Академический Документы

Профессиональный Документы

Культура Документы

Requiremnt Hahahha

Загружено:

Mots OrejolaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Requiremnt Hahahha

Загружено:

Mots OrejolaАвторское право:

Доступные форматы

I.D.A.

JR BUILDERS & CONSTRUCTION SUPPLY

Notes to Financial Statement

As of and For the years ended December 31, 2015 and 2014

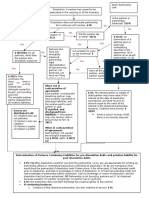

15. Financial Instruments

The companys financial assets and liabilities are recognized initially at cost which is the fair value of the

consideration given (in the case of assets) or received (in the liabilities).

Fair values are determined by reference to market-based evidence, which is the amount for which the financial

assets could be exchanged between a knowledgeable willing buyer and a knowledgeable willing seller in an

arms length transaction as at the valuation date.

The following tables set forth the carrying values and estimated values of the Companys financial assets and

liabilities recognized as of December 31, 2015 and 2014.

2015 2014

Carrying Value Fair Value Carrying Value Fair Value

Financial Asset

Cash 3,741,139.58 3,741,139.58 3,719,360.12 3,719,360.12

Retention Receivable 1,077,465.48 1,077,465.48 1,980,182.69 1,980,182.12

4,181,605.16 4,818,605.16 5,699,542.81 5,699,542.81

Financial Liabilities

Trade Payable 0.00 0.00 0.00 0.00

Advances from Contracts 0.00 0.00 2,085,756.96 2,085,756.96

0.00 0.00 2,085,756.96 2,085,756.96

The following methods and assumptions were used to estimate the fair value of each class of financial instrument

for which it is practicable to estimate such value.

Financial instruments whose carrying amounts approximate fair value. Management has determined that the

carrying amounts of cash, trades and other payables reasonably approximate their fair values because of their

short maturities.

The company maintains cash to meet its liquidity requirements for up to 30-day periods and the Company

maintains adequate highly liquid assets in the form of inventory to assure necessary liquidity.

Retention receivable consists of a regular customer, and based on historical information about said customer

default rates, management consider the credit quality of trade receivables that are not past due or impaired to be

good. All of the Companys trades and other receivables have been reviewed for indicators of impairment.

The fair values of trade and other payables have not been individually disclosed as, due to their short duration,

management considers the carrying amounts recognized in the balance sheet to be reasonable approximation of

their fair values.

Вам также может понравиться

- Irr Ra 9184 Infra LДокумент73 страницыIrr Ra 9184 Infra LMots Orejola100% (3)

- I Sag Permit ApplicationДокумент1 страницаI Sag Permit ApplicationMots OrejolaОценок пока нет

- Certificate of Appreciation: Republic of The Philippines Province of Samar Municipality of Basey Barangay BasiaoДокумент1 страницаCertificate of Appreciation: Republic of The Philippines Province of Samar Municipality of Basey Barangay BasiaoMots OrejolaОценок пока нет

- Plate No. Title 1 Roofing and Trusses 2 Painting 3 Septic Vault 4 Plumbing Plan 5 Electrical Plan 6 Notes and SpecificationsДокумент1 страницаPlate No. Title 1 Roofing and Trusses 2 Painting 3 Septic Vault 4 Plumbing Plan 5 Electrical Plan 6 Notes and SpecificationsMots OrejolaОценок пока нет

- Engineering Surveys - Compound, Reversed, Simple CurvesДокумент11 страницEngineering Surveys - Compound, Reversed, Simple CurvesMots OrejolaОценок пока нет

- Diary of A Teenage Superhero Book ReportДокумент4 страницыDiary of A Teenage Superhero Book ReportMots OrejolaОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Ultratech Cement Ltd.Документ24 страницыUltratech Cement Ltd.Avinash GanesanОценок пока нет

- Voluntary Winding UpДокумент2 страницыVoluntary Winding UpAbhishekBoobОценок пока нет

- Lesson-7 Basic Principles of Preparing Final Account (Capital and Revenue)Документ8 страницLesson-7 Basic Principles of Preparing Final Account (Capital and Revenue)ranjan1491Оценок пока нет

- Fax Cover Page 6 Pages: Attention: Robert GouletДокумент6 страницFax Cover Page 6 Pages: Attention: Robert Gouletrobert gouletОценок пока нет

- Role or Importance of State Bank of Pakistan in Economic Development of PakistanДокумент3 страницыRole or Importance of State Bank of Pakistan in Economic Development of PakistanMohammad Hasan100% (1)

- Feasibility Study - Steel Products WeldingДокумент7 страницFeasibility Study - Steel Products WeldingWaseem MalikОценок пока нет

- Chap 6 and 8 Midterm Review SeatworkДокумент2 страницыChap 6 and 8 Midterm Review SeatworkLouina Yncierto0% (1)

- PPTДокумент35 страницPPTShivam ChauhanОценок пока нет

- 2nd Year Accounting Notes For IДокумент4 страницы2nd Year Accounting Notes For Iiramanwar50% (2)

- Cash FlowДокумент6 страницCash FlowLara Lewis AchillesОценок пока нет

- Argentina Peso CrisisДокумент9 страницArgentina Peso CrisisastrocriteОценок пока нет

- Measuring Macroeconomic Activity: © 2014 Pearson Education, IncДокумент22 страницыMeasuring Macroeconomic Activity: © 2014 Pearson Education, IncchooisinОценок пока нет

- Fin 22Документ6 страницFin 22Princess AduanaОценок пока нет

- UPA DissolutionДокумент1 страницаUPA DissolutionNiraj ThakkerОценок пока нет

- Financial Accounting Theory 2e by Deegan 2006 Ch05Документ41 страницаFinancial Accounting Theory 2e by Deegan 2006 Ch05Hamarr WandayuОценок пока нет

- Convergent Outsourcing Collection Letter FDCPAДокумент1 страницаConvergent Outsourcing Collection Letter FDCPAghostgripОценок пока нет

- Business Cycles Ups and DownsДокумент8 страницBusiness Cycles Ups and DownsmadhavithakurОценок пока нет

- 4.model Problems On Final AccountsДокумент4 страницы4.model Problems On Final Accountsparth38Оценок пока нет

- 7110 s14 Ms 21Документ8 страниц7110 s14 Ms 21Muhammad UmairОценок пока нет

- Installment Promissory Note With Balloon PaymentДокумент3 страницыInstallment Promissory Note With Balloon PaymentkennjrОценок пока нет

- Finanzas Corporativas I: Semana #9: Politica de Capital de TrabajoДокумент53 страницыFinanzas Corporativas I: Semana #9: Politica de Capital de TrabajoChristian Sebastian Warthon AzurinОценок пока нет

- Mickeystartsatextilebusinessaccontacyppt 150824161312 Lva1 App6891Документ37 страницMickeystartsatextilebusinessaccontacyppt 150824161312 Lva1 App6891Sandeep ManipatruniОценок пока нет

- Liabilities of The Parties To An InstrumentДокумент2 страницыLiabilities of The Parties To An InstrumentRonel Buhay100% (1)

- Zimbabwe CaseДокумент16 страницZimbabwe CaseAnshul VermaОценок пока нет

- Financial Management - 2 Marks Questions and AnswersДокумент2 страницыFinancial Management - 2 Marks Questions and AnswersKumara Kannan Rengasamy100% (4)

- Sales Pineda ReviewerДокумент7 страницSales Pineda ReviewerDumstey100% (1)

- Kinds of PartnershipДокумент4 страницыKinds of PartnershipIrvinne Heather Chua GoОценок пока нет

- The Determination of Exchange RatesДокумент20 страницThe Determination of Exchange RatesSauryadeep DwivediОценок пока нет

- Accounting/Series 4 2011 (Code30124)Документ16 страницAccounting/Series 4 2011 (Code30124)Hein Linn Kyaw100% (1)

- HyperinflationДокумент2 страницыHyperinflationDanix Acedera50% (2)