Академический Документы

Профессиональный Документы

Культура Документы

Rohtas Computatio2013-14

Загружено:

Ashish ShahИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Rohtas Computatio2013-14

Загружено:

Ashish ShahАвторское право:

Доступные форматы

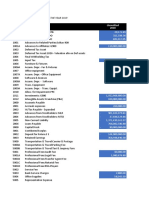

Assessee Name SHRI ROHTASSINGH C SIHAG

Assessment Year 2014-2015 A/c.Year Ending 31-03-2014

Proprietor of INDUSTRIAL CARRYING CORPORATION

Address 25 A 2

ABHISHEK COMPLEX

GIDC ROAD

MAKARPURA

City VADODARA : 390 010 State GUJARAT

Telephone 0265-3042708 Mobile 93272 30430

PAN ARDPS7234C Range/Ward 2(2)/BARODA

Status INDIVIDUAL (01) Residential status (01) Resident

Date of Birth 04-04-1967

Resi.Address G 117 VRAJDHARA SOCIETY NO 2

MAKARPURA ROAD

MAKARPURA ROAD

MAKARPURA BARODA

Business TRANSPORTER

Method of Account MERCANTILE

Method of Stock AT COST OR MARKET RATE WHICHEVER IS LOWER.

Source of Income BUSINESS/PROFESSION

Bank A/c.No. C.A. : 565010200004558 Bank Name UTI BANK

IFSC Code UTIB0000565 Branch Name MANJALPUR

Gross Tax on Rs. 456140 25,614

Less : Rebate under Section 87A 2000

---------------

23,614

Add :

Edu.Cess & Higher Edu.Cess 708

--------------- 708

24,322

Tax Deducted at Sources :

Otherthan Salary 0

--------------- 0

Advance-tax Paid :

Challan No.: 59 / BSR: 00001456 / Date: 13-03-2014 25,000

--------------- 25,000

Total Prepaid Taxes --------------- (678.00)

---------------

Tax Refundable (678.00)

Interest u/s.234C

Deferment of Advance Tax Payment 651

--------------- 651

--------------- 651

---------------

Balance Refundable (27.00)

Rounded Off To Nearest 10 (30.00)

===========

SN Block of Assets (Name) W.D.V. Add:Upto Add:After Less: Sold Balance Allow. Depre.(%)

Elegible Next Year Short

30/09 30/09 /Deletion Depre. W.D.V. Gain

1 PLANT & MACHINERY @ 15% 380246 64276 0 0 444522 15 66678 377844 Nil

2 COMPUTER @ 60% 8909 24550 0 0 33459 60 20075 13384 Nil

3 BUILDING @ 5% 190655 0 0 0 190655 5 9533 181122 Nil

4 FURNITURE & FITTINGS @ 10% 102079 9789 6800 0 118668 10 11527 107141 Nil

Income of current year (Fill this column

Sr. Head/Source of Income House

only

property

if income

loss

is of

zero

theor

current

Other

positive)

sources

Business

year setloss

off

Loss

(other

(other

than loss from

Current

race horses)

yearsof

Income

the current

remaining

year set

after

offset off

than speculation

No.

loss)

of the current year

set off

Loss to be adjusted (Total Loss) (Total Loss) (Total Loss)

121770 0 0

i Salaries 0 0 0 0 0

ii House Property 0 0 0 0 0

iii Business (Incl.speculation profit) 690799 121770 0 0 569029

iv Short Term Capital Gain 0 0 0 0 0

v Long Term Capital Gain 0 0 0 0 0

vi Other sources (incl.profit from owning race

0 houses) 0 0 0 0

vii Total loss set off 121770 0 0

viii Loss remaining after set-off 0 0 0

Sr. TAN No. of the Name of the deductor Total Tax Amt.out of (4)

No. deductor Deducted claimed for this year

05

01 02 03 04

1

Вам также может понравиться

- LogisticsДокумент1 страницаLogisticsmucintayhoОценок пока нет

- Computer-Aided Administration of Registration Department (CARD), Hyderabad, Andhra PradeshДокумент2 страницыComputer-Aided Administration of Registration Department (CARD), Hyderabad, Andhra PradeshtechiealyyОценок пока нет

- Tyrone Wilson StatementДокумент2 страницыTyrone Wilson StatementDaily FreemanОценок пока нет

- 11.03.2024 Balance Sheet.Документ2 страницы11.03.2024 Balance Sheet.bagalwadpattinassniОценок пока нет

- CS2023 SunnyДокумент2 страницыCS2023 Sunnyrohit. remooОценок пока нет

- CS2022Документ2 страницыCS2022gst65206Оценок пока нет

- CS2023Документ2 страницыCS2023gst65206Оценок пока нет

- JP Balance SheetДокумент1 страницаJP Balance Sheetsmith sethisОценок пока нет

- CS2016 Dinesh GuptaДокумент2 страницыCS2016 Dinesh Guptakashish guptaОценок пока нет

- Cs2021 Itr FileДокумент2 страницыCs2021 Itr FileAbhi RajputОценок пока нет

- CS 2022Документ1 страницаCS 2022dk1100861Оценок пока нет

- Comp. Chart Aman Malhotra 2021-22Документ2 страницыComp. Chart Aman Malhotra 2021-22Sachin ChopraОценок пока нет

- The Ars - Cash Flow 2023Документ70 страницThe Ars - Cash Flow 2023Irwan syachОценок пока нет

- Unaudited Trial Balance For The Year 2019: Sultan 900 Capital, IncДокумент18 страницUnaudited Trial Balance For The Year 2019: Sultan 900 Capital, IncGlennizze GalvezОценок пока нет

- CG - 2018-2019 - Jayshree Jay KariaДокумент2 страницыCG - 2018-2019 - Jayshree Jay KariaAnil kadamОценок пока нет

- svtlx1 - Trial Balance PDFДокумент2 страницыsvtlx1 - Trial Balance PDFRajeshОценок пока нет

- RamasДокумент2 страницыRamasRis Samar100% (1)

- TDS Calculator - 2017-18Документ9 страницTDS Calculator - 2017-18rohithnatramОценок пока нет

- ITC17Документ1 страницаITC17Kok yoke KewОценок пока нет

- Computation Mumbai Bazaar 2022Документ3 страницыComputation Mumbai Bazaar 2022Sanjeev RanjanОценок пока нет

- CS2022 PDFДокумент2 страницыCS2022 PDFHardeep MannОценок пока нет

- 2020 PNLДокумент1 страница2020 PNLParthОценок пока нет

- Bir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of January, 2018Документ5 страницBir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of January, 2018MaricrisОценок пока нет

- Computation PINKAL PDFДокумент5 страницComputation PINKAL PDFParthОценок пока нет

- Ipr2020 - Rosales, Josha IzzavelleДокумент2 страницыIpr2020 - Rosales, Josha IzzavelleBaggyaro LaparanОценок пока нет

- Marlon Payslip FebruaryДокумент2 страницыMarlon Payslip FebruaryMary Ann GubanОценок пока нет

- Balance Gral Jun 2022 y 2021Документ1 страницаBalance Gral Jun 2022 y 2021quinterolerma8Оценок пока нет

- Income Tax Calculator FY 2022-23 (AY 2023-24) FormatДокумент3 страницыIncome Tax Calculator FY 2022-23 (AY 2023-24) FormatAnkush SinghОценок пока нет

- Ag PDFДокумент3 страницыAg PDFAmar GuptaОценок пока нет

- Option Chain (Equity Derivatives)Документ2 страницыOption Chain (Equity Derivatives)The599499Оценок пока нет

- Denish Ashok SherdiwalaДокумент3 страницыDenish Ashok SherdiwalaDenish SherdiwalaОценок пока нет

- M.C AthertonДокумент6 страницM.C AthertonMarsha ClementОценок пока нет

- Gautam TradresДокумент2 страницыGautam Tradressourav84Оценок пока нет

- Registry of Allotments and Obligations RAO.2023Документ19 страницRegistry of Allotments and Obligations RAO.2023Jewel Madelo VertudazoОценок пока нет

- Board of Directors Meeting-Cvl For MayДокумент6 страницBoard of Directors Meeting-Cvl For MayChristian LlanteroОценок пока нет

- Harkesh Kumar Singh Payslip For: SEP 2010: HDFC Bank LimitedДокумент4 страницыHarkesh Kumar Singh Payslip For: SEP 2010: HDFC Bank LimitedPawan Kumar SinghОценок пока нет

- Sumana Podder: Taxation Assignment - 1Документ3 страницыSumana Podder: Taxation Assignment - 1akash deyОценок пока нет

- Alphalist 1604CF Schedule 7.3 For The Y-2019Документ7 страницAlphalist 1604CF Schedule 7.3 For The Y-2019Belen OngОценок пока нет

- Computation For Due Period: Current DuesДокумент4 страницыComputation For Due Period: Current DuesPratik GuptaОценок пока нет

- Cierrecont 63669Документ2 страницыCierrecont 63669Leo de los SantosОценок пока нет

- RossanaДокумент1 страницаRossanaMatt BonОценок пока нет

- RossanaДокумент1 страницаRossanaMatt BonОценок пока нет

- Schedule SAMPLEДокумент5 страницSchedule SAMPLEGlenda JaneoОценок пока нет

- Get Job Id 49410Документ16 страницGet Job Id 49410Dario Jose Uribe GarciaОценок пока нет

- S20 TX MWI Sample AnswersДокумент8 страницS20 TX MWI Sample AnswersangaОценок пока нет

- January 2023Документ1 страницаJanuary 2023biplab chowdhuryОценок пока нет

- AffidavitДокумент1 страницаAffidavitcherry lynОценок пока нет

- Nang KarenДокумент2 страницыNang KarenMatt BonОценок пока нет

- Estrope, Ana MarielleДокумент2 страницыEstrope, Ana Mariellejepoy palaruanОценок пока нет

- Master - 10-8400 Budget Template ANSWERSДокумент57 страницMaster - 10-8400 Budget Template ANSWERSJonathan LeeОценок пока нет

- Snet March'22 Fs - 2206Документ3 страницыSnet March'22 Fs - 2206Ayush SharmaОценок пока нет

- DuplicateДокумент5 страницDuplicateKrunal SiddhapuraОценок пока нет

- SPP Dan SPM 2018Документ62 страницыSPP Dan SPM 2018Abay Papah NauraОценок пока нет

- ASTL-Sched 10.14.21Документ37 страницASTL-Sched 10.14.21Guile Gabriel AlogОценок пока нет

- Case Study: Security Analysis Abc Bank LTDДокумент3 страницыCase Study: Security Analysis Abc Bank LTDSiddharajsinh GohilОценок пока нет

- Munna KhanДокумент4 страницыMunna Khanpocox5inОценок пока нет

- DAДокумент1 страницаDAsuperfarma.09Оценок пока нет

- Computation A.Y 2019-20Документ1 страницаComputation A.Y 2019-20kishan bhalodiyaОценок пока нет

- S K Construction Trading 2021Документ3 страницыS K Construction Trading 2021SPM CONSTECHОценок пока нет

- FileДокумент1 страницаFileMathanОценок пока нет

- Milkfood Annual Report 2021Документ108 страницMilkfood Annual Report 2021Kamalapati BeheraОценок пока нет

- TVS CreditДокумент1 страницаTVS CreditaryanОценок пока нет

- Form GST REG-06: Government of IndiaДокумент3 страницыForm GST REG-06: Government of IndiaAshish ShahОценок пока нет

- The Maharaja Sayajirao University of BarodaДокумент1 страницаThe Maharaja Sayajirao University of BarodaAshish ShahОценок пока нет

- Tax Payer Counterfoil: State Bank of IndiaДокумент1 страницаTax Payer Counterfoil: State Bank of IndiaAshish ShahОценок пока нет

- Prime StillДокумент1 страницаPrime StillAshish ShahОценок пока нет

- Certificate Ss ImpexДокумент1 страницаCertificate Ss ImpexAshish ShahОценок пока нет

- FORM 101A (Appended To Form 101) Details of Additional Places of Business/Branches/Godowns in Gujarat StateДокумент1 страницаFORM 101A (Appended To Form 101) Details of Additional Places of Business/Branches/Godowns in Gujarat StateAshish ShahОценок пока нет

- Government of GujaratДокумент1 страницаGovernment of GujaratAshish ShahОценок пока нет

- DeclationДокумент1 страницаDeclationAshish ShahОценок пока нет

- CG CalДокумент2 страницыCG CalAshish ShahОценок пока нет

- To Whomsoever It May Concern: Explicit Finance LTDДокумент1 страницаTo Whomsoever It May Concern: Explicit Finance LTDAshish ShahОценок пока нет

- Guide For Search CasesДокумент11 страницGuide For Search CasesAshish ShahОценок пока нет

- Jeevan Usha Bonds: Application FormДокумент8 страницJeevan Usha Bonds: Application FormAshish ShahОценок пока нет

- Gopal: Income of The TrustДокумент23 страницыGopal: Income of The TrustAshish ShahОценок пока нет

- Loan Against Shares (LAS) AgreementДокумент21 страницаLoan Against Shares (LAS) AgreementAshish ShahОценок пока нет

- Constitution IndiaДокумент46 страницConstitution IndiaAshish ShahОценок пока нет

- WCL8 (Assembly)Документ1 страницаWCL8 (Assembly)Md.Bellal HossainОценок пока нет

- Oscar Niemeyer: History StyleДокумент1 страницаOscar Niemeyer: History StyleAntonette RabuyaОценок пока нет

- Presentation Mini Case MeДокумент10 страницPresentation Mini Case MeMohammad Osman GoniОценок пока нет

- Aetna V WolfДокумент2 страницыAetna V WolfJakob EmersonОценок пока нет

- Acts Punishable: Elements of Illegal Sale (ID)Документ5 страницActs Punishable: Elements of Illegal Sale (ID)Jenny wicasОценок пока нет

- Service Bulletin 7001Документ14 страницService Bulletin 7001carlosОценок пока нет

- Department of Education: Attendance SheetДокумент2 страницыDepartment of Education: Attendance SheetLiam Sean Han100% (1)

- Foaming at The MouthДокумент1 страницаFoaming at The Mouth90JDSF8938JLSNF390J3Оценок пока нет

- The UCC and The IRSДокумент14 страницThe UCC and The IRSjsands51100% (2)

- Credcases Atty. BananaДокумент12 страницCredcases Atty. BananaKobe BullmastiffОценок пока нет

- Parking Tariff For CMRL Metro StationsДокумент4 страницыParking Tariff For CMRL Metro StationsVijay KumarОценок пока нет

- 2-Samonte Vs de La SalleДокумент1 страница2-Samonte Vs de La SalleLove EsmeroОценок пока нет

- Ms Evers Notes DiscussionQsДокумент8 страницMs Evers Notes DiscussionQsDana Michelle ClarkeОценок пока нет

- Jawaban Kieso Intermediate Accounting p19-4Документ3 страницыJawaban Kieso Intermediate Accounting p19-4nadiaulyОценок пока нет

- Tabang vs. National Labor Relations CommissionДокумент6 страницTabang vs. National Labor Relations CommissionRMC PropertyLawОценок пока нет

- Juz AmmaДокумент214 страницJuz AmmaIli Liyana Khairunnisa KamardinОценок пока нет

- Ratio AnalysisДокумент36 страницRatio AnalysisHARVENDRA9022 SINGHОценок пока нет

- Tantuico JR V RepublicДокумент10 страницTantuico JR V RepublicMhaliОценок пока нет

- Board of Commissioners V Dela RosaДокумент4 страницыBoard of Commissioners V Dela RosaAnonymous AUdGvY100% (2)

- Art 1455 and 1456 JurisprudenceДокумент7 страницArt 1455 and 1456 JurisprudenceMiguel OsidaОценок пока нет

- Processes To Compel AppearanceДокумент34 страницыProcesses To Compel AppearanceNayem Miazi100% (2)

- BDA Advises JAFCO On Sale of Isuzu Glass To Basic Capital ManagementДокумент3 страницыBDA Advises JAFCO On Sale of Isuzu Glass To Basic Capital ManagementPR.comОценок пока нет

- 8 Soc - Sec.rep - Ser. 123, Unempl - Ins.rep. CCH 15,667 Alfred Mimms v. Margaret M. Heckler, Secretary of The Department of Health and Human Services, 750 F.2d 180, 2d Cir. (1984)Документ8 страниц8 Soc - Sec.rep - Ser. 123, Unempl - Ins.rep. CCH 15,667 Alfred Mimms v. Margaret M. Heckler, Secretary of The Department of Health and Human Services, 750 F.2d 180, 2d Cir. (1984)Scribd Government DocsОценок пока нет

- Annual Income Tax ReturnДокумент2 страницыAnnual Income Tax ReturnRAS ConsultancyОценок пока нет

- Indian Exhibition Industry Association (IEIA)Документ6 страницIndian Exhibition Industry Association (IEIA)Anurag KanaujiaОценок пока нет

- The PassiveДокумент12 страницThe PassiveCliver Rusvel Cari SucasacaОценок пока нет

- MCQ On Guidance Note CAROДокумент63 страницыMCQ On Guidance Note CAROUma Suryanarayanan100% (1)