 2016

Transaction October November December

Regular Sales 8,000,000.00 7,000,000.00 16,000,000.00

Government Sales 1,000,000.00 600,000.00 800,000.00

Export Sales 700,000.00 800,000.00 700,000.00

Exempt Sales 580,000.00 670,000.00 1,050,000.00

Input tax from previous

period - - -

Purchase of Goods

(attributable to 12%

Vatable Sales only) 6,100,000.00 5,500,000.00 12,400,000.00

Purchase of Goods

(attributable to Zero-

Rated Sales) 500,000.00 500,000.00 520,000.00

Purchase of Goods

(attributable to Exempt

Sales) 300,000.00 580,000.00 870,000.00

Purchase of Services

(attributable to 12%

Vatable sales and zero-

rated sales) 600,000.00 550,000.00 750,000.00

Purchase of Goods

(attributable to

government sales)

850,000.00 870,000.00 850,000.00

Purchases from NON-

VAT Suppliers 400,000.00 470,000.00 850,000.00

REQUIRED:

a. PREPARE THE APPROPRIATE VAT FORMS FOR JANUARY UNTIL DECEMBER.

CREDITS TO SIR CEDRIC NARANJO FOR THIS OUTPUT

Вам также может понравиться

- Income TAX: Prof. Jeanefer Reyes CPA, MPAДокумент37 страницIncome TAX: Prof. Jeanefer Reyes CPA, MPAmark anthony espiritu75% (4)

- Guidelines On Accreditation of CSOs (LSB Representation) - DILG MC 2019-72Документ18 страницGuidelines On Accreditation of CSOs (LSB Representation) - DILG MC 2019-72Cedric Dequito100% (1)

- C79 Service Kit and Parts List GuideДокумент32 страницыC79 Service Kit and Parts List Guiderobert100% (2)

- Difference Between OS1 and OS2 Single Mode Fiber Cable - Fiber Optic Cabling SolutionsДокумент2 страницыDifference Between OS1 and OS2 Single Mode Fiber Cable - Fiber Optic Cabling SolutionsDharma Teja TanetiОценок пока нет

- BUSINESS TAX CALCULATIONSДокумент13 страницBUSINESS TAX CALCULATIONSKathleen AgustinОценок пока нет

- Guide To Quarterly VAT ReturnДокумент14 страницGuide To Quarterly VAT ReturnMary Jane MarañoОценок пока нет

- H. Other Percentage TaxesДокумент32 страницыH. Other Percentage TaxesMaha CastroОценок пока нет

- VAT Problems and Calculations for BOI-Registered CorporationsДокумент10 страницVAT Problems and Calculations for BOI-Registered CorporationsMark Gelo WinchesterОценок пока нет

- Sales 3,000,000.00: Invoice Price 112,000.00Документ11 страницSales 3,000,000.00: Invoice Price 112,000.00Alicia FelicianoОценок пока нет

- Mr Taha Sales Tax Computation Feb 2020Документ5 страницMr Taha Sales Tax Computation Feb 2020Rida ShahОценок пока нет

- Activity 13 May 2023 Key To CorrectionДокумент1 страницаActivity 13 May 2023 Key To CorrectionJohn Paul MagbitangОценок пока нет

- Information For Items 21 & 22Документ3 страницыInformation For Items 21 & 22Kurt Morin CantorОценок пока нет

- Chapter-13 (SOLVED PAST PAPTERS OF ICMA STAGE IV PDFДокумент14 страницChapter-13 (SOLVED PAST PAPTERS OF ICMA STAGE IV PDFDani QureshiОценок пока нет

- TBLTAX Chapter 4 VAT Integrative ProblemsДокумент4 страницыTBLTAX Chapter 4 VAT Integrative ProblemsBeny MiraflorОценок пока нет

- Bud GettingДокумент8 страницBud GettingLorena Mae LasquiteОценок пока нет

- Solving Tax ProblemsДокумент4 страницыSolving Tax ProblemsPaupauОценок пока нет

- Income and Business Taxation AssignmentsДокумент5 страницIncome and Business Taxation AssignmentsGideon Tangan Ines Jr.Оценок пока нет

- ICMA Sales Tax (1) - 1Документ13 страницICMA Sales Tax (1) - 1Numan Rox100% (1)

- 115,200.00 Two 100,200.00 TwoДокумент19 страниц115,200.00 Two 100,200.00 TwoAlexandra Nicole IsaacОценок пока нет

- TaxationДокумент5 страницTaxationPauline Jasmine Sta AnaОценок пока нет

- TAX2 ReyesДокумент9 страницTAX2 ReyesClaire BarrettoОценок пока нет

- Special Allowable Itemized DeductionsДокумент13 страницSpecial Allowable Itemized DeductionsSandia EspejoОценок пока нет

- Chapter 9 Part 2 Input VatДокумент24 страницыChapter 9 Part 2 Input VatChristian PelimcoОценок пока нет

- Chapter 15 PDFДокумент11 страницChapter 15 PDFG & E ApparelОценок пока нет

- Assignment 1 - Taxation On Individuals-SolutionsДокумент5 страницAssignment 1 - Taxation On Individuals-SolutionsCleofe Mae Piñero AseñasОценок пока нет

- Corporate Income TaxДокумент8 страницCorporate Income TaxClaire BarbaОценок пока нет

- L-NU AA-23-02-01-18 Finals Exam ReviewДокумент10 страницL-NU AA-23-02-01-18 Finals Exam ReviewAmie Jane MirandaОценок пока нет

- Business Tax Guide: VAT, Percentage Tax, ExemptionsДокумент44 страницыBusiness Tax Guide: VAT, Percentage Tax, ExemptionsZhaneah Rhej SaradОценок пока нет

- ACCTAX2 Business Case RecentДокумент5 страницACCTAX2 Business Case RecentHazel Joy DemaganteОценок пока нет

- Computation On Income Tax ReportДокумент5 страницComputation On Income Tax ReportJeane Mae BooОценок пока нет

- VatДокумент16 страницVatCPA100% (1)

- Quizzer: Value-Added Tax: Answer: 100k X 12% 12,000Документ4 страницыQuizzer: Value-Added Tax: Answer: 100k X 12% 12,000Rogelio Jr A. MacionОценок пока нет

- Output and Input VAT1Документ21 страницаOutput and Input VAT1Eza MayandiaОценок пока нет

- Accounting Methods and Installment ReportingДокумент40 страницAccounting Methods and Installment ReportingKatherine EderosasОценок пока нет

- Analyze budgeted purchases, COGS, inventory for manufacturing businessДокумент13 страницAnalyze budgeted purchases, COGS, inventory for manufacturing businessJillian Dela CruzОценок пока нет

- Tax Endterm Business Taxes: ExampleДокумент4 страницыTax Endterm Business Taxes: ExampleCharmaine ChuaОценок пока нет

- Income Tax Calculation for Multiple Individuals and EntitiesДокумент8 страницIncome Tax Calculation for Multiple Individuals and EntitiesLyka RoguelОценок пока нет

- Allowable DeductionsДокумент9 страницAllowable DeductionsLyka RoguelОценок пока нет

- PrelimQuiz1 AnswerKeyДокумент3 страницыPrelimQuiz1 AnswerKeyAnnabelle RafolsОценок пока нет

- Income Tax Computation for Two Trusts and BeneficiaryДокумент14 страницIncome Tax Computation for Two Trusts and BeneficiaryPark MinyoungОценок пока нет

- VAT Is Under Business TaxationДокумент5 страницVAT Is Under Business Taxationreagan blaireОценок пока нет

- Name: Jean Rose T. Bustamante Bsma-3 Set B Income TaxationДокумент5 страницName: Jean Rose T. Bustamante Bsma-3 Set B Income TaxationJean Rose Tabagay BustamanteОценок пока нет

- Tax calculations for compensation, business income, and passive incomeДокумент21 страницаTax calculations for compensation, business income, and passive incomeAlarich CatayocОценок пока нет

- 9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsДокумент4 страницы9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsRyan CartaОценок пока нет

- Intermediate Accounting Chapter 10 InventoriesДокумент9 страницIntermediate Accounting Chapter 10 InventoriesBlue SkyОценок пока нет

- Direct LaborДокумент8 страницDirect LaborAreli DuyoОценок пока нет

- SAMPLE PROBLEMS ON REGULAR TAXES (CTT Exam)Документ1 страницаSAMPLE PROBLEMS ON REGULAR TAXES (CTT Exam)Mharck AtienzaОценок пока нет

- Installed Cost of Proposed Machine 400,000Документ5 страницInstalled Cost of Proposed Machine 400,000Mariame Abasola CagabhionОценок пока нет

- Opal ProjectsДокумент3 страницыOpal ProjectsMigs CruzОценок пока нет

- Direct Cash Flow StatementДокумент1 страницаDirect Cash Flow StatementJeffrey DorotheoОценок пока нет

- Exercise 2Документ15 страницExercise 2Riezel PepitoОценок пока нет

- Tax ReportДокумент5 страницTax ReportHanna Lyn BaliscoОценок пока нет

- Local Media603729699590229664Документ3 страницыLocal Media603729699590229664Mallari, Princess Diane D.Оценок пока нет

- Cash and Accrual BasisДокумент3 страницыCash and Accrual Basisattiva jade100% (1)

- Gross Receipts Less: OSD (X Taxable Income Tax Due Basic Excess (2,550,000 - 2,000,000 Total Tax DueДокумент10 страницGross Receipts Less: OSD (X Taxable Income Tax Due Basic Excess (2,550,000 - 2,000,000 Total Tax DueMarie CarreraОценок пока нет

- VAT IllustrationsДокумент1 страницаVAT IllustrationsThu ThuОценок пока нет

- Cash Flow Statement QuestionДокумент5 страницCash Flow Statement QuestionsatyaОценок пока нет

- CW-8 MHA SolutionДокумент3 страницыCW-8 MHA SolutionRida ShahОценок пока нет

- 3.2 Tax AssignmentДокумент1 страница3.2 Tax AssignmentHazel Malveda GamillaОценок пока нет

- Philhealth and Pag-IBIG contribution tables explainedДокумент5 страницPhilhealth and Pag-IBIG contribution tables explainedMaraiah InciongОценок пока нет

- Optional Standard Deductions ExampleДокумент7 страницOptional Standard Deductions ExampleSandia EspejoОценок пока нет

- Proforma Computation Cost Ratio and Inventory Shortage CalculationДокумент6 страницProforma Computation Cost Ratio and Inventory Shortage CalculationKelsey VersaceОценок пока нет

- A Rectangle IsДокумент6 страницA Rectangle IsPhilip CastroОценок пока нет

- Advance Merry Christmas PartxzДокумент1 страницаAdvance Merry Christmas PartxzPhilip CastroОценок пока нет

- 11Документ1 страница11Philip CastroОценок пока нет

- Install Cybertracker and Smart Apps, Import Patrol Data, Create ReportsДокумент2 страницыInstall Cybertracker and Smart Apps, Import Patrol Data, Create ReportsPhilip CastroОценок пока нет

- Addition of Algebraic ExpressionsДокумент1 страницаAddition of Algebraic ExpressionsPhilip CastroОценок пока нет

- Psa 800 PDFДокумент20 страницPsa 800 PDFshambiruarОценок пока нет

- About The AuthorДокумент3 страницыAbout The AuthorPhilip CastroОценок пока нет

- Advance Merry Christmas PartxzДокумент1 страницаAdvance Merry Christmas PartxzPhilip CastroОценок пока нет

- Addition of Algebraic ExpressionsДокумент1 страницаAddition of Algebraic ExpressionsPhilip CastroОценок пока нет

- About The AuthorДокумент3 страницыAbout The AuthorPhilip CastroОценок пока нет

- Book of OpticsДокумент3 страницыBook of OpticsPhilip CastroОценок пока нет

- 1st YearДокумент3 страницы1st YearPhilip CastroОценок пока нет

- RR No. 13-2018 CorrectedДокумент20 страницRR No. 13-2018 CorrectedRap BaguioОценок пока нет

- TAX - PreweekДокумент16 страницTAX - PreweekPhilip CastroОценок пока нет

- Domain and Range Exercises Solutions 162Документ4 страницыDomain and Range Exercises Solutions 162sumitОценок пока нет

- Anime StatusesДокумент2 страницыAnime StatusesPhilip CastroОценок пока нет

- Anime StatusДокумент2 страницыAnime StatusPhilip CastroОценок пока нет

- RR No. 12-2018: New Consolidated RR on Estate Tax and Donor's TaxДокумент20 страницRR No. 12-2018: New Consolidated RR on Estate Tax and Donor's Taxjune Alvarez100% (1)

- Atq - 1Документ7 страницAtq - 1Philip CastroОценок пока нет

- 01 Glossary of Terms December 2002Документ20 страниц01 Glossary of Terms December 2002Tracy KayeОценок пока нет

- Raw MaterialsДокумент1 страницаRaw MaterialsPhilip CastroОценок пока нет

- Reaction PaperДокумент13 страницReaction PaperPhilip CastroОценок пока нет

- OMДокумент10 страницOMPhilip CastroОценок пока нет

- Sacrament of Holy OrdersДокумент18 страницSacrament of Holy OrdersPhilip CastroОценок пока нет

- OMДокумент10 страницOMPhilip CastroОценок пока нет

- BeatrixДокумент4 страницыBeatrixPhilip CastroОценок пока нет

- Answer Key in Professional, RA 9298....Документ1 страницаAnswer Key in Professional, RA 9298....Philip CastroОценок пока нет

- ECON3 AhihiДокумент26 страницECON3 AhihiPhilip CastroОценок пока нет

- DocxДокумент25 страницDocxPhilip Castro67% (3)

- MaanДокумент3 страницыMaanPhilip CastroОценок пока нет

- 9 QP - SSC - MOCK EXAMДокумент5 страниц9 QP - SSC - MOCK EXAMramОценок пока нет

- AHP for Car SelectionДокумент41 страницаAHP for Car SelectionNguyên BùiОценок пока нет

- Improvements To Increase The Efficiency of The Alphazero Algorithm: A Case Study in The Game 'Connect 4'Документ9 страницImprovements To Increase The Efficiency of The Alphazero Algorithm: A Case Study in The Game 'Connect 4'Lam Mai NgocОценок пока нет

- Rebranding Brief TemplateДокумент8 страницRebranding Brief TemplateRushiraj Patel100% (1)

- Individual Differences: Mental Ability, Personality and DemographicsДокумент22 страницыIndividual Differences: Mental Ability, Personality and DemographicsAlera Kim100% (2)

- PRE EmtionДокумент10 страницPRE EmtionYahya JanОценок пока нет

- Weka Tutorial 2Документ50 страницWeka Tutorial 2Fikri FarisОценок пока нет

- Gps Anti Jammer Gpsdome - Effective Protection Against JammingДокумент2 страницыGps Anti Jammer Gpsdome - Effective Protection Against JammingCarlos VillegasОценок пока нет

- Department of Labor: kwc25 (Rev-01-05)Документ24 страницыDepartment of Labor: kwc25 (Rev-01-05)USA_DepartmentOfLaborОценок пока нет

- CompactLogix 5480 Controller Sales GuideДокумент2 страницыCompactLogix 5480 Controller Sales GuideMora ArthaОценок пока нет

- 1 Estafa - Arriola Vs PeopleДокумент11 страниц1 Estafa - Arriola Vs PeopleAtty Richard TenorioОценок пока нет

- UKIERI Result Announcement-1Документ2 страницыUKIERI Result Announcement-1kozhiiiОценок пока нет

- Discretionary Lending Power Updated Sep 2012Документ28 страницDiscretionary Lending Power Updated Sep 2012akranjan888Оценок пока нет

- ADSLADSLADSLДокумент83 страницыADSLADSLADSLKrishnan Unni GОценок пока нет

- POS CAL SF No4 B2 BCF H300x300 7mmweld R0 PDFДокумент23 страницыPOS CAL SF No4 B2 BCF H300x300 7mmweld R0 PDFNguyễn Duy QuangОценок пока нет

- 1LE1503-2AA43-4AA4 Datasheet enДокумент1 страница1LE1503-2AA43-4AA4 Datasheet enAndrei LupuОценок пока нет

- Supply Chain ManagementДокумент30 страницSupply Chain ManagementSanchit SinghalОценок пока нет

- Bentone 30 Msds (Eu-Be)Документ6 страницBentone 30 Msds (Eu-Be)Amir Ososs0% (1)

- Spouses Mariano Z. Velarde and Avelina D. VELARDE, Petitioners, vs. COURT OF Appeals, David A. RAYMUNDO and GEORGE RAYMUNDO, RespondentsДокумент11 страницSpouses Mariano Z. Velarde and Avelina D. VELARDE, Petitioners, vs. COURT OF Appeals, David A. RAYMUNDO and GEORGE RAYMUNDO, RespondentsRobyn JonesОценок пока нет

- E2 PTAct 9 7 1 DirectionsДокумент4 страницыE2 PTAct 9 7 1 DirectionsEmzy SorianoОценок пока нет

- Mba Assignment SampleДокумент5 страницMba Assignment Sampleabdallah abdОценок пока нет

- Self-Assessment On Accountability: I. QuestionsДокумент2 страницыSelf-Assessment On Accountability: I. QuestionsAjit Kumar SahuОценок пока нет

- Enerflex 381338Документ2 страницыEnerflex 381338midoel.ziatyОценок пока нет

- Haryana Retial GarmentsДокумент8 страницHaryana Retial Garmentssudesh.samastОценок пока нет

- Debentures Issued Are SecuritiesДокумент8 страницDebentures Issued Are Securitiesarthimalla priyankaОценок пока нет

- CTS experiments comparisonДокумент2 страницыCTS experiments comparisonmanojkumarОценок пока нет

- A320 Normal ProceduresДокумент40 страницA320 Normal ProceduresRajesh KumarОценок пока нет