Академический Документы

Профессиональный Документы

Культура Документы

Individual Annual Income Tax Return

Загружено:

Hafiedz SИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Individual Annual Income Tax Return

Загружено:

Hafiedz SАвторское право:

Доступные форматы

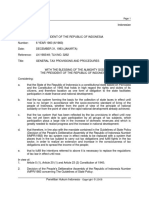

1770 INDIVIDUAL ANNUAL INCOME TAX RETURN 2 0

TAXABLE YEAR

FORM WITH INCOME:

to

FROM BUSINESS/SELF-EMPLOYMENT THAT IMPLEMENT ACCOUNTING OR

MINISTRY OF FINANCE DEEMED NET INCOME MM YY MM YY

DIRECTORATE GENERAL OF TAXES

FROM EMPLOYMENT FOR ONE OR MORE EMPLOYER(S) DEEMED ACCOUNTING

SUBJECT TO FINAL AND/OR FINALIZED TAX

FROM OTHER INCOME .. AMENDED RETURN

ATTENTION:

FOLLOW INSTRUCTION IN THE MANUAL

PRINT OR TYPE WITH CAPITAL LETTER AND BLACK INK

MARK " X " IN THE APPROPRIATE BOX

TIN :

IDENTITY

TAXPAYER'S NAME :

BUSINESS CLASSIFICATION/SELF : KLU :

EMPLOYMENT

TELEPHONE /FAX NO : /

UP DATE OF IDENTITY : YES, SEPARATE ATTACHMENT NO

*) The filling columns of Rupiah value must be without decimal value (see example in instruction book page 3) IDR *)

1. DOMESTIC NET INCOME FROM BUSINESS AND/OR SELF EMPLOYMENT

[From Form 1770 - I page 1 total part A or Form 1770 - I page 2 Total Part B column 5]

1

2. DOMESTIC NET INCOME FROM EMPLOYMENT

[From Form 1770 - I page 2 Total Part C column 5]

2

A. NET INCOME

3. OTHER DOMESTIC NET INCOME

[From Form 1770 - I page 2 Total Part D column 3]

3

4. FOREIGN NET INCOME

[Complete it from separate attachment, if any foreign income, see instruction book]

4

5. TOTAL NET INCOME (LINE 1 + 2 + 3 + 4)

5

..

6. ZAKAT/OBLIGATED CHARITY

6

7. TOTAL NET INCOME AFTER ZAKAT/OBLIGATED CHARITY (LINE 5 - LINE 6)

7

8. LOSS CARRIED FORWARD

8

B. TAXABLE

9. TOTAL NET INCOME AFTER LOSS CARRIED FORWARD (LINE 7 - LINE 8)

INCOME

10. PERSONAL EXEMPTION TK/ K/ K/I/ PH/ HB/ 10

11. TAXABLE INCOME (LINE 9 - LINE 10)

11

12. TAX PAYABLE (TAX RATE ON ARTICLE 17 X LINE 11)

12

PAYABLE

C. TAX

13. ADJUSTMENT FOR FOREIGN TAX CREDITS REFUNDED AND HAD BEEN CREDITED IN THE PREVIOUS

YEAR RETURN (Income Tax Article 24)

13

14. TOTAL TAX PAYABLE ( LINE 12 + 13)

14

15. TAX WITHHELD BY OTHER PARTY/PAID /WITHHELD BY FOREIGN COUNTRIES AND BORNE BY THE

GOVERNMENT [From Form 1770 -II Total Part A column 7] 15

16. a. TAX DUE AFTER CREDIT

(14-15) 16

D. TAX CREDIT

b. TAX OVERLY WITHELD

17. PREPAID TAX: a. MONTHLY INSTALLMENT OF INCOME TAX ARTICLE 25

a

b. NOTICE OF TAX COLLECTION ON INCOME TAX ARTICLE 25 (PRINCIPAL ONLY)

b

c. INCOME TAX PAID ON THE DEPARTURE (FISCAL)

c

18. TOTAL TAX CREDIT (a+b+c)

18

SETTLED

19. a. UNDERPAID TAX (INCOME TAX ARTICLE 29)

OVER/UNDER PAID

(16-18) ON 19

E. INCOME TAX

b. OVERPAID TAX (INCOME TAX ARTICLE 28 A) DATE MONTH YEAR

20. REQUEST: Overpaid amount stated in 19.b would be a. REFUNDED c. REFUNDED WITH SKPPKP ARTICLE 17 C (COMPLIANCE TAXPAYER)

COMPENSATED WITH OUTSTANDING REFUNDED WITH SKPPKP ARTICLE 17 D (CERTAIN CRITERIA OF

b. TAX PAYABLE

d. TAXPAYER)

INCOME TAX ARTICLE 25

FOR THE SUBSEQUENT

21. MONTHLY INSTALLMENT FOR THE SUBSEQUENT YEAR 21

INSTALLMENT OF

F. MONTHLY

THE AMOUNT IS CALCULATED BY:

YEAR

a. 1/12 X THE TOTAL OF LINE 16 c. SEPARATE CALCULATION ATTACHED

b. CALCULATION OF PARTICULAR INDIVIDUAL TAXPAYER

OTHER THAN FORM OF 1770 - I TO 1770 - IV WITH THIS ALSO ATTACHED:

CALCULATION OF INSTALLMENT OF INCOME TAX ARTICLE 25 FOR THE SUBSEQUENT

a. POWER OF ATTORNEY (If needed) g.

ATTACHMENTS

YEAR

b. THIRD COPY OF TAX PAYMENT RECEIPT OF INCOME TAX ARTICLE 29 h. COPY OF RECEIPT OF INCOME TAX PAID ON THE DEPARTURE (FISCAL)

INCOME TAX CALCULATION FOR MARRIED TAXPAYER WITH SPLIT ESTATE AND/OR

c.

BALANCE SHEET AND INCOME STATEMENT, OR RECAPITULATION OF MONTHLY GROSS REVENUE i. HAS HER OWN TIN

G.

DETAILS OF INCOME AND PAYMENT OF INCOME TAX ARTICLE 25 (only for particular

d. CALCULATION OF TAX LOSS COMPENSATION j. Taxpayer)

RECEIPTS OF WITHHOLDING TAX/TAX BORNE BY THE GOVERNMENT/TAX PAID AND WITHELD IN FOREIGN

e. COUNTRY

k.

f. COPY OF FORM 1721-A1 AND/OR 1721-A2 (.Pages) l.

DECLARATION

Understanding all the sanctions provided by the law and regulations, i hereby declare that the information stated in this return, including all attachments provided, are SIGNATURE

true, complete, clear, and under no circumtances whatsoever

TAXPAYER REPRESENTATIVE DATE - -

FULL NAME

TIN

F.1.1.32.16

Вам также может понравиться

- Bilingual TRF 1770S-2016Документ10 страницBilingual TRF 1770S-2016Vtrock The'IlectraОценок пока нет

- General Instructions For The Completion PDF Form 1770 SДокумент14 страницGeneral Instructions For The Completion PDF Form 1770 SHafiedz S100% (1)

- Tugas Form Isian SPT 1770-2016 (Sofiyatul Muniroh - 0162)Документ16 страницTugas Form Isian SPT 1770-2016 (Sofiyatul Muniroh - 0162)rafi gamingОценок пока нет

- Form-1770 Induk EnglishДокумент1 страницаForm-1770 Induk Englishasmeldi100% (1)

- Annual Individual Income Tax ReturnДокумент1 страницаAnnual Individual Income Tax ReturnellenruntunuwuОценок пока нет

- Annual Individual Income Tax Return: Attachment - IДокумент5 страницAnnual Individual Income Tax Return: Attachment - IellenruntunuwuОценок пока нет

- SPT Tahunan PPH OP 1170 - Ali BabaДокумент16 страницSPT Tahunan PPH OP 1170 - Ali BabaMuhammadIshakОценок пока нет

- Corporate Annual Income Tax ReturnДокумент33 страницыCorporate Annual Income Tax ReturnHafiedz SОценок пока нет

- Bilingual TRF 1771 PDFДокумент18 страницBilingual TRF 1771 PDFviviОценок пока нет

- Manual Instruction - 1770 - 2010 - English PDFДокумент46 страницManual Instruction - 1770 - 2010 - English PDFHafiedz SОценок пока нет

- Manual Book 1770 PDFДокумент46 страницManual Book 1770 PDFHafiedz SОценок пока нет

- Nda - R&TДокумент5 страницNda - R&TKhushi PachauriОценок пока нет

- 1721 - A1 - English VersionДокумент2 страницы1721 - A1 - English VersionOki Indriawan100% (1)

- FORM A - Statutory Declaration of Assets, Liabilities and IncomeДокумент7 страницFORM A - Statutory Declaration of Assets, Liabilities and IncomeCACReid100% (1)

- Undang-Undang 2009 42-EnglishДокумент52 страницыUndang-Undang 2009 42-Englishmohamad_cipto100% (1)

- Contract Agreement Sparks BuildersДокумент3 страницыContract Agreement Sparks BuildersNeri DelfinОценок пока нет

- Offer Letter FormatДокумент5 страницOffer Letter FormatSandeep Kumar100% (1)

- Establishment Process of Ordinary Rep Office in IndonesiaДокумент7 страницEstablishment Process of Ordinary Rep Office in IndonesiaZakaria KartohardjonoОценок пока нет

- Policy and ProceduresДокумент167 страницPolicy and ProceduresPlanet RestaurantОценок пока нет

- Appointment LetterДокумент1 страницаAppointment LetterAdoniz TabucalОценок пока нет

- 2O Sample Offer LetterДокумент12 страниц2O Sample Offer LetterlieyaОценок пока нет

- List of LDD Corporate Documents For PTДокумент2 страницыList of LDD Corporate Documents For PTMirza AlexanderОценок пока нет

- Valid Agreement Under Indonesian LawДокумент3 страницыValid Agreement Under Indonesian LawAgung Kurnia Saputra100% (1)

- Independent Contractor Tutor AgreementДокумент7 страницIndependent Contractor Tutor AgreementMaya LiОценок пока нет

- Establishment Process of Rep Office Contractor in IndonesiaДокумент8 страницEstablishment Process of Rep Office Contractor in IndonesiaZakaria KartohardjonoОценок пока нет

- Ship Agency Services Tariff (Eng)Документ9 страницShip Agency Services Tariff (Eng)seyfiОценок пока нет

- FAQ - Employment Act 1955 Amendment (2022) Updated - PDF Version 1Документ61 страницаFAQ - Employment Act 1955 Amendment (2022) Updated - PDF Version 1CHérylSumОценок пока нет

- Personal GuaranteeДокумент6 страницPersonal GuaranteeRicky Yulianto SaputroОценок пока нет

- Services To Be Performed by Manager (2013)Документ2 страницыServices To Be Performed by Manager (2013)Angel KnightОценок пока нет

- Notice of 9th Annual General MeetingДокумент2 страницыNotice of 9th Annual General MeetingOseni Paul AbiolaОценок пока нет

- Transfer of Right of SharesДокумент3 страницыTransfer of Right of Sharessaut pakpahan100% (1)

- Memorandum-Of-Understanding ICON PLUS Sacomtel 25OCT2021 REVДокумент4 страницыMemorandum-Of-Understanding ICON PLUS Sacomtel 25OCT2021 REVAgustino KuncoroОценок пока нет

- Withholding Tax 101Документ82 страницыWithholding Tax 101Maria GinalynОценок пока нет

- Hire Purchase AgreementДокумент20 страницHire Purchase AgreementPradeep GautamОценок пока нет

- BIR RegulationsДокумент13 страницBIR RegulationsDaphne Dione BelderolОценок пока нет

- Basis of Malaysia Income TaxДокумент17 страницBasis of Malaysia Income TaxhelenxiaochingОценок пока нет

- Deed of Power of Attorney To Sell SharesДокумент8 страницDeed of Power of Attorney To Sell SharesridhofauzisОценок пока нет

- Sale and Purchase Agreement Malaysia SampleДокумент19 страницSale and Purchase Agreement Malaysia SamplerotinansatuОценок пока нет

- Appendix ContractДокумент2 страницыAppendix ContractDianОценок пока нет

- Services Contract - Google Docs 1Документ8 страницServices Contract - Google Docs 1api-423207215100% (1)

- BIR Ruling (DA - (TAR-001) 046-10)Документ4 страницыBIR Ruling (DA - (TAR-001) 046-10)amadieu100% (1)

- Notification Form Foreign CorporationДокумент2 страницыNotification Form Foreign CorporationJenel ChuОценок пока нет

- Contract Agreement ExampleДокумент15 страницContract Agreement ExampleAxiv The GreatОценок пока нет

- Standing Instruction Format: Mortgages/DVRA/Ver5.0/July2013Документ5 страницStanding Instruction Format: Mortgages/DVRA/Ver5.0/July2013Yudhi OctoraОценок пока нет

- Subcontracting Agreement ModelДокумент2 страницыSubcontracting Agreement ModellamagОценок пока нет

- Joint Venture Partnership Agreement TemplateДокумент10 страницJoint Venture Partnership Agreement TemplateAmitDwivediОценок пока нет

- WR155 Camshaft & Chain PDFДокумент1 страницаWR155 Camshaft & Chain PDFRandiОценок пока нет

- Tutor AgreementДокумент7 страницTutor AgreementJhana IlaoОценок пока нет

- Bir Ruling 044-10Документ4 страницыBir Ruling 044-10Jason CertezaОценок пока нет

- Subcontractor Agreement (Draft Bilingual)Документ44 страницыSubcontractor Agreement (Draft Bilingual)Jimmy Agung SilitongaОценок пока нет

- PFF002 EmployersDataForm V06Документ2 страницыPFF002 EmployersDataForm V06hitme bensiОценок пока нет

- Law No. 6 of 1983 On General Tax Provisions and Procedures (English)Документ41 страницаLaw No. 6 of 1983 On General Tax Provisions and Procedures (English)Ranny Hadrianto100% (2)

- Shareholders Agreement Finish (Mirza Hafez)Документ26 страницShareholders Agreement Finish (Mirza Hafez)JonDissectionОценок пока нет

- Annexure To Discount AgreementДокумент5 страницAnnexure To Discount AgreementbrajeshdhnОценок пока нет

- Contract of Sale and Purchase 1Документ3 страницыContract of Sale and Purchase 1gimaraqualityОценок пока нет

- 1770 EnglishДокумент6 страниц1770 Englishhafiedzs sОценок пока нет

- Not Printed in Mode "Fit Size" or "Shrink Size": General Instructions For The Completion SPT 1770 Digital FormДокумент16 страницNot Printed in Mode "Fit Size" or "Shrink Size": General Instructions For The Completion SPT 1770 Digital FormAnastasia FelinaОценок пока нет

- Not Printed in Mode "Fit Size" or "Shrink Size": General Instructions For The Completion SPT 1770 Digital FormДокумент16 страницNot Printed in Mode "Fit Size" or "Shrink Size": General Instructions For The Completion SPT 1770 Digital FormJ. Aryadi P.Оценок пока нет

- Analisis Produk - Baru - Analisis Produk - Sedang BerlangsungДокумент5 страницAnalisis Produk - Baru - Analisis Produk - Sedang BerlangsungHafiedz SОценок пока нет

- Journal of Financial Crime: Article InformationДокумент13 страницJournal of Financial Crime: Article InformationHafiedz SОценок пока нет

- Auditing The Revenue CycleДокумент1 страницаAuditing The Revenue CycleHafiedz SОценок пока нет

- Earnings Management Practices in India: A Study of Auditor's PerceptionДокумент6 страницEarnings Management Practices in India: A Study of Auditor's PerceptionHafiedz SОценок пока нет

- Corporate Annual Income Tax ReturnДокумент33 страницыCorporate Annual Income Tax ReturnHafiedz SОценок пока нет

- Manual Instruction - 1770 - 2010 - English PDFДокумент46 страницManual Instruction - 1770 - 2010 - English PDFHafiedz SОценок пока нет

- Manual Book 1770 PDFДокумент46 страницManual Book 1770 PDFHafiedz SОценок пока нет

- 03 - Additional Form 1770 - II 2010Документ2 страницы03 - Additional Form 1770 - II 2010Hafiedz SОценок пока нет

- 1770 EnglishДокумент6 страниц1770 Englishhafiedzs sОценок пока нет

- Figuerres vs. Court of AppealsДокумент13 страницFiguerres vs. Court of AppealsPaul PsyОценок пока нет

- Taxes, Tax Laws, and Tax AdministrationДокумент8 страницTaxes, Tax Laws, and Tax AdministrationAilene MendozaОценок пока нет

- CompanyДокумент2 страницыCompanyhusse fokОценок пока нет

- Chapter 2 Residence Status of IndividualsДокумент48 страницChapter 2 Residence Status of IndividualsHazlina HusseinОценок пока нет

- Signature Name & Mobile No of Person/Party Who Is Receiving The Material With Rubber StampДокумент2 страницыSignature Name & Mobile No of Person/Party Who Is Receiving The Material With Rubber StampVISHNU RAJ V67% (3)

- Business Studies Past PaperДокумент4 страницыBusiness Studies Past Paperbereket tesfayeОценок пока нет

- Gonzalo Puyat & Sons vs. City of Manila, G.R. No.17447, April 30, 1963 (7 CRA 790)Документ9 страницGonzalo Puyat & Sons vs. City of Manila, G.R. No.17447, April 30, 1963 (7 CRA 790)Riza AkkangОценок пока нет

- HEPI Press Release September Pdf2010Документ7 страницHEPI Press Release September Pdf2010Philip LewisОценок пока нет

- A-28, Lawrence Road,, New Delhi - 110035 Delhi Pay Slip For The Month of January-2018Документ2 страницыA-28, Lawrence Road,, New Delhi - 110035 Delhi Pay Slip For The Month of January-2018Reiki Channel Anuj BhargavaОценок пока нет

- MCQ On TDS, TCS & Advance TaxДокумент15 страницMCQ On TDS, TCS & Advance TaxPrakhar GuptaОценок пока нет

- Sector Thematic - Building Materials - Centrum 27042020Документ67 страницSector Thematic - Building Materials - Centrum 27042020vikasaggarwal01100% (1)

- Tendernotice 1Документ15 страницTendernotice 1jukesh thakurОценок пока нет

- Chapter 4.3Документ21 страницаChapter 4.3samysahhileОценок пока нет

- MYOB AccountingДокумент114 страницMYOB Accountingmukarromin100% (1)

- Bill Cum Receipt - Ms Humki Devi .Документ1 страницаBill Cum Receipt - Ms Humki Devi .Rahul SsdotraОценок пока нет

- Tax Cases 2ND BATCHДокумент17 страницTax Cases 2ND BATCHBestie BushОценок пока нет

- Understanding The Effect of Domestic Resource Mobilisation On Real Aggregate Output in NigeriaДокумент24 страницыUnderstanding The Effect of Domestic Resource Mobilisation On Real Aggregate Output in NigeriaOlusola Joel OyelekeОценок пока нет

- CF R.A. 10845 in Relation To National Internal Revenue Code of 1997, As Amended, Section 109.cДокумент8 страницCF R.A. 10845 in Relation To National Internal Revenue Code of 1997, As Amended, Section 109.cAce ParkerОценок пока нет

- FS AnalysisДокумент46 страницFS AnalysisjaxxОценок пока нет

- ML-20-026 Upasani Super Specaility HospitalДокумент1 страницаML-20-026 Upasani Super Specaility Hospitaltranshind overseasОценок пока нет

- CIR v. CA, CTA & Soriano Corp.Документ3 страницыCIR v. CA, CTA & Soriano Corp.Hinata ShoyoОценок пока нет

- Vat Advisor ExamДокумент79 страницVat Advisor ExamMoin UddinОценок пока нет

- Cir vs. Sony Philippines Inc. G.R. No. 178697 November 17 2010Документ10 страницCir vs. Sony Philippines Inc. G.R. No. 178697 November 17 2010Mark SiccuanОценок пока нет

- CMO 2009.compressedДокумент182 страницыCMO 2009.compressedMark Francis TolibasОценок пока нет

- Banking Law - Case CommentaryДокумент4 страницыBanking Law - Case CommentaryAnasuya NairОценок пока нет

- Checklist For Due Diligence Report For BanksДокумент16 страницChecklist For Due Diligence Report For BanksAddisu Mengist ZОценок пока нет

- Macroeconomics: PGDM: 2016 - 18 Term 2 (September - December, 2016) (Lecture 05)Документ48 страницMacroeconomics: PGDM: 2016 - 18 Term 2 (September - December, 2016) (Lecture 05)RohanОценок пока нет

- DFP-Module-2 v1410Документ130 страницDFP-Module-2 v1410Geviena Pinky Sy SarmientoОценок пока нет

- Income Taxation Chapter 9Документ11 страницIncome Taxation Chapter 9Kim Patrice NavarraОценок пока нет

- Homewood Suites Terms and ConditionsДокумент4 страницыHomewood Suites Terms and ConditionsRyan LawlerОценок пока нет