Академический Документы

Профессиональный Документы

Культура Документы

Comprehensive Problem - Merchandising Business

Загружено:

Jasper Andrew AdjaraniАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Comprehensive Problem - Merchandising Business

Загружено:

Jasper Andrew AdjaraniАвторское право:

Доступные форматы

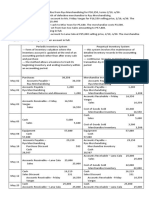

Comprehensive Problem

Accounting for Merchandising Business

The post-closing trial balance of the general ledger of Wilson Retail Company at December 31, 2016, reflected the

following:

__________Account Debit Credit

Cash 27,000

Accounts receivable 20,000

Inventory 35,000

Prepaid insurance (20 months remaining) 900

Equipment (20-year life, no salvage value) 50,000

Accumulated depreciation 22,500

Accounts payable 7,500

Salaries payable 4,000

Wilson, Capital 98,900

______ ________

132,900 132,900

The company is using the perpetual inventory system. The following transactions occurred during January 2017:

January 1 Invested additional cash of P321,000 in the business.

January 2 Collected the accounts from customers from last month in full.

January 3 Purchased office supplies of P5,000 on account.

January 4 Purchased inventory costing P210,000 for cash, including freight of P3,000.

January 5 Sold goods for P200,000 cash. The cost of the goods sold is P120,000.

January 6 Paid the accrued salaries from the previous month.

January 7 Returned goods to your supplier costing P3,000 due to defects.

January 8 Sold goods on account for P80,000. Terms are at 2/10, n/30. The cost of the goods sold is P48,000.

January 9 Purchased goods on account for P60,000. Terms are at 1/5, n/25.

January 10 Paid the account with the suppliers on the January 3 purchase.

January 11 Paid the accounts to suppliers from last month in full.

January 12 Paid a mechanic for P4,500 for repairs and maintenance of the equipment.

January 13 Paid the account with suppliers on the January 9 purchase.

January 15 Paid mid-month salaries totaling P14,000.

January 15 Purchased a new equipment costing P20,000 for cash. The equipment has a useful life of 5 years and a 10%

salvage value.

January 16 Borrowed P25,000 from a bank. Interest was at 10% per annum.

January 17 Received the payment due from the customer on the January 8 sale.

January 19 Purchased goods on account for P25,000. The terms are 2/8, n/20.

January 20 Sold goods for P100,000 cash. The cost of the goods is in the same proportion with its sales price as usually

transacted. Upon delivery to the customer, the Company paid P5,000 freight.

January 23 Received P15,000 from a customer as advanced payment for goods to be paid on February 14.

January 25 Sold goods for P50,000 on account. The terms was 3/15, n/45. The cost of the goods sold was P40,000

January 27 Customers returned P3,000 worth of inventory back to the Company due to poor quality. The goods were

originally sold last January 25.

January 29 Paid the account with the suppliers on the January 19 purchase.

January 30 Paid the following expenses: Rent P15,000, Light and water P8,500, Advertising (good for one year)

P4,250.

Additional information:

Supplies at the end of the month, as counted, is valued at P2,000.

Salaries of P14,500 needs to be accrued.

Ending inventory is P61,400 per physical count

Requirements:

1. Analyzed the aforementioned transactions and prepare the journal entries for the month of January.

2. Post the journal entries to their respective accounts and compute the month-end balances per account.

3. Prepare the necessary adjusting entries at the end of the month.

4. Prepare a worksheet showing the following:

5. The unadjusted trial balance

6. The adjustments per account, if necessary

7. The adjusted trial balance

8. Prepare the balance sheet and the income statement of the proprietor for the month ended January 31, 2017.

9. Prepare the closing entries.

10. Prepare the post-closing trial balance.

Вам также может понравиться

- Practice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetДокумент11 страницPractice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetBenedict FajardoОценок пока нет

- Adjusting Entries Exercises LandscapeДокумент3 страницыAdjusting Entries Exercises LandscapeTatyanna Kaliah100% (3)

- Comprehensive ProblemДокумент2 страницыComprehensive ProblemCeline Floranza100% (1)

- IE 312 Financial Accounting Problem SetДокумент2 страницыIE 312 Financial Accounting Problem SetMijo Cruz67% (3)

- Accounting For Merchandising BusinessДокумент6 страницAccounting For Merchandising BusinessElla Acosta100% (1)

- AIS Journal Entries and Adjusting EntriesДокумент2 страницыAIS Journal Entries and Adjusting EntriesIeva Francheska Agustin83% (6)

- Test Bank 4Документ5 страницTest Bank 4Jinx Cyrus RodilloОценок пока нет

- Accounting For Merchandising Operations LongДокумент32 страницыAccounting For Merchandising Operations Longgk concepcionОценок пока нет

- AdjustingДокумент39 страницAdjustingRica mae camon100% (1)

- Acctg Closing Entries, Post Closing Trial Balance and Reversing EntriesДокумент21 страницаAcctg Closing Entries, Post Closing Trial Balance and Reversing EntriesDaisy Marie A. Rosel100% (1)

- Accounting For Merchandising CompaniesДокумент11 страницAccounting For Merchandising CompaniesJesseca JosafatОценок пока нет

- Orca Share Media1605010109407 6731900321930361605Документ37 страницOrca Share Media1605010109407 6731900321930361605MARY JUSTINE PAQUIBOTОценок пока нет

- Journal Entries GuideДокумент5 страницJournal Entries GuideRaez Rodillado100% (1)

- Journal entries for merchandising operationsДокумент4 страницыJournal entries for merchandising operationsArrabela PalmaОценок пока нет

- Practice Set I AcctgДокумент14 страницPractice Set I AcctgJan Pearl Hinampas100% (1)

- Midterm Exam Accounting 3 Hawk Hardware Store TransactionsДокумент1 страницаMidterm Exam Accounting 3 Hawk Hardware Store TransactionsJT Gal60% (5)

- Periodic Method Illustrative ProblemДокумент30 страницPeriodic Method Illustrative ProblemRose Marie Hermosa100% (3)

- Nursing Home TransactionsДокумент4 страницыNursing Home TransactionsRaul Soriano CabantingОценок пока нет

- PROBLEMДокумент3 страницыPROBLEMVine Vine D (Viney23rd)0% (6)

- Accounting Basics: Recording TransactionsДокумент8 страницAccounting Basics: Recording TransactionsRegina Bengado100% (1)

- Periodic Inventory System Merchandising ProblemДокумент1 страницаPeriodic Inventory System Merchandising ProblemVincent Madrid100% (6)

- Seatwork 10.6.21Документ6 страницSeatwork 10.6.21Ashley MarloweОценок пока нет

- Merchandising Periodic SampleДокумент14 страницMerchandising Periodic SampleYam Pinoy100% (2)

- Perpetual System, Problem #17Документ2 страницыPerpetual System, Problem #17Feiya LiuОценок пока нет

- Tesda Perpetual GuidelinesДокумент12 страницTesda Perpetual GuidelinesMichael Angelo Laguna Dela FuenteОценок пока нет

- Basic accounting model and key concepts in 40 charactersДокумент3 страницыBasic accounting model and key concepts in 40 charactersdlinds2X1Оценок пока нет

- Canton, E. - General Ledger - Alabang Plumbing (Solution)Документ4 страницыCanton, E. - General Ledger - Alabang Plumbing (Solution)Edmalyn CantonОценок пока нет

- Adjusting Entries: Fundamentals of Accountancy, Business and Management-1Документ22 страницыAdjusting Entries: Fundamentals of Accountancy, Business and Management-1Arminda VillaminОценок пока нет

- MerchandisingДокумент20 страницMerchandisingDave PeraltaОценок пока нет

- Financial Accounting I: Classify Items & Analyze TransactionsДокумент3 страницыFinancial Accounting I: Classify Items & Analyze TransactionsJane Carla BorromeoОценок пока нет

- Fundamentals of Accounting I ACCOUNTING CYCLE: CompletionДокумент14 страницFundamentals of Accounting I ACCOUNTING CYCLE: Completionericacadago100% (1)

- 2016 14 PPT Acctg1 Adjusting EntriesДокумент20 страниц2016 14 PPT Acctg1 Adjusting Entriesash wu100% (3)

- Merchandising Quiz 1 Answer Key PDFДокумент8 страницMerchandising Quiz 1 Answer Key PDFAngelie JalandoniОценок пока нет

- Accounting For Merchandising Operations LongДокумент2 страницыAccounting For Merchandising Operations Longgk concepcionОценок пока нет

- Accounting transactions exampleДокумент3 страницыAccounting transactions exampleMylen Noel Elgincolin ManlapazОценок пока нет

- Joannamarie Uy ProblemДокумент1 страницаJoannamarie Uy ProblemFeiya Liu50% (2)

- Santa Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The PhilippinesДокумент19 страницSanta Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The PhilippinesareumОценок пока нет

- Exercise 1 Merchandising UpdatedДокумент5 страницExercise 1 Merchandising UpdatedShiela RengelОценок пока нет

- Problem Special JournalsДокумент6 страницProblem Special JournalsCarmi Fecero100% (2)

- Accounting Cycle: For Service BusinessДокумент105 страницAccounting Cycle: For Service BusinessLouie Jay Legaspi100% (1)

- Merchandising Perpetual Inv Sys Coco Computer StoreДокумент18 страницMerchandising Perpetual Inv Sys Coco Computer StoreMadelyn Espiritu100% (4)

- UntitledДокумент7 страницUntitledKit BalagapoОценок пока нет

- Fabm 2 Practice SetДокумент33 страницыFabm 2 Practice SetJen Trixie Gallardo57% (7)

- Manual Accounting Practice SetДокумент13 страницManual Accounting Practice SetNguyen Thien Anh Tran100% (2)

- ACT1101, PRB, Midterm, Wit Ans KeyДокумент5 страницACT1101, PRB, Midterm, Wit Ans KeyDyen100% (1)

- Basic Accounting ReviewerДокумент4 страницыBasic Accounting ReviewerRyan Dizon100% (1)

- AC1Документ1 страницаAC1Lyanna Mormont25% (4)

- Journalize the above transactions in the general journal of Bert PhotographyДокумент24 страницыJournalize the above transactions in the general journal of Bert PhotographyManuel Panotes Reantazo50% (2)

- TransactionДокумент1 страницаTransactionMARVIN ROSEL0% (1)

- Quick Tests Unit 1 and Unit 2Документ47 страницQuick Tests Unit 1 and Unit 2junjun100% (2)

- University of Cebu senior high school department compilation notesДокумент8 страницUniversity of Cebu senior high school department compilation notesAndra FleurОценок пока нет

- Financial Statement Worksheet DetoyaДокумент8 страницFinancial Statement Worksheet Detoyasharon emailОценок пока нет

- FAR Assignment 1Документ3 страницыFAR Assignment 1Abegail Marababol50% (12)

- PERPETUAL INVENTORY SYSTEM - Practice SetДокумент25 страницPERPETUAL INVENTORY SYSTEM - Practice SetJAY100% (2)

- Exercise 3 Adjusting Entries - Service BusinessДокумент2 страницыExercise 3 Adjusting Entries - Service BusinessMarc Viduya75% (4)

- Davao Commercial Center Chart of AccountsДокумент2 страницыDavao Commercial Center Chart of AccountsFrancis Raagas67% (3)

- Accounting: Adjusting EntriesДокумент11 страницAccounting: Adjusting EntriesCamellia100% (2)

- Merchandising Bus Prub Periodic MethodДокумент2 страницыMerchandising Bus Prub Periodic MethodChristopher Keith BernidoОценок пока нет

- Saint Columban College Business Education 2nd Semester Financial StatementsДокумент3 страницыSaint Columban College Business Education 2nd Semester Financial StatementsJoe Honey Cañas Carbajosa100% (1)

- Exercises in Adjusting EntriesДокумент5 страницExercises in Adjusting EntriesJhon Robert BelandoОценок пока нет

- Max S Group Inc PSE MAXS FinancialsДокумент36 страницMax S Group Inc PSE MAXS FinancialsJasper Andrew AdjaraniОценок пока нет

- Case Answer: Nordic Foot BridgeДокумент3 страницыCase Answer: Nordic Foot BridgeJasper Andrew Adjarani100% (1)

- Jollibee Foods Corporation PSE JFC FinancialsДокумент38 страницJollibee Foods Corporation PSE JFC FinancialsJasper Andrew AdjaraniОценок пока нет

- Bias BustersДокумент1 страницаBias BustersJasper Andrew AdjaraniОценок пока нет

- Trustees CertificateДокумент1 страницаTrustees CertificateJasper Andrew Adjarani100% (1)

- ACEI - Release Waiver Quitclaim - CorporateДокумент4 страницыACEI - Release Waiver Quitclaim - CorporateAcie Acie AcieОценок пока нет

- Back pay and termination benefits for 14 employeesДокумент5 страницBack pay and termination benefits for 14 employeesJasper Andrew AdjaraniОценок пока нет

- Chap 4 Report - Demand EstimationДокумент24 страницыChap 4 Report - Demand EstimationJasper Andrew AdjaraniОценок пока нет

- Engagement Letter (Coop)Документ2 страницыEngagement Letter (Coop)Jasper Andrew Adjarani100% (1)

- Statement of MGT Responsibility ITRДокумент1 страницаStatement of MGT Responsibility ITRJasper Andrew AdjaraniОценок пока нет

- Social enterprise impact communitiesДокумент1 страницаSocial enterprise impact communitiesJasper Andrew AdjaraniОценок пока нет

- CSR Paper Sample TemplateДокумент8 страницCSR Paper Sample TemplateJasper Andrew AdjaraniОценок пока нет

- Financial Management CourseДокумент14 страницFinancial Management CourseJasper Andrew AdjaraniОценок пока нет

- SMR - ItrДокумент1 страницаSMR - ItrJasper Andrew AdjaraniОценок пока нет

- MBA - Financial Management (Activity 3 - Risk & Return)Документ1 страницаMBA - Financial Management (Activity 3 - Risk & Return)Jasper Andrew AdjaraniОценок пока нет

- Sample Financial Management ProblemsДокумент8 страницSample Financial Management ProblemsJasper Andrew AdjaraniОценок пока нет

- Acknowledgment ReceiptДокумент1 страницаAcknowledgment ReceiptJasper Andrew AdjaraniОценок пока нет

- I. Problem: Lapses in CommunicationДокумент2 страницыI. Problem: Lapses in CommunicationJasper Andrew AdjaraniОценок пока нет

- Strat Man FormatДокумент1 страницаStrat Man FormatJasper Andrew AdjaraniОценок пока нет

- Authorization LetterДокумент1 страницаAuthorization LetterJasper Andrew AdjaraniОценок пока нет

- RMYC CUP 1 DUMAGUETE 2014 TOP QUESTIONSДокумент15 страницRMYC CUP 1 DUMAGUETE 2014 TOP QUESTIONSJasper Andrew AdjaraniОценок пока нет

- RMYC Cup 2 - RevДокумент9 страницRMYC Cup 2 - RevJasper Andrew AdjaraniОценок пока нет

- Basic Accounting TutorialsДокумент1 страницаBasic Accounting TutorialsJasper Andrew AdjaraniОценок пока нет

- Financial Reporting for School Org (40chДокумент1 страницаFinancial Reporting for School Org (40chJasper Andrew AdjaraniОценок пока нет

- Key Performance Indicators To Track Smart VillagesДокумент1 страницаKey Performance Indicators To Track Smart VillagesJasper Andrew AdjaraniОценок пока нет

- Case 1 - Mr. ReyesДокумент3 страницыCase 1 - Mr. ReyesJasper Andrew AdjaraniОценок пока нет

- Strat Man FormatДокумент1 страницаStrat Man FormatJasper Andrew AdjaraniОценок пока нет

- Case 2 - Mr. AranetaДокумент3 страницыCase 2 - Mr. AranetaJasper Andrew AdjaraniОценок пока нет

- Strategic Goals: Social Development IndicatorsДокумент4 страницыStrategic Goals: Social Development IndicatorsJasper Andrew AdjaraniОценок пока нет

- Astudillo v. Board of Directors Case DigestДокумент2 страницыAstudillo v. Board of Directors Case DigestKRISANTA DE GUZMANОценок пока нет

- Tort-Defense of Volunti Non Fit InjuriaДокумент5 страницTort-Defense of Volunti Non Fit InjuriaHarsh GuptaОценок пока нет

- Lok Ur Committee ReportДокумент62 страницыLok Ur Committee ReportLokanath MishraОценок пока нет

- Presentation On Taxation of The Microfinance IndustryДокумент23 страницыPresentation On Taxation of The Microfinance IndustryFranco DurantОценок пока нет

- Infante Vs Aran BuildersДокумент2 страницыInfante Vs Aran BuildersPop CornОценок пока нет

- Loan Application FormДокумент2 страницыLoan Application FormDean DanaiОценок пока нет

- Presented To: Prof. SUNIL PARKAR: (Mergers in Banking Sector) Group-12Документ22 страницыPresented To: Prof. SUNIL PARKAR: (Mergers in Banking Sector) Group-12Mihir Sansare100% (1)

- Ann 7 LetterДокумент4 страницыAnn 7 LettergillmoodieОценок пока нет

- Understanding The Law Pauline UnderstandДокумент12 страницUnderstanding The Law Pauline UnderstandSesekurentus Parshilingi Shulushuluu GaterisОценок пока нет

- Carbon Dioxide: Safety Data SheetДокумент9 страницCarbon Dioxide: Safety Data Sheetolivares91Оценок пока нет

- KEY REGENT FAMILIES OF JAVA'S HISTORIC REGIONSДокумент36 страницKEY REGENT FAMILIES OF JAVA'S HISTORIC REGIONSfenta pradiptaОценок пока нет

- Demonetization To Digitalization: A Step Toward Progress: Discover The World's ResearchДокумент48 страницDemonetization To Digitalization: A Step Toward Progress: Discover The World's ResearchAman PawarОценок пока нет

- Midwest Protouch CleaningДокумент3 страницыMidwest Protouch CleaningalisellsrealestateОценок пока нет

- Pran 27001 SOA Compliance ChecklistДокумент39 страницPran 27001 SOA Compliance Checklistpraneeth.marpallyОценок пока нет

- Fact Sheet - Overview of POCA 2Документ5 страницFact Sheet - Overview of POCA 2Vanesa SlaveОценок пока нет

- 11 November 2016Документ559 страниц11 November 2016naeem rasheedОценок пока нет

- A2010 Torts DigestsДокумент179 страницA2010 Torts Digestscmv mendoza100% (2)

- Binondo Church History and ProfileДокумент1 страницаBinondo Church History and ProfileJohhan Joseph AraraoОценок пока нет

- Appendix VOL 2 of 3 (X149367) PDFДокумент313 страницAppendix VOL 2 of 3 (X149367) PDFL. A. PatersonОценок пока нет

- What Is Martial Law?Документ5 страницWhat Is Martial Law?Drey TabilogОценок пока нет

- Financial and Managerial Accounting 7th Edition Wild Solutions ManualДокумент39 страницFinancial and Managerial Accounting 7th Edition Wild Solutions Manualcanellacitrinec0kkb100% (26)

- Genesis Porting v2Документ28 страницGenesis Porting v2prem kumarОценок пока нет

- The Co-Operative Societies Act: ShortДокумент34 страницыThe Co-Operative Societies Act: ShortRamesh RamОценок пока нет

- PHILIPPINE NATIONAL BANK, PETITIONER, v. FELINA GIRON-ROQUEДокумент2 страницыPHILIPPINE NATIONAL BANK, PETITIONER, v. FELINA GIRON-ROQUEabbywinsterОценок пока нет

- Building The State (1781-1797) - Text-Based BookДокумент20 страницBuilding The State (1781-1797) - Text-Based Booktopsyturvydom20025814Оценок пока нет

- Sandiganbayan Upholds Malversation ConvictionДокумент2 страницыSandiganbayan Upholds Malversation ConvictioniamReadyPlayerOneОценок пока нет

- What Is A Tangible Asset Comparison To Non-Tangible AssetsДокумент7 страницWhat Is A Tangible Asset Comparison To Non-Tangible AssetshieutlbkreportОценок пока нет

- General Durable Power of AttorneyДокумент4 страницыGeneral Durable Power of AttorneynrrtaftОценок пока нет

- Court Affirms Suppression of DUI Evidence in Ohio Speeding CaseДокумент11 страницCourt Affirms Suppression of DUI Evidence in Ohio Speeding CaseTeresa LynnОценок пока нет

- I'm A Little Snowman, Piano - VoiceДокумент2 страницыI'm A Little Snowman, Piano - VoiceNeda Marijanović100% (3)