Академический Документы

Профессиональный Документы

Культура Документы

Notes LOA

Загружено:

Christine C. ReyesАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Notes LOA

Загружено:

Christine C. ReyesАвторское право:

Доступные форматы

There is grave abuse of discretion when the determination of probable cause is exercised in an

arbitrary or despotic manner, due to passion or personal hostility, so patent and gross as to amount

to an evasion of a positive duty or a virtual refusal to perform a duty enjoined by law.

Respondent spouses, on the other hand, argue that the instant Petition should be dismissed as

petitioner availed of the wrong remedy

Respondent spouses defense that they had sufficient savings to purchase the properties remains

self-serving at this point since they have not yet presented any evidence to support this. And since

there is no evidence yet to suggest that the money they used to buy the properties was from an

existing fund, it is safe to assume that that money is income or a flow of wealth other than a mere

return on capital. It is a basic concept in taxation that income denotes a flow of wealth during a

definite period of time, while capital is a fund or property existing at one distinct point in time.81

n view of the foregoing, we are convinced that there is probable cause to indict respondent spouses

for tax evasion as petitioner was able to show that a tax is due from them. Probable cause, for

purposes of filing a criminal information, is defined as such facts that are sufficient to engender a

well-founded belief that a crime has been committed, that the accused is probably guilty thereof,

and that he should be held for trial.82 It bears stressing that the determination of probable cause

does not require actual or absolute certainty, nor clear and convincing evidence of guilt; it only

requires reasonable belief or probability that more likely than not a crime has been committed by

the accused.83

Before we close, we must stress that our ruling in this case should not be interpreted as

an unbridled license for our tax officials to engage in fishing expeditions and witch-

hunting. They should not abuse their investigative powers, instead they should exercise

the same within the bounds of the law. They must properly observe the guidelines in

making assessments and investigative procedures to ensure that the constitutional rights

of the taxpayers are well protected as we cannot allow the floodgates to be opened for

frivolous and malicious tax suits. G.R. No. 197590, November 24, 2014

BUREAU OF INTERNAL REVENUE, AS REPRESENTED BY THE COMMISSIONER OF INTERNAL

REVENUE, Petitioner, v. COURT OF APPEALS, SPOUSES ANTONIO VILLAN MANLY, AND

RUBY ONG MANLY, Respondents.

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- CS Form No. 7 Clearance FormДокумент6 страницCS Form No. 7 Clearance FormBenedict Van Velasco83% (12)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- DALE STRICKLAND v. ERNST & YOUNG LLPДокумент5 страницDALE STRICKLAND v. ERNST & YOUNG LLPalex trincheraОценок пока нет

- Trust DeedДокумент4 страницыTrust DeedNeetu PandeyОценок пока нет

- Aff of Waiver of Rights in Conjugal PropДокумент2 страницыAff of Waiver of Rights in Conjugal PropChristine C. Reyes100% (3)

- Notice of Termination - Pro FormaДокумент1 страницаNotice of Termination - Pro FormaChristine C. ReyesОценок пока нет

- Notice of Termination - Pro FormaДокумент1 страницаNotice of Termination - Pro FormaChristine C. ReyesОценок пока нет

- Attorney MisconductДокумент3 страницыAttorney Misconductamy ferrulli100% (1)

- Franchise AgreementДокумент21 страницаFranchise AgreementChristine C. Reyes85% (13)

- Law of Carriage NotesДокумент37 страницLaw of Carriage NotesKumar SpandanОценок пока нет

- Moot Court MemoДокумент27 страницMoot Court MemoAlam Hasan Ali75% (12)

- HLURB Case Form No 01 ComplaintДокумент2 страницыHLURB Case Form No 01 ComplaintEarl Kristoffer Pirante100% (1)

- EXPLANATION For SERVICE and FILING by REGISTERED MAILДокумент1 страницаEXPLANATION For SERVICE and FILING by REGISTERED MAILChristine C. ReyesОценок пока нет

- Rev MOAДокумент6 страницRev MOAChristine C. ReyesОценок пока нет

- Conflict - Philsec Investment vs. CAДокумент3 страницыConflict - Philsec Investment vs. CATogz Mape100% (2)

- LAND TITLES OUTLINE AND REVIEWER For MIDTERMS (Aquino) PDFДокумент13 страницLAND TITLES OUTLINE AND REVIEWER For MIDTERMS (Aquino) PDFChristine C. ReyesОценок пока нет

- Hold Departure Order DOJ Department Circular No PDFДокумент3 страницыHold Departure Order DOJ Department Circular No PDFferreous 3Оценок пока нет

- Acknowledgement: Sumit Kumar SumanДокумент21 страницаAcknowledgement: Sumit Kumar SumanSureshОценок пока нет

- RULE 118 01 Zaldivar v. People MALLARIДокумент2 страницыRULE 118 01 Zaldivar v. People MALLARIquasideliksОценок пока нет

- Sarmiento Vs Comelec DigestДокумент2 страницыSarmiento Vs Comelec DigestNoemi Alvarez80% (5)

- Culpa Aquiliana, Culpa Criminal and Culpa Contractual DistinguishedДокумент2 страницыCulpa Aquiliana, Culpa Criminal and Culpa Contractual DistinguishedLilibeth Macaso74% (34)

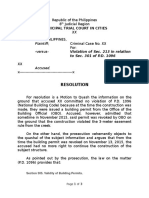

- Reso On Motion To Quash PD 1096Документ3 страницыReso On Motion To Quash PD 1096Lzl BastesОценок пока нет

- SHS Perforated Materials vs. Manuel DiazДокумент3 страницыSHS Perforated Materials vs. Manuel DiazRJ PasОценок пока нет

- Sample MemorandumДокумент13 страницSample MemorandumChristine C. ReyesОценок пока нет

- Hobe Sound Currents August 2012 Vol. 2 Issue #6Документ24 страницыHobe Sound Currents August 2012 Vol. 2 Issue #6Barbara ClowdusОценок пока нет

- Land Retention Rights (GRP 26)Документ65 страницLand Retention Rights (GRP 26)Christine C. Reyes100% (1)

- Articles of IncorporationДокумент8 страницArticles of IncorporationChristine C. ReyesОценок пока нет

- ALG-CL-2.1: Request For Legal Representation - Lawyer Is Requested To Provide InformationДокумент4 страницыALG-CL-2.1: Request For Legal Representation - Lawyer Is Requested To Provide InformationChristine C. ReyesОценок пока нет

- Amending Pagcor CharterДокумент3 страницыAmending Pagcor CharterChristine C. ReyesОценок пока нет

- References and AnnotationsДокумент1 страницаReferences and AnnotationsChristine C. ReyesОценок пока нет

- General Partnership Agreement TemplateДокумент10 страницGeneral Partnership Agreement Templatechris lee100% (1)

- Savor The Experience - Bphs AnnivДокумент2 страницыSavor The Experience - Bphs AnnivChristine C. ReyesОценок пока нет

- Pagcor CharterДокумент9 страницPagcor CharterChristine C. ReyesОценок пока нет

- Required Document ChecklistДокумент3 страницыRequired Document ChecklistFrederick Xavier LimОценок пока нет

- CEZA CharterДокумент5 страницCEZA CharterChristine C. ReyesОценок пока нет

- Sworn AttestationДокумент2 страницыSworn AttestationChristine C. ReyesОценок пока нет

- Spa HongДокумент2 страницыSpa HongChristine C. ReyesОценок пока нет

- Organizational Chart: Owner / ManagerДокумент1 страницаOrganizational Chart: Owner / ManagerChristine C. ReyesОценок пока нет

- ProfileДокумент2 страницыProfileChristine C. ReyesОценок пока нет

- Annotations BERNARDINOДокумент14 страницAnnotations BERNARDINOChristine C. ReyesОценок пока нет

- Johnny AnnotationДокумент3 страницыJohnny AnnotationChristine C. ReyesОценок пока нет

- DAR AO 9 Series 1993Документ12 страницDAR AO 9 Series 1993Diannee RomanoОценок пока нет

- PoliRev - PreambleДокумент3 страницыPoliRev - PreambleChristine C. ReyesОценок пока нет

- Cipaa PDFДокумент11 страницCipaa PDFdownloademail100% (2)

- Speedplay, Inc. v. Bebop, IncДокумент12 страницSpeedplay, Inc. v. Bebop, IncSamuel RichardsonОценок пока нет

- LETTEROFGUARANTEEДокумент1 страницаLETTEROFGUARANTEELim DongseopОценок пока нет

- Banking Academy, Hanoi Btec HND in Business (Finance) : Group Assignment Cover SheetДокумент7 страницBanking Academy, Hanoi Btec HND in Business (Finance) : Group Assignment Cover Sheethi_monestyОценок пока нет

- WO 672 Gyan Das Mahant - Labour SupplyДокумент4 страницыWO 672 Gyan Das Mahant - Labour Supplyvijayabhaskar kilariОценок пока нет

- California Artichoke & Vegetable Growers Corp., Et Al. v. Lindsay Foods International, Et Al. - Document No. 16Документ7 страницCalifornia Artichoke & Vegetable Growers Corp., Et Al. v. Lindsay Foods International, Et Al. - Document No. 16Justia.comОценок пока нет

- SARELSON LAW FIRM, P.A., 1200 Brickell Avenue, Suite 1440, Miami, Florida 33131, 305-379-0305, 800-421-9954 (Fax) 1Документ73 страницыSARELSON LAW FIRM, P.A., 1200 Brickell Avenue, Suite 1440, Miami, Florida 33131, 305-379-0305, 800-421-9954 (Fax) 1Matthew Seth SarelsonОценок пока нет

- Filed: Patrick FisherДокумент59 страницFiled: Patrick FisherScribd Government DocsОценок пока нет

- Manufacturer's Warranty and Limitation of ClaimsДокумент2 страницыManufacturer's Warranty and Limitation of ClaimsBrandon TrocОценок пока нет

- July 15, 2011, Luc Begin alleged Statement of Claim or Notice of Proceedings regarding Fredericton Police Force beatings of Luc Begin events 17 July 2009 and 01:00am the 18 July 2009, night- club “Sweetwaters”,Документ7 страницJuly 15, 2011, Luc Begin alleged Statement of Claim or Notice of Proceedings regarding Fredericton Police Force beatings of Luc Begin events 17 July 2009 and 01:00am the 18 July 2009, night- club “Sweetwaters”,Justice Done Dirt CheapОценок пока нет

- GR 176657 Dfa Vs FalconДокумент18 страницGR 176657 Dfa Vs FalconCesar CoОценок пока нет

- Deposition of Erica Johnson SeckДокумент55 страницDeposition of Erica Johnson SeckStopGovt WasteОценок пока нет

- G.p.t.of C.rajareddyДокумент3 страницыG.p.t.of C.rajareddyaskbalicОценок пока нет

- LTD Digest FinalsДокумент24 страницыLTD Digest FinalsMark Lester Lee Aure100% (1)

- 2018 Tzca 280Документ13 страниц2018 Tzca 280LameckОценок пока нет

- ISC Legal StudiesДокумент10 страницISC Legal StudiesGaurav BisariaОценок пока нет