Академический Документы

Профессиональный Документы

Культура Документы

Journal of European Social Policy: Sustaining State Welfare in Hard Times: Who Will Foot The Bill?

Загружено:

irina8082Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Journal of European Social Policy: Sustaining State Welfare in Hard Times: Who Will Foot The Bill?

Загружено:

irina8082Авторское право:

Доступные форматы

Journal of European Social Policy

http://esp.sagepub.com

Sustaining State Welfare in Hard Times: Who Will Foot the Bill?

Peter Taylor-Gooby

Journal of European Social Policy 2001; 11; 133

DOI: 10.1177/095892870101100203

The online version of this article can be found at:

http://esp.sagepub.com/cgi/content/abstract/11/2/133

Published by:

http://www.sagepublications.com

Additional services and information for Journal of European Social Policy can be found at:

Email Alerts: http://esp.sagepub.com/cgi/alerts

Subscriptions: http://esp.sagepub.com/subscriptions

Reprints: http://www.sagepub.com/journalsReprints.nav

Permissions: http://www.sagepub.co.uk/journalsPermissions.nav

Citations http://esp.sagepub.com/cgi/content/refs/11/2/133

Downloaded from http://esp.sagepub.com by cutare cutarescu on October 29, 2009

ARTICLE

Sustaining state welfare in hard times: who will foot the bill?

Peter Taylor-Gooby, University of Kent, UK

Summary Rsum

Recent studies of how European welfare Les tudes rcentes sur la manire dont les

systems are responding to current pressures Etats Providence rpondent aux pressions

agree that welfare states display remarkable actuelles ont en commun quelles aboutissent

resilience. They are being reformed rather constater que ceux-ci font montre dune

than dismantled. New policies are concerned remarquable rsistance. Ils sont en train dtre

to contain costs and to promote activation, non pas dmantels mais bien plus dtre

stressing the contribution of welfare to eco- rforms. Les nouvelles politiques se concen-

nomic competitiveness. Will people support trent sur la limitation des cots et lactivation

cost constraint? This paper analyses attitude ainsi que sur la mise en vidence de lapport

survey data from the 1980s and 1990s to de la protection sociale la comptitivit

show that approval of the main welfare serv- conomique. Est-ce quil existe un appui

ices is high, but, in contrast to the findings of cette limitation des cots? Cet article analyse

earlier studies, there is now some evidence of les donnes denqutes dopinion des annes

declining support. Attitudes are not structured 1980 et 1990. Il montre que lapprobation

according to the accounts of the new politics envers les principaux services est leve mais

of welfare (which imply that each regime will contrairement aux rsultats dtudes

produce its own pattern of interests in relation antrieures il existe quelques signes dun

to the groups whose interests are entrenched dclin de cet appui. Les attitudes ne sont pas

by current arrangements) but reflect broad distribues tels que prvues par les tenants des

lines of income, age and gender, cross-cutting nouvelles politiques du Welfare (selon

national differences. There is little support for lesquels chaque rgime produit sa propre

cuts in social services, but an equally low level structure dintrts lis aux groupes dont les

of willingness to pay the extra taxes and social intrts sont consolids par les arrangements

contributions required to maintain current en vigueur) mais refltent les diffrences de

standards of provision in the face of rising revenus, dge et de genre, de nationalits.

pressures on welfare. An agenda of activation Il ny a que peu dappui pour des coupes

is likely to prove more acceptable politically dans les services mais galement pour payer

than one of cost constraint in all regimes. The des taxes ou des contributions supplmen-

implication is that European welfare states taires afin de maintenir les niveaux atteints

face a straitened future, between increasing face aux pressions croissantes. Un agenda

demands and constrained resources, which dactivation est plus acceptable politiquement

may lead public opinion support to dwindle dans tous les rgimes quune de rduction des

further. cots. Limplication est que les systmes de

protection sociale europens se trouvent

coincs. entre des demandes croissantes et des

rductions supplmentaires des cots; ce qui

Key words peut conduire une nouvelle diminution du

soutien de lopinion publique.

attitudes, politics of welfare, retrenchment,

welfare state reform

Journal of European Social Policy 0958-9287 (200105)11:2 Copyright 2001 SAGE Publications, London, Thousand

Oaks and New Delhi, Vol 11 (2): 133147; 017012

Downloaded from http://esp.sagepub.com by cutare cutarescu on October 29, 2009

134 T AY L O R - G O O B Y

Welfare under altered circumstances much attention. Analysis supports three main

points. First, despite the concerns of the 1980s

and early 1990s, the European welfare state is

The European welfare state provides a distinc- resilient in its response to current pressures. It

tive solution to the problem of securing social is not contracting, nor is it obsolete. Indeed

integration within competitive capitalism. It the clear and sober message is that survival

developed during the three decades of secure is possible and likely and desirable, as

growth following the Second World War. The Kuhnle concludes his study of the 1990s in

stability and sustainability of the welfare set- Europe (2000a: 237). Similarly Beck and col-

tlement now face major challenges as the labour leagues stress the essential value and viability

market and family structures which it was of the European solution to the problem of

designed to support undergo rapid change, as achieving a measure of social justice within a

increasing numbers of older people confi- capitalist market system (Beck et al., 1998).

dently expect better pensions, health and social Ferrera and Rhodes also conclude from the

care; as globalization undermines the author- work of the 1999 European University Institute

ity of the national state; and as the parallel Forum, Recasting the European Welfare State,

expansion of the EU creates an increasingly that the welfare state is a largely successful

unified and competitive market in Western solution to the problem of reconciling growth

Europe with further prospects of expansion to with social cohesion (Ferrera and Rhodes,

the East and around the Mediterranean basin. 2000: 279). The evidence that state provision

It is likely that the cost of sustaining current is maintained or expanded is typically rein-

levels of provision, let alone achieving the forced with evidence of public approval from

improvements that many people accept as attitude surveys (see for example, Pierson,

normal in the market sector of the economy, 1996: 162, 165; Rhodes, 1996: 308; Ross,

will rise. This paper discusses the implications 2000: Footnote 39; van Kersbergen, 2000:

of welfare values for the future development 23). However, almost all the surveys cited

of European social provision, using as evidence analyse data from the 1980s and early 1990s

surveys of public attitudes which reflect those and do not cover recent developments.

values. Public opinion is generally supportive Second, resilience is often driven by the

of state welfare in principle. However, attitudes entrenched interests of particular groups who

may be moving against state welfare in the are advantaged by current arrangements. As

1990s. When questions about the finance of Pierson (1994) puts it the welfare state now

services are examined, citizens are equivocal represents the status quo. Governments find

in their endorsement of higher taxes and con- it electorally unsatisfying to confront citizens

tributions. This raises questions about the well- with cuts in valued services. The risk is that,

documented public support for state welfare. as Esping-Andersen concludes in a recent

As the cost of maintaining pensions and health major study, current arrangements lead to

care rises, will citizens be happy to foot the bill? median voter support for anachronistic

We review recent developments and analyse modes of welfare production (1999: 184).

attitude survey data in the light of theories Welfare policy making must proceed by indi-

about the new (and old) politics of welfare. rection, and by achieving systematic reforms

which reduce the capacity of particular inter-

Recent developments in welfare states ests to mobilize the defence of existing policies

(see, for example, Freeman and Moran, 2000;

Goul Andersen, 2000; Merrien and Bonoli,

Resilience 2000; Palier, 2000).

This approach produces a more sophisti-

The current problems of state welfare attract cated account of resilience since it implies that

Journal of European Social Policy 2001 11 (2)

Downloaded from http://esp.sagepub.com by cutare cutarescu on October 29, 2009

S U S TA I N I N G S TAT E W E L FA R E IN HARD TIMES 135

the mechanisms of resilience differ in different others identify similar developments. It is

contexts. Differences in the nature of welfare worth noting two trends conspicuous by their

provision and in the extent to which different absence: although the virtues of greater indi-

interests are able to exert an influence lead to vidual responsibility are commonly endorsed

differing reform agendas, although welfare there is no overall transfer of provision to the

states are confronted with broadly similar private sector (except in isolated instances

pressures. For example, Fritz Scharpf con- where the market already plays a major role,

cludes a major analysis of the impact of glob- such as UK pensions policy), although policies

alization on welfare systems: while there is no to provide incentives for private provision are

reason to think that economic viability should developing in a number of countries; nor to

be incompatible with [welfare] aspirations, the family, although welfare state support for

still welfare states differ greatly in their vul- social care varies greatly. Private pensions may

nerability to international economic pressures play a more important role at some stage in

in the specific problems they need to the future as policies to encourage their

address and in the policy options that they expansion have a greater impact, but state

could reach under the constraints of existing provision is currently of very much greater

policy legacies and the institutional con- importance in almost all European countries.

straints of existing veto positions (1999: These points add up to the suggestion that

389). welfare systems are successful in adjusting to a

Third, current reforms and restructurings changed environment in ways that reflect dif-

do not involve convergence but include com- ferences in their current structure and organi-

mon themes of cost control and activation. zation, and the political and cultural

For example, Jens Alber and Guy Standing characteristics of the national context in

report from a major study of social dumping which they developed. Welfare is being recali-

that there was neither convergence in the brated, recast, is in transition, restructur-

sense of catch-up processes, nor polarisation ing, evolving or being modified, as recent

in recent years although at best we can iden- titles suggest. The welfare state in Europe is

tify certain regional clusters (Alber and doing well under difficult circumstances.

Standing, 2000: 107, 112; see also Daly, However, most commentators agree that the

1997). Although welfare states do not march political processes that drive current reforms

in step down the same highway, there are a differ from those that underlay the earlier

number of common trends. The European growth of state welfare. Will social values set

Commissions official biennial report sums limits to successful adaptation?

these up under two general headings cost

containment and activating policy to reduce

the number of people dependent on social The new politics of welfare

transfers (CEC, 1998: 19). Ferrera and

Rhodes decompose these: cost control

involves adjustments in response to socio- A number of approaches suggest that support

demographic developments, mainly in pen- for the welfare state will decline, whether as a

sions and health care, and also a trend to result of increasing affluence (Inglehart,

more accurate targeting of resources on those 1997), a transition to a post-Fordist politi-

in need. Activation policies include the general cal economy (Jessop, 2000), sharper social

shift from a passive to an active approach in divisions (Galbraith 1993; Wilensky, 1975)

the management of unemployment and the or new patterns of experience and social

modification of financial arrangements to interests reinforced by greater individual self-

promote competitiveness by containing labour confidence (Beck et al., 1994; Giddens, 1994;

costs (2000: 47). Kuhnle (2000a: 2345) and 2000). Such theories do not appear to give a

Journal of European Social Policy 2001 11 (2)

Downloaded from http://esp.sagepub.com by cutare cutarescu on October 29, 2009

136 T AY L O R - G O O B Y

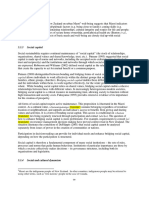

Table 1 Welfare cleavages in particular regimes

Market position Gender State sector Insider/outsider

Social Democratic (Sweden) X X

Conservative/Corporatist (Germany) X X

Liberal (UK) X

satisfactory account of resilience, which is the or between political Right and Left, and the

focus of the current paper (for a full discus- realization by the middle class that horizontal

sion, see Bonoli et al., 2000: Ch. 4). They tend redistribution enabled better-off groups to

to refer to holistic social change affecting all gain greater security from state welfare was a

of society (post-materialism, post-Fordism, pivotal development in assembling a mass

affluence, globalization or social reflexivity). constituency in support of social spending

The new politics approach (Pierson, 1994) (Baldwin, 1990).

stresses the part played by different interests Conflicts about retrenchment are seen to

in changing social contexts. Since these inter- relate more finely to the detail of welfare state

ests may conflict with each other, but have a design. To simplify a complex debate (see

primary defensive orientation, the new politics Esping-Andersen, 1990; 1996; 1999; Pierson,

is distinct both from the traditional politics of 1996), the social democratic regime with its

growth, in which all interests can be satisfied large state sector offering substantial job

as the welfare state expands, and the neo- opportunities to women risks conflicts in rela-

liberal politics of cuts and marketization, tion to gender and sector, but not so much in

which confronts welfare directly but offers relation to market position, since it is univer-

voters lower taxes (see Ross, 2000: 1518). salistic and inclusive; the market-based liberal

The key point is that any attempt to dismantle regime involves conflict between those who

the welfare state confronts entrenched inter- are strong or weak in the market, but is indif-

ests and will therefore provoke unpopularity, ferent to gender and labour market position,

so governments which wish to contain spend- and has a small state sector; the conservative

ing must act indirectly. Welfare systems corporatist regime generates conflict between

display path-dependency (Hall and Taylor, labour market insiders and outsiders and

1996; Immergut, 1998): all things being equal, also on lines of gender, but market and sector

current arrangements, by the very fact of their conflicts are secondary. The pattern is summa-

existence, inhibit change. They resist cutbacks, rized in Table 1, although since individual

but also run the risk of becoming increasingly welfare states do not conform exactly to a

inappropriate to new needs as they develop. particular regime type the role played by par-

This leads to a structured diversity in ticular cleavages in practice is likely to be a

response to similar pressures, since different matter of degree rather than of absolute dis-

welfare systems entrench different interests tinction.

and offer different degrees of openness to

emergent demands for provision and services.

The new politics approach thus identifies dif- Policy making and value-frameworks:

ferent social interests as relevant in the era of cultures of welfare

welfare retrenchment from those that domi-

nated expansion. As welfare systems grew, the Policy-making structures operate within cul-

basic conflicts were between those who tural frameworks which associate particular

believed they would have to pay and those values with state, market, occupational and

who believed they would be net gainers. Thus family welfare. Three core values are identi-

welfare politics was structured on class lines, fied as important in relation to European

Journal of European Social Policy 2001 11 (2)

Downloaded from http://esp.sagepub.com by cutare cutarescu on October 29, 2009

S U S TA I N I N G S TAT E W E L FA R E IN HARD TIMES 137

welfare traditions broadly corresponding to The expected contribution of worker-

Esping-Andersens three worlds (1990) citi- citizens in Nordic countries, the limits on

zenship, need and desert. The first implies a benefits in a context where welfare must not

value-commitment to state universalism at a conflict with the labour market in Anglo-

generous level, designed to promote an inte- Saxon countries and the work-linked sub-

grative social equality and summed up in the sidiarity of corporatist welfare ensure that

Swedish concept of state welfare as providing work legitimates entitlement everywhere. The

the peoples home. This approach is most importance of the family ethic varies, with

clearly expressed in Nordic welfare states. It corporatist Christian Democrat and

does not imply that generous support is avail- Mediterranean countries displaying more

able on request, but is linked to the belief that familism than universalist Nordic countries

social inclusion also implies a contribution to and with the Anglo-Saxon countries in an

society, typically through paid work. The intermediate position. The implication is that,

work line has become stronger in recent years of the two main policy directions in welfare

(Eitrheim and Kuhnle, 2000; Kosonen, 2000). state reform identified earlier, activation

The second approach is the contrary, the towards a more competitive and work-linked

liberal market ideology of welfare state mini- structure can find a ready correspondence

malism with the assumption that benefits will with welfare values across different types of

only be provided at subsistence level for those country. However, cost containment as a strat-

unable to survive in the market. The morality egy involves rather different issues in different

of independence from state welfare is strongly welfare states. In social democratic countries,

enforced. Such values are most clearly it may provoke concerns about the adequacy

expressed in the Anglo-Saxon model, found in of more meagre provision, in Christian

Europe in the Irish and UK systems. The Democrat countries where there are strong

approach reinforces a work ethic by a differ- associations between status and receipt it may

ent route, since work and private property are conflict with the expectations that groups

more legitimate bases for a claim on resources regard as legitimate. Only within the Anglo-

than need, and welfare must be organized to Saxon market ethos with its limited assump-

reinforce work incentives. tions about entitlement is it likely to gain an

The third value-orientation is associated accepted place on the agenda.

with the Catholic/Christian Democrat princi- This may go some way to explaining recent

ple of subsidiarity (Spicker, 1991). Needs policy developments: attempts to cut back

should be met at the appropriate level by the provision generally meet with more serious

appropriate agency, and sources of support (and usually effective) opposition than do

are conceived in a hierarchy of family, firm measures to activate benefits for unemployed

and state. The more distant institutions are people (Bonoli et al., 2000: Ch. 2). For

only appropriate when those closest to the example, the 1999 pension reform in

individual cannot meet needs. This principle Germany generated a major party controversy

influences the European Christian Democrat in the run-up to the 1998 election which

approach which links welfare to family and marked the end of the tradition of consensus

occupational systems in Germany, Italy, pension policy making, and was one of the

Switzerland and to some extent France and factors associated with the Kohl defeat. The

Spain (van Kersbergen, 1995). In practice, stricter requirements for availability for work

social insurance has become the most impor- in the 1993 Federal Assistance Act and the

tant system for meeting welfare needs, so that benefit cuts in the 1996 Unemployment

work and welfare are linked, again by a differ- Assistance Reform Act were opposed by social

ent route, since it is a work-based contribu- democrats, but provoked less controversy and

tion record that guarantees entitlement. the bulk of the shift towards workfare

Journal of European Social Policy 2001 11 (2)

Downloaded from http://esp.sagepub.com by cutare cutarescu on October 29, 2009

138 T AY L O R - G O O B Y

remains untouched. The Nordic countries racy that social attitudes are simply the sum

have overcome the crisis of the early 1990s of individual attitudes. Social psychological

with welfare state institutions and pro- theories indicate that the processes which

grammes largely intact (Kuhnle, 2000b: 225). produce collective attitudes are far more

The main change is the stricter imposition of complex than this implies. Second, there are

the work line (Eitrheim and Kuhnle, 2000: issues of technique. The pre-structured ques-

56). Only in the UK, with its distinctive elec- tions typically employed of necessity embody

toral system which gives exceptional power to a weak reflection of any individuals ideas. In

the party of government, do reforms in both particular they do not take into account

directions proceed. The New Labour reality as it faces policymakers (extra welfare

Government has made no move to reinstate involves extra spending); and citizens (policies

unemployment benefit (abolished under the are typically bundled together in party plat-

previous Government), but has instead estab- forms, so that individuals cannot make sepa-

lished a major workfare/trainfare programme. rate electoral judgements on each). Third,

At the same time the project of privatization while scholars may think in terms of an

of the bulk of pension provision (initiated abstract welfare state, most people have

under Thatcher) continues, with some modifi- separate and possibly inconsistent views on

cations to protect poorer groups. different services and benefits and on the

tax necessary to pay for them. The notion

of an attitude to the welfare state, as opposed

Values: the evidence of attitude to attitudes to pensions, unemployment

surveys insurance or assistance, itself requires investi-

gation.

In this paper we use the International Social

The accounts reviewed above in the three Survey Project (ISSP), a major multi-country

areas of welfare resilience, new politics and omnibus attitude survey with the advantage

underlying social values offer good opportuni- that modules are repeated at five-year inter-

ties for the investigation of social attitudes to vals. Analysis includes the 1996 module which

welfare. Are attitudes structured as the theo- was not available to the earlier, most fre-

ries of new politics and entrenched interests quently quoted studies (Evans, 1996; Ferrera,

imply? Do they endorse or contradict the 1993; Kaase and Newton, 1995; Papadakis

main themes in accounts of welfare state and Bean, 1993; Pettersen, 1995; Roller,

recalibration? 1995; Svallfors, 1997; Svallfors and Taylor-

Attitude survey data suffers from a number Gooby, 1999). The research focuses on

of shortcomings and is used here in the Germany, Sweden and the UK, chosen as

absence of other convenient ways of accessing examples of the value-frameworks discussed

what people in different European welfare earlier and because they have been used to

states think about the future of welfare. The represent Esping-Andersens influential regime

results from different studies in different types in Western Europe. Regimes are, of

national contexts and in the same country course, ideal types, intended to capture the

over time show consistent patterns rather than big picture (Esping Andersen, 1990: 2) and

random fluctuations. It is thus reasonable to not nations with specific histories. Welfare

assume that something which has a relation- provision in all three countries (as elsewhere

ship to social values is being measured (Evans, in Europe) received severe but different shocks

1996: 202). The chief problems lie in three during the period reviewed in Germany

areas. associated with the costs and pressures of

First, the logic of the method as it is typi- reunification, in Sweden with the economic

cally employed assumes summative democ- crisis and devaluation in 1992, and in the

Journal of European Social Policy 2001 11 (2)

Downloaded from http://esp.sagepub.com by cutare cutarescu on October 29, 2009

S U S TA I N I N G S TAT E W E L FA R E IN HARD TIMES 139

Table 2 Support for state welfare, 198596 (ISSP, %)

It is the states Germany Sweden UK

responsibility to provide: Definitely Probably Definitely Probably Definitely Probably

A decent standard of

living for the old

1985 56a 41 79 20

1990 62 37 79 20

1996 53 44 69 29 71 26

Health care for the sick

1985 54a 44 86 13

1990 64 36 85 15

1996 56 42 71 25 82 17

A decent standard of

living for the unemployed

1985 24a 62 45 41

1990 28 55 32 48

1996 24 60 52 38 28 49

And to reduce income

differences between rich

and poor

1985 26a 38 44 24

1990 29 40 42 32

1996 32 37 43 28 35 33

Note: a Former West Germany only.

UK from the crisis and effective devaluation care) is stronger than support for provision

consequent on exit from EMU in 1992. These for minorities such as unemployment benefits

and other factors influenced welfare debates. (whether because such benefits are less legiti-

Nonetheless, the broad framework of provi- mate, or because they command a weaker

sion remains representative of corporatist, constituency of self-interest). Support for

universal citizenship and liberal-leaning direct redistribution between better-off and

approaches respectively. This justifies the worse-off groups is also weaker. Third, there

examination of attitudes in these countries as are clear national variations Swedish social

a guide to welfare values in the range of West democracy and the liberal UK are much

European settings. keener on state provision than Germany.

Possibly, UK enthusiasm is a response to weak

provision and Germanys growing coolness

Resilience reflects the costs of reunification.

Table 2 gives the proportion who definitely

Attitude surveys have investigated two general support state provision in a range of areas

aspects of attitudes to welfare: attitudes to from 1985 (for Germany and the UK) to

state responsibility in the main areas of provi- 1996. The pattern contrasts with that of other

sion, and attitudes to redistribution. There is studies which typically aggregate the view that

considerable agreement across the main provision is definitely the states responsibility

studies on three points. First, there is general with the view that it is probably the states

support for the main areas of state provision. responsibility, to provide a combined measure

Second, support for areas of state provision of support (which may mask declining convic-

which most people use (pensions, health tion), and the study was of necessity carried

Journal of European Social Policy 2001 11 (2)

Downloaded from http://esp.sagepub.com by cutare cutarescu on October 29, 2009

140 T AY L O R - G O O B Y

out before the 1996 data became available. towards, rather than away from, support for

This leads to another point the more recent the welfare state.

surveys provide some indication of a greater Overall support for state welfare shows

hesitancy in support for state welfare. In most indications of a tendency to diminish in some

cases, the percentage stating that the service is areas, and social divisions play a role.

definitely the states responsibility has fallen However, the limited extent of the decline

between 1990 and 1996, with a correspon- does not correspond to the theories that

ding increase in the percentage describing it as directly challenge the claims about the

probably the states responsibility. resilience of the welfare state. If correct, they

This pattern of answers begins to cast some are not true yet. How do attitude surveys

doubt on theories that suggest welfare state relate to the more sophisticated new politics

resilience is rooted in public esteem, but does approach?

not provide sufficiently decisive evidence of a

shift to undermine them. The main welfare

state services still receive the support of sub- The new politics of welfare

stantial majorities. None of the theories that

directly challenge resilience deals with the The new politics perspective deals with

clear differences between countries and areas resistance to reform, and is in some ways the

of provision found in the evidence. There are converse of the traditional politics of welfare.

also some further difficulties. The most widely discussed approach identifies

The arguments about the significance of relevant groups in relation to state or private-

social divisions find some support, especially sector employment, gender and social class

in relation to attitudes to inequality and redis- interests and goes on to analyse the particular

tribution, but class divisions are not suffi- structures of interest division in particular

ciently strong to undermine overall support for regime types, discussed earlier in relation to

state welfare. The most thorough-going analy- Table 1. Table 3 provides a general overview

sis is by Svallfors (1997), who has developed of attitudes to the welfare state in the three

more accurately comparable class measures countries, covering the areas of state responsi-

than previous research and detects stronger bility for provision for pensioners (a service

class differences (see, for example, Roller, which most people might expect to use as part

1995: 2204). Both class and gender vari- of a normal life-course) and unemployed

ables have clear effects in all four countries. people (benefits which may apply to a minor-

Men and higher-level non-manuals are clearly ity) and also redistribution between rich and

less supportive of government redistribution poor (direct vertical rather than horizontal

than women and workers . The patterns, for redistribution). The table says nothing about

both class and non-class variables are very how state responsibility should be discharged

similar across nations (Svallfors, 1997: 293). or (beyond the reference to a decent standard

Papadakis and Bean produce similar findings of living) the level of provision or the degree

from an analysis which focuses on attitudes to of redistribution. As in the other regressions in

the areas of legitimate government responsi- the paper, the model reported is a best fit

bility and spending rather than redistribution: model, including the variables predicted by

class politics received the strongest support theory which show a significant relationship

(1993: 247). The social class divisions which to the dependent variable. The statistics are

Wilensky (1975: 11619) and Galbraith odds ratios, which allow the reader to

(1993: 1517) identify appear significant, and compare the extent to which members of the

divisions in relation to gender interests also group are more likely to have the characteris-

play a role. It is clear, however, that they do so tic of the dependent variable.

in a context where the overall direction is The most striking feature is the similarity

Journal of European Social Policy 2001 11 (2)

Downloaded from http://esp.sagepub.com by cutare cutarescu on October 29, 2009

S U S TA I N I N G S TAT E W E L FA R E IN HARD TIMES 141

Table 3 Support for state welfare (logistic regressions, odds ratios, best fit models, ISSP, 1996)

It should definitely be the governments responsibility to

(a) provide a decent standard of living for the old

Germany Sweden UK

Woman 1.28a 1.30b 1.29c

Older 1.37a 1.82a 1.45a

High income 0.64a 0.70a 0.65a

% correct predictions 55.9 66.3 69.5

Model chi squared 71.2a 36.8a 20.6a

(b) provide a decent standard of living for the unemployed

Germany Sweden UK

Full-time worker 0.67a 0.54a 0.54a

Woman 1.56a

High income 0.43a 0.57a 0.63a

% correct predictions 77.6 63.0 73.5

Model chi squared 90.0a 78.2a 29.1a

(c) reduce income differences between the rich and the poor

Germany Sweden UK

Govt employee 1.47a 0.72c

Full-time worker 0.68a

Woman 1.21b 1.37a

Older 1.36a 1.96a

Younger 0.60a

High income 0.42a 0.34a 0.28a

% correct predictions 69.9 63.9 67.8

Model chi squared 107.4a 112.3a 77.1a

Notes:

a Significant at 1% level.

b Significant at 5% level.

c Significant at 7% level.

rather than the differences between the coun- fits neatly with a simplified version of the pre-

tries. Gender, old age and income make a dif- dictions of regime theory. Most of the other

ference to attitudes to pensions and being a relationships correspond to a crude notion of

full-time worker and income (and in Sweden, traditional self-interest (higher income people

gender) to attitudes to benefits for unem- oppose state welfare, full-time workers do not

ployed people. While income is again signifi- support the unemployed, older women bear

cant in relation to redistribution, and age the impact of shortcomings in pension provi-

emerges in all the countries, there is some sion).

indication of national differences. Full-time Attitudes to the welfare state in general

employment is associated with opposition to reflect the broad social patterns identified by

redistribution in the UK, gender in Germany Papadakis and Bean and Svallfors rather than

and Sweden and government employment in regime differences. They do not fit the cleav-

Sweden and the UK. The combined role of ages posited by new politics theorists, but

gender and state employment in this case is rather follow the traditions of the old politics

the only aspect of the pattern of attitudes that of welfare based on the most general social

Journal of European Social Policy 2001 11 (2)

Downloaded from http://esp.sagepub.com by cutare cutarescu on October 29, 2009

142 T AY L O R - G O O B Y

Table 4 Support for cuts to help the economy and willingness to pay for better welfare (ISSP, 1996, %)

Germany Sweden UK

(a) Endorse spending cuts to help the economy 84 58 45

(b) Endorse tax cuts even though social services cut 44 44 22

% of those who endorse (a) who also endorse (b) 46 59 29

N 3470 1360 996

divisions. Of course, patterns of attitudes do tax and spending depend on the context in

not necessarily correspond to the capacity for which they are asked. A question in the

political mobilization. However, it is interest- section of the questionnaire that deals with

ing that government employees do not identify things the government might do for the

with state welfare more closely in Sweden, or economy asks if respondents are in favour of

those full time in the labour market in or oppose government spending cuts in

Germany. general. A separate question asked in the

Regime theory provides an account of sta- welfare section sets taxation directly against

bility rather than of the response to pressures welfare spending (If the government had a

for change. We go on to examine popular atti- choice between reducing taxes or spending

tudes to the policies currently developing to more on social services, which do you think it

meet the challenges to the welfare state. should do? We mean all taxes together includ-

ing wage deductions, income tax, taxes on

goods and services and all the rest). Both the

Value-frameworks: putting your money cost constraint and the activation agenda

where your mouth is versus having your pursue spending constraint on economic

cake and eating it grounds, but public opinion tends to favour

the welfare state for its own sake. When cuts

The discussion above identified three main are presented in an economic context, they

European value-frameworks, loosely corre- receive stronger support, particularly marked

sponding to the principal welfare regimes. The in Germany (Table 4). Willingness to support

different value-frameworks all leave an open service cuts is weak in the UK. There is a clear

door to activation reforms but differ in their inconsistency in the patterns of answers

response to cost constraint. We focus here on brought out in the third row of the table. Only

the latter issue. in Sweden do more than half of those who

Debates about welfare reform involve both endorse economic cuts also accept cuts in

the finance and the provision of services and services, and the proportion is less than a

benefits. Political discourse, the experience of quarter in the UK.

citizens and the questions asked in attitude The implication that patterns of attitudes

surveys all tend to divorce the two. However, may produce real difficulties for a government

endorsement of current patterns of welfare that seeks to marshal support for welfare

provision entails support for the taxes and retrenchment in order to aid the economy is

social contributions required to sustain them. strengthened when attitudes to financing and

Given that demographic shifts and higher receiving particular welfare state services are

unemployment (let alone the service improve- examined. Table 5 gives a cross-tabulation of

ments needed to match the improving per- support for more spending on a particular

formance of the private sector) will involve service and support for lower taxes rather

more spending, the question arises of who is than more state spending. Substantial

willing to pay to maintain welfare standards. numbers want lower taxes and more expen-

Responses to questions about attitudes to sive services an individually rational but

Journal of European Social Policy 2001 11 (2)

Downloaded from http://esp.sagepub.com by cutare cutarescu on October 29, 2009

S U S TA I N I N G S TAT E W E L FA R E IN HARD TIMES 143

Table 5 Contradictory attitudes: those who want more spent on a particular service who also state a

preference for reductions in tax and contributions to more social spending (1996, %)

Germany Sweden UK

Health 53 51 27

Education 54 52 25

Pensions 54 51 25

Unemployment benefits 45 45 15

collectively impractical approach in As with support for welfare as a state

Germany and Sweden, and rather fewer in the responsibility (see Table 3), income and age

UK, where support for increased spending play a strong role in support for cuts across

rather than tax cuts is stronger. countries and in both tables. Other factors

The extent to which different groups of vary. In Germany, support for cuts to help the

voters will endorse or reject social spending economy is associated with full-time worker

cuts is central to the success of the cost con- status, and opposition to social service cuts

straint policies discussed earlier. We examined with government employment and gender. In

patterns of support for cuts to help the Sweden, support in the first area with full-

economy and as a policy choice through logis- time worker status and not being a state-

tic regressions (Tables 6 and 7). sector worker, and in the second with gender.

Table 6 Support for state spending cuts to help the economy (logistic regressions)

Germany Sweden UK

Govt employee 0.62a

Full-time worker 1.30b 1.31b

Older 1.36b

Younger 0.75a

High income 1.33a

Low income 1.50b

% correct predictions 83.4 57.2b 59.0

Model chi squared 10.0b 28.8b 13.0b

Notes:

a Significant at 5% level.

b Significant at 1% level.

Table 7 Reduce tax even if it means social service cuts (logistic regressions)

Germany Sweden UK

Govt employee 0.63b

Full-time worker 1.22b

Woman 0.83a 0.72b

Younger 0.86a 1.23c 1.77b

High income 1.77b 1.70b

Low income 0.68a

% correct predictions 58.4 58.0 78.1

Model chi squared 78.5b 27.7b 18.63b

Notes:

a Significant at the 1% level.

b Significant at the 5% level.

c Significant at 8% level.

Journal of European Social Policy 2001 11 (2)

Downloaded from http://esp.sagepub.com by cutare cutarescu on October 29, 2009

144 T AY L O R - G O O B Y

Table 8 Views on whether tax levels on members of different income groups are too low or too high

by those on low and high incomes (ISSP, 1996, %)

Germany Sweden UK

Quartiles Bottom Top Bottom Top Bottom Top

Tax on high income

Too high 12 16 12 36 23 20

Too low 64 58 67 46 46 41

N 784 647 236 293 169 203

Tax on middle income

Too high 49 50 40 53 36 31

Too low 5 3 6 1 11 9

N 799 667 234 296 176 207

Tax on low income

Too high 88 79 84 70 85 63

Too low 0 1 2 1 2 1

N 830 665 239 290 176 206

Total tax receipts % GDP 38 52 36

Highest income tax rate % 56 60 40

Source: Rows 15, 16 (OECD, 2000: 38).

Only in the UK are the same significant rela- that produces a more consistent pattern of

tionships found in both areas, with age and answers. The way issues are presented in ques-

income. However, the directions of the rela- tionnaires and also, presumably, in political

tionships differ. In Germany there is a signifi- debate exerts a strong influence on the way

cant relationship between older age and people understand and respond to them.

support for cuts for the economy, and also However, there is some consistency in the

between youth and willingness to see taxes factors associated with support for cuts and

and services cut. In the UK, the association is those linked to support for state welfare.

between youth and opposition to economic The contradiction between simultaneous

cuts, but endorsement of social service cuts, calls for more welfare spending on a particu-

while low income is linked to support for eco- lar service and for cuts in all forms of taxation

nomic cuts but opposition to service cuts. and social contributions at the cost of lower

These findings indicate that patterns of atti- social spending in general raises the question

tudes in relation to the issues closest to of where people think the extra money will

current policy directions are complex and come from. One indication of possible sources

likely to be affected by national political of finance for additional welfare spending lies

issues. In Germany, older people may be most in views on where the tax burden lies heaviest.

concerned about the economy, while younger Table 8 gives a cross-tabulation of such views

people may feel that they bear the brunt of the by income group. It shows that there is strong

tax burden associated with reunification. In agreement that tax on low-income people is

the UK, younger people may see themselves as too high and on high-income people too low

net contributors to rather than beneficiaries in all three welfare states (although in Sweden,

from social services, while those on low where taxes are highest, there is a noticeable

incomes may feel that they would benefit from group among the better-off who think their

a stronger economy, but lose out from service own group pays too much tax). Tax on

cuts. The experience of cuts under the 1991 middle-income people is seen as too high by

bourgeois and 1994 social democrat-led coali- sizeable groups in Germany and Sweden, but

tion in Sweden may have generated a debate by a smaller group in the UK. This indicates

Journal of European Social Policy 2001 11 (2)

Downloaded from http://esp.sagepub.com by cutare cutarescu on October 29, 2009

S U S TA I N I N G S TAT E W E L FA R E IN HARD TIMES 145

that it is going to be difficult to achieve a and horizontal redistribution attract more

political consensus on financing the extra support than vertical redistribution. This is

costs of state welfare through higher taxes or entirely consonant with the postwar politics of

contributions from lower or middle-income welfare state expansion. There is now some

people (with the possible exception of the UK, evidence that support is in decline. However,

which has a smaller welfare state and lower the structure of attitudes does not conform to

taxes than the other two countries). the regime-based patterns of group conflicts

There is considerable agreement across the most frequently identified in the new politics

income scale that taxes at the top are too low of welfare. Rather the clearest divisions lie

in Germany and a measure of agreement in between liberal Anglo-Saxon and other

Sweden, although also indications that the top systems, and follow the traditional divisions

quartile themselves resist the idea. In the UK of class, age and gender interests, cross-cutting

there is little difference between better and national differences in regime.

worse-off in their views, but just under half When attention turns from statements of

think taxes at the top too low while about a approval of state responsibilities and policies

fifth think them too high. In short, when it to the finance of welfare provision, difficulties

comes to paying for a more expensive welfare emerge. It is simply not clear which social

system, the pattern of divisions about state groups are willing to pay for the services they

welfare is rather different from that displayed endorse. The real problems of reform may be

in regime analysis: it is the corporatist regime rather more similar between regimes than

that reveals most consensus, while the social theory predicts and may lie in getting voters to

democratic regime displays the possibility of accept either tax and contribution increases or

conflict and the liberal one that of inertia. to acquiesce in retrenchment as much as in the

However, in none of the countries is it obvious defeat of particular interest groups in conflicts

where support for extra spending is under- over welfare spending constraint. One impli-

pinned by an obvious willingness to pay the cation is that the agenda of welfare state acti-

cost. This returns us to the agenda of vation may be everywhere easier to advance

retrenchment, where endorsement is highly than the agenda of cost containment, and this

sensitive to the way policies are presented. may be the future direction of policy.

The data on attitudes to tax and spending

calls into question the link that is often drawn

between support for state welfare and the Acknowledgements

resilience of the welfare state. Most people

favour the main state services. Majorities in

some countries are prepared to endorse spend- The author gratefully acknowledges the

ing cuts when these are presented as helpful to support of the ESRC in funding this research

the economy, but sizeable groups are also keen under grant R000222914; and of the ZUMA

on higher taxes for more welfare spending in Archive at Cologne in making the ISSP data

principle. Which groups will volunteer to pay available at short notice.

the taxes to support the maintenance of those

services is much less clear.

Appendix: variables used in the

regressions

Conclusion

Independent variables (reference 0)

Women: Female gender 1;

Public opinion everywhere has traditionally Low income: in bottom quartile of equivalized

endorsed the welfare state. Mass provision family income distribution 1;

Journal of European Social Policy 2001 11 (2)

Downloaded from http://esp.sagepub.com by cutare cutarescu on October 29, 2009

146 T AY L O R - G O O B Y

High income: in top quartile of equivalized family Freeman, R. and Moran, M. (2000) Reforming

income distribution 1; health care in Europe, West European Politics,

Younger: in bottom third of age distribution 1; 23 (2): 3558.

Older: in top third of age distribution 1; Galbraith, J. (1993) The Culture of Contentment.

Government employee: government employee 1 London: Penguin.

(does not include nationalized industry workers); Giddens, A. (1994) Beyond Left and Right.

Full-time worker: works 35 hours + (UK 30 hours Cambridge: Polity Press.

+) in main job 1. Giddens, A. (2000) The Third Way and its Critics.

Cambridge: Polity Press.

Goul Anderson, J. (2000) The welfare state crisis

and beyond, in S. Kuhnle (ed.) The Survival of

References the European Welfare State. London: Routledge.

Hall, P. and Taylor, R. (1996) Political Science and

the Three New Institutionalisms, Political

Alber, J. and Standing, G. (2000) Social Dumping, Studies 44 (5): 93657.

Catch-up or Convergence? Europe in a Com- Immergut, E. (1998) The Theoretical Core of the

parative Global Context, Journal of European New Institutionalism, Politics and Society 26 (1):

Social Policy 10 (2): 99119. 534.

Baldwin, P. (1990) The Politics of Social Solidarity, Inglehart, R. (1997) Modernisation and

Class Bases of the European Welfare State, Postmodernization, Cultural, Economic, and

18751975. Cambridge: Cambridge University Political Change in 43 Societies. Princeton, NJ:

Press. Princeton University Press.

Beck, U., Giddens, A. and Lash, S. (1994) Reflexive Jessop, B. (2000), The Future of the Welfare State.

Modernisation. Cambridge Polity Press. Cambridge: Polity Press.

Beck, W., van der Maesen, L. and Walker, A. (1998) Kaase, M. and Newton, K. (1995) Beliefs in

The Social Quality of Europe. Bristol: Policy Press. Government. Oxford: Oxford University Press.

Bonoli, G., George, V. and Taylor-Gooby, P. (2000) Kosonen, P. (2000) Activation, Incentives and

European Welfare Futures. Cambridge: Polity Workfare in Nordic Welfare States, in MIRE

Press. (ed.) Comparing Social Welfare Systems in

Commission of the European Community (CEC) Nordic Europe and France. Paris: MSH Ange-

(1998) Social Protection in Europe, 1997, DGV. Guilpin.

Luxembourg: Office for the Official Publications Kuhnle, S. (ed) (2000a) The Survival of the

of the European Communities. European Welfare State. London: Routledge.

Daly, M. (1997) Welfare States under Pressure: Kuhnle, S. (2000b) The Scandinavian welfare state

Cash Benefits in European Welfare States over in the 1990s, West European Politics, 23 (2):

the Last Ten Years, Journal of European Social 20928.

Policy 7 (2): 12946. Merrien, F.X. and Bonoli, G. (2000) Implementing

Eitrheim, P. and Kuhnle, S. (2000) Nordic Welfare major welfare state reform a comparison of

States in the 1990s, in S. Kuhnle (ed.) Survival of France and Switzerland, in S. Kuhnle (ed.) The

the European Welfare State. London: Routledge. Survival of the European Welfare State. London:

Esping-Andersen, G. (1990) Three Worlds of Routledge.

Welfare Capitalism. Cambridge: Polity Press. OECD (2000) OECD in Figures at

Esping-Andersen, G. (ed.) (1996) Welfare States in http://www.oecd.org/publications/figures/

Transition. National Adaptations in Global Palier, B. (2000) Defrosting the French Welfare

Economies. London: Sage. State, West European Politics, 23 (2): 11336.

Esping-Andersen, G. (1999) The Social Foundations Papadakis, E. and Bean, C. (1993) Popular Support

of Post-industrial Economies. Oxford: Oxford for the Welfare State, Journal of Public Policy 13

University Press. (3): 22754.

Evans, G. (1996) Cross-national Differences in Pettersen, P. (1995) The Welfare State: the Security

Support for Welfare and Redistribution, in Dimension, in O. Borre and E. Scarborough

B. Taylor and K. Thomson (eds) Understanding (eds) The Scope of Government. Oxford: Oxford

Change in Social Attitudes. Aldershot: CREST/ University Press.

Dartmouth. Pierson, P. (1994) Dismantling the Welfare State?

Ferrera, M. (1993) EC Citizens and Social Reagan, Thatcher and the Politics of Retrench-

Protection. CEC Brussels, VE2. ment. Cambridge: Cambridge University Press.

Ferrera, M. and Rhodes, M. (2000) Recasting Pierson, P. (1996) The Politics of the New Welfare

European Welfare States, West European Politics State, World Politics 48 (2): 14379.

23 (2): 110. Rhodes, M. (1996) Globalisation and West

Journal of European Social Policy 2001 11 (2)

Downloaded from http://esp.sagepub.com by cutare cutarescu on October 29, 2009

S U S TA I N I N G S TAT E W E L FA R E IN HARD TIMES 147

European Welfare States, Journal of European Svallfors, S. (1997) Worlds of Welfare and

Social Policy 6 (4): 30427. Attitudes to Distribution: a Comparison of Eight

Roller, E. (1995) The Welfare State: the Equality Western Nations, European Sociological Review

Dimension, in O. Borre and E. Scarborough 13 (3): 283304.

(eds) The Scope of Government. Oxford: Oxford Svallfors, S. and Taylor-Gooby, P. (eds) (1999) The

University Press. End of the Welfare State? London: Routledge.

Ross, F. (2000) Interest and Choice in the Not van Kersbergen, K. (1995) Social Capitalism. A

Quite so New Politics of Welfare, West Euro- Study of Christian Democracy and the Welfare

pean Politics 23 (2): 1134. State. London: Routledge.

Scharpf, F. (1999) The Viability of Advanced van Kersbergen, K. (2000) The declining resistance

Welfare State in the International Economy: of the welfare state to change, in S. Kuhnle (ed.)

Vulnerabilities and Options, Working Paper No. The Survival of the European Welfare State.

99/9. Max Planck Institute for the Study of London: Routledge.

Societies. Wilensky, H. (1975) The Welfare State and

Spicker, P. (1991) The Principle of Subsidiarity and Equality: Structural and Ideological Roots of

the Social Policy of the European Community, Public Expenditures. Berkeley: University of

Journal of European Social Policy 1 (1): 314. California Press.

Journal of European Social Policy 2001 11 (2)

Downloaded from http://esp.sagepub.com by cutare cutarescu on October 29, 2009

Вам также может понравиться

- Wood GoughДокумент14 страницWood GoughMatias ValenzuelaОценок пока нет

- The Economics of Enough: How to Run the Economy as If the Future MattersОт EverandThe Economics of Enough: How to Run the Economy as If the Future MattersОценок пока нет

- Cambridge University Press World Politics: This Content Downloaded From 200.89.140.130 On Tue, 29 May 2018 13:49:27 UTCДокумент33 страницыCambridge University Press World Politics: This Content Downloaded From 200.89.140.130 On Tue, 29 May 2018 13:49:27 UTCValentina GómezОценок пока нет

- Why Do Welfare States Persist - Clem Brooks, Jeff ManzaДокумент2 страницыWhy Do Welfare States Persist - Clem Brooks, Jeff Manzaiulia_dumitruОценок пока нет

- Brooks ISQДокумент22 страницыBrooks ISQClaudiu_1105Оценок пока нет

- Social Capital and The Impact of The Recent Economic Crisis: Comparing The Effects of Economic and Fiscal Policy DevelopmentsДокумент19 страницSocial Capital and The Impact of The Recent Economic Crisis: Comparing The Effects of Economic and Fiscal Policy DevelopmentsBAYU KHARISMAОценок пока нет

- Welfare - Joseph Stiglitz - FINAL PDFДокумент31 страницаWelfare - Joseph Stiglitz - FINAL PDFRoosevelt InstituteОценок пока нет

- The Welfare State A Glossary For Public HealthДокумент14 страницThe Welfare State A Glossary For Public HealthPs ParedeОценок пока нет

- Restructuring Welfare StatesДокумент38 страницRestructuring Welfare StatesPedro DiasОценок пока нет

- Health systems investment promotes economic growthДокумент4 страницыHealth systems investment promotes economic growthGsar Gsar GsarОценок пока нет

- Distribution Led GrowthДокумент27 страницDistribution Led GrowthAdarsh Kumar GuptaОценок пока нет

- Copia de (Draft) FinalpaperДокумент16 страницCopia de (Draft) FinalpaperAlex PmОценок пока нет

- The Evolution of Thinking About Poverty: Exploring the InteractionsДокумент41 страницаThe Evolution of Thinking About Poverty: Exploring the InteractionsShoaib Shaikh100% (1)

- Monetary CircuitДокумент12 страницMonetary CircuitiarrasyiОценок пока нет

- Poverty Inequality and Social Policy in Transition Economies MILLANOVICДокумент65 страницPoverty Inequality and Social Policy in Transition Economies MILLANOVICstavroula14Оценок пока нет

- Chapter 11Документ10 страницChapter 11I change my name For no reasonОценок пока нет

- Gough 2010 Economic Crisis Climate Change and The Future of Welfare StatesДокумент15 страницGough 2010 Economic Crisis Climate Change and The Future of Welfare StatesC EstherОценок пока нет

- Policy Persistence: Tain Farm Subsidies, Then It Would PresumablyДокумент10 страницPolicy Persistence: Tain Farm Subsidies, Then It Would PresumablyFelipe RomeroОценок пока нет

- Baumol, W.J.and Bowen, W.G. - 1966-Performing Arts The Economic Dilemma. NewДокумент25 страницBaumol, W.J.and Bowen, W.G. - 1966-Performing Arts The Economic Dilemma. NewUros Bacic UnsОценок пока нет

- In The European Union: Catholic ChurchДокумент10 страницIn The European Union: Catholic ChurchJesús BastanteОценок пока нет

- Political, Economic and Social Rationale of Welfare and Social Security A Comparative Analysis of Malaysia and ChinaДокумент29 страницPolitical, Economic and Social Rationale of Welfare and Social Security A Comparative Analysis of Malaysia and ChinavolatilevortecsОценок пока нет

- Rethinking Economic Models for Sustainability and StabilityДокумент3 страницыRethinking Economic Models for Sustainability and StabilityMary Jane Santin GanzalinoОценок пока нет

- Block 1Документ59 страницBlock 1Jeshin SomanОценок пока нет

- An Essay on the Dynamics of Welfare State ArrangementsДокумент32 страницыAn Essay on the Dynamics of Welfare State ArrangementsPuissant Manamon BayangОценок пока нет

- Crisis and Transition of NGOs in Europe - Petropoulos & Valvis - FinalДокумент35 страницCrisis and Transition of NGOs in Europe - Petropoulos & Valvis - FinaluhghjghОценок пока нет

- Building A Sustainable Welfare StateДокумент27 страницBuilding A Sustainable Welfare Statemarcmyomyint1663Оценок пока нет

- PHRP3322309 1Документ6 страницPHRP3322309 1ScotОценок пока нет

- 5.3.3 Social Capital: Capital Allows Individuals To Work Effectively Within The Distinct Groups That Make Up Society (EgДокумент5 страниц5.3.3 Social Capital: Capital Allows Individuals To Work Effectively Within The Distinct Groups That Make Up Society (Egabdulaziz.issa8Оценок пока нет

- Hacker 2004 CДокумент18 страницHacker 2004 CAlex PriuliОценок пока нет

- Competition and Circulation of Economic ElitesДокумент11 страницCompetition and Circulation of Economic ElitesXimena CastroОценок пока нет

- Article On Effects of Public ExpenditureДокумент11 страницArticle On Effects of Public Expendituretanmoydebnath474Оценок пока нет

- Classifying Welfare StatesДокумент22 страницыClassifying Welfare StatesAyesha CarmoucheОценок пока нет

- Lucas 2003Документ14 страницLucas 2003LucianaОценок пока нет

- Sustanable DevelopmentДокумент10 страницSustanable Developmentsushant dawaneОценок пока нет

- Crises, Movements and CommonsДокумент22 страницыCrises, Movements and CommonsschizophonixОценок пока нет

- Ab0cd: Social Capital in Transition: A First Look at The EvidenceДокумент31 страницаAb0cd: Social Capital in Transition: A First Look at The Evidenceakita1610Оценок пока нет

- Persson Is InequalityДокумент48 страницPersson Is InequalityMafeAcevedoОценок пока нет

- Europe's Welfare RetrenchmentДокумент33 страницыEurope's Welfare RetrenchmentPopa IrinaОценок пока нет

- By William Easterly: Working Paper Number 94 August 2006Документ34 страницыBy William Easterly: Working Paper Number 94 August 2006Mohan Kumar SinghОценок пока нет

- Great Recession, Great Regression? The Welfare State in The Twenty-First CenturyДокумент44 страницыGreat Recession, Great Regression? The Welfare State in The Twenty-First Centurycarapalida01Оценок пока нет

- Hacker - Review Article - Dismantling The Health Care State - Political Institutions, Public Policies and The Comparative Politics of Health ReformДокумент32 страницыHacker - Review Article - Dismantling The Health Care State - Political Institutions, Public Policies and The Comparative Politics of Health ReformflfogliatoОценок пока нет

- Complexity Bardar What Is DevelopmentДокумент18 страницComplexity Bardar What Is DevelopmentBanat TemesvarОценок пока нет

- Are The Western Welfare States Still Competitive?: Pfaller, AlfredДокумент9 страницAre The Western Welfare States Still Competitive?: Pfaller, Alfredmuhammadzaidjanjua426Оценок пока нет

- Inequality and Growth-Theory and Policy Implications-Theo S. Eicher, Stephen J. TurnovskyДокумент342 страницыInequality and Growth-Theory and Policy Implications-Theo S. Eicher, Stephen J. TurnovskyMahin Alam100% (1)

- 16 - Korpi Palme Paradox Redistribution 1998 ASRДокумент28 страниц16 - Korpi Palme Paradox Redistribution 1998 ASRCorrado BisottoОценок пока нет

- The Environmental Paradox of The Welfare State The Dynamics of SustainabilityДокумент20 страницThe Environmental Paradox of The Welfare State The Dynamics of SustainabilityD. Silva EscobarОценок пока нет

- 997 Jenson Rev 03-03-06Документ33 страницы997 Jenson Rev 03-03-06MonicaОценок пока нет

- Retreating State? Political Economy of Welfare Regime Change in TurkeyДокумент34 страницыRetreating State? Political Economy of Welfare Regime Change in TurkeyMuhammed DönmezОценок пока нет

- Morel Palme-Financing The Welfare stateFINALДокумент16 страницMorel Palme-Financing The Welfare stateFINALTrsjofkОценок пока нет

- Does Culture Affect Economic OutcomesДокумент100 страницDoes Culture Affect Economic OutcomesCleber DiasОценок пока нет

- Does Culture Affect Economic Outcomes? - L. Guiso, P. Sapienza L. ZingalesДокумент79 страницDoes Culture Affect Economic Outcomes? - L. Guiso, P. Sapienza L. ZingalesLudwigОценок пока нет

- DassdwgeerhfgshsthsДокумент9 страницDassdwgeerhfgshsthsStas StincaОценок пока нет

- Book Review: Journal of Development Economics Vol. 67 (2002) 485 - 490Документ6 страницBook Review: Journal of Development Economics Vol. 67 (2002) 485 - 490J0hnny23Оценок пока нет

- Institutional Quality and Poverty Measures in A Cross-Section of CountriesДокумент13 страницInstitutional Quality and Poverty Measures in A Cross-Section of CountriesSyed Aal-e RazaОценок пока нет

- Lesson 2 - Defining of Development Economics (First Part)Документ16 страницLesson 2 - Defining of Development Economics (First Part)Rose RaboОценок пока нет

- Participation and Development: Perspectives From The Comprehensive Development ParadigmДокумент20 страницParticipation and Development: Perspectives From The Comprehensive Development ParadigmEnrique SilvaОценок пока нет

- Robert Lucas JR - Macroeconomic PrioritiesДокумент24 страницыRobert Lucas JR - Macroeconomic PrioritiesDouglas Fabrízzio CamargoОценок пока нет

- Who Gets What? Overcoming Barriers to Equitable RedistributionДокумент2 страницыWho Gets What? Overcoming Barriers to Equitable RedistributionSTEPHEN NEIL CASTAÑOОценок пока нет

- Historical Back Ground of Social PolicyДокумент6 страницHistorical Back Ground of Social PolicyGuyo DimaОценок пока нет

- Whiteheadcomorbid10 2 PDFДокумент52 страницыWhiteheadcomorbid10 2 PDFAnonymous E2REcA25cОценок пока нет

- Report On The Implementation of The European Security Strategy 2008Документ12 страницReport On The Implementation of The European Security Strategy 2008neoconsОценок пока нет

- Various - The National Security Strategy of The UKДокумент64 страницыVarious - The National Security Strategy of The UKirina8082Оценок пока нет

- Anglia Si AnglitoiuДокумент9 страницAnglia Si Anglitoiuirina8082Оценок пока нет

- John L. Clarke - Europe's Military and Security ForcesДокумент64 страницыJohn L. Clarke - Europe's Military and Security Forcesirina8082Оценок пока нет

- Dossier de Presse LBlanc DSN en AnglaisДокумент48 страницDossier de Presse LBlanc DSN en AnglaisThinkDefenceОценок пока нет

- Egyptian MythologyДокумент77 страницEgyptian Mythologyirina8082Оценок пока нет

- Whiteheadcomorbid10 2 PDFДокумент52 страницыWhiteheadcomorbid10 2 PDFAnonymous E2REcA25cОценок пока нет

- BookieДокумент43 страницыBookieirina8082Оценок пока нет

- Conservative FeminismДокумент26 страницConservative Feminismirina8082Оценок пока нет

- Maurice Nicoll The Mark PDFДокумент4 страницыMaurice Nicoll The Mark PDFErwin KroonОценок пока нет

- Maurice Nicoll The Mark PDFДокумент4 страницыMaurice Nicoll The Mark PDFErwin KroonОценок пока нет

- Stress and CrisisДокумент5 страницStress and CrisisZechariah NicholasОценок пока нет

- Intro To SK PlanningДокумент62 страницыIntro To SK PlanningLindsey Marie100% (1)

- Group 4 Chapter 1 3 NewДокумент50 страницGroup 4 Chapter 1 3 NewIan Kenneth LimОценок пока нет

- Costs and Consequences PDF Wdf88910Документ148 страницCosts and Consequences PDF Wdf88910Yaqueline Calloapaza ChallcoОценок пока нет

- The Road to ResilienceДокумент7 страницThe Road to ResiliencedoinagamanОценок пока нет

- Improving Team Relationships Using An Emotional Intelligence LensДокумент4 страницыImproving Team Relationships Using An Emotional Intelligence LensAnonymous I6S5wbОценок пока нет

- SSM201 SourceДокумент146 страницSSM201 SourcePhuoc Hien NguyenОценок пока нет

- Call For Papers - SPGC Summit 2024 - Amalfi Coast - May 15-17Документ8 страницCall For Papers - SPGC Summit 2024 - Amalfi Coast - May 15-17MariuAguilarОценок пока нет

- Motivation in Today's WorkplaceДокумент10 страницMotivation in Today's WorkplaceRatnadeep MitraОценок пока нет

- 2023 2026 Calgary Police Budget 1Документ5 страниц2023 2026 Calgary Police Budget 1Darren KrauseОценок пока нет

- AI Research ProposalДокумент8 страницAI Research ProposalFatima AfzalОценок пока нет

- 2 Module For GEH 111Документ23 страницы2 Module For GEH 111Danilo Jr Oribello Navaja100% (2)

- Rutter 1985 ResilienceДокумент15 страницRutter 1985 ResilienceLandoGuillénChávezОценок пока нет

- Goby-Shrimp Mutualism Costs and BenefitsДокумент20 страницGoby-Shrimp Mutualism Costs and BenefitsKhandoker Raisul AzadОценок пока нет

- KPIs Per BEDP PillarДокумент94 страницыKPIs Per BEDP PillarEmily D. MontecilloОценок пока нет

- Work Immersion Performance AppraisalДокумент5 страницWork Immersion Performance AppraisalRecy Beth EscopelОценок пока нет

- ACT Tessera Review PackageДокумент46 страницACT Tessera Review PackageNataly LostaunauОценок пока нет

- Powerpoint Employment Focused Mental Health and Wellbeing GuidanceДокумент68 страницPowerpoint Employment Focused Mental Health and Wellbeing GuidanceHafizuddin RazidОценок пока нет

- Manual Emdr Parts Work Treating Complex TraumaДокумент73 страницыManual Emdr Parts Work Treating Complex Traumacora4eva5699100% (1)

- The Life After Teenage Pregnancy - Research PaperДокумент40 страницThe Life After Teenage Pregnancy - Research PaperJolly Tapawan0% (1)

- NARRATIVE REPORT Community Resilience and Sustainable Development Advocates of The PhilippinesДокумент8 страницNARRATIVE REPORT Community Resilience and Sustainable Development Advocates of The PhilippinesJan Dominic D. CorpuzОценок пока нет

- USAID: Title II and How It WorksДокумент31 страницаUSAID: Title II and How It WorksPetr BoháčekОценок пока нет

- Coulter, 2014 Strength-Based For Trauma YoungstersДокумент18 страницCoulter, 2014 Strength-Based For Trauma YoungstersLorena LeylerОценок пока нет

- Mcgill PT Essential SkillsДокумент3 страницыMcgill PT Essential SkillsMarko MarkovicОценок пока нет

- From Poverty To PowerДокумент26 страницFrom Poverty To PowerTheIndio75% (4)

- NICABM LindaGraham Brain2014Документ21 страницаNICABM LindaGraham Brain2014acehussainОценок пока нет

- Research Plan ProposalДокумент11 страницResearch Plan ProposalsweetiramОценок пока нет

- Abstract Book of 1ST International and 3RD Indian Psychological Science Congress Held On 24-25, February, 2014 at Chandigarh - IndiaДокумент264 страницыAbstract Book of 1ST International and 3RD Indian Psychological Science Congress Held On 24-25, February, 2014 at Chandigarh - IndiaRosHanLalОценок пока нет

- Resilience in AgingДокумент23 страницыResilience in AgingAna Flavia CondeОценок пока нет

- RQ TEST - Supplemental For Session 1Документ2 страницыRQ TEST - Supplemental For Session 1Bello NelsonОценок пока нет

- When Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfОт EverandWhen Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfРейтинг: 5 из 5 звезд5/5 (36)

- Workin' Our Way Home: The Incredible True Story of a Homeless Ex-Con and a Grieving Millionaire Thrown Together to Save Each OtherОт EverandWorkin' Our Way Home: The Incredible True Story of a Homeless Ex-Con and a Grieving Millionaire Thrown Together to Save Each OtherОценок пока нет

- The Great Displacement: Climate Change and the Next American MigrationОт EverandThe Great Displacement: Climate Change and the Next American MigrationРейтинг: 4.5 из 5 звезд4.5/5 (32)

- Hillbilly Elegy: A Memoir of a Family and Culture in CrisisОт EverandHillbilly Elegy: A Memoir of a Family and Culture in CrisisРейтинг: 4 из 5 звезд4/5 (4276)

- Nickel and Dimed: On (Not) Getting By in AmericaОт EverandNickel and Dimed: On (Not) Getting By in AmericaРейтинг: 4 из 5 звезд4/5 (186)

- High-Risers: Cabrini-Green and the Fate of American Public HousingОт EverandHigh-Risers: Cabrini-Green and the Fate of American Public HousingОценок пока нет

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyОт EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyРейтинг: 4.5 из 5 звезд4.5/5 (263)

- Heartland: A Memoir of Working Hard and Being Broke in the Richest Country on EarthОт EverandHeartland: A Memoir of Working Hard and Being Broke in the Richest Country on EarthРейтинг: 4 из 5 звезд4/5 (269)

- Fucked at Birth: Recalibrating the American Dream for the 2020sОт EverandFucked at Birth: Recalibrating the American Dream for the 2020sРейтинг: 4 из 5 звезд4/5 (173)

- Not a Crime to Be Poor: The Criminalization of Poverty in AmericaОт EverandNot a Crime to Be Poor: The Criminalization of Poverty in AmericaРейтинг: 4.5 из 5 звезд4.5/5 (37)

- The Injustice of Place: Uncovering the Legacy of Poverty in AmericaОт EverandThe Injustice of Place: Uncovering the Legacy of Poverty in AmericaРейтинг: 4.5 из 5 звезд4.5/5 (2)

- Charity Detox: What Charity Would Look Like If We Cared About ResultsОт EverandCharity Detox: What Charity Would Look Like If We Cared About ResultsРейтинг: 4 из 5 звезд4/5 (9)

- The Great Displacement: Climate Change and the Next American MigrationОт EverandThe Great Displacement: Climate Change and the Next American MigrationРейтинг: 4 из 5 звезд4/5 (19)

- When Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfОт EverandWhen Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfРейтинг: 4 из 5 звезд4/5 (126)

- The Mole People: Life in the Tunnels Beneath New York CityОт EverandThe Mole People: Life in the Tunnels Beneath New York CityРейтинг: 3.5 из 5 звезд3.5/5 (190)

- Alienated America: Why Some Places Thrive While Others CollapseОт EverandAlienated America: Why Some Places Thrive While Others CollapseРейтинг: 4 из 5 звезд4/5 (35)

- The Meth Lunches: Food and Longing in an American CityОт EverandThe Meth Lunches: Food and Longing in an American CityРейтинг: 5 из 5 звезд5/5 (5)

- Heartland: A Memoir of Working Hard and Being Broke in the Richest Country on EarthОт EverandHeartland: A Memoir of Working Hard and Being Broke in the Richest Country on EarthРейтинг: 4 из 5 звезд4/5 (188)

- Sons, Daughters, and Sidewalk Psychotics: Mental Illness and Homelessness in Los AngelesОт EverandSons, Daughters, and Sidewalk Psychotics: Mental Illness and Homelessness in Los AngelesОценок пока нет

- Downeast: Five Maine Girls and the Unseen Story of Rural AmericaОт EverandDowneast: Five Maine Girls and the Unseen Story of Rural AmericaРейтинг: 4 из 5 звезд4/5 (21)