Академический Документы

Профессиональный Документы

Культура Документы

India and Capex - Kotak (08 Aug 08)

Загружено:

didwaniasАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

India and Capex - Kotak (08 Aug 08)

Загружено:

didwaniasАвторское право:

Доступные форматы

INDIA DAILY EQUITY MARKETS

India Daily Summary - August 18, 2008 August 18, 2008

Change, %

India 14-Aug 1-day 1-mo 3-mo

Sensex 14,724 (2.4) 16.2 (15.2)

Nifty 4,431 (2.2) 14.8 (13.4)

Contents Global/Regional indices

Dow Jones 11,660 0.4 1.4 (10.2)

Economy: Capex in large projects peaked in FY2008; unlikely to drop much in

FTSE 5,455 (0.8) 1.5 (13.5)

FY2009E

Nikkie 13,250 1.8 3.5 (6.8)

Hang Seng 20,989 (0.8) (4.0) (18.1)

KOSPI 1,570 (0.1) 4.0 (16.7)

News Roundup Value traded - India

Moving avg, Rs bn

Corporate

14-Aug 1-mo 3-mo

< With the prospects of Indias access to global nuclear reactor technology Cash (NSE+BSE) 157.9 190.8 186.5

brightening, several companies are vying for new projects planned across the Derivatives (NSE) 476.4 401.0 329

country, including Westinghouse Electric Company (AO1,000 series of Deri. open interest 782.6 728 756

reactors), GE-Hitachi (ABWR reactor series), Areva (1,000 MW European

pressurized reactors) and the Russian atomic energy agency Rosatom

(VVER1,000 reactors). (BL)

Forex/money market

< Trai will ask the Department of Telecom to take action against GSM operators

like Bharti Airtel, Vodafone Essar and Idea Cellular if they fail to connect Change, basis points

their networks to Reliance Communications GS network by August 21, 2008. 14-Aug 1-day 1-mo 3-mo

(ET) Rs/US$ 42.7 0 (10) 15

6mo fwd prem, % 0.7 (25) 71 24

< Reliance Big Entertainment, which earlier this year announced that global

investor George Soros will invest US$100 mn for a 3% stake in the company, is Net investment (US$mn)

yet to close the deal. (ET)

13-Aug MTD CYTD

< Fortis Healthworld, a Religare Group company, will acquire pharmacy retail chain FIIs (160) (168) (6,914)

CRS Health as part of its expansion, while rechristening itself as Religare MFs (62) 28 2,710

Wellness. (BS)

Top movers -3mo basis

< Hearst Corporation-owned merchandising licensing firm King Features

Syndicate is looking for multi-level non-exclusive deals with consumer product Change, %

Best performers 14-Aug 1-day 1-mo 3-mo

firms in India and is in talks with Frito-Lay, Titan, Bombay Dyeing, Lilliput

and retail chain Lifestyle, among others. (ET) OIL & NATURAL GAS CORP

1,066

LTD (1.6) 13.0 12.1

CIPLA LTD 234 0.9 8.8 9.8

< Lemon Tree, the upscale mid-market hotel, has invested around Rs500 crore in CROMPTON GREAVES LIMITED

261 (4.9) 14.0 9.5

the domestic market and around Rs200 crore in New York in the past two INDIAN OIL CORPORATION441

LTD (2.6) 15.5 7.2

months. (ET) DIVI'S LABORATORIES LTD

1,530 (4.1) 16.2 5.8

< A consortium of real estate developer Indu Projects, US-based healthcare Worst performers

major John Hopkins and Hyderabad-based CARE Hospital is setting p a 2,000 HOUSING DEVELOPMENT432

& INFRAS

(7.5) (0.1) (47.0)

bed health city in Nagpur with an investment of Rs750 crore through a INDIABULLS REAL ESTATE304

LTD (13.3) 4.8 (43.6)

combination of debt and equity. (ET) INFRASTRUCTURE DEV FINANCE

96 (7.9) (12.2) (42.9)

UNITECH LIMITED 169 (6.8) 13.3 (41.0)

CENTURY TEXTILES & INDS

497LTD (4.6) 7.6 (39.3)

Economic and political

< Commodities tumbled across the board prior to the weekend, with gold sinking

below US$800 an ounce to almost a nine-month low as evidence mounted that

slowing economic growth was hitting global demand. (BL)

< Public sector banks have placed a new claim on the central government for their

successful implantation of the farm debt waiver and debt relief scheme in a

record time - they want the government to pay interest on the amount involved.

(BL)

< The Finance Ministry has granted excise duty exemption to goods procured for

setting up ultra mega power projects with installed capacity of 3,960 MW or

above. (BL)

< IRDA is on course to develop commonly accepted benchmarks and disclosures to

value insurance companies as this would be crucial when Indian partners dilute

their shareholding from 74% to 26%. (ET)

Source: ET = Economic Times, BS = Business Standard, FE = Financial Express, BL = Business Line.

Kotak Institutional Equities Research

kotak.research@kotak.com

Kotak Institutional Equities Research Mumbai: +91-22-6634-1100 1

For Private Circulation Only. FOR IMPORTANT INFORMATION ABOUT KOTAK SECURITIES RATING SYSTEM AND OTHER DISCLOSURES, REFER TO THE END

OF THIS MATERIAL, GO TO HEDGES AT http://www.kotaksecurities.com.

India Daily Summary - August 18, 2008

Economy Capex in large projects peaked in FY2008; unlikely to drop much in

FY2009E

Sector coverage view N/A

Mridul Saggar : mridul.saggar@kotak.com, +91-22-6634-1245

New projects assisted by banks/FIs in FY2008 envisage capex of Rs2.84 tn (Rs2.83 tn

in FY2007)

Envisaged capex in FY2008 at Rs.2.45 tn or US$60.9 bn Rs2.19 tn in FY2007)

Pipeline capex in FY2009 at Rs1.73 tn from projects till FY2008

We expect envisaged capex to drop marginally to Rs2.3 tn in FY2009E, but fall more

steeply to Rs1.6-1.9 tn in FY2010E

Reinforcing our view that bulwarks against headwinds are firmly in place (see our

Economy report of May 29, 2008), a new RBI study (August Bulletin) maintains that

capex has reached a new peak in FY2008 and is likely to stay high in FY2009. We

reiterate that fears of investment stalling in FY2009 are indeed overblown. Capex in

large projects may have peaked in FY2008 but a sharp drop is unlikely in FY2009E. We

had estimated large projects capex in a range of Rs2.0-2.5 tn, stating that it could still

be at least 6X of the trough in FY2002. However, we repeat that investment could

drop in FY2010 on the back of rising interest rates.

RBI: New projects capex stays high in FY2008

The investment cycle that started from the trough in FY2002 sustained momentum at

least till FY2008:

910 new projects (which were sanctioned financial assistance by banks/FIs in

FY2008) have envisaged capex of Rs2.84 bn (US$70.6 bn) which, though the

highest ever, is only marginally up from Rs2.83 bn (US$62.6 bn) for FY2007 when

1,054 new projects were sanctioned such assistance (see Exhibit 1).

Capex in FY2008 at Rs2.45 tn (Rs2.19 tn in FY2007) was 6.5X the FY2002 trough

Total envisaged capex in FY2008 in new and past projects was Rs2.45 tn (US$60.9

bn), 11.7% higher than Rs2.19 tn (US$48.5 bn) in FY2007 (see Exhibit 2). While

capex peaked in FY2008, the investment cycle had decelerated from jumps in

FY2007 (72.7%) and FY2005 (64.9%). RBI capex data for FY2007 was slightly

below our May economy report estimate of Rs2.7 tn.

Capex in FY2008 was 6.5X of Rs377 bn in FY2002 which was the trough. Clearly

the amplitude and the length of the present investment cycle have been large.

Considering the above, we reiterate that while investment could drop ahead, the

drop coming from a much higher base is unlikely to be as severe as in the 1990s.

It may be added that project capex as captured in the RBI study amounts to Rs2.19 tn

in FY2007, which is 41.3% of the gross fixed capital formation (GFCF) of Rs.5.3 tn as

per the national accounts data.

Strong pipeline capex likely to sustain investment momentum in FY2009

RBI study confirms that pipeline investment in FY2009 was strong.

Pipeline envisaged capex for FY2009 from past projects till FY2008 were Rs.1.73 tn

(US$52.3 bn). This included Rs1.48 tn from projects sanctioned financial assistance

from banks/FIs (Rs1.25 tn in FY2008), Rs197 bn from ECBs without funding from

banks/FIs and Rs51 bn from capital markets without funding from banks/FIs).

With Rs1.73 tn of fixed investment in pipeline from large projects, new projects with

envisaged investment of Rs0.72 tn or more in FY2009 would be necessary for capex

of FY2008 to be surpassed this year. RBI expects this to be realized.

2 Kotak Institutional Equities Research

India Daily Summary - August 18, 2008

However, in our view, this is less likely in the current macroeconomic environment

of tight monetary policy contributing to high interest rates and large increase in

government liabilities that are likely to crowd out private investment. Anecdotal

evidence suggests, new investments being planned might drop in FY2009 to about

0.5 tn or slightly above that.

We believe that even as the capex cycle turns in FY2009, total capex in FY2009E

could still be about Rs2.3 tn on the back of strong pipeline investment. As such,

capex in FY2009E could still be over 6X of the trough in FY2002.

We expect investment in FY2010 to drop on back of high interest rates

Investment climate has deteriorated significantly in 2009 as a result of high interest

rates and fiscal drag. So, unless there is a perceptible improvement in the investment

climate, capex could decelerate further in FY2010 as pipeline investment may drop to

about Rs1.0 tn in FY2010E. We expect total fixed investment from large projects to fall

to a range of Rs1.6-1.9 tn in FY2010E. Monetary policy tightening in FY2009 in the

backdrop of supply-side shock transmitted from abroad has been large. Higher nominal

interest rates have raised the user cost of capital and would impact new investment

unless monetary policy tightening is quickly unwound in FY2010. With inflation

passthrough still incomplete, we recognize that rate cuts may not be large over the

next year. As such, we consider the possibility of investment falling ahead as highly

probable. Some of the projects already in pipeline can also see deferring of investment

plans, but this amount is unlikely to be very large.

Power projects, metals industry driving present investment boom

The current capex cycle has been heavily driven by thrust to the infrastructure

investments. Power projects accounted for 33.9% of envisaged capex in 910 projects

sanctioned assistance FY2008 (see Exhibit 3). Telecom, ports & airports, roads, SEZs,

etc accounted for another 13.1%. Metal industry accounted for 15.6%. A capex in

power projects of Rs10.3 tn was planned during 11th Five Year Plan (FY2008-12), but

most of this has already been sanctioned assistance and got covered in new projects

till FY2008.

Gujarat continued to be the top destination for new project investment, while

Chhattisgarh appeared as the new hot spot (see Exhibit 4)

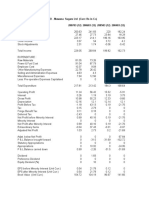

Exhibit 1: Projects sanctioned assistance in FY2007 & FY2008 have fixed investments of

Rs1.4 tn for FY2009

Capex in large projects by year of sanction of financial assistance by banks/Fis with

breakups detailing phasing of investment over the period 2005-2013, March fiscal year-ends

2005 2006 2007 2008 2009 2010 2011 2012 2013

3,500

2,800

2,100

1,400

700

0

FY2006 FY2007 FY2008

Source: Reserve Bank of India

Kotak Institutional Equities Research 3

India Daily Summary - August 18, 2008

Exhibit 2: Investment cycle peaked with Rs2.45 tn capex in FY2008, but investments

unlikely to drop much

Capex during the year in large projects (pipeline+new projects), 1997-2009E, March fiscal year-ends,

3,000

Capex without FIs

Capex from projects sanctioned assistance in other years

Capex from projects sanctioned assistance in the year

2,000

1,000

0

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009E

Source: Reserve Bank of India, Kotak Institutional Equities estimates.

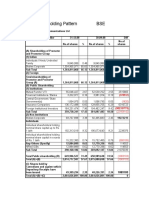

Exhibit 3: Power, metals industry capex driving investment boom

Industry-wise distribution of envisaged capex in large projects by year of sanction of financial assistance

FY2007 FY2008

No. of capex % share in No. of capex % share in

projects (in Rs bn) total projects (in Rs bn) total

1 Infrastructure 125 1,017 35.9 142 1,337 47.0

(i) Power 64 515 18.2 71 964 33.9

(ii) SEZ, industrial, biotech & IT parks 37 85 3.0 52 185 6.5

(iii) Telecom 9 180 6.3 9 119 4.2

(iv) Roads, storage & water management 8 131 4.6 4 49 1.7

(v) Ports & Airports 7 107 3.8 6 20 0.7

2 Metal & metal products 130 399 14.1 128 445 15.6

3 Coke & petroleum products 11 441 15.6 5 172 6.0

4 Others 183 106 3.8 181 168 5.9

5 Cement 27 106 3.7 26 140 4.9

6 Textiles 258 259 9.1 120 107 3.8

7 Hotels & restaurants 74 111 3.9 54 93 3.3

8 Construction 34 93 3.3 39 90 3.2

9 Transport equipents 29 52 1.8 38 81 2.9

10 Pharmaceuticals & drugs 33 17 0.6 39 52 1.8

11 Transport services 17 16 0.6 18 36 1.3

12 Hospitals 21 14 0.5 28 30 1.1

13 Sugar 33 89 3.1 16 30 1.1

14 Chemical & petrochemicals 35 41 1.5 27 27 0.9

15 Paper & paper products 24 29 1.0 18 22 0.8

16 Electrical & non-electrical machinery 20 45 1.6 31 14 0.5

Total 1,054 2,834 100.0 910 2,844 100.0

Source: Reserve Bank of India

4 Kotak Institutional Equities Research

India Daily Summary - August 18, 2008

Exhibit 4: Gujarat, Maharashtra, Orissa, A.P. and Chhatisgarh account for nearly 70% of new projects capex

State-wise distribution of envisaged capex in large projects by year of sanction of financial assistance

FY2007 FY2008

No. of capex % share in No. of capex % share in

projects (in Rs bn) total projects (in Rs bn) total

1 Gujarat 86 732 28.4 100 624 25.2

2 Maharshtra 142 243 9.4 149 362 14.6

3 Orissa 23 148 5.7 23 309 12.5

4 Andhra Pradesh 105 252 9.8 92 242 9.8

5 Chhattisgarh 13 24 0.9 12 177 7.1

6 Tamil Nadu 157 243 9.4 95 160 6.5

7 Karnataka 91 199 7.7 65 106 4.3

8 Uttar Pradesh 60 98 3.8 42 98 4.0

9 Jharkahnd 13 72 2.8 16 69 2.8

10 Madhya Pradesh 23 49 1.9 19 63 2.5

11 West Bengal 37 34 1.3 42 60 2.4

12 Himanchal Pradesh 30 26 1.0 23 37 1.5

13 Delhi 19 64 2.5 19 33 1.3

14 Rajasthan 38 98 3.8 23 28 1.1

15 Haryana 42 39 1.5 30 28 1.1

16 Punjab 48 59 2.3 31 20 0.8

17 Uttarakhand 31 56 2.2 27 17 0.7

18 Sikkim 3 94 3.7 1 1 0.0

19 Others 47 50 1.9 34 42 1.7

20 Multi-state 46 254 9.9 67 367 14.8

Total 1,008 2,580 100.0 843 2,477 100.0

Source: Reserve Bank of India

Kotak Institutional Equities Research 5

India Daily Summary - August 18, 2008

"Each of the analysts named below hereby certifies that, with respect to each subject company and its securities for which the analyst is

responsible in this report, (1) all of the views expressed in this report accurately reflect his or her personal views about the subject

companies and securities, and (2) no part of his or her compensation was, is, or will be, directly or indirectly, related

to the specific recommendations or views expressed in this report: Mridul Saggar."

Kotak Institutional Equities Research coverage universe

Distribution of ratings/investment banking relationships

Percentage of companies covered by Kotak Institutional

70% Equities, within the specified category.

60%

Percentage of companies within each category for which

Kotak Institutional Equities and or its affiliates has provided

50%

investment banking services within the previous 12 months.

40%

33.8% 34.5%

30% * The above categories are defined as follows: Buy = OP;

Hold = IL; Sell = U. Buy, Hold and Sell are not defined

20.9% Kotak Institutional Equities ratings and should not be

20% constructed as investment opinions. Rather, these ratings

are used illustratively to comply with applicable regulations.

3.0% 8.1% As of 30/06/2008 Kotak Institutional Equities Investment

10%

5.2% Research had investment ratings on 143 equity

3.0% 0.7% securities.

0%

BUY ADD REDUCE SELL

Source: Kotak Institutional Equities. As of June 30, 2008

Ratings and other definitions/identifiers

Rating system

Definitions of ratings

BUY. We expect this stock to outperform the BSE Sensex by 10% over the next 12 months.

ADD. We expect this stock to outperform the BSE Sensex by 0-10% over the next 12 months.

REDUCE: We expect this stock to underperform the BSE Sensex by 0-10% over the next 12 months.

SELL: We expect this stock to underperform the BSE Sensexby more than 10% over the next 12 months.

Our target price are also on 12-month horizon basis.

Other definitions

Coverage view. The coverage view represents each analysts overall fundamental outlook on the Sector. The coverage view will consist of one of the following designations:

Attractive (A), Neutral (N), Cautious (C).

Other ratings/identifiers

NR = Not Rated. The investment rating and target price, if any, have been suspended temporarily. Such suspension is in compliance with applicable regulation(s) and/or

Kotak Securities policies in circumstances when Kotak Securities or its affiliates is acting in an advisory capacity in a merger or strategic transaction involving this company

and in certain other circumstances.

CS = Coverage Suspended. Kotak Securities has suspended coverage of this company.

NC = Not Covered. Kotak Securities does not cover this company.

RS = Rating Suspended. Kotak Securities Research has suspended the investment rating and price target, if any, for this stock, because there is not a sufficient fundamental

basis for determining an investment rating or target. The previous investment rating and price target, if any, are no longer in effect for this stock and should not be relied

upon.

NA = Not Available or Not Applicable. The information is not available for display or is not applicable.

NM = Not Meaningful. The information is not meaningful and is therefore excluded.

6 Kotak Institutional Equities Research

India Daily Summary - August 18, 2008

Corporate Office Overseas Offices

Kotak Securities Ltd. Kotak Mahindra (UK) Ltd. Kotak Mahindra Inc.

Bakhtawar, 1st Floor 6th Floor, Portsoken House 50 Main Street, Suite No.310

229, Nariman Point 155-157 The Minories Westchester Financial Centre

Mumbai 400 021, India London EC 3N 1 LS White Plains, New York 10606

Tel: +91-22-6634-1100 Tel: +44-20-7977-6900 / 6940 Tel: +1-914-997-6120

Copyright 2008 Kotak Institutional Equities (Kotak Securities Limited). All rights reserved.

Kotak Securities Limited and its affiliates are a full-service, integrated investment banking, investment management, brokerage and financing group. We along with our affiliates

are leading underwriter of securities and participants in virtually all securities trading markets in India. We and our affiliates have investment banking and other business

relationships with a significant percentage of the companies covered by our Investment Research Department. Our research professionals provide important input into our

investment banking and other business selection processes. Investors should assume that Kotak Securities Limited and/or its affiliates are seeking or will seek investment banking

or other business from the company or companies that are the subject of this material and that the research professionals who were involved in preparing this material may

participate in the solicitation of such business. Our research professionals are paid in part based on the profitability of Kotak Securities Limited, which include earnings from

investment banking and other business. Kotak Securities Limited generally prohibits its analysts, persons reporting to analysts, and members of their households from maintaining

a financial interest in the securities or derivatives of any companies that the analysts cover. Additionally, Kotak Securities Limited generally prohibits its analysts and persons

reporting to analysts from serving as an officer, director, or advisory board member of any companies that the analysts cover. Our salespeople, traders, and other professionals

may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed herein, and our proprietary

trading and investing businesses may make investment decisions that are inconsistent with the recommendations expressed herein. In reviewing these materials, you should be

aware that any or all of the foregoing, among other things, may give rise to real or potential conflicts of interest. Additionally, other important information regarding our

relationships with the company or companies that are the subject of this material is provided herein.

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

We are not soliciting any action based on this material. It is for the general information of clients of Kotak Securities Limited. It does not constitute a personal recommendation

or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any advice or recommendation in this material, clients

should consider whether it is suitable for their particular circumstances and, if necessary, seek professional advice. The price and value of the investments referred to in this

material and the income from them may go down as well as up, and investors may realize losses on any investments. Past performance is not a guide for future performance,

future returns are not guaranteed and a loss of original capital may occur. Kotak Securities Limited does not provide tax advise to its clients, and all investors are strongly advised

to consult with their tax advisers regarding any potential investment.

Certain transactions -including those involving futures, options, and other derivatives as well as non-investment-grade securities - give rise to substantial risk and are not suitable

for all investors. The material is based on information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such.

Opinions expressed are our current opinions as of the date appearing on this material only. We endeavor to update on a reasonable basis the information discussed in this material,

but regulatory, compliance, or other reasons may prevent us from doing so. We and our affiliates, officers, directors, and employees, including persons involved in the preparation

or issuance of this material, may from time to time have long or short positions in, act as principal in, and buy or sell the securities or derivatives thereof of companies

mentioned herein. For the purpose of calculating whether Kotak Securities Limited and its affiliates holds beneficially owns or controls, including the right to vote for directors,

1% of more of the equity shares of the subject issuer of a research report, the holdings does not include accounts managed by Kotak Mahindra Mutual Fund.Kotak Securities

Limited and its non US affiliates may, to the extent permissible under applicable laws, have acted on or used this research to the extent that it relates to non US issuers, prior

to or immediately following its publication. Foreign currency denominated securities are subject to fluctuations in exchange rates that could have an adverse effect on the value

or price of or income derived from the investment. In addition , investors in securities such as ADRs, the value of which are influenced by foreign currencies affectively assume

currency risk. In addition options involve risks and are not suitable for all investors. Please ensure that you have read and understood the current derivatives risk disclosure

document before entering into any derivative transactions.

This report has not been prepared by Kotak Mahindra Inc. (KMInc). However KMInc has reviewed the report and, in so far as it includes current or historical information, it is

believed to be reliable, although its accuracy and completeness cannot be guaranteed. Any reference to Kotak Securities Limited shall also be deemed to mean and include Kotak

Mahindra Inc.

Kotak Securities Ltd.

Kotak Institutional

Bakhtawar, 1st floor, Equities Research

229 Nariman Point, Mumbai 400 021, India. Tel: +91-22-6634-1100 Fax: +91-22-2288-64537

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Rain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImproveДокумент8 страницRain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImprovedidwaniasОценок пока нет

- Rbi Allowed Banks To Increase Limit From 10 To 15 PercentДокумент10 страницRbi Allowed Banks To Increase Limit From 10 To 15 PercentdidwaniasОценок пока нет

- BandhanBank 15 3 18 PLДокумент1 страницаBandhanBank 15 3 18 PLdidwaniasОценок пока нет

- Idfc QTR FinancialsДокумент2 страницыIdfc QTR FinancialsdidwaniasОценок пока нет

- APL Apollo Antique Stock Broking Coverage Aprl 17Документ17 страницAPL Apollo Antique Stock Broking Coverage Aprl 17didwaniasОценок пока нет

- MARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodayДокумент2 страницыMARKET ESTIMATES FOR Sep, 2008 Results To Be Announced TodaydidwaniasОценок пока нет

- Information Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsДокумент8 страницInformation Technology: Covid-19, Oil Price Dip To Pose Near Term HeadwindsdidwaniasОценок пока нет

- Industry Report Card April 2018Документ16 страницIndustry Report Card April 2018didwaniasОценок пока нет

- 0hsie F PDFДокумент416 страниц0hsie F PDFchemkumar16Оценок пока нет

- Weekly Technical PicksДокумент4 страницыWeekly Technical PicksMaruthee SharmaОценок пока нет

- Sensex AnalysisДокумент2 страницыSensex AnalysisdidwaniasОценок пока нет

- Bandhan Bank Building Strong Franchise Through Retail FocusДокумент13 страницBandhan Bank Building Strong Franchise Through Retail FocusdidwaniasОценок пока нет

- IDEA One PagerДокумент6 страницIDEA One PagerdidwaniasОценок пока нет

- Financials 7-11-08Документ6 страницFinancials 7-11-08didwaniasОценок пока нет

- Sponge Iron Industry B K Oct 06 PDFДокумент30 страницSponge Iron Industry B K Oct 06 PDFdidwaniasОценок пока нет

- Mawana FinancialsДокумент8 страницMawana FinancialsdidwaniasОценок пока нет

- IFLEX One PagerДокумент1 страницаIFLEX One PagerdidwaniasОценок пока нет

- Shareholding Pattern BSEДокумент3 страницыShareholding Pattern BSEdidwaniasОценок пока нет

- BHEL One PagerДокумент1 страницаBHEL One PagerdidwaniasОценок пока нет

- 24 Jun 08 - BHELДокумент4 страницы24 Jun 08 - BHELdidwaniasОценок пока нет

- HSBC Private Bank Strategy MattersДокумент4 страницыHSBC Private Bank Strategy MattersdidwaniasОценок пока нет

- 'A' Grade Turnaround: Associated Cement CompaniesДокумент3 страницы'A' Grade Turnaround: Associated Cement CompaniesdidwaniasОценок пока нет

- Citizens Guide 2008Документ12 страницCitizens Guide 2008DeliajrsОценок пока нет

- The Subprime Meltdown: Understanding Accounting-Related AllegationsДокумент7 страницThe Subprime Meltdown: Understanding Accounting-Related AllegationsdidwaniasОценок пока нет

- IAG+ +India+Strategy+ (June+08)Документ17 страницIAG+ +India+Strategy+ (June+08)api-3862995Оценок пока нет

- Sanjiv KaulДокумент18 страницSanjiv KaulsdОценок пока нет

- IAG+ +India+Strategy+ (June+08)Документ17 страницIAG+ +India+Strategy+ (June+08)api-3862995Оценок пока нет

- Income & Growth One Pager 06302008Документ2 страницыIncome & Growth One Pager 06302008didwaniasОценок пока нет

- CKP PresentationДокумент39 страницCKP PresentationdidwaniasОценок пока нет

- Kpo VsbpoДокумент3 страницыKpo VsbposdОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Importance of Stock MarketДокумент4 страницыImportance of Stock MarketRajdeep KaurОценок пока нет

- A Report On The Indian Exchange Traded Funds (ETF) IndustryДокумент26 страницA Report On The Indian Exchange Traded Funds (ETF) IndustryHitendra PanchalОценок пока нет

- HDFC Mutual FundДокумент93 страницыHDFC Mutual FundKomal MansukhaniОценок пока нет

- Exchange Traded Funds (Etfs) What Is An Etf?Документ3 страницыExchange Traded Funds (Etfs) What Is An Etf?RahulОценок пока нет

- FDI Impact on Indian Airline IndustryДокумент45 страницFDI Impact on Indian Airline IndustryVaibhav BhadauriaОценок пока нет

- Tourism PlanningДокумент14 страницTourism PlanningAsiful AlamОценок пока нет

- Corporate Governance & Business EthicsДокумент79 страницCorporate Governance & Business EthicsRishi Ahuja0% (1)

- #Stock Trading SecretsДокумент40 страниц#Stock Trading Secretsmatsumoto100% (2)

- FM&SДокумент18 страницFM&SVinay Gowda D MОценок пока нет

- Chapter 9 Project Cash FlowsДокумент28 страницChapter 9 Project Cash FlowsGovinda AgrawalОценок пока нет

- Lecture 4 - ReformattingДокумент31 страницаLecture 4 - ReformattingnopeОценок пока нет

- Fundamental Analysis of Banking Industry in IndiaДокумент42 страницыFundamental Analysis of Banking Industry in IndiaGurpreet Kaur86% (7)

- SOURAV'S SIP ON SBI MUTUAL FUND (Introduction)Документ106 страницSOURAV'S SIP ON SBI MUTUAL FUND (Introduction)sourabha86100% (1)

- Importance of Descriptive Statistics For Business Decision Making.Документ7 страницImportance of Descriptive Statistics For Business Decision Making.Lasitha NawarathnaОценок пока нет

- Tax Incentives G. 07 BsДокумент10 страницTax Incentives G. 07 BsLevenson KadegheОценок пока нет

- Journal (Jaya College) - Investment Awareness of Working Women Investors in Chennai CityДокумент12 страницJournal (Jaya College) - Investment Awareness of Working Women Investors in Chennai CityMythili Karthikeyan100% (1)

- Sukuk vs. Bonds: Stock ReactionДокумент17 страницSukuk vs. Bonds: Stock ReactionWasim ShahОценок пока нет

- Mutual Fund Analysis ComparisonДокумент76 страницMutual Fund Analysis ComparisonsantoshbansodeОценок пока нет

- Assign No 5 - OpleДокумент3 страницыAssign No 5 - OpleLester Nazarene OpleОценок пока нет

- Venture Capital - Fund Raising and Fund StructureДокумент52 страницыVenture Capital - Fund Raising and Fund StructureSimon ChenОценок пока нет

- Akash CPДокумент48 страницAkash CPEr Aks PatelОценок пока нет

- Bse Trading SystemДокумент4 страницыBse Trading SystemRaman Kumar67% (3)

- The Stock Market For DummiesДокумент2 страницыThe Stock Market For DummiesjikolpОценок пока нет

- ANAND-RATHI Tanuj Kumar ProjectДокумент90 страницANAND-RATHI Tanuj Kumar ProjectTanuj Kumar50% (2)

- SEBI Regulations Explained in 40 CharactersДокумент19 страницSEBI Regulations Explained in 40 CharactersMurugesh KumarОценок пока нет

- JPM Private BankДокумент31 страницаJPM Private BankZerohedge100% (2)

- Political Risk Factors and TheirДокумент21 страницаPolitical Risk Factors and TheircrsalinasОценок пока нет

- Enigma Case StudyДокумент7 страницEnigma Case Studyutkarsh bhargavaОценок пока нет

- Chapter 004 F2009Документ7 страницChapter 004 F2009mallumainhunmailОценок пока нет

- BS NOTES Kombaz-1Документ331 страницаBS NOTES Kombaz-1tiller kambanjeОценок пока нет