Академический Документы

Профессиональный Документы

Культура Документы

Unitech: De-Merger Approved Maintain Buy

Загружено:

kasi.loguИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Unitech: De-Merger Approved Maintain Buy

Загружено:

kasi.loguАвторское право:

Доступные форматы

Property

India I Equities

Flash

23 April 2010

Unitech Rating: Buy

Target Price: Rs105

De-merger approved; maintain Buy Share Price: Rs84

Maintain Buy. Unitech’s board has approved a plan to hive off

some businesses into a new entity called Unitech Infra to un-lock

value. We see little value addition to our NAV until more progress

is made. We maintain our Buy rating and target price of Rs105.

Unitech Infra – the new entity. The new entity would own

Unitech’s divisions such as GCC, Towers, IT SEZs, amusement

park and telecoms. The advisors have put the new entity’s fair

value at Rs49.8bn (approximately 4x actual book value), which

after the split would be stated as book value and have debt of

Rs3.5bn. We await clarity from the “de-merger” documents and Key data UT IN/UNTE.BO

financial re-statements. 52-week high/low Rs118/40

Sensex/Nifty 17461/5230

Seeking to unlock value. The de-merger is to focus on infra and 3-m average volume US$71.4m

related verticals and unlock value in them. At present, the largest Market cap Rs199bn/US$4470m

value (Rs34.8bn) arises from its telecoms stake and share in UCP. Shares outstanding 2386.6m

Free float 56%

We await project progress/details in the construction and BOT

Promoters 45%

businesses before adding value.

Foreign Institutions 32%

Domestic Institutions 4%

For Unitech. Although Unitech would control 35% of the new

Public 19%

entity, we would assign a holding company discount (30%), which

would add little (Rs3 a share) to current valuations.

Valuation. Our target is on par with the Mar ’11 NAV of Rs105.

At the current market price, the stock trades at 1.8x FY11e P/BV.

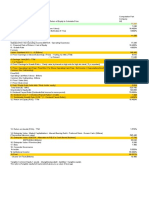

Key financials Relative price performance

Year end 31 Mar FY08 FY09 FY10 e FY11 e FY12 e

Sales (Rs m) 41,152 28,502 26,906 35,916 49,495

Net Profit (Rs m) 16,362 11,921 7,141 10,473 15,864 120

EPS (Rs) 6.3 4.6 2.8 4.0 6.3 Unitech

100

Growth (%) 151.9 (27.2) (39.4) 46.0 55.9

PE (x) 13.3 18.3 30.1 20.6 13.2 80

Sensex

P BV (x) 6.1 4.2 2.0 1.8 1.7 60

RoE (%) 58.8 27.3 9.1 9.2 13.1

40

RoCE(%) 24.0 11.6 8.5 9.9 14.3

Apr-09

May-09

Jun-09

Jul-09

Aug-09

Sep-09

Oct-09

Jan-10

Feb-10

Nov-09

Dec-09

Mar-10

Apr-10

Dividend Yield (%) 0.2 0.1 0.1 1.2 2.4

Net Gearing (%) 198.4 162.7 47.4 37.8 33.3

Source: Company, Anand Rathi Research Source: Capitaline, Anand Rathi Research

Anand Rathi Financial Services Limited does and seeks to do business with companies covered in its research reports. Thus, investors should be aware that the firm

may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment

decision. Disclosures and analyst certifications are located in Appendix 1

Anand Rathi Research India Equities

23 April 2010 Unitech – De-merger approved; maintain Buy

Unitech Infra – the new entity

Why the split

Unitech split off five business verticals into a new company Unitech Infra.

The proposed “de-merger” would be to focus on the infrastructure

businesses, which had been lagging behind the property-dominant

company, given financial and execution constraints. Management indicates

that the new company would have a dedicated and experienced team.

Most of the business vertical heads are already in place, with a new CEO

and CFO to be appointed soon. The financial health of the new company

will be much better, with only Rs3.5bn in debt and, with the infrastructure

Unitech Infra would now focus on verticals would make credit availability easier.

infrastructure and related verticals,

which was constrained while part of Fig 1 – Unitech Infra – proposed structure

Unitech

UNITECH

Infrastructure Development Infrastructure Investments

Services

General Construction Hospitality

Facilities and Property 32.75% interest in

Management Services Uninor (telecomms

SEZs / IT Parks

joint veture with

BOT Telenor)

Logistics Parks

Industrial Parks Township Management

Transmission Tower

Amusement Parks

Source: Company

“De-merger” scheme

After the split, Unitech would hold 35% in Unitech infra and act as a

sponsor for further activities. The board approved a swap ratio of 1:1; the

Unitech shareholders would get one remaining 65% of Unitech Infra would be divided equally among

share of Unitech Infra (at Rs2 FV) Unitech’s shareholders.

and Unitech would hold 35% of

Unitech Infra After the “de-merger” process (of approvals from the board, exchanges,

shareholders, creditors and the judiciary), the shares of the new entity

would be listed. This would take four to six months. Management has

indicated listing in CY10.

Arriving at a fair value

According to provisional 9MFY10 figures provided, Unitech Infra had a

net profit of Rs0.5bn on revenue of Rs3.2bn.

Unitech Infra has debt of Rs3.5bn and a net worth of Rs49.8bn. The net

worth has been arrived at using the fair-value method, book value being

significantly less than the fair value. For most of the assets in Unitech

Infra, value unlocking is only on the horizon. Most of the value, though,

would be derived from investments in the telecomms venture and in

Unitech Corporate Parks (UCP).

Anand Rathi Research 3

23 April 2010 Unitech – De-merger approved; maintain Buy

Seeking to unlock value

Infrastructure – the oldest arm

Starting in infrastructure, Unitech graduated to a property company in the

1990s. The infrastructure vertical would, to start with, pull together

general construction, BOT and the transmission tower businesses. At

present, the company continues to contract for construction s abroad

though it plans once again to expand its footprint locally. It has Letters of

Intent (LOIs) for expected orders of Rs22bn from Unitech.

For the BOT business, the company is looking for a technical partner to

start focusing on projects of between Rs20bn and Rs40bn. Given its past

Infrastructure could be a major

execution, it technically qualifies for various categories of projects.

value driver, but that would depend

on orders Unitech initially planned to sell its transmission tower business (with a

factory in Nagpur). It has an order book of Rs5.1bn (with Rs1.3bn being

developed). The business secures margins of 7-8%.

Fig 2 – Infrastructure vertical

Value Assigned (Rs bn)

Business Initially Now Remark

General Construction Nil Nil Order book expected based on future sales of Unitech

BOT Nil Nil Looking for a technical tie-up. Some lag till projects received

Transmission tower 1.0 1.5 More clarity on order book. Current order book of Rs 5.1bn

Source: Anand Rathi Research

Telecomms investments and UCP stake

Unitech’s investment in Uninor is ~Rs6bn. The three year lock-in from

the license date ends Jan ’11. The acquisition also had convenants that

Unitech could not sell its stake for three years from Telenor Investment

Investments in telecomms and the (1.5 years left) unless there is an M&A.

joint venture stake in UCP put the

maximum value at Rs34.8bn Unitech holds 40% in UCP (36% in one of six) and also obtains

management and sponsorship fees from it.

Fig 3 – Uninor and UCP stake

Value Assigned (Rs bn)

Business Initially Now Remark

Uninor Investment 21.0 21.0 Valued at 30% discount to deal value

UCP Stake 13.8 13.8 40% stake in the UCP assets; UCP listed on AIM

Source: Company, Anand Rathi Research

Amusement Park and the hospitality business

Unitech has two partially operational amusement parks, one each in Noida

(148 acres) and Rohini (62 acres). The retail malls and 22 rides each are

operational, while water parks at both locations are being constructed.

Fig 4 – Amusement parks: present status

Project Area (sq ft) Location Status

Great India Place 1,200,000.0 Noida - 148 a Leased and Operational

Grand Galleria 350,000.0 Noida - 148 a Under construction

Water Park - Noida NA Noida - 148 a Under construction

Phases 3,4,5 NA Noida - 148 a Planned

Metro Walk 200,000.0 Rohini, Delhi Leased and Operational

Water Park - Noida NA Rohini, Delhi Under construction

Chandigarh NA Chandigarh Planned, land in possession

Source: Company, Anand Rathi Research

Anand Rathi Research 4

23 April 2010 Unitech – De-merger approved; maintain Buy

In FY07 the company had divested part of the equity in Rohini and the

Noida amusement parks to private equity firms at Rs13.5bn. A third

amusement park is planned in Chandigarh over 73 acres.

The company has indicated developing 11 hotels (2,100 rooms) in the the

next seven to eight years. Of these, one on NH8, in Gurgaon and another

in Kolkatta (Mariott) are being constructed. Given the business downturn

and financial constraints, in FY09-10 management had slowed down its

hospitality plans. Unitech eventually plans to monetize the hotel

properties.

Fig 5 – Amusement parks and the hospitality business

Value Assigned (Rs bn)

Business Initially Now Remark

Noida Amusement Park 4.6 7.0 Extra FSI of 2.5m sq ft in Noida not valued

initially, some incremental value to rides buss

Rohini, Delhi Amusement Park 1.4 1.6 Some incremental value to rides business

Chandigarh Amusement Park Nil Nil Under litigation; to be cleared in due course.

Launch 3 years away

Hospitality NA NA Since development plans weren’t fixed, had taken

market value of respected land parcel in Unitech

Source: Company, Anand Rathi Research

Logistics and industrial park; property management

The company has one logistics park near Kona, in Kolkata, already

launched for lease/sale, to be handed over in phases. Two industrial parks

are planned in the NCR, one of 315 acres (could be extended to 500 acres)

where Unitech held a 50% stake and the other, over 86 acres, recently

acquired. Initially, we had initially assumed only land values for our

valuation.

Fig 6 – Logistics and industrial Park; property management

Business Area (Acres) UT Stake Remark

Kolkata International Logistic Park 73.0 90% Land Value taken initially

Farukhnagar Industrial Park 315.0 50% To be launched soon; supporting

Group housing and Commercial

MewatIndustrial Park 86.0 100% New Land Acquisition;

Development post a year

Facilities and property management; 10.3 (m sq ft) 100% Manages Unitech properties

Township management

Source: Anand Rathi Research

In property management, the company has 10.3m sq. ft. and manages

various townships and golf courses constructed by Unitech.

Value addition

Given clarity in assets to be “de-merged” and some development plans,

this would add Rs5bn to the value (from our initial case of Rs45bn). We

await further clarity in financials and development/order book of the

infrastructure vertical.

Anand Rathi Research 5

23 April 2010 Unitech – De-merger approved; maintain Buy

Unitech – After the split

Financials

Given that the current net worth of Unitech Infra is stated at fair value,

for the “de-merger” process, Unitech’s books would first have to be re-

stated. Indications from the management put the book value at between

20% and 25% of Unitech Infra’s fair value (Rs49.8bn). We await further

clarity from the management.

Fig 7 – Financials

9MFY10 Unitech Unitech Infra Remark

Net Worth 101.8 49.8 Fair value of Unitech Infra taken

Debt 63.5 3.5

D/E 0.62 0.07

Example - Post Demerger

Net Worth 89.4 49.8 Assuming book value to be 25% of Unitech Infra

fair value (current management estimates)

Debt 60.0 3.5 Debt of Rs 3.5bn to transfer

D/E 0.67 0.07 Debt / equity to go up slightly

Source: Company

Land bank

Unitech’s land-bank share before the split, according to the last QIP

document, was 7,467 acres (of 9,060 acres). The split removes 550 acres

from the current share of Unitech land bank. The company has been

acquiring small land parcels in Gurgaon for its new township (Nirvana

County 2 – 700 acres) to make the land contiguous. Approx. 100 acres is

“guided” to be acquired by end-FY11.

Fig 8 – Land bank: before and after the split

(in acres) Land Available UT's Share

Land Bank - as of June'09 9,060.2 7,467.0

At Unitech Infra’s book value of Noida Amusement Park 148.0 58.5

Rs49.8bn, value added to Unitech Rohini Amusement Park 62.2 31.1

would be Rs3 a share Chandigarh Amusement Park 73.7 73.7

Kolkakata Logistic Park 73.0 65.7

Farukhnagar industrial park 315.0 157.5

UCP land bank 197.5 79.0

Hospitality projects 93.9 84.5

Post De-merger UT land Bank 8,096.8 6,917.0

Source: Company, Anand Rathi Research

Value addition

Given Unitech Infra’s book value at ~Rs50bn, with Unitech holding a

35% stake, the value addition after the split would be Rs3 a share, at a

30% holding-company discount.

Fig 9 – Value addition to Unitech

Unitech Infra - Net worth (Rs m) 49,795.0

For Unitech - o/s shares for 35% stake (m) 1,408.7

total o/s shares in Unitech Infra 4,024.9

Book value of Unitech Infra (Rs / share) 12.4

35% of BV of Unitech Infra (Rs / share) 4.3

Post 30% holding company discount (Rs / share) 3.0

Source: Anand Rathi Research

Anand Rathi Research 6

Appendix 1

Analyst Certification

The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issuers and no part of the

compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations or views expressed by the research

analyst(s) in this report.

Important Disclosures on subject companies

Rating and Target Price History (as of 22 April 2010)

600

Date Rating TP (Rs) Share

Unitech Price

500 1 1-Dec-09 Buy 127 1

400 2 5-Apr-10 Buy 105 2

300

200

1

100

0 2

Jan-08

Apr-08

Jul-08

Oct-08

Jan-09

Apr-09

Jul-09

Oct-09

Jan-10

Apr-10

The research analysts, strategists, or research associates principally responsible for the preparation of Anand Rathi Research have received compensation based

upon various factors, including quality of research, investor client feedback, stock picking, competitive factors, firm revenues and overall investment banking

revenues.

Anand Rathi Ratings Definitions

Analysts’ ratings and the corresponding expected returns take into account our definitions of Large Caps (>US$1bn) and Mid/Small Caps (<US$1bn) as described

in the Ratings Table below.

Ratings Guide

Buy Hold Sell

Large Caps (>US$1bn) >20% 5-20% <5%

Mid/Small Caps (<US$1bn) >30% 10-30% <10%

Anand Rathi Research Ratings Distribution (as of 31 Mar 10)

Buy Hold Sell

Anand Rathi Research stock coverage (118) 61% 12% 27%

% who are investment banking clients 8% 0% 0%

Other Disclosures

This report has been issued by Anand Rathi Financial Services Limited (ARFSL), which is regulated by SEBI.

The information herein was obtained from various sources; we do not guarantee its accuracy or completeness. Neither the information nor any opinion expressed

constitutes an offer, or an invitation to make an offer, to buy or sell any securities or any options, futures or other derivatives related to such securities ("related

investments"). ARFSL and its affiliates may trade for their own accounts as market maker / jobber and/or arbitrageur in any securities of this issuer(s) or in related

investments, and may be on the opposite side of public orders. ARFSL, its affiliates, directors, officers, and employees may have a long or short position in any

securities of this issuer(s) or in related investments. ARFSL or its affiliates may from time to time perform investment banking or other services for, or solicit

investment banking or other business from, any entity mentioned in this report. This research report is prepared for private circulation. It does not have regard to

the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial

advice regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that

statements regarding future prospects may not be realized. Investors should note that income from such securities, if any, may fluctuate and that each security's

price or value may rise or fall. Past performance is not necessarily a guide to future performance. Foreign currency rates of exchange may adversely affect the

value, price or income of any security or related investment mentioned in this report.

This document is intended only for professional investors as defined under the relevant laws of Hong Kong and is not intended for the public in Hong Kong. The

contents of this document have not been reviewed by any regulatory authority in Hong Kong. No action has been taken in Hong Kong to permit the distribution of

this document. This document is distributed on a confidential basis. This document may not be reproduced in any form or transmitted to any person other than the

person to whom it is addressed.

If this report is made available in Hong Kong by, or on behalf of, Anand Rathi Financial Services (HK) Limited., it is attributable to Anand Rathi Financial Services

(HK) Limited., Unit 1211, Bank of America Tower, 12 Harcourt Road, Central, Hong Kong. Anand Rathi Financial Services (HK) Limited. is regulated by the Hong

Kong Securities and Futures Commission.

Anand Rathi Financial Services Limited and Anand Rathi Share & Stock Brokers Limited are members of The Stock Exchange, Mumbai, and the National Stock

Exchange of India.

© 2010 Anand Rathi Financial Services Limited. All rights reserved. This report or any portion hereof may not be reprinted, sold or redistributed without the written

consent of Anand Rathi Financial Services Limited.

Additional information on recommended securities/instruments is available on request.

Вам также может понравиться

- Balance Sheet StructuresОт EverandBalance Sheet StructuresAnthony N BirtsОценок пока нет

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsОт EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsОценок пока нет

- Infosys LTD 20361 - Research and Analysis Report - ICICIdirectДокумент6 страницInfosys LTD 20361 - Research and Analysis Report - ICICIdirectVivek GuptaОценок пока нет

- Torrent Company Updt Sep22Документ6 страницTorrent Company Updt Sep22Aa BaОценок пока нет

- Rating Rationale-CRISILДокумент6 страницRating Rationale-CRISILSagar KansalОценок пока нет

- Unitech Jan08Документ25 страницUnitech Jan08api-3826612100% (2)

- DiwaliPicks 2010Документ5 страницDiwaliPicks 2010milandeepОценок пока нет

- Infrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundДокумент2 страницыInfrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDeepak Singh PundirОценок пока нет

- IdeaForge Technology IPO Note Motilal OswalДокумент9 страницIdeaForge Technology IPO Note Motilal OswalKrishna GoyalОценок пока нет

- Motilal Pharma ReportДокумент8 страницMotilal Pharma ReportPriyam RoyОценок пока нет

- SPDR S&P Midcap 400 ETF Trust: Fund Inception Date Cusip Key Features About This BenchmarkДокумент2 страницыSPDR S&P Midcap 400 ETF Trust: Fund Inception Date Cusip Key Features About This BenchmarkmuaadhОценок пока нет

- Research Report Prepared By: Rishiraj SinghДокумент7 страницResearch Report Prepared By: Rishiraj Singhshraddha anandОценок пока нет

- TTKH Angel PDFДокумент14 страницTTKH Angel PDFADОценок пока нет

- 20007Документ5 страниц20007Archana J RetinueОценок пока нет

- Structured Products: (Market Linked Debentures)Документ1 страницаStructured Products: (Market Linked Debentures)ghodababuОценок пока нет

- Infrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundДокумент2 страницыInfrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundGaurangОценок пока нет

- Campus Activewear Limited IPO: NeutralДокумент7 страницCampus Activewear Limited IPO: NeutralAkash PawarОценок пока нет

- VATW Q1FY24 ResultsДокумент7 страницVATW Q1FY24 ResultsVishalОценок пока нет

- BUY ITC: On A Steady PathДокумент19 страницBUY ITC: On A Steady PathTatsam VipulОценок пока нет

- Mirae Asset Nyse Fang EtfДокумент2 страницыMirae Asset Nyse Fang EtfAravind MenonОценок пока нет

- First State China A Shares Fund USD B FV en HK IE00B3LV6Z90Документ1 страницаFirst State China A Shares Fund USD B FV en HK IE00B3LV6Z90Jannaki PvОценок пока нет

- IDirect IndigoPaints IPOReviewДокумент16 страницIDirect IndigoPaints IPOReviewbhaskarkakatiОценок пока нет

- AC Penetration Accross CountriesДокумент21 страницаAC Penetration Accross Countrieshh.deepakОценок пока нет

- Peninsula+Land 10-6-08 PLДокумент3 страницыPeninsula+Land 10-6-08 PLapi-3862995Оценок пока нет

- (Kotak) Lupin, May 13, 2021Документ7 страниц(Kotak) Lupin, May 13, 2021Doshi VaibhavОценок пока нет

- Airtel AnalysisДокумент15 страницAirtel AnalysisPriyanshi JainОценок пока нет

- BTG Pactual - Meliuz PDFДокумент4 страницыBTG Pactual - Meliuz PDFRenan Dantas SantosОценок пока нет

- FA-QA SheetДокумент4 страницыFA-QA SheetzacchariahОценок пока нет

- Proteanegovtechnologieslimitedrhp Ibcomments v2 2023Документ11 страницProteanegovtechnologieslimitedrhp Ibcomments v2 2023mohit_999Оценок пока нет

- 205 FinalДокумент42 страницы205 FinalAustin BijuОценок пока нет

- Tanla Solutions (TANSOL) : Rebound in Core Business SegmentsДокумент5 страницTanla Solutions (TANSOL) : Rebound in Core Business SegmentsashishkrishОценок пока нет

- Edgereport Abslamc Iponotes 28-09-2021 285Документ20 страницEdgereport Abslamc Iponotes 28-09-2021 285sudhansumail102Оценок пока нет

- About Parag Parikh Flexi Cap Fund: Foreign Equity InvestmentДокумент10 страницAbout Parag Parikh Flexi Cap Fund: Foreign Equity InvestmentTunirОценок пока нет

- Ngsscef Myr Class Ffs Nov 2023Документ2 страницыNgsscef Myr Class Ffs Nov 2023ming09075225Оценок пока нет

- Ind Niftysmallcap100Документ2 страницыInd Niftysmallcap100Samriddh DhareshwarОценок пока нет

- India Pesticides Limited: Equitas Small Finance Bank Equitas Small Finance BankДокумент19 страницIndia Pesticides Limited: Equitas Small Finance Bank Equitas Small Finance BankGugaОценок пока нет

- Alembic Angel 020810Документ12 страницAlembic Angel 020810giridesh3Оценок пока нет

- AngelBrokingResearch AshokLayland 1QFY2016RU 140815 PDFДокумент11 страницAngelBrokingResearch AshokLayland 1QFY2016RU 140815 PDFAbhishek SinhaОценок пока нет

- Assure9 - Teerth Technospace PDFДокумент17 страницAssure9 - Teerth Technospace PDFneoavi7Оценок пока нет

- GoColors IPO Note AngelOneДокумент7 страницGoColors IPO Note AngelOnedjfreakyОценок пока нет

- HFCL - Initiating Coverage - KSL 210521Документ14 страницHFCL - Initiating Coverage - KSL 210521Dhiren DesaiОценок пока нет

- MTN PitchbookДокумент21 страницаMTN PitchbookGideon Antwi Boadi100% (1)

- Cesc - Buy: Demerger in Sight!Документ10 страницCesc - Buy: Demerger in Sight!AshokОценок пока нет

- CitystateSavingsBankIncPSECSB PublicCompanyДокумент1 страницаCitystateSavingsBankIncPSECSB PublicCompanyLester FarewellОценок пока нет

- Adobe ADBE Stock Dashboard 20100928Документ1 страницаAdobe ADBE Stock Dashboard 20100928Old School ValueОценок пока нет

- Equinix, Inc.: Neutral/ModerateДокумент19 страницEquinix, Inc.: Neutral/ModerateashishkrishОценок пока нет

- ATRAM Global Technology Feeder Fund Fact Sheet Jan 2020Документ2 страницыATRAM Global Technology Feeder Fund Fact Sheet Jan 2020anton clementeОценок пока нет

- Business - 4. Management-: Tushar ShrivastavaДокумент8 страницBusiness - 4. Management-: Tushar ShrivastavaTriveni NagmoteОценок пока нет

- UT V Software (UTVSOF) : Unlocking Value..Документ7 страницUT V Software (UTVSOF) : Unlocking Value..api-19978586Оценок пока нет

- The Best Stock To Add To Your Portfolio This Month Is Here!: November 2020Документ9 страницThe Best Stock To Add To Your Portfolio This Month Is Here!: November 2020Vighnesh KurupОценок пока нет

- Mobile World Investment CorporationДокумент20 страницMobile World Investment Corporationtsunami133100100020Оценок пока нет

- Vanguard Global Stock Index FundДокумент4 страницыVanguard Global Stock Index FundjorgeperezsidecarshotmailomОценок пока нет

- BNP Paribas Substantial Equity Hybrid Fund - Regular Plan - RegularДокумент1 страницаBNP Paribas Substantial Equity Hybrid Fund - Regular Plan - Regularpdk jyotОценок пока нет

- JT Express - Highlights of Draft IPO Prospectus - MW - June - 2023 c8jnqgДокумент18 страницJT Express - Highlights of Draft IPO Prospectus - MW - June - 2023 c8jnqgfkyqn9kp75Оценок пока нет

- CH/HK Equity Research: China MobileДокумент7 страницCH/HK Equity Research: China MobileRanny ChooОценок пока нет

- Tanla - Update - Jul23 - HSIE-202307191442519944993Документ13 страницTanla - Update - Jul23 - HSIE-202307191442519944993jatin khannaОценок пока нет

- FA - Whitepaper - 2015 (1) 2Документ13 страницFA - Whitepaper - 2015 (1) 2BAlmohsinОценок пока нет

- Fund Facts - HDFC TaxSaver - February 2022Документ2 страницыFund Facts - HDFC TaxSaver - February 2022Tarun TiwariОценок пока нет

- APC Individual Assignment - CIC160097Документ10 страницAPC Individual Assignment - CIC160097Siti Nor Azliza AliОценок пока нет

- Axiata Group BHD: Company ReportДокумент6 страницAxiata Group BHD: Company Reportlimml63Оценок пока нет

- Impact of Temperature and Relative Humidity in Quality and Shelf Life of Mango FruitДокумент6 страницImpact of Temperature and Relative Humidity in Quality and Shelf Life of Mango Fruitkasi.loguОценок пока нет

- 9 Ways To Invest in YourselfДокумент5 страниц9 Ways To Invest in Yourselfkasi.loguОценок пока нет

- 9536 IiedДокумент67 страниц9536 Iiedkasi.loguОценок пока нет

- Made in IndiaДокумент8 страницMade in Indiakasi.loguОценок пока нет

- Indian Real Estate Industry Report 210708Документ28 страницIndian Real Estate Industry Report 210708workosaur100% (1)

- FRM 2010 Nov BrochureДокумент15 страницFRM 2010 Nov Brochurekasi.loguОценок пока нет

- Share Capital and SharesДокумент8 страницShare Capital and SharesmathibettuОценок пока нет

- John Case WorksheetДокумент10 страницJohn Case Worksheetzeeshan33% (3)

- Trading Pit Hand Signals Book Notes 06162014Документ5 страницTrading Pit Hand Signals Book Notes 06162014tradingpithistoryОценок пока нет

- Mini Case: The Venezuelan Bolivar Black MarketДокумент14 страницMini Case: The Venezuelan Bolivar Black Marketdragosvoinea96Оценок пока нет

- Lesson 7 Bull Flag Surf Strategy FX M15: by Adam KhooДокумент21 страницаLesson 7 Bull Flag Surf Strategy FX M15: by Adam Khoodaysan60% (5)

- Trading 101Документ27 страницTrading 101Rica NavarroОценок пока нет

- FDRM Project Initial Report Suggested Structure - NSEДокумент4 страницыFDRM Project Initial Report Suggested Structure - NSE60JHEERAK AGRAWALОценок пока нет

- De Clercq, (2006) An Entrepreneur's Guide To The Venture Capital GalaxyДокумент7 страницDe Clercq, (2006) An Entrepreneur's Guide To The Venture Capital GalaxyafghansherОценок пока нет

- EBIT-EPS, ROI-ROE AnalysisДокумент10 страницEBIT-EPS, ROI-ROE AnalysisKUMARI MADHU LATAОценок пока нет

- The Resolution Trust CorporationДокумент5 страницThe Resolution Trust Corporationjakobks13Оценок пока нет

- Early-Stage Startup Valuation - Jeff FaustДокумент15 страницEarly-Stage Startup Valuation - Jeff FausthelenaОценок пока нет

- RBC Asset Allocation GuideДокумент7 страницRBC Asset Allocation GuidevikramОценок пока нет

- IFM Chapter 07 (New Edition)Документ23 страницыIFM Chapter 07 (New Edition)ZackyОценок пока нет

- Case Analysis - Cost of CapitalДокумент5 страницCase Analysis - Cost of CapitalHazraphine LinsoОценок пока нет

- Emabb Ebook - Share 150523Документ8 страницEmabb Ebook - Share 150523Suyitno Bunga Abimanyu RetnoОценок пока нет

- Gainesboro CaseДокумент6 страницGainesboro CaseDanny4118100% (2)

- MCQ FRMДокумент40 страницMCQ FRMAmine IzamОценок пока нет

- The Foreign Exchange MarketДокумент40 страницThe Foreign Exchange MarketabateОценок пока нет

- StressTesting Guidelines by SBPДокумент21 страницаStressTesting Guidelines by SBPkrishmasethiОценок пока нет

- Final Exam IamДокумент10 страницFinal Exam IamAhmed ZEMZEMОценок пока нет

- Dividend PolicyДокумент45 страницDividend PolicyBusHra Alam0% (1)

- MK 1 Kuliah 2 Financial EnvironmentДокумент80 страницMK 1 Kuliah 2 Financial EnvironmentRizkyka Waluyo PutriОценок пока нет

- Pail BankruptcyДокумент12 страницPail BankruptcyZerohedgeОценок пока нет

- AC3059 - FM 2017 RevisionДокумент22 страницыAC3059 - FM 2017 RevisionKaashvi HiranandaniОценок пока нет

- Beginners Guide For Investment in The Stock Market PDFДокумент2 страницыBeginners Guide For Investment in The Stock Market PDFFinnotes orgОценок пока нет

- Bodhanwala, R. J. (2014) - Testing The Efficiency of Price-Earnings Ratio in Constructing Portfolio. IUP Journal of Applied Finance, 20 (3), 111-118.Документ9 страницBodhanwala, R. J. (2014) - Testing The Efficiency of Price-Earnings Ratio in Constructing Portfolio. IUP Journal of Applied Finance, 20 (3), 111-118.firebirdshockwaveОценок пока нет

- Volume Spread Analysis ExamplesДокумент55 страницVolume Spread Analysis Examplesthinkscripter82% (11)

- Paper20A Set2Документ8 страницPaper20A Set2Ramanpreet KaurОценок пока нет

- Marginal Costing InterДокумент9 страницMarginal Costing InterArjun ThawaniОценок пока нет

- Securities Industry Essentials (SIE) Examination: Content OutlineДокумент15 страницSecurities Industry Essentials (SIE) Examination: Content OutlinejayОценок пока нет