Академический Документы

Профессиональный Документы

Культура Документы

Asian Business Travellers 5

Загружено:

IrinaErmurachiИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Asian Business Travellers 5

Загружено:

IrinaErmurachiАвторское право:

Доступные форматы

BUSINESS TRAVEL IS SUSCEPTIBLE TO THE SAME DISRUPTIVE FORCES AS LEISURE

GOING DIGITAL

The shift to digitally enabled booking tools isnt just a priority for travel companiesits what ABTs

want as well. Between online, mobile, and face-to-face (F2F) interactions, F2F was the least-popular

option except for hotel check-ins where it dominated. They arent necessarily ready to pay for the

service. The young generation is more likely to pay for digital processes compared to the old one.

LOW-COST CARRIERS FLYING HIGH

Hot on the heels of the leisure market, the use of LCCs for business travel in Asia is widespread and

expanding rapidly.

At the same time, 41 percent of ABTs themselves stated they are willing or very willing to fly LCCs for

business, with the biggest cheerleaders being in India and Indonesia, unlike Singapore and Japan.

SHARING ECONOMYNASCENT AND GAINING ATTENTION

A significant majority70 percentof Asian business travellers were familiar with sharing economy

accommodation, of which 40 percent were open to considering it as an option for business travel.

Millennials were 11 percent more likely to consider sharing economy accommodation than non

Millennials.

Sharing economy players are not standing stillthey are hungry for growth. Airbnb has reported 700

percent growth since launching its global business travel programme a year ago.

Вам также может понравиться

- Air Travel For A Digital Age White PaperДокумент16 страницAir Travel For A Digital Age White PaperTatiana RokouОценок пока нет

- Travelport Digital Mobile Travel Trends 2019 Report PDFДокумент40 страницTravelport Digital Mobile Travel Trends 2019 Report PDFDharmeshОценок пока нет

- How To Trade When The Market ZIGZAGS: The E-Learning Series For TradersДокумент148 страницHow To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDavid ChalkerОценок пока нет

- Online Travel AgentДокумент9 страницOnline Travel Agentsheinmin thuОценок пока нет

- How Travel Agency Survive in E-Business WorldДокумент8 страницHow Travel Agency Survive in E-Business WorldIna NafaОценок пока нет

- NaftaДокумент18 страницNaftaShabla MohamedОценок пока нет

- Role and Scope of Travel AgencyДокумент16 страницRole and Scope of Travel AgencyshivОценок пока нет

- Legal Agreement LetterДокумент1 страницаLegal Agreement LetterJun RiveraОценок пока нет

- MBBcurrent 564548147990 2022-12-31 PDFДокумент10 страницMBBcurrent 564548147990 2022-12-31 PDFAdeela fazlinОценок пока нет

- Future Trends in Consumer BehaviorДокумент70 страницFuture Trends in Consumer BehaviorNagaraj NavalgundОценок пока нет

- Script For Performance Review MeetingДокумент2 страницыScript For Performance Review MeetingJean Rose Aquino100% (1)

- The Future of Sales: The 50+ Techniques, Tools, and Processes Used by Elite SalespeopleОт EverandThe Future of Sales: The 50+ Techniques, Tools, and Processes Used by Elite SalespeopleОценок пока нет

- Operation ManagementДокумент57 страницOperation ManagementCarmina DongcayanОценок пока нет

- Circle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon PropertyДокумент15 страницCircle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon Propertyqubrex1100% (2)

- Destination Marketing On The WebДокумент75 страницDestination Marketing On The Webmanolis_psarrosОценок пока нет

- The Tourism Industry and The Use of InternetДокумент4 страницыThe Tourism Industry and The Use of Internetraysubha123Оценок пока нет

- Mohit Kabra Article MakeMyTripДокумент3 страницыMohit Kabra Article MakeMyTripPrasanth KumarОценок пока нет

- SITA Passenger IT Trends Survey 2016Документ14 страницSITA Passenger IT Trends Survey 2016AlfianRachmatОценок пока нет

- Comparative Analysis of Oyo & Ginger Grp-9 PDFДокумент31 страницаComparative Analysis of Oyo & Ginger Grp-9 PDFadityakr2410100% (1)

- Case Study Challenges of Online Travel AgentsДокумент2 страницыCase Study Challenges of Online Travel AgentsJOHN PAUL AQUINOОценок пока нет

- Exploring Consumers' Attitudes and Behaviours Toward Online Hotel Room ReservationsДокумент6 страницExploring Consumers' Attitudes and Behaviours Toward Online Hotel Room ReservationsSa PPhireОценок пока нет

- Key Takeaways From Mary Meeker's Internet Trends Report 2018Документ3 страницыKey Takeaways From Mary Meeker's Internet Trends Report 2018Samyukth SridharanОценок пока нет

- WP Redefining The Shopping Center ExperienceДокумент7 страницWP Redefining The Shopping Center ExperienceAmr AnwarОценок пока нет

- Chapter 6 A Qualitative Study If Millennial TouristДокумент4 страницыChapter 6 A Qualitative Study If Millennial TouristShiao Fang LiemОценок пока нет

- RRLДокумент30 страницRRLPat Dizon100% (1)

- How Travel Agency Survive in E-Business World?: Lampy006@students - Unisa.edu - AuДокумент8 страницHow Travel Agency Survive in E-Business World?: Lampy006@students - Unisa.edu - AurazanymОценок пока нет

- Lsme411 Assignment1 (Raisa)Документ5 страницLsme411 Assignment1 (Raisa)researchhubpersonalОценок пока нет

- E-Tourism Assgn. 2Документ2 страницыE-Tourism Assgn. 2Dhanapan KeithellakpamОценок пока нет

- Capturing AMTДокумент40 страницCapturing AMTNabilaSalsaОценок пока нет

- Develop A Concept of A Feasibility FacilityДокумент19 страницDevelop A Concept of A Feasibility FacilitySheldon RajОценок пока нет

- Complete Market Analysis For Couple Travel AppДокумент16 страницComplete Market Analysis For Couple Travel Appengr najeebОценок пока нет

- E-Tourism Assgn. 1Документ4 страницыE-Tourism Assgn. 1Dhanapan KeithellakpamОценок пока нет

- Case Analysis of Huella Online TravelДокумент6 страницCase Analysis of Huella Online TravelPriyatham Kireeti67% (3)

- E-Commerce The Millennial Way I - INTRODUCTION Millennial CommerceДокумент6 страницE-Commerce The Millennial Way I - INTRODUCTION Millennial Commercecloyd collins m palorОценок пока нет

- Final HMT-801 ReportДокумент9 страницFinal HMT-801 ReportHusen AliОценок пока нет

- Business Travel: Managing Communication and CostsДокумент61 страницаBusiness Travel: Managing Communication and CostsAl DdОценок пока нет

- Case 1 RMДокумент4 страницыCase 1 RMMrunal WaghchaureОценок пока нет

- Join - The - Airline - Retail - Revolution - PDF Paxport PDFДокумент26 страницJoin - The - Airline - Retail - Revolution - PDF Paxport PDFAshish KumarОценок пока нет

- SIP - Muskan GaurДокумент16 страницSIP - Muskan GaurMuskan GaurОценок пока нет

- Study On Dimensions of Consumer Trust For Online Tourism Companies in IndiaДокумент23 страницыStudy On Dimensions of Consumer Trust For Online Tourism Companies in IndiadeepikaОценок пока нет

- Airline It Trends Survey 2015Документ12 страницAirline It Trends Survey 2015Mariano PizarroОценок пока нет

- Assignment 9Документ2 страницыAssignment 9Jhosua NepomucenoОценок пока нет

- Assignment 9Документ2 страницыAssignment 9Jhosua NepomucenoОценок пока нет

- Module 6 PDF 2Документ23 страницыModule 6 PDF 2Jiks GalleneroОценок пока нет

- Topic 5 Tourism TrendsДокумент7 страницTopic 5 Tourism TrendsJohnClark BancaleОценок пока нет

- Yasay - Millennials and Mobile Payment BehaviorДокумент15 страницYasay - Millennials and Mobile Payment BehaviorJorj YasayОценок пока нет

- Make My TripДокумент80 страницMake My TripMoin razaОценок пока нет

- AirlinesДокумент6 страницAirlinesKrushali DondaОценок пока нет

- Shopping in A Developing Country: A Demographic Perspective: Michael Adu KWARTENG, MichalДокумент14 страницShopping in A Developing Country: A Demographic Perspective: Michael Adu KWARTENG, MichalJawel CabanayanОценок пока нет

- E Travel Marketing IndiaДокумент28 страницE Travel Marketing IndiajumeroОценок пока нет

- Case Study Social MediaДокумент16 страницCase Study Social MediaNguyễn Phương TrâmОценок пока нет

- Managed Travels Future Is Seamless and MobileДокумент23 страницыManaged Travels Future Is Seamless and MobilemishasinghalОценок пока нет

- Indonesia: The New Tiger of Southeast Asia: InnovationДокумент7 страницIndonesia: The New Tiger of Southeast Asia: InnovationfielimkarelОценок пока нет

- Billionaires PDFДокумент7 страницBillionaires PDFfielimkarelОценок пока нет

- Week 8-9 Tme 100 T. PromotionsДокумент4 страницыWeek 8-9 Tme 100 T. PromotionsDelmae ToledoОценок пока нет

- Customer InformationДокумент3 страницыCustomer Informationlamya abd elhameedОценок пока нет

- Case Study 2Документ5 страницCase Study 2Shamcey Pearl Panes ModestoОценок пока нет

- Acknowledment: Ayan RazaДокумент86 страницAcknowledment: Ayan RazaMoin razaОценок пока нет

- Nielsen Global E Commerce Report August 2014Документ21 страницаNielsen Global E Commerce Report August 2014leonns1Оценок пока нет

- Module 3 Tourism Laws and International Travel ExperienceДокумент19 страницModule 3 Tourism Laws and International Travel ExperienceKathrina TrayaОценок пока нет

- Tourism Product: Direct Indirect ORДокумент6 страницTourism Product: Direct Indirect ORPrashant TotahОценок пока нет

- Laboratory Activity PagasДокумент3 страницыLaboratory Activity PagasJoshuaОценок пока нет

- Air Transport ManagementДокумент5 страницAir Transport ManagementmathguruuОценок пока нет

- StatementsДокумент2 страницыStatementsFIRST FIRSОценок пока нет

- Business Economics - Question BankДокумент4 страницыBusiness Economics - Question BankKinnari SinghОценок пока нет

- © 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenДокумент62 страницы© 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenHIỀN LÊ THỊОценок пока нет

- Monsoon 2023 Registration NoticeДокумент2 страницыMonsoon 2023 Registration NoticeAbhinav AbhiОценок пока нет

- Organic Farming in The Philippines: and How It Affects Philippine AgricultureДокумент6 страницOrganic Farming in The Philippines: and How It Affects Philippine AgricultureSarahОценок пока нет

- Revenue Procedure 2014-11Документ10 страницRevenue Procedure 2014-11Leonard E Sienko JrОценок пока нет

- Application Form For Subscriber Registration: Tier I & Tier II AccountДокумент9 страницApplication Form For Subscriber Registration: Tier I & Tier II AccountSimranjeet SinghОценок пока нет

- S03 - Chapter 5 Job Order Costing Without AnswersДокумент2 страницыS03 - Chapter 5 Job Order Costing Without AnswersRigel Kent MansuetoОценок пока нет

- Stock-Trak Project 2013Документ4 страницыStock-Trak Project 2013viettuan91Оценок пока нет

- Pandit Automotive Pvt. Ltd.Документ6 страницPandit Automotive Pvt. Ltd.JudicialОценок пока нет

- Competition Act: Assignment ONДокумент11 страницCompetition Act: Assignment ONSahil RanaОценок пока нет

- Basice Micro - AssignmentДокумент2 страницыBasice Micro - AssignmentRamiah Colene JaimeОценок пока нет

- Mechanizing Philippine Agriculture For Food SufficiencyДокумент21 страницаMechanizing Philippine Agriculture For Food SufficiencyViverly Joy De GuzmanОценок пока нет

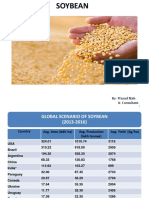

- Soybean Scenario - LaturДокумент18 страницSoybean Scenario - LaturPrasad NaleОценок пока нет

- Vtiger Software For CRMДокумент14 страницVtiger Software For CRMmentolОценок пока нет

- Business Plan SampleДокумент14 страницBusiness Plan SampleGwyneth MuegaОценок пока нет

- Fire Service Resource GuideДокумент45 страницFire Service Resource GuidegarytxОценок пока нет

- Top Form 10 KM 2014 ResultsДокумент60 страницTop Form 10 KM 2014 ResultsabstickleОценок пока нет

- Emergence of Entrepreneurial ClassДокумент16 страницEmergence of Entrepreneurial ClassKavya GuptaОценок пока нет

- Agony of ReformДокумент3 страницыAgony of ReformHarmon SolanteОценок пока нет

- Table 1. Different Modules of Training Proposed On Mushroom Cultivation Technology DetailsДокумент11 страницTable 1. Different Modules of Training Proposed On Mushroom Cultivation Technology DetailsDeepak SharmaОценок пока нет

- Ahmed BashaДокумент1 страницаAhmed BashaYASHОценок пока нет

- Why The Strengths Are Interesting?: FormulationДокумент5 страницWhy The Strengths Are Interesting?: FormulationTang Zhen HaoОценок пока нет

- Bye, Bye Nyakatsi Concept PaperДокумент6 страницBye, Bye Nyakatsi Concept PaperRwandaEmbassyBerlinОценок пока нет