Академический Документы

Профессиональный Документы

Культура Документы

04 BMAC5203 Course Guide

Загружено:

Ali AlshwalАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

04 BMAC5203 Course Guide

Загружено:

Ali AlshwalАвторское право:

Доступные форматы

COURSE GUIDE ix

COURSE GUIDE DESCRIPTION

You must read this Course Guide carefully from the beginning to the end. It tells

you briefly what the course is about and how you can work your way through

the course material. It also suggests the amount of time you are likely to spend in

order to complete the course successfully. Please keep on referring to Course

Guide as you go through the course material as it will help you to clarify

important study components or points that you might miss or overlook.

INTRODUCTION

BMAC5203 Accounting for Business Decision Making is one of the courses

offered by the Business School at Open University Malaysia (OUM). This course

is worth 3 credit hours and should be covered over 8 to 15 weeks.

COURSE AUDIENCE

This course is offered to all learners taking the Master in Business Administration

programme. This module aims to impart the fundamentals of accounting,

designed for business students without any exposure to basic accounting. This

module intends to describe the importance of Accounting Information in

business decisions, to discuss the basic concepts, principles of financial and

management accounting, and apply accounting in planning, control and decision

making which will be useful for subsequent courses.

As an open and distance learner, you should be acquainted with learning

independently and being able to optimise the learning modes and environment

available to you. Before you begin this course, please confirm the course material,

the course requirements and how the course is conducted.

STUDY SCHEDULE

It is a standard OUM practice that learners accumulate 40 study hours for every

credit hour. As such, for a three-credit hour course, you are expected to spend

120 study hours. Table 1 gives an estimation of how the 120 study hours could be

accumulated.

Copyright Open University Malaysia (OUM)

x COURSE GUIDE

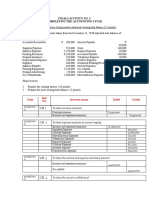

Table 1: Estimation of Time Accumulation of Study Hours

Study

Study Activities

Hours

Briefly go through the course content and participate in initial discussions 5

Study the module 60

Attend 4 tutorial sessions 10

Online participation 12

Revision 15

Assignment(s), Test(s) and Examination(s) 20

TOTAL STUDY HOURS ACCUMULATED 120

COURSE OUTCOMES

By the end of this course, you should be able to:

1. Explain the basic aims (viz. stock valuation, profit determination, decision

making, planning and control) of management accounting (managerial)

information systems in an organisation;

2. Explain the role of ethics in the managerial decision making process; and

3. Apply management accounting concepts, principles and techniques that are

fundamental to effective planning and control, and efficient business

decisions.

COURSE SYNOPSIS

This course is divided into ten topics. The synopsis for each topic is listed as

follows:

Topic 1 begins with an introduction to accounting, especially the financial and

management accounting systems and standards as well as the process of

identifying, measuring, reporting, and analysing information on the economic

events of organisations used by management to plan, evaluate, control and make

decisions.

Copyright Open University Malaysia (OUM)

COURSE GUIDE xi

This topic will help you understand how accounting information is created and

how decision makers, both internal and external, use this information to make

decisions. You will also realise that there is a standard set of rules and regulatory

framework governing how to record and report financial information.

Topic 2 looks at the accounting concepts and assumptions. This is followed by

the common ways to measure income which are the accrual basis and cash basis

methods. Although both cash and accrual basis have their merits, the accountants

have conventionally measured income on an accrual basis. Some of the other

basic accounting principles and concepts that are implicit in financial statements,

such as, the separate entity concept, reliability concept, going concern

convention, materiality convention, monetary unit assumption, historic cost

assumption, time-period concept, consistency principle, disclosure principle and

conservatism principle, are also discussed in this topic.

Topic 3 introduces a number of additional analytical techniques to complement

the ratio analysis, and these techniques include common size vertical analysis

and horizontal analysis. Financial ratios are computed and discussed, where the

prime purpose of each analytical method is to identify potential areas facing

financial distress. Once these areas have been identified, thorough investigations

are carried out to determine the cause of each irregularity, which includes

selecting additional ratios.

Topic 4 begins with a discussion on the concept of cost in decision making. There

can be multiple categories of cost or expenses or organisations, such as,

administrative cost and distribution cost and costs can be classified in different

ways for different purposes for decision making.

Topic 5 examines the concept of the Cost-Volume-Profit (CVP) analysis model

and illustrates how managers use that model to help answer important what-if

business questions. The CVP analysis also helps management accountants alert

managers to the risks and rewards of decisions they are considering, by

illustrating how the bottom-line is affected by changes in activity levels and/or

key pricing or cost components.

Topic 6 discusses the decision-making process and the concept of relevant

information in short-term decision making. The terms Sunk Cost and

Opportunity Cost will also be discussed in understanding the concept of

relevance for decision making.

Copyright Open University Malaysia (OUM)

xii COURSE GUIDE

Topic 7 touches on budgets and discusses the Budgeting Process from the

conception of the plan to the expected execution of it. What and How

resources are to be used over a specified time period including control that uses

feedback on actual operating results to compare with the plan to evaluate

performance in achieving the plan and goals will also be discussed.

Topic 8 discusses the Flexible Budget and its importance. Using the Fixed

Budgets and Flexible Budgets, Variance Analysis will be discussed.

Topic 9 describes the Variance Analysis such as Direct Materials Price and

Efficiency Variances, Direct Labour Price and Efficiency Variances, Variable

Overhead Spending and Efficiency Variance, and Fixed Overhead Spending and

Production-Volume Variances.

Topic 10 describes the responsibility accounting and responsibility centres of an

organisation. Balanced scorecards, as well as performance measurement tools

will be applied such as return on investment and residual income.

TEXT ARRANGEMENT GUIDE

Before you go through this module, it is important that you note the text

arrangement. Understanding the text arrangement will help you to organise your

study of this course in a more objective and effective way. Generally, the text

arrangement for each topic is as follows:

Learning Outcomes: This section refers to what you should achieve after you

have completely covered a topic. As you go through each topic, you should

frequently refer to these learning outcomes. By doing this, you can continuously

gauge your understanding of the topic.

Self-Check: This component of the module is inserted at strategic locations

throughout the module. It may be inserted after one sub-section or a few sub-

sections. It usually comes in the form of a question. When you come across this

component, try to reflect on what you have already learnt thus far. By attempting

to answer the question, you should be able to gauge how well you have

understood the sub-section(s). Most of the time, the answers to the questions can

be found directly from the module itself.

Activity: Like Self-Check, the Activity component is also placed at various

locations or junctures throughout the module. This component may require you to

solve questions, explore short case studies, or conduct an observation or research.

It may even require you to evaluate a given scenario. When you come across an

Activity, you should try to reflect on what you have gathered from the module and

Copyright Open University Malaysia (OUM)

COURSE GUIDE xiii

apply it to real situations. You should, at the same time, engage yourself in higher

order thinking where you might be required to analyse, synthesise and evaluate

instead of only having to recall and define.

Summary: You will find this component at the end of each topic. This component

helps you to recap the whole topic. By going through the summary, you should

be able to gauge your knowledge retention level. Should you find points in the

summary that you do not fully understand, it would be a good idea for you to

revisit the details in the module.

Key Terms: This component can be found at the end of each topic. You should go

through this component to remind yourself of important terms or jargon used

throughout the module. Should you find terms here that you are not able to

explain, you should look for the terms in the module.

References: The References section is where a list of relevant and useful

textbooks, journals, articles, electronic contents or sources can be found. The list

can appear in a few locations such as in the Course Guide (at the References

section), at the end of every topic or at the back of the module. You are

encouraged to read or refer to the suggested sources to obtain the additional

information needed and to enhance your overall understanding of the course.

PRIOR KNOWLEDGE

This is an introductory course. There is no prior knowledge needed.

ASSESSMENT METHOD

Please refer to myINSPIRE.

REFERENCES

Garrison, R. H., Noreen, E. W., Brewer, P. C., Cheng, N. S., & Yuen, K. C. K.

(2012). Managerial accounting, an asian perspective (13th ed.). McGraw-

Hill Companies, Inc.

Ronald, W. H. (2008). Managerial accounting creating value in a dynamic

business environment (7th ed.). McGraw Hill Higher Education.

Hansen, D. R., & Mowen, M. M. (2003). Management accounting (6th ed.). South

Western College Publishing.

Copyright Open University Malaysia (OUM)

xiv COURSE GUIDE

Brandon, C. H., & Drtina, R. E. (1997). Management accounting strategy and

control. McGraw-Hill Companies, Inc.

Weygant, J. J, Kieso, D. E., & Kimmel, P. D. (1999). Managerial accounting: Tools

for business decision-making. John Wiley and Sons, Inc.

Zimmerman, J. L. (2000). Accounting for decision making and control (3rd ed.).

McGraw Hill Companies, Inc.

TAN SRI DR ABDULLAH SANUSI (TSDAS) DIGITAL

LIBRARY

The TSDAS Digital Library has a wide range of print and online resources for

the use of its learners. This comprehensive digital library, which is accessible

through the OUM portal, provides access to more than 30 online databases

comprising e-journals, e-theses, e-books and more. Examples of databases

available are EBSCOhost, ProQuest, SpringerLink, Books247, InfoSci Books,

Emerald Management Plus and Ebrary Electronic Books. As an OUM learner,

you are encouraged to make full use of the resources available through this

library.

Copyright Open University Malaysia (OUM)

Вам также может понравиться

- MPU2223 3223 Course Guide (WM)Документ6 страницMPU2223 3223 Course Guide (WM)Nurul HanisОценок пока нет

- 04 BBNP4103 CGДокумент6 страниц04 BBNP4103 CGChistina YukiОценок пока нет

- 04 BBPP1103 CGДокумент6 страниц04 BBPP1103 CGMahdhivanan MadhiОценок пока нет

- Course GuideДокумент6 страницCourse GuideMd NohОценок пока нет

- 04 BDPP110 CGДокумент5 страниц04 BDPP110 CGPrivate SharingОценок пока нет

- Course GuideДокумент5 страницCourse GuideAN UM HWОценок пока нет

- E CommerceДокумент6 страницE CommerceLuqme Mohamad LuqmanОценок пока нет

- 04 Xboh2103 CGДокумент5 страниц04 Xboh2103 CGThirumaran MuthusamyОценок пока нет

- Des 213Документ105 страницDes 213Pastor-Oshatoba Femi JedidiahОценок пока нет

- HRM2604 Study Guide EДокумент147 страницHRM2604 Study Guide EAmandari SutherlandОценок пока нет

- Managerial Accounting Course SyllabusДокумент7 страницManagerial Accounting Course SyllabusgsdeeepakОценок пока нет

- Modern Methods of Vocational and Industrial TrainingОт EverandModern Methods of Vocational and Industrial TrainingОценок пока нет

- BFN732 ZZДокумент139 страницBFN732 ZZGBОценок пока нет

- ACCT 100 POFA Course Outline Fall Semester 2022-23Документ6 страницACCT 100 POFA Course Outline Fall Semester 2022-23MuhammadОценок пока нет

- Sma Study Pack - Apc315Документ395 страницSma Study Pack - Apc315Trieu Ngo100% (1)

- BA164IU - Production and Operations ManagementsДокумент12 страницBA164IU - Production and Operations Managementsnhihoang2003cfcОценок пока нет

- UT Dallas Syllabus For Aim6305.ot1 06s Taught by Surya Janakiraman (Suryaj)Документ9 страницUT Dallas Syllabus For Aim6305.ot1 06s Taught by Surya Janakiraman (Suryaj)UT Dallas Provost's Technology GroupОценок пока нет

- UWI Management Accounting Course GuideДокумент16 страницUWI Management Accounting Course Guidemolengene882Оценок пока нет

- Managerial Accounting SecretsДокумент30 страницManagerial Accounting Secretsfaiz_dodhiaОценок пока нет

- 04 CBMS4303 CGДокумент6 страниц04 CBMS4303 CGg-48169596Оценок пока нет

- BHM 736 Introductory AccountingДокумент155 страницBHM 736 Introductory AccountingCharles Smith100% (2)

- Principles of Financial AccountingДокумент7 страницPrinciples of Financial AccountingmfaizanzahidОценок пока нет

- LUMS ACCT 100 Principles of Financial AccountingДокумент7 страницLUMS ACCT 100 Principles of Financial AccountingHaseeb Nasir SheikhОценок пока нет

- FAC1503 - 2023 - Module OverviewДокумент11 страницFAC1503 - 2023 - Module OverviewNaledi Monabe100% (1)

- Course Outline: Business 2257: Accounting and Business AnalysisДокумент9 страницCourse Outline: Business 2257: Accounting and Business AnalysistigerОценок пока нет

- Fac 1502Документ365 страницFac 1502Thuthukani100% (1)

- Module Handbook: Module Title Managerial FinanceДокумент12 страницModule Handbook: Module Title Managerial FinanceReswinОценок пока нет

- MBA 881 Business PolicyДокумент191 страницаMBA 881 Business Policysunkanmi hebraheemОценок пока нет

- Hmef5023 CGДокумент6 страницHmef5023 CGSITI ATIQAH BINTI MOHD HASHIM STUDENTОценок пока нет

- Study Guide For Students in Cost AccountingДокумент41 страницаStudy Guide For Students in Cost Accountingjanine moldinОценок пока нет

- ACCT 100-Principles of Financial Accounting - Fall 2018-19Документ7 страницACCT 100-Principles of Financial Accounting - Fall 2018-19Qudsia AbbasОценок пока нет

- BFN 405-LendingДокумент207 страницBFN 405-Lendingjoshua omondiОценок пока нет

- BMME5103 Full Version Study Guide PDFДокумент13 страницBMME5103 Full Version Study Guide PDFWill NguyenОценок пока нет

- Operations Management Course GuideДокумент23 страницыOperations Management Course GuideFiqriОценок пока нет

- LUMS ACCT 100 Financial AccountingДокумент7 страницLUMS ACCT 100 Financial AccountingZulfeqar HaiderОценок пока нет

- ACCT 100 POFA Course Outline Fall Semester 2020 - Online - Updated Oct 1 2020 - 1Документ7 страницACCT 100 POFA Course Outline Fall Semester 2020 - Online - Updated Oct 1 2020 - 1Usama KhanОценок пока нет

- ACCT5955 Management Accounting Control Systems S12005Документ17 страницACCT5955 Management Accounting Control Systems S12005Sucipto Antoni100% (1)

- Accounting concepts module overviewДокумент365 страницAccounting concepts module overviewGetrude Mazimba100% (1)

- IB Semester 2 HandbookДокумент17 страницIB Semester 2 HandbookFranciscoJavierVazquezPachonОценок пока нет

- Principles of Financial AccountingДокумент7 страницPrinciples of Financial Accountinghnoor94Оценок пока нет

- ACCT 100-Principles of Financial Accounting - Atifa Dar - Omair HaroonДокумент7 страницACCT 100-Principles of Financial Accounting - Atifa Dar - Omair HaroonAbdelmonim Awad OsmanОценок пока нет

- Course Syllabus B 716 A Spring 2019 TEMP AOU-FBS-MBA (Updated)Документ7 страницCourse Syllabus B 716 A Spring 2019 TEMP AOU-FBS-MBA (Updated)Emad Adel Abu SafiahОценок пока нет

- Measuring Training ResultsДокумент42 страницыMeasuring Training ResultsHamad AlhajriОценок пока нет

- Corporate MGT StrategyДокумент469 страницCorporate MGT StrategygabrielheroОценок пока нет

- Cost & Management Accounting Course OutlineДокумент7 страницCost & Management Accounting Course OutlineBilal ShahidОценок пока нет

- ACCT3114A - Valuation Using Financial Statements - Dr. Jing LiДокумент8 страницACCT3114A - Valuation Using Financial Statements - Dr. Jing LiTheo GalvannyОценок пока нет

- 001 2012 4 eДокумент365 страниц001 2012 4 eShiran Mahadeo100% (1)

- FMS 427 BusinessPolicy1Документ279 страницFMS 427 BusinessPolicy1Adeniyi Adedolapo OLanrewajuОценок пока нет

- CA Assurance ManualДокумент350 страницCA Assurance ManualErfan Khan100% (1)

- 04 HPGD2303 CGДокумент12 страниц04 HPGD2303 CGNUR FAIZAH BINTI ROSLAN STUDENTОценок пока нет

- Cost Accounting Course GuideДокумент10 страницCost Accounting Course GuideUchayyaОценок пока нет

- Audit & Assurance Study Guide 2015Документ26 страницAudit & Assurance Study Guide 2015Maddie Green100% (1)

- Fundamentals of Cost and Management Accounting (Study Text)Документ353 страницыFundamentals of Cost and Management Accounting (Study Text)farsi786100% (1)

- OPE634 SyllabusДокумент15 страницOPE634 SyllabusEmilio Lamas GarciaОценок пока нет

- Analysis For Business Decisions TextbookДокумент291 страницаAnalysis For Business Decisions TextbookMoses OlabodeОценок пока нет

- Module Plan Corporate Accouunting INSEADДокумент11 страницModule Plan Corporate Accouunting INSEADDeepansh KalraОценок пока нет

- Financial Accounting and Information Systems: Class MBAДокумент6 страницFinancial Accounting and Information Systems: Class MBADaniyal JunaidОценок пока нет

- Fnce203 - Tu JunДокумент4 страницыFnce203 - Tu JunYing SunОценок пока нет

- OG 202 Power Control Issue1.4Документ51 страницаOG 202 Power Control Issue1.4MasTomОценок пока нет

- 5 Oeo107230 Lte Eran6.0 Cs Fallback Feature Issue 1.00Документ34 страницы5 Oeo107230 Lte Eran6.0 Cs Fallback Feature Issue 1.00Ali AlshwalОценок пока нет

- Ibflex: In-Building and Outdoor Network TestingДокумент4 страницыIbflex: In-Building and Outdoor Network TestingAli AlshwalОценок пока нет

- Corning IncorporatedДокумент4 страницыCorning IncorporatedWidya WardaniОценок пока нет

- Corning IncorporatedДокумент2 страницыCorning IncorporatedAli AlshwalОценок пока нет

- Compared: Fibre Broadband Services in Malaysia - TM Vs TIME Vs Maxis Vs CelcomДокумент14 страницCompared: Fibre Broadband Services in Malaysia - TM Vs TIME Vs Maxis Vs CelcomAli AlshwalОценок пока нет

- Business Finance: Quarter 3 - Module 3: Budget Preparation and Projected Financial StatementsДокумент31 страницаBusiness Finance: Quarter 3 - Module 3: Budget Preparation and Projected Financial StatementsAsset Dy74% (23)

- FAR3 Group AssignmentДокумент11 страницFAR3 Group AssignmentAin FatihahОценок пока нет

- Jaisalmer 384Документ299 страницJaisalmer 384sakar guptaОценок пока нет

- Advanced Accounting UpdatesДокумент113 страницAdvanced Accounting UpdatesYash KediaОценок пока нет

- Abysina Bank 2020Документ116 страницAbysina Bank 2020Yared Deribew0% (1)

- 4.01 Accounting and FinanceДокумент17 страниц4.01 Accounting and FinanceAbhishekОценок пока нет

- Accounting For Property Plant and EquipmentДокумент6 страницAccounting For Property Plant and EquipmentmostafaОценок пока нет

- X Accounting 2Документ419 страницX Accounting 2Amaury Guillermo Baez100% (2)

- RPS - Akuntansi - Manajemen - Berbasis - OBE - DistanceLearning - Share Ke MHSДокумент13 страницRPS - Akuntansi - Manajemen - Berbasis - OBE - DistanceLearning - Share Ke MHSaulia endiniОценок пока нет

- InvestmentsДокумент13 страницInvestmentsCorinne GohocОценок пока нет

- CA Program Timetable Yearly Term 1 2023 - Term 4 2024Документ3 страницыCA Program Timetable Yearly Term 1 2023 - Term 4 2024NXTKILLERX GamingОценок пока нет

- SOP Arshdeep Singh, UelДокумент3 страницыSOP Arshdeep Singh, Uelcosmo worldОценок пока нет

- Applied Auditing 2Документ11 страницApplied Auditing 2Leny Joy DupoОценок пока нет

- Bridgeloyalty Company Profile - 2019Документ20 страницBridgeloyalty Company Profile - 2019Rohit KrishnaОценок пока нет

- UTS-Bhs Inggris Akuntansi MalamДокумент1 страницаUTS-Bhs Inggris Akuntansi MalamAnonymous Fn7Ko5riKT100% (1)

- Chapter 3 - The Adjusting ProcessДокумент55 страницChapter 3 - The Adjusting ProcessfitrieyfieyОценок пока нет

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Документ3 страницыNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- Chapter 14 Akun Keuangan TugasДокумент2 страницыChapter 14 Akun Keuangan Tugassegeri kecОценок пока нет

- AUT - 2016 Postgraduate Business ResearchДокумент23 страницыAUT - 2016 Postgraduate Business ResearchbhvilarОценок пока нет

- Auditing and Assurance Services Louwers 4th Edition Solutions ManualДокумент27 страницAuditing and Assurance Services Louwers 4th Edition Solutions ManualKenneth EbertОценок пока нет

- Apple Blossom Cologne Company Financial StatementsДокумент11 страницApple Blossom Cologne Company Financial StatementsCharis Adit67% (3)

- Intermediate Examination: Suggested Answers To QuestionsДокумент16 страницIntermediate Examination: Suggested Answers To QuestionsDINESH K SADAYAKUMARОценок пока нет

- Sy Chim and Felicidad Chan Sy V Sy Siy Ho & Sons, IncДокумент7 страницSy Chim and Felicidad Chan Sy V Sy Siy Ho & Sons, IncJohn YeungОценок пока нет

- Printable Flashcard On Accounting Final Exam Review - Free Flash CardsДокумент16 страницPrintable Flashcard On Accounting Final Exam Review - Free Flash CardsSureshArigelaОценок пока нет

- EXAM ABM 11 Jan 29Документ1 страницаEXAM ABM 11 Jan 29Roz AdaОценок пока нет

- SAP FI General Ledger OverviewДокумент53 страницыSAP FI General Ledger OverviewRizky Lubis100% (1)

- Purchases Day Book and Purchases LedgerДокумент10 страницPurchases Day Book and Purchases LedgerSaad SulemanОценок пока нет

- Airbus Equity ResearchДокумент9 страницAirbus Equity ResearchArnaud SeiteОценок пока нет

- BHM Syllabus MG University Kottayam Kerala IndiaДокумент95 страницBHM Syllabus MG University Kottayam Kerala IndiaprismruthiОценок пока нет