Академический Документы

Профессиональный Документы

Культура Документы

Fire Risk of Cold Room Panel

Загружено:

darby1028Исходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Fire Risk of Cold Room Panel

Загружено:

darby1028Авторское право:

Доступные форматы

regards

n° 5

February 2003

C Christian LEROY Objective

responsibility

for French employers

Insulated sandwich p.3

panels and fire risk

I Didier Schütz, Risk Control Practice Leader

dschutz@scor.com

Risk involving large insulated sandwich panels constitute a big

challenge from a fire prevention / protection standpoint. As the

frequency and severity of losses has been increasing, several

countries have been conducting studies on this subject.

A typical “sandwich panel” has metal skin containing a core of either

non-combustible mineral wool, foamed polystyrene, polyurethane or Private LTC insurance:

polyisocyanurate. Polyurethane filled sandwich panels offer a very

economical solution for achieving reliable temperature control and

international

providing coated, hygienic surfaces that can be washed down comparisons

frequently. Consequently, this type of construction recently has seen

p.5

an important and rapid development in many countries, for food

processing plants, pharmaceutical plants, laboratories,

semiconductors factories, electronic plants, aircraft / automotive

engine testing rooms, ageing rooms, space launch vehicle

industries, etc.

C Musée de la Poste

However, fire will spread very rapidly in buildings containing

combustible-cored sandwich panels because of their heavy

combustible load. In such conditions, if the fire is not controlled in its

early stages by automatic fire protection equipment, it will be quite

impossible to fight it manually due to the heat and toxic corrosive

smoke released. Consequently, after a fire, a large property damage

and a long business interruption period can be expected.

News in brief

The fire exposure of combustible-insulated sandwich panels

p.6

depends on the quality of the foam, the quality of manufacture

(adherence between the sheeting and insulation), and moreover the

quality of on site assembling. Yet, unless adequately arranged,

properly protected by automatic system and or provided with

approved passive protection, no insulated sandwich panel will

withstand a large fire.

...

... continued

Insulated sandwich

panels and fire risk

Increasing frequency and severity so that protection should be considered at either roof

In buildings that use combustible-insulated sandwich level, false ceiling level, or in racks, and should protect

panels, both the frequency and severity of losses building walls and building structures. In some cases,

have increased in the recent years, principally in retrofitting or additional sprinklers should be installed,

warehouses and at food industry sites. depending on the geometry of the room.

Nevertheless, automatic sprinkler protection alone

This increase can be explained by: must not be considered as a substitute for a thermal

barrier.

concentration of values and investments at one

site, compared to two or three previously; Alternative non-combustible insulation ?

Research are made regarding non-combustible

industrial flows optimization: one plant is sandwich panels insulated with rock wool. But rock

dedicated to a single production line, with just- wool panels are currently deemed as:

in-time inventory systems;

automatization, resulting in a decreasing number impossible to develop in freezers for technical

of staff; reasons: density and weight are too high for

Sandwich panels insulation capacity requirements;

constitute severe use of new technologies, i.e. new processes,

challenges for materials and products; difficult to consider in the food industry because

automatic sprinklers food products might be contaminated by mineral

systems an occasional contradiction between fire fibres;

prevention and product quality.

non-economical: the cost of mineral wool

Insulated sandwich panels as systems insulated panels is approximately 2 to 3 times the

Insulated sandwich panels must be considered as cost of plastic foam insulated panels.

systems, not as components. Some criteria must be

evaluated to analyze the combustibility of such Loss Prevention Practices

panels: Good loss prevention practices obviously are crucial.

The integrity of the sandwich panels should be

type of wall facings; ensured as follows:

type of insulation-filling material; there is no exposed combustible foam;

components other than insulation material (vapour panel walls are covered with metal;

barrier, glue, inner and outer coatings).

each panel is adequately joined to another one

Foam plastic insulation, such as polyurethane, and adequately attached to building floors and

polyisocyanurate and polystyrene, is made from a

roofs at the lower and upper ends;

mixture of plastic components and a blowing

(foaming) agent. When involved in a fire, these

there are no non-combustible components other

materials may spread fire damage far beyond normal

than insulation material (vapour barrier, glue, inner

expectations. They may also generate large quantities

of dense, toxic smoke that may contaminate and outer coatings).

machinery, equipment, products or the building, thus

requiring extensive cleaning, repackaging, or even Special precautions also should be taken when

scrapping of a product. installing electrical devices and equipment, and when

conducting cutting & welding operations,

This is the reason why plastics manufacturers representing potential ignition sources. Sufficient

recommend that “exposed urethane insulation must spacing and separation should be ensured between

be protected from accidental ignition by completely the refrigeration system and the rest of the facilities,

covering it with a flame barrier (thermal barrier) as especially when an ammonia refrigeration system is

soon as possible after installation”. used.

Sandwich panels containing plastic foam present SCOR has recently led a detailed survey on insulated

severe challenges for automatic sprinkler systems. sandwich panels specificities and our engineer teams

Polystyrene is 1,5 times more combustible than remain at your disposal for any further information you

polyurethane, forming a combustible liquid when it may need regarding risk analysis, loss prevention,

melts. Automatic sprinklers may not confine the fire, MFL assessment, and all other technical references.

...

2 regards n ° 5 February 2003

... continued

Insulated sandwich

panels and fire risk

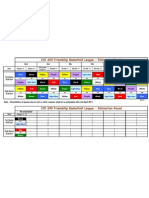

Some catastrophic fires involving combustible insulated sandwich panels

Date, location Occupancy Fire origin, path, damage

1992, France Cheese factory Short circuit on lighting fixture. Fire destroyed more than

10,000m2 in one hour. Fire fighters extinguished the fire in

2.5 hours. Plant is 100% destroyed.

1994, France Cheese factory Overheating of equipment during night in this ISO 9000 newly

built modern plant. Fire destroyed more than 13,000m2. Fire

fighters extinguished the fire in 6 hours. Plant is 75% destroyed.

1994, France Fishery Fire on a truck. Fire destroyed more than 6,700m2 in 35 minutes.

Fire fighters extinguished the fire in more than 1 hour. Plant is

100% destroyed.

1995, France Slaughterhouse Fire on packaging storage. Fire destroyed more than 7,500m2 in

about 1 hour. Fire fighters extinguished the fire in 4.5 hours.

Plant is 75% destroyed.

1996, Belgium Slaughterhouse Fire in cold room. Fire spread and destroyed more than 5,000m2

in about 1 hour. Fire fighters, passing near the plant at the time

of the loss, extinguished the fire in 3 hours. The 52,000m2

plant is 10% destroyed.

1996, France Refrigerated Fire during night. Fire destroyed more than 5,000m2 and

warehouse 27 refrigerated trucks parked outside in about 1 hour. The plant

is 100% destroyed

1997, UK Plastic Fire during idle period. Fire destroyed more than 1,225m2. Fire

wrapping fighters controlled the fire in about 3 hours. Warehouse is 100%

rolls warehouse destroyed. PD= about € 914,000.

1999, Cyprus Cheese factory Fire during idle period; most likely fire is due to hot work. Fire

destroyed more than 9,100m2 in about 1 hour. Fire fighters

extinguished the fire in about 6 hours. Plant is 70% destroyed.

PD/BI= € 17.3 Mio.

Objective responsibility

for French employers

I Jean-Marc Sarafian, Legal and Claims Unit Manager

jsarafian@scor.com

Whereas a number of rulings had previously an obligation of safety of results, notably with regard

concluded "gross negligence chargeable to the to occupational disease contracted by the employee

employer" in French asbestos-related court cases, due to products manufactured or used by the

the Supreme Court of Appeal recently pronounced a company; that the failure to meet this obligation

series of decisions on matters of principle that amounts to gross negligence, according to article

extend beyond pure asbestos to all occupational L. 452-1 of the French code of social security, when

disease and injury. Employers are now deemed to the employer was, or should have been, aware of the

have a so-called obligation "of results" regarding the danger to which his employee was exposed, and

overall safety of their employees. neglected to take the necessary protective measures.

(…)".

On 28 February 2002, a series of rulings by the social

division of the French Supreme Court of Appeal In so doing, the Supreme Court of Appeal aims to

radically transformed the notion of employers' liability: extend the mode of compensation for victims by

"(…) given that by virtue of the employment contract ruling not just on asbestos in the workplace, but also

linking the employer to his employee, the former has on all occupational disease.

...

3 regards n ° 5 February 2003

... continued

Objective responsibility

for French employers

Indeed, in France, as elsewhere, there is a specific

Social Security scheme for compensating occupa-

tional disease or injury. Although this system grants

higher compensation for occupational disease or

injury than the benefits paid by other Social Security

schemes for non-occupational disease or injury, the

employee must waive of any right of recovery against

the employer based on common law.

Only in the case of "gross negligence" can the

employer be subjected to financial sanction. This

sanction comprises two distinct parts:

an increase in the employer's contribution to his

insurance scheme,

compensation for the psychological damage preliminary remarks on the risk, the particularities

suffered by the victim(s). of claims management, the need to establish a

In order to constitute gross negligence, such professional risks prevention policy, and moni-

negligence must be of "exceptional gravity, deriving toring specific risks;

from a wilful act or omission with regard to the

an explanation of what the contract does and

employer's duty to be aware of any dangers and in

does not cover, conditions for the cover to apply,

the absence of any justificatory cause".

and the requirements of the insured, notably

The Supreme Court of Appeal's decision, which has concerning information and declarations to be

since been followed by others and extended to provided to the insurer;

occupational injury, has led to profound deliberation

within the French Federation of Insurance Companies details regarding annual limits of cover;

(FFSA). The consequences of the ruling on known or

a description of the claims management process,

potential claims for past events have been analysed,

from declaration through to settlement, chargea-

as well as how to protect against employers' gross

ble to the limits of cover.

negligence in the future.

Recommendations for drafting the "gross negligence"

Up to now, gross negligence was covered by General

exclusion clause in the new or renewed General Third

Third Party Liability insurance, but it was unclear as to

Party Liability policies complete this frame of

how the cover would be implemented. A study of the

reference.

legal status of the employer in the event of gross

negligence, conducted by the FFSA during 2002, In addition to these recommendations, the FFSA has

The employer concluded that employers did not need liability cover set up a statistical monitoring scheme to observe the

needs a protection so much as protection against the financial forecast increase in claims following the ruling of 28

against the financial consequences of a gross negligence ruling. February 2002. This takes the form of a quarterly

consequences of a questionnaire on occupational injury and disease,

gross negligence Under the French system of gross negligence, the

including compensation paid; number of cases;

ruling employer is not "liable" in the traditional sense; it is

number of victims; assessment of new cases; and the

only exposed to financial sanction, resulting in number and assessment of the stock of cases in

increased contributions to the social welfare body that progress.

bears the cost of the additional compensation

awarded to the victims. The employee, or his/her This close and active technical collaboration between

beneficiaries, has no right of appeal against the insurers and reinsurers makes it possible to protect

employer. against the risk of gross negligence, in the context of

the French market, which is both advanced and

The FFSA has therefore set up a general scheme for complex. The solution proposed by the FFSA is

covering gross negligence, that no longer falls under particularly innovative and meets the needs of

liability but under direct "financial loss" cover (branch insurers and employers alike.

16 k of the French insurance code), and offers

insurers a "frame of reference", comprising:

4 regards n ° 5 February 2003

Private LTC insurance:

international comparisons

I Lucie Taleyson, Head of R&D Center Long Term Care Insurance

ltaleyson@scor.com

The majority of developed countries with aging

populations are confronted with the problem of an

increasing number of dependent, elderly individuals.

In the majority of countries concerned, as state

insurance is confronted with financing problems, it

cannot alone cover all the costs, which has opened

up the way to private insurance.

This article provides readers with an overview, an

initial evaluation of the main private individual LTC

insurance markets. For further information about these

different markets, Regards invites you to read our 9th

Life technical Newsletter.

The two main markets: France and the United

States of America

These two leading markets, in terms of volume and

experience, anticipated the enormous potential of LTC are burgeoning markets in the European Union, Asia

and Canada.

products.

Most markets have opted for indemnity LTC products,

The French market provides fixed indemnity cover in

based on the model adopted in France. As a result,

the form of monthly annuity payments. Once the

the US is the only market to have developed

policyholder is recognised as being eligible, he

reimbursement LTC products on such a large scale.

receives an annuity for life which is fixed when the

policy is underwritten. Three generations of fixed The indemnity model is more straightforward and

indemnity LTC insurance products have emerged one more flexible for the insured than the reimbursement

after another over the past 15 years. The latest model: for insurers it is a better guarantee for success.

generation of products offers cover which increases The indemnity model provides a better response to

according to the degree of impairment, covering both the basic needs of the disabled individual and his

total and partial loss of autonomy. This cover provides family. It is more flexible because the insured is free to

a wide variety of services and assistance for the use benefits for example to pay for informal care

disabled individual and his family. provided by the family. It is also easier for the insured

to understand because the amount of the annuity

After a 20%-25% increase in recent years, the number benefit is determined when the policy is underwritten.

of policyholders should exceed 2 million by the end of And to be eligible for total LTC cover, the only

2002, in other words an increase of over 30% this condition for payment of this annuity is severe

year. permanent loss of autonomy which is precisely when

A close examination The American market evolved on the basis of a disabled individual is in financial need.

of the various LTC reimbursement models. The first generation of For insurers, there is a higher risk of costs escalating

markets prompts products appeared in 1975, but the market did not with the reimbursement model than the indemnity

us to make the start developing until 1985. Depending on the type of model. It is true to say that with the indemnity model it

following remark: cover, benefits granted serve the purpose of is the insured who determines how the money is

the simpler the reimbursing expenses incurred for care and services, spent: eligibility for benefits is based on the fact that

product the easier provided at home or in a nursing home. These the individual is recognised as suffering from loss of

it is to sell. reimbursements have daily or monthly limits. The autonomy. But LTC indemnity products often cover

different types of extended coverage concern permanent loss of autonomy which is more severe

expenses incurred by family and friends, those than that covered by the reimbursement model: it is

incurred for home modification and nursing home therefore easier to verify the degree of impairment.

expenses.

In the United States partial loss of autonomy is

More than 6 million individuals have underwritten a covered: in this way many cases of temporary loss of

long term care policy. The growth in sales in recent autonomy benefit from this cover.

years has been significant, with figures often ranging

between 15%-20%, but this trend started to tail off in In France, the LTC indemnity model has developed in

2001. Furthermore, the current penetration rate of this the form of cover for total and permanent loss of

product is considered to be less than 7% of the autonomy; coverage for partial loss of autonomy,

population concerned. Sales could be promoted by designed more recently, where individuals are more

simplifying products which consumers feel are too likely to regain autonomy should give rise to stricter

complex. claims control. To limit the risk of escalating costs, a

simple solution is to cover only total loss of autonomy.

Two models are currently on offer on markets

Furthermore, the risk of costs escalating with the

worldwide: the indemnity model and indemnity model, which is characterised by the

reimbursement model payment of a fixed monthly cash benefit stipulated in

In many other countries LTC cover is likely to develop the contract, is less significant than that of the

considerably: apart from the Japanese market, where reimbursement model. On the US market, some

long term care has already made great strides, there insurers have in fact underestimated their liabilities,

...

5 regards n ° 5 February 2003

... continued

Private LTC insurance:

international comparisons

notably due to inflationary medical costs: reimbur- SCOR: over 15 years’ experience in LTC

sement limits have been reached more often than insurance

expected. Lastly, administrative costs and expenses The CIRDAD, its International Centre for Research and

incurred managing a reimbursement claims model Development on Long Term Care Insurance, studies

are very high compared with those of an indemnity the risks inherent to LTC insurance and provides the

model. tools required to manage long term liabilities. To

complete its knowledge of the risk and anticipate

To conclude, a close examination of the various LTC trends, the CIRDAD forms partnerships with

markets prompts us to make the following remark: the recognised research specialists on aging and loss of

simpler the product the easier it is to sell. As a result, autonomy. Stronger from its experience, SCOR is able

the majority of countries have opted for the indemnity to provide assistance to customers throughout the

model covering total permanent loss of autonomy to various stages of product design, and in the

launch their LTC cover. monitoring and managing of their risks.

News in brief

I Dominique Dionnet

ddionnet@scor.com

Natural and industrial risks: response by the The three main provisions of this law are:

French government a move towards a compensation system on a

On 3 January 2003, the French minister for Ecology claims made basis, by which "insurance cover

and Sustainable Development presented a draft bill must exist at the time when the claim is made";

on the prevention of technological and natural risks a restriction in the duration of cover (period

and compensation for damage. covered by the contract or five years following

the time when the injury occurred);

The first part of this bill, drawn up, notably,

following the accident at the AZF plant in Toulouse, a better balance of the financial cost of

focuses on technological risks. It mostly deals with compensation linked to nosocomial infections.

the management of hazardous "Seveso" classified Insurers will henceforth cover up to 25% of the

plants, of which there are 670 in France. With invalidity rate; beyond this, compensation will

regard to compensation, the state of "technological be covered by the French national office of

catastrophe" has been provided for in order to

compensation for medical accidents.

compensate victims within a maximum period of

three months. A chapter relating to insurance has

also been incorporated in this bill. Mixed results for the introduction of the 4th

The question of natural risks, and more particularly European Directive on motor insurance

the problem of flood prevention, is covered by the To date, eight European countries have not yet

second section of the bill. It empowers local

taken the necessary steps to align their national

authorities to intervene and enforce easements

with a view to flood prevention and natural legislation with the 4th Directive: France, Greece,

redirecting of watercourses, so as to fight against Ireland, Italy, Luxembourg, the Netherlands,

floods upstream of urbanized areas. Another Portugal and the United Kingdom. This text, which

measure envisages making more information envisages cover for accidents outside the victim's

available to buyers or lessees concerning potential country of residence, was due to come into force in

flood hazards to housing. all member states by 20 July 2002.

New medical liability in France SCOR publications

Health professionals in France now have a new

system under which medical risks are covered by Fo c u s : " C a s e m a n a g e m e n t : a g l o b a l

law No. 2002-1577, dated 30 December 2002, approach to victims". For further information,

concerning medical liability. email: publications@scor.com

Editor: Editing commitee:

Véronique Pornin Dominique Dionnet I, avenue du Général de Gaulle

Lys impression - 91860

Stephane Gin 92074 Paris-La-Défense cedex

Paul Idelson France

Béatrice Julienne www.scor.com

Odile Lasternas-Brécy

Etienne Leroy

François Mallot N°ISSN : 1632-1057

Jean-Marc Sarafian

6 regards n ° 5 Febuary 2003

Вам также может понравиться

- Eurovent 2.3Документ24 страницыEurovent 2.3pipipopo75100% (1)

- Outstanding 12m Bus DrivelineДокумент2 страницыOutstanding 12m Bus DrivelineArshad ShaikhОценок пока нет

- Structural - Analysis - Skid A4401 PDFДокумент94 страницыStructural - Analysis - Skid A4401 PDFMohammed Saleem Syed Khader100% (1)

- MR15 Mechanical Engineering SyllabusДокумент217 страницMR15 Mechanical Engineering Syllabusramji_kkpОценок пока нет

- Air Duct CalculatorДокумент1 страницаAir Duct CalculatorRinaldy100% (9)

- Air Duct CalculatorДокумент1 страницаAir Duct CalculatorRinaldy100% (9)

- 1045 McDaid - Pushing The BoundariesДокумент35 страниц1045 McDaid - Pushing The BoundariesAnonymous NGXdt2BxОценок пока нет

- Dilworth's New Fire Hall PlansДокумент7 страницDilworth's New Fire Hall PlansMelissa Van Der StadОценок пока нет

- Rak-43.3520 Fire Simulation: Simo HostikkaДокумент23 страницыRak-43.3520 Fire Simulation: Simo HostikkamarmoladynaОценок пока нет

- Fire Fighting Equipment Data SheetДокумент2 страницыFire Fighting Equipment Data SheetRian Jamaludin PogramОценок пока нет

- Icel 1006 Emergency Lighting Design Guide Hyp 10-1-2013 PDF 1360669544Документ31 страницаIcel 1006 Emergency Lighting Design Guide Hyp 10-1-2013 PDF 1360669544felipegonzalezmarquezОценок пока нет

- Motor StarterДокумент67 страницMotor Starter7402653100% (2)

- What Is A Fire Sprinkler K-FactorДокумент13 страницWhat Is A Fire Sprinkler K-FactorSofiqОценок пока нет

- A. What Is Balanced/objective Review or Criticism?Документ11 страницA. What Is Balanced/objective Review or Criticism?Risha Ann CortesОценок пока нет

- Fire Door Maintenance GuideДокумент19 страницFire Door Maintenance GuideRuslan ZhivkovОценок пока нет

- Carrier psychrometric chart analysisДокумент1 страницаCarrier psychrometric chart analysisonspsnons100% (3)

- EvacuationGuidePDF-NFPA Nov 2022Документ16 страницEvacuationGuidePDF-NFPA Nov 2022Jose AlvarezОценок пока нет

- Fire StopДокумент76 страницFire StopOmar AL-jazairiОценок пока нет

- A - Sandwich Panels FinalДокумент28 страницA - Sandwich Panels Finalhschoi12Оценок пока нет

- Kingspan Understanding Smoke Control Guide en IeДокумент55 страницKingspan Understanding Smoke Control Guide en IeRasmei NgorОценок пока нет

- Lorient BrochureДокумент28 страницLorient BrochureJerry Lee LiongsonОценок пока нет

- Tyco - Window Sprinklers As An Alternative To Fire PDFДокумент19 страницTyco - Window Sprinklers As An Alternative To Fire PDFingenierosunidosОценок пока нет

- Fire Doors 101 Testing Certification BeyondДокумент55 страницFire Doors 101 Testing Certification BeyondAsoka Kumarasiri JayawardanaОценок пока нет

- Lecture On Fire Prevention PlanningДокумент73 страницыLecture On Fire Prevention PlanningAsad MehboobОценок пока нет

- Emergency Evacuation Planning Guide For People With Disabilities 2 EditionДокумент69 страницEmergency Evacuation Planning Guide For People With Disabilities 2 EditionResta FauziОценок пока нет

- Leak-Test-VacuumДокумент1 страницаLeak-Test-Vacuumdarby1028Оценок пока нет

- CIBSE Training Programme July Dec 2021Документ14 страницCIBSE Training Programme July Dec 2021Renato Jr PadillaОценок пока нет

- Gege Panic Program BroshureДокумент8 страницGege Panic Program BroshurePavithran ParameswaranОценок пока нет

- Foam For Fixed SystemДокумент2 страницыFoam For Fixed SystemRukman SetiawanОценок пока нет

- Prevention and ProtectionДокумент9 страницPrevention and ProtectionMarlon FordeОценок пока нет

- BTI Guide To MIC in Fire Protec - Systems 2005Документ11 страницBTI Guide To MIC in Fire Protec - Systems 2005Claudia MmsОценок пока нет

- Lecture 6Документ22 страницыLecture 6Ali AimranОценок пока нет

- Egress Requirements for BuildingsДокумент23 страницыEgress Requirements for BuildingsAhmed SowilemОценок пока нет

- Fire Alarm Isolation Permit - Form AДокумент1 страницаFire Alarm Isolation Permit - Form AMuhammad Azam0% (1)

- The Buncefield Incident: 11 December 2005Документ208 страницThe Buncefield Incident: 11 December 2005SoroushMalekiОценок пока нет

- Structural Fire Precautions: 3.1 GeneralДокумент39 страницStructural Fire Precautions: 3.1 GeneralEric Ng S LОценок пока нет

- Storage and Handling of Drums & Intermediate Bulk Containers:Ppg26Документ6 страницStorage and Handling of Drums & Intermediate Bulk Containers:Ppg26TC Cüneyt ŞanОценок пока нет

- Buckeye Semifixed SystemsДокумент9 страницBuckeye Semifixed SystemsAndrés Felipe Sarmiento SОценок пока нет

- Firepass® Fire Prevention SystemsДокумент9 страницFirepass® Fire Prevention SystemsArun CherianОценок пока нет

- Fire Risks Assessors Course DetailsДокумент6 страницFire Risks Assessors Course DetailsAr JunОценок пока нет

- Interview: Qurrat-ul-Ain Qamar AftabДокумент27 страницInterview: Qurrat-ul-Ain Qamar AftabqamaОценок пока нет

- Flame SpreadДокумент4 страницыFlame Spreadjack peterson mileОценок пока нет

- Brochure Natural Smoke and Heat Exhaust SystemsДокумент13 страницBrochure Natural Smoke and Heat Exhaust SystemsConstantin GubavuОценок пока нет

- A New Earth - The Environmental ChallengeДокумент16 страницA New Earth - The Environmental ChallengeSara SmtihОценок пока нет

- BS en 12101-13-2022Документ126 страницBS en 12101-13-2022Pham Ba ManhОценок пока нет

- Urban Transformers Safety and Environmental ChallengesДокумент8 страницUrban Transformers Safety and Environmental ChallengesNicodemus Ervino MandalaОценок пока нет

- SCA Guidance-June 21Документ70 страницSCA Guidance-June 21БогданОценок пока нет

- hsg94 PDFДокумент40 страницhsg94 PDFbtjajadiОценок пока нет

- VBH Ironmongery Assortment 2011 2012Документ168 страницVBH Ironmongery Assortment 2011 2012Erika BanguilanОценок пока нет

- 74-3118 - XLS1000 Smoke Management Application ManualДокумент170 страниц74-3118 - XLS1000 Smoke Management Application ManualIssac WongОценок пока нет

- Mechanical Engineering Architecture and Building Printing and BДокумент43 страницыMechanical Engineering Architecture and Building Printing and BAtthapol YuyaОценок пока нет

- Hotel Fire Detection and Alarm RequirementsДокумент9 страницHotel Fire Detection and Alarm RequirementstienlamОценок пока нет

- Guidelines For Facilities For Blind and Vision Impaired PedestriansДокумент46 страницGuidelines For Facilities For Blind and Vision Impaired PedestriansAmul ShresthaОценок пока нет

- Katalog - Fire Voice 2014 PDFДокумент100 страницKatalog - Fire Voice 2014 PDFzaheeruddin_mohdОценок пока нет

- Equivalence and Harmonisation in Reaction-To-fire Performance - April 2012Документ32 страницыEquivalence and Harmonisation in Reaction-To-fire Performance - April 2012Rúben Sobreiro100% (1)

- Chimney Fires White PaperДокумент121 страницаChimney Fires White PaperKaundy BondОценок пока нет

- 051 Health and Safety Good Housekeeping 1Документ6 страниц051 Health and Safety Good Housekeeping 1api-415182300Оценок пока нет

- FireEx GuideДокумент20 страницFireEx GuideLloyd LloydОценок пока нет

- Tameside Metropolitan Borough Council - Fire Risk AssessmentДокумент34 страницыTameside Metropolitan Borough Council - Fire Risk AssessmentВладислав ПиндерОценок пока нет

- Fire Protection Engineering PrinciplesДокумент19 страницFire Protection Engineering PrinciplesHenry Humberto Mesa JimenezОценок пока нет

- AIGA 005 - 10 Fire Hazards of Oxygen and Oxygen Enriched AtmospheresДокумент35 страницAIGA 005 - 10 Fire Hazards of Oxygen and Oxygen Enriched AtmospheresDinar Kresno PutroОценок пока нет

- Ansul Foam Rim Pourer PDFДокумент2 страницыAnsul Foam Rim Pourer PDFIskandar HasibuanОценок пока нет

- Fixed Firefighting Systems - Oxygen Reduction SystemsДокумент33 страницыFixed Firefighting Systems - Oxygen Reduction SystemsAnonymous wtK1AZBiОценок пока нет

- Fire & Life Safety Inspection Report-Thanh Long Bay (Detail Review)Документ97 страницFire & Life Safety Inspection Report-Thanh Long Bay (Detail Review)kimcucspktОценок пока нет

- Carpark Manual First Edition PDFДокумент92 страницыCarpark Manual First Edition PDFFARIDОценок пока нет

- B C F Section 4Документ59 страницB C F Section 4Saeed Ahmed Soomro100% (1)

- Durasteel BrochureДокумент20 страницDurasteel Brochuregunza_picka7103Оценок пока нет

- Membrane Lined Insulated Gutter - BrochureДокумент8 страницMembrane Lined Insulated Gutter - BrochureAThaddeusAntonioОценок пока нет

- Natural Ventilation SystemsДокумент6 страницNatural Ventilation Systemsc4234223Оценок пока нет

- Guide To Insulating Sheathing: Revised January 2007Документ30 страницGuide To Insulating Sheathing: Revised January 2007texas_peteОценок пока нет

- FreonsДокумент4 страницыFreonsdarby1028Оценок пока нет

- Schneider 3-Way ValvesДокумент5 страницSchneider 3-Way Valvesdarby1028Оценок пока нет

- Grades of Stainless Steel A2, A4 in Relation To Fasteners - Graphskill LTDДокумент5 страницGrades of Stainless Steel A2, A4 in Relation To Fasteners - Graphskill LTDdarby1028Оценок пока нет

- 38aks016 CarrierДокумент138 страниц38aks016 CarrierYolanda Borbon100% (1)

- Indian Calendar With HolidaysДокумент12 страницIndian Calendar With HolidayssmiledepakОценок пока нет

- 4 Fire Damper Halton DNV CertificateДокумент3 страницы4 Fire Damper Halton DNV Certificatedarby1028Оценок пока нет

- D5200 ManualДокумент264 страницыD5200 ManualManas GeorgeОценок пока нет

- M 501Документ24 страницыM 501darby1028100% (1)

- E2RMДокумент3 страницыE2RMdarby1028Оценок пока нет

- CCK Schedule - Rev CДокумент1 страницаCCK Schedule - Rev Cdarby1028Оценок пока нет

- DMDPrework QuizДокумент5 страницDMDPrework Quizjunpe- yuutoОценок пока нет

- Homer Christensen ResumeДокумент4 страницыHomer Christensen ResumeR. N. Homer Christensen - Inish Icaro KiОценок пока нет

- Reaction CalorimetryДокумент7 страницReaction CalorimetrySankar Adhikari100% (1)

- Theatre Arts I 9 - 12 Grade Beginning Theatre Students: TH THДокумент18 страницTheatre Arts I 9 - 12 Grade Beginning Theatre Students: TH THAppleSamsonОценок пока нет

- Wei Et Al 2016Документ7 страницWei Et Al 2016Aline HunoОценок пока нет

- EGMM - Training Partner MOUДокумент32 страницыEGMM - Training Partner MOUShaik HussainОценок пока нет

- Type of PoemДокумент10 страницType of PoemYovita SpookieОценок пока нет

- Teacher Commitment and Dedication to Student LearningДокумент8 страницTeacher Commitment and Dedication to Student LearningElma Grace Sales-DalidaОценок пока нет

- Expected OutcomesДокумент4 страницыExpected OutcomesPankaj MahantaОценок пока нет

- Government of The Punjab Primary & Secondary Healthcare DepartmentДокумент3 страницыGovernment of The Punjab Primary & Secondary Healthcare DepartmentYasir GhafoorОценок пока нет

- KCL Thesis PrintingДокумент4 страницыKCL Thesis PrintingMelinda Watson100% (2)

- APTARE IT Analytics: Presenter NameДокумент16 страницAPTARE IT Analytics: Presenter NameCCIE DetectОценок пока нет

- Siemens MS 42.0 Engine Control System GuideДокумент56 страницSiemens MS 42.0 Engine Control System GuideIbnu NugroОценок пока нет

- Impression Techniques in Complete Denture Patients: A ReviewДокумент6 страницImpression Techniques in Complete Denture Patients: A ReviewRoja AllampallyОценок пока нет

- METRIC_ENGLISHДокумент14 страницMETRIC_ENGLISHKehinde AdebayoОценок пока нет

- Destroyed Inventory Deduction ProceduresДокумент7 страницDestroyed Inventory Deduction ProceduresCliff DaquioagОценок пока нет

- Where Are The Women in The Water Pipeline? Wading Out of The Shallows - Women and Water Leadership in GeorgiaДокумент7 страницWhere Are The Women in The Water Pipeline? Wading Out of The Shallows - Women and Water Leadership in GeorgiaADBGADОценок пока нет

- Veolia Moray Outfalls Repair WorksДокумент8 страницVeolia Moray Outfalls Repair WorksGalih PutraОценок пока нет

- Surveying 2 Practical 3Документ15 страницSurveying 2 Practical 3Huzefa AliОценок пока нет

- KG ResearchДокумент257 страницKG ResearchMuhammad HusseinОценок пока нет

- Corporate GovernanceДокумент35 страницCorporate GovernanceshrikirajОценок пока нет

- Imp RssДокумент8 страницImp RssPriya SharmaОценок пока нет

- Online Music QuizДокумент3 страницыOnline Music QuizGiang VõОценок пока нет

- Clinical Indications, Treatment and Current PracticeДокумент14 страницClinical Indications, Treatment and Current PracticefadmayulianiОценок пока нет

- Lay Out New PL Press QltyДокумент68 страницLay Out New PL Press QltyDadan Hendra KurniawanОценок пока нет

- PSAII Final EXAMДокумент15 страницPSAII Final EXAMdaveadeОценок пока нет