Академический Документы

Профессиональный Документы

Культура Документы

Buffett's Asset Allocation Advice

Загружено:

ClaudeИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Buffett's Asset Allocation Advice

Загружено:

ClaudeАвторское право:

Доступные форматы

Buffetts Asset Allocation

Advice: Take It with a Twist

JAVIER ESTRADA

It is illegal to make unauthorized copies of this article, forward to an unauthorized user or to post electronically without Publisher permission.

The Journal of Wealth Management 2016.18.4:59-64. Downloaded from www.iijournals.com by NEW YORK UNIVERSITY on 03/04/16.

R

JAVIER ESTRADA etirees need to carefully balance passively investing in a broadly diversified,

is a professor of finance at the risk of spending too much low-cost portfolio; he does not suggest or

the IESE Business School

and outliving their savings with imply, however, that investors should have

in Barcelona, Spain.

jestrada@iese.edu the risk of spending too little a 90/10 stock/bond allocation. Nonetheless,

and lowering their lifestyle unnecessarily. his comment begs the question: Is the asset

The two main tools they can use to avoid allocation Buffett advised for his wife appro-

falling off either side of the cliff are the port- priate for other investors? If yes, why? If not,

folios withdrawal rate and asset allocation. why not?

Regarding the latter, in his 2013 letter to An obvious distinction between

Berkshire Hathaway shareholders, Warren Buffetts wife and the average investor quickly

Buffett discussed the simple advice he gave comes to mind: The average investor needs

to the trustee who will manage the bequest to implement an asset allocation that carefully

his wife will receive: balances the two risks already mentioned

overspending and underspending. Buffetts

What I advise here is essentially iden- wife, however, is likely to receive a nest egg

tical to certain instructions Ive laid large enough that she will not have to worry

out in my will. One bequest provides about either risk. In other words, nearly any

that cash will be delivered to a trustee asset allocation will enable Buffetts wife to

for my wifes benefit My advice to live comfortably and still outlive her port-

the trustee could not be more simple: folio, which is not the case for most investors.

Put 10% of the cash in short-term That said, this article evaluates the

government bonds and 90% in a very merits of the 90/10 allocation that Buffett

low-cost S&P 500 index fund. (I sug- advised for his wife, relative to other static

gest Vanguards.) I believe the trusts allocations with different stock/bond pro-

long-term results from this policy portions, for investors at large. Furthermore,

will be superior to those attained by it explores two minor twists to the 90/10

most investorswhether pension allocation: one accounting for the behavior

funds, institutions or individuals of the stock market, and the other accounting

who employ high-fee managers. for the relative behavior of the stock and bond

Buffett [2013, p. 20] markets.

In a nutshell, the evidence discussed

Buffett does suggest in his letter that here suggests that, aside from having a very

investors should follow a simple approach by low failure rate, the 90/10 allocation results

SPRING 2016 THE JOURNAL OF WEALTH M ANAGEMENT 59

in an interesting middle ground between the upside Dynamic strategies, on the other hand, seem to

potential of more aggressive static allocations and the feel right in the sense that they may become progres-

downside protection of more conservative static alloca- sively more conservative (as in the age-in-bonds rule) or

tions. Perhaps more interestingly, the minor twists con- take valuation considerations into account, thus aiming

sidered here result in two very simple dynamic strategies to avoid high exposure to overvalued assets. However,

that increase both the upside potential and the downside they may be difficult for retirees to implement and

protection of the 90/10 allocation suggested by Buffett. require information about valuation that retirees may

The rest of the article is organized as follows. The not have or understand.

next section discusses in more detail the issue at stake; Both static and dynamic strategies are considered

It is illegal to make unauthorized copies of this article, forward to an unauthorized user or to post electronically without Publisher permission.

The Journal of Wealth Management 2016.18.4:59-64. Downloaded from www.iijournals.com by NEW YORK UNIVERSITY on 03/04/16.

the section after that discusses the evidence, first consid- in this article. Among the former, eight asset allocations

ering several static strategies, and then considering two with varying stock/bond proportions were evaluated,

simple twists to the 90/10 allocation; and a concluding with special attention paid to the 90/10 split suggested

section provides an assessment of the results. by Buffett. Among the latter, two minor (valuation-

based) twists to the 90/10 allocation were evaluated

THE ISSUE and compared to both the 90/10 and the 60/40 alloca-

tions; the first twist focuses on the valuation of the stock

The two main variables retirees can adjust when market and the second on the relative valuation of the

managing their nest egg, the portfolios withdrawal stock and bond markets.

rate and asset allocation, have both received consider- Importantly, the two dynamic twists considered in

able attention from academics and practitioners. Bengen this article are trivial to implement: Retirees only need

[1994] pioneered the research on sustainable withdrawal information about the performance of stocks, or that of

rates by introducing the 4% rule for withdrawals, and stocks and bonds, over the previous year, which is pub-

much literature soon followed in his wake.1 Academic licly and widely available. Retirees do not need to know

interest in asset allocation during retirement is a more tools of fundamental analysis (such as the price-earnings

recent development but has also received wide atten- ratio [P/E] or cyclically adjusted price-to-earnings ratio

tion. Estrada [2016] reviews and discusses both issues [CAPE]) or technical analysis (such as moving averages

in some detail. or charts), nor do they need to make judgments on the

In terms of asset allocation, retirees can choose valuation of stocks and bonds.

between static or dynamic strategies. The former implies

a constant proportion of stocks and bonds to which the EVIDENCE

portfolio is rebalanced periodically; the 60/40 stock/

bond allocation arguably is the most popular of these This section discusses the evidence as it applies

strategies. The latter implies an asset allocation that to the U.S. market over the 115-year period between

changes over time, which may be implemented in at 1900 and 2014. The first subsection discusses the data

least two ways. One is to have the asset allocation evolve and methodology; the second evaluates static strategies;

in a predetermined fashion, such as in the age-in-bonds and the third evaluates two simple dynamic twists to

rule2 ; the other is to have the asset allocation tied to the 90/10 allocation.

valuation, typically (but not exclusively) focused on the

stock market, so that the weight of stocks is relatively Data and Methodology

high (low) when the market is cheap (expensive).

Needless to say, both static and dynamic strategies The analysis used here was based on the two asset

have their respective pros and cons. Static strategies are classes suggested by Buffett: stocks and short-term gov-

simple and require little information. However, they ernment bonds (U.S. Treasury bills), both represented

may prove increasingly difficult for retirees to maintain by DimsonMarshStaunton indexes, described in detail

if the allocation is aggressive (for example, a 90/10 split by Dimson, Marsh, and Staunton [2002, 2015]. Returns

for a 70-year-old individual with a modest portfolio) and were annual, adjusted by inf lation, and account for cap-

ignore valuation considerations even in extreme situa- ital gains/losses and cash f lows. Over the 19002014

tions (as in December 1999). period considered here, stocks and bonds had mean

60 BUFFETTS A SSET A LLOCATION A DVICE : TAKE IT WITH A TWIST SPRING 2016

annual compound (real) returns of 6.5% and 0.9%, with To that purpose, Exhibit 1 reports the results for eight

annual volatility of 20.0% and 4.6%. static strategies with stock/bond allocations ranging

Because Buffett did not intend to recommend the from 100/0 to 30/70, in all cases rebalanced annually to

90/10 allocation to all investors and therefore was light the stated proportions. The analysis of upside potential

on details, a few assumptions were made to evaluate the and downside protection follows the course suggested

performance of this strategy. It was assumed, first, that by Estrada [2014a, 2014b, 2014c, 2016].

Buffett suggests maintaining a constant 90/10 allocation The strategies that call for equity holdings between

over time; second, that the portfolio is rebalanced once a 100% and 40% have very similar failure rates, none

year to maintain the 90/10 allocation constant; and third, higher than 3.5%. Only when the proportion of stocks

It is illegal to make unauthorized copies of this article, forward to an unauthorized user or to post electronically without Publisher permission.

The Journal of Wealth Management 2016.18.4:59-64. Downloaded from www.iijournals.com by NEW YORK UNIVERSITY on 03/04/16.

that the annual withdrawal is made proportional to the is at or below 30% does the failure rate increase consid-

asset allocation, which implies withdrawing 90% from erably, in all cases above 10%.3 Although opinions are

stocks and 10% from bonds. The last two assumptions, varied regarding what failure rates are acceptable, most

annual rebalancing and proportional withdrawals, were practitioners seem to agree that failure rates below 5%

applied to all the other static strategies considered. The should be viewed as acceptable by most retirees. In short,

second assumption, annual rebalancing, was also applied although the 60/40 strategy never failed, the 100/0 and

to the two dynamic twists to the 90/10 allocation. 40/60 failed 3.5% of the time, and Buffetts 90/10 failed

The analysis was based on a $1,000 nest egg at the 2.3% of the time, there does not seem to be a substantial

beginning of retirement, an initial withdrawal of 4% of difference in the failure rates of portfolios holding at

the nest egg, subsequent withdrawals annually adjusted least 40% in stocks.

by inf lation, and a 30-year retirement period. At the The mean and median bequest of the strategies

beginning of each year the annual withdrawal was made, with a failure rate lower than 5% increase monotonically

the portfolio was then rebalanced (should the strategy

call for rebalancing) to the target allocation for the year,

and then it was compounded at the observed return of

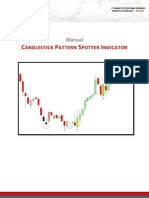

EXHIBIT 1

Static Strategies

stocks and bonds for that year. This process was repeated

at the beginning of each year during the 30-year retire-

ment period, at the end of which the portfolio had a

terminal wealth or bequest that may have been positive

or zero. The first 30-year retirement period considered

was 19001929 and the last one was 19852014, for a

total of 86 rolling (overlapping) periods.

The analysis focused on the failure rate as well

as the upside potential and downside protection pro-

vided by the strategies considered. The failure rate was

defined as the proportion of the 86 retirement periods

considered in which the portfolio was depleted before

30 years; if history is any guide, this failure rate should

serve as a good proxy for the probability of portfolio Notes: This exhibit shows summary statistics for eight static strategies

failure. Both upside potential and downside protection evaluated over 86 rolling 30-year retirement periods, beginning with

19001929 and ending with 19852014. All strategies consider a

were assessed from the distribution of terminal wealth starting capital of $1,000, annual withdrawals of $40 in real terms, and

or bequest, which results from aggregating the 86 wealth annual rebalancing to the stock/bond allocations indicated in the first row.

levels at the end of each of the 86 periods considered. The failure rate (Failure) is the proportion of the 86 retirement periods

in which the portfolio was depleted before 30 years. The statistics that

describe the distribution of terminal wealth across the 86 retirement periods

Static Strategies include the mean; median; standard deviation (SD); average bequest in

the lower 1% (P1), 5% (P5), and 10% (P10) tail; and average bequest

The first step in assessing Buffetts advice was to in the upper 1% (P99), 5% (P95), and 10% (P90) tail. Returns over

the 19002014 period are annual, real, and account for capital gains/

consider several static stock/bond allocations that can be losses and cash flows. All figures are in U.S. dollars except for failure rates

compared to the 90/10 allocation suggested by Buffett. (in %).

SPRING 2016 THE JOURNAL OF WEALTH M ANAGEMENT 61

with the proportion of stocks in the portfolio; put dif- ment periods (P10), the 90/10 allocation underperforms

ferently, the higher the proportion of stocks in the port- the 70/30 split only slightly more than the value of half

folio, the higher the expected bequest. The same is true an annual withdrawal (i.e., comparing $219 to $241).

for the upside potential in particularly good retirement In short, as far as static strategies are concerned,

periods (those occurring less than 1%, 5%, or 10% of the Buffetts suggested allocation has a very low (although

time and quantified by P99, P95, and P90 in Exhibit 1), not the lowest) failure rate; a very high (although not the

which monotonically increases with the proportion of highest) upside potential; and provides very good (but

stocks in the portfolio. In short, the upside potential vari- not the best) downside protection when tail risks strike.

ables favor portfolios heavily invested in stocks, which In other words, Buffetts suggested allocation seems to

It is illegal to make unauthorized copies of this article, forward to an unauthorized user or to post electronically without Publisher permission.

The Journal of Wealth Management 2016.18.4:59-64. Downloaded from www.iijournals.com by NEW YORK UNIVERSITY on 03/04/16.

implies that, from this perspective, Buffetts suggested provide a middle ground between the best-performing

strategy ranks second only to an all-equity portfolio. strategy (100/0) in terms of upside potential and the

Needless to say, risk is an essential component in best-performing strategies (60/40 and 70/30) in terms

the evaluation of any investment strategy. Exhibit 1 of downside protection.

quantifies risk in two ways. The first measure is the

standard deviation of the distribution of terminal wealth Tweaking Buffetts Advice

(SD), which measures uncertainty about the bequest and

suggests that the higher the proportion of stocks in the The evidence discussed so far suggests that Buffetts

portfolio, the more uncertain a retiree will be about his advice is (perhaps unsurprisingly) sound and simple

or her bequest. In this regard, it is important to keep enough for any retiree to implement, at least as far as

in mind that deviations from the mean in either direc- static strategies are concerned. That said, it may be worth

tion increase the standard deviation; hence, the high exploring two minor dynamic twists, both of which are

upside potential of strategies heavily invested in stocks very simple to implement.

contributes substantially to the large standard deviations The first twist (T1) relates the annual withdrawal

of these strategies. to the behavior of the stock market in the previous year.

For this reason, a more plausible method of More precisely, if stocks have gone up, the retiree takes

assessing the risk of the strategies considered here is the annual withdrawal from stocks and then rebalances

by focusing on the terminal wealth in particularly bad the portfolio back to the 90/10 allocation; if stocks have

retirement periods (those occurring less than 1%, 5%, gone down, the retiree takes the annual withdrawal from

or 10% of the time and quantified by P1, P5, and P10 bonds and does not rebalance the portfolio.

in Exhibit 1), which provides a measure of downside The second twist (T2) relates the annual with-

protection when tail risks strike.4 As the exhibit shows, drawal to the relative behavior of the stock and bond mar-

if risk is assessed this way, the 60/40 and 70/30 strategies kets in the previous year. More precisely, if the return

have a slight edge over other strategies. In the worst 1% of stocks has been higher than that of bonds, the retiree

of retirement periods (which, in our case, is the worst- takes the annual withdrawal from stocks and then rebal-

case scenario), all strategies except the 60/40 allocation ances the portfolio back to the 90/10 allocation; if the

fail; in the worst 5% of retirement periods, the 60/40 return of stocks has been lower than that of bonds, the

allocation yields the highest terminal wealth; and in the retiree takes the annual withdrawal from bonds and does

worst 10% of retirement periods, the 70/30 allocation not rebalance the portfolio.

yields the highest terminal wealth. These dynamic twists aim to avoid withdrawing

Importantly, the 90/10 strategy suggested by from stocks when they have gone down (T1) or per-

Buffett does not perform much worse in terms of down- formed worse than bonds (T2). From this perspective,

side protection. To put the aforementioned figures into the twists are inspired by the bucket approach widely dis-

perspective, recall that the analysis was performed in real cussed by Christine Benz in several Morningstar articles

terms and that the annual withdrawal was $40. Hence, and are ultimately based on the concept of mean rever-

in the worst 5% of retirement periods (P5), the 90/10 sion in stocks. Withdrawing from bonds when stocks

allocation underperforms the 60/40 split by only slightly have performed badly, in absolute or relative terms,

more than the value of one annual withdrawal (i.e., allows stocks time to recover. Exhibit 2 reports the

comparing $42 to $93); and in the worst 10% of retire- performance of these two dynamic strategies, together

62 BUFFETTS A SSET A LLOCATION A DVICE : TAKE IT WITH A TWIST SPRING 2016

EXHIBIT 2 two to three annual withdrawals ($88 and $120, as mea-

Tweaking the 90/10 Allocation sured by the mean and median). In terms of downside

protection, the outperformance of T2 over 90/10 is

slightly more than 1.5 to two annual withdrawals ($68

and $81, as measured by P5 and P10).

Also interestingly, both T1 and T2 outperform

the 60/40 allocation. Although the two dynamic strat-

egies have a slightly higher failure rate than the 60/40

allocation (2.3% versus 0%), they provide retirees with

It is illegal to make unauthorized copies of this article, forward to an unauthorized user or to post electronically without Publisher permission.

The Journal of Wealth Management 2016.18.4:59-64. Downloaded from www.iijournals.com by NEW YORK UNIVERSITY on 03/04/16.

more than twice as large an expected bequest, and upside

potential in particularly good retirement periods is well

over twice as large. Furthermore, except in the worst

retirement period (P1), T1 and T2 provide retirees with

better downside protection.

Notes: Exhibit 2 shows summary statistics for four strategies evaluated Finally, although it can hardly be argued that

over 86 rolling 30-year retirement periods, beginning with 19001929 observing the performance of the stock and bond mar-

and ending with 19852014. All strategies consider a starting capital of

$1,000, annual withdrawals of $40 in real terms, and annual rebalancing.

kets is challenging, it is in fact simpler to observe the

The two dynamic strategies consider the behavior of stocks (T1) and the performance of the stock market alone (information on

relative behavior of stocks and bonds (T2) as stated in the text. The failure which, in general, is more readily available than that

rate (Failure) is the proportion of the 86 retirement periods in which the for the bond market). Thus, given the very similar

portfolio was depleted before 30 years. The statistics that describe the distri-

bution of terminal wealth across the 86 retirement periods include the mean; performance of the two twists considered, T1, which

median; standard deviation (SD); average bequest in the lower 1% (P1), only requires an investor to observe the performance of

5% (P5), and 10% (P10) tail; and average bequest in the upper 1% stocks, may be viewed as having a slight edge over T2,

(P99), 5% (P95), and 10% (P90) tail. Returns over the 19002014

period are annual, real, and account for capital gains/losses and cash flows. which requires an investor to observe the performance

All figures are in U.S. dollars except for failure rates (in %). of both stocks and bonds.

with the benchmark 90/10 split and the pervasive 60/40 ASSESSMENT

allocation.

The results of the two twists considered are very A great deal of literature discusses two of the most

similar. Both strategies have the same failure rate (2.3%), important financial decisions retirees need to make: the

T1 has a slightly higher overall upside potential, and T2 withdrawal rate and the asset allocation of their portfo-

provides a slightly better overall downside protection. lios. This article focused on the latter, and more specifi-

Regarding the upside potential, the only exception to cally on the performance of the 90/10 allocation Warren

the slightly better performance of T1 is noted in the Buffett advised a trustee to implement for the bequest

best 1% of retirement periods ($8,683 versus $8,770). In his wife will receive.

terms of downside protection, T1 and T2 yield the same This 90/10 allocation was evaluated first relative

terminal wealth in the worst 1% and 5% of retirement to other static strategies, and then relative to two very

periods, but T2 offers a slightly better protection in the simple, dynamic, valuation-based strategies. Each of the

worst 10% of retirement periods ($300 versus $284). latter strategies only added a minor twist to the alloca-

More interestingly, both T1 and T2 outperform tion suggested by Buffett, based on the performance of

the 90/10 allocation. Although the three strategies have stocks or the relative performance of stocks and bonds.

the same failure rate (2.3%), T1 and T2 provide retirees When compared to other static allocations, the

with both a higher upside potential (as measured by the 90/10 split suggested by Buffett performs well in terms

mean, median, P90, P95, and P99) and better downside of the failure rate, upside potential, and downside pro-

protection (as measured by P5 and P10) than does the tection. In fact, it provides a middle ground between

90/10 allocation. In terms of the expected bequest, the the upside potential of more aggressive static allocations

outperformance of T1 over 90/10 is slightly more than and the downside protection of more conservative static

SPRING 2016 THE JOURNAL OF WEALTH M ANAGEMENT 63

allocations. Put differently, Buffetts advice proves to be REFERENCES

(unsurprisingly) not only simple but also sound.

That said, the two simple twists considered here Bengen, W. Determining Withdrawal Rates Using

Historical Data. Journal of Financial Planning, October 1994,

improve both the upside potential and the downside pro-

pp. 171-180.

tection of the 90/10 allocation. These two twists require

retirees neither to collect vast amounts of information Buffet, W.E. To the Shareholders of Berkshire, Hathaway,

nor to make any valuation judgments but only to observe Inc. Letter, Berkshire Hathaway, 2013.

the performance of the stock market or the relative

performance of the stock and bond markets. In either Dimson, E., P. Marsh, and M. Staunton. Triumph of the

It is illegal to make unauthorized copies of this article, forward to an unauthorized user or to post electronically without Publisher permission.

The Journal of Wealth Management 2016.18.4:59-64. Downloaded from www.iijournals.com by NEW YORK UNIVERSITY on 03/04/16.

circumstance, retirees can, with little effort, improve Optimists101 Years of Investment Returns. Princeton, NJ:

upon the results of the 90/10 allocation. In fact, because Princeton University Press, 2002.

the performance of the two twists is so similar, retirees

may want to lean toward T1 and simply adjust their . Credit Suisse Global Investment Returns Yearbook

asset allocation according to the observed performance 2015. Credit Suisse, February 2015, https://publications.

of stocks. credit-suisse.com/tasks/render/file/?fileID=AE924F44-E396-

A4E5-11E63B09CFE37CCB.

Buffetts asset allocation advice is sound and simple,

and yet many retirees may balk at the thought of holding Estrada, J. The Glidepath Illusion: An International Per-

such an aggressive portfolio. If that is the case, the two spective. The Journal of Portfolio Management, Vol. 40, No. 4

twists considered here may help a little, but probably not (Summer 2014a), pp. 52-64.

enough. However, those retirees who find a 90/10 port-

folio acceptable are likely to find that, with the unsub- . Rethinking Risk. Journal of Asset Management,

stantial additional effort of observing the performance Vol. 15, No. 4 (2014b), pp. 239-259.

of stocks and implementing the first twist discussed,

they may improve the performance of their portfolios. . Rethinking Risk (II): The Size and Value Effects.

The Journal of Wealth Management, Vol. 17, No. 3 (Winter

2014c), pp. 78-83.

ENDNOTES

I would like to thank Jack Rader for his comments. . The Retirement Glidepath: An International Perspec-

Javier Zazurca and David Tamayo provided valuable research tive. The Journal of Investing, forthcoming (2016).

assistance. The views expressed herein and any errors that may

remain are entirely my own.

1

The 4% rule refers to an initial withdrawal of 4% of To order reprints of this article, please contact Dewey Palmieri

the nest egg, followed by withdrawals annually adjusted by at dpalmieri@ iijournals.com or 212-224-3675.

inf lation.

2

This rule suggests that the proportion of bonds in an

investors portfolio should be equal to his or her age, and the

proportion of stocks equal to 100 minus his or her age. As a

result, the proportion of bonds (stocks) increases (decreases)

at the rate of one percentage point per year.

3

As Exhibit 1 shows, the 30/70 strategy has a failure

rate of 12.8%. Strategies with a lower proportion of stocks

(20/80, 10/90, and 0/100) have substantially higher failure

rates (25.6%, 43.0%, 67.4%) and are neither reported in the

exhibit nor further considered in the analysis.

4

Estrada [2014b, 2014c] defines these figures as lower-tail

terminal wealth, a measure of long-term risk that focuses on

extreme and unlikely adverse scenarios.

64 BUFFETTS A SSET A LLOCATION A DVICE : TAKE IT WITH A TWIST SPRING 2016

Вам также может понравиться

- CombinepdfДокумент240 страницCombinepdfNaddieОценок пока нет

- Corporate Finance in 30 Minutes: A Guide For Family Business Directors and ShareholdersДокумент14 страницCorporate Finance in 30 Minutes: A Guide For Family Business Directors and ShareholdersRohan S. PatilОценок пока нет

- Gulf Capital: The Case For Middle Market Structured CapitalДокумент8 страницGulf Capital: The Case For Middle Market Structured CapitalAgeОценок пока нет

- A Perspective On Value InvestingДокумент56 страницA Perspective On Value InvestingPook Kei JinОценок пока нет

- PM Level 1Документ16 страницPM Level 1Papacici Heo U'Оценок пока нет

- The Coffee Can PortfolioДокумент5 страницThe Coffee Can Portfoliosurana50% (2)

- Risk Parity Portfolio vs. Other Asset Allocation Heuristic PortfoliosДокумент11 страницRisk Parity Portfolio vs. Other Asset Allocation Heuristic Portfolioscuitao42Оценок пока нет

- Ninjacators CandlestickPatternSpotter ManualДокумент34 страницыNinjacators CandlestickPatternSpotter ManualiantraderОценок пока нет

- Hedging - Meaning, Example, Areas and Risks, Types, StrategiesДокумент7 страницHedging - Meaning, Example, Areas and Risks, Types, StrategiesP HarishОценок пока нет

- Understanding Investment StrategyДокумент1 страницаUnderstanding Investment StrategySatheesh Kumar TОценок пока нет

- Blanchett 2014Документ12 страницBlanchett 2014jacekinneОценок пока нет

- Black 2013Документ10 страницBlack 2013jacekinneОценок пока нет

- Asset Allocation and Wealth Creation: March 2020Документ22 страницыAsset Allocation and Wealth Creation: March 2020Deepa MistryОценок пока нет

- The Coffee Can Portfolio PDFДокумент5 страницThe Coffee Can Portfolio PDFVenkata Ramana PothulwarОценок пока нет

- Mutual Funds: BelgiumДокумент4 страницыMutual Funds: BelgiumMuthu SelviОценок пока нет

- Capital Structure,: Cost Capital and ValuationДокумент2 страницыCapital Structure,: Cost Capital and ValuationDaden BhutiaОценок пока нет

- Andonov Et Al A Global Perspective On Pension Investments in Real EstateДокумент11 страницAndonov Et Al A Global Perspective On Pension Investments in Real EstateJuan Manuel FigueroaОценок пока нет

- Chapter 10 PAS 28 INVESTMENT IN ASSOCIATESДокумент2 страницыChapter 10 PAS 28 INVESTMENT IN ASSOCIATESgabriel ramosОценок пока нет

- A Spectrum Approach To Active Risk Budgeting: Rethinking The BarbellДокумент12 страницA Spectrum Approach To Active Risk Budgeting: Rethinking The Barbellwangshuqing97Оценок пока нет

- West 2017Документ15 страницWest 2017gogayin869Оценок пока нет

- Invest Europe Pension Fund Guide To Private Equity and Venture CapitalДокумент19 страницInvest Europe Pension Fund Guide To Private Equity and Venture CapitalKamel RamtanОценок пока нет

- BNPP MF Fund Facts August 2020 5245Документ39 страницBNPP MF Fund Facts August 2020 5245Chirag JainОценок пока нет

- Methodology: Omkar Vasudev BhatДокумент1 страницаMethodology: Omkar Vasudev BhataurummaangxinchenОценок пока нет

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0650751489Документ2 страницыKiidoc 2020 07 20 en CH 2020 07 30 Lu0650751489Isabelle ChapuysОценок пока нет

- Ali 2011 InvestДокумент9 страницAli 2011 InvestHarry SipangkarОценок пока нет

- Principles of Sustainable Finance - (Part III Financing Sustainability) - 2Документ41 страницаPrinciples of Sustainable Finance - (Part III Financing Sustainability) - 2SebastianCasanovaCastañedaОценок пока нет

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0337271356Документ2 страницыKiidoc 2020 07 20 en CH 2020 07 30 Lu0337271356Isabelle ChapuysОценок пока нет

- Inside The Black Box - Revealing The Alternative Beta in Hedge Fund Returns - (J.P. Morgan Asset Management)Документ10 страницInside The Black Box - Revealing The Alternative Beta in Hedge Fund Returns - (J.P. Morgan Asset Management)QuantDev-MОценок пока нет

- Drawing A Fine LineДокумент1 страницаDrawing A Fine LineShantanuОценок пока нет

- Article - Asset AllocationДокумент2 страницыArticle - Asset AllocationNikunj KumarОценок пока нет

- 09 07 Nepc Leverage HF and RiskДокумент11 страниц09 07 Nepc Leverage HF and RiskAlexandre Farias FrotaОценок пока нет

- Article - Maximize Your Assets For The Long TermДокумент2 страницыArticle - Maximize Your Assets For The Long TermInformation should be FREEОценок пока нет

- FM (Core) Long-Term FinancingДокумент27 страницFM (Core) Long-Term FinancingMeghna SharmaОценок пока нет

- Great Fund Insights A Great Deal More or A Great Deal Less ILPA S New Deal by Deal Model LPAДокумент3 страницыGreat Fund Insights A Great Deal More or A Great Deal Less ILPA S New Deal by Deal Model LPAoatsubscribedОценок пока нет

- White Paper-How Many Eggs in A Venture Capitalists DozenДокумент7 страницWhite Paper-How Many Eggs in A Venture Capitalists DozenSam RothsteinОценок пока нет

- Measuring Portfolio Factor Exposures A Practical GuideДокумент3 страницыMeasuring Portfolio Factor Exposures A Practical GuideAY6061Оценок пока нет

- AstudyonoverviewofinvestmentmanagementDr G KanagavalliДокумент7 страницAstudyonoverviewofinvestmentmanagementDr G KanagavalliSaurav RanaОценок пока нет

- 8 DR MukeshДокумент4 страницы8 DR Mukeshmahimahimagupta2002Оценок пока нет

- WWF Idh Toolkit FinalДокумент56 страницWWF Idh Toolkit FinalJayverdhan TiwariОценок пока нет

- A Delicate Balance: Setting Foundation and Nonprofit Spending Policy in A Volatile Market EnvironmentДокумент4 страницыA Delicate Balance: Setting Foundation and Nonprofit Spending Policy in A Volatile Market EnvironmentNur Azlin IsmailОценок пока нет

- SAPM All Chapters (Mid Sem)Документ97 страницSAPM All Chapters (Mid Sem)deekshithaОценок пока нет

- Nedgroup Investments Global Flexible Feeder Fund RДокумент3 страницыNedgroup Investments Global Flexible Feeder Fund RdlndlaminiОценок пока нет

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0929190568Документ2 страницыKiidoc 2020 07 20 en CH 2020 07 30 Lu0929190568Isabelle ChapuysОценок пока нет

- Corporate Finance in 30 Minutes: A Guide For Directors and ShareholdersДокумент14 страницCorporate Finance in 30 Minutes: A Guide For Directors and ShareholdersMarcelo Vieira100% (1)

- ERPM 1st UnitДокумент4 страницыERPM 1st UnitRamesh babuОценок пока нет

- Fintech AssignmentДокумент2 страницыFintech AssignmentAlka RajpalОценок пока нет

- Kiidoc 2020 07 22 en CH 2020 07 30 Lu1516025506Документ2 страницыKiidoc 2020 07 22 en CH 2020 07 30 Lu1516025506Isabelle ChapuysОценок пока нет

- Philanthropy Hub Opens To Advisers Australian Share Valuations Overstretched'Документ2 страницыPhilanthropy Hub Opens To Advisers Australian Share Valuations Overstretched'Aarti JОценок пока нет

- The Surprising Alpha From Malkiel's Monkey and Upside-Down StrategiesДокумент15 страницThe Surprising Alpha From Malkiel's Monkey and Upside-Down StrategiesAndresОценок пока нет

- 4 10 Use of Leverage PA 300913Документ11 страниц4 10 Use of Leverage PA 300913Hari Priya TammineediОценок пока нет

- Summary of Fund CharacteristicsДокумент2 страницыSummary of Fund Characteristicsyawotarsing04Оценок пока нет

- A Tale of Prudence IASBДокумент6 страницA Tale of Prudence IASBChrizii SalzОценок пока нет

- The Equity Method of Accounting For Investments: Chapter OneДокумент40 страницThe Equity Method of Accounting For Investments: Chapter Onerendy adiwigunaОценок пока нет

- Kiidoc 2020 07 22 en CH 2020 07 30 Lu1516025415Документ2 страницыKiidoc 2020 07 22 en CH 2020 07 30 Lu1516025415Isabelle ChapuysОценок пока нет

- Ampersand White Paper - Risk Contribution of StocksДокумент16 страницAmpersand White Paper - Risk Contribution of StockstabbforumОценок пока нет

- Kahn, Quantitative Equity Investing-Out of StyleДокумент2 страницыKahn, Quantitative Equity Investing-Out of StyleA EОценок пока нет

- Behavior of Retail Investors Towards Financial Investments With Special Reference To Bhopal Towards Various Investment Alternative 2167 0234 1000336Документ8 страницBehavior of Retail Investors Towards Financial Investments With Special Reference To Bhopal Towards Various Investment Alternative 2167 0234 1000336Sourav PaulОценок пока нет

- Note On The Asset Management IndustryДокумент16 страницNote On The Asset Management IndustryBenj DanaoОценок пока нет

- How Can Mutual Funds Help Me? What Are Mutual Funds? What Are THE Types of Funds? Benefits ofДокумент1 страницаHow Can Mutual Funds Help Me? What Are Mutual Funds? What Are THE Types of Funds? Benefits ofCarmel Buniel SabadoОценок пока нет

- Export Value DeclarationДокумент1 страницаExport Value DeclarationdocrmpjodОценок пока нет

- Rule of 69 - Meaning, Benefits, Limitations and MoreДокумент4 страницыRule of 69 - Meaning, Benefits, Limitations and MoreCandy DollОценок пока нет

- Back Test Report - Divyanshu Sharma (Christ University)Документ18 страницBack Test Report - Divyanshu Sharma (Christ University)divyanshu sharmaОценок пока нет

- B294-TMA-Fall 2023-2024-V1Документ4 страницыB294-TMA-Fall 2023-2024-V1adel.dahbour97Оценок пока нет

- Foreign Exchange Rates (FOREX)Документ2 страницыForeign Exchange Rates (FOREX)LSTОценок пока нет

- MCQ - Issue of SharesДокумент7 страницMCQ - Issue of SharesHarshal KaramchandaniОценок пока нет

- Q2 2023 Enterprise Fintech Report PreviewДокумент12 страницQ2 2023 Enterprise Fintech Report PreviewhojunxiongОценок пока нет

- Reliance Securities Requires MBA Students For Summer Internship: Designation: Management Trainee Project Duration: 2 Months Project DetailsДокумент2 страницыReliance Securities Requires MBA Students For Summer Internship: Designation: Management Trainee Project Duration: 2 Months Project Detailsnishantjain95Оценок пока нет

- Capm Vs Market ModelДокумент28 страницCapm Vs Market Modeldivyakud100% (1)

- Chapter-7 Capital Gain - FA 2020Документ33 страницыChapter-7 Capital Gain - FA 2020Madhav GoyalОценок пока нет

- Quiz AppliedДокумент12 страницQuiz AppliedLharissa Ballesteros100% (1)

- Principles of Finance: Taguig City University Gen. Santos Ave. Upper Bicutan Taguig City College of Business ManagementДокумент4 страницыPrinciples of Finance: Taguig City University Gen. Santos Ave. Upper Bicutan Taguig City College of Business ManagementKimii DoraОценок пока нет

- Module 1 Business Finance Quarter 3 Module 12 Introduction To Financial ManagementДокумент24 страницыModule 1 Business Finance Quarter 3 Module 12 Introduction To Financial ManagementClird Ford CastilloОценок пока нет

- Regmem eДокумент6 страницRegmem eReka IsalОценок пока нет

- 2021 Vietnam Banking Opportunities and ChallengesДокумент3 страницы2021 Vietnam Banking Opportunities and ChallengesCường MạnhОценок пока нет

- Bank Baroda Project.Документ106 страницBank Baroda Project.Ketul SahuОценок пока нет

- BIAYA MODAL CompressedДокумент89 страницBIAYA MODAL CompressedMuh IdhamsyahОценок пока нет

- MIBG - Malaysian Bank Bonds - 230430Документ16 страницMIBG - Malaysian Bank Bonds - 230430Guan JooОценок пока нет

- New Project Awarded To DBL-DECO (JV) in The State of Maharashtra (Company Update)Документ2 страницыNew Project Awarded To DBL-DECO (JV) in The State of Maharashtra (Company Update)Shyam SunderОценок пока нет

- Advanced Financial ManagementДокумент107 страницAdvanced Financial ManagementdirectoricpapОценок пока нет

- Summer Training Project Report On India Bulls TarunДокумент44 страницыSummer Training Project Report On India Bulls TarunTRAUN KULSHRESTHA100% (25)

- Money, Money, Money: Word BankДокумент2 страницыMoney, Money, Money: Word BankabcОценок пока нет

- CH 3 Open Economy Macroeconomics (Chap 3-2017) NewДокумент63 страницыCH 3 Open Economy Macroeconomics (Chap 3-2017) NewLemma MuletaОценок пока нет

- A Study On Portfolio ManagementДокумент3 страницыA Study On Portfolio ManagementEditor IJTSRDОценок пока нет

- Zydus Lifesciences LTDДокумент7 страницZydus Lifesciences LTDMahek SolankiОценок пока нет

- Valuation of Business: CA Aaditya JainДокумент3 страницыValuation of Business: CA Aaditya JainSunita YadavОценок пока нет

- Case Study - What Pay For Performance Looks Like - Michael EisnerДокумент2 страницыCase Study - What Pay For Performance Looks Like - Michael EisnerYen NguyenОценок пока нет

- 02 - Investor Acc MethodДокумент31 страница02 - Investor Acc MethodLukas PrawiraОценок пока нет

- Assignment 3 Dividen Policy: Brigham, E.F. and Houston, J.F., 2015. Fundamentals of Financial Management. CengageДокумент3 страницыAssignment 3 Dividen Policy: Brigham, E.F. and Houston, J.F., 2015. Fundamentals of Financial Management. CengageHIRA KALEEMОценок пока нет