Академический Документы

Профессиональный Документы

Культура Документы

ITC not available under CGST Act Section 17(5

Загружено:

Deepak Wadhwa0 оценок0% нашли этот документ полезным (0 голосов)

26 просмотров1 страницаSection 17 (5) of the CGST act lists 12 services for which input tax credit is not available under the Goods and Services Tax (GST) in India. These include motor vehicles except for dealers, transportation services, and driving schools; membership of clubs and fitness centers; travel benefits for employees; rent a car, life and health insurance except when mandatory; goods or services for personal use; works contracts for construction; composition levy taxpayers; goods that are lost, stolen or disposed of; goods or services received by real estate developers; nonresident taxpayers; and certain food/catering and health services. Input tax credit is also not available in cases of willful fraud.

Исходное описание:

go

Оригинальное название

Input Tax Credit

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документSection 17 (5) of the CGST act lists 12 services for which input tax credit is not available under the Goods and Services Tax (GST) in India. These include motor vehicles except for dealers, transportation services, and driving schools; membership of clubs and fitness centers; travel benefits for employees; rent a car, life and health insurance except when mandatory; goods or services for personal use; works contracts for construction; composition levy taxpayers; goods that are lost, stolen or disposed of; goods or services received by real estate developers; nonresident taxpayers; and certain food/catering and health services. Input tax credit is also not available in cases of willful fraud.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

26 просмотров1 страницаITC not available under CGST Act Section 17(5

Загружено:

Deepak WadhwaSection 17 (5) of the CGST act lists 12 services for which input tax credit is not available under the Goods and Services Tax (GST) in India. These include motor vehicles except for dealers, transportation services, and driving schools; membership of clubs and fitness centers; travel benefits for employees; rent a car, life and health insurance except when mandatory; goods or services for personal use; works contracts for construction; composition levy taxpayers; goods that are lost, stolen or disposed of; goods or services received by real estate developers; nonresident taxpayers; and certain food/catering and health services. Input tax credit is also not available in cases of willful fraud.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

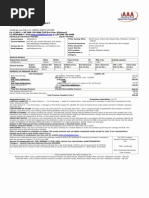

Section 17 (5) of CGST act- input tax credit shall not be

available for the following services.

SL Services on which ITC is not available

No

1 Input tax credit (ITC) of Motor vehicles and other conveyance not allowed under

GST expect in following cases

1. Dealer of motor vehicles

2. Transportation of passengers

3. Driving schools

4. The vehicle used for transportation of Goods

2 Membership of club, health and fitness center

3 Travel benefits extended to employees on vacation such as Leave or home travel

concession

4 Rent a cab, life insurance, and health insurance except under two cases

When the government makes mandatory for an employer

5 Goods or services or both used for personal consumption

6 Works contract services when supplied for construction of immovable property

7 ITC under Composition levy

8 ITC on goods lost, stolen, destroyed, written off or disposed of by way of gift or

free samples

9 ITC on goods or services received by Real Estate Developer

10 ITC in case of Nonresident taxable Person

11 ITC in case of Food and beverages, outdoor catering, health services etc.

12 ITC in case of willful fraud

Вам также может понравиться

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsОт EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsОценок пока нет

- GST Input Tax Credit ConditionsДокумент1 страницаGST Input Tax Credit ConditionsShail MehtaОценок пока нет

- Unit 3 - ITC-1Документ9 страницUnit 3 - ITC-1Shivani YadavОценок пока нет

- Motor Proposal ConfirmationДокумент4 страницыMotor Proposal Confirmationwilliam.pangОценок пока нет

- Day2session3 4Документ60 страницDay2session3 4Kuwar RaiОценок пока нет

- Motor Proposal Confirmation (Proof of No Claims BonusДокумент4 страницыMotor Proposal Confirmation (Proof of No Claims BonusHaris AhmadОценок пока нет

- Block Credit Under GSTДокумент2 страницыBlock Credit Under GSTparam.ginniОценок пока нет

- DVLA D796 Form PDFДокумент3 страницыDVLA D796 Form PDFJordan cadmanОценок пока нет

- GST ITC ConditionsДокумент6 страницGST ITC ConditionsKenny PhilipsОценок пока нет

- Motor Proposal ConfirmationДокумент4 страницыMotor Proposal ConfirmationAlexandru SmarandaОценок пока нет

- Meg Stephan L. Cañal Tax 2 FinalsДокумент3 страницыMeg Stephan L. Cañal Tax 2 FinalsgirlОценок пока нет

- This Form May Be Photocopied - Void Unless Complete Information Is SuppliedДокумент2 страницыThis Form May Be Photocopied - Void Unless Complete Information Is SuppliedCristian De la cruz cantilloОценок пока нет

- Rental Agreement For BikeДокумент7 страницRental Agreement For Bikeminolianuruddima4Оценок пока нет

- Iffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017Документ3 страницыIffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017ams20110% (1)

- Duplicate Motor Insurance Statement CheckДокумент4 страницыDuplicate Motor Insurance Statement Checkramadh111Оценок пока нет

- Temporary Movement Permit Insurance PolicyДокумент4 страницыTemporary Movement Permit Insurance PolicyBessОценок пока нет

- PHP Residents T&csДокумент1 страницаPHP Residents T&csMark John PascuaОценок пока нет

- Harpriti PolicyДокумент1 страницаHarpriti PolicyIASkanhaОценок пока нет

- Preferential TaxationДокумент9 страницPreferential TaxationMОценок пока нет

- HDFC ERGO car insurance policy detailsДокумент1 страницаHDFC ERGO car insurance policy detailsHarsh Sahrawat100% (3)

- Cases when ITC is not available under GSTДокумент8 страницCases when ITC is not available under GSTAnkit MaheshwariОценок пока нет

- Basic Own DamageДокумент3 страницыBasic Own DamageHarsh PriyaОценок пока нет

- SHORT TERM INSURANCE POLICY DETAILSДокумент1 страницаSHORT TERM INSURANCE POLICY DETAILSMarinFeraruОценок пока нет

- E-Text - Week - 3 Unit 3: Reverse Charge Mechanism (RCM)Документ3 страницыE-Text - Week - 3 Unit 3: Reverse Charge Mechanism (RCM)rajneeshkarloopiaОценок пока нет

- Reverse Charge Mechanism (RCM) ExplainedДокумент3 страницыReverse Charge Mechanism (RCM) ExplainedrajneeshkarloopiaОценок пока нет

- Policy PDFДокумент4 страницыPolicy PDFshubhamОценок пока нет

- Blocked CreditsДокумент4 страницыBlocked CreditsRahul KLОценок пока нет

- Income Tax Case List Exam Related PurposeДокумент9 страницIncome Tax Case List Exam Related PurposeShubham PhophaliaОценок пока нет

- Vehicle Insurance Policy FormatДокумент4 страницыVehicle Insurance Policy Formatarunavonline_947835049% (59)

- Service TaxДокумент55 страницService Taxtushar vatsОценок пока нет

- GST Input Tax Credit ConditionsДокумент8 страницGST Input Tax Credit Conditionsayusha dasОценок пока нет

- Demands and Needs StatementДокумент34 страницыDemands and Needs StatementrandyooiscribdОценок пока нет

- ABN 27 285 643 255 Temporary Movement PermitДокумент4 страницыABN 27 285 643 255 Temporary Movement PermitBessОценок пока нет

- Gsis Citizen CharterДокумент62 страницыGsis Citizen CharterCharles John Palabrica CubarОценок пока нет

- ICMAP Business Law Past PapersДокумент5 страницICMAP Business Law Past Papersmuhzahid786Оценок пока нет

- Certificate Private Hire 2020Документ2 страницыCertificate Private Hire 2020raj6912377Оценок пока нет

- Negative List of Services and Exempted ServicesДокумент19 страницNegative List of Services and Exempted ServicesViraj WadkarОценок пока нет

- Expanded Senior Citizens Act of 2010Документ17 страницExpanded Senior Citizens Act of 2010Kimboy Elizalde PanaguitonОценок пока нет

- Anita InsuranceДокумент1 страницаAnita Insurancevaishali180189Оценок пока нет

- Corporate AgentsДокумент8 страницCorporate AgentsPrashant TetaliОценок пока нет

- Registration Certificate ExplainedДокумент2 страницыRegistration Certificate ExplainedElle ParahaОценок пока нет

- PCP 96175276 PDFДокумент3 страницыPCP 96175276 PDFpvsairam100% (5)

- MOTOR INSURANCE CERTIFICATEДокумент3 страницыMOTOR INSURANCE CERTIFICATEJagateeswaran KanagarajОценок пока нет

- Hero Insurance Broking India PVT Ltd-MISP - OrDER 228 Dd17!12!2019Документ16 страницHero Insurance Broking India PVT Ltd-MISP - OrDER 228 Dd17!12!2019Moneylife FoundationОценок пока нет

- Icici LombardДокумент1 страницаIcici LombardTony Jacob33% (3)

- Gsis CitizensCharterДокумент76 страницGsis CitizensCharterRhodora BernabeОценок пока нет

- GST Guidance on Input Tax CreditДокумент21 страницаGST Guidance on Input Tax CreditSUNIL PUJARIОценок пока нет

- 2312100095928100000Документ2 страницы2312100095928100000Kavin Prakash100% (2)

- Transfer of Input Tax Credit and Its Related Issues: Who Can Claim ITC?Документ11 страницTransfer of Input Tax Credit and Its Related Issues: Who Can Claim ITC?Vishal DubeyОценок пока нет

- Taxation LawДокумент3 страницыTaxation Lawfoxsmith8Оценок пока нет

- Two Wheeler PA ProposalДокумент3 страницыTwo Wheeler PA Proposalmurali9026100% (1)

- FOREIGN CONTRIBUTION REGULATION ACTДокумент26 страницFOREIGN CONTRIBUTION REGULATION ACTSachin RaikarОценок пока нет

- Supply and Its TypesДокумент30 страницSupply and Its TypesAmit GuptaОценок пока нет

- Special Corporations, Partnerships, Gross IncomeДокумент20 страницSpecial Corporations, Partnerships, Gross IncomeRizzalyn ArriesgadoОценок пока нет

- Input Tax Credit Under GSTДокумент35 страницInput Tax Credit Under GSTGiri SukumarОценок пока нет

- AwesomeДокумент2 страницыAwesomeAmit BanerjeeОценок пока нет

- Certificate of Motor InsuranceДокумент2 страницыCertificate of Motor InsurancefxhhadОценок пока нет

- Inclusions in Gross IncomeДокумент4 страницыInclusions in Gross IncomeNaiza Mae R. BinayaoОценок пока нет

- Proof of travel not required for LTA claims: SCДокумент3 страницыProof of travel not required for LTA claims: SCyagayОценок пока нет

- FISC - Income TaxДокумент10 страницFISC - Income TaxDaniela CaraОценок пока нет

- RegДокумент53 страницыRegDeepak WadhwaОценок пока нет

- Vision Debit NoteДокумент1 страницаVision Debit NoteDeepak WadhwaОценок пока нет

- Tally Short CutsДокумент5 страницTally Short CutsDeepak WadhwaОценок пока нет

- 11 Excel Data Cleaning TechniquesДокумент6 страниц11 Excel Data Cleaning TechniquesDeepak WadhwaОценок пока нет

- End User Guide To Accounts Receivable in Sap FiДокумент82 страницыEnd User Guide To Accounts Receivable in Sap FiVelayudham ThiyagarajanОценок пока нет

- Press Information Bureau Government of India Ministry of FinanceДокумент3 страницыPress Information Bureau Government of India Ministry of FinanceDeepak WadhwaОценок пока нет

- Manual Filing & REfundДокумент12 страницManual Filing & REfundDeepak WadhwaОценок пока нет

- UP VAT ANNUAL RETURNДокумент5 страницUP VAT ANNUAL RETURNDeepak WadhwaОценок пока нет

- Form GST Rfd-11 Furnishing of Bond or Letter of Undertaking For Export of Goods or ServicesДокумент5 страницForm GST Rfd-11 Furnishing of Bond or Letter of Undertaking For Export of Goods or ServicesDeepak WadhwaОценок пока нет

- GST Comprehensive Notes For CA Cs and Cma FinalДокумент12 страницGST Comprehensive Notes For CA Cs and Cma FinalDeepak WadhwaОценок пока нет

- GST Sction ListДокумент1 страницаGST Sction ListDeepak WadhwaОценок пока нет

- Fly Ash BricksДокумент29 страницFly Ash BricksSashankPsОценок пока нет

- CGST Sction ListДокумент4 страницыCGST Sction ListDeepak WadhwaОценок пока нет

- JOB PROCEDURE UNDER GSTДокумент18 страницJOB PROCEDURE UNDER GSTDeepak WadhwaОценок пока нет

- GST Returns - Revised Due DatesДокумент1 страницаGST Returns - Revised Due DatesPrabhakar K SОценок пока нет

- Standard On AuditДокумент70 страницStandard On AuditDeepak WadhwaОценок пока нет

- For M.edДокумент11 страницFor M.edDeepak WadhwaОценок пока нет

- 084 Shunya Ka DarshanДокумент57 страниц084 Shunya Ka DarshanRiddhi ShahОценок пока нет

- GST Chapter Wise RateДокумент213 страницGST Chapter Wise RateMoneycontrol News92% (280)

- LSMW Legacy System Migration Workbench: AB1007 - Conversion v1.0Документ106 страницLSMW Legacy System Migration Workbench: AB1007 - Conversion v1.0Deepak WadhwaОценок пока нет

- Syllabus PDFДокумент9 страницSyllabus PDFevsgoud_goudОценок пока нет

- Dhyan PDFДокумент3 страницыDhyan PDFDeepak WadhwaОценок пока нет

- SapДокумент46 страницSapganesanmani1985Оценок пока нет

- Stock & Receivable Audit: For Dated As OnДокумент3 страницыStock & Receivable Audit: For Dated As OnDeepak WadhwaОценок пока нет

- Stock & Receivable Audit: For Dated As OnДокумент3 страницыStock & Receivable Audit: For Dated As OnDeepak WadhwaОценок пока нет

- 250 MR Excel Keyboard ShortcutsДокумент17 страниц250 MR Excel Keyboard ShortcutsNam Duy VuОценок пока нет

- Student FeedbackДокумент1 страницаStudent FeedbackDeepak WadhwaОценок пока нет

- Trading FormДокумент17 страницTrading FormDeepak WadhwaОценок пока нет

- 8593form 9 FinalДокумент5 страниц8593form 9 FinalDeepak WadhwaОценок пока нет