Академический Документы

Профессиональный Документы

Культура Документы

NG Nigeria Income Tax Calculator

Загружено:

obumuyaemesi0 оценок0% нашли этот документ полезным (0 голосов)

93 просмотров1 страницаNg Nigeria Income Tax Calculator

Оригинальное название

Ng Nigeria Income Tax Calculator

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документNg Nigeria Income Tax Calculator

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

93 просмотров1 страницаNG Nigeria Income Tax Calculator

Загружено:

obumuyaemesiNg Nigeria Income Tax Calculator

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

InsideTax

Nigeria Income Tax Calculator

Mobile. Offline. Do it yourself

In its bid to make easy and hassle-free the process of determining the income tax payable by employees or

individuals in the formal or informal sector, Akintola Williams Deloitte has developed an Income Tax Calculator for

Nigeria

Taxpayers are the single most both earned and the NITC is its accessibility. Once

significant group of stakeholders in unearned. downloaded on your device, you do

the Nigerian tax system, so declares not need data service to make use of

the National Tax Policy (NTP). Thus In Nigeria, the it. To access the NITC, visit

every effort that is directed at Federal Inland http://www.wecadeloitte.com/TaxCal

achieving among others: Revenue service culator from any mobile device to use

(FIRS) is the the calculator online. You can also

? simplicity, certainty and clarity as a

?

authority for download it from Google play Store

way of that taxpayers understand monitoring for Android device directly.

and trust the tax system; collection and

? low compliance cost i.e. the

? administration of Alternatively, interested users can use

economic costs of time required and tax in Nigeria. A tax the QR code shown below by directly

the expense which the taxpayer may calculator can be scanning to their phones in lieu of

incur during the procedures for accessed from its opening a browser and typing the

compliance can be managed at website to aid tax URL.

minimum levels at all times, would payers determine an

ensure an overall improvement in estimate of Nigeria Helpline

the quality of the tax system. tax that will be

deducted from their Tomiwa Adefokun

The NTP thus encourages the income. Most of +234 (0) 807 9887 393

development of structures, platforms, these online tools

tools and/or applications that can are only accessible It may be of interest to note that this

enhance and simplify compliance for via the internet. application is the first mobile

taxpayers. application developed by any of the

In its bid to make Big 4 professional service firms

Income tax computation and or its easy and hassle-free with Nigerian public as a primary

payment need not be capital the process of target. It is also the first mobile

punishment (cf: Jeff Hayes). It also determining the application to be developed by any of

does not need to trigger a feeling of payers to get an indication of the tax income tax payable these firms, locally in Nigeria, for

loss or want of control. Many people that is applicable on their income, by employees or public use.

believe that where taxes are individuals in the

concerned, they are victims, held formal or informal Join us to share our moment of innovation!

hostage by an inevitable process that sector, Akintola

allows them no input, no control Williams Deloitte This publication contains general

where people believe that they lack has developed an information only and Akintola Williams

Income Tax Deloitte is not, by means of this

control, they seldom try to assert publication, rendering accounting,

control (Richard Carlson Don't Sweat Calculator for business, financial, investment, legal, tax,

Guide to Taxes). Nigeria. The or other professional advice or services.

Calculator is a very

The reality however is that taxpayers simple application Deloitte refers to one or more of Deloitte

always complain that the tax amount that helps to Touche Tohmatsu Limited, a UK private

deducted from their pay is too high. calculate tax due in company limited by guarantee (DTTL),

line with the its network of member firms, and their

Given that under the Pay-As-You-Earn related entities. DTTL and each of its

tax regime, the employer is the Nigerian Income member firms are legally separate and

collection agent for the State Internal Tax law. The independent entities. DTTL (also referred

Revenue Service of the State in which Nigeria Income Tax to as Deloitte Global) does not provide

the employees are resident, the role Calculator (NITC) services to clients. Please see

shows in one click a www.deloitte.com/about for a more

actors in the case of corporate detailed description of DTTL and its

taxpayers involved in the process of summary of member firms.

computing tax assessed on the incomes,

individual comprise the various human allowances, Akintola Williams Deloitte a member firm

resource personnel, finance personnel deductions and net of Deloitte Touche Tohmatsu Limited,

provides audit, tax, consulting,

and external tax consultants. income both accounting and financial advisory,

monthly and corporate finance and risk advisory

In developed economies, the tax annual. services to public and private clients

authority's website is usually the first spanning multiple industries. Please visit

The plus value of us at www.deloitte.com/ng

point of reference for individual tax

International capabilities with local delivery.

Oluseye Arowolo Fatai Folarin

Partner | Tax & Regulatory Services Lead Partner | Tax & Regulatory Services

oarowolo@deloitte.com ffolarin@deloitte.com

2014. For information, contact Akintola Williams Deloitte

Вам также может понравиться

- 18p36top41 PDFДокумент6 страниц18p36top41 PDFAmit KumarОценок пока нет

- Fkakasa BookletДокумент8 страницFkakasa BookletLaban Lakers PhilclaraОценок пока нет

- Sovos VAT Managers EbookДокумент7 страницSovos VAT Managers EbookJavier CandoОценок пока нет

- NG Tax Administration in Nigeria and The Challenge of ITДокумент1 страницаNG Tax Administration in Nigeria and The Challenge of ITbvenkatachalamОценок пока нет

- ONESOURCE Tax Provision: Close Faster, File EarlierДокумент2 страницыONESOURCE Tax Provision: Close Faster, File EarlierAqua LiveОценок пока нет

- Jfa 20221002 16Документ9 страницJfa 20221002 16Assefa GebreamlakeОценок пока нет

- E ChallanДокумент2 страницыE Challansonal shahОценок пока нет

- E InvoiceДокумент7 страницE InvoiceIzzah IzzatiОценок пока нет

- Tax Alert Efris RolloutДокумент2 страницыTax Alert Efris RolloutdingОценок пока нет

- Livingstone Institute of Business and Engineering StudiesДокумент6 страницLivingstone Institute of Business and Engineering StudiesGibson NsofuОценок пока нет

- Machine Learning-Based Predictive Analysis On Electronic Billing Machines To Value Added Tax Revenues GrowthДокумент8 страницMachine Learning-Based Predictive Analysis On Electronic Billing Machines To Value Added Tax Revenues GrowthInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- E-Invoice System: User Manual - Bulk Generation & Cancellation ToolДокумент23 страницыE-Invoice System: User Manual - Bulk Generation & Cancellation Toolsuman.neel59386Оценок пока нет

- The Value Added Tax (Digital Marketplace Supply) Regulations, 2020Документ10 страницThe Value Added Tax (Digital Marketplace Supply) Regulations, 2020HerbertОценок пока нет

- As21008 Pij-Itac-Preso 062321Документ17 страницAs21008 Pij-Itac-Preso 062321Vivek KulkarniОценок пока нет

- SCG - Chartered Accountant - Outsourced Accounting ServicesДокумент11 страницSCG - Chartered Accountant - Outsourced Accounting ServicesAnil. webricationОценок пока нет

- Electronic Fiscal Receipting and Invoicing Solution: KakasaДокумент6 страницElectronic Fiscal Receipting and Invoicing Solution: KakasaMichael Kazinda100% (1)

- Enghouse - APN Setup - EbookДокумент15 страницEnghouse - APN Setup - EbookloreОценок пока нет

- Future of Tax 1680038935Документ12 страницFuture of Tax 1680038935Драгана БојковскаОценок пока нет

- MAA15Документ20 страницMAA15Zarana PatelОценок пока нет

- Sky ManualДокумент361 страницаSky ManualMark SilbermanОценок пока нет

- Trader ManualДокумент121 страницаTrader ManualTs'epo MochekeleОценок пока нет

- The Role of Computer in SocietyДокумент41 страницаThe Role of Computer in SocietyErnie EnokelaОценок пока нет

- ClearTax PresentationДокумент28 страницClearTax PresentationYogendra GuptaОценок пока нет

- FCH - Settlement Bridge - IOTRONДокумент2 страницыFCH - Settlement Bridge - IOTRONStevenОценок пока нет

- Taxation of The Digital Economy in Kenya.Документ4 страницыTaxation of The Digital Economy in Kenya.charles_kiokoОценок пока нет

- CM Dashboard, Prison Modernization, SDGДокумент6 страницCM Dashboard, Prison Modernization, SDGAtharva PrasadОценок пока нет

- E-ISSN 2829-5404, P-ISSN 2829-7040:, Wajib - Ginting@inaba - Ac.idДокумент7 страницE-ISSN 2829-5404, P-ISSN 2829-7040:, Wajib - Ginting@inaba - Ac.idYohanaОценок пока нет

- Sidebrief Pitch FullДокумент12 страницSidebrief Pitch FullDavid HundeyinОценок пока нет

- Einvoce - Gepp User ManualДокумент29 страницEinvoce - Gepp User ManualDadang TirthaОценок пока нет

- Clover Data Integration Case StudyДокумент1 страницаClover Data Integration Case StudyharishkodeОценок пока нет

- Understanding The World Trade Organization Trade Facilitation AgreementДокумент15 страницUnderstanding The World Trade Organization Trade Facilitation AgreementHenry DiyokeОценок пока нет

- Applying VAT To ElectronicДокумент7 страницApplying VAT To ElectronicAhmad KhanОценок пока нет

- Indian Digital PolicyДокумент11 страницIndian Digital PolicyUdit AggarwalОценок пока нет

- Taxation of The Digital EconomyДокумент15 страницTaxation of The Digital EconomyREJAY89Оценок пока нет

- Application MonitoringДокумент4 страницыApplication MonitoringgiehertezОценок пока нет

- Scintl Payment Gateway InterfaceДокумент13 страницScintl Payment Gateway InterfaceRichard KalibataОценок пока нет

- ZATCA E-Invoicing Report 2022 2Документ22 страницыZATCA E-Invoicing Report 2022 2ahmedОценок пока нет

- Accenture PoV Revenue AssuranceДокумент4 страницыAccenture PoV Revenue AssurancedrishtichhabriaОценок пока нет

- Technology Advancement Likely To Heavily Impact How Taxpayers Interact With Tax Authorities in The FutureДокумент2 страницыTechnology Advancement Likely To Heavily Impact How Taxpayers Interact With Tax Authorities in The FutureRohullah RafatОценок пока нет

- 2019 ACH Risk Assessment and AuditДокумент15 страниц2019 ACH Risk Assessment and Audithemantsharma.usОценок пока нет

- ECL Advisory Version 0.4Документ29 страницECL Advisory Version 0.4Yash ChhabraОценок пока нет

- Toll Payment Collection Using NFCДокумент14 страницToll Payment Collection Using NFCMuthuCoolОценок пока нет

- Implementation and Analysis of A ComputerisedДокумент8 страницImplementation and Analysis of A ComputerisedInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Service Connection Within 15 Days For Industry Up To 112 KW: Connecting With ConfidenceДокумент5 страницService Connection Within 15 Days For Industry Up To 112 KW: Connecting With ConfidenceNagaraja SОценок пока нет

- Futuremobiledatabilling PDFДокумент8 страницFuturemobiledatabilling PDFManduCerianoОценок пока нет

- Irjet V6i41081Документ3 страницыIrjet V6i41081Sachin KudariОценок пока нет

- Tax Tribune Vol.41 IOTAДокумент19 страницTax Tribune Vol.41 IOTAPushparaj AlphonseОценок пока нет

- Fiscalization Presentation 300723 DRCДокумент16 страницFiscalization Presentation 300723 DRCEBALEОценок пока нет

- To Implement Cloud Computing by Using Agile Methodology in Indian E-GovernanceДокумент5 страницTo Implement Cloud Computing by Using Agile Methodology in Indian E-GovernancePRAFULKUMAR PARMARОценок пока нет

- Tunisia: Economy ProfileДокумент65 страницTunisia: Economy ProfilelachtarОценок пока нет

- Automated Toll Tax CollectionДокумент5 страницAutomated Toll Tax CollectiondheepanОценок пока нет

- Final - TwofactorAuthendicationДокумент71 страницаFinal - TwofactorAuthendicationsmartsafin13Оценок пока нет

- Araxxe Whitepaper Revenue Assurance and Digital RevolutionДокумент21 страницаAraxxe Whitepaper Revenue Assurance and Digital RevolutionAli babaОценок пока нет

- Deloitte NL Ths Airline Iot Passenger Experience Part 1Документ8 страницDeloitte NL Ths Airline Iot Passenger Experience Part 1Maged Mohamed MekhemarОценок пока нет

- KPMG Flash News Verizon Communications Singapore Pte LTDДокумент6 страницKPMG Flash News Verizon Communications Singapore Pte LTDManish GuptaОценок пока нет

- Trader Manual PDFДокумент121 страницаTrader Manual PDFlorenneth88% (16)

- Roxas City Government Information Systems Strategic Plan Version 1.01 January 2013Документ12 страницRoxas City Government Information Systems Strategic Plan Version 1.01 January 2013bong goОценок пока нет

- Digital Compliance: Platform From SAPДокумент9 страницDigital Compliance: Platform From SAPsiddharthadeepakОценок пока нет

- An Introduction to SDN Intent Based NetworkingОт EverandAn Introduction to SDN Intent Based NetworkingРейтинг: 5 из 5 звезд5/5 (1)

- TDS-Foam Pig-PU-MD-CC PDFДокумент1 страницаTDS-Foam Pig-PU-MD-CC PDFobumuyaemesiОценок пока нет

- Liquefied Natural Gas I CBIДокумент2 страницыLiquefied Natural Gas I CBIobumuyaemesiОценок пока нет

- Sludge Pump: High-Performance Products. Designed For You!Документ1 страницаSludge Pump: High-Performance Products. Designed For You!obumuyaemesiОценок пока нет

- Origins of Internal Flow SystemsДокумент2 страницыOrigins of Internal Flow SystemsobumuyaemesiОценок пока нет

- Choke PDFДокумент32 страницыChoke PDFobumuyaemesi100% (1)

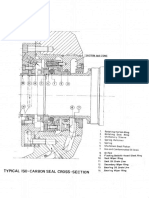

- X Section ISO Carbon SealДокумент1 страницаX Section ISO Carbon SealobumuyaemesiОценок пока нет

- Globe Valve1 DatasheetДокумент1 страницаGlobe Valve1 DatasheetobumuyaemesiОценок пока нет

- Spare Parts List: Sludge Pumps CP 0077Документ16 страницSpare Parts List: Sludge Pumps CP 0077obumuyaemesiОценок пока нет

- New Cardrige Design - BRXsealДокумент15 страницNew Cardrige Design - BRXsealobumuyaemesi100% (1)

- Simulating Cooling Water Circuit Dynamics: Mentor Graphics, Mechanical Analysis DivisionДокумент8 страницSimulating Cooling Water Circuit Dynamics: Mentor Graphics, Mechanical Analysis DivisionobumuyaemesiОценок пока нет

- WGV1002 Api 6a Gate PDFДокумент13 страницWGV1002 Api 6a Gate PDFobumuyaemesiОценок пока нет

- 1.23 Horizontal Self Priming Multistage PumpДокумент3 страницы1.23 Horizontal Self Priming Multistage PumpobumuyaemesiОценок пока нет

- HD Api610Документ5 страницHD Api610Venkat RanganОценок пока нет

- C 04407527Документ44 страницыC 04407527plgrodriguesОценок пока нет

- Cameron Subsea SystemsДокумент49 страницCameron Subsea Systemsady_fernando100% (4)

- Nigerian PAYE Calculator 4.0Документ2 страницыNigerian PAYE Calculator 4.0obumuyaemesi100% (1)

- Performance Trend of CompressorДокумент39 страницPerformance Trend of CompressorobumuyaemesiОценок пока нет

- Chemical Injection Metering PDFДокумент16 страницChemical Injection Metering PDFobumuyaemesiОценок пока нет

- Chemical Injection MeteringДокумент2 страницыChemical Injection MeteringobumuyaemesiОценок пока нет

- Flow MasterДокумент37 страницFlow MasterobumuyaemesiОценок пока нет

- P1064-00-M05-122-R1 - Butterfly ValveДокумент9 страницP1064-00-M05-122-R1 - Butterfly ValveNarayana MugalurОценок пока нет

- Question Bank of DRCBMДокумент11 страницQuestion Bank of DRCBMrishinathnehruОценок пока нет

- 161 PDFДокумент20 страниц161 PDFsb_al20Оценок пока нет

- Battery Management System (BMS) For Lithium-Ion BatteriesДокумент98 страницBattery Management System (BMS) For Lithium-Ion BatteriesAndre Coutinho100% (3)

- MM6 Chapter 05 Constructions Rev 05 2010Документ36 страницMM6 Chapter 05 Constructions Rev 05 2010mileОценок пока нет

- Mid 185 - Ppid 305 - Fmi 12Документ3 страницыMid 185 - Ppid 305 - Fmi 12AkbarОценок пока нет

- Monitoring OverviewДокумент77 страницMonitoring Overviewmbal@diballi.nlОценок пока нет

- Marine Engine Comparison 180 Horse PowerДокумент1 страницаMarine Engine Comparison 180 Horse PowerBoris SitorusОценок пока нет

- Continental Ram Automotive Product Catalogue 08-09-17Документ164 страницыContinental Ram Automotive Product Catalogue 08-09-17Jenny Mora LeonОценок пока нет

- Analysis of Island Detection in PV Rich Micro-Grid2 PDFДокумент25 страницAnalysis of Island Detection in PV Rich Micro-Grid2 PDFIsha ChandraОценок пока нет

- Bending Fatigue Failure in Gear Tooth IJERTV2IS60387 PDFДокумент8 страницBending Fatigue Failure in Gear Tooth IJERTV2IS60387 PDFsabaris ksОценок пока нет

- Geely Case StudyДокумент6 страницGeely Case StudyMayank Verma100% (1)

- ROTHAN Grad - Msu 0128D 15388 PDFДокумент181 страницаROTHAN Grad - Msu 0128D 15388 PDFSonsai QuiruОценок пока нет

- Release NotesДокумент17 страницRelease NotesDiego AriasОценок пока нет

- Worksheet Titanic Python PDFДокумент8 страницWorksheet Titanic Python PDFrashmimehОценок пока нет

- Harga HDD SSD NasДокумент13 страницHarga HDD SSD NasYudi BasseloОценок пока нет

- Zx200-5G Hydraulic Circuit Diagram (Standard) : Arm CylДокумент1 страницаZx200-5G Hydraulic Circuit Diagram (Standard) : Arm CylTùng HUỳnhОценок пока нет

- Nestle New Product Development Feb 06Документ16 страницNestle New Product Development Feb 06Raghav SagarОценок пока нет

- Stefano Scodanibbio ObituarioДокумент3 страницыStefano Scodanibbio ObituarioluisalvazОценок пока нет

- Bentley Bim WhitepaperДокумент10 страницBentley Bim WhitepaperAyman KandeelОценок пока нет

- CH 25 Sec 2 - IndustrializationДокумент6 страницCH 25 Sec 2 - IndustrializationMrEHsiehОценок пока нет

- Large Touch Screen Interface Fully Integrated DICOM: Captus 4000e ReportsДокумент2 страницыLarge Touch Screen Interface Fully Integrated DICOM: Captus 4000e ReportsAntony SantosОценок пока нет

- Advantage Federal Credit Union - Case Study HDMДокумент2 страницыAdvantage Federal Credit Union - Case Study HDMspaceskipperОценок пока нет

- Alagappa University: Karaikudi - 630 003, Tamilnadu, IndiaДокумент17 страницAlagappa University: Karaikudi - 630 003, Tamilnadu, IndiaVeanganОценок пока нет

- PRINT MEDIA - Yesterday, Today and TomorrowДокумент21 страницаPRINT MEDIA - Yesterday, Today and Tomorrowmonirba48Оценок пока нет

- X10CrNi18-8 MaterialsДокумент10 страницX10CrNi18-8 MaterialsRinda ManuОценок пока нет

- Wind Turbine Power Plant in NigeriaДокумент12 страницWind Turbine Power Plant in NigeriaAhmed AbdelhamidОценок пока нет

- Signal Circuit EMI: UnwantedДокумент4 страницыSignal Circuit EMI: UnwantedmarichuОценок пока нет

- EBTS Volume 1 - System Installation and Testing - Motorola iDENДокумент583 страницыEBTS Volume 1 - System Installation and Testing - Motorola iDENPedro Aldana QuintanaОценок пока нет

- BUsiness Propoal TemplateДокумент7 страницBUsiness Propoal TemplateShonga CatsОценок пока нет