Академический Документы

Профессиональный Документы

Культура Документы

Renaissance IPO Review Q3

Загружено:

Anonymous Ht0MIJАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Renaissance IPO Review Q3

Загружено:

Anonymous Ht0MIJАвторское право:

Доступные форматы

Global IPO Market

3Q 2017 Quarterly Review

September 29, 2017

Strong Performance Drives Active Global IPO Market

The global IPO market continued to be active in the 3Q17, riding strong momentum from the first half of the year. Global IPO

proceeds totaled $33.4 billion in the 3Q17, up 12% from the year-ago period, led by Asia Pacific with 44% share of all proceeds raised.

Asia Pacific proceeds benefited from billion-dollar deals like NetLink Trust in Singapore ($1.7 billion), ZhongAn Online Insurance in

Hong Kong ($1.5 billion) and SBI Life in India ($1.3 billion). Europe took second place with 31% of proceeds, and included the two

largest deals of the quarter, Pirelli ($2.7 billion) and Landis+Gyr ($2.4 billion). After a period of dormancy, activity in Latin America

is starting to pick up, with the region accounting for 9% of proceeds. Buoyed by stellar returns in North America, global IPOs in the

third quarter averaged a healthy 16% return excluding China A-shares. With a robust pipeline and strong IPO performance, we expect

issuance to remain active for the remainder of 2017.

Full global 3Q17 review available for Renaissance Capital research clients.

Key Takeaways:

Global IPO market remains active with diversified issuance

Asia Pacific leads with 44% share of proceeds raised

Global returns averaged 16% (excluding A-shares) thanks to robust North America returns

Renaissance International IPO Index (IPOXUS) outperforms with 24.5% return year-to-date

Best performing sectors were health care and consumer discretionary

IPO pipeline remains robust including multi-billion-dollar deals for 2017

Global IPO Activity

3Q 2016 4Q 2016 1Q 2017 2Q 2017 3Q 2017 YoY

Proceeds Raised (US$) $29.7B $40.1B $24.4B $39.3B $33.4B 12.4%

Number of Deals 66 96 71 100 90 36.4%

Median Deal Size (US$) $192mm $193mm $196mm $227mm $201mm 4.4%

Source: Renaissance Capital. Global statistics include IPOs with a deal size of at least $100 million and exclude closed-end funds and SPACs. Data as of September 29, 2017.

Global IPO Activity

$160

123 150

$140 96 100 90

$120 72 77 71

Proceeds (US$ billions)

66 100

$100 42

29 50

$80

$51.2 $55.5

$60 $40.1 $39.3 0

$26.8 $29.7 $33.4

$40 $24.4

$13.6 $9.6 -50

$20

$0 -100

2Q 2015 3Q 2015 4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016 1Q 2017 2Q 2017 3Q 2017

Global IPO Proceeds Raised Number of Global IPOs

Source: Renaissance Capital. Global statistics include IPOs with a deal size of at least $100 million and exclude closed-end funds and SPACs. Data as of September 29, 2017.

Renaissance Capital is a global IPO investment adviser providing pre-IPO fundamental research and IPO market analytics to institutional investors.

Renaissance Capital manages portfolios of unseasoned equities through IPO-focused exchanged traded funds (ETFs) and separately managed

institutional accounts. For more information, visit www.renaissancecapital.com.

Page 1 of 1

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Walt Disney Case SolutionДокумент5 страницWalt Disney Case Solutiontsjakab100% (4)

- Corps Outline StoneДокумент63 страницыCorps Outline StoneBen VisserОценок пока нет

- IRR Leyte Investment Code of 2004Документ22 страницыIRR Leyte Investment Code of 2004Ramil M PerezОценок пока нет

- Corporation LAW AoI ByLaws Proj Ver 1Документ21 страницаCorporation LAW AoI ByLaws Proj Ver 1Kevin G. PerezОценок пока нет

- Vikash Marketing Plans of SpicejetДокумент9 страницVikash Marketing Plans of SpicejetvikashpgdmОценок пока нет

- People vs. MendezДокумент84 страницыPeople vs. MendezYosef_dОценок пока нет

- As 061818Документ4 страницыAs 061818Anonymous Ht0MIJОценок пока нет

- Citron SnapДокумент7 страницCitron SnapAnonymous Ht0MIJОценок пока нет

- NetflixДокумент4 страницыNetflixAnonymous Ht0MIJОценок пока нет

- ISGZSGДокумент16 страницISGZSGAnonymous Ht0MIJОценок пока нет

- Factsheet Global Allocation EnglishДокумент5 страницFactsheet Global Allocation EnglishAnonymous Ht0MIJОценок пока нет

- Fitbit From Fad To FutureДокумент11 страницFitbit From Fad To FutureAnonymous Ht0MIJОценок пока нет

- Inogen CitronДокумент8 страницInogen CitronAnonymous Ht0MIJОценок пока нет

- The Evolution of Vanguard Advisor's Alpha: From Portfolios To PeopleДокумент18 страницThe Evolution of Vanguard Advisor's Alpha: From Portfolios To PeopleAnonymous Ht0MIJОценок пока нет

- Where Are We in The Credit Cycle?: Gene Tannuzzo, Senior Portfolio ManagerДокумент1 страницаWhere Are We in The Credit Cycle?: Gene Tannuzzo, Senior Portfolio ManagerAnonymous Ht0MIJОценок пока нет

- IP Capital Partners CommentaryДокумент15 страницIP Capital Partners CommentaryAnonymous Ht0MIJОценок пока нет

- The Evolution of Vanguard Advisor's Alpha: From Portfolios To PeopleДокумент18 страницThe Evolution of Vanguard Advisor's Alpha: From Portfolios To PeopleAnonymous Ht0MIJОценок пока нет

- SlidesДокумент70 страницSlidesAnonymous Ht0MIJОценок пока нет

- Fpa Capital Fund Commentary 2017 q4Документ12 страницFpa Capital Fund Commentary 2017 q4Anonymous Ht0MIJОценок пока нет

- 2018 02 24berkshireletterДокумент148 страниц2018 02 24berkshireletterZerohedgeОценок пока нет

- l0284 NB Solving For 2018Документ28 страницl0284 NB Solving For 2018Anonymous Ht0MIJОценок пока нет

- Municipal Bond Market CommentaryДокумент8 страницMunicipal Bond Market CommentaryAnonymous Ht0MIJОценок пока нет

- SlidesДокумент70 страницSlidesAnonymous Ht0MIJОценок пока нет

- As 010818Документ5 страницAs 010818Anonymous Ht0MIJОценок пока нет

- Ffir Us B M 20171130 TRДокумент12 страницFfir Us B M 20171130 TRAnonymous Ht0MIJОценок пока нет

- Broadleaf Partners Fourth Quarter 2017 CommentaryДокумент4 страницыBroadleaf Partners Fourth Quarter 2017 CommentaryAnonymous Ht0MIJОценок пока нет

- Vltava Fund Dopis Letter To Shareholders 2017Документ7 страницVltava Fund Dopis Letter To Shareholders 2017Anonymous Ht0MIJОценок пока нет

- Bittles Market Notes PDFДокумент3 страницыBittles Market Notes PDFAnonymous Ht0MIJОценок пока нет

- Gmo Quarterly LetterДокумент22 страницыGmo Quarterly LetterAnonymous Ht0MIJОценок пока нет

- Q4 Letter Dec. 17 Final 1Документ4 страницыQ4 Letter Dec. 17 Final 1Anonymous Ht0MIJОценок пока нет

- Technical Review and OutlookДокумент7 страницTechnical Review and OutlookAnonymous Ht0MIJОценок пока нет

- Master Investor Magazine Issue 33 High Res Microsoft and Coca ColaДокумент6 страницMaster Investor Magazine Issue 33 High Res Microsoft and Coca ColaKishok Paul100% (2)

- Bittles Market NotesДокумент4 страницыBittles Market NotesAnonymous Ht0MIJОценок пока нет

- Tami Q3 2017Документ7 страницTami Q3 2017Anonymous Ht0MIJ100% (1)

- Fixed Income Weekly CommentaryДокумент3 страницыFixed Income Weekly CommentaryAnonymous Ht0MIJОценок пока нет

- As 121117Документ4 страницыAs 121117Anonymous Ht0MIJОценок пока нет

- Operations Management 1 - BeaДокумент27 страницOperations Management 1 - BeaBea Renela Gabinete ConcepcionОценок пока нет

- Stakeholders, Managers, and EthicsДокумент39 страницStakeholders, Managers, and EthicsJian Zhi TehОценок пока нет

- Corpo CasesДокумент157 страницCorpo CasesNor LitsОценок пока нет

- Bi-Annual RJIO TrackerДокумент24 страницыBi-Annual RJIO TrackerArjun PОценок пока нет

- Real Options and Mergers Insights for M&A DealsДокумент26 страницReal Options and Mergers Insights for M&A DealsasmaОценок пока нет

- FAQДокумент58 страницFAQvivekluvinОценок пока нет

- Module 9: What Is A Brand?: Brand Next Manifesto by Wolff OlinsДокумент4 страницыModule 9: What Is A Brand?: Brand Next Manifesto by Wolff OlinsRui ManuelОценок пока нет

- EWS #3 Valloire ResultsДокумент4 страницыEWS #3 Valloire ResultsmkazimerОценок пока нет

- The Parable of The Sadhu: A Position Paper 2/13/17 INTB 1203 Team 2 Donovan Dicks, Janelle Dinsmore, Sebastian Filmer, Jiaxin Feng, Kamil GadzhievДокумент7 страницThe Parable of The Sadhu: A Position Paper 2/13/17 INTB 1203 Team 2 Donovan Dicks, Janelle Dinsmore, Sebastian Filmer, Jiaxin Feng, Kamil Gadzhievapi-353441982100% (1)

- Stakeholder Engagement Beyond the Myth of Corporate ResponsibilityДокумент15 страницStakeholder Engagement Beyond the Myth of Corporate ResponsibilityEduardo Cisneros100% (1)

- Pesonet FaqsДокумент4 страницыPesonet FaqsRey Razel CaveОценок пока нет

- 1979 Letter To Shareholders - Berkshire HathawayДокумент9 страниц1979 Letter To Shareholders - Berkshire HathawayYashОценок пока нет

- Partnership Accounting RecordsДокумент17 страницPartnership Accounting RecordsHaroon Khan100% (1)

- Kotler Mm13e Media 16Документ37 страницKotler Mm13e Media 16Bingalee58Оценок пока нет

- 4.5m (CONSTRUCTION, REHABILITATION, IMPROVEMENT - Siargao, Surigao Del Norte)Документ2 страницы4.5m (CONSTRUCTION, REHABILITATION, IMPROVEMENT - Siargao, Surigao Del Norte)arafatbauntoОценок пока нет

- Kotler & Keller (Pp. 325-349)Документ3 страницыKotler & Keller (Pp. 325-349)Lucía ZanabriaОценок пока нет

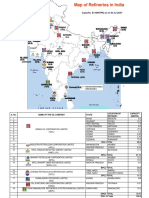

- Map of Indian Refineries CapacityДокумент2 страницыMap of Indian Refineries CapacitykutikuppalaОценок пока нет

- Whirlpool IndiaДокумент6 страницWhirlpool Indiadjsandypeeyush100% (1)

- Inox Wind Bags 100 MW Repeat Order From Tata Power Renewable Energy Limited (Company Update)Документ3 страницыInox Wind Bags 100 MW Repeat Order From Tata Power Renewable Energy Limited (Company Update)Shyam SunderОценок пока нет

- KTT AR2014 Full ReportДокумент187 страницKTT AR2014 Full ReportswarnalathaОценок пока нет

- Wall's Ice CreamДокумент15 страницWall's Ice Creammuhd_syafiq_23Оценок пока нет

- 1 What Did Arthur Andersen Contribute To The Enron DisasterДокумент1 страница1 What Did Arthur Andersen Contribute To The Enron DisasterAmit PandeyОценок пока нет

- Catherines Kids Portfolio Jenny GrichДокумент18 страницCatherines Kids Portfolio Jenny Grichapi-258325145Оценок пока нет