Академический Документы

Профессиональный Документы

Культура Документы

Flowchart

Загружено:

vrprasad.dudalaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Flowchart

Загружено:

vrprasad.dudalaАвторское право:

Доступные форматы

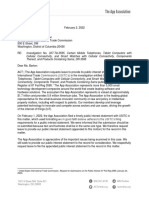

INCOME TAX RETURN FILING PROCESS FLOW

Download the ITR Data Sheet .

Fill the Data Sheet in Capital Letters, and Submit the documents email the filled data sheet and form 16 & and any other

alongwith Form 16 & any other documents which are required documents required for filing of tax returns to "

for Tax filing purpose @ Helpdesk. infoteamworkz@gmail.com

Please make the online transfer to below account

OUR UPI ID:9743500130@UPI

KIRAN K K : CANARA BANK

Please make the Service Charges @ helpdesk & do collect the HASSAN MAIN BRANCH

SB A/C :0531101066954

Cash receipt from Teamworkz Represantative. IFSC CODE :CNRB0000531

MICR :573015302

IF TAX IS PAYABLE

We shall process your records and file the returns and send ITR

We shall share the tax computation workings & also the challan V & Tax workings to your email ID provided at data sheet.

copy, for tax payment, post payment of the taxes, Online/Offline,

share the tax payment details to infoteamworkz@gmail.com .

Keep a Copy of Tax Computation workings & ITR V form for your

records and Send Just send this acknowledgement form using a

regular or speed post (no courier allowed) to "Centralized Processing Alternatively you can do the

Centre, Income Tax Department, Bengaluru 560500 eVerification using OTP generated

through Aadhar/Netbanking/

Income Tax portal Login option so

that you need not to send any

document to CPC Bangalore via

Post.

Upon Receipt of ITR V from the Assessee, ( within 120 days of Return

Filing date ) CPC Shall send an email acknowledging the receipt of ITR

V.

Filing of Income Tax Return Process completes.

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Dawood University of Engineering and Technology, KarachiДокумент19 страницDawood University of Engineering and Technology, KarachiOSAMAОценок пока нет

- 22-02-02 ITC-3595 ACT Motion For Leave To File Corrected StatementДокумент2 страницы22-02-02 ITC-3595 ACT Motion For Leave To File Corrected StatementFlorian MuellerОценок пока нет

- Task Checklist Exhibition Re 2019Документ4 страницыTask Checklist Exhibition Re 2019zikrillah1Оценок пока нет

- 54 Channel EEG Digital SystemДокумент2 страницы54 Channel EEG Digital SystemDavit SoesantoОценок пока нет

- SLHT Grade 7 CSS Week 2Документ6 страницSLHT Grade 7 CSS Week 2princeyahweОценок пока нет

- Instruction Manual: Portable Vibrometer: VM-4424S/HДокумент35 страницInstruction Manual: Portable Vibrometer: VM-4424S/HKitti BoonsongОценок пока нет

- I. Electronic Commerce Act of 2000 (R.A. 8792)Документ3 страницыI. Electronic Commerce Act of 2000 (R.A. 8792)Lorelie SantosОценок пока нет

- CIM Standards Overview Layers 2 and 3Документ80 страницCIM Standards Overview Layers 2 and 3AweSome, ST,MTОценок пока нет

- MYTHO Manual RCFДокумент32 страницыMYTHO Manual RCFNicola Yubo GalliОценок пока нет

- Creating EPortfolio As A Technology ToolДокумент56 страницCreating EPortfolio As A Technology ToolTrisha CenitaОценок пока нет

- Kerio Control Adminguide en 9.2.8 3061Документ352 страницыKerio Control Adminguide en 9.2.8 3061Nushabe CeferovaОценок пока нет

- Remote SensingДокумент31 страницаRemote SensingKousik BiswasОценок пока нет

- Paparan Dirjen Pedum 2019Документ14 страницPaparan Dirjen Pedum 2019Erick TzeОценок пока нет

- Sample Camb Igcse Co Sci 001-013-So PDFДокумент16 страницSample Camb Igcse Co Sci 001-013-So PDFali002200Оценок пока нет

- Vdocuments - MX - ptc04 II Epon Access Hardware Installation Manualpdf PDFДокумент23 страницыVdocuments - MX - ptc04 II Epon Access Hardware Installation Manualpdf PDFJuan Ayala SizalimaОценок пока нет

- Types of LayoutДокумент8 страницTypes of LayoutWidya YuliartiОценок пока нет

- Feetwood Battery Control CenterДокумент9 страницFeetwood Battery Control Centerfrank rojasОценок пока нет

- Demo Information and Execution Instructions: Gnostice Edocengine Demo NotesДокумент7 страницDemo Information and Execution Instructions: Gnostice Edocengine Demo NotesJavier MuñozОценок пока нет

- Thesis Progress TrackerДокумент4 страницыThesis Progress Trackerheatherbeninatianchorage100% (2)

- Wii Okami ManualДокумент25 страницWii Okami Manualbeatrizascensao.workОценок пока нет

- IBM Content Manager OnDemand and FileNet-2Документ88 страницIBM Content Manager OnDemand and FileNet-2David ResendizОценок пока нет

- 电子书Документ474 страницы电子书Grace YinОценок пока нет

- MCS-012 Block 2Документ102 страницыMCS-012 Block 2Abhishek VeerkarОценок пока нет

- Gerald Prince A Dictionary of Narratology PDFДокумент5 страницGerald Prince A Dictionary of Narratology PDFAl GhamОценок пока нет

- CH 31Документ58 страницCH 31Jeffrey KankwaОценок пока нет

- How to Register for Smart Prepaid Innovation Generation FAQsДокумент12 страницHow to Register for Smart Prepaid Innovation Generation FAQsKELLY CAMILLE GALIT ALAIRОценок пока нет

- UpdatepasswordДокумент4 страницыUpdatepasswordsaadouli nouhaОценок пока нет

- Tems Cell PlannerДокумент7 страницTems Cell Plannerkerek2Оценок пока нет

- Red Hat Enterprise Linux 5 Installation Guide Es ESДокумент288 страницRed Hat Enterprise Linux 5 Installation Guide Es EScompas87Оценок пока нет

- Practical ApplicationДокумент224 страницыPractical ApplicationHanumat Sanyasi NouduriОценок пока нет