Академический Документы

Профессиональный Документы

Культура Документы

7 1

Загружено:

Berby Boy0 оценок0% нашли этот документ полезным (0 голосов)

16 просмотров3 страницыОригинальное название

7.1.docx

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

16 просмотров3 страницы7 1

Загружено:

Berby BoyАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

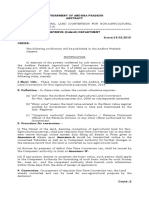

COMPLIANCE REQUIREMENTS

SEC. 113. Invoicing and Accounting Requirements for VAT-Registered Persons. -

(A) Invoicing Requirements. - A VAT-registered person shall issue:

(1) A VAT invoice for every sale, barter or exchange of goods or properties; and

(2) A VAT official receipt for every lease of goods or properties, and for every sale, barter or

exchange of services. [74]

(B) Information Contained in the VAT Invoice or VAT Official Receipt. - The following

information shall be indicated in the VAT invoice or VAT official receipt:

(1) A statement that the seller is a VAT-registered person, followed by his Taxpayer's

Identification Number (TIN); and

(2) The total amount which the purchaser pays or is obligated to pay to the seller with the

indication that such amount includes the value-added tax. Provided, That:

(a) The amount of the tax shall be known as a separate item in the invoice or receipt;

(b) If the sale is exempt from value-added tax, the term "VAT-exempt sale: shall be written or

printed prominently on the invoice or receipt;

(c) If the sale is subject to zero percent (0%) value-added tax, the term "zero-rated sale" shall

be written or printed prominently on the invoice or receipt.

(d) If the sale involved goods, properties or services some of which are subject to and some of

which are VAT zero-rated or Vat exempt, the invoice or receipt shall clearly indicate

the break-down of the sale price between its taxable, exempt and zero-rated

components, and the calculation of the value-added tax on each portion of the sale

shall be known on the invoice or receipt: Provided, That the seller may issue

separate invoices or receipts for the taxable, exempt, and zero-rated components of

the sale.

(3) The date of transaction, quantity, unit cost and description of the goods or properties or

nature of the service; and

(4) In the case of sales in the amount of One thousand pesos (P1,000) or more where the sale

or transfer is made to a VAT-registered person, the name, business style, if any, address

and Taxpayer Identification Number (TIN) of the purchaser, customer or client. [75]

(C) Accounting Requirements. - Notwithstanding the provisions of Section 233, all persons

subject to the value-added tax under Sections 106 and 108 shall, in addition to the regular

accounting records required, maintain a subsidiary sales journal and subsidiary purchase

journal on which the daily sales and purchases are recorded. The subsidiary journals shall

contain such information as may be required by the Secretary of Finance.

(D) Consequence of Issuing Erroneous VAT Invoice or VAT Official Receipt. -

(1) If a person who is not a VAT-registered persons issues an invoice or receipt showing his

Taxpayer Identification Number (TIN), followed by the word "VAT";

(a) The issuer shall, in addition to any liability to other percentage taxes, be liable to:

(i) The tax imposed in Section 106 or 108 without the benefit of any input tax credit; and

(ii) A 50% surcharge under Section 248(B) of this Code; [76]

(b) The VAT shall, if the other requisite information required under Subsection (B) hereof is

shown on the invoice or receipt, be recognized as an input tax credit to the

purchaser under Section 110 of this Code.

(2) If a VAT-registered person issues a VAT invoice or VAT official receipt for a VAT-exempt

transaction, but fails to display prominently on the invoice or receipt the term 'VAT

exempt sale', the issuer shall be liable to account for the tax imposed in section 106 or

108 as if Section 109 did not apply. [77]

(E) Transitional Period. - Notwithstanding Subsection (B) hereof, taxpayers may continue to

issue VAT invoices and VAT official receipt for the period July 1, 2005 to December 31, 2005 in

accordance with Bureau of Internal Revenue administrative practices that existed as of

December 31, 2004.

SEC. 114. Return and Payment of Value-Added Tax. -

(A) In General. - Every person liable to pay the value-added tax imposed under this Title shall

file a quarterly return of the amount of his gross sales or receipts within twenty-five (25) days

following the close of each taxable quarter prescribed for each taxpayer: Provided, however,

That VAT-registered persons shall pay the value-added tax on a monthly basis.

Any person, whose registration has been cancelled in accordance with Section 236, shall file a

return and pay the tax due thereon within twenty-five (25) days from the date of cancellation of

registration: Provided, That only one consolidated return shall be filed by the taxpayer for his

principal place of business or head office and all branches.

(B) Where to File the Return and Pay the Tax. - Except as the Commissioner otherwise

permits, the return shall be filed with and the tax paid to an authorized agent bank, Revenue

Collection Officer or duly authorized city or municipal Treasurer in the Philippines located within

the revenue district where the taxpayer is registered or required to register.

(C) Withholding of Value-added Tax. - The Government or any of its political subdivisions,

instrumentalities or agencies, including government-owned or -controlled corporations (GOCCs)

shall, before making payment on account of each purchase of goods and services which are f

are subject to the value-added tax imposed in Sections 106 and 108 of this Code, deduct and

withhold the value-added tax imposed in Sections 106 and 108 of this Code, deduct and

withhold a final value-added tax at the rate of five percent (5%) of the gross payment thereof:

Provided, That the payment for lease or use of properties or property rights to nonresident

owners shall be subject to ten percent (10%) [78] withholding tax at the time of payment. For

purposes of this Section, the payor or person in control of the payment shall be considered as

the withholding agent. [79]

The value-added tax withheld under this Section shall be remitted within ten (10) days following

the end of the month the withholding was made.

SEC. 115. Power of the Commissioner to Suspend the Business Operations of a

Taxpayer. - The Commissioner or his authorized representative is hereby empowered to

suspend the business operations and temporarily close the business establishment of any

person for any of the following violations:

(a) In the case of a VAT-registered Person. -

(1) Failure to issue receipts or invoices;

(2) Failure to file a value-added tax return as required under Section 114; or

(3) Understatement of taxable sales or receipts by thirty percent (30%) or more of his correct

taxable sales or receipts for the taxable quarter.

(b) Failure of any Person to Register as Required under Section 236.

The temporary closure of the establishment shall be for the duration of not less than five (5)

days and shall be lifted only upon compliance with whatever requirements prescribed by the

Commissioner in the closure order.

Вам также может понравиться

- Preservation of Books of Accounts and Other Accounting Records All Internal Revenue Officers and Others ConcernedДокумент4 страницыPreservation of Books of Accounts and Other Accounting Records All Internal Revenue Officers and Others ConcernedBerby BoyОценок пока нет

- 33045-2013-Preservation of Books of Accounts and Other20190130-5466-18f5bx4 PDFДокумент4 страницы33045-2013-Preservation of Books of Accounts and Other20190130-5466-18f5bx4 PDFBerby BoyОценок пока нет

- Determination of The Philippine Tax Liability of Online Streaming PlatformsДокумент4 страницыDetermination of The Philippine Tax Liability of Online Streaming PlatformsBerby BoyОценок пока нет

- Thesis CommentsДокумент2 страницыThesis CommentsBerby BoyОценок пока нет

- Thesis CommentsДокумент2 страницыThesis CommentsBerby BoyОценок пока нет

- #SarilingSikap2019 Specpro BATCH 9Документ48 страниц#SarilingSikap2019 Specpro BATCH 9Berby BoyОценок пока нет

- Del Castillo Remedial Law Cases - StoryboardДокумент2 страницыDel Castillo Remedial Law Cases - StoryboardBerby BoyОценок пока нет

- SEC. 203. Period of Limitation Upon Assessment and Collection. - Except AsДокумент32 страницыSEC. 203. Period of Limitation Upon Assessment and Collection. - Except AsBerby BoyОценок пока нет

- Notice and Agenda of Annual Meeting of StockholdersДокумент3 страницыNotice and Agenda of Annual Meeting of StockholdersBerby BoyОценок пока нет

- That Judgment ofДокумент60 страницThat Judgment ofBerby BoyОценок пока нет

- Eastern Broadcasting v. DansДокумент4 страницыEastern Broadcasting v. DansBerby BoyОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Provisions: B22 Major Changes in TaxДокумент9 страницProvisions: B22 Major Changes in TaxasdjkfnasdbifbadОценок пока нет

- Bir Ruling 047-2013Документ8 страницBir Ruling 047-2013Ar Yan SebОценок пока нет

- 3rd BOCE MinutesДокумент8 страниц3rd BOCE MinutesKrishna Kanth KОценок пока нет

- 2021 HSC EconomicsДокумент24 страницы2021 HSC EconomicspotpalОценок пока нет

- ConsolidatedCustomerInvoice 27035262 RRY 1610391057Документ3 страницыConsolidatedCustomerInvoice 27035262 RRY 1610391057NaniОценок пока нет

- Income Statement - Kieso 4Документ34 страницыIncome Statement - Kieso 4Muhammad RezaОценок пока нет

- Executive Summary: Sandeep Kumar & AssociatesДокумент28 страницExecutive Summary: Sandeep Kumar & AssociatesAarti YadavОценок пока нет

- Roxas v. RaffertyДокумент2 страницыRoxas v. RaffertySophiaFrancescaEspinosaОценок пока нет

- Invoice 222374 Bhagat Enterprises District VBD Officer DumkaДокумент2 страницыInvoice 222374 Bhagat Enterprises District VBD Officer DumkaITCT EDUCATIONОценок пока нет

- Boat InvoiceДокумент1 страницаBoat Invoiceshiv kumarОценок пока нет

- Comm. of Internal Revenue v. CA, G. R. No. 47421, May 14, 1990Документ3 страницыComm. of Internal Revenue v. CA, G. R. No. 47421, May 14, 1990Gracëëy UyОценок пока нет

- Form 16Документ2 страницыForm 16SIVA100% (1)

- GST Book Bank AnswersДокумент10 страницGST Book Bank AnswersAditya DasОценок пока нет

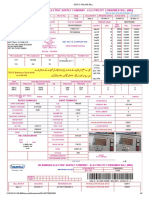

- Islamabad Electric Supply Company - Electricity Consumer Bill (Mdi)Документ2 страницыIslamabad Electric Supply Company - Electricity Consumer Bill (Mdi)saleem khanОценок пока нет

- 04 BELL, Stephanie e Wray, L. Randall. Fiscal Effects On Reserves and The In-Dependence of The FedДокумент11 страниц04 BELL, Stephanie e Wray, L. Randall. Fiscal Effects On Reserves and The In-Dependence of The FedGuilherme UchimuraОценок пока нет

- Nala 2018Документ6 страницNala 2018Raghu RamОценок пока нет

- Solved MR and Mrs Janus Operate A Restaurant Business As AДокумент1 страницаSolved MR and Mrs Janus Operate A Restaurant Business As AAnbu jaromiaОценок пока нет

- Consolidated Financial Statement From BPCL Website - 2019 - 20Документ10 страницConsolidated Financial Statement From BPCL Website - 2019 - 20Mahesh RamamurthyОценок пока нет

- Management Equity Incentives and Corporate Tax AvoДокумент13 страницManagement Equity Incentives and Corporate Tax AvoWenXingyue ArielОценок пока нет

- Rulers Core RulebookДокумент68 страницRulers Core RulebookJon NicholОценок пока нет

- Chapter 12: Assessment of Various Entities: Section - A: Statutory UpdateДокумент49 страницChapter 12: Assessment of Various Entities: Section - A: Statutory UpdateAmol TambeОценок пока нет

- 10 Semi/ MM Subject - English L.L. Set - 1: Time: 3 Hrs. Marks: 80Документ6 страниц10 Semi/ MM Subject - English L.L. Set - 1: Time: 3 Hrs. Marks: 80SHANTAICOMPUTER MKCLОценок пока нет

- 07 Pakistan Mining Cadastre DR Hamid AshrafДокумент51 страница07 Pakistan Mining Cadastre DR Hamid AshrafEmRan LeghariОценок пока нет

- HWK - 6Документ3 страницыHWK - 6Karen Nicole Lopez0% (1)

- Chapter 4Документ14 страницChapter 4Ke LopezОценок пока нет

- INCOME TAX Ready Reckoner - by CA HARSHIL SHETHДокумент38 страницINCOME TAX Ready Reckoner - by CA HARSHIL SHETHCA Harshil ShethОценок пока нет

- Ashmi EnterprisesДокумент1 страницаAshmi EnterprisesUmesh chandra ThakurОценок пока нет

- Dehghanpouri, H., Soltani, Z., & Rostamzadeh, R. (2020) .Документ17 страницDehghanpouri, H., Soltani, Z., & Rostamzadeh, R. (2020) .lya natasyaОценок пока нет

- Operations Management: Location StrategiesДокумент18 страницOperations Management: Location StrategiesRavi JakharОценок пока нет

- May 2 Iesco Online BillДокумент1 страницаMay 2 Iesco Online BillShehzad hasnainiОценок пока нет