Академический Документы

Профессиональный Документы

Культура Документы

lm1 Syllabus 2016 20160107 132354

Загружено:

xjackxОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

lm1 Syllabus 2016 20160107 132354

Загружено:

xjackxАвторское право:

Доступные форматы

London Market insurance essentials

Objective

To provide an essential grounding in the operation of the London insurance market.

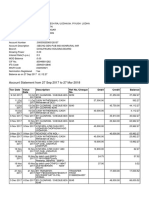

Summary of learning outcomes Number of questions

in the examination*

1. Understand basic terminology used within the general insurance market 6

2. Understand the fundamental principles of insurance 10

3. Understand the main classes of insurance written in the London Market 4

4. Understand the insurance cycle 1

5. Understand reinsurance within the insurance market 3

6. Understand the structure of the London Market 5

7. Understand the London Market regulatory and legal environment 10

8. Understand the importance of appropriate systems and controls 2

9. Understand data protection and money laundering legislation and requirements 2

10. Understand the brokers role in the way that business is conducted in the London

4

Market

11. Understand the underwriters role in the way that business is conducted in the 3

London Market

*The test specification has an in-built element of flexibility. It is designed to be used as a guide for study and is not a

statement of actual number of questions that will appear in every exam. However, the number of questions testing each

learning outcome will generally be within the range plus or minus 2 of the number indicated.

Important notes

Method of assessment: 50 multiple choice questions (MCQs). 1 hour is allowed for this examination.

This syllabus will be examined from 1 May 2016 until 31 December 2017.

Candidates will be examined on the basis of English law and practice unless otherwise stated.

Candidates should refer to the CII website for the latest information on changes to law and practice

and when they will be examined:

1. Visit www.cii.co.uk/updates

2. Select the appropriate qualification

3. Select your unit on the right hand side of the page

Wording in italics in the syllabus will only be tested from October 2016

Published February 2016 LM1

The Chartered Insurance Institute 2016

1. Understand basic terminology used 7. Understand the London Market

within the general insurance market regulatory and legal environment

1.1 Explain the principle of utmost good faith/good 7.1 Describe the role, aims, approach to regulation;

faith and principles for business of the industry

1.2 Define the meaning of proximate cause regulator

1.3 Define indemnity 7.2 Describe the role of major international

regulators, including licensing

1.4 Explain the concept of contribution

7.3 Explain the governance of the Lloyds Market

1.5 Explain what is meant by subrogation

7.4 Examine and explain the role of the Financial

2. Understand the fundamental Ombudsman Service and the Financial Services

Compensation Scheme

principles of insurance

7.5 Explain the basic powers of the industry regulator

2.1 Describe the concept of risk for the authorisation, supervision and regulation

2.2 Explain the categories of risk of insurers

2.3 Explain the principle of the pooling of risks 7.6 Explain the basic powers of the industry regulator

2.4 Explain the difference between a peril and a for the authorisation, supervision and regulation

hazard as this relates to insurance of insurance intermediaries

2.5 Give examples of physical and moral hazards 7.7 Define what is meant by a contract of insurance

2.6 List the types of insurable and uninsurable risks 7.8 Describe the essentials of a valid contract of

insurance

2.7 Explain the basic purpose of insurance

2.8 Explain the primary and secondary functions of 8. Understand the importance of

insurance

appropriate systems and controls

2.9 Explain the importance of the claims handling

process 8.1 Explain the purpose of sanctions

8.2 Examine and describe the basic systems and

3. Understand the main classes of controls to ensure adherence to EU, US and UK

legislation

insurance written in the London

Market 9. Understand data protection and

3.1 Describe the main classes of insurance written in money laundering legislation and

the London Market

requirements

3.2 Describe the main features of the different

classes of insurance 9.1 Explain the principles, rights and restrictions of

the Data Protection Act of 1998

4. Understand the insurance cycle 9.2 Explain the various requirements to ensure

money laundering compliance when dealing with

4.1 Outline and explain the insurance cycle

clients

5. Understand reinsurance within the 10. Understand the brokers role in the

insurance market way that business is conducted in the

5.1 Explain the purpose of reinsurance

London Market

5.2 Describe the main terminology used in

10.1 Explain the role and responsibilities of brokers

connection with reinsurance transactions

10.2 Explain the business process of broking and the

6. Understand the structure of the parties involved

London Market 10.3 Explain the brokers role in the handling of

premiums

6.1 Describe the main providers in the London Market

including Lloyds, Company market and P&I Clubs 10.4 Explain the brokers role in claims notification,

investigation and settlement

6.2 Explain the importance of the London Market and

why clients may decide to place their business 11. Understand the underwriters role in

within this market

the way that business is conducted in

6.3 Explain the role of the London Market

associations the London Market

6.4 Explain the way that business is transacted in the 11.1 Explain the role and responsibilities of

London Market underwriters

11.2 Explain the role and responsibilities of the lead

and following underwriters within the London

Market

Published February 2016 2 of 3

The Chartered Insurance Institute 2016

The Insurance Institute of London holds a lecture on

Reading list revision techniques for CII exams approximately three

times a year. The slides from their most recent lectures

The following list provides details of various can be found at www.cii.co.uk/iilrevision (CII/PFS

publications which may assist you with your studies. members only).

Note: The examination will test the syllabus alone.

The reading list is provided for guidance only and is

not in itself the subject of the examination.

The publications will help you keep up-to-date with

developments and will provide a wider coverage of

syllabus topics.

CII/PFS members can borrow most of the additional

study materials below from Knowledge Services.

CII study texts can be consulted from within the

library.

New materials are added frequently - for information

about new releases and lending service, please go to

www.cii.co.uk/knowledge or email

knowledge@cii.co.uk.

CII study texts

London Market Insurance Essentials. London: CII. Study

text LM1.

Books (and ebooks)

Insurance theory and practice. Rob Thoyts. Routledge,

2010.*

Periodicals

The Journal. London: CII. Six issues a year. Also available

online via www.cii.co.uk/knowledge (CII/PFS members

only).

Market magazine. Lloyd's of London. Quarterly.

Post magazine. London: Incisive Financial Publishing.

Weekly. Also available online at www.postonline.co.uk.

Reference materials

Concise encyclopedia of insurance terms. Laurence S.

Silver, et al. New York: Routledge, 2010.*

Dictionary of insurance. C Bennett. 2nd ed. London:

Pearson Education, 2004.

* Also available as an ebook through Discovery via

www.cii.co.uk/discovery (CII/PFS members only).

Examination guides

An examination guide, which includes a specimen paper,

is available to purchase via www.cii.co.uk.

If you have a current study text enrolment, the current

examination guide is included and is accessible via

Revisionmate (www.revisionmate.com). Details of how to

access Revisionmate are on the first page of your study

text.

It is recommended that you only study from the most

recent versions of the examination guides.

Exam technique/study skills

There are many modestly priced guides available in

bookshops. You should choose one which suits your

requirements.

Published February 2016 3 of 3

The Chartered Insurance Institute 2016

Вам также может понравиться

- Project Reportfinal - Revised PDFДокумент50 страницProject Reportfinal - Revised PDFAllan PinkertonОценок пока нет

- Data Analysis With PANDAS: Cheat SheetДокумент4 страницыData Analysis With PANDAS: Cheat Sheetnesayu67% (3)

- Cream Awards 2020 V4entryform UPDATED2Документ8 страницCream Awards 2020 V4entryform UPDATED2xjackxОценок пока нет

- Komodo National Park DaytripДокумент5 страницKomodo National Park DaytripxjackxОценок пока нет

- Data Analysis With PANDAS: Cheat SheetДокумент4 страницыData Analysis With PANDAS: Cheat Sheetnesayu67% (3)

- Numerical AnalysisДокумент8 страницNumerical AnalysisvenkatgramОценок пока нет

- Slides 1 Pandas From The InsideДокумент49 страницSlides 1 Pandas From The InsidexjackxОценок пока нет

- Enherent Business AnalyticsДокумент24 страницыEnherent Business AnalyticsxjackxОценок пока нет

- Basic Principles of Life InsuranceДокумент44 страницыBasic Principles of Life InsuranceAlanОценок пока нет

- Legal Rights Brochure PDFДокумент2 страницыLegal Rights Brochure PDFxjackxОценок пока нет

- Training T Test 16 enДокумент50 страницTraining T Test 16 enRaúl Moreno GómezОценок пока нет

- Sas Insurance Analytics Architecture 104891Документ4 страницыSas Insurance Analytics Architecture 104891xjackxОценок пока нет

- IBM Q1 Technical Marketing ASSET2 - Data Science Methodology-Best Practices For Successful Implementations Ov37176 PDFДокумент6 страницIBM Q1 Technical Marketing ASSET2 - Data Science Methodology-Best Practices For Successful Implementations Ov37176 PDFxjackxОценок пока нет

- pq012616 PDFДокумент5 страницpq012616 PDFxjackxОценок пока нет

- Orange County Jail: Percentage of Inmates by RaceДокумент2 страницыOrange County Jail: Percentage of Inmates by RacexjackxОценок пока нет

- Enthought Python Pandas Cheat Sheets 1 8 v1.0.2Документ8 страницEnthought Python Pandas Cheat Sheets 1 8 v1.0.2kaskorajaОценок пока нет

- KolmogorovДокумент5 страницKolmogorovxjackxОценок пока нет

- Numpy Cheat Sheet: Umpy Umerical YthonДокумент1 страницаNumpy Cheat Sheet: Umpy Umerical YthonfreyespadaaОценок пока нет

- Mid Term Sol PDFДокумент6 страницMid Term Sol PDFxjackxОценок пока нет

- Hybrid Ground-Source Heat Pumps: Saving Energy and CostДокумент2 страницыHybrid Ground-Source Heat Pumps: Saving Energy and CostxjackxОценок пока нет

- Chart Suggestions - A Thought-StarterДокумент1 страницаChart Suggestions - A Thought-StarterDoc AllaínОценок пока нет

- Dask Parallel Computing Cheat SheetДокумент2 страницыDask Parallel Computing Cheat SheetxjackxОценок пока нет

- Blockchain in Insurance Opportunity or Threat PDFДокумент9 страницBlockchain in Insurance Opportunity or Threat PDFxjackxОценок пока нет

- Heating & Cooling Load Calculation Program - CLTD/CLF/SCL MethodДокумент43 страницыHeating & Cooling Load Calculation Program - CLTD/CLF/SCL MethodSenthilnathanОценок пока нет

- Chap12 CorinthBookDraft Final2 PDFДокумент39 страницChap12 CorinthBookDraft Final2 PDFFrew FrewОценок пока нет

- Hybrid Ground-Source Heat Pumps: Saving Energy and CostДокумент2 страницыHybrid Ground-Source Heat Pumps: Saving Energy and CostxjackxОценок пока нет

- Beam Deflection FormulaeДокумент2 страницыBeam Deflection Formulae7575757575100% (6)

- Mid Term Sol PDFДокумент6 страницMid Term Sol PDFxjackxОценок пока нет

- Fall 16Документ2 страницыFall 16xjackxОценок пока нет

- Grashof ConditionsДокумент4 страницыGrashof ConditionsxjackxОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- NETPAY APPLICATION FORM FOR LELONG MERCHANTSДокумент10 страницNETPAY APPLICATION FORM FOR LELONG MERCHANTSmr4zieОценок пока нет

- Meralco Bill 325458600101 07272020 - 3 (3591)Документ2 страницыMeralco Bill 325458600101 07272020 - 3 (3591)Ave de GuzmanОценок пока нет

- Transportation Case Digest: Mayer Steel Pipe Corp. V. CA (1997)Документ2 страницыTransportation Case Digest: Mayer Steel Pipe Corp. V. CA (1997)jobelle barcellanoОценок пока нет

- Quarterly Value-Added Tax Declaration: Kawanihan NG Rentas InternasДокумент1 страницаQuarterly Value-Added Tax Declaration: Kawanihan NG Rentas Internaschiahwalousette100% (1)

- History of HSBC in AsiaДокумент35 страницHistory of HSBC in AsiaMonir HosenОценок пока нет

- Account statement details for Mr. Chandresh Raj LodhaДокумент3 страницыAccount statement details for Mr. Chandresh Raj LodhaHemlata LodhaОценок пока нет

- ROAROENPMДокумент24 страницыROAROENPMPudding FcОценок пока нет

- Andhra Pradesh DCCB Directory 2012-13Документ149 страницAndhra Pradesh DCCB Directory 2012-13SumitОценок пока нет

- 3.2 Credit and Debt ManagementДокумент35 страниц3.2 Credit and Debt Managementsuhada asriОценок пока нет

- My Card Place PDFДокумент3 страницыMy Card Place PDFDIGITAL PATRIOTSОценок пока нет

- Foia 2011.10.106Документ115 страницFoia 2011.10.106Judicial Watch, Inc.Оценок пока нет

- Service Tax: Aiaims Mms-AДокумент31 страницаService Tax: Aiaims Mms-AAbbas Haider NaqviОценок пока нет

- MECO vs Yatco: Tax on Insurance Premiums Paid to Foreign CorpsДокумент5 страницMECO vs Yatco: Tax on Insurance Premiums Paid to Foreign CorpsVida MarieОценок пока нет

- Senior Manager Internal Audit in Boston MA Providence RI Resume Edward NolanДокумент3 страницыSenior Manager Internal Audit in Boston MA Providence RI Resume Edward NolanEdwardNolanОценок пока нет

- Merchant BankingДокумент23 страницыMerchant Bankingmukeshdilse100% (1)

- Selling ATM Card Cashout ICQ 747095810 Dumps Pin Emv Chip ATM Skimmers Track2 PinДокумент3 страницыSelling ATM Card Cashout ICQ 747095810 Dumps Pin Emv Chip ATM Skimmers Track2 Pinnguyen cuongОценок пока нет

- Rental Agreement-Bouncy RentalsДокумент2 страницыRental Agreement-Bouncy RentalsZury MansurОценок пока нет

- Internship ReportДокумент44 страницыInternship Reportতোফায়েল আহমেদОценок пока нет

- New Sources of Leverage Loans: Making Use of FHA Loans in A NMTC TransactionДокумент4 страницыNew Sources of Leverage Loans: Making Use of FHA Loans in A NMTC TransactionReznick Group NMTC PracticeОценок пока нет

- Factors Influencing Consumers' Intention to Use Mobile Money in NigeriaДокумент159 страницFactors Influencing Consumers' Intention to Use Mobile Money in NigeriaNk NoviaОценок пока нет

- Case 11-20Документ20 страницCase 11-20balbasjuliusОценок пока нет

- Project On MCB GCUFДокумент19 страницProject On MCB GCUFAmna Goher100% (1)

- WEEK 3 Jobs in Accounting PDFДокумент2 страницыWEEK 3 Jobs in Accounting PDFdaniОценок пока нет

- Factoring ForfaitingДокумент19 страницFactoring ForfaitingSumesh MirashiОценок пока нет

- Universal Banking HDFCДокумент16 страницUniversal Banking HDFCrajesh bathulaОценок пока нет

- Ports & Terminals in India - Key FactsДокумент11 страницPorts & Terminals in India - Key FactsJyoti DasguptaОценок пока нет

- HSBC's Global Operations and Financial PerformanceДокумент40 страницHSBC's Global Operations and Financial PerformanceIndu yadavОценок пока нет

- Keng Hua Vs CA-1Документ2 страницыKeng Hua Vs CA-1Raymond Roque100% (1)

- Executive Summary My ReportДокумент1 страницаExecutive Summary My ReportNirob Hasan VoorОценок пока нет

- Loan Origination System - Final Note - July 26 2022Документ22 страницыLoan Origination System - Final Note - July 26 2022Ahsan Bin Asim100% (1)