Академический Документы

Профессиональный Документы

Культура Документы

HMDF

Загружено:

maricarАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

HMDF

Загружено:

maricarАвторское право:

Доступные форматы

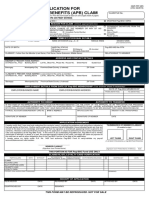

HQP-SLF-065

MULTI-PURPOSE LOAN (MPL) (V02, 06/2017)

APPLICATION FORM (For IISP Branch Only)

Pag-IBIG MID No./RTN APPLICATION No.

(To be filled out by applicant. Print this form back to back on one single sheet of paper)

Type or Print Entries

LAST NAME FIRST NAME NAME EXTENSION (e.g., Jr., II) MIDDLE NAME MAIDEN MIDDLE NAME DATE OF BIRTH PLACE OF BIRTH

(For married women)

MOTHERS MAIDEN NAME NATIONALITY SEX MARITAL STATUS CITIZENSHIP EMAIL ADDRESS

Male Single Widower Annulled

Female Married Legally Separated

PRESENT HOME ADDRESS Unit/Room No., Floor Building Name Lot No., Block No., Phase No. House No. Street Name CELL PHONE NUMBER (Required) HOME TEL. NUMBER

Subdivision Barangay Municipality/City Province/State/Country (if abroad) ZIP Code APPLICANTS TAXPAYER SSS/GSIS No.

IDENTIFICATION NUMBER (TIN)

PERMANENT HOME ADDRESS Unit/Room No., Floor Building Name Lot No., Block No., Phase No. House No. Street Name BUSINESS TEL. NUMBER NATURE OF WORK

Subdivision Barangay Municipality/City Province/State/Country (if abroad) ZIP Code EMPLOYEE ID NUMBER DESIRED LOAN AMOUNT

EMPLOYER/BUSINESS NAME DATE OF EMPLOYMENT LOAN PURPOSE

Non-Housing Related

Livelihood/additional capital in small business Vacation/travel

EMPLOYER/BUSINESS ADDRESS Unit/Room No., Floor Building Name Lot No., Block No., Phase No. House No. Street Name Tuition/Educational Expenses Special events

Health & wellness Car repair

Purchase of appliance & furniture/electronic Health & wellness

gadgets

Subdivision Barangay Municipality/City Province/State/Country (if abroad) ZIP Code

Housing Related

Minor home improvement/home renovation/ Others, specify

upgrades ________________

PREVIOUS EMPLOYMENT DETAILS FROM DATE OF Pag-IBIG MEMBERSHIP (Use another sheet if necessary)

EMPLOYER/BUSINESS NAME EMPLOYER/BUSINESS ADDRESS FROM (mm/yy) TO (mm/yy)

SIGNATURE OF APPLICANT PAYROLL ACCOUNT/DISBURSEMENT CARD/PACKAGE UNIT ID

In the event of the approval of my application for Multi-Purpose Loan, I hereby authorize

Pag-IBIG Fund to credit my loan proceeds through my Payroll Account/Disbursement Card that

NAME OF BANK/BRANCH

I have indicated on the right portion.

APPLICATION AGREEMENT

In consideration of the loan that may be granted by virtue of this application subject to the pertinent provisions of the This office agrees to collect the corresponding monthly

Implementing Rules and Regulations of Pag-IBIG Fund, I hereby waive my rights under R.A. No. 1405 and authorize amortization on this loan and the MS of herein applicant

Pag-IBIG Fund to verify/validate my payroll account/disbursement card. Furthermore, I hereby authorize my present employer, through salary deduction, together with the employer

______________________________________________________________________________ or any employer with counterpart, and remit said amounts to Pag-IBIG Fund on or

whom I may get employed in the future, to deduct the monthly membership savings (MS) and monthly amortization due from before the 15th day of each month, for the duration that the loan

my salary and remit the same to Pag-IBIG Fund. If the resulting monthly net take home pay after deducting the computed monthly remains outstanding. However, should we deduct the monthly

amortization on MPL falls below the monthly net take home pay as required under the GAA/company policy, I authorize Pag-IBIG amortization due from the applicants salary but failed to remit

Fund to compute for a lower loanable amount. it on due date, this office agrees to pay the corresponding

penalty charged to applicant equivalent to 1/20 of 1% of any

I understand that should I fail to pay the monthly amortization due, I shall be charged with a penalty of 1/20 of 1% of any unpaid unpaid amount for every day of delay and penalty for non-

amount for every day of delay. remittance equivalent to 1/10 of 1% per day of delay of the

If for any reason excess loan proceeds are erroneously credited to my payroll account/disbursement card, I hereby authorize amount payable from the date the loan amortization or

Pag-IBIG Fund to debit/deduct the excess amount from my account without need of further notice of demand. Should my payments fall due until paid.

account balance be insufficient, the Fund has the right to demand for the excess amount to be refunded.

I authorize Pag-IBIG Fund to disclose, submit, share or exchange any of my account information to legal and government _________________________________________

regulating agencies, other banks, merchant partners or third party in accordance with R.A. No. 9510 and other related or HEAD OF OFFICE OR AUTHORIZED SIGNATORY

pertinent laws and regulations. The credit information may also be transferred to service providers (e.g., Credit Information (Signature over Printed Name)

Corporation, Bankers Association of the Philippines - Credit Bureau), likewise in accordance with laws and regulations.

I certify that the information given and any or all statements made herein are true and correct to the best of my knowledge _________________________________________

and belief. I hereby certify under pain of perjury that my signature appearing herein is genuine and authentic. DESIGNATION

______________ _______________ ______________

___________________________________ Pag-IBIG AGENCY CODE BRANCH CODE

Signature of Applicant over Printed Name EMPLOYER ID NO.

PROMISSORY NOTE

For value received, I promise to pay on due date without need of demand to the order of 5. I shall be considered in default in any of the following cases:

Pag-IBIG Fund with principal office at Petron MegaPlaza, 358, Sen. Gil Puyat Avenue., City a. Any willful misrepresentation in any of the documents executed in relation hereto;

of Makati the sum of Pesos: b. Failure to pay any three (3) consecutive monthly amortizations;

c. Failure to pay any three (3) consecutive membership savings;

(P_______________) Philippine Currency, with an interest at the rate of 10.5% per annum d. Violation of any of the membership/STL/housing loan policies, rules, regulations, and

(equivalent rate of 17.50% based on diminishing principal balance), with interest during the guidelines of the Pag-IBIG Fund.

grace period and shall be amortized equally over the term of the loan. 6. In the event of default, the outstanding loan obligation shall become due and shall be

deducted from the TAV after exerting all collection efforts. However, immediate

I hereby waive notice of demand for payment and agree that any legal action, which may offsetting of my outstanding loan obligation may be effected immediately upon approval

arise in relation to this note, may be instituted in the proper court of Makati City. of my request, provided such request is based on the following justifiable reasons and

upon validation by the Fund: Borrowers unemployment; illness of the member-borrower

Finally, this note shall likewise be subject to the following terms and conditions: or any of his immediate family members as certified by a licensed physician that, by

1. I shall pay the amount of Pesos: _______________________________ reason thereof, resulted in his failure to pay the required amortization when due; or

(P_______________) through salary deduction, whenever feasible, over a maximum death of any of his immediate family members that, by reason thereof, resulted in his

period of 24 months, with a grace period of 2 months. In case of suspension from work, failure to pay the required amortization when due.

leave of absence without pay, insufficiency of take home pay at any time during the 7. In the event of membership termination prior to loan maturity, any outstanding loan

term of the loan, payments should be made directly to the Fund or its accredited obligation, shall be deducted from my TAV and/or any amount due me or my

collecting agents. beneficiaries in the possession of the Fund. In case of my death, the outstanding

2. Payments are due on or before the 15th day of the month starting on obligation shall be computed up to the date of death. Any payment received after date

_________________________ and 23 succeeding months thereafter. of death shall be refunded to my beneficiaries.

3. Payments shall be applied according to the following order of priorities: Penalties, 8. In case of falsification, misrepresentation or any similar acts committed by me,

Interest and Principal. Pag-IBIG Fund shall automatically suspend my loan privileges indefinitely. I shall abide

4. A penalty of 1/20 of 1% of any unpaid amount shall be charged to me for every day of with all the applicable rules and regulations governing this lending program that

delay. Pag-IBIG Fund may promulgate from time to time.

Signed in the presence of:

________________________________ ________________________________

Witness Witness __________________________________

(Signature over Printed Name) (Signature over Printed Name) Signature of Applicant over Printed Name

AUTHORITY TO DEDUCT (Optional)

In case of retirement/separation from employment, I hereby authorize my employer to deduct any outstanding MPL balance from my retirement SIGNATURE OF APPLICANT

or separation benefits to fully settle my loan obligation. In the event that my retirement/separation benefit is not sufficient to settle the outstanding

balance of my MPL or my employer fails for whatever reason, to deduct the same from said retirement/separation benefits, I hereby authorize

Pag-IBIG Fund to apply whatever benefits are due me from the Fund to settle the said obligation.

THIS PORTION IS FOR Pag-IBIG FUND USE ONLY

RECEIVED BY DATE REVIEWED BY DATE APPROVED/DISAPPROVED BY DATE

THIS FORM CAN BE REPRODUCED. NOT FOR SALE

HQP-SLF-065

GUIDELINES AND INSTRUCTIONS (V02, 06/2017)

(For IISP Branch Only)

A. Who May File

Pag-IBIG Fund member who satisfies the following requirements:

1. Has made at least 24 monthly membership savings (MS);

A member who has withdrawn his MS due to membership maturity or who has optionally withdrawn

his MS, cannot obtain an MPL unless and until after he has subsequently paid 24 MS following the

CERTIFICATE OF NET PAY month of the said withdrawal

A member, who does not meet the required 24 MS, may nevertheless, be allowed to avail of an

MPL if his total savings is at least equivalent to 24 MS at the rate applicable to him.

2. Has made at least one (1) MS within the last six (6) months prior to the date of loan application;

3. If with existing Pag-IBIG housing loan, the account must not be in default as of the date of application;

4. If with existing MPL and/or Calamity Loan, the account/s is/are not in default as of date of application;

and

5. Has sufficient proof of income.

B. How to File

NAME OF BORROWER The applicant shall:

1. Secure the Multi-Purpose Loan Application Form (MPLAF) from any Pag-IBIG Fund NCR/ Regional

branch or download from Pag-IBIG website at www.pagibigfund.gov.ph.

For the month of: _________________ 2. Accomplish 1 copy of the application form.

3. Attach photocopy of payroll account/disbursement card/deposit slip (for newly-opened account).

4. Submit accomplished application, together with the required documents to any Pag-IBIG Fund NCR/

Regional Branch. Processing of loans shall commence only upon submission of complete documents.

Basic Salary _________________ C. Loan Features

1. Loan Amount

A qualified Pag-IBIG member shall be allowed to borrow an amount based on the lowest of the

Add: Allowances following:

1.1 Desired Loan Amount

1.2 Loan Entitlement

_____________________ __________ Equivalent to eighty percent (80%) of TAV. However, If the borrower has an existing calamity loan,

the loanable amount shall be the difference between the eighty percent of the borrowers TAV and

the outstanding balance of his calamity loan.

_____________________ __________ 1.3 Capacity-to-pay

The loanable amount shall be limited to an amount which will not render the borrowers Net Take

Home Pay (NTHP) to fall below the minimum requirement as prescribed by the General

_____________________ __________ Appropriation Act (GAA) or company policy, whichever is applicable.

2. Interest Rate

The loan shall be charged with an interest of 10.5% p.a. (equivalent rate of 17.50% based on

_____________________ __________ diminishing principal balance).

3. Loan Term

The loan shall be repaid over a maximum period of twenty-four (24) months, with a grace period of two

_____________________ __________ (2) months.

4. Loan Release

_____________________ __________ The loan proceeds shall be released through any of the following modes:

a) Crediting to the borrowers disbursement card;

b) Crediting to the borrowers bank account through LANDBANKs Payroll Credit Systems Validation

(PACSVAL);

c) Through check payable to the borrower. However, when the check remains unclaimed for a period

of thirty (30) calendar days from the DV/Check date, the loan shall be cancelled.

Gross Monthly Income __________ d) Other acceptable modes of disbursement.

5. Loan Payments

5.1 The loan shall be paid in equal monthly payments in such amounts as may fully cover the principal

and interest over the loan period. Said amortization shall be made, whenever feasible, through

Less: Deductions salary deduction.

5.2 For self-employed individuals, Overseas Filipino Workers (OFWs), or other types of individual

payors, monthly payments shall be paid over-the-counter or any other modes if payment approved

_____________________ __________ by the Fund.

5.3 Payments shall be remitted to the Fund on or before the fifteenth (15th) day of each month, starting

on the third (3rd) month following the date on the DV/check or manual disbursement voucher.

_____________________ __________ 5.4 If the due date falls on a non-working day, the monthly amortization shall be paid before due date

or on the first working day after the due date.

5.5 The borrower may fully pay the outstanding balance of the loan prior to loan maturity.

_____________________ __________ 5.6 The borrower shall pay directly to the Fund in case the borrower is unable to pay through salary

Issued this _______ day of _________, 20__. deduction for any of the following circumstances such as but not limited to:

a. Suspension from work

I_____________________

certify under pain of perjury that __________

the above- b. Leave of absence without pay

mentioned information is true and correct. c. Insufficiency of take home pay at any time during the term of the loan; or

d. Other circumstances analogous to the foregoing.

_____________________ __________ 5.7 Payment shall be applied according to the following order of priorities:

a. Penalties; if any

b. Interest; and

E. ___________________________________________

_____________________

Loan Renewal __________ c. Principal

HEAD OF OFFICE/AUTHORIZED SIGNATORY 5.8 Any amount in excess of the required monthly amortization shall be applied to succeeding

F. Loan Renewal (Signature

over printed name) amortizations which will be posted on the next due date.

6. Penalties

The borrower shall be charged a penalty of 1/20 of 1% of any unpaid amount for every day of delay.

However, for borrowers paying their loans through salary deduction, penalties shall be reversed only

Total Deductions __________ upon presentation of proof that non-payment was due to the fault of the employer. The said penalties

including the penalty for non-remittance equivalent to 1/10 of 1% per day of delay of the amount payable

from the date the loan amortizations or payments fall due until paid, shall then be charged against the

employer.

7. Default

Net Monthly Income __________ The borrower shall be in default in any of the following cases:

a. Any willful misrepresentation made by the borrower in any of the documents executed in relation

hereto.

b. Failure of the borrower to pay any three (3) consecutive monthly amortizations.

c. Failure of the borrower to pay any three (3) consecutive Pag-IBIG monthly savings.

d. Violation by the borrower of any of the membership/STL/housing loan policies, rules, regulations,

and guidelines of Pag-IBIG Fund.

E. Other Provisions

1. The MPL and/or Calamity Loan programs shall be treated as separate and distinct from each other.

Issued this _______ day of _________, 20__. Hence, the member shall be allowed to avail of an MPL while he still has an outstanding Calamity Loan,

and vice versa. Application for loans on these two programs shall be governed by their corresponding

I certify under pain of perjury that the above- guidelines. The outstanding loan balance of the Calamity Loan shall not be deducted from the proceeds

of the MPL.

mentioned information is true and correct. 2. In no case, shall the aggregate STL exceed eighty percent (80%) of the borrowers TAV.

3. In the event of membership termination prior to loan maturity, the outstanding loan shall be deducted

from the borrowers TAV and/or any amount due him or his beneficiaries in the possession of the Fund.

In case of borrowers death, the outstanding obligation shall be computed up to the date of death. Any

___________________________________________ payments received after shall be refunded to the borrowers beneficiary.

4. An eligible member who is an active member under more than one employer shall have only one

HEAD OF OFFICE/AUTHORIZED SIGNATORY outstanding MPL at any given time. At point of application, the member shall choose which employer

(Signature over printed name) shall deduct and remit his monthly MPL amortizations.

5. A borrower may renew his MPL after payment of equivalent to six (6) monthly amortizations; not earlier

than sixth (6th) monthly amortization due date; and provided that he meets the eligibility in these

guidelines. The proceeds of the new loan shall be applied to the borrowers outstanding MPL obligation

and the net proceeds shall then be released to him. In case of full payment prior to loan maturity, a

borrower shall be allowed to apply for a new loan anytime thereafter.

6. If TAV offsetting has been effected on the borrowers defaulting MPL, he may apply for a new MPL

provided he has paid at least the equivalent of 6 monthly amortizations prior to default and its

consequent offsetting against the borrowers TAV. However, if he has paid less the than the equivalent

of 6 monthly amortizations prior to default, he may apply for a new loan only after two (2) years from

the date of TAV offsetting.

Вам также может понравиться

- PFF285 ApplicationProvidentBenefitsClaim V08Документ5 страницPFF285 ApplicationProvidentBenefitsClaim V08Trisha ApalisОценок пока нет

- Calamity Loan Application Form (CLAF)Документ2 страницыCalamity Loan Application Form (CLAF)Ayan VicoОценок пока нет

- Pag-IBIG Provident Benefits Claim FormДокумент2 страницыPag-IBIG Provident Benefits Claim FormCarlo Beltran Valerio0% (2)

- SLF002 Calamity Loan Application FormДокумент2 страницыSLF002 Calamity Loan Application FormRoy NarapОценок пока нет

- SSS Sickness BenefitДокумент5 страницSSS Sickness BenefitBehappy FamiliesОценок пока нет

- Applying for a Business PermitДокумент2 страницыApplying for a Business PermitJessel Recelestino-EsculturaОценок пока нет

- Member'S Contribution Remittance Form (MCRF) : Employer/Business Name Employer/Business AddressДокумент4 страницыMember'S Contribution Remittance Form (MCRF) : Employer/Business Name Employer/Business AddressBinoe ManalonОценок пока нет

- PRC Form Action Sheet Form For CertificationДокумент2 страницыPRC Form Action Sheet Form For CertificationKei Samson100% (2)

- HLF058 Bvs-Da V03Документ1 страницаHLF058 Bvs-Da V03James CaberaОценок пока нет

- BVS Form 2022Документ1 страницаBVS Form 2022Atibroc Neyadnis MariaginaОценок пока нет

- Referral Form Jessa 2021Документ1 страницаReferral Form Jessa 2021Jessa MaeОценок пока нет

- Refusal of TreatmentДокумент1 страницаRefusal of TreatmentTzeph H. Ahrns100% (1)

- Deficiency LetterДокумент1 страницаDeficiency LetterTanmoy Pal ChowdhuryОценок пока нет

- Mark Bryan Jeff F. Gagala: Bachelor of Science in NursingДокумент3 страницыMark Bryan Jeff F. Gagala: Bachelor of Science in NursingBryan QuebralОценок пока нет

- Hospital Document Hospital Empanelment Request FormДокумент2 страницыHospital Document Hospital Empanelment Request FormsrisaravananОценок пока нет

- New Borrowers Validation SheetДокумент1 страницаNew Borrowers Validation SheetalecksgodinezОценок пока нет

- Asian Homes - Pag-IBIG Multi-Purpose Loan ApplicationДокумент1 страницаAsian Homes - Pag-IBIG Multi-Purpose Loan ApplicationRodolfo Gamboa Pinzon100% (1)

- Please Note: Tests Have To Be Taken Within A Year!Документ1 страницаPlease Note: Tests Have To Be Taken Within A Year!ubaidullahОценок пока нет

- HH Profiling FormДокумент1 страницаHH Profiling FormNel JerezОценок пока нет

- Employee Personal Information: (Tick Mark) (Tick Mark) (Tick Mark)Документ4 страницыEmployee Personal Information: (Tick Mark) (Tick Mark) (Tick Mark)nimishshrivastavОценок пока нет

- Bank's Mudra Loan FormДокумент4 страницыBank's Mudra Loan FormRAM NAIDU CHOPPAОценок пока нет

- Membership Savings Remittance Form (MSRF, HQP-PFF-114, V01)Документ2 страницыMembership Savings Remittance Form (MSRF, HQP-PFF-114, V01)Sevy D PoloyapoyОценок пока нет

- Philhealth cf4Документ6 страницPhilhealth cf4Jose AcuinОценок пока нет

- Philippine Health Insurance Member Data RecordДокумент1 страницаPhilippine Health Insurance Member Data RecordMabelle Trapalgar100% (2)

- Referral Form SummaryДокумент8 страницReferral Form Summarycar3laОценок пока нет

- Form 34 - Third-Party Chipwashing and Junket Operators Notification FormДокумент3 страницыForm 34 - Third-Party Chipwashing and Junket Operators Notification FormmmeeeowwОценок пока нет

- Latest Payment Details for OFWДокумент1 страницаLatest Payment Details for OFWDan William BadiqueОценок пока нет

- Statement of ServiceДокумент1 страницаStatement of ServiceTerzky TerceroОценок пока нет

- Deped Form 137-E: Edukasyon Sa Pagpapakatao Edukasyon Sa PagpapakataoДокумент2 страницыDeped Form 137-E: Edukasyon Sa Pagpapakatao Edukasyon Sa PagpapakataoJeje AngelesОценок пока нет

- Section H. Morbidity Diseases ReportДокумент5 страницSection H. Morbidity Diseases ReportSeriel TismoОценок пока нет

- Letter For TB DOTSДокумент1 страницаLetter For TB DOTSGail Karl Hernaez PollicarОценок пока нет

- Tenant Application Form 2018Документ2 страницыTenant Application Form 2018Mae Camille VeraОценок пока нет

- DengueДокумент2 страницыDengueTherence Marie LacsonОценок пока нет

- Authorization Letter for Senior to Purchase GoodsДокумент1 страницаAuthorization Letter for Senior to Purchase GoodsRaeinhyer JohnОценок пока нет

- Limiac, Erica Banting, Carlvastine Corpin, Rachael Mae Ferreria, Patrick JohnДокумент61 страницаLimiac, Erica Banting, Carlvastine Corpin, Rachael Mae Ferreria, Patrick JohnAnnalyn BenemeritoОценок пока нет

- Combined Neo Sign-Off Sheets 2021 WAH SUPPLEMENTДокумент8 страницCombined Neo Sign-Off Sheets 2021 WAH SUPPLEMENTAl UrbienОценок пока нет

- Personal Information Sheet PDFДокумент2 страницыPersonal Information Sheet PDFRonelyn CalimbayanОценок пока нет

- PRC Forms UpdatedДокумент5 страницPRC Forms Updatedehjing100% (3)

- Administration Sheet For Dangerous Drugs Ward StocksДокумент17 страницAdministration Sheet For Dangerous Drugs Ward Stocksrosel sarmientoОценок пока нет

- Referral FormДокумент2 страницыReferral FormRANDY BAOGBOG100% (1)

- Provide feedback to improve production efficiencyДокумент2 страницыProvide feedback to improve production efficiencyBea DeLuis de TomasОценок пока нет

- Medical Certificate: Callo Medical Clinic and LaboratoryДокумент2 страницыMedical Certificate: Callo Medical Clinic and LaboratoryFerdinand ValdezОценок пока нет

- Memorial Hermann Discharge Papers - 3Документ5 страницMemorial Hermann Discharge Papers - 3Alaska JamesОценок пока нет

- HR Requirements for McKenzie DistributionДокумент1 страницаHR Requirements for McKenzie DistributionJessica MelitanteОценок пока нет

- Valenzuela Medical Center Discharge SummaryДокумент2 страницыValenzuela Medical Center Discharge SummaryGerald AndersonОценок пока нет

- Random Drug Test: CertificationДокумент2 страницыRandom Drug Test: CertificationApril BoreresОценок пока нет

- Annual Medical ReportДокумент6 страницAnnual Medical ReportVictor Jr MesaОценок пока нет

- RA CIVILENG Manila Nov2017 e PDFДокумент317 страницRA CIVILENG Manila Nov2017 e PDFPhilBoardResults100% (1)

- StuFAP Application FormДокумент1 страницаStuFAP Application FormArvin F. Villodres80% (5)

- Cebu Doc Doctors PDFДокумент9 страницCebu Doc Doctors PDFlehsem20006985Оценок пока нет

- Application FormДокумент2 страницыApplication FormJugal Zala0% (1)

- Oath of Undertaking: National Fire Training InstituteДокумент1 страницаOath of Undertaking: National Fire Training InstituteEller-Jed Manalac MendozaОценок пока нет

- CS Form No. 212 Revised Personal Data Sheet 2 Blank FormДокумент13 страницCS Form No. 212 Revised Personal Data Sheet 2 Blank Formclaire juarezОценок пока нет

- Philippine health insurer extends deadline for scanned claim formsДокумент1 страницаPhilippine health insurer extends deadline for scanned claim formsLeonard Paris GabatОценок пока нет

- SLF065 MultiPurposeLoanApplicationForm V05Документ3 страницыSLF065 MultiPurposeLoanApplicationForm V05JOSPEH ONTORIAОценок пока нет

- Pag-IBIG MPL Loan ApplicationДокумент2 страницыPag-IBIG MPL Loan ApplicationBecca BelenОценок пока нет

- Multi-Purpose Loan (MPL) Application Form: Crown Hotel Management CorpДокумент2 страницыMulti-Purpose Loan (MPL) Application Form: Crown Hotel Management CorpMA BethОценок пока нет

- SLF065 MultiPurposeLoanApplicationForm V03Документ2 страницыSLF065 MultiPurposeLoanApplicationForm V03Belle Adante100% (1)

- SLF065 MultiPurposeLoanApplicationForm V04Документ3 страницыSLF065 MultiPurposeLoanApplicationForm V04Catherine Quijano100% (1)

- PAGIBIG SALARY MultiPurposeLoanApplicationForm - V05Документ3 страницыPAGIBIG SALARY MultiPurposeLoanApplicationForm - V05michelleqborbeОценок пока нет

- Electronic Deposit Instructions DIRECT DEPOSITДокумент4 страницыElectronic Deposit Instructions DIRECT DEPOSITPedro PerezОценок пока нет

- Internship Report WWWДокумент68 страницInternship Report WWWWasim Imam100% (1)

- Critical Assessment of Performance of Mergers and AcquisitionsДокумент12 страницCritical Assessment of Performance of Mergers and AcquisitionsThe IjbmtОценок пока нет

- Hotel Guest Cycle ScriptДокумент3 страницыHotel Guest Cycle ScriptShirleyfe PalomaОценок пока нет

- Notes On by Aman SrivastavaДокумент5 страницNotes On by Aman SrivastavaAshish LatherОценок пока нет

- Hire purchase and installment sale transactions explainedДокумент12 страницHire purchase and installment sale transactions explainedShwetta GogawaleОценок пока нет

- Scrisoare de Intentie - EnglezaДокумент1 страницаScrisoare de Intentie - EnglezaDobrin Tina IasminaОценок пока нет

- Organization Study On Canara BankДокумент77 страницOrganization Study On Canara Bankmokshasinchana0% (2)

- Federal Judge Rules: MERS Mortgage Transfers Are IllegalДокумент3 страницыFederal Judge Rules: MERS Mortgage Transfers Are IllegalHelpin Hand100% (4)

- Credit Risk Management at Dashen BankДокумент48 страницCredit Risk Management at Dashen Bankmubarek oumerОценок пока нет

- BC NEIA Booklet English 01-08-2019Документ14 страницBC NEIA Booklet English 01-08-2019abhiroopboseОценок пока нет

- EBL internship report on HRM practicesДокумент54 страницыEBL internship report on HRM practicesHossan SabbirОценок пока нет

- Swift: Presented by Arun.K.SДокумент9 страницSwift: Presented by Arun.K.SArun Karuthala100% (1)

- 0452 w13 QP 11Документ20 страниц0452 w13 QP 11Naðooshii AbdallahОценок пока нет

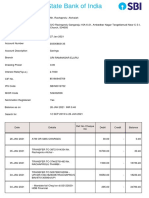

- State Bank of India savings account statement for Mr. Rachaprolu AtchaiahДокумент12 страницState Bank of India savings account statement for Mr. Rachaprolu AtchaiahRajesh pvkОценок пока нет

- Maybank Sustainability Report 2014Документ150 страницMaybank Sustainability Report 2014Rezha SetyoОценок пока нет

- Kaneshiro V Michael Kim, Bank of America Home LoansДокумент9 страницKaneshiro V Michael Kim, Bank of America Home LoansForeclosure FraudОценок пока нет

- EESA06 Final Exam PDFДокумент16 страницEESA06 Final Exam PDFAsh S0% (1)

- Credit Trans - Bpi Family Bank VS FrancoДокумент3 страницыCredit Trans - Bpi Family Bank VS FrancoRITCHER QUITEVISОценок пока нет

- Principles of Managerial Finance: Fifteenth Edition, Global EditionДокумент61 страницаPrinciples of Managerial Finance: Fifteenth Edition, Global EditionMustafa VaranОценок пока нет

- Asset Privatization Vs Ca (300 Scra 579)Документ1 страницаAsset Privatization Vs Ca (300 Scra 579)Girlie Marie SorianoОценок пока нет

- Agent's unauthorized mortgage binds himself personallyДокумент2 страницыAgent's unauthorized mortgage binds himself personallyJDR JDRОценок пока нет

- PLDT Account No. 0193069916 PDFДокумент4 страницыPLDT Account No. 0193069916 PDFEli FaustinoОценок пока нет

- BSE SME Listing Requirements for CompaniesДокумент4 страницыBSE SME Listing Requirements for CompaniesShinil NambrathОценок пока нет

- PaymentTechology 05 2013 30 SectorДокумент23 страницыPaymentTechology 05 2013 30 Sectoriemif2013Оценок пока нет

- AffidavitДокумент19 страницAffidavitppghoshinОценок пока нет

- Analysis of PMJDY scheme and its role in financial inclusionДокумент14 страницAnalysis of PMJDY scheme and its role in financial inclusionBikash Kumar Nayak100% (1)

- List of Ex-Eq SH (Scheme of Arrangement) PDFДокумент479 страницList of Ex-Eq SH (Scheme of Arrangement) PDFrkdexports100% (2)

- Cac de Luyen ThiДокумент4 страницыCac de Luyen ThinguyenngocquynhchiОценок пока нет

- Ford Motor 7.7% - 2097 - US345370BS81Документ16 страницFord Motor 7.7% - 2097 - US345370BS81montyviaderoОценок пока нет