Академический Документы

Профессиональный Документы

Культура Документы

NM Tybms SSF Prelims

Загружено:

Vinayak PuthranИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

NM Tybms SSF Prelims

Загружено:

Vinayak PuthranАвторское право:

Доступные форматы

Genius is the ability to reduce the Complicated to the Simple-A.

Einstein

TYBMS SSF

2004 - 05 60 marks 2 hrs. Date: Apr’ 05

Note: 1. Section I, Question No. 1 and 2 are compulsory.

2. Attempt any 3 questions from Section II.

SECTION I

Q 1. CONCEPT TESTING (15)

a) Book Running Lead Manager

b) Minimum Subscription

c) Escrow Mechanism

d) Du Pont Formula of ROI

e) Sec. 115 JB on MAT

Q 2. A fresh BMS was totally frustrated with the job he got as a result of the placement cell recruitment.

Within one month of his stay in the organization he began to feel that he was “just a glorified clerk who was

unable to put into practice all the wonderful things that the XYZ BMS College had taught him. He decided

that enough is enough and he must make a noise about it.

One day, mustering all the courage he could (thanks to the rigorous training he had in Organizational

Behavior) he walked up to his boss and said “Sir I am feel I am wasting my valuable youth in this

organization. You might as well get a monkey to do all the trivial things you are making me do here.”

The boss was calm and unperturbed. There was a gleam on his face, as he tried to fathom the

implication of what he had just heard.. “A wonderful idea”, indeed he muttered to himself. Then he took a

pad and pencil and made the following notes:

a. Cost of monkey Rs. 20,000.

b. It would take 6 months to train the monkey.

c. Cost of the training (and feeding the monkey during the period of training Rs. 500 per month.

d. Annual cost of feeding the monkey and providing shelter to him Rs. 5,000.

e. Salary paid to the Manager Rs. 60,000 per year.

f. The monkey will have a life of 10 years. Cost of monkey can be written off on a straight line basis.

g. The firm pays tax at 40%

h. The cost of capital of the firm is 20%

i. Project-end scrap value is Nil.

While the boss was busy putting these points on paper, the phone bell rung. It was the Managing Director

who wanted him immediately to discuss a new business proposal.

He trusts the pad into your hands and saying. “Let me have your remarks when I get beck” and rushes out to

see the BIG BOSS……

(Present value of an annuity of Re. 1 @ 20% is 4.192)

Evaluate the proposal of replacing the Manager with the Monkey by applying NPV criteria. (15)

Special Study in Finance TYBMS Sem VI Prof. Pawan Jhabak 1

Genius is the ability to reduce the Complicated to the Simple-A.Einstein

SECTION II

Q 3. The director of the following Indian company has approached you with their concern for the current

business scenario and future prospects.

Infosys Software Ltd. is a well established company in the field of software development, e-service

provider and man power consultancy service. Its clientele is mainly in the banking, airways and transport

sector. Almost 60% of the revenue comes from overseas clients. It has shown a steady growth and progress

for last five years and has paid dividend of 15%, 15%, 17%, 20%, and25%, and still a large amount of

profits were ploughed back every year. Till December 2003 everything was going smoothly, but all of a

sudden the overseas countries having maximum business associates, saw the rise of anti-outsourcing

agitations. The problem got further aggravated by rupee becoming stronger day by day against the US

dollar. The company some how managed to complete the ongoing contract but is not so sure of the future

prospects. The company is also in the process of finalizing new business ventures with ” non- affected

countries” and also taking steps to expand its operations more in India. The company is hopeful of getting

the better results for all its efforts.

Give your guidance in above case, with special reference to the issues related to Dividend/Bonus policy and

future share price behavior on the Stock Exchange.

Q 4. The following data is available in respect of PJ Textiles Ltd.: (10)

i. The company as incorporated in 2002 with the promoters having experience of more than 35 years in

the textile field and is a brand leader in micro yarn.

ii. The company proposes to borrow the term loan under TUFS (Technology Up gradation Funds

Scheme).

iii. The present installed capacity is 10 machines or 6000 TPA or polyester texturised yarn.

iv. The additional investment will increase the installed capacity by 3600 TPA.

v. The present and proposed set up is at Silvassa a backward area and enjoys income tax holiday for 5

years. Tax rate is 40%.

vi. ICICI, IDBI and SBI financed the present unit.

vii. The project will result into economies of scale, reduced cost of production, higher production due to

yarn speed being faster due to latest generation machine, best quality due to the modernized

machine.

viii. The expected ROI of the project is 18 % (ROI = EBIT / Total Assets x 100).

ix. Depreciation for project is Rs.400 lakhs every year.

x. The cost of proposed project and the means of finance are as follows:

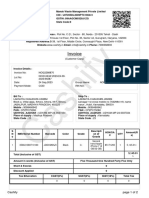

Proposed Project Rs. In Lakhs

Cost Of Project

xi. Land And Site Development 27 The term lending

Factory Building 155 institution has interest

Plant And Machinery 1604 rate of 10 % for similar

Electrical Installation 24 risk project and the term

Misc. Fixed Assets 10 loan is repayable in 5

Pre Operative Exp. 20 years with installment

Contingencies 67 and interest repayable at

Margin Money For Working Capital 93 the end of each year.

Total 2000

General Manager of the

Means Of Finance

term lending institution

Promoters Funds

has requested you to:

Additional Equity Share Capital 300

Internal Cash Accrual 500

Term Loan 1200

Total 2000

Special Study in Finance TYBMS Sem VI Prof. Pawan Jhabak 2

Genius is the ability to reduce the Complicated to the Simple-A.Einstein

a. Prepare Flash Report from the point of view of the term lending institution.

b. Evaluate the project for profitability in the next 5 years.

c. Calculate the debt service coverage ratio for the term loan.

Q 5. For division/allocation of Reliance Group Companies between the Ambani Brothers which method

of Share Valuation do you propose and why? (10)

Q 6. What is Buy Back of Shares? State four rationale of Buyback with reference to RIL case. (10)

Q 7. State 14 principal steps in IPO. (10)

Special Study in Finance TYBMS Sem VI Prof. Pawan Jhabak 3

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- OCCURRENCE REPORT FORM - MOR01 Version 1.0Документ2 страницыOCCURRENCE REPORT FORM - MOR01 Version 1.0Vinayak PuthranОценок пока нет

- Occurrence Report Form: Document Type: Form Confidentiality: NoneДокумент1 страницаOccurrence Report Form: Document Type: Form Confidentiality: NoneVinayak PuthranОценок пока нет

- Civil Aviation Requirements Section 5 - Air Safety Series 'C' Part I Issue II, 20 OCTOBER 2015 Effective: ForthwithДокумент37 страницCivil Aviation Requirements Section 5 - Air Safety Series 'C' Part I Issue II, 20 OCTOBER 2015 Effective: ForthwithVinayak PuthranОценок пока нет

- ATC OCCURRENCE REPORT FORM - MOR02 Version 1.0Документ1 страницаATC OCCURRENCE REPORT FORM - MOR02 Version 1.0Vinayak PuthranОценок пока нет

- Power by Hour / Pay by Hour (PBH) : OverviewДокумент7 страницPower by Hour / Pay by Hour (PBH) : OverviewVinayak PuthranОценок пока нет

- Jssi Hourly Cost Maintenance Programs (2020)Документ5 страницJssi Hourly Cost Maintenance Programs (2020)Vinayak PuthranОценок пока нет

- Region State Retailer Name Retailer UidДокумент6 страницRegion State Retailer Name Retailer UidVinayak PuthranОценок пока нет

- Aircraft Finance With NotesДокумент62 страницыAircraft Finance With NotesVinayak PuthranОценок пока нет

- AR Eng 2020 21Документ124 страницыAR Eng 2020 21Vinayak PuthranОценок пока нет

- Chain Name Format AddressДокумент7 страницChain Name Format AddressVinayak PuthranОценок пока нет

- Region State Retailer Name Retailer UidДокумент6 страницRegion State Retailer Name Retailer UidVinayak PuthranОценок пока нет

- RecruitmentДокумент33 страницыRecruitmentvarun19aug67% (3)

- IntroductionДокумент96 страницIntroductionVinayak PuthranОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- ANSYS Meshing Users GuideДокумент520 страницANSYS Meshing Users GuideJayakrishnan P SОценок пока нет

- C022031601010479 SoadДокумент5 страницC022031601010479 Soadnitu kumariОценок пока нет

- HHI Elite Club - Summary of Benefits 3Документ3 страницыHHI Elite Club - Summary of Benefits 3ghosh_prosenjitОценок пока нет

- Advintek CP 1Документ6 страницAdvintek CP 1mpathygdОценок пока нет

- Villareal vs. PeopleДокумент11 страницVillareal vs. PeopleJan Carlo SanchezОценок пока нет

- Delo Protecion CATERPILLARДокумент1 страницаDelo Protecion CATERPILLARjohnОценок пока нет

- Labour Law ProjectДокумент16 страницLabour Law ProjectDevendra DhruwОценок пока нет

- Uthm Pme Talk - Module 1Документ22 страницыUthm Pme Talk - Module 1emy syafiqahОценок пока нет

- Swadhar Greh SchemeДокумент12 страницSwadhar Greh SchemeShuchi SareenОценок пока нет

- 309 SCRA 177 Phil Inter-Island Trading Corp Vs COAДокумент7 страниц309 SCRA 177 Phil Inter-Island Trading Corp Vs COAPanda CatОценок пока нет

- Baker ElectronicsДокумент1 страницаBaker ElectronicsleicatapangОценок пока нет

- Al Awasim Min Al Qawasim (AbuBakr Bin Al Arabi)Документ199 страницAl Awasim Min Al Qawasim (AbuBakr Bin Al Arabi)Islamic Reserch Center (IRC)Оценок пока нет

- Rawls TheoryДокумент4 страницыRawls TheoryAcademic ServicesОценок пока нет

- Accounting For Cooperative SocietiesДокумент31 страницаAccounting For Cooperative SocietiesAbdul Kadir ArsiwalaОценок пока нет

- TachometerДокумент7 страницTachometerEngr MahaОценок пока нет

- Notes On Qawaid FiqhiyaДокумент2 страницыNotes On Qawaid FiqhiyatariqsoasОценок пока нет

- It's That Time of Year Again - Property Tax Payments Due: VillagerДокумент16 страницIt's That Time of Year Again - Property Tax Payments Due: VillagerThe Kohler VillagerОценок пока нет

- English LicenseДокумент4 страницыEnglish LicenseasdfОценок пока нет

- 6 Kalimas of Islam With English TranslationДокумент5 страниц6 Kalimas of Islam With English TranslationAfaz RahmanОценок пока нет

- TRUE OR FALSE. Write TRUE If The Statement Is True and Write FALSE If The Statement Is FalseДокумент2 страницыTRUE OR FALSE. Write TRUE If The Statement Is True and Write FALSE If The Statement Is FalseBea Clarence IgnacioОценок пока нет

- 2023 Peruvian Citrus Operations ManualДокумент30 страниц2023 Peruvian Citrus Operations ManualDamarys Leyva SalinasОценок пока нет

- Tanganyika Buffer SDS 20160112Документ8 страницTanganyika Buffer SDS 20160112Jorge Restrepo HernandezОценок пока нет

- Answer Sheet Week 7 & 8Документ5 страницAnswer Sheet Week 7 & 8Jamel Khia Albarando LisondraОценок пока нет

- Bill Iphone 7fДокумент2 страницыBill Iphone 7fyadawadsbОценок пока нет

- Cases 3Документ283 страницыCases 3Tesia MandaloОценок пока нет

- Motion For Preliminary InjunctionДокумент4 страницыMotion For Preliminary InjunctionElliott SchuchardtОценок пока нет

- 1 3 01 Government InstitutesДокумент6 страниц1 3 01 Government InstitutesRog CatalystОценок пока нет

- K-8 March 2014 Lunch MenuДокумент1 страницаK-8 March 2014 Lunch MenuMedford Public Schools and City of Medford, MAОценок пока нет

- The LetterДокумент13 страницThe Letterkschofield100% (2)

- Physical Education ProjectДокумент7 страницPhysical Education ProjectToshan KaushikОценок пока нет